by Aussie Firebug | Sep 10, 2015 | Net Worth

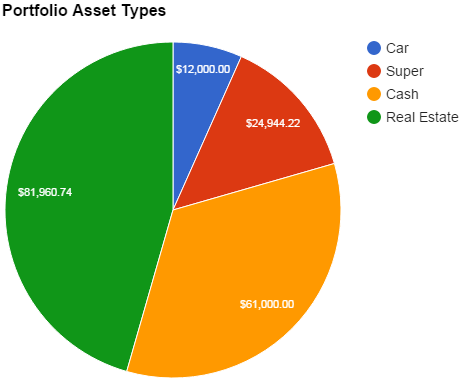

Not a lot to report during the last month. I was able to save a bucket load of cash simply from the fact that I didn’t do anything that cost money other than necessities. I am going on a international holiday at the end of September so I won’t be able to save as much that month.

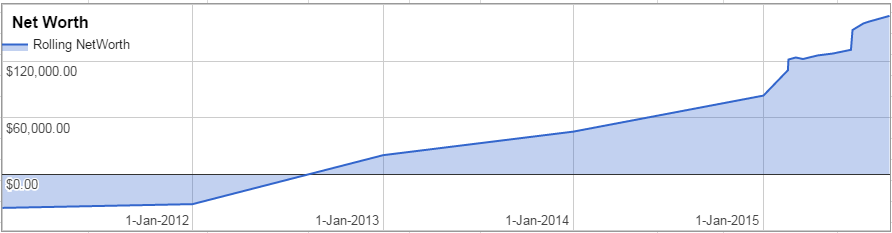

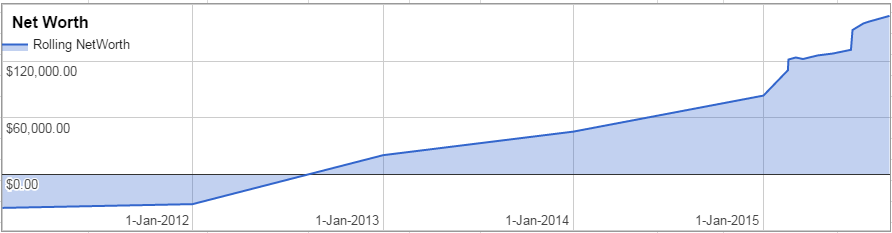

| Date |

Rolling NetWorth |

$ Change |

% Change |

Notes |

| 1-Jan-2011 |

-$36,000.00 |

$0 |

0.00% |

HECCS debt |

| 1-Jan-2012 |

-$32,000.00 |

$4,000 |

0.00% |

Started Full-time work late Nov |

| 1-Jan-2013 |

$20,000.00 |

$52,000 |

0.00% |

Built property and recieved FHOG ($21,000) |

| 1-Jan-2014 |

$45,000.00 |

$25,000 |

125.00% |

|

| 1-Jan-2015 |

$83,254.21 |

$38,254 |

85.01% |

Bought second IP |

| 17-Feb-2015 |

$110,215.44 |

$26,961 |

32.38% |

|

| 18-Feb-2015 |

$121,541.41 |

$11,326 |

10.28% |

|

| 4-Mar-2015 |

$123,715.44 |

$2,174 |

1.79% |

|

| 18-Mar-2015 |

$122,128.44 |

-$1,587 |

-1.28% |

Paid for holiday |

| 15-Apr-2015 |

$125,906.00 |

$3,778 |

3.09% |

Withdrew equity from property |

| 14-May-2015 |

$127,906.96 |

$2,001 |

1.59% |

|

| 18-Jun-2015 |

$131,904.96 |

$3,998 |

3.13% |

|

| 21-Jun-2015 |

$152,904.96 |

$21,000 |

15.92% |

IP’s revauled |

| 12-Jul-2015 |

$159,904.96 |

$7,000 |

4.58% |

Paid 4K off HECS Debt |

| 23-Jul-2015 |

$161,904.96 |

$2,000 |

1.25% |

|

| 31-Aug-2015 |

$167,904.96 |

$6,000 |

3.71% |

|

by Aussie Firebug | Sep 7, 2015 | Classics, Investing

Unless you have been living under a rock I’m sure you have heard of the term negative gearing. Some swear by it, others say that it is responsible for the outrageous house prices in the Sydney and Melbourne market. At the time of writing this, the current median house price in Sydney is $1,000,616 and Melbourne is $668,030! But what is Negative gearing, why do I think it’s for dummies (most of the time) and why doesn’t Negative Gearing’s cooler brother Positive Gearing get as much attention?

Negative Gearing Explained

The first thing to understand is the term ‘gearing’ which simply means to invest on borrowed money. Why would someone invest on borrowed money? Because investing on borrowed money allows you to get bigger bang for your buck (technical called leveraging), for example:

If I invested $50K straight into an Exchange Traded Fund that returned 10% annually I would make $5K in one year. But if I used that $50K as a down payment for a house worth $250K that increased in value to $275K over the course of one year I have successfully used leverage to my advantage. You see, even though the ETF had a better return on investment (ROI) of 10% compared to the house ($250K to $275K is a 9% ROI), the leveraged investment was able to return $25K compared to $5K from the ETF. This is possible because you are investing the same amount of capital but are acquiring a much larger asset.

Of course I’m leaving out a ton in the above example but that’s just to explain the basics and how gearing is meant to work.

OK so now you understand what leveraging\gearing is and how it’s meant to work. If we continue with the above example and break down the costs associated with holding the asset for one year and the income it produces (rent) it might look something like this

| Expenses |

|

Income |

|

| Management fees |

$1,000 |

Rent p/w |

$235 |

| Water Bills |

$600 |

|

|

| Interest Repayments |

$10,000 |

|

|

| Insurance |

$600 |

|

|

| Rates |

$1,600 |

|

|

| Depreciation |

$7,600 |

|

|

| Total |

$21,400 |

Total |

$12,220 |

Which would mean that the investment is negatively geared because the outgoings are greater that the income produced by the asset. You are basically losing $9,180 dollar a year to hold this asset. Why would anyone buy something that looses them money? Because they think they can make it back through capital gains. Which in the above example is correct since the house gains 25K and only loses around 9K.

While some people like to invest like this, it ain’t for me. The reason I don’t like this way to invest is because every year you loose REAL money out of your account and it affects cash flow position which impacts your lifestyle. You might not be able to go on that holiday every year if you were consistently having to fork out 9K on the investment property. You never see the capital gains money until you sell the house, your gains are only on paper until you actually sell. The house might be worth 25K more after year 1 and then 25K more again after year 2 but then the market slumps and your house is suddenly worth 40K less after year 3. Meanwhile your negatively geared asset has consistently been draining you of 9K yearly. It comes back to the basics of investing and for me my light bulb moment. You buy assets that make you money. Negative gearing is buying assets that loose you money with the hope of making that money back and more when you sell… No thanks

Pay Less Tax

What is unusual about negative gearing in Australia is that the law allows you to offset the tax you pay on your wage with the losses from an investment. Not all country’s allow you to do this. I’m not going into a lot of detail about taxes because it’s just too hard with so many different situations but the gist of it is that you can claim a deduction in your tax return from the loss you made on an investment property.

For example, if you earned 70K a year and you lost 9K with a negatively geared investment property the tax man looks at that and allows you to offset your salary of 70K by 9K thus your real earnings that financial year is 61K and not 70K. And this difference is the reason you can get a big tax return at the end of the financial year. Because you paid tax on the whole 70K throughout the year the tax man refunds you the tax you would had paid on the 9K which equals $2,925* using the income tax rates 2014-2015.

BUT!!!! You have to remember that even though you paid less tax and got a tax return of near 3K, you still lost 9K to do so. When you hear people bragging about ‘My tax return was $12,000 dollars this year how smart am I!’ just remember that they would have had to have lost a heaps of money in order to offset their salary to get that big of a return. The aim in property investing is not to pay no tax at all. It is to make the most money possible in the shortest amount of time with the least aggravation. There are ways to minimise the amount of tax you pay but your goals should never be paying not tax at all. Ideally you want to be paying loads of tax each year, because if you’re paying heaps of tax that means your making bucket loads of money. If you live in this wondering country of Australia you’re going to have to pay tax. Get over it.

When is it OK to Negatively Gear?

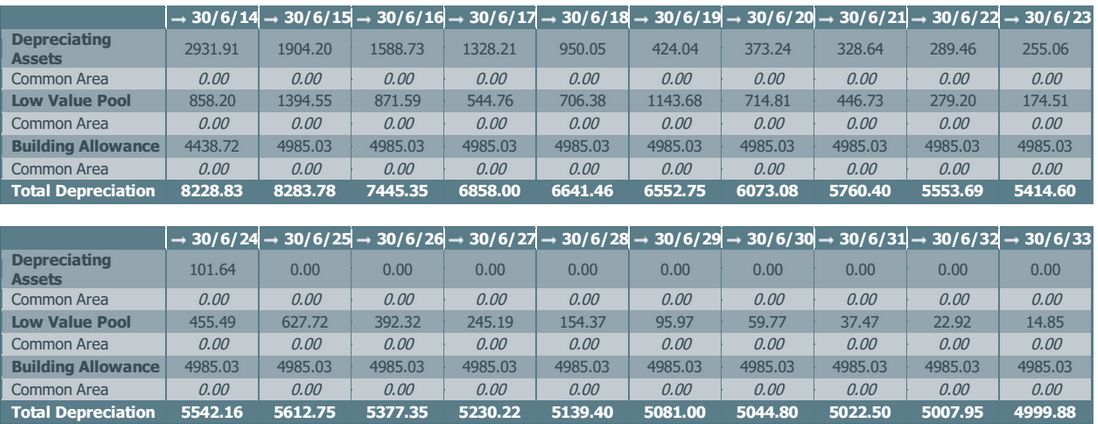

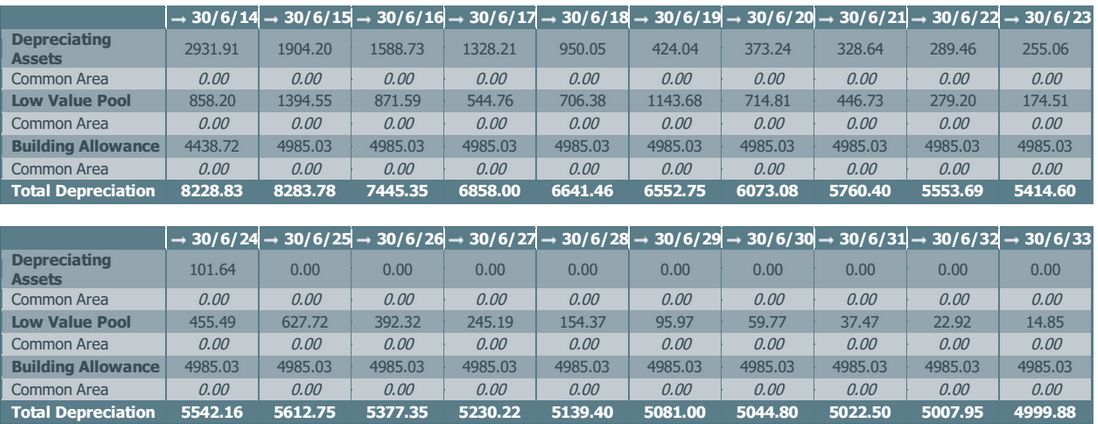

I’m going to sound like a massive hypocrite right now but all my properties are negatively geared BUT have positive cash flow increasing my ability to save cash for the next deposit. Huh? Didn’t I just say that negatively geared properties lose you money each year? Yes I did but there is one key category to the expenses of a property that makes it different from the rest. Depreciation! When you buy/build an investment property you should get a depreciation report made. This is basically paying a professional depreciator to come to your property and work out how much value things are going to depreciate by each year. The carpet might lose $200 value each year for the next 15 years, the deck might deteriorate by $400 a year for the next 20 years and so on. They value everything on the property and give you the value that the property loses throughout the next 20 or so years. Below is from a report of one of my own properties

The total depreciation at the bottom of every financial year is what my accountant is after to use in my tax return. The reason why depreciation is different to every other expense is that it does not affect cash flow. I technically make a lose on paper but I don’t actually have to give 8K to anyone, it’s simply what the property has lost in value during that time. My own cash flow position with my properties is that my rent covers ALL expenses and leaves me with a little left over. But when you factor in the depreciation I’m technically negative gearing even though I have a positive cash flow. For example:

| Expenses |

|

Income |

|

| Management fees |

$1,000 |

Rent p/w |

$350 |

| Water Bills |

$ 600 |

|

|

| Interest Repayments |

$10,000 |

|

|

| Insurance |

$ 600 |

|

|

| Rates |

$1,600 |

|

|

| Depreciation |

$7,600 |

|

|

| Total |

$21,400 |

Total |

$18,200 |

Technically I am losing $3,200 dollars holding this property. BUT the big difference with the above is that if you take out the loss from depreciation I actually have a positive cash flow of $4,400 dollars. Deprecation puts me in the negatives which is OK because that means I can then claim the loss on my tax return and get even more money in my pocket! The entire time I’m holding this asset I am having $$$’s flow into my bank account and not out of it PLUS I’m not even factoring in capital gains which may or may not be occurring. Capital gains is the gravy on top for me though, as long as an asset is cash flowing I continue to buy more of them.

Positive Gearing

And now finally onto the my favorite way to invest, Positive Gearing. You may have figured it out by now but just in case you haven’t. Positive gearing is when the rent you collect covers all costs including depreciation and leaves you with a surplus. You have to pay tax on this surplus but that’s OK because it’s extra money in your pocket and for me it’s better to be earning $1 dollar more and paying 37c tax than it is to be losing $1 and saving 37c tax.

So if positive gearing is so bloody fantastic, why is everyone doing it? Because it’s not easy to find positively geared properties straight off the bat. You can find them in places like mining towns and in the country but mining towns are usually extremely reliant on one industry and if the mine shuts you’re screwed. Country towns are OK but often lack that capital growth seen in the capital cities.

There are only two way to make money from Real Estate. Having positive cash flow from the rent (positive gearing) or having the price of the asset increase from when you bought it (capital growth). Nirvana is purchasing a positively geared property that will have big capital gains in the future. The thing about capital gains though is that you can’t really control it from the market perspective. Sure you can do a reno to increase the value of the house or something, but if outside factors come into play such as China slowing down, Australia going into recession or Europe going down the drain and the buyers market gets spooked and stops buying. Economics 101 ‘supply and demand’ tell us no matter how much you’ve improved the property it may be worth significantly less than what you’ve paid for it. In a rough time like this your cash flow will either help see you through so you can hold the asset until the market rebounds or it will cause you significant grief as you continue to fork out $$$ each week for an asset that is continually losing money. Cash flow is more manageable and easy to predict. You can see roughly what the properties similar to yours is renting for, work out the costs for repayments, rates, water etc. and get a rough idea if the property will be negative, neutral (doesn’t lose or make money) or positive. Outside influences that affect cash flow are usually less volatile too (interest rate, rent prices etc.).

Negatively geared properties should eventually turn into positive over time as rent rises. Realistically, neutrally geared properties in a highly sought area with good potential for growth are the ones I’m interested in. They don’t drain your pockets as the property looks after itself and with every rent increase you are slowly turning the property into the positive area while also having a property with great upside for growth. I would love to get a positively geared property with big upside for growth but the bottom line is they are extremely hard to find in a capital city without lucking out somehow. It is very possible to get neutrally geared properties in up and coming areas which will turn positive over time.

Wrapping Up

Negative gearing saves you paying tax but you lose more than you get from you tax return. If you are negatively gearing you must be 100% confident that the property is going to go up in value whilst your holding it. This is the only way you can make money through negative gearing. Next time you meet someone who is paying little to no tax using negative gearing just be aware that they are actually losing money until they sell and most likely don’t realise this. I only advocate negative gearing if you still have positive cash flow which is the method I’m currently using.

Positive gearing is where it’s at and all investors should be striving to get to this state because there is no good reason not to. The asset produces more income than expenses. Simply investing really, buy things that make you money. Positive gearing does this. Yes you pay tax but if you’re planning to become rich through Real Estate guess what? You’re ganna have to pay tax!

Thoughts, feelings, questions and emotions in the comment section below.

*Assuming that this person falls in the $37,001 – $80,000 tax bracket and is paying 32.5c for every dollar they earn