Finally feel like we’re making progress again this month.

The ETFs are doing great, Super is up, killer month for savings and we booked a holiday. That a domi (made up word used to describe good things) if I’ve ever seen one!

We are actually paying for flight and accommodation for not only us but both our parents too. This doesn’t sound too frugal but my parents recently retired and Mrs. Firebug’s mum retired last year so we thought it might be a nice surprise trip for everyone. I have wanted to take my parents on a holiday for a while now. They are the single biggest reason why I’m in the position I’m in today and even have the option to retire early. Not just from teaching me good life skills, how to be frugal, how to work hard, setting the right examples etc. But just for being genuinely great parents.

One of my biggest financial advantages ever was living at home until I was 26. Meals were ready for me when I finished work, didn’t have to do laundry or do much cleaning, hardly any bills. I helped out around the house (mowing the lawns and odd jobs for dad) but definitely enjoyed the luxuries of living at home. Stay at home for as long as possible people!

But seriously, it sounds easy in theory, but you have to have a good relationship with your parents and sacrifice your independence to do this. I loved my time at home but was well and truly ready to move out when I did, even though it wasn’t the best move financially.

I probably will never be able to repay my parents for everything they have given me. But I know that a nice holiday to Queensland with Mrs. FBs family will make them happy.

One more thing that pops up in my mind about Mum and Dad that I love, is they have worked their asses off to be in the position to retire around 60 completely financially independent! I would 100% support them if they needed it in their golden years. It’s the least any child can do and in many countries without a pension, this is the norm. But the fact that they have raised a family of three and set themselves up for retirement is inspirational to say the least.

Inheritance is an interesting topic that I have not even really begun to explore. But right now, I’m not sure I want to leave my kids a fortune at all. What I do endeavor to achieve is a fantastic upbringing for them and no financial stress caused by Mrs. FB or myself in the future. Just as my parents have done for me.

The FIRE community’s growth has exploded in the last few months. When some of us got featured in mainstream media, it seems the general public discovered a very niche community within the world of personal finance.

I sometimes get asked what would happen if everyone became as obsessed to reach FIRE as me.

Well firstly, it would be terrible for my investments. I invest in companies that rely on people buying or using their products. If no one was spending, the economy would not grow very fast. I want people to buy stuff!

But I don’t think there is even the slightest chance that this would happen. Time will tell, but my guess is that for the majority of new people who have discovered this blog and the community within the last few months. The concept of FIRE will only strick a cord with a small minority.

Most people will love the idea of retiring early. But I’m guessing that when they figure out what it takes to achieve it, they will pass.

The funny thing about reaching FIRE is that anyone can do it. Don’t have to be smart, lucky, an investing genius, from a wealthy family or anything else extraordinary.

You just have to be disciplined and have patience.

Net Worth Update

The markets are back!

Big month for the ETFs and Super giving the net worth nearly a $10K bump!

We also saved really well with a relatively inexpensive month! 👌👌👌

Hopefully, we can get a few months in the black and get a roll on heading into winter!

Properties

No changes in the properties this month.

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

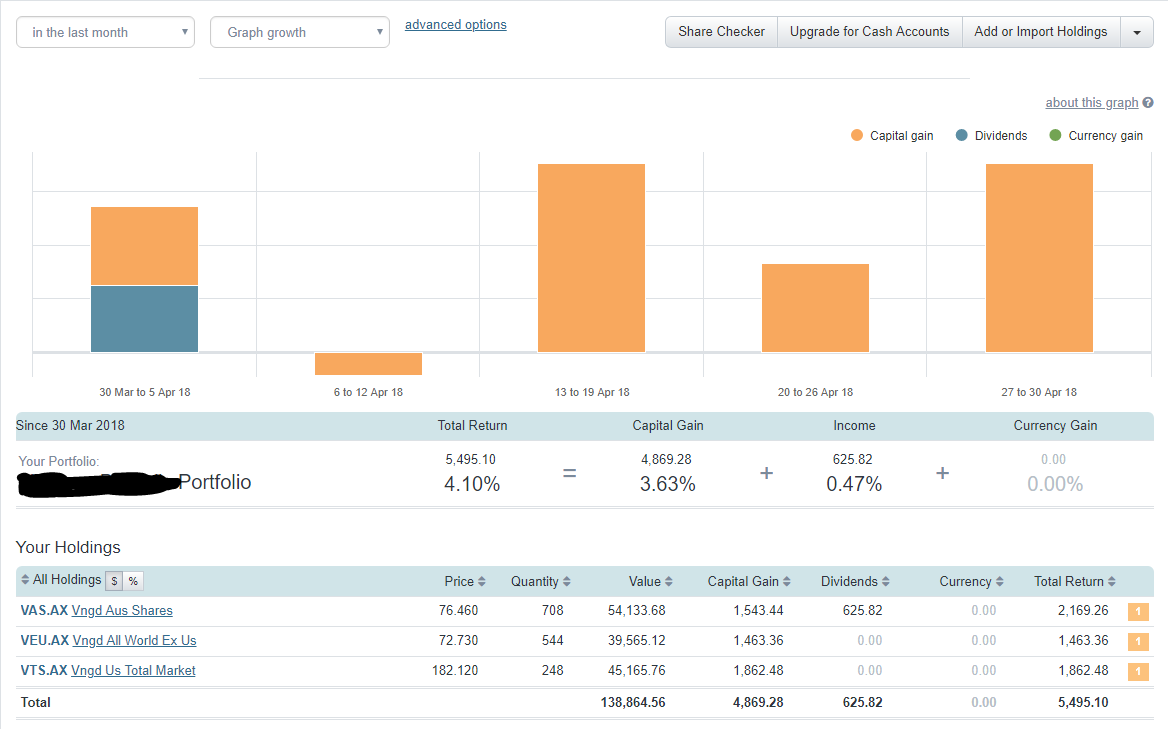

ETFs

Here’s how our ETFs did

Not bad at all 🤑🤑

Good spread across the board and with the extra dividends, VAS was the number one gainer for last month.

Networth

Congratulations, another step towards the goal! I’m curious as to why you hold such a large amount of cash, it seems to be far in excess of what most people would have and a lot more than the 3-6 months of living expenses that most people recommend?

Could Beto cover unforseen expenses on the three properties?

Good point Brad. I do keep around $3K-$5K in an offset against each property in case of emergency fixes.

It’s good to have some cash on hand when a good buying opportunity presents itself (stocks). I would also assume Mr FB also has this cash in an offset account contributing to his mortgages?

All our spare cash/emergency fund are sitting in an offset 🙂

Much more efficient use of cash vs a HISA

Hi Sean,

Good spot. We might be buying a home to live in, in the next few years. I want a pretty decent cash buffer to pounce if something catches our eye. It isn’t locked in or anything like that but having extra cash is never a bad thing.

Fair enough. I assumed there was some sort of reason for it being such a large balance instead of just the standard 3-6 months of living expenses, because otherwise the opportunity cost of the foregone potential return of shares or property etc is a lot of money each year. Depending on how you run the numbers and what assumptions you make it’s a hell of a lot more than the difference between your 3 fund portfolio and VDHG on your current balances for example.

Sorry Sean I forgot to mention that I like to keep $5K cash for each property to cover unexpected costs.

Your parents did your laundry for you? Jeez man, haha.

Just kidding… congrats on a great month!

Where did that ETF screenshot come from? I don’t recognise the platform. Nice work on the net worth increase! 😄

It’s from ShareSight. They have a free account with up to 10 holdings. More is $10/month from memory

Osmium is correct. I use Sharesight

I love it that you’re taking your parents on a holiday – I was super happy to be able to pay for a trip back home to Europe for my partner, myself and my dad for my dad’s 70th birthday. I’m extra glad now, since he passed away unexpectedly 2 years later. He was was wonderful, loving dad and I have a really special memory of the whole family (aunts, uncles and cousins) together. I don’t want my purse strings ever be so tight that love couldn’t stretch them a bit.

Lovely story SKB.

Hi Aussie FIRE bug,

Love the blogs and I am learning a lot from your blogs.

I have been on my own journey to grow my net worth since graduating but not really having a purpose. It was really only recently discovering FIRE that I am beginning to flesh out my purpose. Keen to hear from you one day on your purpose.

In the meantime, I am teaching my kids financial literacy so that they will have the freedom to pursue their own happiness without having to be tied down by money. I call my kids, FIRE kids. Check out our blog Mama is the Boss! http://mamaistheboss.com/home/.

This is also the link to FIRE kids April net worth http://mamaistheboss.com/2018/05/07/april-18-networth-update/

Is that sharesight tracking of EFTs? This might be a silly question but if that is sharesight do you track your reinvested dividends by forwarding your vanguard dividend emails to saresight or by the Auto Dividend Reinvestment setting?

Congratulations on a great month

Dividends are automatically included in the reports Basil. Even if DRP is on or off.

I agree, anyone who can stay at home should! It wasn’t an option for me, but when I look at how much rent I could have saved over the last 11 years….

Mr B still lives at home and used this to his advantage to get into the property market (in Sydney no less) so for any millennial noobs reading – be nice to your parents!

Congrats on a stellar month and your part about paying for everyone to go on a holiday together is super sweet and thoughtful. Well done on being great with your finances and your relationships – great balance 🙂

Thanks MB 🙂

Love your work mate. The latest podcasts have been awesome.

Just wondering about your stock portfolio, do you have any plans to buy into bonds as well or will you stick with the 100% in stocks? Seems very aggressive. Also, being in the industry you must hear about the ‘next big stock’ all the time, do you get tempted to throw any money at speculative stocks?

Cheers.

Hi Chris,

100% stocks for me mate. It’s all about risk tolerance and volatility. I have done my homework and like to think I have a pretty good understanding on how the stock market works. When (not if) the next crash comes in, I will be prepared mentally and know that the best thing to do will be to continue investing like nothing ever happened. I don’t plan to ever have bonds on my portfolio tbh.

I’m not in the industry mate. I work in IT 🤓

Speculative stocks just don’t interest me in the slightest. Maybe one day. Even so, I’d never put more than 5% into it.

Hi There,

Surprised to see you use equity and super in your networth? Are you basing your fire date base on that facts?

I personally don’t count neither super nor equity as I intend to FIRE before super kicks in and then there is no use to me of the equity to generate cash flow..

Hi Grogounet,

I’m not sure why you wouldn’t consider Super in your net worth!

It’s an asset that is owned by you first and foremost. And it generates an income.

The other reason is that Super plays a massive part in retiring early too! Super is the most tax efficient vehicle investors have in Australia. The only catch is that you need to be a certain age before you can get to it. But the two-phased approach to early retirement I have written about here https://www.aussiefirebug.com/australian-financial-independence-calculator/ is the quickest way to financial independence for Australians.

Not sure why you don’t consider equity in your calculations? Can you expand on this one a little?

Lovely words there about your parents mate, that’s really nice. Hope you all enjoy the holiday!

I planned to stay at home forever until I realised there wasn’t any jobs around in my area, so that backfired lol.

As for the new folks, hopefully lots of them stick around, but sadly it’s more likely than only a few will.

Don’t think we have to worry about the lack of spending in the economy, it seems to be getting even more entrenched if anything!

Sorry for the late comment, but the whole “what if everyone became frugal?” question is about as relevant as “what if everyone rode bikes instead of driving cars?” or “what if everyone stopped being rude to each other?”. It won’t happen ever, so it’s pointless really spending any time worrying about it. I could go on, but suffice to say I know plenty of people whose raison d’etre is nothing other buying shit. Money’s there to be spent, after all!

Very true Chris

I enjoyed this article! (Yes I know it’s from 2018 but I’m pedantic about reading in chronological order 😛 ) Like you I appreciate living at home so much as an advantage in my journey. Still living at home at 28 myself – did 3 years on my own when I was moving around for work and had that taste, but I’m pretty content with the lifestyle of living at home. There’s no rush for me to get out; I’m happy to wait till I move in with a future partner to leave, or if I decide to stay single I’m happy to live with my mum forever.

I do come from a cultural background where continuing to care for parents in their old age is the norm, of course. I’m considering setting up a trust with my mum as one of the beneficiaries. From reading your earlier posts I know you have a family trust, do you know how being a beneficiary would affect ability to receive an aged pension re assets test? My mum is still 15 years away from being able to get the age pension but I wouldn’t want to set up a trust for her and then it turn out that she is ineligible for a pension because it’s too asset rich.

Moving out of home was the worst financial decision we ever made 😂!

As far as the trust goes, I’m not an expert but I’m almost certain that just being a beneficiary won’t affect someone. It’s if income is distributed to them that may affect their eligibility for the pension.

Probably worth getting some paid advice on the matter if you’re really concerned though 👍