There are countless sites/articles/forums about financial independence (FI) on the world wide web. I’ve often come across really clever, well developed calculators that offer a really good visualisation on how long you have to go before you reach FI. But the longer I searched for the best calculator the longer I realised that they were all geared towards other countries.

One of the main reasons I created this site was to offer my fellow countrymen quality information that was tailored for an Australian audience.

The biggest issue I had with every single one of these FIRE calculators out there was they didn’t factor in our Super system. The US system, which is the main system upon which I found almost all of the calculators accounted for, has a fundamentally different way their citizens can withdraw from their retirement accounts.

To put it simply, in the US you only need one portfolio to be at a certain amount before you are considered FI. But because you can’t access your Super before your preservation age (99% of the time) you end up with two. Your Super portfolio and a portfolio outside of it.

So what’s one to do? Do I just keep plugging away at my personal portfolio until I reach my FI number? That seems like a waste since Super has such a big tax advantage. You’re not likely to beat the 15% tax breaks on your Super.

But I don’t want to put money into Super because I want to retire young! And I won’t be able to touch the money until my preservation age (60 for me).

Decisions decisions decisions!

Introducing The Australian Financial Independence Calculator

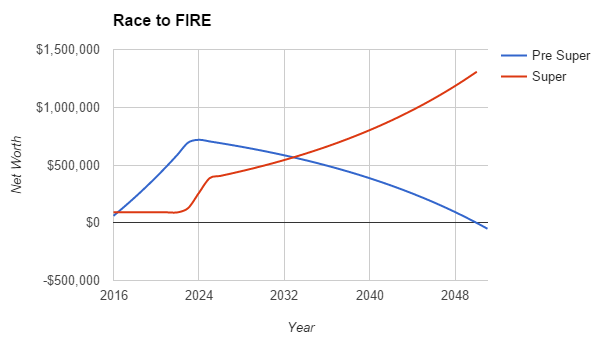

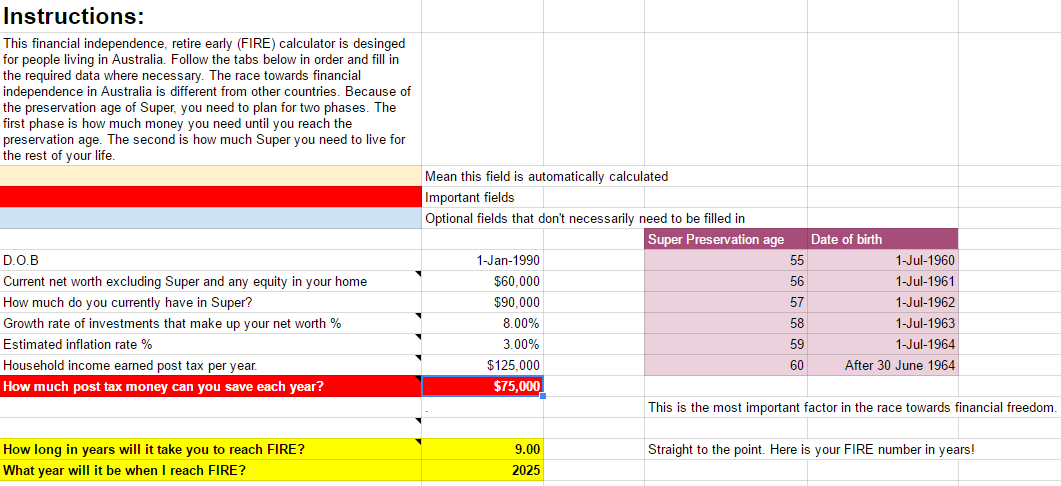

The above are two screen shots from the calculator showing the basic settings and the graph that it generates.

You will notice there are two lines in the graph. The Pre Super number is what you will be living off until you can access your Super. The Super number is obviously what’s in your Super.

In a nutshell, the most optimal way to reach FIRE here in Australia is to:

-

- Step 1. Have enough money to survive until your preservation age (when you can access Super). No matter how much you have in your Super, you won’t be able to retire early and pursue your other goals in life if you don’t have money coming in to live off. Step 1 is not meant to last you forever though. It’s only meant to last you until when you hit your preservation age and can then access your Super. You will notice in the above graph that your Pre Super number goes up and up and up…and then slowly tapers off past $0. This is by design. You want your Pre Super number to be at $0 when you access your Super.

-

- Step 2. Have enough in Super to cover all your living expenses forever! You will notice that the red line (Super) has a number of dips.

-

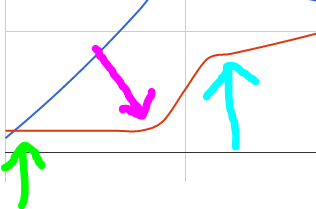

- The green part of the line indicates how much Super you currently have at the start. This will move slowly up (depending on how much Super you have) over the years as your super grows from compounding interest until you hit the pink arrow.

-

- The pink arrow indicates the time you have reached your Pre Super number. When you have reached your Pre Super number you theoretically should be able to live entirely off that number until preservation age (assuming all conditions stay the same). This means that 100% of your after tax income will be going into your Super account until you reach your Super Number.

-

- Your Super number is not actually your FI number. Your FI number will be reach in your Super account at the very start of your preservation year. But no sooner than that, because that is the most efficient and fastest way to reach FIRE. The calculator works out how many years it’s going to take you to reach your Pre Super number and then does some cool math and works out that you need a certain amount in your Super for it to grow into your FI number the year you can access it.

Pretty cool huh!

Video Of The Calculator In Action

Work In Progress

The calculator has some flaws. It’s a work in progress. If you find a flaw please let me know and I’ll try to fix it.

Download Now

Enter your email address and not only will I send you the calculator. I will send you updated revisions of it ever time I fix a bug or the laws in Australia change.

Great effort mate. Just what I’ve been looking for and eager to try it out

Cheers Mate

Hi

Thanks so much for this – much appreciated!

I’m not sure if I missed something here – I worked out I can save $50k a year and it’ll take me some time to get there!

But how do I know whether I need to be investing that money in or outside of super? Any help in clarifying is appreciated?

Thanks!

Nice one Firebug. I’d be keen to give your calculator a try. There’s a really great retirement calculator from an US blogger I have been using. It’ll be interesting to compare the two and see the difference the Oz based super numbers make.

Yep it is interesting. The US calculators are great but because they can access their retirement accounts early it’s not quite the same.

Legend! I need this in my life (where is the ‘enter email’ field?)

bump

It’s now updated mate.

I accidentally forgot to add the download link (D’oh!)

haha, glad it wasn’t just me being blind then! Cheers for putting this together, I’ve lazily half built something like this a million times.

Nice work, looking forward to kick it’s tires.

Forgot to mention, you should be including the Governments Old Age Pension as well (unless I somehow missed that?). Even if it may or may not be there in the future or may or may not be the current amount, it’s something that some people can currently rely on so it will be a factor in their FIRE plans.

Hey GT,

I’ll look into it and see if it will be in the next updated version.

Cheers

Hey AFB, I’ve been using this calculator and noticed the contributions on the super page seem out. It may just be an error in the version I’ve downloaded but the contributions are listed as my total income not income saved so this brings the fire date forward unrealistically.

Hi, I noticed the same thing! I thought I was just reading it wrong…

I get it now (after reading through the comments) 🙂 – you continue working after the pre-super number is reached, and you live off your saved amount pre-super and put your whole income into super until you reach your super number. Then you can finally FIRE!

You got it!

Hit me with it. I work with financial spreadsheets for a lot of my job so keen to dig in and help develop this. Just a thought but it might be better served as a google doc?

Hi Chris,

I have emailed you privately.

Cheers

I’m a bit confused with the explanation of the arrows (and the video isn’t working, I was hoping to get a bit more out of that). To me it reads as if…

1/ You work, have normal contributions to super (red), and save up until you reach an amount that could cover your living expenses (blue).

2/ You continue to work, now putting that blue money into your red super. “This means that 100% of your after tax income will be going into your Super account until you reach your Super Number.”

3/ You retire at 60, preservation age. “Your Super number is not actually your FI number. Your FI number will be reach in your Super account at the very start of your preservation year.”

I know I’m missing something, but I can’t figure out what.

Just watched the video, now I get it. Thanks.

Yeah I had some issues with the video. All good now though 🙂

Just watched the video, now I get it. Thanks.

Hi,

Thanks for your efforts on this. It is a great idea.

I have noticed a bug. WIthout even changing any values it shows an error on the Step One Tab.

2026 10 $65,000 Err:502 Err:502 Err:502

Also, again without changing any values, why does the super line on the graph not show any increase until 2024? Assuming that at least some of the income is derived from employment, wouldn’t there be a compulsory super contribution?

Hi,

I’m fixing Super and a few other things. I will release an updated version later.

What are you using to open the file? Google Docs? Excel?

I’m using Excel 2010 and I’m not getting any errors.

Try Google Docs if it’s not working.

I’ve been wanting to see someone put out a calculator for us Aussies for ages, nice work. Looking forward to playing with it.

I’m also keen to see more functionality around super guarantee and salary sacrifice etc in future versions.

Now I just need to figure out how to model the next 2 years of paying off the house prior to investing full bore in ETFs!

Thanks for this mate. Nice video, cool to put a voice to the blog 🙂

Cheers mate 🙂

This is awesome, thanks for putting it together! Yay for an Aussie calculator 🙂

Feedback:

– Easy fix, could you resize the comment boxes, currently in excel 2013 the comment boxes cannot display the whole comment.

– Compulsory Super contributions from the employer during step 1 have not been accounted for.

– Interest earned on Super contributions during step 1 has not been calculated.

Keep up the great work. Yell out if you need a hand, I’m happy to try to help.

Hi Sharon,

Yep the Super fixes are coming. Just have to find the time lol.

Thanks for the feedback

Hi Firebug,

I have been looking for an Aussie base Calculator for some time thanks for your work. I noticed a few thing with the calculator.

1. Super doesn’t increase year to year should be at least the 9.5% employer contribution , plus any salary sacrifice.

2. After you start saving super it uses the total post tax number rather than, How much post tax money can you save each year.

Would be happy to test out the next version of the Calculator. let me know.

Hi Chris,

1. Yep Super need fixing.

2. This is by design. Once you have reached your Pre Super number you can dump 100% of your after tax income towards Super. This is because your Pre Super number will allow you to completely live off it until preservation age hence no need for any income to be spent anywhere else other than your Super.

The next version will be out soon!

Hi mate

Entered my email but it hasn’t come through. Is there a lag between submission and sending?

Hey Nick.

I checked and I seen that your email was sent. All good now mate? How long was the delay btw? The email didn’t show up in your spam did it?

Cheers

Hey mate

Looks like the work firewall blocked it. Sent it to a personal email and now its all good. Came through almost straight away.

Cheers

Thanks for this!

I’ve been trying to create my own because the US ones did not fit.

This will save heaps of time.

Keep up hard work!

No worries mate. I’m close to releasing the updated version b/c there are a few bugs in the current one. So keep an eye out for the email.

Cheers 🙂

I was fiddling around with this today, tried to build my own in excel, got frustrated and ended up bashing together a javascipty version (with less functionality) – I’d love to get your opinion on it 🙂

http://firebythirtyfive.blogspot.com.au/2017/01/i-made-calculator.html

Hi LadyFIRE,

Awesome work!

I want to build my excel version into a web app one day. You have done a great job.

PS I have released a newer version of the calculator in case you haven’t seen it yet. It cleans up a lot of formatting for the excel version.

Cheers

Great calculator!

A couple of things to consider:

1. It would be great to be able to input salary sacrifice amounts and also marginal tax rates for two people.

2. When you reach your pre-super number you dont want to necessarily put in all your income into super. You would need to take into account the concessional contribution cap, the non-concessional contribution cap and that once your super balance reaches 1.6m (indexed), you cant

put in any more non-concessional contributions (from 1 July 2017).

3. It would be good to have an assumption of your income being indexed at x amount eg. 2%pa.

Good suggestions. The calculator is not perfect and you’re right with the non-concessional contributions cap. I might add more to it eventually but the original purpose of it was to have people understand that early retirement is a two phased approach in Australia.

Thanks for the comment 🙂

Thanks so much for your awesome site! Just wondering, is it possible to factor HECs debt repayments into this calculator?

Hi Nikki,

I since HECs is already taken out of your pay, just plug in your expenses as is and it should be right. It’s not going to be 100% accurate but it never was made for that. Just opening peoples eyes to the two phases of FIRE for aussies.

There was another guy that made an improvement on this calculator which you can get here.

https://docs.google.com/spreadsheets/d/1xfkb2tROMET_5sBeFizvbiK69ZnP3QokwMNcjgRoSvM/edit#gid=1320446647

Check that out. It may have what you’re looking for.

Cheers

great work firebug

i plugged my numbers into your calculator and it has told me i have already reached FI , i am still in the salt mine but it did make me smile to know i can go when i have had enough.

one thing about you millennials you guys are so generous with your knowledge i am really impressed i am a gen X and seriously grateful.

letting go of the treadmill is often actually difficult to do even when you have more than you need would be great to get a podcast with someone who has some deprogramming strategies.

mad fientist has touched on it with his podcast with the happy philosopher but i find at 45 its an abyss i still not up to jumping into.

great work

Hi Josh,

You make a great point. I will try to get someone on the podcast to chat about this in the future.

Cheers

Hey Firebug,

Thanks for making the Calculator freely available – much appreciated.

Any chance you could do a version for couples?

And while I’m asking… 🙂 is it possible to add a way to pause both savings and super contributions for a period if you are out of the workforce (studying, kids, etc.)

Cheers!

Hi there.

Will it work if you have much lot more outside super than inside super? Self employed here.

Thanks

Chris

Hi Chrid,

There are certain situations that the calculator does not handle well. If you have a lot outside Super and are very close the FI. The calculator may still suggest dumping everything into Super and living off your pre-Super amount. But in reality, if you are close or have a lot outside Super. You probably just want to keep investing outside of Super until you hit FIRE.

Hope that helps 🙂

Hi there,

Dave at Strong Money Australia just referred me to this calculator and it is certainly very interesting and makes a great point. It is really helpful to see Australian specific information on this journey. My husband and I are currently grappling with the question of whether to make additional contributions to super (we are 38) to take advantage of the tax concessions or whether to invest in income producing dividends to be able to build up our investments available for FIRE earlier. I would love to see some thoughts / discussion around this point.

Hi Naomi,

If you’re not planning to quit work then the answer will always be Super every time.

But if you want to pull up sticks before your preservation age. You just need enough money outside Super to last you until you can access it.

Have you got enough money in Super currently for it to compound into your FIRE number come preservation age?

Hi Firebug,

Thank you so much for creating this. I was trying to work this out myself for about a week and then came across your calculator. Both useful and inspiring. Thanks again.

No worries Derek.

It’s not perfect (as people are constantly reminding me lol).

But I think it does do a good job to get people to realise the unique two-phased retirement plan for Aussies wishing to retire early 🙂

Hi Firebug,

Thanks for creating the calculator. Just thought I would point out that most people would have a mortgage during the wealth building phase and the mortgage repayments would likely stop once FIRE. Hence your calculator doesn’t take that into account and just assumes the “mortgage = expense” would continue into the FIRE phase.

That’s correct Superman.

The calculators not perfect. In reality, you would need to adjust it accordingly to fit your situation as time goes by.

This is awesome mate! Thanks so much for putting this together. I’m really trying to get a more data-driven map for my financial decisions, and this tool is perfect for that.

However I am a little anxious about future changes to super laws, and don’t want to place all my life’s savings in the fickle hands of the government. I will certainly look at upping my contributions to 15% though, it’s great for tax savings.

Keep up the hard work 🙂

Thanks Nelson 🙂

Thank you so much for this calculator! It has been invaluable in my financial planning.

I have a couple of questions:

– I’m wondering why you have updated the calculator to include pre and post tax income per year?

– Is the monthly passive income once you reach fire based on how much I spend a month on current lifestyle including inflation (Tab: Step 1 Pre Super: B12)? Or does your calculations replace the full yearly post tax income?

Appreciate the guidance and keep up the awesome work/blog

Hi Daniel,

Firstly, love the enthusiasm dude but please don’t make financial decisions based on this calculator!

It has many flaws and you should always seek professional advice when it comes to such important things.

Onto your questions:

1. The pre tax amount is used when calculating Super amounts. The post tax amount is used when calculating your savings rate.

2. It does factor in inflation. When you reach FIRE, your portfolio will theoretically replace your monthly expenses while also factoring in inflation.

Thanks for the encourage dude 🙂

Will do!

Great article.

My wife and I have been looking for tools to help us make informed decisions about how much we’ll need to save to have the option of retiring early, and have been using the 4% rule as a default.

It’s great to find a tool designed for the Australian context.

Thanks for making it available

This is a great tool and gives a great insight into a solid retirement plan. I noticed when u submit an email u get currently get version 1.2 of the spreadsheet, a friend sent me link to version 1.4 he found on Reddit. Is that an unofficial biuld? It has extea data and workings tabs to see how it allocates funds over the years

Hi Chito,

There have been a few people out there that have modded my original calculator. It was most likely one of those ones.

There are some kick-ass ones I’ve seen. Maybe I’ll add it to the official build one day.

The most single important assumption in your model would be the Super Preservation age. Although the current table shows everyone who was born after 1964 will be able to access their Super at the age of 60, I notice the age tends to increase by one year for each age group with the same one year older. Do you think there is a possibility that the Super Preservation age may continue to increase over time? If so this will make a big difference for younger generation aiming to retire early and how the want to invest.

I’d say it’s almost a certainty that the government will raise the age. This will impact us FIRE chasers who will be relying on Super as part of their plan. If that was to happen, you would need to readjust your strategy to fit. No different to if something drastic happened in the markets when you retired. You might have to recalculate your position.

Hi AF

Thank you so much for this, and for all the info you’ve generated on FI. I’m with a DBS scheme for the majority of my super (a hangover from when I had no idea about money. The majority of my super payout will be calculated based on a formula, not subject to compounding interest as per usual super. Not ideal for someone on a path to FI). Is there a way I can input this added lump sum payout at preservation age into the calculator?

Thanks again!

Hi Hannah,

I have stopped development on the calculator but others around the internet have continued it. Check this one out. Maybe it has those options you’re looking for.

https://docs.google.com/spreadsheets/d/1e62XU47vq3PNZMT3YF7SC-EXxJPKa701QE-9MlSQI9c/edit#gid=1951821915

am already retired and when I put in my details it just gave me the current date and nothing else to do with it.

Hi Ken,

Can you send me an email with a screenshot mate. [email protected]

Cheers

also the calculator only showed the cash I have for the start. the super I have was wrong as it was not used. only the cash was used to draw your graps.

Please send me calculator and keep me in the loop. Many thanks.

Hi Anna,

Fill in your email above and the calculator will be emailed to you automatically.

Hi Aussie Firebug,

I downloaded your calculator the other day, and I then made a yearly count-down to see how the balances would work year by year using inflation adjusted future values. When I use your example values saved in the FIRE calculator, in my calculation the money would run out too early during the FIRE period before gaining access to super at 60. And also, the super balance would not last as long as what your calculator suggests.

I have been digging deep in trying to understand where the difference comes from – because my calculator shows future values and yours shows present values, it is not very easy to work out.

However, one question springs to my mind about the way you determine that $1.5M is needed for super balance at age 60 by using the PV function and 4% rule. The function is using the 60K withdrawal value to determine that $1.5M is needed in 23 years time. Shouldn’t that $60K be first adjusted by yearly inflation so that you would use the withdrawal future value?

Anyway, if you were interested, I’d be happy to send my spreadsheet to you in case you could explain the difference between the calculations.

Regardless, your calculator has been a great help in getting me thinking about all sorts of retirement aspects, so thanks heaps.

There is a cell in there somewhere which has inflation. This number is used for all calculations. So while the actual number will look different in the future (much larger due to inflation) inflation has already been factored into everything. It’s a bit to get your head around but it is in there.

Thanks Firebug – yes I worked it out eventually. In my calculation I was supposedly using future values, but was actually using present value for one part of the calculation, so no wonder it wasn’t matching! And whilst in the middle of it all, I even got muddled up the present and future values in your spreadsheet. However, now that I got it, I must say that I really like your calculator. It illustrates the main points in the timeline very well. It is a good starting point, and after this I am much more able to explore the more complicated issues like effects of tax and limits in salary sacrificing and what not! I feel much more confident and empowered now with my plans for future.

Thanks mate you sharing this. Can you explain the household income post tax per year (your youtube clip does not have that row). if I make this amount more the “how long in years will it take you to reach FIRE” increases. I thought that the more post tax income would make my years to FIRE decrease. Not sure if I am doing something wrong?

Again thank you for sharing this tool

Hi Aussie Fire Bug,

Thanks for this calculator first of all! I’m also curious as to the above question – it seems that my time to FIRE is reduced when my post-tax household income is smaller?

Cheers,

Tom

Hi Tom,

If your household income increases but your savings stay the same. The calculator issues that you have increased the amount of money needed to maintain your lifestyle and thus increases the years for you to FIRE.

The reverse is also true.

If you decrease your post tax income but keep the amount you’re able to save the same, the calculator now assumes you need less money per year to maintain your lifestyle and thus reduces the amount of time to FIRE.

I hope that makes sense mate.

Cheers

Hi,

I have received the master calculator in my email but after I save it as an MSexcel file, I still can’t make any edits to it.

Can you please tell me where I might be going wrong

Cheers

Try to save a copy to your Google Drive account. You will be able to edit once you save your own copy. Hope that helps

Hi. The email/download link doesn’t seem to be working at the moment.

Yes – I haven’t been able to receive it either.

Hi Amanda,

What’s your email? I’ll send it to you.

Hi

Thanks

[email protected]

Hi Mark,

Seems to be working for me. What’s your email? I’ll send it to you.

Hi. I’m trying to access the calculator and also your email updates. Have entered email details a few times and using different browsers. Even though it says success I don’t seem to be receiving anything…

Hoping you can send through to me and add me to your distribution list?

Hi Cara,

I checked your email address and it’s in my system since Nov 7th. But it is reporting that all emails are being bounced..?

Send me an email to [email protected] and I’ll double check I can send you mail.

There may be a spam filter or something at your end.

Hey mate,

Step 2 Super -> cell B7 =PV(‘Step 1 Pre Super’!B10,’Step 1 Pre Super’!B17-1.71,0,-B5)

What’s with the 1.71 years?

Ugh… it was so long ago I made this calculator. It has many flaws.

Going back over it briefly now, I recall something along the lines of it being really hard to work out the sweet spot for when your Pre super number reaches enough and your Super number has to kick in. My functions weren’t perfect and I think for the main purpose of the master file, I may have added a little to that cell to make the periods a perfect ’20’ instead of 18.something.

That’s all I can recall sorry.

Probably doesn’t help lol

Hey mate, any chance you figured out the reason/workaround for justifying the 1.71 years?

Literally every single can be justified except for this 1.71 figure, and I want to really understand it.

Thanks so much!

It’s been so long but I might have another look and see why it’s there.

That’d be awesome if you could! It’s a really great calculator, but I know that 1.71 will bug me for forever if I’m not sure I know why it’s there haha.

Also just of curiosity, do you still use this calculator? You mentioned that it’s been so long, so I wonder if you use a different one now?

I don’t use it at all!

The main point of the calculator was to show the math behind the most optimal way to invest for FIRE. And that is a two-phase system for Australians.

But life doesn’t work like a spreadsheet and while it can guide our journey and show me what’s mathematically possible, we tend to take a more realistic approach for reaching financial independence. We don’t want to do the drawdown method and that means we will only build up our snowball outside of Super.

We’ll pay more tax as a result but that’s the method that works best for us psychologically.

Mate, this is fantastic! Love your blog and realising how effortless achieving FIRE can be!

Quick question, after I reach the pre-super number, you say these savings are used to last until preservation age? But at the same time, all of my income goes into my super account for 3 years to ensure it grows to the accurate number at preservation age right? So i’ll need to continue to work for a few years after I achieve the pre-super number and live off the interest and some of the pre-super savings each year?

Sorry if it sounds like a stupid question, just can get my head around it!

Thanks,

Kurt

Hi Kurt,

Your thinking is correct. You need to hit both phases to ensure FIRE.

But the thing is, while the above is the absolute fasted way to FIRE for Aussies, I’ll probably just build up my FI number outside of Super because they are always tinkering with the rules and once I’ve hit my pre Super number, it shouldn’t be that much longer for me to build it up outside Super.

This is a bit of a shame too because Super has a lot of tax benefits but the preservation age is a killer for FIRE unless you’re a bit closer to it than I am.

I wish they would let us access it earlier 🙁

Thanks for getting back to me so quickly!

Your thinking is similar to mine, I would rather build my FI number outside of super (which I should be able to do well before retirement) so I can use it earlier, then have the luxury of some extra funds waiting for me when I turn 60!

Looking forward to continuing the quest for FIRE!

Kurt

Managed to down load the calculator but unable to fill in the cells.

Need advise thankyou

Hi Wayne,

You’ll need to make your own copy in Google sheets or use the Excel document if you want to edit the calculator mate.

Cheers

thanks, I didn’t notice the allow editing on the excel sheet.

You need to download a copy for yourself mate. Or use the attached Excel spreadsheet

Hello.

I like the potential in your calculator.

But, in playing around with the calculator, it appears to me that the Interest Made on the Pre-Super Deposits doesn’t account for the annual income tax payable on the interest which would affect the capital growth rate. Am I right?

I know you’ve already noted the absence of any allowance for concessional super contributions but I was wondering if it would be possible to include a nominal or marginal tax rate field for that Pre-Super Interest Made where it is not savings via superannuation contribution? …Especially for those of us who don’t live in a home that we own!

I appreciate that everyone’s tax circumstances are different, but an assumption that interest made pre-super, while still working, is not taxed is unrealistic and makes FIRE seem a lot closer than it is. It would be useful to visualise the impact of, say, a nominal tax rate on earnings.

Hi Grace,

Nice idea.

What you could do to tailor it towards your own circumstances more is reduce the expected return amount by a few basis points (or however much you calculate your personal tax situation would be) and go from there. Not perfect but better than nothing 🙂

Cheers

Great! But a question: how can this calculator take into account salary sacrifice into super?

Thanks!

It doesn’t have that ability to do that just yet. It’s due for an update though so keep an eye out.

Hi I just got this emailed, but I think there’s an error in the spreadsheet version I have. In B28-29 on page 1, B14, 15-18 on page 2 and B4, 6-9 on page 3. Please help I really want to sort this out for myself! =D

Cheers

Sorry I figured it out it was just the date input wanted a written date

Hi, great work on this calculator exactly what I was looking for! I’m a beginner investor and I had a question around the growth rate field. Is that intended to just reflect capital growth or to include things like dividend payments? Do ETFs and LICs on average return 8-9% inclusive of expected dividend returns or is it prudent to forecast dividends at a different rate?

Great work on all this by the way!

No worries mate.

That return rate should include absolutely everything. Capital growth, dividends, franking credits, currency gains etc. Shares have historically returned ~8 percentage before inflation.

Cheers

Thank you!

Hi afb, just one other question! 🙂

Is that 8% also inflation adjusted?

Thanks!

No

Thank you! 🙏🏼

Hi AFB. Is the 8% also before any CGT or tax considerations? Will I need to factor that in too? I’m assuming it is already inclusive of CGT as the calculator uses a post tax estimate yearly incomes and expenses?

Tax situations are not accounted for in the calculator. It was too hard to build in all the different scenarios so you will need to adjust the numbers to suit your circumstances.

Thanks for this! The best Australian-based calculator there is.

Gracias Amigo!

You really make it appear really easy with your presentation but I to

find this matter to be actually one thing

that I believe I might by no means understand. It kind of feels too

complex and very extensive for me. I’m looking ahead to your

next publish, I’ll try to get the dangle of it!

Have you watched the YouTube vid? That helps a bit I feel

I get it now (after reading through the comments) 🙂 – you continue working after the pre-super number is reached, and you live off your saved amount pre-super and put your whole income into super until you reach your super number. Then you can finally FIRE!

Hey Firebug, this is awesome.

I am curious, is there some logic behind saving the pre super $$ first then putting money into the super to get your post super number?

Maybe it is possible to calculate an amount to voluntarily contribute to super such that the dates are the same, this would bring the retirement date forward a bit I think maybe

Hey Tinka, you can account for salary sacrifice by working out your percentage of contributions and adjusting the 9.5% figure in the spreadsheet. For example if you’re on 100k, your employer puts in 9.5k and you SS an additional 15k, then your effective contribution is 24.5%.

However this will almost certainly push your date back as you are reducing your ability to build the wealth outside of superannuation which is intended to allow you to retire early and live from until your preservation age. I am planning to stop SS for this reason so if anyone sees a flaw in my logic, please let me know.

Just wondering what the life expectancy that is presumed in the calculator. From what I can work out I think it has been set at about 83 years of age. Is there a way to adjust that presumption. Thanks

Ahhh not sure I’m following this one mate. Which cell are you referring to?

This is so motivating. Suddenly I can see when I will be financially independent, and it’s not that far away, and now that I can see the horizon, I don’t mind saving even more! Thanks.

Hi mate, I entered my email address a few times but never got the email. How can i access this calculator?

Never mind, I was able to receive it once i used my mobile browser

👍

Thanks Aussie Firebug! Really appreciate the time and effort you put in to create this. Bonus gratitude for sharing it freely. I’ve found this and your Net Worth spreadsheet to be really useful for helping me start my FIRE journey 🙂

My pleasure Big Nick

All the best with your journey 🙂

Hi,

I have a question. On the super phase, when the money potentially “lasts forever” , are you only drawing on the return from your super investment or are you gradually using up your capital amount ?

If you are not using up the capital amount, would it be possible to put in the calculator the option to retire using both the super returns and capital amount? (assuming you don’t want to live money behind to your family, etc). I presume you would achieve FIRE earlier this way ?

I also would like to know a bit more about what happens later on. Once you retire, do you leave your money on your super account or do you switch it to a more lucrative investment (if there is any?).

Also, I am not sure about the rules; once you retire and start accessing super, would it become tax free (instead of 15%)? And if so, does the calculator takes this in consideration?

Thanks !

Hi Deborah,

There are two phases. The first is getting enough outside of Super to last you until you reach your preservation age. The second phase is having enough in Super to last forever.

Once you reach the first phase, all your money is going into Super. Once Super reaches the point where it will compound to your FIRE number, you start living off your portfolio that’s outside of Super.

The calculator doesn’t factor in taxes, unfortunately (it was too hard to model for).

Hope that helps 🙂

Hi Aussie Firebug, thank you so much for sharing this calculator and also your knowledge to help others achieve FIRE. You’re a good example of how FIREd people can create value by helping others outside of the traditional jobs.

I have some questions I hope you can clarify for me:

1. Am I right to assume that your calculator calculates the numbers based on TODAY’s $ value? I see that you calculate interest by deducting the growth rate by the inflation rate. Does this mean that I should be looking at the age at which I can retire instead of the numbers because the numbers will be much higher when I’m odler. In this case, let’s say my Super has to be $1m for me to live off it forever, but actually that $1m is in today’s dollar value, so could potentially be $1m * 3%^years if I want to determine the actual number to FIRE?

2. Your calculator suggests that between hitting our pre-super number and FIREing, we should put all income into our Super. I’m assuming you didn’t take into account the tax on the amount of contributions above the general concessional contribution cap? It’d be something for me to consider if this is the case.

Thanks again Firebug!

Hi Hamlet,

Thanks for the kind words, I’m glad you’re enjoying the content 🙂

1. Inflation is accounted for throughout the calculator. But you’re right that the numbers are shown in today’s dollars where in reality they will look different in the future (greater returns but also greater expenses). But the inflation cell should account for this anyway.

2. I have a disclaimer in the calculator on the first page that says I haven’t factored in tax and I agree that you ideally should first SS up until the max and then dump the rest outside… but it was too hard for me to model for different tax situations so I dropped it.

Hope that helps mate 🙂

Hi mate, I believe there is an error with a formula in cell B9 within tab “step 2 super”. The formula calls for cell B24 in tab “start here” (total yearly wages after taxes). Instead, I think it should reference the cell B25 in tab “start here” (total yearly savings), because this is the amount that can be contributed towards the super. As is, I think the calculator underestimates the number of years to FIRE.

What are your thoughts mate?

Hi AFB,

Thanks for all the amazing work!

I’ve one suggestion for your consideration. I think that this calculator is overestimating the numbers by calculating on the basis of real growth only i.e. growth – inflation rate. For instance, say growth is 8% and inflation is 3% which means real growth is 5%. Now consider below 2 simple scenarios for investing $100 for 1 year:

Scenario1 (Based on real growth only as it’s in your calculator): 100*(1+5%)=105$

Scenario2 (Based on growth and inflation separately): 100*(1+8%)/(1+3%)=104.8$

Would love to hear your feedback on above.

Thanks & Regards.

I cannot thank you enough! This is exactly what is missing for Australians when we have to calculate when we can retire.

Thank you, thank you, thank you.

Thanks so much for all the work you’ve put into creating and maintaining this calculator – it’s really helpful!

I have one quick question. I’m receiving a small payrise in the next couple of months and when I update the post tax income amount, the number of years to retirement increases, however in reality this would decrease for me as I could save even more money. Is this because the amount calculated that is required for living expenses is based on the post tax income amount? If so, would it be possible to make the yearly living expenses a field that you can do an optional override on so that we can adjust our living expenses and see what impact this has on the end result?

No worries Sarah and your assumptions are correct.

If you’re earning more money but don’t adjust your savings cell, the calculator assumes you need a bigger portfolio to maintain your increased lifestyle and therefore adds on years until retirement.

The easy thing to do is to adjust the amount you can save.

I hope this helps 🙂

Cheers

Hi FB,

I think I disagree but I’m not smart enough to know if I’m right lol.

Tell me, how can you get to your FIRE goal as soon as possible if you’re also putting money into your super? If you’re putting extra money into super, assuming until you can self manage it, this means your putting less into your FIRE portfolio and hence increasing the amount of time to reach FIRE right?

Secondly until you can self manage your basically just throwing money into the abyss and hoping it works out well seeing as super options are pretty basic and vague.

My plan was to completely ignore super. Just work on reaching FIRE goal and living off that via the MMM way. Once super is reached, I’d consider it a bonus.

I don’t know if I’m right or not as I’m fairly new to all of this and have never been that good with numbers.

Also as an aside I’ve seen a lot of these calculator’s but have not seen many calculators for post FIRE to work out how much money your actually left with after income and capital gains taxes from dividends and selling off some ETFs. Do you know of a good one that exists for Aussies?

Thanks for this! So easy to input and play around with numbers as well as interpret the calculations.

Is there a simple way of calculating known leaner savings/regular contribution years?

E.g. upcoming maternity leave will likely result in no savings for that 12 months; then once at school age, plans to reduce work hours will change potential savings rate. I can change the Pre-Super deposit amount but this has no flow on effect on interest, savings and balance totals.

No worries Sarah 🙂

The calculator is not that sophisticated I’m afraid.

Thanks for the calculator!

I think that if the strategy is changed to do Step-2 before Step-1, your time to reach FI will definitively be much shorter.

The reason is the tax advantages of super and the fact that your super money will have more time to compound than your out-of-super investments. What do you think?

For most people that would be correct. I’ve address these concerns on the first page of the calculator but generally speaking you’re right.

Hey man thanks for your template, but there is 1 thing i am not sure how to reflect this.

For example, I have 2 properties and 1 is invenstment and 1 is my own living, and for my investment, this is paying by the teaneant, the rest is paying by myself, so some of my living expense going to the equity build up, how do i reflect that? Since I am not going to hold the invenstment property forever

But on the sheet this is reducing my saving ability

Well done, great effort.

I’m wondering if you’ve implemented the ATO limits on super eg maximum $110,000 non-concessional contributions per year ($330k with 3 year bring forward) or concessional limit of $27,500 and 15% contribution tax. Also the General Transfer Balance Cap currently $1,900,000.

I tried to check your formulas but even with the named ranges the excel formulas are difficult to read.

I have not.

Modeling for taxes was too hard (too many different situations), and I ran out of time. There’s a note in the calculator that addresses it, and I think a few other people have remade my calculator to include various situations.

I guess my major contribution was the concept of two pots (inside and outside Super). I can’t recall anyone in the FIRE community discussing it in detail prior to this calculator.

in my situation I am getting 11% super from my employer and salary sacrificing to 15% does this calculator still work if I put it on 15% knowing I will get taxed in my super for the extra I put in? I want to leave it at 15% and then save hard buy shares and a home I have 200k in super and it does not look that bad the way I calculated it and it shows I could retire in around 4 years but I do not know if I just invest in shares for longer stay working until I have enough for a home then keep investing if I need to until I have a home and enough to live off until retirement.