by Aussie Firebug | Apr 15, 2024 | Net Worth

I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

We officially launched the co-working space in March.

This was a big moment for the team. After dreaming about it for over 18 months, it was very cool to see our vision come to life.

Something unexpected that crept up on me was the almost full-time nature of this venture. I’ve been at the space nearly daily, ensuring everything runs smoothly and doing walkthroughs for potential customers.

For someone who hasn’t needed to leave the house for five consecutive days in almost four years, it’s been quite exhausting, to say the least 😅😮💨.

It’s been a stark reminder of how draining a full-time job can be—even when it’s just working on a computer, for heaven’s sake!

Honestly, I’m tried just thinking about how most people manage five days a week, non-stop, for over 40 years, dealing with kids and everything else 😴.

Physical activity was one of the first things to suffer when we opened up. Since then, I’ve only managed to hit the gym once a week, which isn’t a great habit to fall into.

We’re working on a solution by trying to arrange for two university students from the area to help run the space. In exchange, they’ll get free study space for the year. This should free up some of our time, and I’m hoping to get back to spending three days a week on my data business.

In other news…

I’m looking forward to dedicating more time to AFB content in the upcoming months. There are a few podcasts currently being edited and plenty of unread emails, but my family and other ventures have been my priority these past few months. I promise new content is on the way soon.

Thanks for staying patient 🙏

Net Worth Update

Another exceptional month for BTC, accompanied by strong performances from stocks and Super, resulted in a fantastic month overall.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

I had some big bills to pay for the business but our lifestyle expenses were very low in March.

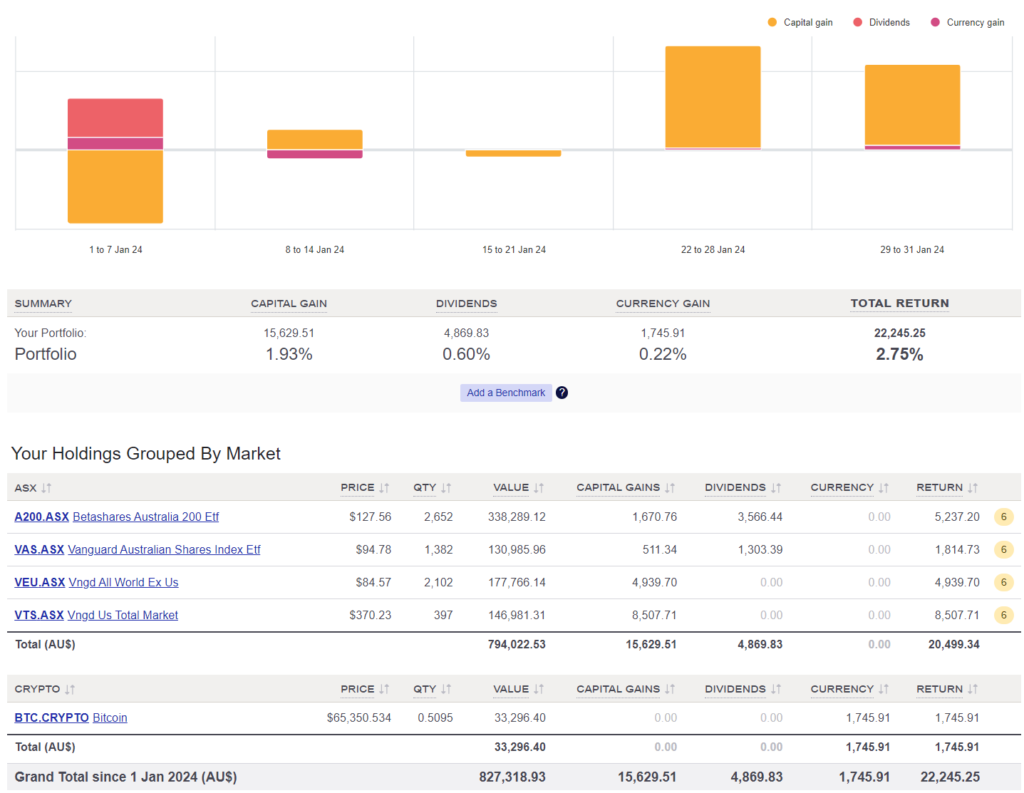

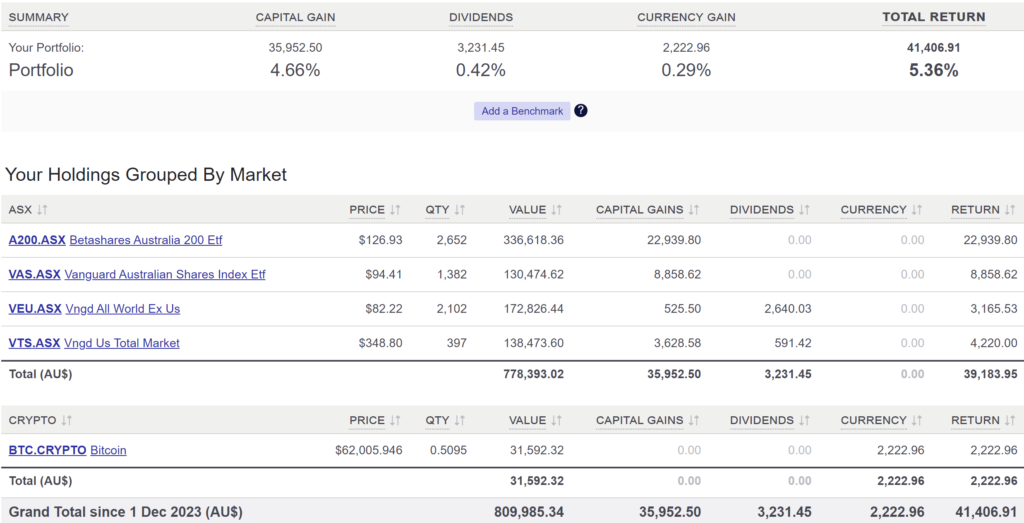

Shares

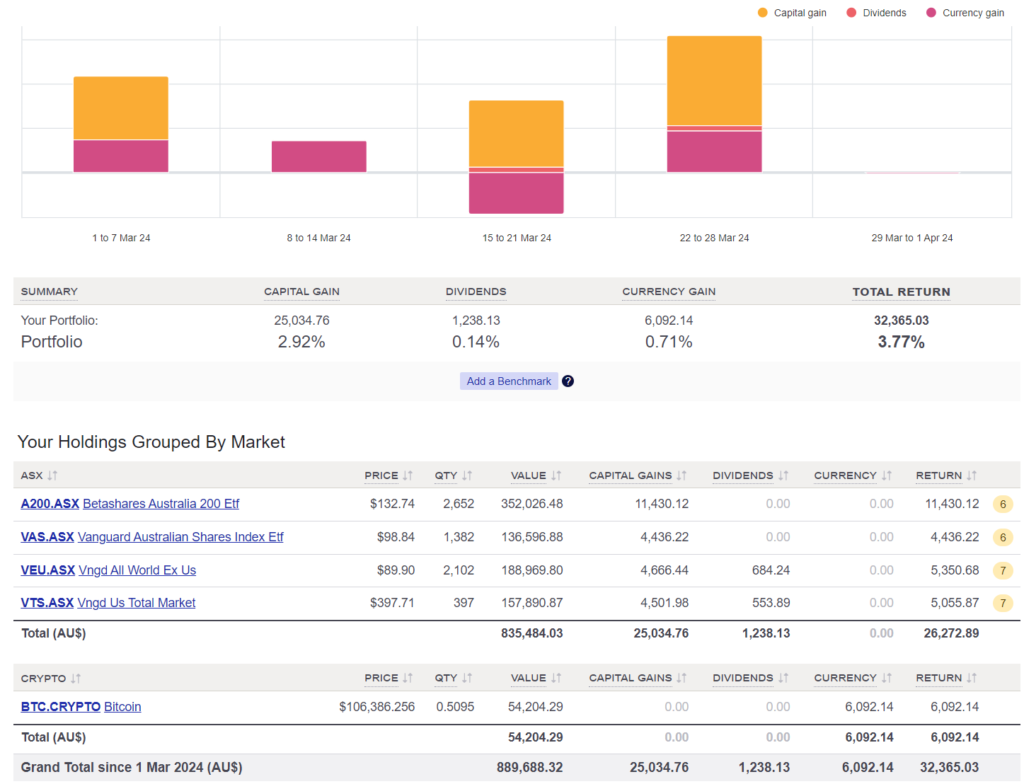

The above graph was created by Sharesight

Some nice dividends were announced in March which will hit the account in April.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | Mar 9, 2024 | Net Worth

I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

First off, I want to address a mistake from last month’s update.

I forgot to record the sale of 87 VTS units on 08/12/2023 in my personal spreadsheet during an extremely busy December period. Although it was recorded in Sharesight, I forgot to add that sale to my Google Doc File, which is where these updates are ultimately calculated.

I’ve updated the February figures, and all future updates will now include the VTS sale.

Special thanks to Pat and David for spotting the discrepancy and bringing it to my attention.

In other news…

I’ve been pouring my weekends into making our co-working space dream a reality, and we’re almost at the finish line for our big launch in April!

This project has been so much fun.

I’ve gone into business with one of my best mates, and we’re both building this dream to address a core problem in our lives.

We work from home and want to connect more with other creatives in our community.

The best part about this project for me was the incentives from both parties involved.

Of course, we need to cover our costs, and turning a profit would be a bonus, but what truly matters is creating an amazing communal working environment for us and other locals. At this point in our lives, this pursuit holds greater value than any financial gain.

And that’s the cool part. We are both in a fortunate position (financially speaking) to start pursuing fun and fulfilling projects that ignite the soul.

We worked all weekend last week, but it didn’t feel like work at all. I was with one of my best mates installing sound baffles, pumping Kanye on the speakers, talking smack, and dreaming of what this place could turn into!

If I think back to my previous ~10 years in the corporate world, work was never this fun. Ever!

On the other hand, I’ve hardly had any free time in the last two months (the podcast is coming back soon, I swear😅).

Between my Data business, the co-working dream and tending to my 5-month-old daughter… it’s been a tad hectic.

But at least we have secured our first member at the space 🥰.

Net Worth Update

Another big month for all our assets across the board, especially BTC.

BTC has surged to occupy more than 5% of our portfolio, a significant jump from its initial position of less than 2%. This year, it’s seen an incredible rally, and it’ll be fascinating to observe its trajectory in 2024, whether it continues to climb or perhaps takes a dip.

We don’t have any hard rules about when we would consider selling off part of our BTC split.

From the beginning, I’ve always said that I’m looking forward to actually using our BTC one day and not just hodling it indefinitely.

But I can’t lie… If BTC truly went to the moon, I would, at some point, have to reconsider our strategy and potentially sell some of it down to rebalance the portfolio. It would need to get up towards 50% of our portfolio, though, so it’s a long way off.

That’s only in an environment where I couldn’t spend BTC directly.

It’s a shame Tesla stopped accepting BTC as payment a few years ago. We would have legitimately considered paying for the new Model Y in BTC instead of fiat.

Maybe Musk will bring that feature back one day 🤞.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

We had a pretty low month expense-wise, but I spent quite a bit of the company’s money onboarding my first staffer, which was exciting!

The demand for data engineering work with government departments continues to grow, and onboarding some help was part of my overall dream of having a small local data team.

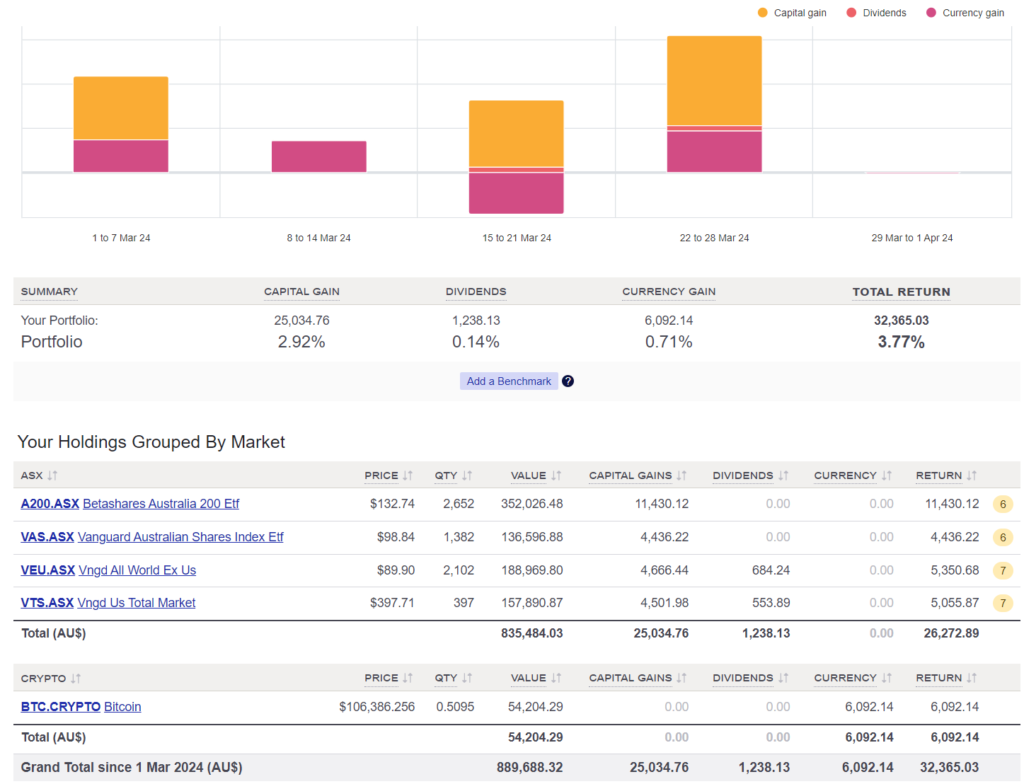

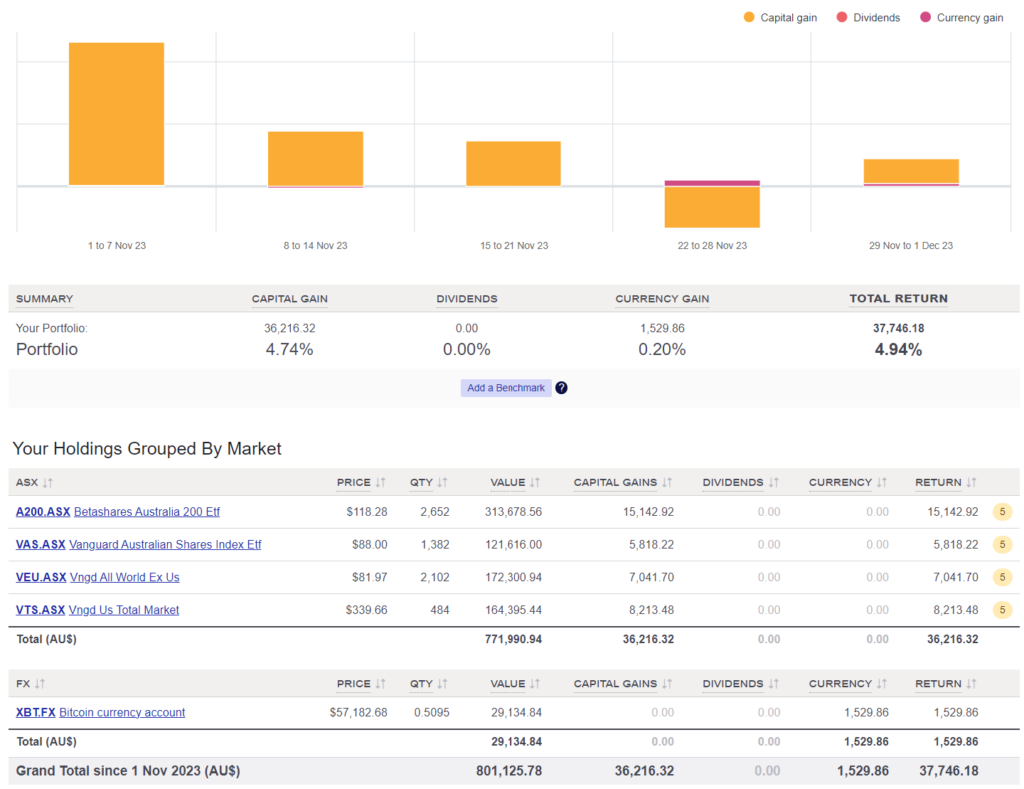

Shares

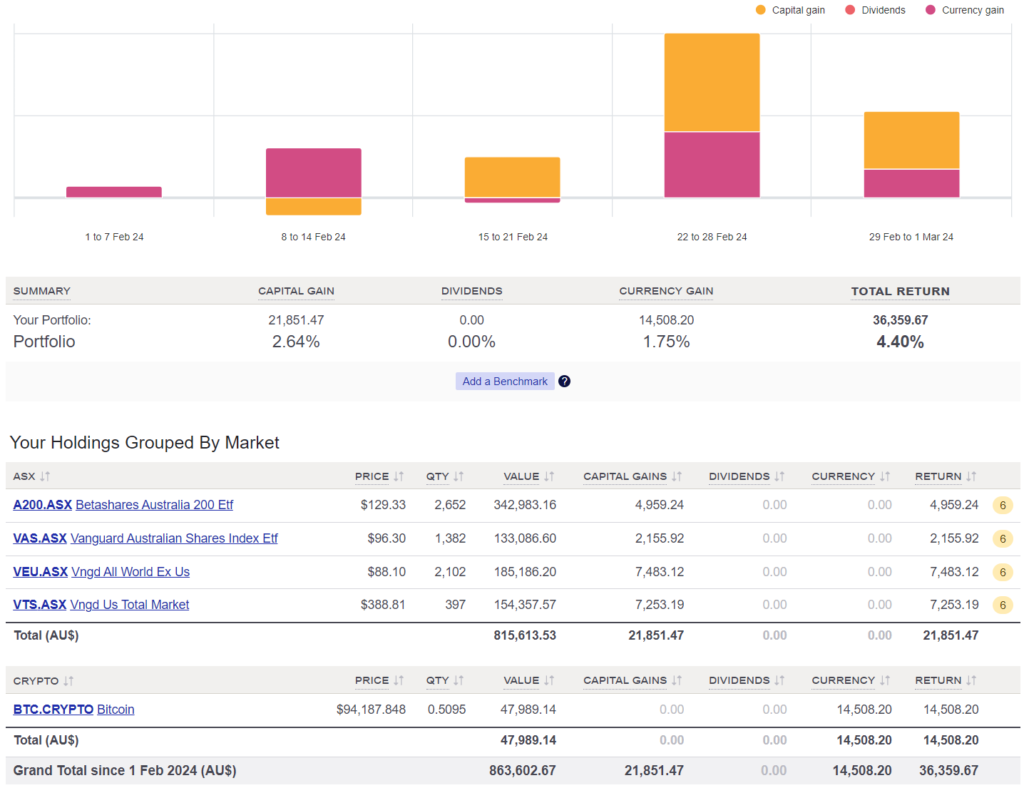

The above graph was created by Sharesight

It seemed like the whole world was on the rise in Feb.

Huge returns across the board.

We did not buy any shares in this month.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | Feb 4, 2024 | Net Worth

I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

*Updated 08/02/2024: There was a miscalculation for this update that was originally published. I’ve updated the title and numbers to be accurate. The oversight was due to failing to record the sale of 87 VTS units on 08/12/2023 in my personal spreadsheet during a busy period, which has now been updated for accuracy.

I’m not one for making New Year’s resolutions, but if there’s one area where I really want to improve in 2024, it’s getting stuff done now and not later.

“Tomorrow is often the busiest day of the week.” – Spanish Proverb

This quote really hits home for me. It perfectly captures how I often catch myself thinking, “Ah, I’ll just do it tomorrow,” but then, before I know it, four weeks have flown by and it’s still not done.

I’ve made it a real priority to just do the bloody job (whatever they my be) today and don’t push it out unless it’s absolutely necessary.

I used to stroll by the weeds sprouting in my garden, always telling myself, “I’ll tackle that over the weekend.”

But this year, I’ve changed my tune. Now, the moment I spot them, I simply bend down and yank them out.

Starting off strong is key for me. I make it a point to pick out a couple of tasks in the morning, be it something on my laptop or just tidying up around the house, that I know I can knock out fast and easy.

It’s all about building that initial momentum. Once I’m on a roll, it’s easy.

This productivity hack does have its drawbacks… it’s harder to kick back and relax since it feels like there’s always something on the to-do list.

I’ve wrestled with this dichotomy my whole FIRE journey.

I want to reach financial independence so I can relax and prioritise all the other non-working aspects of my life. Yet, I can’t help but feel like I’m squandering an amazing opportunity if I’m not being productive.

One thing’s for sure… procrastination is no friend to either goal.

Another NY reoslution I’ve made that’s done wonders for my productivity (and probably hygiene) – no phone when I’m on the throne.

It’s unbelievable how much time I waste scrolling on my phone when I’m on the loo. It’s also kinda gross as well 😂.

Net Worth Update

The share market had another great month In January which propelled the NW to all time highs.

We saw a pretty hefty chunk of cash go out the door, thanks to a few pricey buys we needed for setting up the co-working space. I’m not including those in our ‘expenses’ chart below since they weren’t about keeping up our standard of living. Instead, they were one-off purchases tied to getting the new business off the ground.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

.

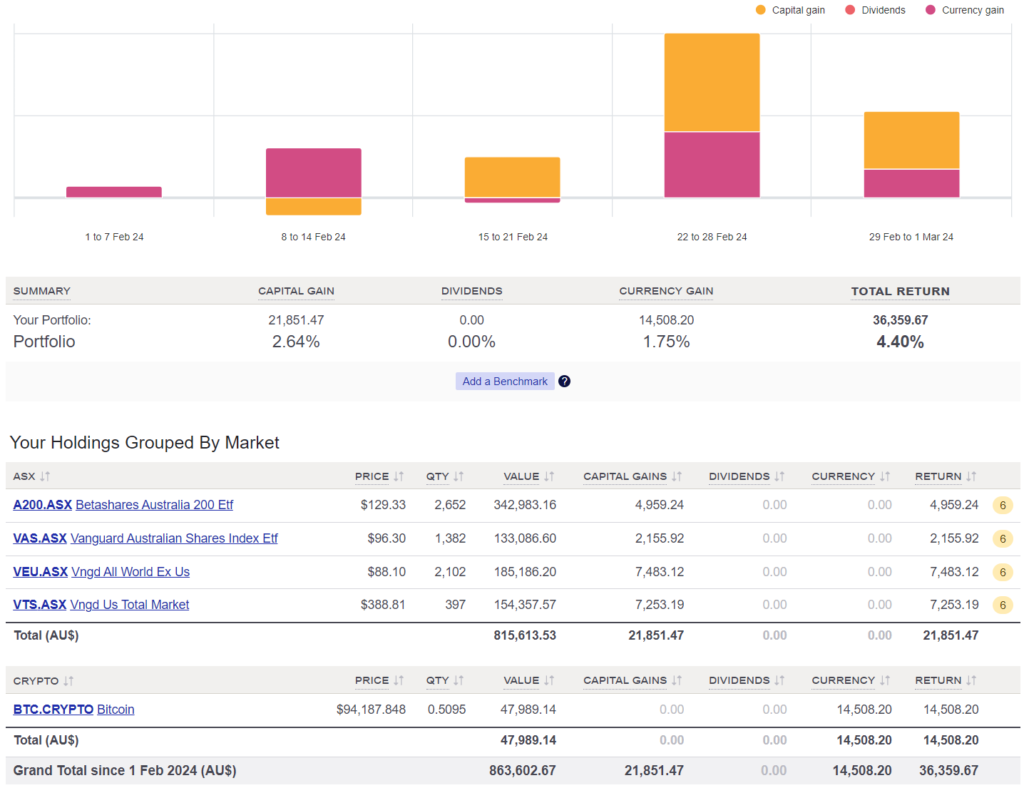

Shares

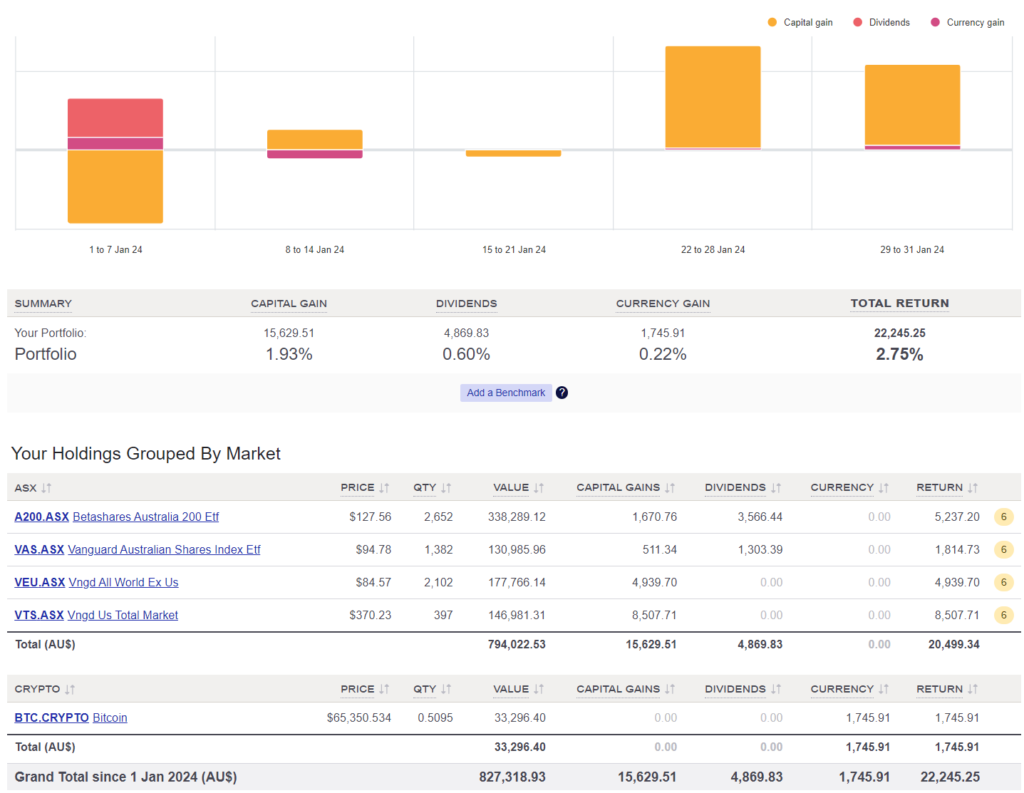

The above graph was created by Sharesight

Seeing nearly $5K in dividends come through in January was definitely a welcomed sight.

I found myself mulling over our passive income setup recently.

We’ve got five days each year that we really look forward to. There are the four days when dividends get paid out, plus that extra special day when we receive our refund from the franking credits. And honestly, the wait between those five days never feels long. Just as one batch of dividends lands in our account, it feels like the next payout is just around the corner.

I love this way to invest, especially from a psychological point of view. It’s like having a mini payday always on the horizon.

Passive investing. Simply amazing!

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | Jan 7, 2024 | Net Worth

I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

As a relatively new father of three months now, I feel compelled to write about a device that has significantly improved the well-being of both my wife and me.

And I promise I’m in no way, shape, or form affiliated with the company selling this product.

The greatest invention of the 21st century

The bad boy pictured above is called a SNOO, and it’s basically a smart device for your little bambino.

This thing is crazy:

- It has 4 different levels of ‘rocking’, which helps soothe your baby to sleep.

- It has a microphone to detect if your baby is crying (which can then increase the levels up or down depending on what pre-made settings you have assigned in the app).

- It has a speaker for white noise and a ‘hushing’ sound if your baby starts to get upset.

- The app tracks your baby’s sleeping patterns, which apparently is useful if you want to sleep train (we haven’t got this far yet)

But most importantly, it helps you and your partner get better sleep for the first 6 months, which is invaluable.

We got our SNOO second-hand for $800, which might sound like a lot of money (and it is), but good God, that sum seems laughably low compared to the value it has brought us.

Picture this:

It’s 4:30 AM, and you have been jolted awake by your baby’s cries.

You’re smack bang in the middle of some REM goodness and so tired you could nearly throw up. You’re just about to flick the covers off and rock your baby back to sleep when you hear the SNOO’s responsive rocking motion kick it up a notch and start soothing your baby.

You give it a minute or two, and, to your absolute astonishment, your baby goes back to sleep, and you get another glorious sleep cycle.

🙌

Words can’t explain how glad I am that we set ourselves up before having kids. Now, spending nearly $1,000 on a device like this doesn’t cost me a wink of sleep. I would have never done that in my 20’s and it gives me anxiety to think I would have forgone such a great innovation for the sake of getting ahead financially.

The SNOO has been a godsend for us so far, but I’ve also read that it bites you in the ass when you have to take it away… but I’ll take 6 months of sleep and then deal with the consequences any day of the week.

Good luck, future Firebug 😅

Net Worth Update

Santa came early for us share market investor in December.

A huge month for all asset classes to boost our NW to a record high of $1,283,257.

| Years End |

Net Worth |

| 2021 |

$1,038,417 |

| 2022 |

$1,171,120 |

| 2023 |

$1,283,257 |

We started 2023 at $1,149,655, which means we increased our net worth by $133,602 during the year.

But here’s the astonishing thing… we didn’t make any investments throughout the year, and we spent all of our dividends!

Yeah yeah yeah, I know 2023 was an exceptional year, but still.

The power of compounding is crazy!

We spent all our investment income, took two trips abroad, had a baby, didn’t work for six months, made no new investments, and yet our net worth still grew by over $130K — absolutely mind-blowing! 🤯

For anyone reading this who might be just beginning their journey, I have one message for you:

Keep going.

The snowball is so bloody hard to get going. But once it’s rolling, it gets easier and easier. And you get to a point where it feels like you’re playing this money game on easy mode.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

A pretty normal month spending-wise.

Shares

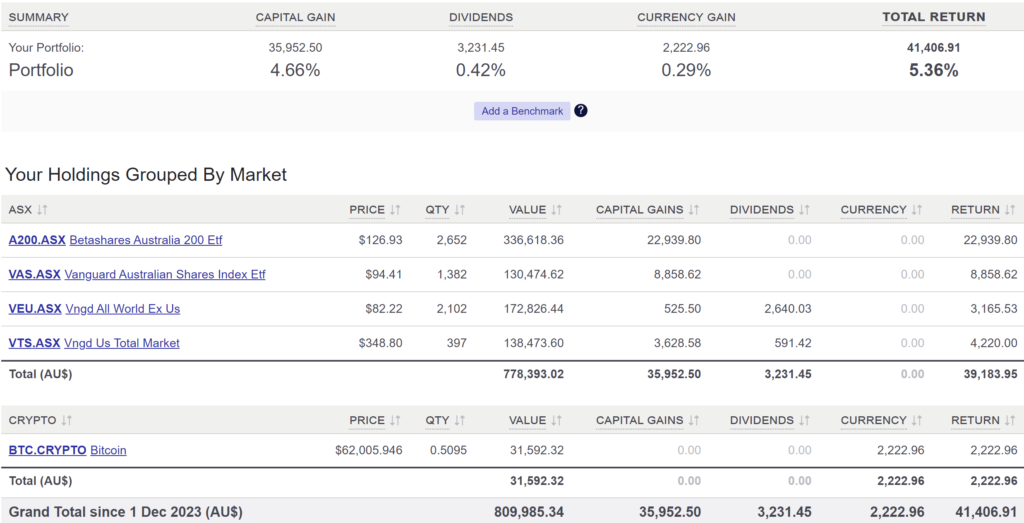

The above graph was created by Sharesight

For the first time ever, we sold a significant amount of shares in December.

We sold $30K worth of VTS to help seed our co-working dream.

We opted for VTS as it had become the most out-weighted holding compared to VEU.

I didn’t want to sell any of our Australian shares (A200 and VAS) because they will naturally decrease in weight over time as they typically distribute larger dividends.

Mentally, I struggled with the decision to sell such a significant number of shares, but I had to keep reminding myself what was actually important.

Do I care more about missing out on market gains, or is it more important to me to chase a dream?

Given that my family and I are in a comfortable financial position, I believe the above question is rhetorical.

The $30K is going to be used to help set up our space with furniture, management software and security management.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | Dec 21, 2023 | Net Worth

I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

We secured the lease for our co-working dream in November 🥳.

Our new Co-working space

This was the first step towards our goal of creating a community-focused shared environment for small business owners and entrepreneurs.

There are so many unknowns when you start a venture like this one.

- What’s the demand?

- How much do you charge?

- What are the ongoing costs?

- What type of permits do you need?

I thought adjusting to life without the stability and assurance of a full-time job was challenging enough. However, pouring money into such an unknown project tops it.

But here’s the rub: it’s so bloody exciting!

There’s a profound sense of fulfilment that comes from being in charge of your own destiny.

I’ve also noticed something very interesting when discussing this idea with friends and family. People love to point out all the things that can go wrong and rarely see the potential upside.

And it’s not like they are doing it deliberatively to be nasty. There seems to be an inherent truth about humans: our operating system is wired more to avoid losses than to actively seek gains.

Many people are comfortable remaining in their 9-5 jobs, contributing to their boss’s dreams, rather than taking the leap to pursue and build their own.

That’s not to say there’s anything wrong with the old 9-5. But I do wonder how many kick-ass products/services have remained unrealised because those capable of starting them were too risk-averse to take the plunge.

FIRE has given us the financial courage to give this a go without worrying about my family suffering if it fails.

And even if we do fail, the satisfaction of having a crack will remain. In the end, it’s the effort and the journey that counts.

Net Worth Update

Wowee!

What a huge month for our portfolio, Super and BTC.

This is coming off a three-month slide that saw our net worth decrease by over $76k!

That encapsulates the essence of the volatility game in the stock market. It’s the reason we earn the returns we do as investors. Not everyone can withstand these fluctuations, and those who can are rewarded accordingly.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Booking another Bali holiday for next year saw a spike in our spending in November.

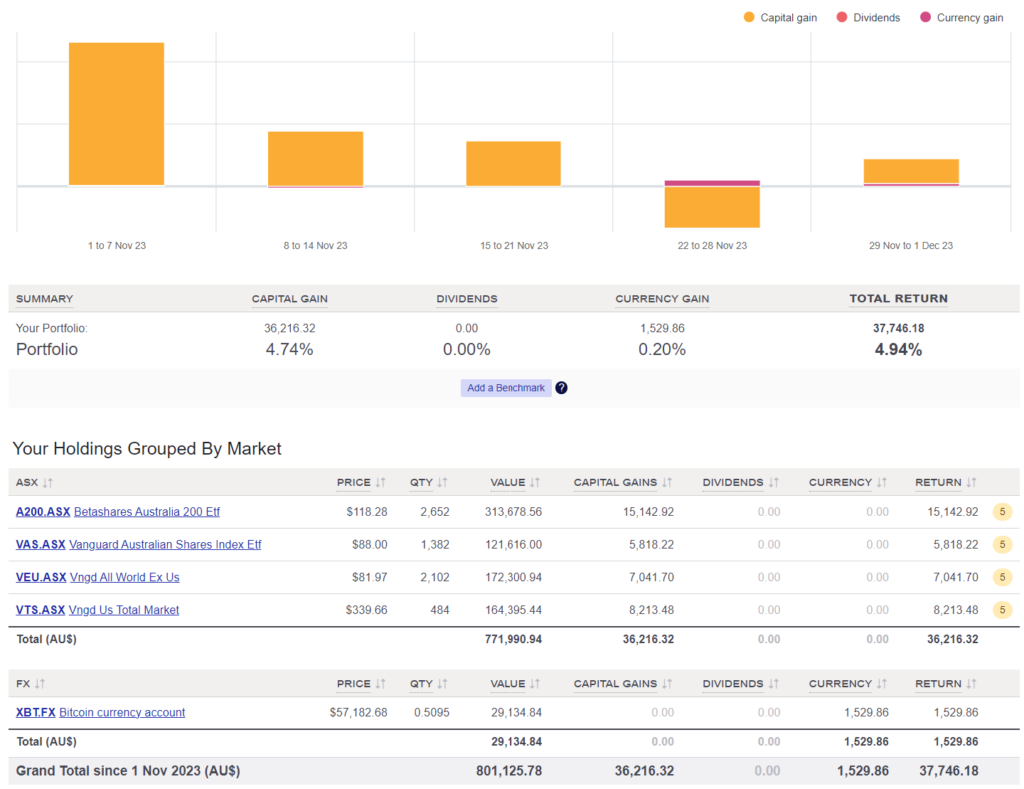

Shares

The above graph was created by Sharesight

It seemed like the entire world was on an absolute tear in November.

VTS has a whopping 5.26% gain in a single month followed by our Aussie shares (~5.05%) and then VEU (4.26%).

BTC continues to climb up and up increasing in value by 6.04%.

We made no purchases in November.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

Networth