by Aussie Firebug | Jun 6, 2022 | Classics, Investing, Tax

We’re on track to increase our wealth by $100,000 dollars over the next 20 years by strategically changing the use of our home loan.

Not by taking on more debt.

Not by changing our asset allocation.

Not by increasing our risk tolerance.

2 transactions were all it took for us to start deducting interest repayments on part of our home loan.

This is a strategy known as ‘Debt Recycling’ (DR).

This article has been on my mind for a while but I really wanted to go through the process firsthand before writing about it. There are a few different ways to do DR but I’ll just be covering how we did it because I don’t know all the nuances with the other methods.

So let’s break it down!

What Defines Debt Recycling

DR = Turning non-deductible debt into deductible debt.

In our case, we wanted to be able to claim our PPoR (Principal Place of Residence) home loan interest as a tax deduction.

Without DR you can’t claim interest from your PPoR loan like you would with an investment property (IP) loan.

How We Did It

*Please note that all the examples in this article will be simplified. Things like rate changes throughout the year, loan repayments and when we officially started DR will remain constant to make it easier to explain.

For simplicity purposes, I’m going to explain our method of DR without our Family trust. I’ll add in the family trust later so everyone who does have a trust can see how we did it but I want to make it simple to start with.

IMO, DR works best when you have a lump sum that you’re planning to invest anyway. That was the position we found ourselves in after we sold IP2 and had over $200K in cash.

We also bought our PPoR last year and I was planning to DR part of our home loan so I made sure that we split it into two parts.

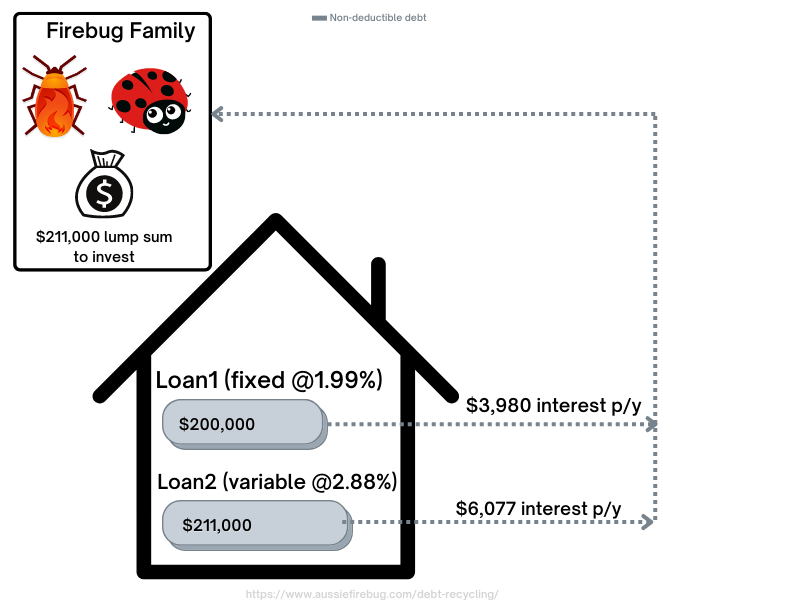

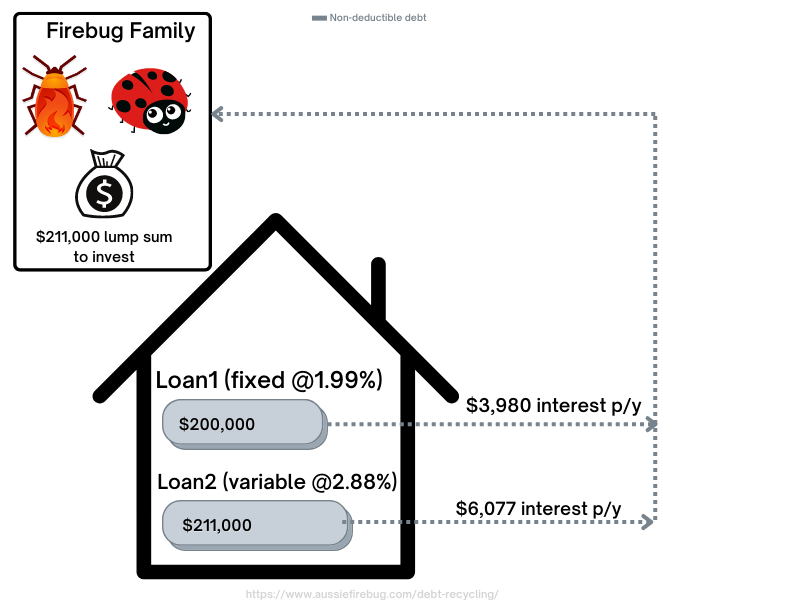

Here is how our situation looked before DR.

Before DR

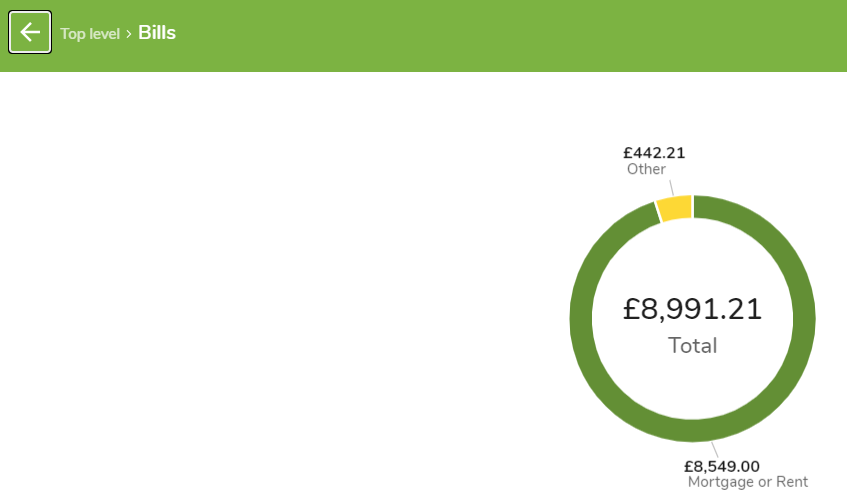

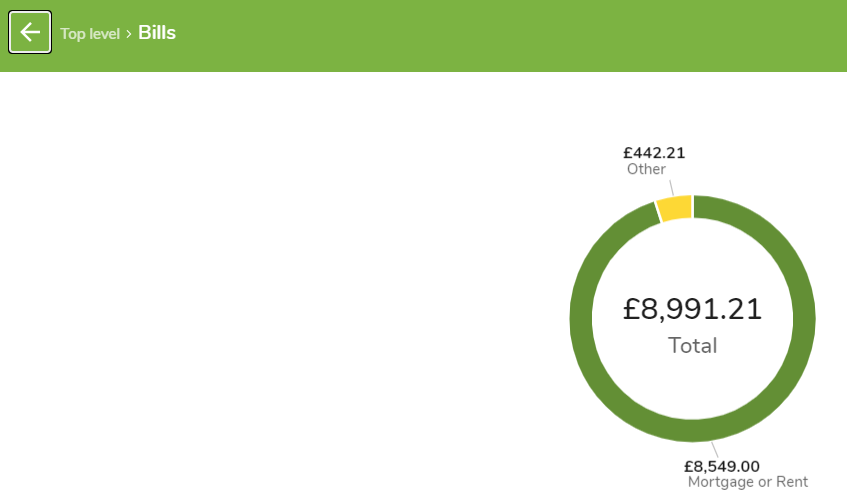

As you can see in the above picture, Mrs Firebug (Ladybug in the picture 😂) and I have to pay ~$10K of interest a year for both our home loans (which are secured against our PPoR). These are real numbers (sorry Melbourne and Sydney folk 🙈) when we first settled on our home.

We can’t claim that ~$10K as a deduction because the use of the borrowed funds were for our PPoR and not an income-producing asset.

We also have a lump sum of $211,000 from the sale of our investment property that we would like to invest.

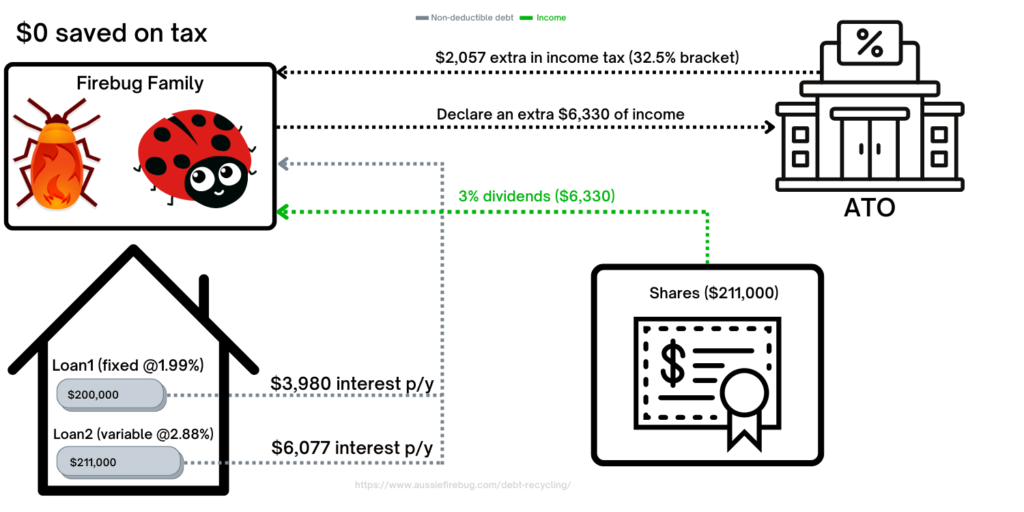

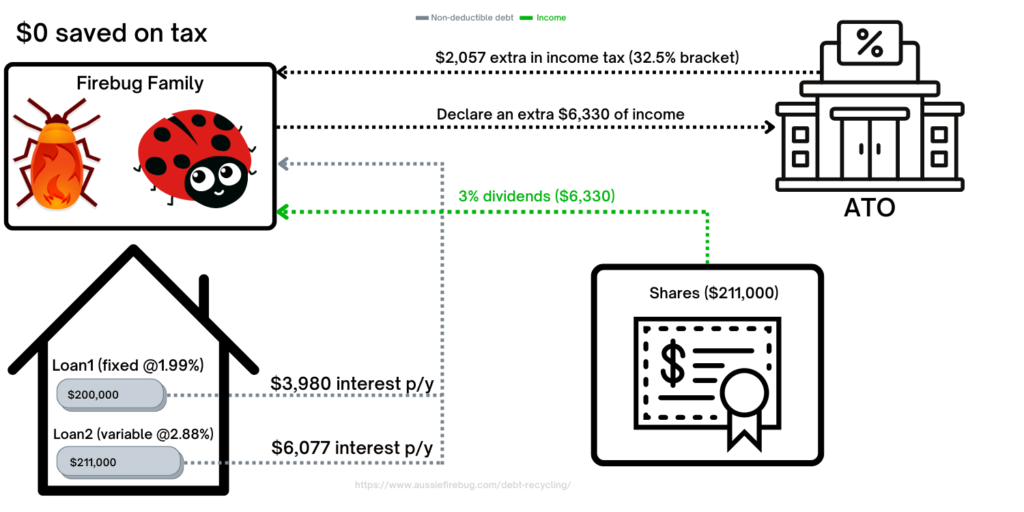

For illustrative purposes, below is how it would have looked if we skipped DR and just invested our cash in shares.

Investing without DR

There’s nothing wrong with the above picture but the Firebug Family doesn’t save any tax on their PPoR home loans.

The point of DR is to change the use of the borrowed money for deductions.

We were able to change the use of loan 2 by completely paying it down and then redrawing it out to invest in shares.

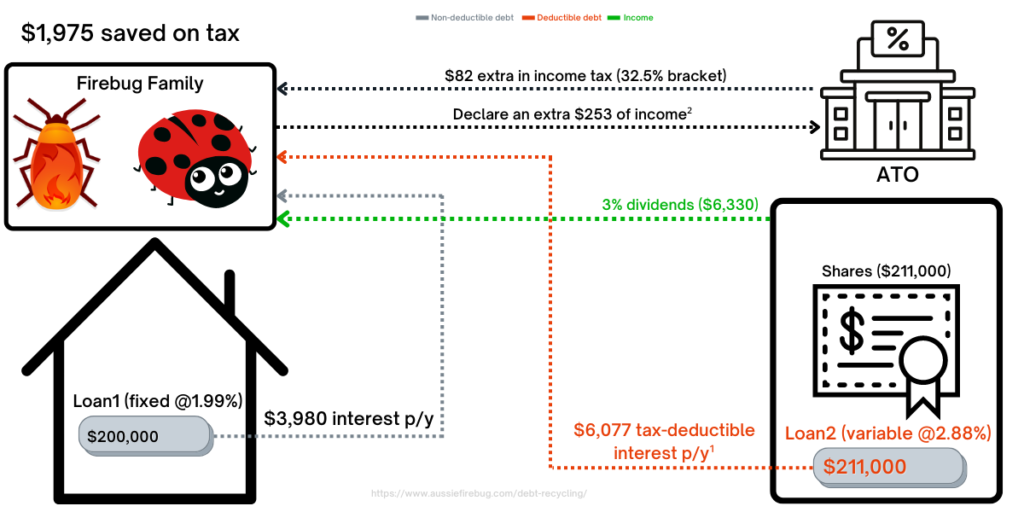

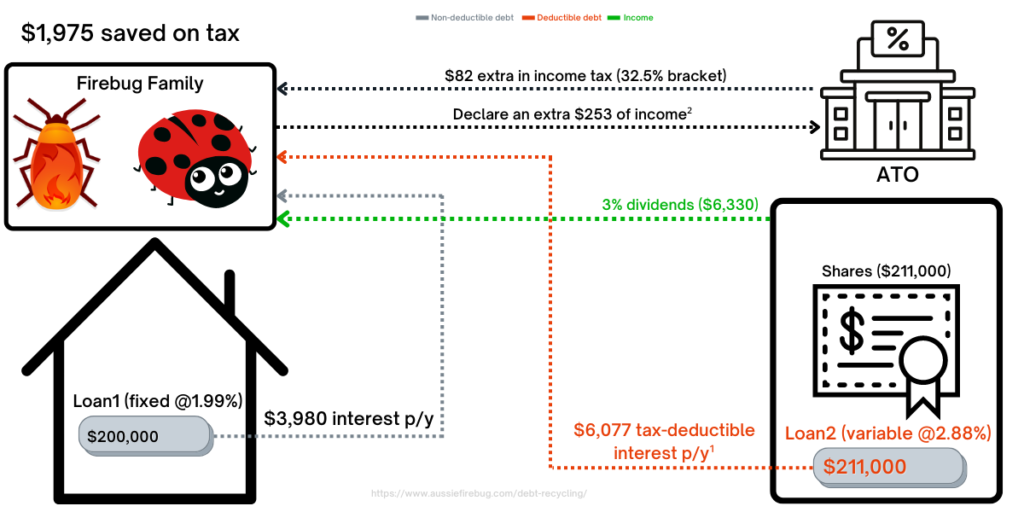

This is how it looked after DR Loan2.

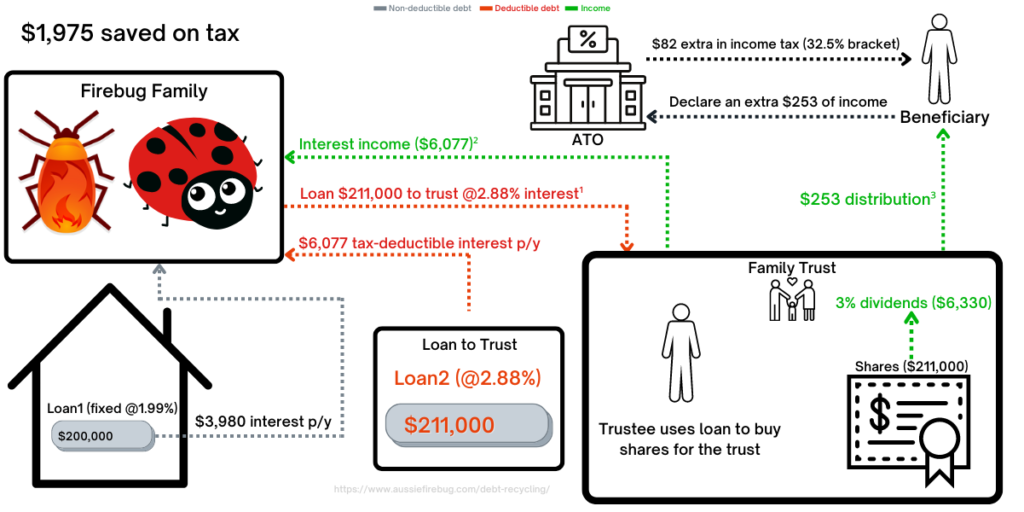

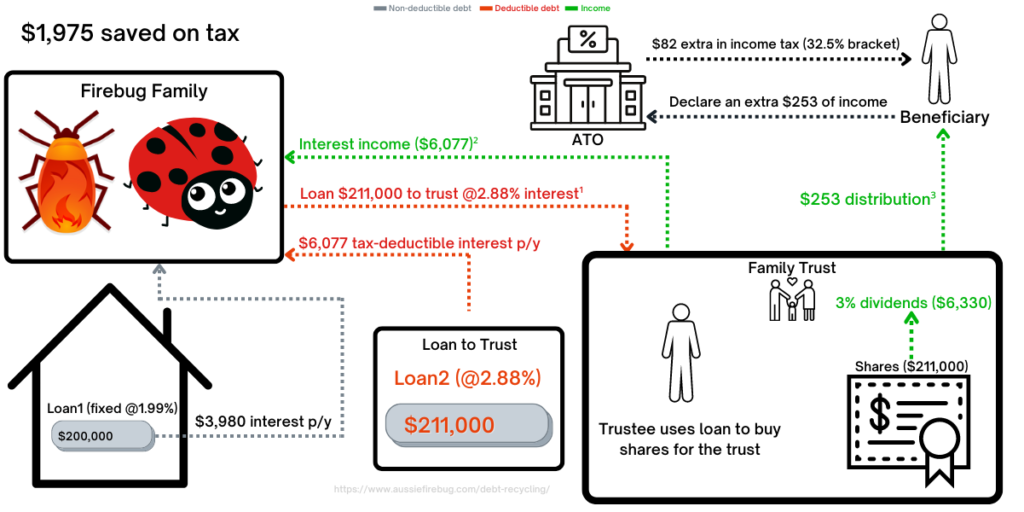

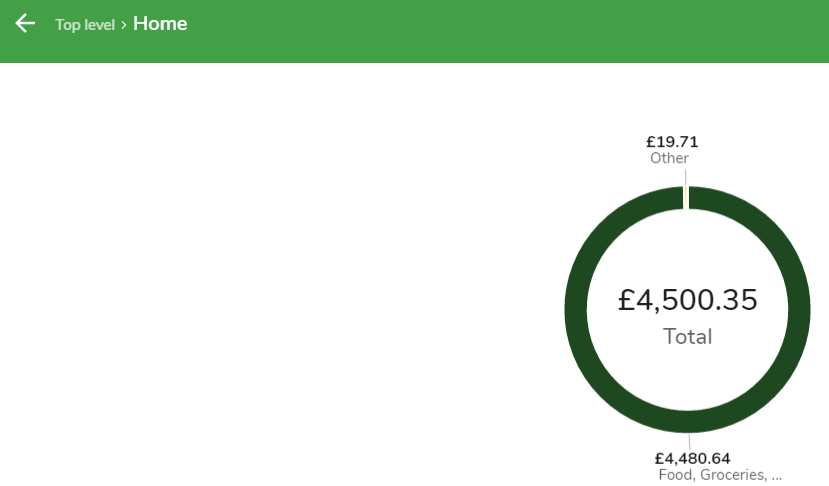

DR

¹ Loan2 was paid down and redrawn to purchase shares. Loan2’s interest payments are now tax-deductible

² The Firebug family received $6,330 in dividends but can deduct $6,077 in expenses from Loan2 and thus only need to declare $253 in additional income.

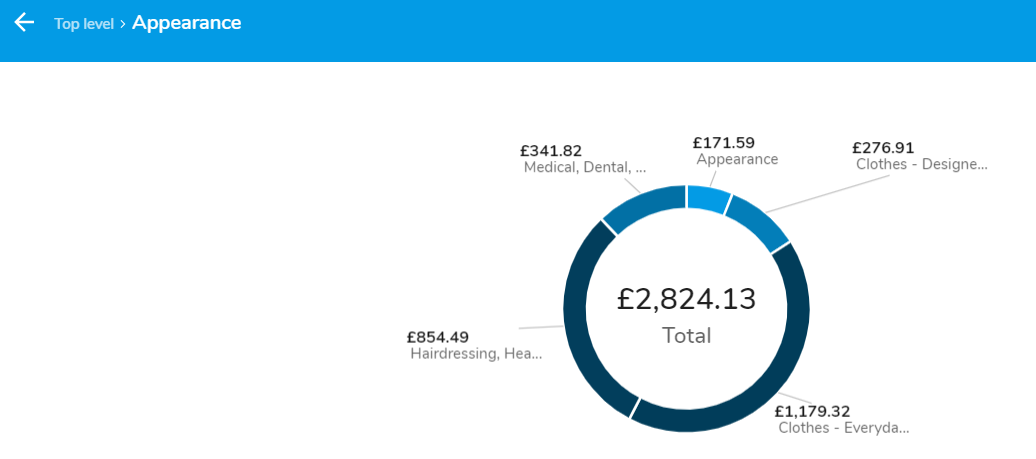

As you can see in picture 2 we were able to change the use of Loan2 to become an investment loan.

We then used this new loan to buy income-producing assets (shares) and are now able to claim a deduction on the accrued interest saving a total of $1,975 on tax.

But how exactly did we repurpose the loan?

In one word… redraw.

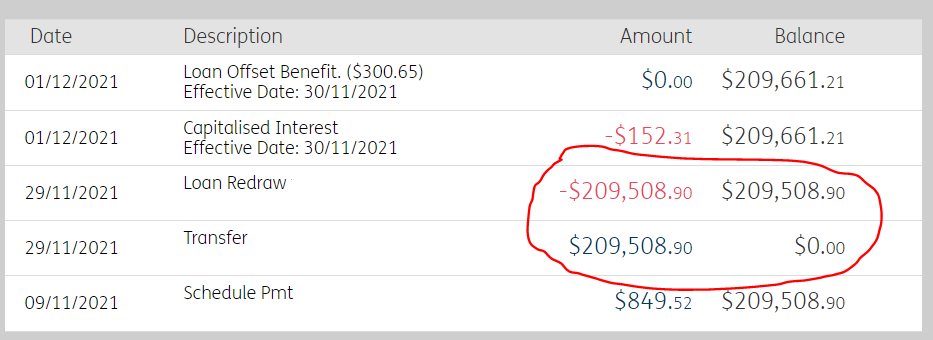

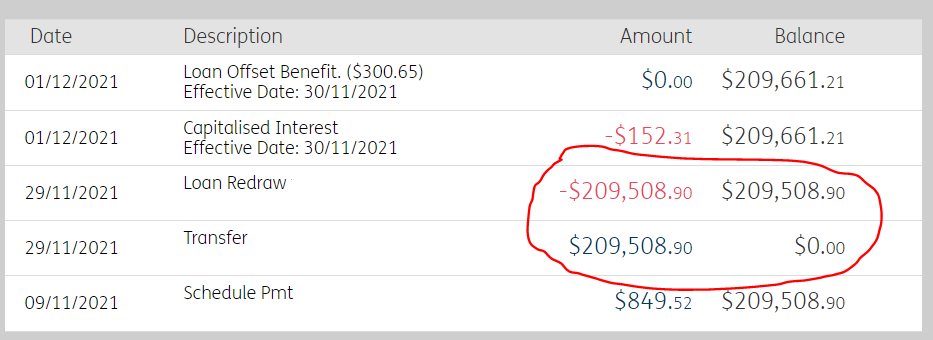

Once we sold IP2 and had the large lump sum, I simply paid down Loan2 completely and then redrew it back out.

The above picture shows the balance for Loan2 to originally be $209,508.90 on the 9th of November 2021. I paid it down to $0 on the 29th and then used the redraw facility to pull the $209,508.90 back out straight away. Redrawing from a loan is considered new borrowings by the ATO.

I was very worried that the loan would automatically close so I went down to an actual branch to ensure that it didn’t. The girl that helped me actually knew what DR was which helped a lot.

And that’s basically it.

We essentially are in the exact same position we would have been without DR but now Loan2’s debt is tax-deductible.

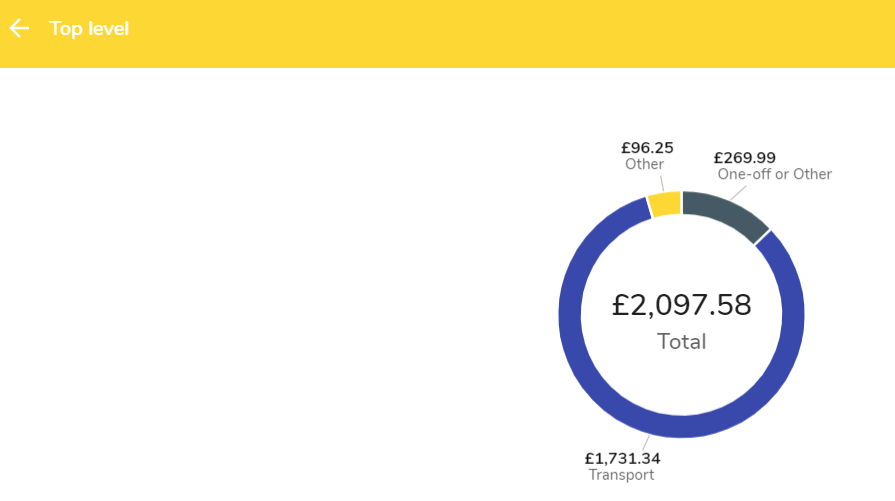

How We Did It (With The Trust)

The concept of DR remains the same, it’s just more complicated with a trust. (like a lot of things 😅)

Here’s how we did it.

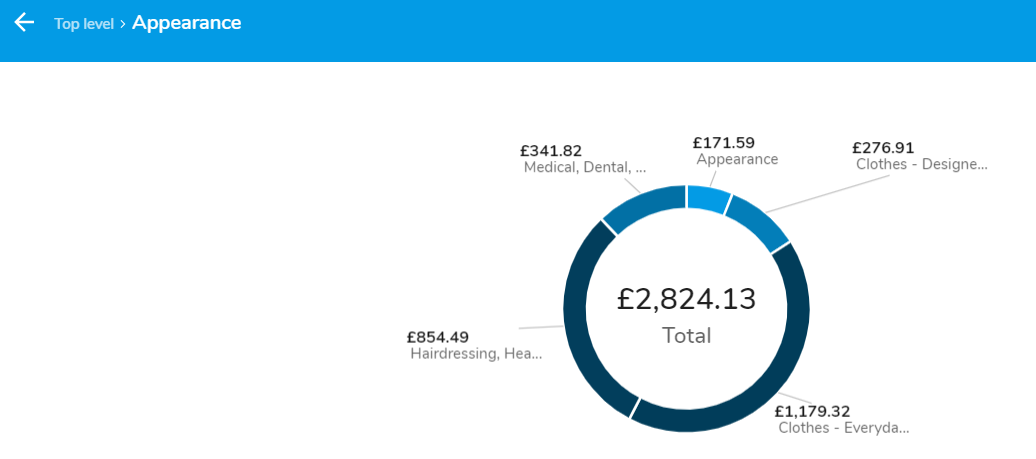

DR with a Trust

¹ You need to make sure that the terms of the loan allow for changes in interest rate to be the same as what the bank is charging you. In this example, it’s constant at 2.88% when in reality the interest rate would fluctuate. The loan agreement between the Firebugs and the trustee needs to be in writing and on arm’s length terms too.

² The Firebug Family pay and receive the same amount ($6,077) so their tax position is nill.

³ The distribution is only $253 because the trust had to pay $6,077 in interest to the Firebug Family. The distribution will be taxed at the marginal rate of the beneficiary.

There’s a lot going on in the above picture but I hope it makes sense. Leave me a comment below if you need something explained in more detail.

What If I Don’t Have A Lump Sum?

Not everyone will have a large sum of money to completely pay down a split of their loan. We implement a dollar-cost averaging strategy which means we don’t save up large amounts to drop in at once. The sale of IP2 presented a rare opportunity for us to execute our DR strategy but I understand that won’t be the case for most people.

Annoyingly, I actually had some examples and financial products that are suitable for people who want to do DR whilst DCA’ing. But since ASIC doesn’t let people like me talk about those sorts of things without paying them money, I unfortunately had to delete this part out of the article :(.

Terry W Tips and Future Podcast

I reached out to one of if not the best SMEs (subject matter expert) for DR in Australia for his top tips. I’m also teeing up another podcast with him to do a DR specific episode. Please let me know in the comment section what you want us to cover and I’ll try to add it in 🙂

If you want to know more about Terry, check out the first podcast we did together here. He also has his own podcast which you can check out here.

Terry’s top tips 👇

- You can only claim interest if borrowing to buy income-producing assets

- You need to avoid mixing loans as this will reduce tax savings

- Split loans first before repaying

- Repayment needs to be done once in full

- Redraws can be done in stages

- If borrowing to buy non-dividend paying shares the interest could be a cost base expense so it would still be worth splitting and recording the interest as it will reduce CGT.

- Written loan agreements on arm’s length terms are needed if the borrower and the investor are different

- Never redraw into a savings account with cash as it will cause a mixed loan

- Avoid paying into a share trading account with cash in there as this will cause a mixed loan.

- It is possible to debt recycle with any loan that has redraw, but some loan products are better than others, so see your broker about this.

- Debt recycling is a tax strategy so only registered tax agents or tax lawyers can advise on it.

- Advice on what to invest in would be financial advice if it involves shares or super as these are financial products so only an AFSL holder or authorized representative could advise on this.

- It is possible to debt recycle with investment properties too.

Conclusion

It’s important to note that DR didn’t change our investments, amount of debt, asset allocation or anything else really. We simply changed the use of the borrowed money.

I used the 32.5% tax bracket but this strategy would save you even more money if you have a higher marginal tax rate (I forgot to include the medicare levy too which would have made the tax savings even more impressive).

There’s also a pretty good chance that interest rates are going to rise in the next couple of years.

More interest = more deductions for us.

Oh, and if you’re wondering how I came to that $100,000 number in the intro. I simply punched in $1,975 into a compound interest calculator for 20 years at 8 interest. There are a bunch of assumptions right there but it’s impossible to know how the interest rate will move over that time period and we plan to redraw equity out of Loan1 and Loan2 which will mean more deductions. Essentially, we don’t ever plan to pay off our PPoR loan. I eventually want to DR Loan1 and then continuously redraw equity for the foreseeable future (Thornhill style!).

This strategy is something that took less than a week to sort out but will be saving us money for as long as we have debt against our PPoR.

Pretty cool if you ask me 🙂

Are you doing DR? I’d love to know why or why not in the comments section below.

As always,

Spark that 🔥

by Aussie Firebug | Apr 8, 2022 | Investing

In the middle of 2017, a colleague of mine asked the entire IT team if they wanted to buy some Bitcoin. He was pretty into it and had been explaining to us how it all worked. The conversation went something like this:

“Hey guys, my friend is buying some Bitcoin and if you want him to purchase some for you then now is a good time. I can set you guys up with your wallets and everything and then we can transfer some Crypto to each other and I’ll show you the transaction on the blockchain. You guys in?”

Now you might think I’m a sporty outgoing personality type (which is true) but at my core, I’m a massive nerd 🤓. And although I had been reading about Bitcoin for a few years I was still very much intrigued by the blockchain technology that powered it and I wanted to see for myself what all the hype was about.

So nearly everyone in the IT team bought $100 worth of Bitcoin in September 2017 when the going price was $4,763 AUD. I was rather unimpressed that there was a $5.50 transaction fee (5.5% of the investment!) just to buy the bloody thing so I only ended up with ~$94 bucks worth which at the time was 2% of a Bitcoin.

This was just a bit of fun to see how it all worked. We bought enough to muck around, but not enough to move the needle… or so I thought.

The 2017 Boom and Bust

The next few months were crazy!

We would come into the office each week and the first point of call was talking about the price of Bitcoin. It was skyrocketing!

Our $94 turned into $150 in a mere matter of weeks. And then $250, and then $450. We all had a laugh that this was our ticket to early retirement (they didn’t know about my blog 🙈) and we were only a few weeks away from buying a Ferrari.

Bitcoin peaked on the 16th of December 2017 at $25,506 AUD and our initial investment of $94 dollars had turned into $510 in less than three months.

Now I understand that it wasn’t a lot of money because our initial investment was so low but the return on investment was out of this world. Everything is hard to quantify if you don’t have a point of reference. I understood that even though we only made ~$400 bucks, the rate of return over that short period of time with zero effort was likely never to be repeated again in my lifetime.

And then came the crash…

Source: Yahoo Finance

Our tiny slither of Bitcoin which was valued at $510 in December 2017 plummeted back down to earth and bottomed out at $96 dollars a year later in December 2018.

This was my first taste of the Bitcoin rollercoaster everyone talks about.

Post Crash and General Feelings

A few of the guys in the team had actually sold their Bitcoin at around $450-$500 which was pretty much the peak in 2017 so they were very happy.

But I never had any intention of selling mine.

First and foremost, I was curious about the tech. However, I had a lot of reservations about the practicality of Bitcoin as a currency and if I’m being honest, I didn’t really think it was going to take off. I kept racking my brains on what problem Bitcoin was actually solving for me as an Australian. I understood the utility of this Cryptocurrency for other countries where the government was freezing accounts. And there was definitely a utility for criminals to send and receive value anonymously. But I could do everything I wanted to do with Australian dollars almost just as quickly as Bitcoin and with fewer fees.

I just couldn’t see this thing taking off.

I didn’t really understand what Bitcoin was back then. What it could be and what it represented.

But I had this hunch that it might be worth holding onto moving forward and the worst-case scenario meant that I’d lose my initial $100 bucks… not a big deal.

If I’m being honest, I was actually hoping Bitcoin and the other cryptocurrencies would eventually disappear. I was receiving a fair few emails from readers asking me about it and I originally just thought it was a Ponzi scheme. No intrinsic value, hardly any utility for Australians, high transactional fees etc. It also seemed complex and I couldn’t be bothered learning about something that I thought was going to be a relic of the past within a few years. I never included my tiny amount of Bitcoin in my net worth updates because I didn’t want any more emails.

But crash after crash Bitcoin continued to rise from the ashes to reach new heights.

This new ‘thing’ just wouldn’t stay dead…

Down The Rabbit Hole

The biggest turning point for me to do a deeper dive into the world of Bitcoin was when it surged again in late 2020. I was personally getting a lot of requests to do a Crypto podcast as well as a bunch of threads popping up in the FIRE Facebook group.

It was around this time that I read Why I’ve Changed My Mind on Bitcoin by Nick from the ‘Of Dollars and Data’ blog. I really value Nick’s commentary and that article really cemented the idea that there might be more to this Bitcoin thing than meets the eye. If Nick was writing about it, it was worth another look.

I decided to commit to educating myself on Bitcoin so when I eventually booked an expert on the podcast, I didn’t sound like too much of a n00b.

A quick side story….

I actually was in communication with Alex Saunders from Nugget news about coming on the podcast. He was one of the most recommended Australian authorities within the Crypto space and had built up a huge following online. Everything looked legit so I sent him a few emails. I nearly fell off my chair a few weeks later when my mate sent me an article that said Alex was being taken to court for potentially millions of dollars owing to his community 🤯.

Holy cow. This Crypto space was like the wild west.

Another name that kept coming up was an Australian who was living in the US, Vijay Boyapati. Vijay wrote the very popular book ‘The Bullish Case for Bitcoin’ and was very good at articulating his ideas during interviews. I reached out to him and he agreed to come on the podcast last year.

His book really changed what I thought I knew about money.

The mistake I made when I first came across Bitcoin was that I didn’t know the history of money. You need to really understand how money came about in the first place to give you the context of why the invention of Bitcoin was a game-changer. Explaining this could be an entire blog post on its own (or maybe a few posts honestly) but if you’re interested, Vijay’s book is a great starting point.

The history of money is more of a psychological deep dive into how humans interact and trade with each other. It’s super fascinating stuff and it challenged some core beliefs I had previously.

I started watching Michael Saylor’s videos on YouTube and I really enjoyed the ‘Decoding Bitcoin’ series from the Australian podcast The Passive Income Project.

The more I read, the more I realised how little I understood about money. I know a decent amount about how to become financially independent, but the mechanics of where money came from, how it’s created and why it works is an entire discipline.

Risk vs Reward

For me personally, the risk-reward proposition for a small amount of Bitcoin is quite attractive.

And it’s for this reason that we have now allocated 1% of the portfolio to this new asset class (we currently have around $12K of Bitcoin). And I’m seriously thinking about upping that to 2% in the future but let’s start with 1%.

This is the way I look at it – the worst-case scenario is that Bitcoin becomes worthless and we lose 100% of our investment. It’s only 1% of our portfolio so while I don’t like wasting money, it’s not going to ruin us financially. The upside for this investment however is unlimited.

I don’t know what’s going to happen in the future but I’m fairly confident that Cryptocurrencies are going to play some sort of role in our financial lives moving forward. I don’t know if Bitcoin will be the dominant player in 15 years but it’s the horse I’m backing for now.

I was very close to spreading that 1% across the other top 10 Crypto (by market cap) but I’m just not as educated on them and lacked conviction.

I think Bitcoin has a major ‘first mover’ advantage with its network but its crowning jewel is the decentralised nature of the protocol. I’ve read that other Cryptocurrencies are not decentralised and there are actually a few people at the top running the show. From my understanding, the whole point of using blockchain technology is to be decentralised. If you want to create an app, community, new system or whatever and it’s not going to be decentralised, you’re much better off using traditional technology with a normal database. That would be a lot more efficient as the processing power required to run the blockchain can be quite high.

I’m not an expert though so please if I’ve got this part wrong, let me know about it in the comments. Why would you use blockchain tech if whatever it was you were building didn’t need to be decentralised?

End Goal

I’ve used the word ‘investing’ a few times in this article but I’m hesitant to call anything to do with Bitcoin an ‘investment’.

I’m not even sure I know what to call it.

It’s not really investing but I think it has graduated past gambling at this point. There’s definitely a heavy amount of speculation but every investment in history has had some degree of speculation by definition.

It’s now possible to generate an income from your Cryptocurrencies but this isn’t something I have experience with so I can’t comment on the practicality and risks associated with staking.

The way I see it, we have two potential scenarios that can play out:

- Bitcoin succeeds and is adopted worldwide

- Bitcoin fails and becomes worthless

The goal is scenario 1.

We don’t have any intention of converting our Bitcoin back to fiat currency. This technology either works or it doesn’t. And if it does work, we should be able to use our Bitcoin for future purchases.

It’s more of a store of wealth than anything. Of course, I want the value of Bitcoin to go to the moon now that we own some. But the main strategy behind this purchase is for us to be able to actually pay for future expenses using this Bitcoin.

Think of it like money that buys more the longer you hold it. An interesting concept given the current rate of inflation.

This is different from our shares portfolio which is being built to generate passive income for us.

But Why?

If I’m already living a great semi-retired life and am on track to reach full financial independence within the next few years – why bother with Bitcoin at all?

That’s a great question!

There are a few reasons

- I’m interested in the technology and personally get satisfaction from participating

- I’ve concluded that the upside of Bitcoin succeeding far outweighs the downside of it failing given a small allocation within our portfolio

- It’s a vote for a better system

Points 1 and 2 are pretty self-explanatory but I want to expand on point 3.

When I was trying to think of the utility of Bitcoin back in 2017 I didn’t really understand how inflation worked and how it is used by the government.

I’m not an expert so I’m not going to try and pretend to know all the complexities of our current financial system but it doesn’t take a rocket scientist to know that inflation is rising in Australia. Your dollars are buying less each year even factoring in wage growth.

One of the main problems with the way our democracy works is that politicians are incentivised to be shortsighted. They are constantly slapping on band-aids rather than actually fixing the problem.

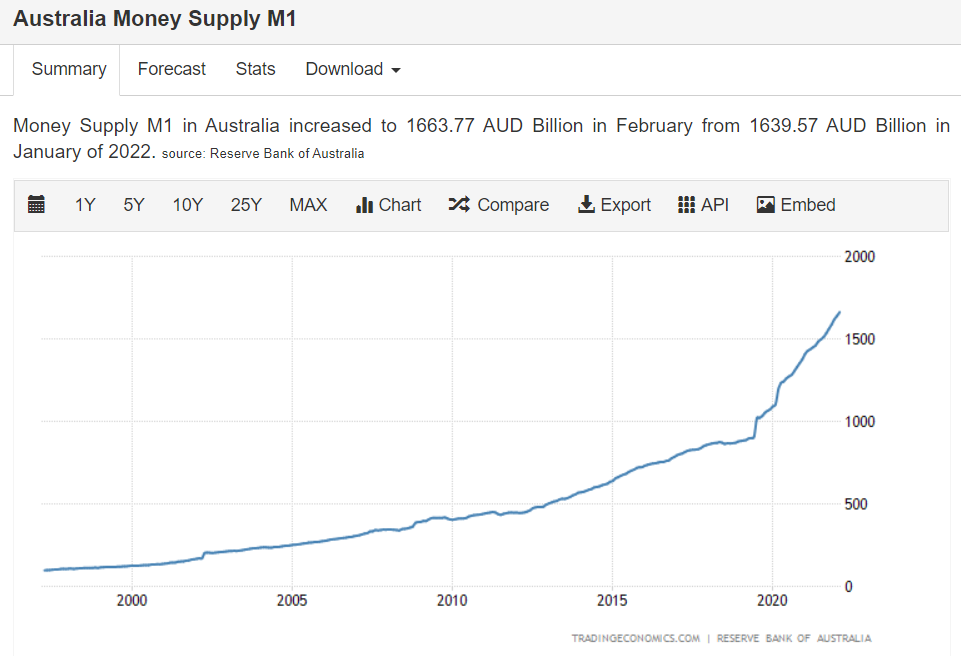

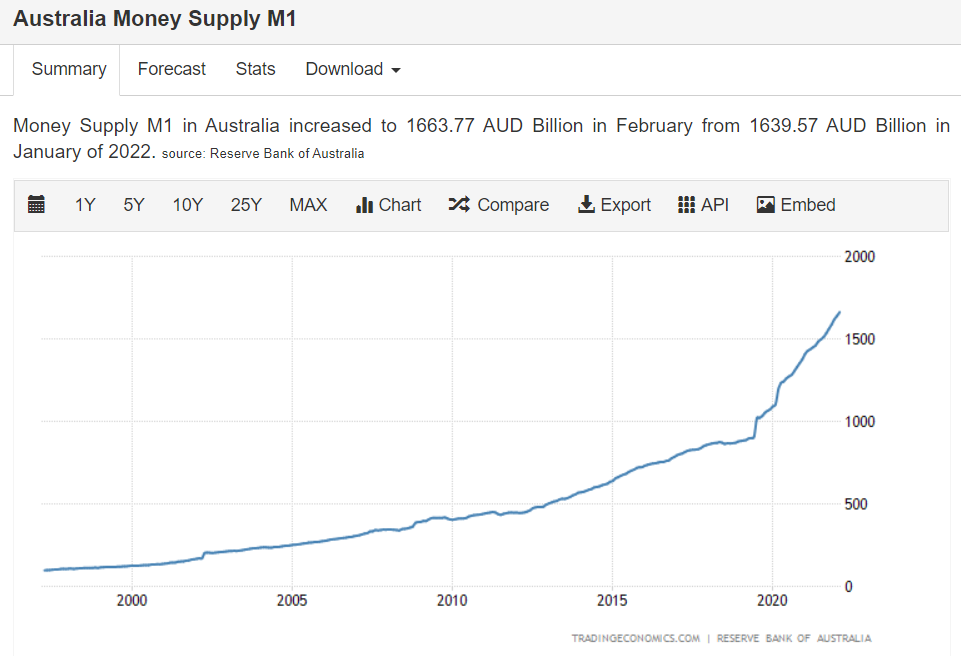

An obvious example of this is how much money has been created over the last few years. But this quick sugar hit doesn’t come for free. Someone always has to pay the bill. And all this printing has started to come back to bite us in the ass.

Source: https://tradingeconomics.com/

Inflation is a hidden tax.

People hardly even know it’s happening.

But make no mistake about it, high inflation without wage growth means you’re losing purchasing power. Your hard-earned dollars are becoming less useful and the rate at which they depreciate is out of your control.

I don’t like the fact that short-sighted politicians are happy to fire up the money printer at the expense of fiscally responsible savers that have built up a safety net. Is it too hard for them to maybe tighten their belts a bit in bad times? Why does it seem like every solution these days is to start making it rain at the first sign of the economy slowing?

I’m not saying I have all the answers, I’m just pointing out that the relentless drive for continuous growth is punishing responsible savers through the debasement of our currency and rewarding speculators loading up on cheap debt.

The more money that is created, the less purchasing power we all have.

Bitcoin flips this narrative.

The amount of Bitcoin that can be created is set in stone. It can’t be changed.

Part of me wants this experiment with Cryptocurrencies to succeed because I think it presents a superior financial system that can’t be screwed with by corruption and greed. Both of which are unfortunately innate traits of human beings.

Converting my fiat currency to Bitcoin is a vote for a better system.

Conclusion

We’re officially in the Crypto game (technically have been since 2017 😜).

I’ve really enjoyed learning about Bitcoin over the past few years but it was the history of money that really caught my attention. I find it absolutely fascinating how humans created and used money in past generations and I think the history of money is a prerequisite to fully understanding the utility of this new technology.

Over the last two years, the risk/reward proposition has shifted for me personally and I now consider a small amount of Bitcoin in a portfolio to be perfectly appropriate for any Australian looking to reach financial independence.

You’ll be fine without it of course but I think we’ve reached the point where most people can rationalise someone having a small amount. This is a lot different from years gone by when a lot of well-regarded reasonable voices would have publically shamed anyone who even thought about ‘investing’ in Cryptocurrencies. I must admit that I was secretly judging people who were buying it back in the day too 🙈.

We live and learn and I can admit when I was wrong.

I’d love to know what you guys think about Bitcoin in the comments.

Are you starting to believe? Or is it still a huge Ponzi scheme?

As always,

Spark that 🔥

by Aussie Firebug | Dec 4, 2021 | Investing, Real Estate

Our third and last investment property (IP) has officially been sold 🎉👏

It was actually the second investment property that we bought and I’ve always referred to it at IP2 in this blog but we sold IP1 back in 2018 and IP3 a few months ago which is why it’s technically the third to hit the road.

Selling IP2 continues our strategy for creating a passive income to fund our lifestyle in retirement. The investment properties had a different purpose in our original strategy for reaching financial independence, but now we exited all our positions in direct real estate except for our PPoR which we bought in 2021.

What Was The Return?

Following the theme from the IP1 and IP3 sale articles, I’ll get straight to the point.

We turned $56,326into $119,094 over 8 years which works out to be an annualized after-tax return of 11.29%.

If you’re interested in all the finer details of how we arrived at that figure please read on.

The Numbers

IP2 was bought in SE Queensland for $169K in 2014.

Buying expenses

| $2,000 |

Initial deposit |

| $380 |

Building and Pest inspection |

| $25,700 |

More of the deposit |

| $6,487 |

Rest of Deposit |

| $6,625 |

Outlays including stamp duty and Legal Fees |

| $200.00 |

Settlement Fee |

| $488 |

Land Titles Office |

| $9,900 |

Buyer’s agent fee |

| $200 |

Guarantee Fee |

| $200 |

Fee for attending settlement |

- I paid a 20% deposit to avoid LMI

- I used a buyer’s agent because back in 2014 I was very time-poor. I didn’t have the time or desire to go up to Queensland to scope out the place and really do my due diligence so I outsourced it.

Actual money spent so far: $52,181

Cash Flow/Holding Costs

| Cash flow |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

Year 6 |

Year 7 |

Year 8 |

| Rent – Expenses |

-$1,121 |

-$2,116 |

$1,148 |

-$1,202 |

$1,672 |

$64 |

-$3,144 |

-$2,041 |

| Depreciation |

$5,940 |

$4,556 |

$3,496 |

$2,799 |

$2,339 |

$2,036 |

$1,835 |

$1,702 |

| Tax Refund |

$2,613 |

$2,469 |

$869 |

$1,480 |

$247 |

$730 |

$1,842 |

$1,385 |

| Total |

$1,492 |

$353 |

$2,017 |

$278 |

$1,919 |

$794 |

-$1,302 |

-$656 |

Total cash flow over the 8 years = $4,894

Notes:

- I had a lot of repairs that needed to be taken care of before I sold the property in years 7 and 8.

- I’ve included depreciation and a tax refund even though this property was held in a trust and not in my name. This means that the taxable income of the trust was lowered but my personal income was not affected. It’s hard to measure the full effect of the depreciation so I just used a refund amount based on the 37c tax bracket as I did for IP1 and IP3.

- I used the diminishing value method for depreciation.

Actual money spent so far: $47,287

Selling Costs

- $635 – Conveyancing

- $8,405 – Went through a traditional agent for the sale because the property was located in Queensland and I wasn’t in a position to go up there and host open days. The commission was a lot more than IP3 because apparently gold coast property has a premium attached 🙄

Total Selling Costs: $9,040

Total money committed to this investment over 8 years: $56,327

The IP was sold in November for $250,000

I invested $56,327 of my own money and received $119,094 ($250,000 – $135,800 + $4,894) 8 years later giving me an annualised return of 11.29%.

Return on Investment (ROI) and Tax

I used this website to calculate my return on investment for IP3. The formula was the following:

Annualized Return = ((Ending value of investment / Beginning value of investment) ^ (1 / Number years held)) – 1

And just like I explained in my IP1 Sold article, I’m only calculating how much of my money was spent, and how much cash I got back after I sold. Because that’s all that really matters IMO, it’s all about the cash on cash returns.

The tax bill for this investment will be washed through the trust and all of the gains will most likely go to my self-funded retiree parents or potentially my sister who has just had a baby and isn’t working. They will hopefully be kind enough to gift the profit back to the trust. So no tax be will be paid for this investment.

One last thing to note is that even though we had this property over 8 financial years, we technically only owned it for 7. So I used 7 in the calculations FYI

Why Did We Sell?

In a nutshell, selling our investment properties is part of our current investment strategy. We want to pump more $$$ into our index style share portfolio to create a passive income stream that will free us from the 9 to 5 grind.

Conclusion

Not much else to say really. I’ve been talking about going 100% passive for years and it feels awesome to finally be in this position.

The only thing left for us to do is deploy the $200K+ of cash we have sitting in the bank atm. We plan to debt recycling part of our PPoR loan with this money before we dump it into the markets but the details of that are in another article that I’ll hopefully publish before the end of the year (not long now).

Real Estate has been an incredible wealth-building tool for Mrs FB and I but there’s something super satisfying knowing the days of tenant issues are over… at least for now. We have no intention of jumping back into real estate in the future but ya just never know!

Spark that 🔥

by Aussie Firebug | Jul 2, 2021 | Investing, Real Estate

Our second investment property (IP) has officially been sold 🎉👏

I say second because we first sold IP1 back in 2018, but this IP was actually the third property we bought and I’ve always referred to it as IP3 on this site so it can be a bit confusing.

Selling IP3 continues our strategy for creating a passive income to fund our lifestyle in retirement. The investment properties had a different purpose in our original strategy for reaching financial independence, but now we are looking to exit all our positions in direct real estate except for our PPoR which we bought in 2021.

We still have one IP left (IP2) which hopefully will be sold at the end of 2021.

What Was The Return?

Following the theme from the IP1 sale article, I’ll get straight to the point.

We turned $65,313 into $126,298 over 6 years which works out to be an annualized after-tax return of 11.62%.

If you’re interested in all the finer details of how we arrived at that figure please read on.

The Numbers

IP3 was bought in SE Queensland for $250K in 2015.

Buying expenses

| $1,000.00 |

Initial deposit |

| $400.00 |

Building and Pest inspection |

| $11,500.00 |

More of the deposit |

| $37,900.25 |

Rest of Deposit |

| $2,078.83 |

Legal and conveyancing fees |

| $200.00 |

Settlement Fee |

| $728.40 |

Land Titles Office |

| $9,900.00 |

Buyer’s agent fee |

- Stamp duty was added to the loan for this IP instead of paying it upfront.

- I paid a 20% deposit to avoid LMI

- I used a buyer’s agent because back in 2015 I was very time poor. I didn’t have the time or desire to go up to Queensland to scope out the place and really do my due diligence so I out sourced it.

Actual money spent so far: $63,707

Cash Flow/Holding Costs

| Cash flow |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

Year 6 |

| Rent – Expenses |

$1,679 |

-$118 |

-$1,976 |

$711 |

-$1,285 |

-$1,989 |

| Depreciation |

$6,911 |

$4,117 |

$3,375 |

$2,872 |

$2,529 |

$2,293 |

| Tax Refund |

$1,935 |

$1,567 |

$1,979 |

$799 |

$1,411 |

$1,584 |

| Total |

$3,615 |

$1,448 |

$3 |

$1,510 |

$126 |

-$404 |

Total cash flow over the 6 years = $6,298

Notes:

- I had a lot of repairs that needed to be taken care of before I sold the property in year 6 which was the most expensive year. Year 3 and 5 also had some pretty hefty R&M jobs too.

- I’ve included depreciation and a tax refund even though this property was held in a trust and not in my name. This means that the taxable income of the trust was lowered but my personal income was not affected. It’s hard to measure the full effect of the depreciation so I just used a refund amount based on the 37c tax bracket as I did for IP1.

- I used the diminishing value method for depreciation.

Actual money spent so far: $57,409

Selling Costs

- $599 – Conveyancing

- $7,305 – Went through a traditional agent for the sale because the property was located in Queensland and I wasn’t in a position to go up there and host open days

Total Selling Costs: $7,904

Total money committed to this investment over 6 years: $65,313

The IP was sold in June for $320,000

I invested $65,313 of my own money and received $126,298 6 years later giving me an annualised return of 11.62%.

Return on Investment (ROI) and Tax

I used this website to calculate my return on investment for IP3. The formula was the following:

Annualized Return = ((Ending value of investment / Beginning value of investment) ^ (1 / Number years held)) – 1

And just like I explained in my IP1 Sold article, I’m only calculating how much of my money was spent, and how much cash I got back after I sold. Because that’s all that really matters IMO, it’s all about the cash on cash returns.

I know people like to crunch the numbers based on purchase and sold prices without factoring in leverage, but I just can’t see how this gives an accurate depiction of the investment when 99.99% of property investors use leverage when investing. It’s the only way real estate makes sense IMO.

The tax bill for this investment was washed through the trust and most of the gains actually went to my self-funded retiree parents. So just like IP1, we didn’t actually have to pay any tax for IP3.

I need to write another trust article that highlights our strategy when it comes to trust distributions because the trust is actually shaping up to be an enormous tax minimisation vehicle especially combined with debt recycling which will also be doing once our new home settles this month.

Why Did I Sell?

In a nutshell, selling our investment properties is part of our current investment strategy. We want to pump more $$$ into our index style share portfolio to create a passive income stream that will free us from the 9 to 5 grind.

Conclusion

IP3 wasn’t that much of a headache tbh. But it was still way more work than our share portfolio. I know hindsight is 20/20, but the share market would have actually made us more money in the same period of time with 0 work involved… 😑

But this is easy to say now in 2021 after a huge bull market. I’m still happy with the returns but it further illustrates to me that you really need to add value or solve a problem with real estate to make bank.

This may surprise some of you but I bought, managed and sold IP3 without ever actually seeing it in person 😅.

I paid someone a very high amount to do all the due diligence work for me so I was confident that the property was legit (I was still nervous until I received my first rent check lol). I also never improved the value of the property which is one of the biggest advantages I’ve always said property has over shares… the ability to physically add value. I seriously just bought it, dealt with a few tenant issues here and there and sold it 6 years later.

IP1 was very different because I put in the work (sweat equity) and physically improved the value of the home which was reflected in the sale price.

And now we only have IP2 left which we will be putting on the market later this year 🙂

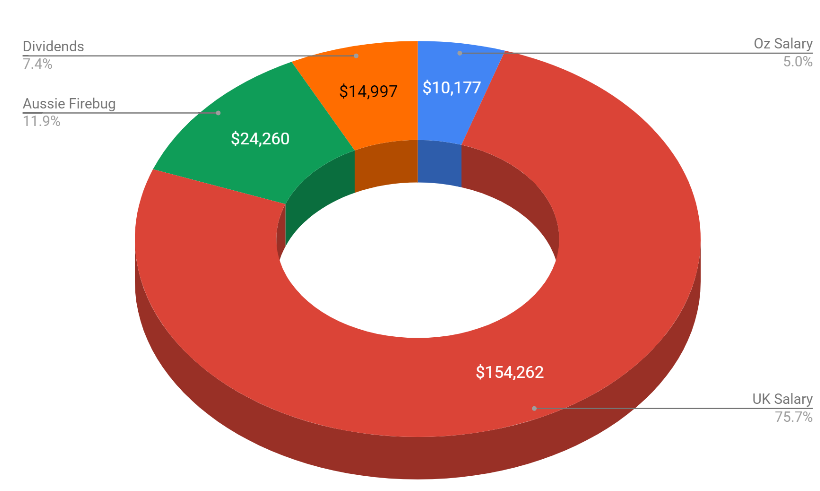

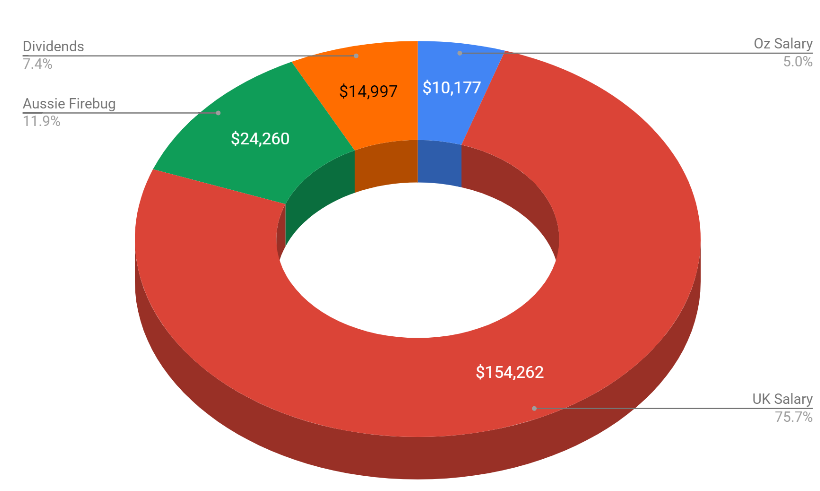

by Aussie Firebug | Jan 2, 2021 | Financial Independence, Investing, Tax

I’m writing today’s article as if I could somehow post it back in time, two years prior would have been perfect.

You see, Mrs Firebug and I were packing up our life in Australia, about to jet off to the other side of the globe with a strong desire to see all the wonderful and interesting places that Europe offers. But quitting your job and moving to London can be scary shit yo! I’m a pretty confident person normally but you do second guess yourself when you’re out of your comfort zone.

But you know what? Working hard and investing during our early/mid 20’s left us in a really good spot financially and we avoided a lot of potential worry and stress had we made this trip beforehand.

Still, I really had no idea what to expect and wasted a lot of time and money simply because I didn’t know what I’m going to share with you in today’s piece.

I’m writing this guide to help ya out. If you fall into one of these categories:

- You want to move to London

- You already live in London

- You want to move overseas but continue to invest in Australia as we have done

Then this is the guide for you!

Are you sure you want to live in London?

Before we dive into the article, I want to warn any would-be Londoners of one unavoidable fact.

London is stupidly expensive!

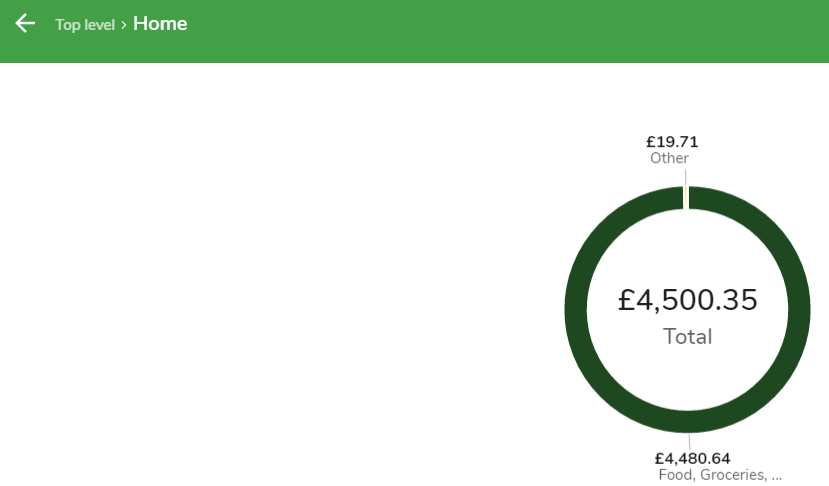

It ranked 19th in Mercer’s 26th annual cost of living report. To put that into perspective, Syndey ranked 66th and Melbourne came in at 99th.

You really need to ask yourself what’s important. We predominately moved to the UK to be close to Europe for travelling. Mrs. FB is a school teacher and she basically earns the same amount of money in London as she would in just about any other city or town in the UK. But most of the high paying contract jobs in tech were in London which is the reason we decided to move there.

Had I been in an industry that didn’t attract a premium in The Big Smoke, there’s a very good chance we would have ended up somewhere else like Liverpool, Edinburgh or Belfast.

IMO, you really should heavily consider living somewhere else if your salary is < £35K or you can get paid a similar wage somewhere else in the UK.

I know a lot of people who moved to London straight after uni that worked minimum wage jobs at a bar and couch-surfed through Europe. London would be one of the last places on earth I would choose to live if I had a minimum-wage gig (Cafe work in Thailand/Mylasia comes to mind). Don’t get me wrong, it’s an amazing city, but there’s an array of other really good cities in the UK where you can do lower-paid work and not have to pay the outrageous rental costs of The Big Smoke.

But if you’re still keen on London, please do read on.

Setting up life in London

Find a home

We lived in two apartments during our tenure, the first being in Norbury (Zone 3) before succumbing to the classic Aussie stereotype and set up shop in Melbourne 2.0 aka Clapham (Zone 2). We were paying £900/m (bills included) in Norbury for our room that had a private ensuite in a brand new apartment right next to the overground station. In Clapham North we paid £900 + bills (£60) per month for a classic Edwardian style flat that was a lot older but actually had more character which grew on me.

The Zones dictate how central the location is to the city (Zone 1 being the most central location) and they actually make a difference in the cost of public transport too.

Zone 1 is too expensive IMO (you may be able to find a cracking deal) and we found the sweet spot in terms of location and price was in Zone 2. Zone 3 was ok but if you’re planning to commute via bike, you could be looking at a 45-60 minute trip each way which is a little bit offputting for most. IMO it is so worth paying a bit extra to be closer to the city so you can cut down your riding time to be 20-30 minutes to the CBD. Check out this zone map for more info.

One of the best resources I can recommend is the Aussies in London Facebook groups. There are a few of them getting about and sometimes the groups that are a bit smaller (<15,000) are actually better. These groups are not only fantastic to find spare rooms, but they also act as a market place for second-hand bikes, clothes plus tips and tricks. You can usually get some killer deals on there when people move back to Australia and sell a lot of their stuff. If you post a pic of yourself with a bit of a write-up, there is a great chance that you’ll get some messages from people looking for a flatmate. I’m not on Facebook anymore but I’m sure there are a few people in those groups who’d benefit from this guide so feel free to share this around.

We personally found this way of finding a place much better than going through websites like Spareroom which was the website we used for our first place. Those other websites will charge you a premium to be able to access newly listed rooms/properties plus dealing directly with the flatmates was always a better experience even when we didn’t want to live in the flat.

It depends on what you’re looking for too. A lot of people will say that you should live with people from other cultures/countries to get the proper experience which probably won’t happen if you’re looking for rooms on an Australian Facebook page.

Here are my general recommendations based on our experiences for finding a home in London.

- Flat sharing is fun and is a key part of the experience (way cheaper too)

- Couples have it much cheaper than singles even factoring in the extra price couples sometimes have to pay for

- Having our own ensuite was worth it (for us)

- London has great public transport but there are some black spots. Try to get as close to a tube station/overground as you can. If you can get near a big hub (like Clapham Junction), even better

- Biking is the best way to get around the city (more on this below)! Bike superhighways are a recent edition (I believe old Bojo had something to do with them actually) to London but they are superb and something I would try to live near to make my commute into the city a hell of a lot easier. There is a world of difference riding in a dedicated lane vs weaving in and out of traffic

Banking

Thank your lucky stars that you didn’t move to London ~ pre-2016. Setting up a bank account used to be one of the most bothersome tasks before the digital banking shakeup in 2014 that changed everything. Horror stories used to be common where people would move to London and get stuck in a shit sandwich loop. They couldn’t sign up for a flat because the rental agency wanted to see payslips/bank statements but the old school banks wouldn’t let someone open up an account that didn’t have a place of residency in the UK, but they couldn’t get a place without… yeah, you get it.

What a nightmare!

From what I heard, the 2008 financial crisis introduced extremely strict banking rules which meant a whole bunch of red tape and general pain for ex-pats trying to start a new life. Fast forward 6 years and the government started to ease the barrier of entry for banking licences and reduce the restrictions which gave rise to a new concept in baking… the challenger banks.

You might have heard of 86 400, Volt and Up. These are called Neo banks in Australia but they’re really just copy cats based off a concept that was started here in London.

I bank with both Monzo and Starling and can recommend both. They are seriously epic. The apps for both are extremely well developed and do everything you need. You can’t get a better interest rate for international travel either and there are no fees associated with the account.

But the best feature of all, hands down, is how effortlessly you set up your account. It’s 100% done through the app. No branches or dealing with people at all. You fill out a bunch of questions, record a selfie video saying who you are, take a photo of your passport and a few other documents and you’re done. The card gets mail out to your location and that’s it!

If I had to choose, I’d probably go with Monzo purely because it’s more popular and they’re cool features you can do if you share a meal with a group and everyone uses Monzo.

Phone Plans

Boy oh boy is it ganna be hard going back to Australian phone plans after you see what kind of deals you can get in the UK.

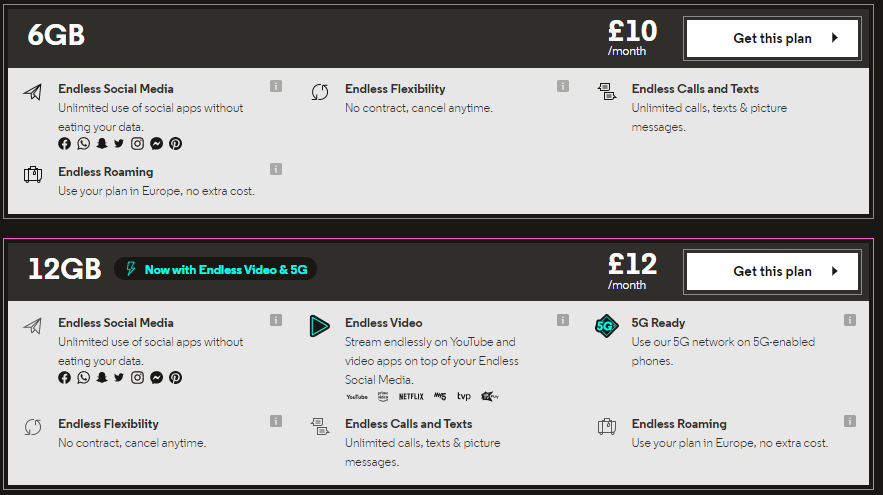

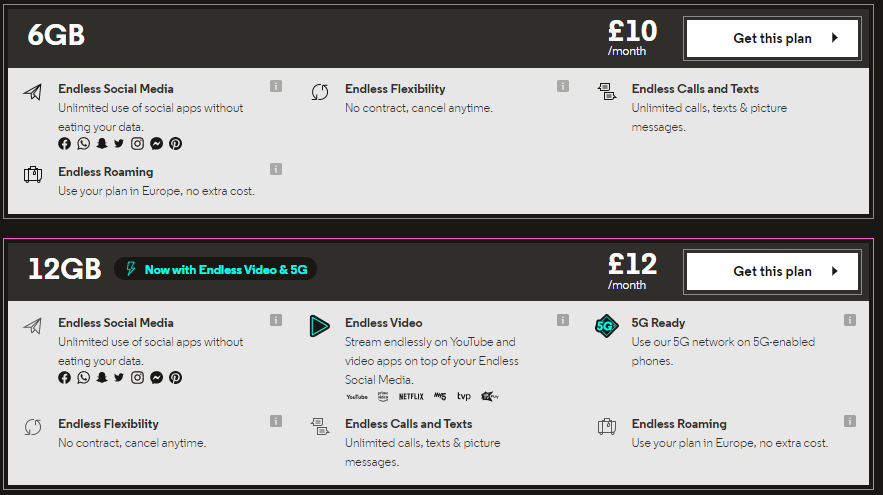

Mrs. FB and I are both with Voxi (a subsidiary of Vodaphone) and their plans are very good. Going from country Victoria where I was paying something like $40 for a gig of data which wouldn’t even bloody work half the time, to deals like these was unreal.

Unbelievable! £12 quid (~$24 AUD) for unlimited video streaming/social media. And the connection was never a problem for us here in the south of London.

It’s cheap and it works but the best feature bar none was definitely not having to get a new sim card when we were hopping around Europe to all the other countries. I love technology 🙏.

We can only vouch for Voxi because it’s the plan we used but I have seen other similar ones that were just as good.

Transport

This is a big topic and one that can potentially save you £1,000’s of pounds each year.

First things first. Download City Mapper right now! It’s hands down the best navigation app for getting around London. I’m a massive Google Maps fanboy and it took me a while to migrate over to City Mapper but man, once I did, I was well and truly converted. It is really designed for cities (there’s one for NYC, Paris, Hong Kong) and I found it to be a lot more accurate than Google Maps was when it came to service disruptions.

IMO, biking is the most superior form of transport in London and it’s not even close! You might be rolling your eyes because this is such a FIRE thing to say but trust me with this one, London is a really bike-friendly city with the additions of the Bike Superhighways that were added in the last few years.

I’m not even saying this because of how much money you save and the added benefit of the extra exercise, it’s generally a mood booster to cycle around this gorgeous city each morning when I was commuting to the office. It’s also the quickest form of transport (I consistently flew past cars commuting up High street on my way to the city) and you are never rushing to catch a train or bus. How many of you guys out there look forward to your commute in the mornings? If the sun was shining, my morning rides were more often than not one of the best parts of my day. Now granted I have been told that 2020 did have particularly good spring/summer/autumn and the weather does play a big part. But boy oh boy when the sun does come out, riding through Battersea park, over London Bridge and around the cute streets of Notting Hill are memories I’m going to cherish forever and I know I’ll miss those rides when we’re back in Australia.

Handy tip: Check if your employer participates in the Cycle to Work scheme. You get a bike for free at the start, then the amount is deducted from your pay every month until it’s paid off. Because the amount is deducted before tax, you end paying less tax, and therefore you pay less than the bike actually cost.

The London Underground AKA “The Tube” is a feat of engineering the likes of which I’ve never seen before. It boggles the mind how I can miss a train and wait no more than 90 seconds before another one rocks up. The efficiency for a network to run like this is mindblowing for my simple noggin 🤯 and I have to admit, when I first started catching the tube, there is a little bit of novelty it.

I have fond memories of landing my first contract and catching the tube to work in central London. I really felt like a Londoner power walking through the endless crowds of white-collar city slickers in my new chinos and overcoat… and theeeeeeeeeeeeeen the novelty wore off three weeks later 😂.

I really only caught the tube (pre-covid) when I had to after I bought a bike. It’s bloody handy to have it up your sleeve though.

One of the best features of ‘Transport For London’ (tfl) is being able to use your cards tap and go technology straight off the plane. You know how travellers have to buy a Miki card when they get to Melbourne and want to use public transport? You don’t need to do that in London which is fantastic. You as long as you have a VISA/Master Card with tap and go tech you’re good to start using the public transport system. You can even use your Apple watch to tap on and off. Pretty sweet!

Handy tip: If you’re under 30, the number 1 thing I would recommend is buying a railcard as soon as you get here and pair it to your Oyster card which is the equivalent of a Myki/Oapl (city transport card).

Unfortunately, you need an Oyster card to have the railcard discount apply to your fares (there was talk about linking the railcard to your bank card but not sure how far along that is). The card costs £30 and you can seriously make that back within 2 trips out of the city if you’re using the national rail for a big trip. The card typically saves you 1/3 of the fair for both buses and trains during non-peak times and you’d be hard-pressed to find anyone who wouldn’t save money buying this card.

It’s a digital card too which is cool. You download an app and when you buy national rail tickets, you just select that you own a railcard and you’ll get a discount (you’ll have to show the app if an inspector comes by of course, however, we never got asked to show our railcards).

Buses cost £1.5 per trip (or £1 if you use your railcard during off-peak) and get the job done. They aren’t as quick as the tube usually, but unless you’re in a rush, the buses are great and it can save you a lot of £££ during your stay.

Gyms

We had memberships at PureGym and TheGym which are budget gyms (around £19.99/m) and had everything we needed. You can keep fit just by running and doing bodyweight exercises tbh. I’ve just always prioritised a gym and those two above were the best value for money that I could find.

Tips and Tricks

Cheap Flights

Sky scanner is pretty much the go-to website for searching and comparing flights. However, I would recommend to book directly with the airlines especially with so many cancellations due to covid and the third party websites can be a nightmare to get refunds from.

Euro-star

The Euro-star was a fabulous option for us to travel directly to Paris and Brussels. It can be quite expensive but if you book in advance you can get some really good deals and avoid the dreaded airport. It leaves from St Pancras International Station which is attached to Kings Cross Station.

Sending Money Back Home

I have sent over $60K AUD back home (to continue investing of course) using a company called Transferwise. They have the best rates for sending money back and the process is really simple. You can get a free £500 transfer by using my affiliate link* which means you won’t have to pay any fees.

I’ve also sent money from Australia to my Monzo bank account too.

* This link is an affiliate link and I may earn some commission from it. Please see my affiliate page for more info.

Finding a job

We only have experience in two areas which I’ll cover below. But there’s just so many different pathways to finding a job in London that it would impossible to cover them all.

I will say that for white-collar workers, LinkedIn is utilized heavily. Make sure that’s up to date and looking good.

Teaching

By Mrs. FB

Being a teacher is a great job to have when moving to London or any UK city for that matter. I am a Primary school teacher and was able to take care of a lot of the admin side of things before I left Australia. I chose to sign up with anzuk Education as I had a friend who had used them as her agency. They took care of a lot of the paperwork before my arrival and organised my DBS and International Police Check which you will need to work in schools. They will give you copies of these at your registration appointment. I found them to be organised and professional.

When we arrived in London I went to my registration appointment at the agency and spoke to them about what type of work I was looking for and they asked if I wanted to use an Umbrella company or PAYE. I chose PAYE because I was only using one agency and this would be a higher day rate in the end as the umbrella company take a chunk for their fees. I started with day to day supply work so I could become more familiar with the school system. This was okay but requires you to be flexible and move around to a lot of different schools which I didn’t always love especially when you get a tough class! I also felt quite overwhelmed trying to find different schools especially being new to London and using the tube and overground for the first time. I ended up only saying yes to work that had a reasonable commute time as some days it would take an hour to travel to the school.

I started at £135 a day (PAYE) and just accepted that rate initially. This was probably my biggest regret as I should have negotiated my pay from the get-go and would encourage you to do so. At the time I had 5 years teaching experience and my friend who was working with the same agency and only had 1-year experience started at the same rate. I learnt pretty quickly that all agencies are the same in that respect and will try to pay you as little as they can get away with unless you challenge them.

After a month of supply work, I ended up taking a long term contract for the summer term teaching a Grade 3 class at a Catholic school in Vauxhall. I was lucky that the class were lovely and I got along really well with some of the teachers at the school. We would go for Friday night drinks at the pub to debrief about the week. I preferred working at the same school each day and being able to make better connections with the staff and students but with this comes more responsibility and planning. I made sure to ask for a higher day rate from the agency and was earning £160 (PAYE). After the summer break, I was called by the agency to once again work at this school and cover a Year 4 class which I was very excited about, especially not having to find another school. I taught there until the pandemic hit and was then able to go on furlough pay through the agency which I was super grateful for.

Overall, my experience of teaching in London was really positive. My top tips would be:

- Negotiate your pay: don’t be too scared to ask for a higher rate. I am a people pleaser and it was very difficult for me to do this but with a little pep talk from Mr FB I was a pro in no time 😉. You will hear the same spiel from the agency each time about them only taking a small cut for their fees etc (don’t believe them lol). You can even speak to other agencies to get an idea of how much they offer as a day rate and use this as leverage.

- It’s okay to be picky: If you didn’t like the school or the class you were teaching for the day and the agency want you to continue working there, say no. I did a number of trial lessons/days at different schools before I accepted my long term position.

- Find a contact at the school: If you like a particular school, make sure to talk to the deputy headteacher or whoever is in charge of finding supply teachers at the school. Tell them you had a great day and would love to come back, that way they can request you again through the agency.

Hope this was helpful 🙂

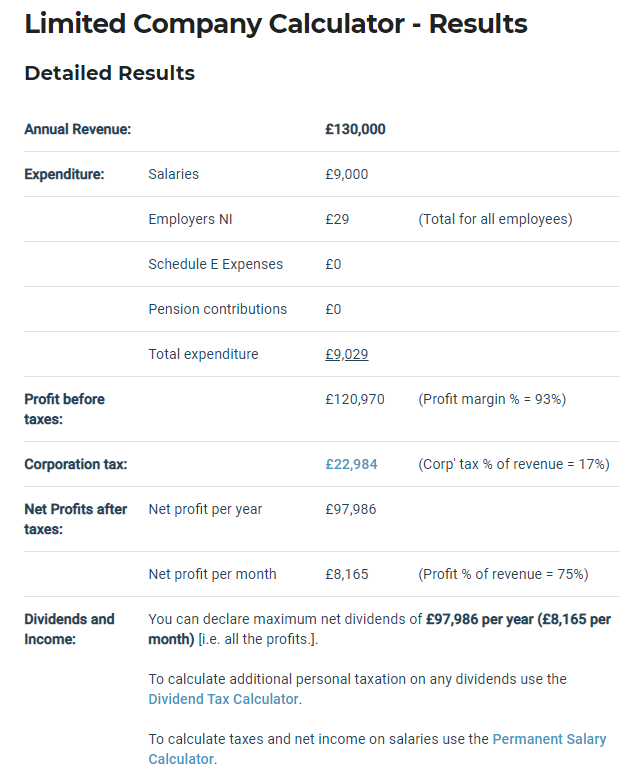

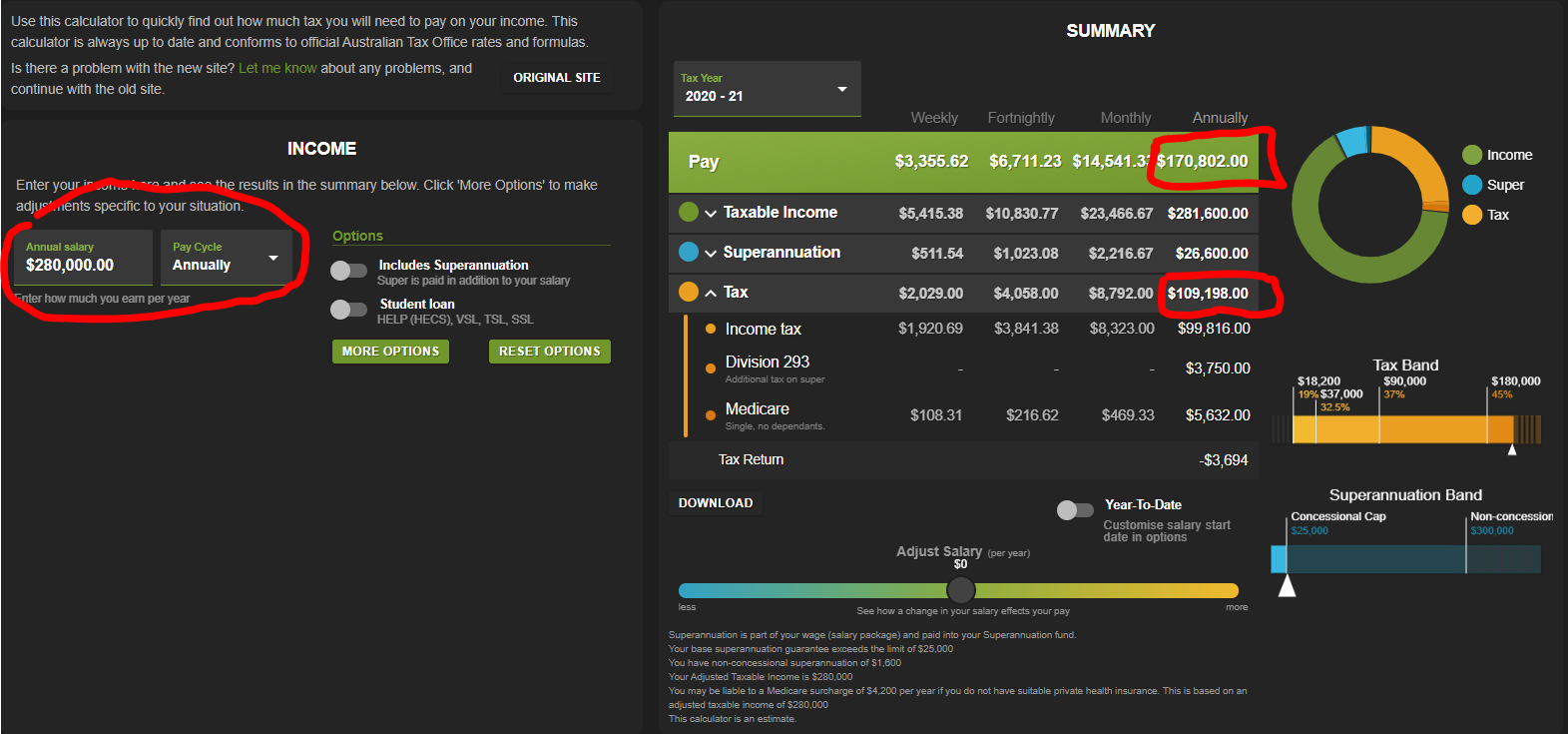

Contracting (in tech)

Okie Dokie, this part below is probably what I would have liked to have known the most when I got to London at the start of 2019.

A lot of people are attracted to contracting predominately due to the below three reasons

- Contractors charge more than their PAYG counterparts

- Contractors pay a lot less tax

- Contractors can deduct a lot of expenses

I had always heard how lucrative contracts were in Australia and you could reasonably expect to double your hourly wage in sacrifice of job security, Super, holiday pay, sick leave etc. etc.

This suited me down to a tee! We didn’t come to London to build a career or to try and save money, we wanted a job that would allow us to make enough money to live and travel basically.

And after 8 years in the public sector, I wanted to see if I had the chops to handle the private industry in one of the most competitive job markets in the world.

To say I was unsure is putting it lightly… and I’ve always been a confident/optimistic type of guy but quitting your job and moving to the other side of the world can strike fear into even the most bullish of people.

The below guide is everything you’ll need to know to land a high paying contract gig in London and something that would have saved me a lot of headaches and wasted time. It won’t cover all the administration tasks for running a company (too much to cover) but I’ll link to some great resources that go over everything in detail.

Limited, Umbrella or PAYE?

The structure in which you contract in is probably the first piece of this puzzle you need to figure out.

Almost all contractors I met in London were operating under a Limited company structure due to the major tax advantages. But that doesn’t mean it’s the best option for everybody so it’s good to know what the options are.

I know it can be a bit boring but you really need to know about a piece of legislation called IR35 because it has major implications for contractors and is more often than not, the deciding factor for what structure you choose.

In a nutshell, IR35 was introduced to stop contractors working as ‘disguised employees’ whilst receiving all the tax benefits on being a contractor. The lack of job security and employee benefits are the reason why contractors have tax advantages in the first place. Therefore if you’re working as a ‘disguised employee’, HMRC (UK’s ATO) will argue the point that you’re not accepting the increased risks and you will not be entitled to the tax advantages.

You can read up on their definition of a ‘disguised employee’ but I think we all known who they’re talking about. You know the guys that work a job for years and then decide to start a company and contract back to their employer at double the rate without skipping a beat. I’ve meant a few people who have done that within government over the years and it’s a smart thing to do really. The UK government see this as a tax loophole and I can understand why they want to plug it.

The definition of what is considered outside of IR35 (you’re not a ‘disguised employee’) vs what’s inside IR35 (you’re a ‘disguised employee’ and will not receive any tax benefit) is a grey area and will be assessed case by case if you ever get audited. Usually, the contracts are advertised as either inside or outside IR35 online which helps.

Limited Company

Generally, if the gig falls outside of IR35 and you’re going to be making > £30K then you’ll most likely be better off using a Limited Company (otherwise an Umbrella Company is the way to go).

Ther’s a lot more administration overheads Limited Companies though so be aware that you’ll have to do a lot more work. Raising invoices (and following them up 🙄), paying for insurances, registering your company and submitting a separate tax return etc.

The UK’s government website is a fantastic resource with a lot of really great written articles. If you’re convinced that setting up your own company is the right move, I’d strongly recommend this starting guide.

Umbrella Company

The major advantage here is everything is done for you. You save yourselves a lot of time and stress by going through an Umbrella as the contract is actually held by the umbrella company and the employer. You don’t get paid by the employer, they pay your umbrella company and then the umbrella company pays you.

The IR35 ruling is less important here because as far as I’m aware if you’re going through an umbrella, you’re going to be paying the full amount of national insurance (NI) tax so it’s pretty much irrelevant. This does open your options up a lot more though as almost all public sector contracts fall within IR35.

The main reason a lot of people start contracting in the first place is to make as much money as possible. It’s for this reason that most choose to go through a Limited Company vs Umbrella.

PAYE

It’s possible to become PAYE through an agencies payroll (if they offer it).

This option is the most inefficient (in terms of tax minimisation) of the three because you will have to pay full tax and NI contributions on all your earns and you won’t be able to claim valid business expenses.

Finding contracts

There’s a lot of different ways to skin a cat but I’ll cover what worked for me.

I used a website called Job Serve to find contracts but there are soooooooooo many places to find jobs it can be overwhelming. I wouldn’t recommend signing up to a whole bunch of alerts on various sites because the same job gets advertised across many platforms and your inbox will become unmanageable really quick.

There are a few niche websites that you need to pay to see ‘private listings’ but I never used them so I can’t comment.

I’m not sure if Melbourne or Sydney are the same but be prepared to deal with recruitment companies in London. It’s almost unheard of that a company will advertise a contract directly. 99% of the time it will go through a recruitment company and I have no idea why. The amount of people that are in recruitment in London is insane. Really high turn over rate too but I have heard you can make bank if you hustle hard without any quals or experience so it’s appealing to a lot of young people. It can be really frustrating dealing with a middle man that doesn’t know the requirements half the time and they never call you back to say if you didn’t get the gig 🙄. If you don’t hear from them within a week, it’s safe to assume that you weren’t shortlisted.

Here’s how the game is played:

- A company decides they need a contractor for X amount of time and are willing to pay £Y per day

- More often than not, a specific skill is required in a project that the company either doesn’t have in-house, or they need more of ASAP. It’s partly because of this urgency that contractors are paid as much as they are

- The job description with requirements and nice to haves are prepared (half the time by just copying a template or another listing). Handy tip: don’t be discouraged by how much experience and skills are in these job descriptions. They are so over the top and don’t reflect what you’ll be doing 90% of the time. I once came across a listing that said you needed 3 years experience in a technology called Dataflows which would have been fine… except Dataflows was invented in 2018 😂

- The new contract hits the recruitment market like a fresh shipment of crack to LA in the ’80s. An ungodly amount of recruitment agencies all rush out to and try to find a suitable candidate as they take a cut from your daily rate for however long the contract goes for. They will usually advertise the day rate with their cut already factored in (but always ask!). So if you see a contract for £450/d, the company that needs a contractor is probably actually paying something like £650/d but £200 of that goes to the recruitment company

- If it’s at a good rate within the city, the candidates are usually shortlisted within a few hours (that’s been my experience anyway). Handy tip: When I was ready to land a new contract I would basically refresh the Job Serve page (with my keywords) every 15 minutes. As soon as a contract pops up that you’re interested in, call the recruiter to touch base with them which will do three things:

1. It shows that you’re really interested in this contract. Recruiters want candidates to be able to go to interviews that same day sometimes (happen to me once). Make sure you get their actual email address so you can send your resume to them directly

2. You have a chance to ask a bit more about the contract that may not have been in the listing. You can confirm that it’s outside of IR35, open to someone on a tier 5 visa, located within London etc. Sometimes you can get a bit more out of them in terms of what the project is about and this will help you decide on whether you do in fact have the skills to perform what’s required.

3. You will prioritise your resume over others and the recruiter will actively look out for yours in their inbox if the phone call has been successful

- If you’re still keen to get the gig, tweak your resume to make sure you cover all the key requirements (don’t stress if you’re not proficient in everything, just say you have some skills and back yourself to learn on the fly if needed. The goal here is to make it to the interview) and update your LinkedIn page to make sure it matches (yes, some people do check to make sure it matches your resume). This was one of my resume’s I used when I was applying for contracts last year.

- If everything has gone right, you should be getting a call from a recruiter pretty soon (within a week) to set up your interview. Go in with confidence and crush it to secure the contract 👊

- Once you win the gig, you’ll be sent a formal contract that lists a whole bunch of crap but you’re probably only really interested in making sure that the day rate is what was agreed upon and the details for your first day.

- Rock up on the first day and go from there… your boss for the engagement will tell you who you need to send the invoice to and how accounts payable works etc. etc.

And there you have it, you’re officially a contractor in the big city 😊

The above is my experience but it may be different for you. I’d love to hear from an actual London recruiter in the comment section and get their take on the whole situation.

Mistakes

The two biggest mistakes I made when I was first looking for contracts were:

- Applying for contracts that were over a week old. Recruiters will always tell you that the contract hasn’t been filled yet but what they’re really doing is just hedging their bets if something happens to their current candidate. There’s no harm in applying for old contracts but all three of my gigs in London came from freshies and after speaking to a few recruiters at the pub, it’s really a game of first in best dressed with this type of work. I mean think about it, if the company really wanted to take the time and invest in finding the right person, they would probably just create a permanent position. Contractors are hired guns!

- Not jazzing up my LinkedIn for the first two weeks 😅. I cannot stress this enough, LinkedIn is really, really important in London for some reason. I did have a LinkedIn profile before I came to London but I hadn’t updated it in years. A big reason my phone was dead quiet during the first few weeks was because of how bad my LinkedIn profile was. No previous experience, no updated profile pic, no quals or skills.

Paperwork

I used a company called SJD as my accountant for both my personal and companies tax returns. If I could do it again, I’d just create an account with Free Agent and pay to use that product. It’s the cheaper option but it’s also the easier one IMO. My accountant didn’t do a whole lot TBH and it sort of annoyed my every time I saw the £110 go out of my business account each month. Their software was crap too. I would hire an accountant to help with the closure of the company and that’s about it.

It doesn’t take much to learn the ins and outs of using HMRC website and the Free Agent software really covers everything you need to run a small Limited Company used for contracting. The hardest part of contracting is raising invoices and chasing them for payment. But if you work for a good company that pays on time, it’s super easy.

You’ll also need to pay for public liability and indemnity insurance to cover your ass in case something goes horribly wrong. This usually costs < £1,000 depending on how much coverage you get.

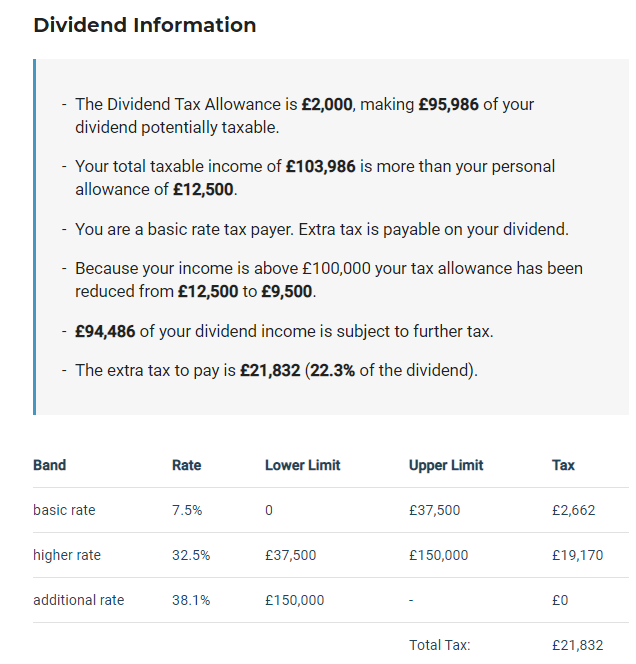

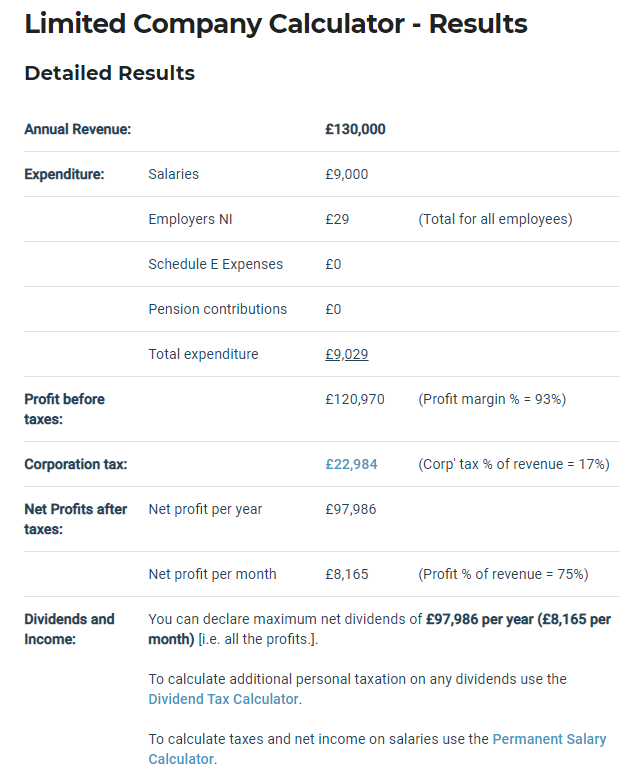

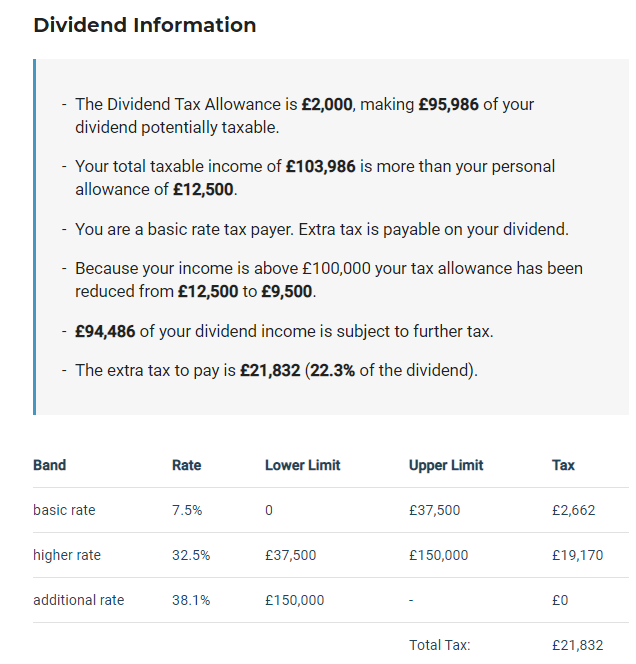

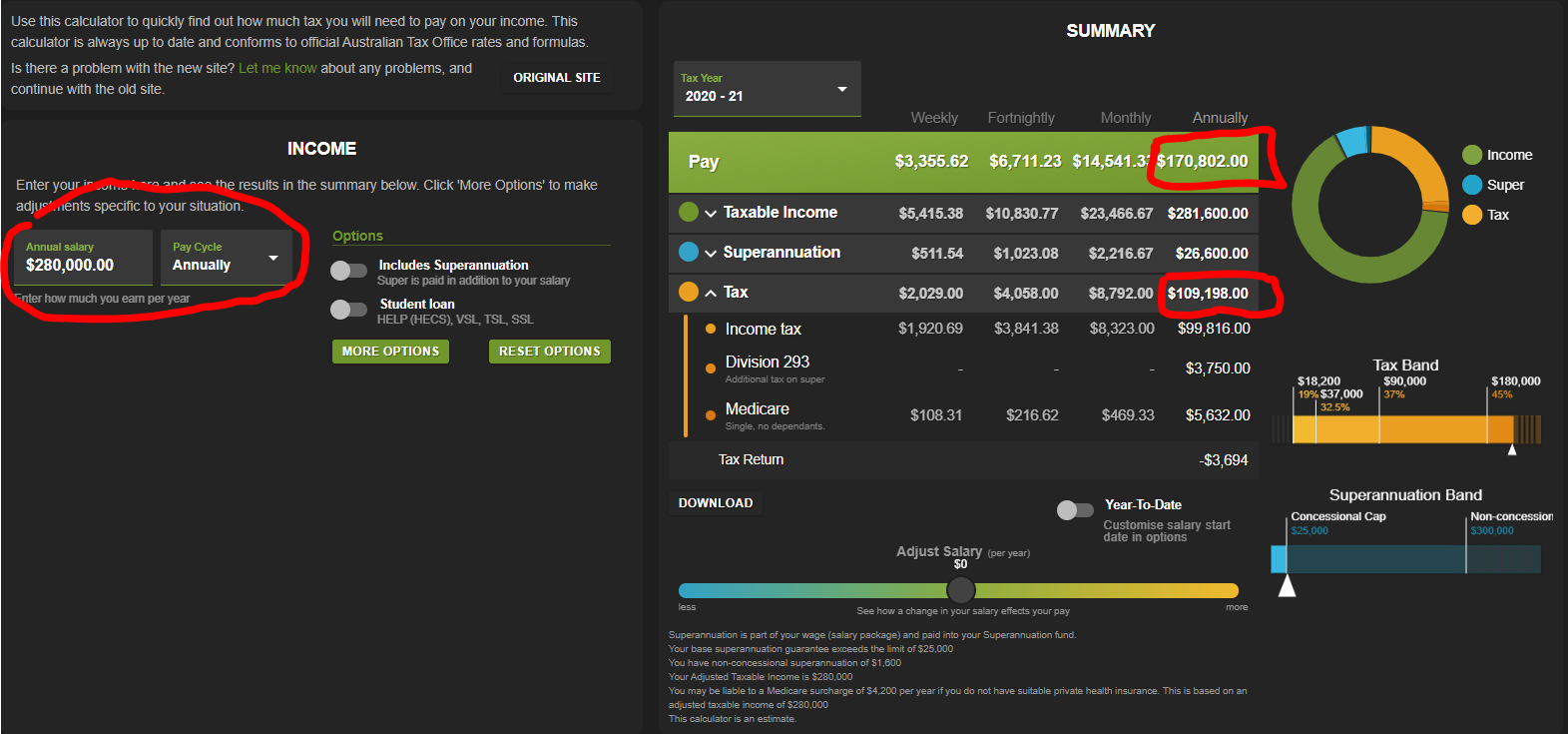

Salary/Dividends

What many contractors do is pay themselves a small salary and then pay the rest of the money they made through dividends which have a much lower tax rate. This does depend on a number of things, IR35 being on the most important ones.

Resources

The best resource I can recommend hands down has to be Contractor UK. It’s predominately a forum board but it also has some really well-written articles that cover everything you’ll need to know about contracting in the UK.

It covers the entire UK but the community seems to be heavily London based and leans towards Tech jobs. I asked many questions on that forum and it helped me out a lot.

Tax/Investing whilst overseas

I’ve had a tonne of questions over the last two years about these two topics.

They usually go something like…

“AFB, how do you invest back in Australia when you’re in London” & “How does it affect your tax return”?

This is such a hard area to get good solid info on because of how different the rules can be for different circumstances.

Take our situation for example. We have been able to continually invest without much hassle whilst being overseas because all of our wealth is held in a discretionary trust fund with a corporate trustee. What I did before we left Australia was cease control of the company that was the corporate trustee of the trust and have my mum step in to run it while we were away. That meant that she had 100% control of our assets and technically could have gone on a YOLO trip of her own (plz no mum). The advantages of being able to distribute income from the trust to other people worked perfectly for our situation even though I had no intention of utilising the trust this way when I first set it up. When we return in a few weeks, I will retake ownership of the company and be back in control.

In hindsight, would I set up a trust just to make it easier if/when I moved overseas? No, I wouldn’t. Investing through a trust overcomplicates things and you can FIRE without one.

There are different strategies for utilising retirement accounts in the UK but it’s just so circumstantial with too much to cover. I never went on a deep dive into these strategies either because I was a contractor. Mrs. FB opted out of her pension scheme so she receives more £££ but paid more tax. This works for us because Super isn’t a part of our financial independence strategy.

International tax law is an insanely complicated and circumstantial topic and I’ve got no hope in hell trying to explain 1% of it in a blog post. So what I’ve done is invite Evan Beissel, a Tax Partner at Mazars to create a guest post (below) that will cover the basics.

Please let me know in the comment section below what specific questions you want answered. I’m going to get Evan on the podcast in 2021 to flesh out other topics we no doubt missed in this brief overview.

*FYI this isn’t a paid guest post. Evan reads the blog and offered his services and expertise for this article for free and AFB gets no kickbacks. I’m sure Mazars will get some traffic but the content below is of mutual benefit to both the AFB audience and Mazars.

Moving overseas and Tax, A short guide for Firebug’s

By Evan Beissel, Tax Partner, Mazars

Whilst tax law is an immensely complex topic, many of us can get away with only interacting with a small number of rules that are relatively easy to understand. For example, most working Australians

would know that when they prepare their tax return that their salary is included in their income and that certain work-related expenses and charitable donations may be deducted from their income to

calculate their taxable income.

However, one way that you can make your tax affairs substantially more complex is to move

overseas. Not only do you need to now understand the tax rules of another country where you are

living and earning income, but you may also still be subject Australian tax to some extent. You have

now entered the mysterious and wonderful world of international tax.

Whilst there is no one-size-fits-all playbook to these tax rules, there are some key concepts and topics that are common to many, which I will try and explore here and hopefully leave you with a bit more knowledge than you started with.

Tax residency 101

Tax residency is a huge topic and too big a topic to cover in detail here, but it is well worth covering

the basics.

Firstly, tax residency is a concept that exists separate from residency for immigration purposes. For

simplicity, for the rest of this article, I will simply refer to residents and non-residents as meaning in

relation to tax residency. Most developed countries (Australia included) tax their residents on

worldwide income whilst non-residents are generally only taxed on income sourced in that country.

Source is another topic that can get quite complicated, but as a simple example, salary

income from working in an overseas country would generally be sourced in that country, and

investment income such as dividends received from a foreign company is generally sourced where the company is based.

Another key issue to understand is that tax residency is not exclusive, and every country has different rules. So you can, for example, remain a tax resident of Australia whilst living in the UK, but also be a tax resident of the UK. In this case, double taxation agreements become critical – these are agreements between two countries on which country has priority of taxing rights in various

circumstances. Not all countries have a DTA with Australia, however, these are in place for most

developed countries including the UK.

In Australia, there are a number of residency tests that can cause you to be a resident for tax

purposes. The most relevant of these is the ‘ordinary resides test’ and the ‘domicile test’.

Under the ordinary resides test, you are a resident of Australia if you ordinarily reside in Australia.

Generally, this is not difficult to establish –for example, if you are living permanently in Australian do

not have a home in any other country. However, it can get difficult to establish where someone

ordinarily resides if they spend time in multiple countries and have multiple residences where they

regularly reside. There is a body of legal precedent to assist in these greyer areas, but for most

people, this is not an issue and it doesn’t warrant further discussion here. Suffice to say, if you move

overseas for an extended period and don’t retain a home in Australia usually you would be considered to no longer ordinarily reside in Australia.

The domicile test relies on the legal concept of domicile which in broad terms refers to a person’s

legal ‘home country’. Without going down a rabbit hole on domicile rules, as a starting point if you and your parents live permanently in Australia then it is likely you have an Australian domicile. However, if you or your parents immigrated to Australia, then it is possible you may not have an Australian domicile. This distinction is critical as someone with an Australian domicile is much more likely to remain an Australian resident when they move overseas.

Under the domicile test, someone who has Australian domicile is a resident of Australia unless they have established a permanent place of abode outside Australia. A permanent place of abode refers to a locality rather than a dwelling (e.g. you might establish London as your permanent place of abode, rather than a particular house or flat that you live in whilst you are residing there). Permanent does not mean indefinite but does require an intention to reside on a ‘permanent’ basis. There is no minimum time period that is considered to indicate permanency and this is an area of residency rules that can be quite difficult to establish with certainty.

Whilst the ATO have sometimes used a two year period as a rule-of-thumb, this is not based in legal precedent. Ultimately, whether you have established a permanent place of abode outside Australia will depend on the specifics of your own circumstances.

Tax issues for Aussies moving to London

So you’ve decided you want to move to London for a couple of years. What does this mean tax-wise?

Firstly, tax residence becomes important here:

- Depending on your individual circumstances you may or may not cease to be an Australian

tax resident. If you do remain an Australian tax resident, you would be liable for tax in

Australia on income earnt in the UK

- If you are living in the UK for an extended period you are likely to become a UK tax resident

during your stay, and so will also be taxed in the UK.

To illustrate, let’s consider a couple of examples. For both examples, let’s assume you have the following income sources whilst living in the UK:

- Salary income from a job in the UK

- Rental income from an Australian property

- Dividend income from Australian shares

- Retaining Australian residency

In this case, it is likely you would also be treated as a UK tax resident whilst living there so you would be a dual resident for tax purposes. In broad terms, both countries will therefore tax all your worldwide income (note this is a simplistic summary but should be the case for most ordinary salary-earners with modest investment income). However, the country where the income arises (i.e. where it is sourced) would have priority of taxing rights, and the other country should provide a credit for tax paid in the other country subject to rules in each country which may limit the tax credit allowed. The tax paid on each type of income is summarised below.

|

Australia |

UK |

| First taxing rights |

Australian rental income Australian dividend income |

UK salary |

| Second taxing rights (with credit for tax paid in first country) |

UK salary |

Australian rental income

Australian dividend income |

- Ceasing Australian residency