by Aussie Firebug | Oct 21, 2023 | Net Worth

I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

Not a lot to report for this month so I’ll just be posting the basics.

Net Worth Update

Ouch!

The markets hammered our portfolio in August with Share and Super being hit the hardest.

Honestly, I’ve been quite occupied throughout August, so I haven’t been keeping a close eye on things. Nevertheless, as we begin to withdraw from our portfolio, these somewhat significant downward swings are stinging a bit more.

All good though. My business signed another client in August, so there should be a big PO coming my way in the coming months.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

We hardly left the house in August which was reflected in our low expenses.

Shares

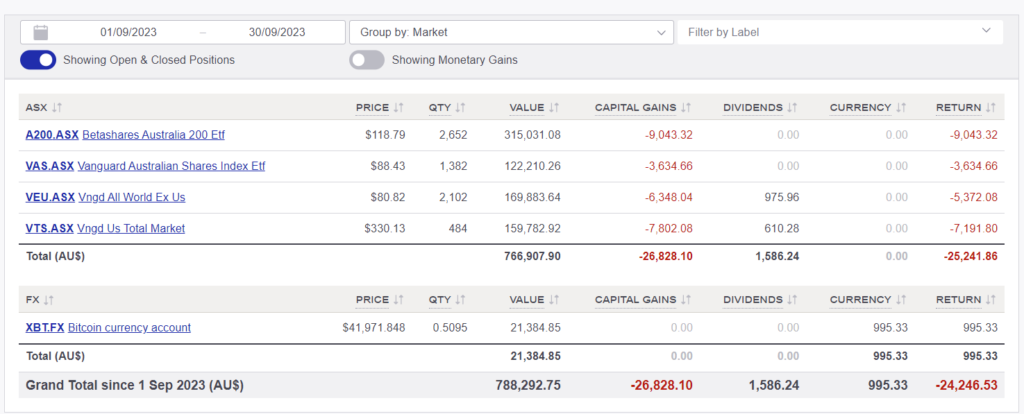

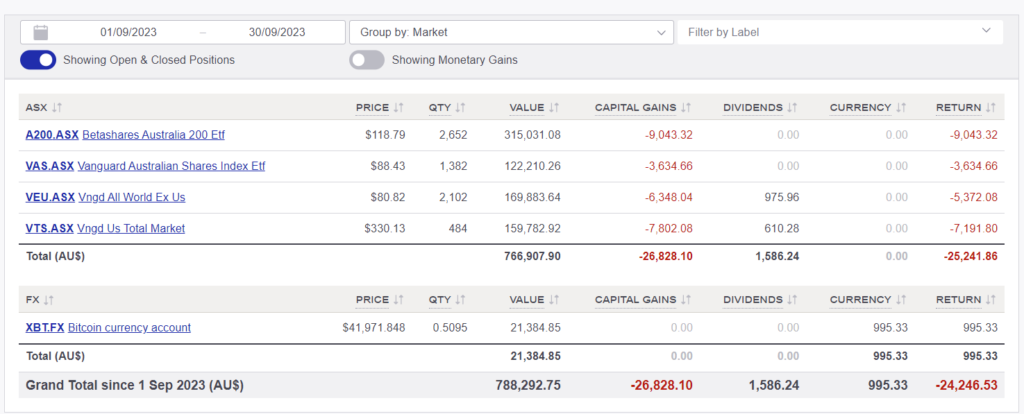

The above graph was created by Sharesight

Once we get the $$$ from the upcoming PO, I might consider buying more shares, although I find myself leaning towards reinvesting the funds back into the business. Both options are quite tempting.

Growing the business seems way more fun, though haha.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | Sep 16, 2023 | Net Worth

I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

I’ve said it before, and I’ll say it again.

As much as I love online communities, nothing beats in-person gatherings with like-minded people.

Which is why it was so awesome to have the guys from the Rask team come down to my hometown and put on a roadshow. The FIRE community in Latrobe Valley showed out, and we had a packed room filled with like-minded individuals, all enjoying a great evening together.

Ana from the GRSC podcast and Captain FI

Owen from Rask

Traralgon crowd

Ana and Emma from The Broke Generation

It was so cool to meet folks who came all the way from the other side of Melbourne to be there too. I really did my best to chat with everyone that night, but if I didn’t get to you, I’m genuinely sorry, and I hope we can catch up at the next meetup.

Shoutout to Adrian from Chartscape for creating this personalised poster that beautifully illustrates our net worth journey (with the blue graph in the background) from the very start up to our July update. It’s an awesome digital art piece, and it’s hanging up in my office mate 🙂

Net Worth Update

I had a big tax bill for the company, which, along with some other big expenses, was the primary factor behind the substantial loss this month.

All other asset classes went down too except for Super.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

August was a fairly typical month for us.

Shares

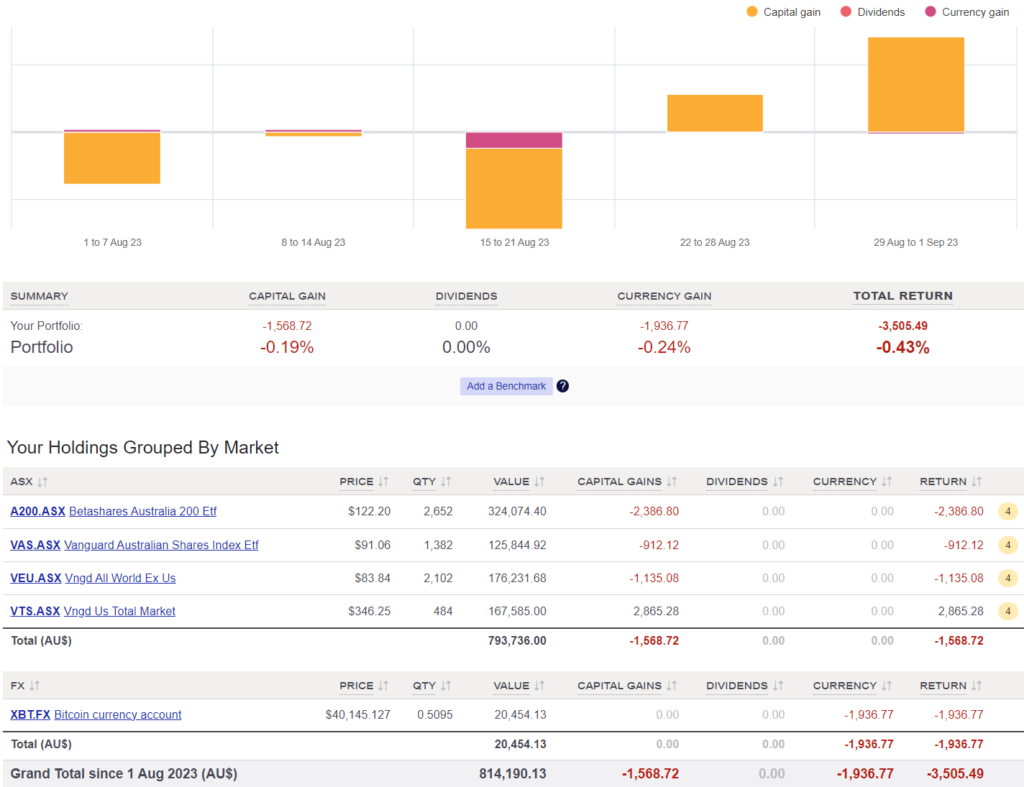

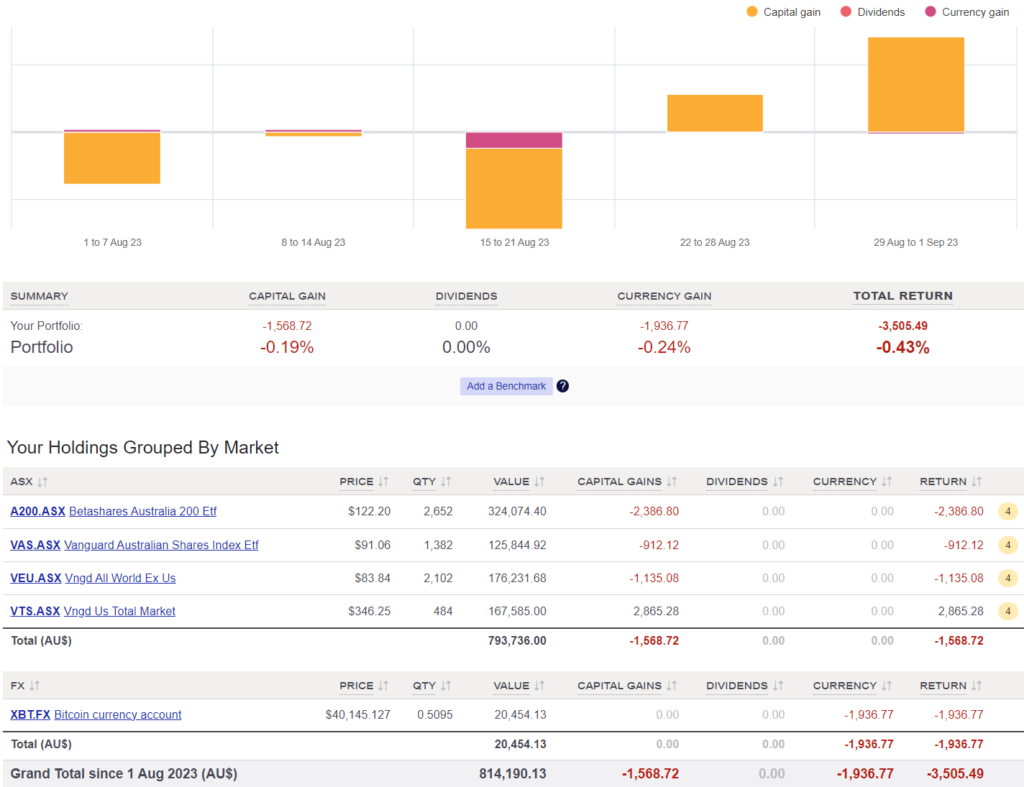

The above graph is created by Sharesight

We didn’t buy any shares in August.

I’m currently working on a long-overdue article. It will provide an update on our current strategy and where we stand in the grand scheme of things. You can expect it to be released before the end of the month 🙂

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | Aug 9, 2023 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

In July, I felt fortunate to be blessed with the opportunity to work from the comfort of my home. My social side has been longing for more real-life interactions for a while now (hence my co-working space ambitions) but honestly, in the middle of winter I’m pretty content to be inside in a hoodie and moccasins 😂.

It might sound weird to some but I really enjoy going for a walk first thing in the morning when there’s still ice on the grass (my fellow Victorians will know what I’m talking about). It wakes me up and get’s the blood flowing.

During that 15-minute stroll, my mind tends to wander. On occasion, it’s focused on what I want to get done by day’s end. There are moments when my thoughts drift towards upcoming events and the future. And then there are instances when I find myself fixated on that joke I cracked that nobody laughed at 😅.

My walking shifts into autopilot mode, and since I’m mostly unable to reach for my phone or use my computer, it’s just me and my thoughts for a while. Almost like meditation, I guess.

And then there’s a different type of meditation I get when I’m at the gym. There are times at the gym when the physical demands of exercise completely occupy my mind. In those moments, my brain’s capacity for attention becomes entirely absorbed, leaving no room for any other thoughts.

I’m solely focused on lifting something heavy and placing it back down (it sounds funny when I write it out like that).

Having time to let my mind wander and time, when it’s completely focused, are both important mental exercises I need to feel centred.

In other news…

There’s only one week to go before the RASK roadshow tour in my hometown.

There’s going to be a lot of my local FIRE community joining along with other great guests and speakers.

See y’all next week 🔥

AFB x RASK Traralgon meet-up

Net Worth Update

The share market did the heavy lifting in July with BTC being the only asset class that went down.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

It’s been a very, very long time since we had a sub $4K month. This is mainly because we didn’t book any future trips and just stayed home for the whole of July. It’s funny to think that $4K a month was our baseline pre-London.

Shares

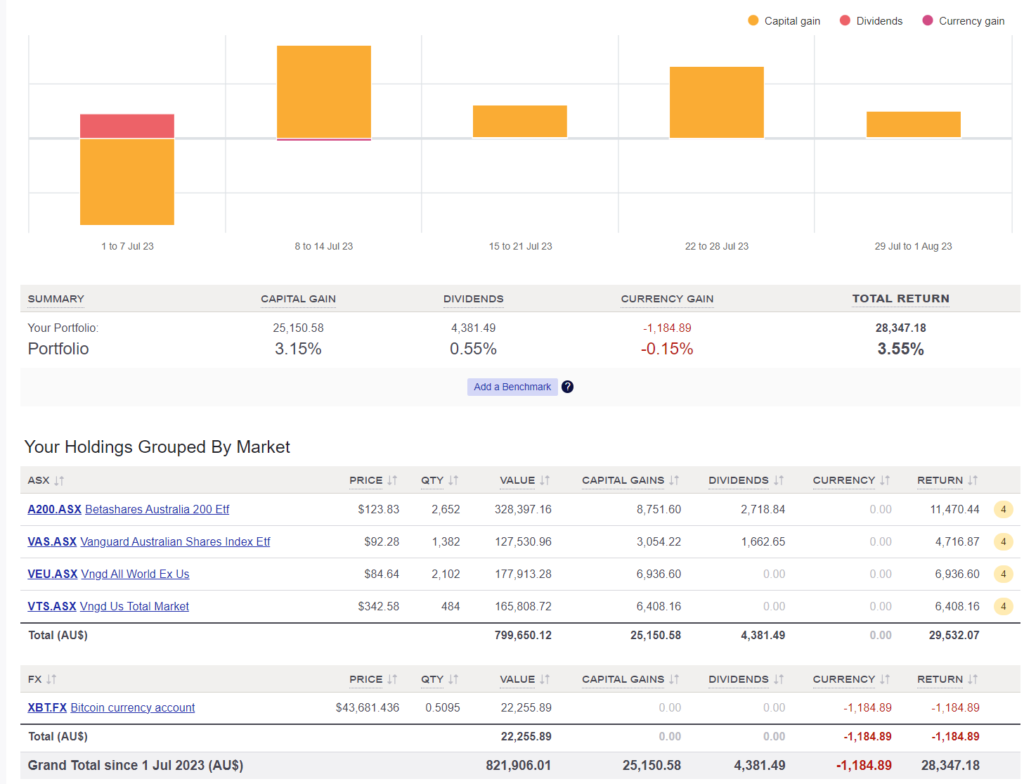

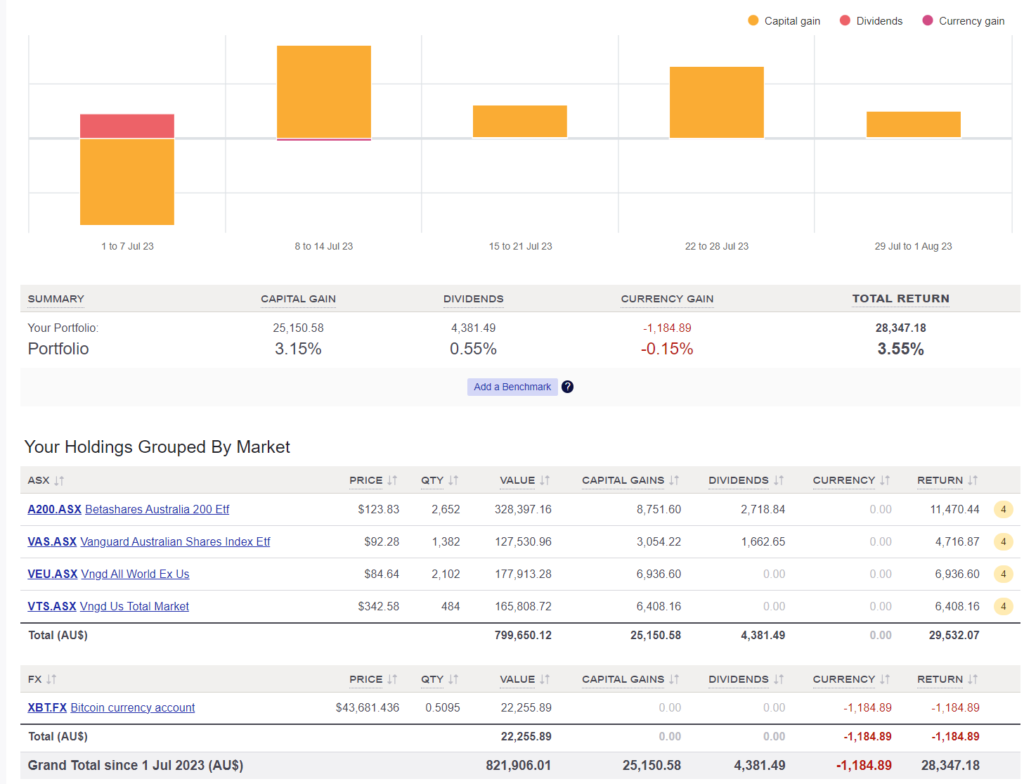

The above graph is created by Sharesight

We didn’t buy any shares in July.

I’m planning to record a podcast soon to provide an update on our progress towards FIRE, as I’ve received numerous messages inquiring about it.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | Jul 4, 2023 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

We managed to squeeze in a winter escape to Bali in June.

In my July update from last year, I briefly discussed the extent of Bali’s transformation, and this recent trip only reinforced that impression.

Bali has always been the Bogan capital of the world to me. But that reputation needs serious reform.

Don’t get me wrong, you’ll still occasionally bump into the southern cross-tattooed, foul-talking drunk bogan in Kuta. But further up the coast in Legian and Seminyak lies pure paradise.

I was quite surprised to learn about its stellar reputation worldwide as well. Americans often choose to travel over 20 hours to vacation in Bali instead of opting for more “local” destinations like Mexico or the Caribbean.

Crazy!

Jimbaran Bay

During this trip, I was also on a reconnaissance mission. I have a strong desire to permanently incorporate a Southeast Asian destination into my lifestyle at some point.

In my line of work, I possess a unique superpower: the ability to perform meaningful work without being physically present. This blessing allows me to escape Victoria’s winter for a few weeks every year, all while maintaining a sense of productivity.

During a laid-back holiday like in Bali, I tend to get a bit bored. I reach my limit after a week or two of pure relaxation.

However, incorporating a few weeks of meaningful work into my stay changes that dynamic. That’s why I was eager to find a cool co-working space.

I found a place called GoWork (a rip-off of WeWorks haha) and it was awesome!

It cost me $14 AUD for the day but they have monthly rates which work out a lot cheaper.

Kudos to the interior designers responsible for this space as well. I took numerous pictures, drawing inspiration for when I eventually have the opportunity to venture into starting my own co-working space in Latrobe Valley.

Co-Working Space

In other exciting news, I’m thrilled to announce that I am finally organising a meetup for the FIRE community in my hometown of Traralgon.

The good folk at RASK are coming down as part of their roadshow tour. They’ve asked me to talk at this event and I thought it would be a great opportunity.

There are only 100 tickets available and 28 have already been sold.

You can use the code “15OFF” until this Friday to get 15% off.

AFB x RASK Traralgon meet-up

Net Worth Update

In June, everything experienced an upward trend, but the main increase came from the renewal fees for my data platform license for another year.

I license the platform on an annual basis, and it has been 12 months since my client initially signed up.

I am currently working on two promising leads, and I am hopeful of securing the next contract before the end of the year which might mean another big bump but we’ll see.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

The expenses during June were relatively normal, as we had already paid for the Bali trip in the preceding months.

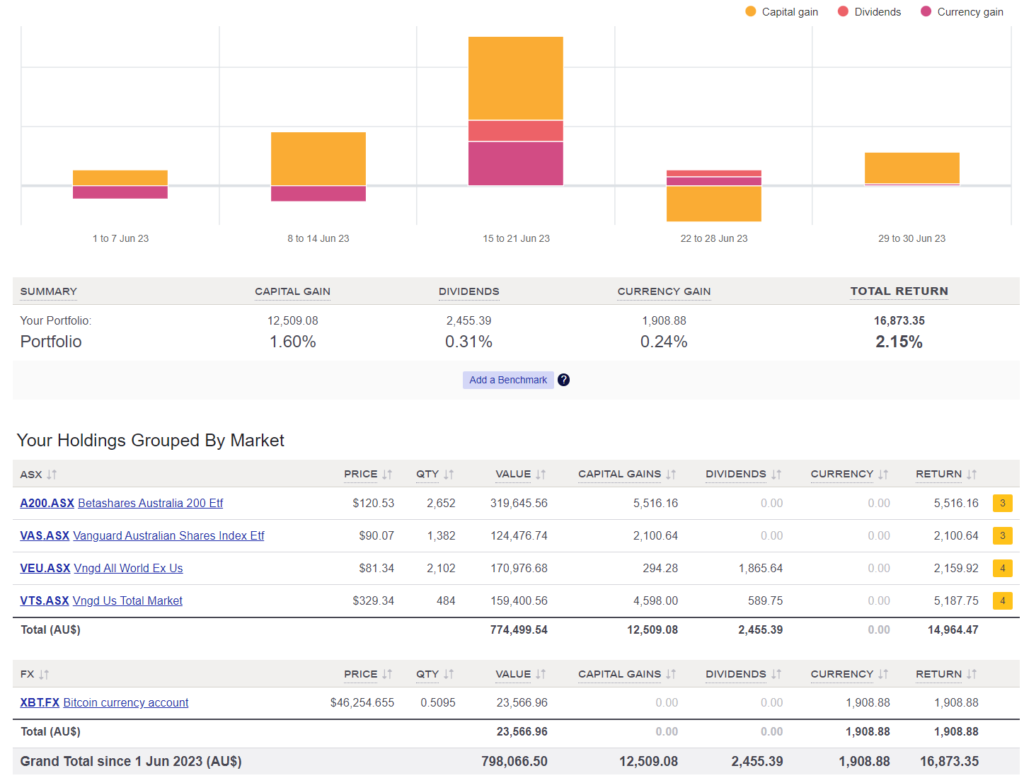

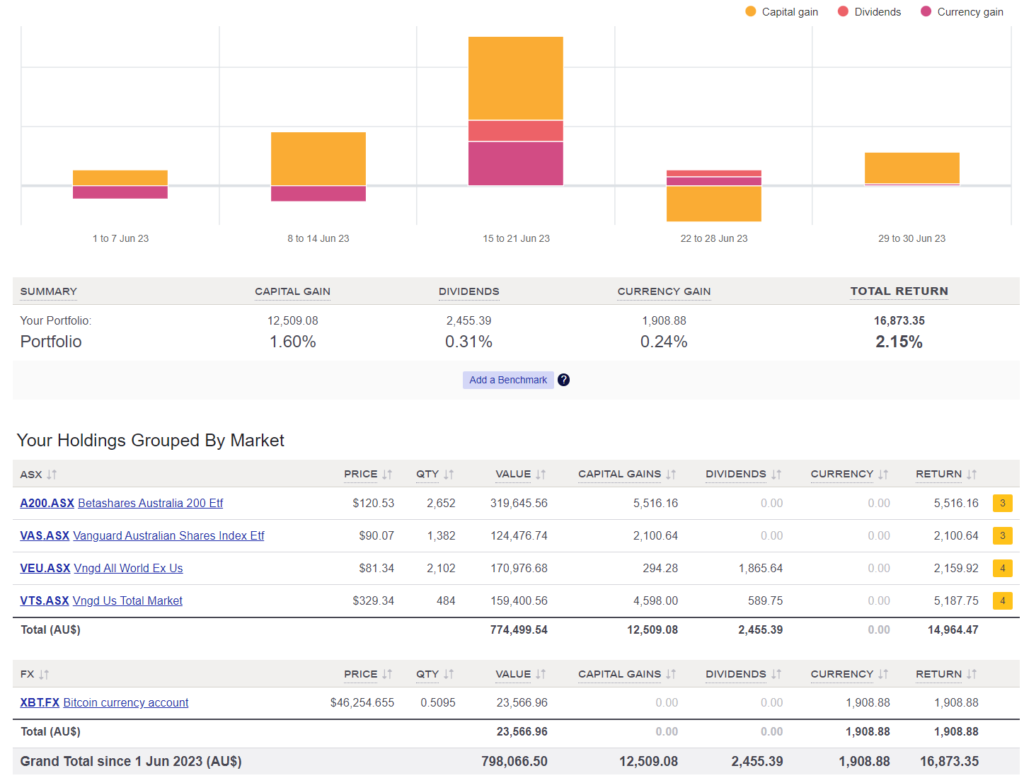

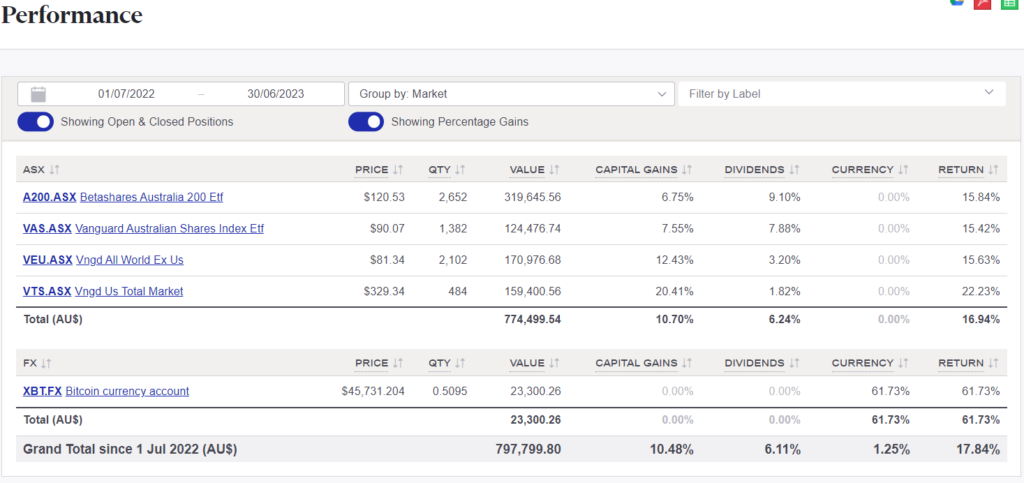

Shares

The above graph is created by Sharesight

Fantastic returns across the board!

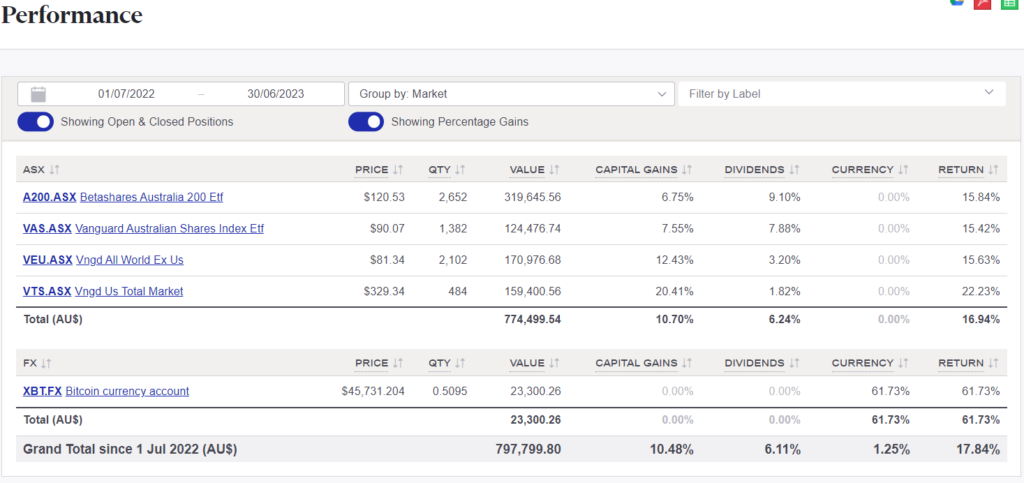

With the fiscal year now concluded, I made the decision to evaluate the performance of my portfolio over the past 12 months, and the results were surprising to me.

22/23 Performance

Nearly 17% from passive ETF’s!!!

Yeah, I know shares had a big year the previous year but still, pretty cool to see.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | Jun 10, 2023 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

Not a lot to report for the month of May.

I’ve been working nonstop on my business and preparing for a big conference at the end of June.

It’s amazing how fun work is when you’re in control and have a personal goal to work towards. What’s equally amazing is how many different hats you have to wear to get other businesses to buy your product.

In the month of May, I’ve been a:

- Marketer

- Developer

- CIO

- CEO

- Graphics designer

- Data Engineer

You’d think that building a product that’s better than anything else in the market would be enough.

But it’s not.

So much of what drives business is relationships. I remember when adults use to tell me that networking was one of life’s most important skills.

“Get out there. Meet people. Get to know them”.

It’s hard for a teenager to fully grasp what this means.

But as I’ve gotten older, it’s become crystal clear that developing relationships is paramount if you want to do business.

Another slightly annoying thing is how much authority LinkedIn has.

I’ve never posted on LinkedIn before. I had a profile years ago but it’s been sitting dormant because I just didn’t see the point. The whole website seemed like a showoff extravaganza.

But it has a level of authority in the niche that I’m selling to (government). Potential clients were telling me it was a red flag that my company didn’t have a LinkedIn presence 🙄.

So I had to put some effort into building a company page and posting some content.

This social media peacocking is part of the game you have to play when you’re new. It just is what it is. And if I want to reach my goals, I can either play the game or give up and try something else.

Wearing these different hats for the company and learning different skills is fun. It’s not what I want to be doing all the time but I absolutely love learning about the human behavioural science of commerce.

I’d wager that 90% of the deal comes from marketing and your reputation/relations in the industry. If you have a good rep and are known to produce exemplary work, half the battle is won. When you’re the new guy on the block, you have to establish authority by building brand awareness and offering a competitive advantage.

This is something I’ve always wanted to have a go at and it’s been a lot of fun so far. I’m hoping that I can land a big contract or two after the conference and hire someone.

My dream of the co-working space is on pause until early next year.

Net Worth Update

Everything went done this month with Super being the only asset class in the black.

A lot of cold hard cash went out of our accounts in May too.

The two big reasons for this were a big tax bill for the company and the cost of the June conference.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

I don’t include company expenses in the above graph because we don’t rely on them to maintain our lifestyles. I’ll probably remove company assets (cash) from these updates eventually to make things clearer too.

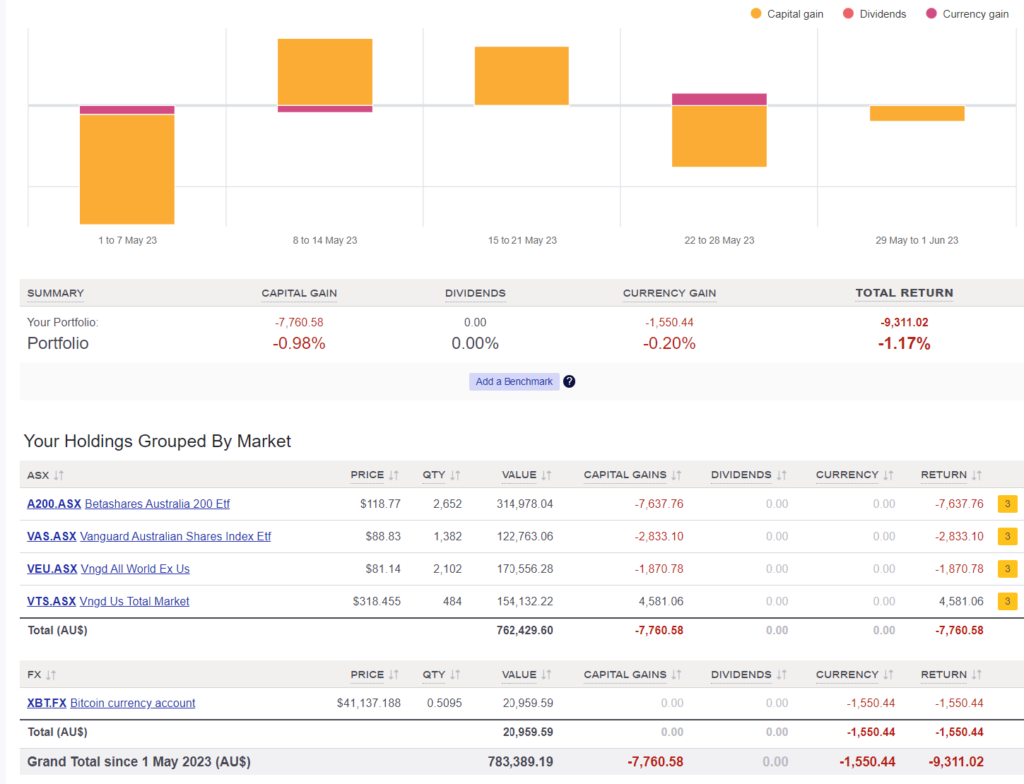

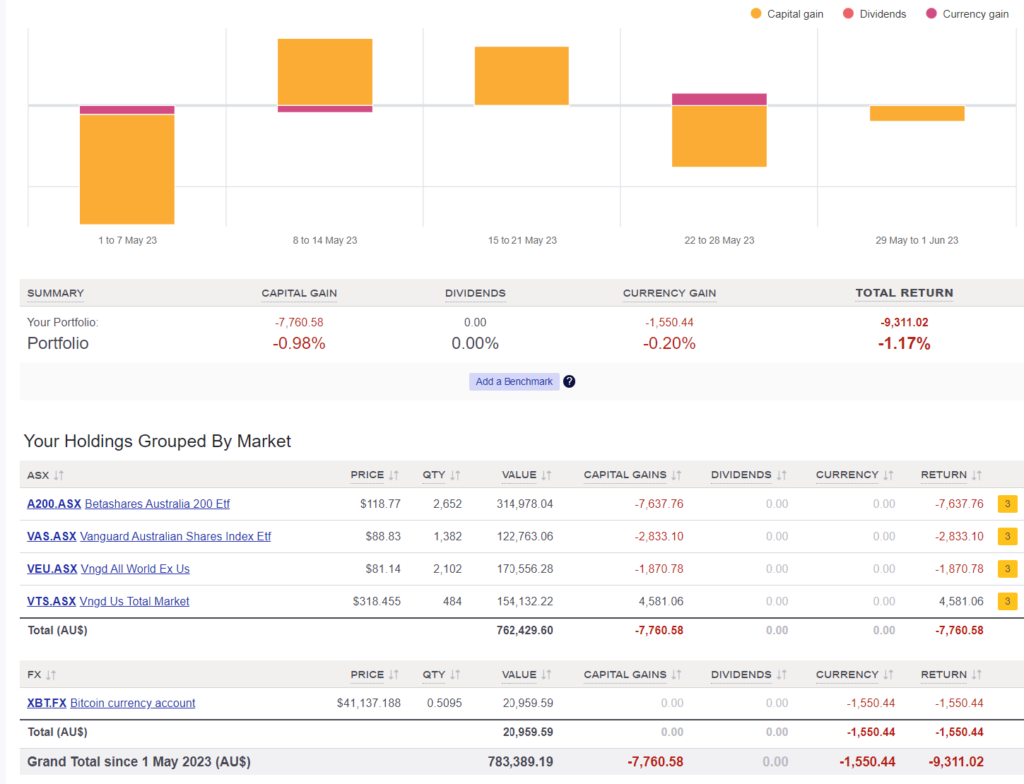

Shares

The above graph is created by Sharesight

I’ve added our Bitcoin holdings to our Sharesight portfolio!

This was really cool because I’ve never worked out the total return we’ve made since 2017. As I type this out today, we’ve had a total return of 4.44%. A lot of that has to do with buying the bulk of our Bitcoin last year and the price of BTC going down a fair chunk since then.

I’m still waiting for businesses to offer the lightning network so we can use our coins in day-to-day transactions. Maybe that day will never come but I’m hopeful for now.

No new purchases again for May. Most of our spare cash is going into the business.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | May 7, 2023 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

We landed back in Australia at the end of April after a month abroad.

Japan was such a unique adventure and I’m really glad we persisted with booking it. We were close to going last year but the Covid restrictions meant we would most likely get a half-baked experience.

I have so many great things to say about Japan that it’s hard to know where to start.

As most people would have probably guessed, the food was amazing.

Ramen is life 🍜!

Interestingly enough, we found that Sushi was more of a delicacy than a quick lunch snack like it is in Australia. I think the West has bastardised Sushi. We didn’t see any deep-fried chicken sushi rolls for example 😂.

The cities are so clean! I’m talking ridiculously clean. Australia is pretty clean by world standards, but Japan is next level. And it’s ironic because it’s so hard to find a bin. Cleanliness is built into their way of life.

I’m not sure if this is common knowledge or not (I didn’t know about it) but it appears that Japan has a strong biking culture. It was one of the first things that jumped out at me when I was walking around Tokyo on our first morning. So many people were riding their bikes around. And hardly anyone was wearing a helmet! There were so many bikes that we routinely saw bike parking signs outside of restaurants directing people to park their bikes around the corner and not to clog up the footpath.

I had heard that Japanese people were respectful but the level of politeness still surprised me. Even if they didn’t speak English, they would often go out of their way to accommodate our group. I loved the constant bowing too. Gestures of respect and welcome radiated throughout the cities and towns we visited.

It was so cool to learn some Japanese history before our trip and then see some of those historic sites in real life.

Fun fact of the day, for about 200 years, between the early 17th century and the mid-19th century, Japan pursued a policy of isolation known as “Sakoku,” which literally means “closed country” in Japanese. During this period, Japan severely restricted contact with foreign countries and only allowed limited trade and diplomatic relations with China, the Netherlands, and a few other countries.

The Tokugawa shogunate, which was the feudal government that ruled Japan during this period, believed that foreign influence and ideas could undermine their power and control over Japanese society. To prevent this, they imposed strict regulations on travel and trade, and prohibited Japanese citizens from leaving the country by penalty of death.

As a result, Japan remained largely isolated from the outside world and developed its own unique culture, traditions, and technologies. However, this policy also hindered Japan’s economic and social development, and eventually contributed to its vulnerability to foreign powers, leading to the country’s eventual opening to the world in the 1850s.

Brasilian Jiu-Jitsu can be traced back to Japan through its roots in traditional Japanese Jiu-Jitsu which is cool. I trained at a Dojo in Osaka and will cherish the experience forever.

BJJ in Osaka

I felt like a kid again when we did a day trip to Universal Studio Japan. They have the only Super Nintendo World theme park in the world!

Super Nintendo World

I have a few photos of Super Nintendo World but they honestly don’t do it justice. Check it out on YouTube if you want to see it but it’s actually insane. Like, the amount of detail in this world is crazy. It’s like I was transported back to being 10 years old playing the SNES with my dad haha. They even had little mini-games inside where you had to punch the coin blocks to get more points and beat the Goomba’s in a race plus a whole bunch of other stuff. We all had a little Bluetooth band (I’m wearing my Luigi one in the pic) which recorded your score whilst in the world. You could look up the scoreboard for the day and see where you ranked. It was CRAZY!

We didn’t go on that many rides because the wait times were also crazy but I just loved being inside the theme worlds and visiting the shops and little shows. My second favourite place was Harry Potter World and the detail they went to was better than Super Nintendo World. They had built a goddamn castle on a hill that you could legit go into and walk around in!

We ended our Japanese trip by visiting the city of Hiroshima.

Hiroshima is located in the western part of Japan’s main island, Honshu. It is best known as the site of the first atomic bombing in history, which occurred on August 6, 1945, during World War II.

At 8:15 a.m. on that day, a United States B-29 bomber named Enola Gay dropped an atomic bomb over the city, killing an estimated 140,000 people, many of them civilians, and injuring countless others. The bomb, nicknamed “Little Boy,” devastated the city, destroying most of its buildings and causing widespread fires and radiation poisoning.

A building that survived the bomb.

We visited the Hiroshima Peace Memorial Museum which is dedicated to preserving the memory of the atomic bombing and promoting a message of peace and nuclear disarmament.

I’ll be honest, the audio tour was really hard to get through. The stories you hear from the survivors plus the images and artifacts in the museum were devastating.

I could go on and on about Japan but I’ll wrap things up here. Solid trip and we will be back one day!

We flew to South Korea for five nights after leaving Japan.

We stayed in the capital of South Korea, Seoul.

I was impressed with the number of electric cars in Seoul.

Mrs FB and I would routinely be surprised by how quiet some streets were. They were full of cars, but sometimes it was 100% EVs. So eerie when you can’t hear cars coming. I think manufacturers may need to address that in the future.

It makes sense since both Kia and Hyundai are Korean companies and they are near the top of the EV frontier.

My favourite part about visiting South Korea hands-down was going to DMZ (Demilitarized Zone).

The Korean Demilitarized Zone (DMZ) is a 250-kilometre-long and 4-kilometre-wide buffer zone that separates North and South Korea. It was established after the end of the Korean War in 1953 as part of the armistice agreement between the two countries.

The DMZ is one of the most heavily fortified borders in the world, with troops from both North and South Korea stationed along its length. The area is strictly controlled and access is limited to authorized personnel only.

DMZ at the border of North Korea

We got 10 meters from the North Korean border by going down into The Third Tunnel of Aggression but photos were strictly forbidden down there.

The Third Tunnel of Aggression is a tunnel that was discovered in 1978 by South Korean forces near the Korean DMZ. It is one of four known tunnels that North Korea dug beneath the DMZ with the aim of launching a surprise attack on South Korea.

The tunnel is approximately 1.6 kilometres long and 2 meters wide, and is located about 50 kilometres from Seoul. It is estimated that it could accommodate up to 30,000 North Korean soldiers per hour in the event of an invasion.

The tunnel was discovered after South Korea became suspicious of several sinkholes that had appeared near the DMZ. They conducted an investigation and eventually discovered the tunnel, which had been dug through solid rock by North Korean soldiers using explosives and pneumatic drills.

This is pretty funny but apparently, North Korea told South Korea they were just mining for coal and had stuffed up the drilling. This excuse may have worked if there was only one tunnel, but South Korea has officially found four so far apparently there are more than 20 😂

Net Worth Update

Everything was up in April except our cash holdings.

I’ve spent a fair chunk of change promoting my company hoping to land a big contract this year. I’m going to start ramping things up as soon as I have more work.

I’m not going to lie, it’s really nice being able to get home from a big holiday like our Japan/South Korea trip and not have to be back in the office first thing Monday morning. But I’ve been craving a new challenge for nearly a year and I still have a dream of fostering my very own fun/exciting work environment. Combining that with a community-based co-working space is the dream!

But I need a hell of a lot more money to make this dream a reality. And more important than money, I need contracts.

I don’t really care about the money so much as I care about having enough work to sustain a small team. I should be able to start looking at putting 1 or 2 people on towards the end of the year if everything goes to plan.

If you have skills in Python (pandas, sqlalchemy, requests), SQL and/or any data visualisation program, shoot me an email and we can have a chat. The job could be done remotely but I want to hang out with great people in the real world so coming into Latrobe Valley a few days a week would be a must.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

A few big expenses for the business this month.

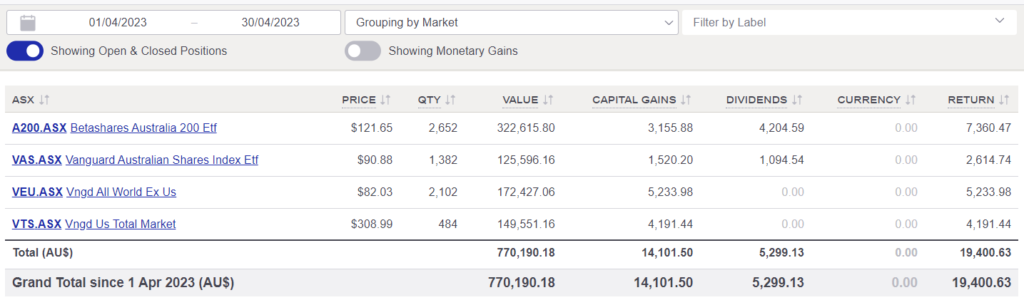

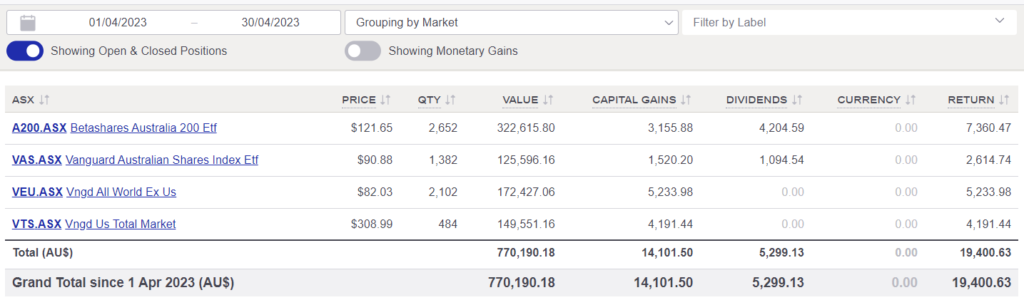

Shares

The above graph is created by Sharesight

A big month in the share market but no new purchases.

All spare cash went into the business in April. I’m hoping to start investing again after the next contract.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Networth