by Aussie Firebug | Jan 28, 2022 | Classics, Popular Article, Uncategorized

Reflection time.

I started full-time work at the end of 2011 and discovered the concept of financial independence (FI) sometime in 2012 after reading Rich Dad Poor Dad by Robert Kiyosaki.

That book (and the concept of FI) changed my life.

It wasn’t until a year after reading that book that I stumbled across Mr Money Mustache and the FIRE movement, which again, changed my life.

10 years. That’s how long I’ve been chipping away at this goal. And a lot can change ya know. My mindset, goals, strategy, desires, priorities have all shifted throughout the last decade. I’ve been thinking a lot about the lessons I’ve learned throughout the journey. What worked? What didn’t? What’s the point of it all?

Let’s get it.

1. The ultimate goal is to be happy. Never lose sight of this

We’re starting this list with the most important lesson.

It’s a bit philosophical but it’s really important and it sets the tone for everything we do. Have you ever asked yourself the following question and really mulled it over?

“What do I want in life?”

Now, there are going to be thousands of different answers to that questions depending on who you’re speaking to but the common denominator will always be the same… a desire to feel joy/to be happy.

Going snowboarding is pretty obvious. That’s fun as hell! But going to the gym 3 times a week and lifting heavy shit is… less obvious. One involves instant gratification whereas the other is delayed by a series of uncomfortable painful sessions.

The driver and end result for both activities is still the same. To be happy.

This driver for happiness is behind nearly everything we do. But figuring out what sort of life is going to be fulfilling and bring us purpose is a personal journey. The sooner you identify the key drivers of your happiness, the quicker you can start to plan out your ideal life.

I know life sometimes feels really complicated and stressful but at the end of the day, we’re still just another animal on Earth whose needs and desires haven’t changed that much over the ~50,000 years we’ve been roaming around.

In 1943 an American psychologist called Abraham Maslow published a paper called “A Theory of Human Motivation” which included the now very famous Maslow’s hierarchy of needs.

Maslow’s hierarchy of needs

This hierarchy of needs is universal and transcends generations.

A spice merchant in Ancient Egypt 3100 BC would still need to cover each level on the pyramid (pun intended).

Start from the bottom and work your way up and don’t skip over the physiological needs either.

You’d be surprised how many people would feel 10X better by just getting a decent amount of sleep each night and eating the right foods.

How FIRE plays a part in helping you achieve a level of happiness can be explained better in lesson 2.

2. Find your why of FI

One of the biggest mistakes I have personally made and that I see all the time is people thinking that reaching financial independence will make them happy.

Spoiler alert. It doesn’t.

You need to find your ‘why’. Why do you want to reach FI? What will reaching FI mean for you? How will it make you happy?

Speaking from personal experience, FIRE resonated with me because whilst I quite enjoyed my job, I resented the fact that I was ‘stuck’ there 5 days a week. I didn’t like that feeling. And before I knew that FIRE was even a thing, I thought I was going to be in the cubicle for 40+ years 🤮

FIRE for me was about gaining more of the most precious resource we all have. Our time!

Free time is crucial for satisfying the top level of Maslow’s pyramid.

Money is just a man-made abstraction that doesn’t have any intrinsic value. We can leverage money to create more time and freedom in our lives. The most important part is knowing how to use this extra time and freedom to enrich our lives. Having a rock-solid ‘why of FI’ will help tremendously throughout your journey.

3. Master behaviours, not spreadsheets

This lesson took me many years to learn but it’s a goodie.

At the start of my journey, I was really attracted to the math and statistical side of FIRE. I loved reading about the Mad Fientist’s tax strategies (even though they were US based), MMM’s shockingly simple math behind early retirement and how the trinity study modelled over 80 years of data to come up with the 4% rule.

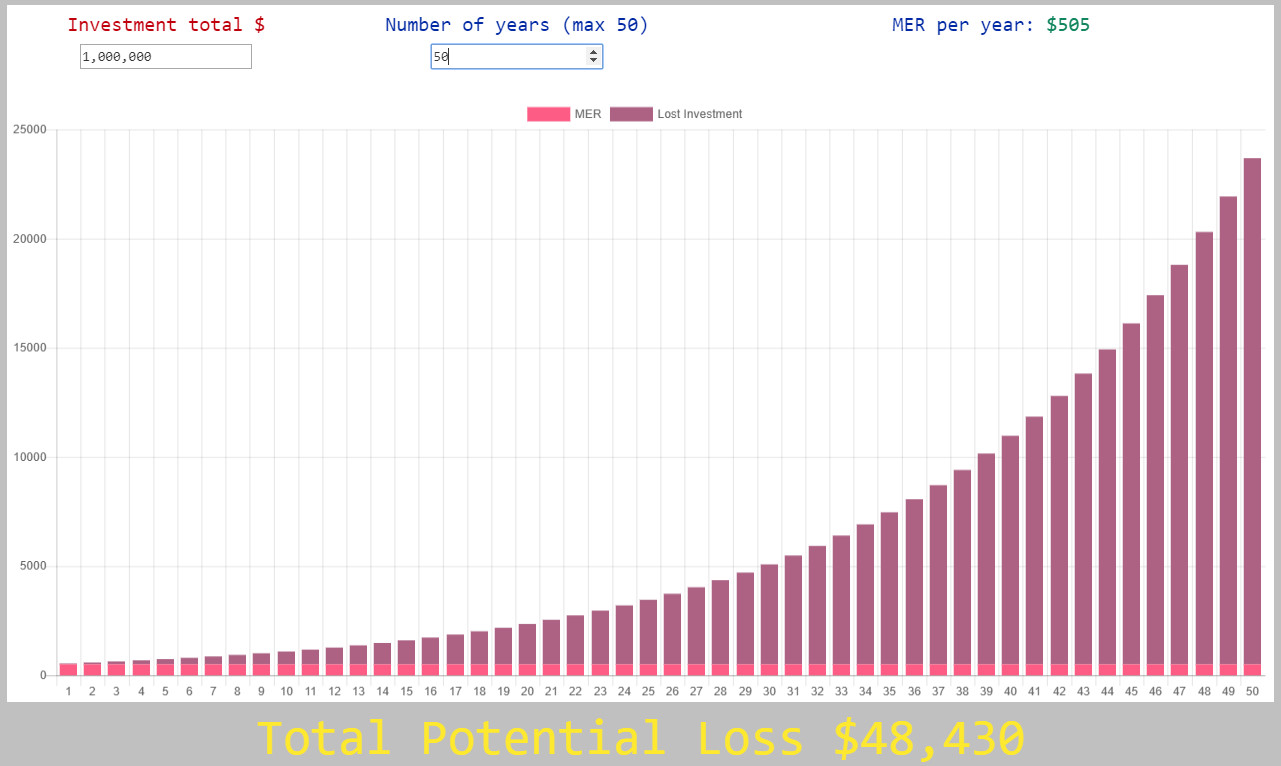

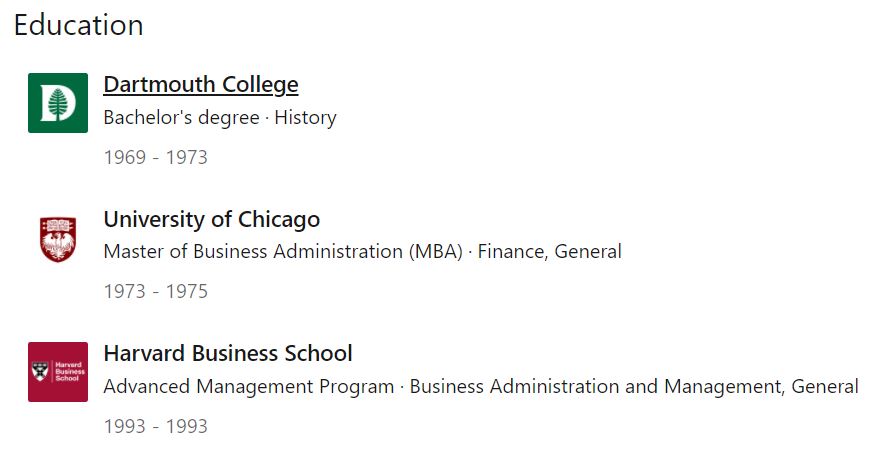

I used to seriously whip out the calculator on my phone at all hours of the night to crunch some number because I was obsessing over a 0.07% difference in management fees lol 😅.

But the further down the FIRE rabbit hole I traverse, the more I realise that spreadsheets, modelling and the math behind money management all meant diddly squat if your emotions and psychological makeup are not equipped to stay the course throughout your journey.

I’m not saying the numbers don’t matter, because they most definitely do. But our behaviours matter more.

“Financial success is not a hard science. It’s a soft skill, where how you behave is more important than what you know”

– Morgan Housel

There’s a great story that illustrates this point perfectly. In the intro of one of my favourite books, ‘The Psychology of Money’ by Morgan Housel. Morgan compares the stark contrast between an American Janitor called Ronald Read with a Harvard-educated Merrill Lynch executive named Richard Fuscone.

From his wiki page:

Ronald James Read (October 23, 1921 – June 2, 2014) was an American philanthropist, investor, janitor, and gas station attendant. Read grew up in Dummerston, Vermont, in an impoverished farming household. He walked or hitchhiked 6.4 km daily to his high school and was the first high school graduate in his family.

Read repaired cars at a gas station for 25 years and was a janitor at JCPenny for 17 years. He purchased a 2 bedroom house for $12K in 1959 and lived there for the rest of his life.

Friends of Read have been on record saying that he didn’t really get up to much. Some said his hobby was wood chopping and he lived a very low key life.

Read died in 2014 at the ripe old age of 92 which is where the plot thickens… Read made international news when he left over $6,000,000 (USD) to his local hospital and library. He also left over $2,000,000 to his stepkids too 🤯.

Read’s friends were dumbfounded. Where did he get all that money from?

Friends and family went looking for answers but they discovered there was no secret.

No lottery wins.

No hidden inheritance.

No hidden high paying secret spy job that he’d been keeping under wraps.

Read simply spent less than he earned and invested the rest in blue-chip stocks. The power of compound interest over decades did its thing and his low-income modest lifestyle managed to create a snowball worth more than $8M (USD) 🤯🤯🤯.

Ronald Read

Richard Fuscone was in the news a few months before the passing of Ronald Read for very different reasons.

Fuscone is basically the polar opposite of Read.

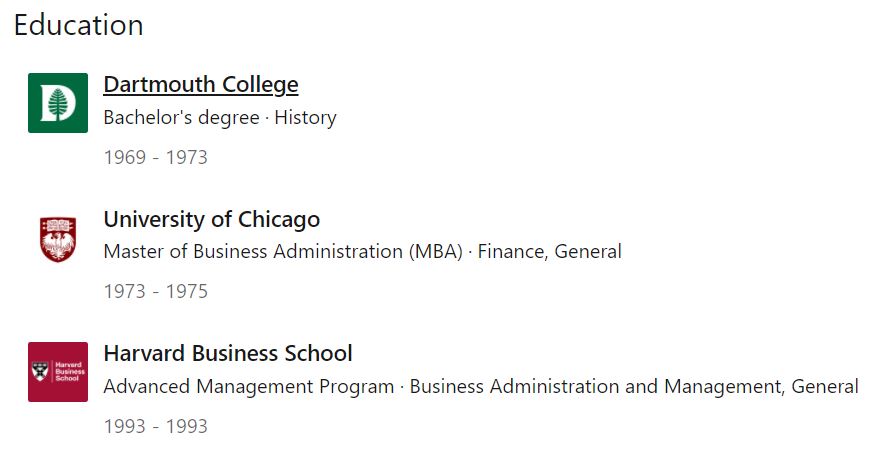

To say he’s well educated is putting it lightly. Check this out for a resume

I mean damn! That’s some serious alumni. And for those who don’t know, the University of Chicago offers one of the most prestigious MBA programs in the world. We’re talking about the upper echelon of prestigious education here.

Fuscone was a high flying executive who retired in his 40’s to pursue philanthropy and was once included in a “40 under 40” list of successful businesspeople. Fuscone got into financial difficulty in the mid-2000s after he borrowed heavily to expand his 18,000-square foot home that had 11 bathrooms, two elevators, two pools, seven garages, and cost more than $90,000 a month to maintain.

Then the 2008 financial crisis hit.

High levels of debt coupled with illiquid assets left Fuscone bankrupt.

A few months before Ronald Read passed and left his fortune to charity, Richard Fuscone’s home was sold in a foreclosure auction for 75% less than an insurance company figured it was worth… ouch!

Ronald Read was patient, Richard Fuscone was greedy. That’s all it took to overcome the enormous education and experience gap between the two.

So what’s the moral of the story?

It’s not about how smart you are, it’s about how you behave.

4. Getting wealthy is simple. Don’t overthink it

“Life is really simple, but we insist on making it complicated.”

– Confucius

Almost every single wealth-building strategy can be boiled down to three steps:

- Spend less than you earn

- Invest the surplus

- Wait

That’s it… seriously.

Now there’s an absolute chasm between ‘get rich quick’ schemes and long term investing but those three principles hold true 99% of the time. How you invest and what you invest in doesn’t particularly matter. As long as you’re outpacing inflation and have strong conviction in your investments you should be moving towards financial independence.

Fidelity Investments is a multinational financial services corporation based in Boston, Massachusetts. An interesting discovery was made when a customer account audit revealed that the best investors in their database were either dead or inactive.

How could that possibly be?

How could someone that’s not adjusting their portfolio to the macro and micro economic news, outperform savvy investors with all the latest up to date data at their fingertips?

Well, it turns out that when it comes to investing… less is more.

Which is very unintuitive and goes against basic logic.

See the thing is, almost no one can beat the market over the long term. But people (myself included) constantly fall for the trap of trying to add complex financial instruments to somehow gain an advantage over ‘unsophisticated’ investors. I’ve always been raised that you need to put in the effort to reap a reward. You have to work hard to get anything in life worth having. This is true for most things… just not when it comes to investing.

I created and now invest through a trust fund because I associated its complexity and mystic with higher returns.

I thought I needed to do something different. I needed to outwork others to have a good return.

Choosing an ordinary index fund and adding to it each month without doing anything else just felt…lazy lol. I had all this pent up excitement after discovering FIRE and I wanted to channel this energy into the journey. I wanted to work my ass off so I could reach FI as quickly as possible and I felt like boring lazy index investing is only for people who aren’t willing to put in the work. It’s taken me years to accept that not only is this approach perfectly fine, but it’s also statically the most optimal choice most investors can make.

Keeping it simple also frees you up to concentrate on what’s really important in life which ties into the first lesson, to be happy.

Complexity has the potential to steal your most precious resources; time and energy.

Money is the slave that works for us, not the other way around.

5. What’s measured is managed

If I could give only one tip to anyone looking to be better with their money, it would be to start tracking your expenses.

That’s it.

You don’t even have to do anything else. I promise you that you’ll save money and optimise your expenses within the very first session. You might think that you know what you spend money on but I’ll bet the house that the first time you analyse three months of expenses, you’ll be surprised.

This lesson falls under the umbrella of Lesson 3 ‘Master behaviour, not spreadsheets’. It’s been well documented that keeping track of any metric and reviewing it regularly has a psychological effect on humans that can help us improve a focus area.

If a sprinter wants to be faster, they’ll keep a record of how fast they run.

If a presidential candidate wants to become the president, they’ll record and analyse poll data with their team.

If Tesla wants to design self-driving cars, they’ll create, test and record different algorithms continuously and keep track of what did and didn’t work.

I think you get the idea.

What’s measured is managed!

And if you’re not measuring the most fundamental aspect of FIRE, you won’t be able to manage it effectively. Plenty of people can still reach FI without ever tracking their expenses but I know first-hand that measuring how much you’re spending and what your spending it on has a lot of positive psychological effects.

Some of the positives of tracking are:

- You regularly review where your precious dollars are being allocated to each month. Think back to lesson 1. ‘The ultimate goal is to be happy’. Is the stuff you’re buying ultimately making you happy?

- You can accurately calculate your current FIRE number? Guessing how much you spend each year to maintain your current lifestyle can create stress and anxiety when the time comes to retire. You’ll second guess yourself. Even though things can and will change throughout your life, if you’ve been tracking your expenses for a few years you’ll have a much better idea of what size portfolio you’ll need to retire.

- It’s super easy to trim the fat. Unused memberships and subscription services can sometimes fly under the radar. Reviewing expenses bring this wastage front and centre.

But be warned… overdoing this area can actually have negative consequences.

I used to be one of the worlds biggest tightasses (still pretty tight compared to most ‘normal’ people haha) but what I’ve found through the last decade of managing money is that the majority of people will find great success if they focus on the big four areas.

- Housing

- Transport

- Food/drinks (including alcohol)

- Holidays

Try to optimise these big areas and don’t kill yourself for paying for a haircut.

I’d say that the top one (housing) is probably the most important. Buying a huge house at a young age can stunt your wealth creation potential. Spending 50+% of your paycheck on rent has the same effect. You want to get your snowball up and running asap and let the compound interest do the heavy lifting over many years/decades.

If you optimise those big four areas to a point where you’re living a great life whilst having a decent savings rate it’s only a matter of time before you hit FIRE 🎉.

Ultimately, this lesson is super effective at improving your behaviours when it comes to money management.

6. Income potential is often overlooked

Over the last decade, I’ve met and spoken to a lot of people who have reached financial independence and there seems to be a common theme.

- They are good savers

- They have a higher than average income

The funny thing is that a lot of these people are actually below average investors. I heard all sorts of stories about how they might have lost money on a development, got swindled by a pyramid scheme or lost it all on a speculative stock. Yet they seem to reach FI decades earlier than most after eventually figuring out some form of investment that works for them.

The bulk of their wealth comes from a healthy savings rate powered by a high income.

For the first 7 or so years on my journey towards FI, I focussed solely on saving a whole lot of money and investing it in both real estate and stocks.

It wasn’t until I moved overseas in 2019 and more than doubled my hourly rate did I truly appreciate the power of earning more money.

I mean it’s pretty obvious, isn’t it?

The more you earn the more you can save and reach FI quicker. But for some reason, I always prioritised saving more and reading the same investing strategies over and over again making little tweaks here and there.

Having a high savings rate is really important. I reckon we managed to optimise our expenses after 1 or two years at most. After that, it’s pretty much been on autopilot. We have a pretty good idea about what brings us joy and where our dollars go.

I’ve spent way too long (especially at the start) obsessing over the ‘investing’ part of the FIRE equation. There are soooooooo many articles, videos, books, podcasts etc. that dive into all sorts of whizz-bang investing strategies that it can be confusing as hell.

It’s sorta like when you go to the Cheesecake Factory. Their menu is so bloody big and confusing that it can be overwhelming. I’ll try to read absolutely everything because I don’t want to order a meal and then have food envy because something better was further down the menu 😂. This is what’s known as analysis paralysis and a lot of people can fall prey to it (it personally took me years of reading about the stock market before taking the plunge).

It’s natural to feel like you need to know absolutely everything before dropping your money into the markets. But the truth is that we all make mistakes and the most basic concept of investing is buying things (real estate, stocks, precious metals, bonds etc.) that make you money. Don’t stress too much about building the perfect portfolio because I’m telling you it doesn’t exist.

Index investing appeals to so many people because it’s passive, diversified, low cost and provides a great return with little effort. Don’t overthink it. Work out a portfolio that you have strong conviction in and one that will allow you to sleep at night. Save your money and keep adding to the portfolio regularly.

If you still have time and energy to commit to FIRE after your expenses are under control and you’re happy with your investing strategy, I’d seriously start to look to increase your income.

High savings + high income + below-average investments

is better than

High savings + below-average income + above-average investments

Obviously, it does depend on how epic your investment returns are but generally the above is true from what I’ve personally experienced and seen over the last decade.

There are heaps of ways you can increase your income. I wrote about a few of them in this article here.

7. Compound interest takes years to notice

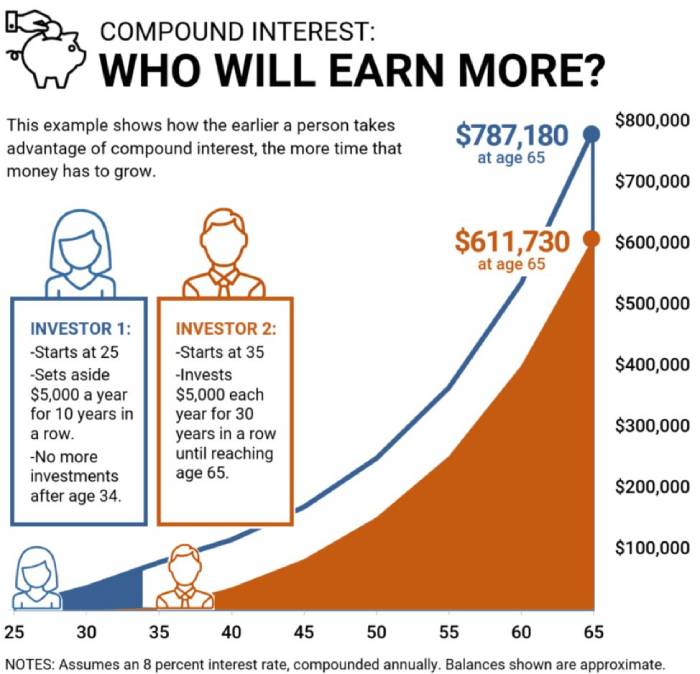

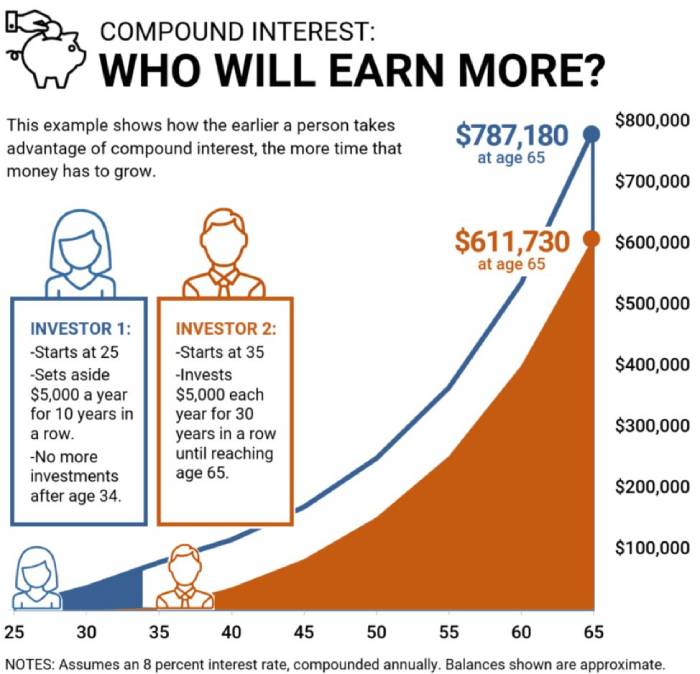

I learnt about the power of compound interest pretty early. There’s that famous story about two colleagues that’s told 100 different ways but it always illustrates the same point. Investing early and taking advantage of compound interest pays off in the long run.

This little graphic is one example.

Image Source: Mark Catanzaro

I’d like to think most people in the FIRE community have come across this (or something similar) before.

But most people (myself included) have a hard time truly appreciating the magnitude of compound interest and it doesn’t start to feel real until you’re near the end of your journey. There’s something about exponential growth that makes it difficult to grasp from an emotional point of view even when we understand the math. I think it has to do with most other things in life being linear. We do basic arithmetic almost every day in our lives but I don’t know anyone who can compute exponential growth without a calculator.

If we need half a dozen eggs for a recipe and know we already have 2 at home, that’s a simple subtraction problem that’s easy to think about on the fly and makes sense. If we choose to buy a car worth $10K instead of $15K. That’s an obvious savings of $5K which makes it easy to immediately appreciate on the spot.

But it’s hard sometimes to come to grips with putting away large sums of money now so the future you in 10-30 years can live a better life.

Here’s one of my favourite examples of exponential growth that you can play with your friends.

The story of the monthly coins.

If I gave you $1 each day in the month of January, how much money would you have at the end of the month?

Most people would be quick to shout $31 right.

But suppose I gave you $1 on the first day of January and double it every day until the end of the month ($2 on the second day, $4 on the third and so on), without cheating, try to have a guess in your head how much money you would have at the end of the month.

Take a few seconds to think about it and keep a mental note.

….

….

….

The answer is $2.1 billion dollars. That’s a billion… with a B 😱

Try this example with your friends to see what number they guess. 99% of the time they won’t get anywhere near the correct answer.

I use the example to illustrate the point that compound interest is not intuitive to grasp and it really only starts to take off in the later years. Speaking from experience, I really noticed compound interest once we had around $400K+ invested and our FIRE number is $1.25M for context.

Before that, it feels like you’re doing all the heavy lifting yourself through savings (which is pretty much what’s happening).

But boy oh boy it’s an amazing feeling when the freight train starts to pick up steam and suddenly your investments are making more money than you can save each month. After that, there’s no stopping it and you’ll feel like you’re almost cheating as you race towards the finish line.

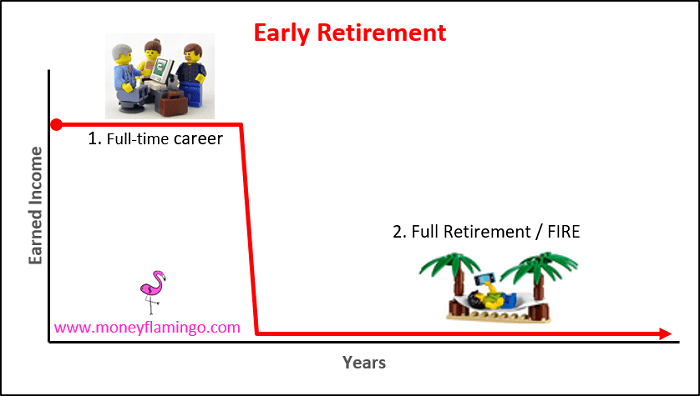

8. Most people are really after semi-retirement

Every single financially independent person I’ve ever met, read about or listened to still ‘works’ and makes money outside their investments one way or another.

I’ve added talking marks to the letter ‘work’ because it’s not really traditional work but people can get really anal when it comes to the word retire. I’ve always interpreted RE (retire early) part of FIRE as the moment you quit your cubicle/wage slave job and pursue meaningful work that brings you purpose.

But this can be confusing because not everyone has something they’re super passionate about. There’s a large portion of the community that really likes the social aspect and comradery of their normal day job but just want a little bit more free time in the week to get stuff done and enjoy life.

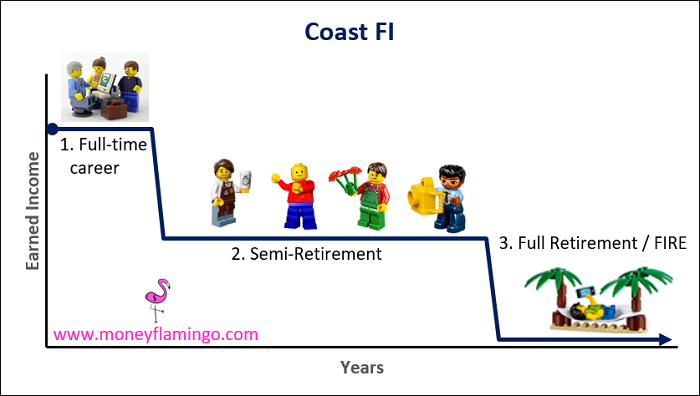

Based on the emails I’ve been receiving for the last 7 or so years I’ve come to the following conclusion. Most people in the FIRE community are really just looking to work 2-3 days a week and maintain their current lifestyle with some passive income to cover the rest/set them up for retirement in their golden years.

And as someone who is currently only working 3 days a week, I must say that I’m becoming more convinced that semi-retirement is the sweet spot for the bulk of the community too.

Full financial independence is great and it’s what we should be aiming for later on in life, but building up a portfolio that kicks off enough passive income to free up one or two days a week can have astonishing results.

And the best part about compound interest is that the momentum you build up early on in the journey only gets stronger and can carry you all the way to full fledge FI without you needing to add to your portfolio after a certain point.

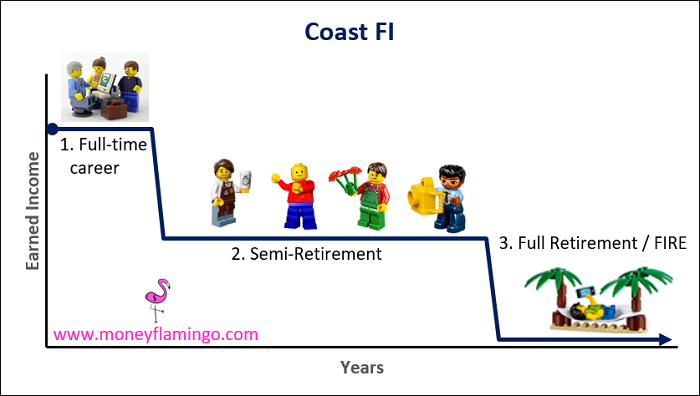

This concept is known as Coast FI or Flamingo FI and the end result is the same. Full financial independence.

But if you drop down to semi-retirement during your journey you’ll obviously not have as much money to contribute to your portfolio and won’t reach FI as fast.

Traditional FIRE. Source:moneyflamingo.com

Coast FI. Source:moneyflamingo.com

If you want to know more about coast FIRE I’d highly recommend you check out this article at the money flamingo blog (Aussie specific too!).

The odds of someone never working and making any sort of income outside of their portfolio ever again after reaching FIRE is incredibly low. I’ve been saying this for a few years now but the 4% rule is over-conservative in my book. Putting aside the fact that the author of the 4% rule has increased it to 5%, any additional income after you’ve reached FI completely blows out the modelling.

Let me give an example.

Our FIRE number is $1.25M which will generate $50K per year based on the 4% rule.

Let’s assume that we get to the $1.25M, declare FIRE but decide to both work 1 day a week for 8 hours at $30 an hour.

Would you believe that our combined take-home income would be ~$25K a year? That’s half of what we need to bloody live on!

The portfolio could easily cover the rest and here’s the amazing part. Because we wouldn’t need to be drawing down 4% of the portfolio, it could compound away for longer at the higher amount.

Here’s what half of the portfolio ($625K), if left alone, could potentially grow to given an 8% return after 10 years.

~$1.35M is more than our original FIRE number!

And it’s really important to realise that we only worked one 8 hour day at $30 an hour in this example. You could imagine how dramatic the modelling changes if you worked an extra day or charged a higher hourly rate.

There are two main points here.

- You’re almost certainly going to be earning money post FIRE

- The 4% assume no extra income ever. This is extremely unlikely if you reach FIRE in your 20’s, 30’s, 40’s or even maybe 50’s.

9. Find your ‘enough’

Joseph Heller, an important and funny writer

now dead,

and I were at a party given by a billionaire

on Shelter Island.

I said, “Joe, how does it make you feel

to know that our host only yesterday

may have made more money

than your novel ‘Catch-22’

has earned in its entire history?”

And Joe said, “I’ve got something he can never have.”

And I said, “What on earth could that be, Joe?”

And Joe said, “The knowledge that I’ve got enough.”

— A poem for The New Yorker in May of 2005 by Kurt Vonnegut

I honestly think there’s something in our DNA as humans to always want more.

It has to be some sort of evolutionary trait right.

Imagine two homo sapiens coming across an enormous fruit tree bearing 50 ripe Apples.

The first human decides to only eat enough to be full and then leaves.

The second human gorges themselves and then picks and carries as many as they can hold back to camp with no consideration of others.

Which personality traits do you think has the better chance of surviving and passing on their genes to the next generation? As unfortunate as it is, selfishness is rewarded in the animal kingdom. I know it’s hard to imagine with all our fancy pants technology and civilisation, but we’re not actually that far removed from our prehistoric ancestors and evolution hasn’t yet caught up to deal with the current situation we find ourselves in.

Most of us are hard-wired to always want more.

But you’ll never become FI if your desires and wants continue to increase forever.

Think back to lesson one “The goal is to be happy”.

If you desire something and you don’t have it, this usually results in a feeling of unhappiness. And there are only two ways to fix it.

- You work hard and get what you want.

- You find happiness elsewhere and stop wanting it.

Depending on how exorbitant your wants and desires are, option 1 could mean many decades climbing the corporate ladder working 70+ hours weeks to fund your:

- 3,000sq m Toorak mansion

- 6 beds, 5 bathroom holiday house in Byron Bay

- 5 cars

- 3 jet ski’s

- And so on

Now I don’t want to be judgemental here. If you really want all those things and think the work required is worth it. Sweet. Go for it. Everyone is different.

But if you’re reading this article, odds are that you’re more attracted to the idea of living a simple yet great life that prioritises freedom, autonomy, health, relationships and ultimately happiness.

Figuring out what your ‘enough’ is takes a long time. This is partly because our wants and desires evolve as we get older and our circumstances change.

I for example, never really put too much value in travelling before 2019. I’d been on a few trips here and there and whilst it was good fun, I used to think that international travel was insanely expensive and overrated. Travelling around the world and living in the UK for 2 years completely changed my outlook on a lot of things and broadened my horizons. I now consider travelling to be part of our lifestyle and something we will need to factor into our numbers.

And even though I think a little bit of lifestyle inflation is perfectly normal and healthy, you’ll never have peace of mind until you discover your ‘enough’.

If you don’t figure it out, you’ll always be wanting more.

10. We’re all dealt a different hand in the game of life

There’s a quote that I can’t seem to find that loosely goes like this.

A CEO was perfectly happy with their $1M bonus until they found out a competitor CEO received $100 more

Comparisons. We’re all guilty of making them.

And the messed up part is sometimes we were happy until we see what someone else has.

It happens all the time and is part of the reason I’ve disconnected all of my social media accounts.

Practising the art of gratitude can be really helpful to remind yourself of all the great things in your life. But we’re humans and I’ve fallen victim to unrealistic comparisons a bunch of times. It’s perfectly natural to stumble across someone who you may have gone to school with and be jealous of the life they’re living now.

What I’ve come to realise after hearing from literally thousands of Aussies on their way to FI is that there can be a gigantic gap between peers within the same cohort. I’m talking about the advantages and disadvantages between two people who on surface value seem to be pretty equal.

There’s a great book called Outliers by Malcolm Gladwell that explains just how incredible one little advantage early on in someone’s life can completely change their trajectory.

Did you know that 40% of the best hockey players in Canada are born between January and March?

This is no coincidence. It turns out that in minor league hockey, children are grouped by birth year and players born in January are, on average, bigger and taller than December-born players.

This seemingly unimportant attribute gives players born in the first months of the year a head start that turns into a lifelong advantage.

That one little leg up can have the following flow-on effects:

- They are bigger and stronger than their peers which makes hockey easy for them

- They are noticed by coaches and identified as a good player. Extra coaching or special treatment may be given

- They will most likely be chosen to represent their squad team which means more playing time against a higher level of competition and access to better coaching

- They continue to get extra playing time against elite competition with the best coaches in the country year after year

These sorts of advantages happen all the time and compound throughout one’s life.

The same is equally true for disadvantages.

But it’s really hard to know what cards a person has been dealt even if you know them quite well. And it’s almost impossible when reading a stranger’s blog or listening to a guest on a podcast.

The goal of FI is a mastery of money that’s a personal journey.

A little bit of healthy competition can be good but never feel inadequate when you come across someone similar who seems to have it all figured out. They may have been dealt two aces.

The reverse is also true.

We have no idea what has happened in someone’s life that has influenced the position they’re in now.

In summary, compete against the person in the mirror.

Wake up each day trying to be a better version of yourself.

Because…

“Comparison Is the Thief of Joy”

— Theodore Roosevelt

That’s a wrap! 10 the biggest lessons I’ve learned over the past 10 years pursuing FI!

I’d love to know what was your favourite lessons in the comment section below 🙂

As always,

Spark that 🔥

by Aussie Firebug | Sep 27, 2020 | Classics, Mindset, Popular Article

The below article is actually a chapter I wrote for a great collaboration ebook put together by Pearler. I would highly recommend checking out the entire eBook (for free of course) which you can grab here.

“A dollar saved is better than a dollar earned”

We’ve all heard that one before. The ability to save more than you earn is a fundamental principle upon which FIRE is built.

Hands-down the most important step for reaching FIRE is how much of your paycheck you can keep and invest.

You cannot earn/invest your way out of bad money habits. It will eventually catch up with you no matter how much money you make. If you’re spending more than you earn, you’re going to be broke. It’s just simple mathematics!

It’s sorta the equivalent of trying to outwork a bad diet and expect results in the gym. In fact, there are so many parallels between good financial habits and being fit and healthy it’s uncanny. Most health/fitness experts would agree that your diet probably plays the biggest role in keeping your body happy. The other two major players would most likely be exercise and sleep. If you’re nailing all three of those, there’s a pretty good chance your body is feeling awesome.

Savings is to FIRE, what eating the right foods is to living a healthy lifestyle.

And if we follow this little analogy a bit further we might conclude that…earning money in FIRE is equivalent to or around the same level of importance as exercise when it comes to health and fitness. And maybe we can put getting a good nights rest at the level of investing.

It’s not a perfect one for one comparison but it makes for a good metaphor so let’s keep rolling with it.

I’d wager that 90% of FIRE content is either about saving money or investing. But we seldom read how to earn more money even though it has astronomical benefits when implemented correctly. It’s true that FIRE is income agnostic, two people with a savings rate of 65% will both reach FIRE in around 10 years even if one earns $60K and the other $400K.

But there comes a point of diminishing returns for both saving money and investing.

The purpose of this article is to explain how beneficial it is to spend more time and energy increasing the amount of $$$ that flow into your accounts. Anyone who is on this path is already doing some form of exercise (earning money) but if you can look past your standard crunches and pushups you’ll discover there are gymnasiums out there filled with weird and wonderful machines that provide all types of workouts. And when you combine a great diet with a dialled in training routine that works best for you, the gainz can be off the charts.

BFYB Factor

The aim here is to illustrate just how much of an impact increasing your income (even a tiny bit!) can have on your journey towards FIRE.

Let’s try and apply the same metric to the three most important focus areas IMHO when it comes to reaching FIRE.

- Save more than you earn

- Increase how much you earn

- Invest your savings

We’ll call the metric BFYB (bang for your buck).

BFYB = The amount of effort required to improve a focus area

Let’s look at our first focus area (save more than you earn) and re-establish why it has the best BFYB value.

Increasing Your Savings Rate

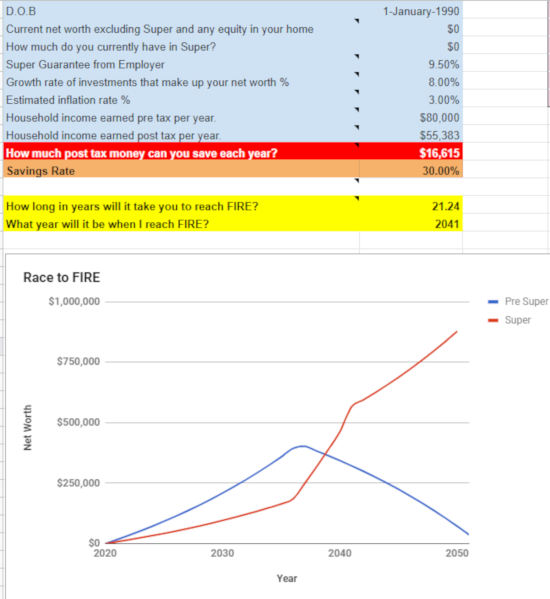

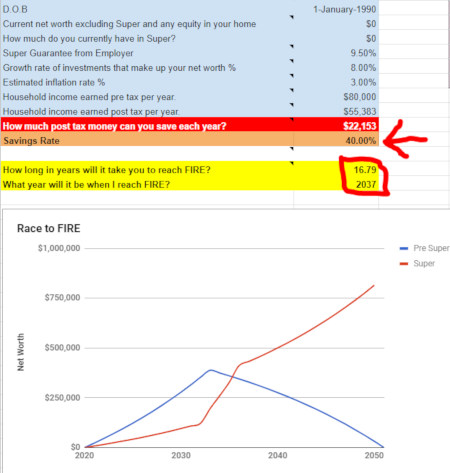

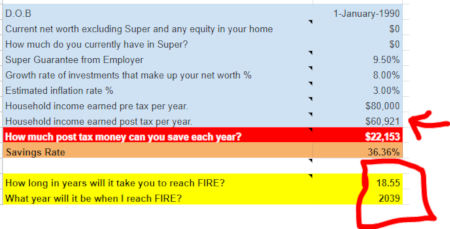

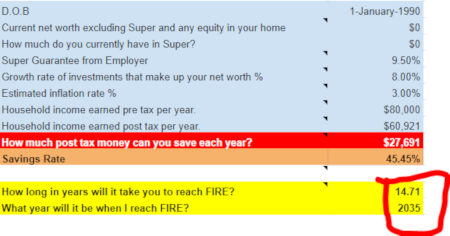

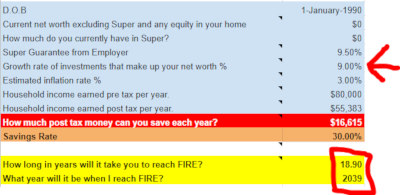

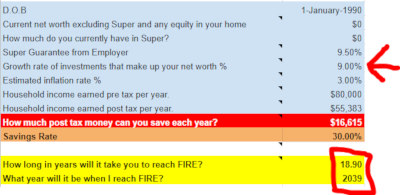

Using The Australian Financial Independence Calculator we can plug in Joe Smith’s journey towards FIRE starting from $0.

We’re assuming he is a single 30-year-old Sparky from Brisbane who owns his 3 bedroom home (no mortgage), works 38-40 hours a week, doesn’t have kids and all the below numbers stay constant over the next 30 years to make the modelling super simple.

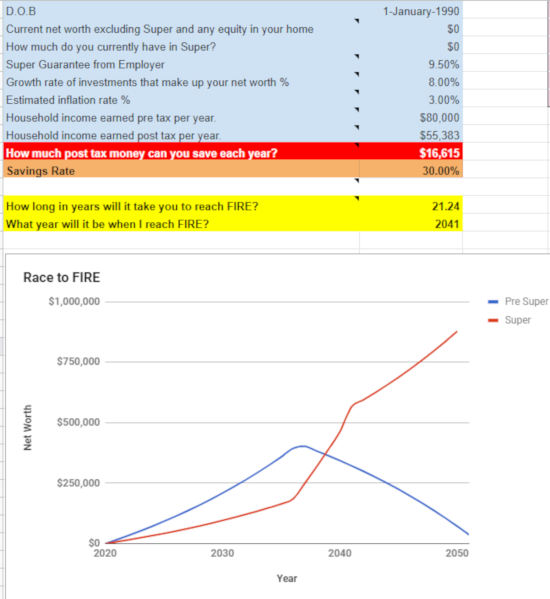

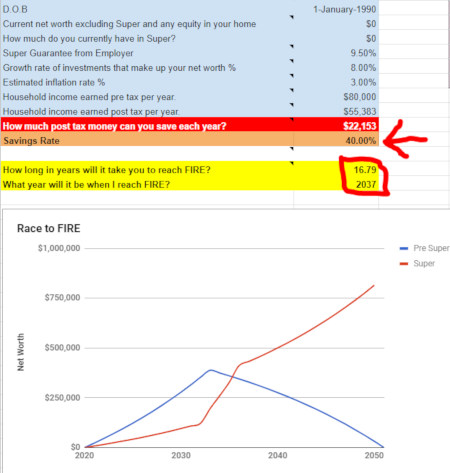

Ok, so an Australian who earns $80K with a savings rate of 30% can retire in 21.2 years. Not too shabby.

A 30% savings rate is already way above the average but let’s just assume Joe, whilst obviously a diligent saver already, is living a pretty normal consumerist 21st-century lifestyle with a heap more fat to cut. I don’t think it’s unrealistic or even that hard for him to go from a 30% savings rate to 40% given his circumstances above. The difference between 30%-40% is $5,538 a year or $106 week. I would almost guarantee that 90% of Australians spend more than $106 dollars a week on things they don’t need or even want half the time (myself included). Optimising big-ticket items like housing, transport and food would almost certainly save a whole lot more than the $106 a week we require for this example.

Anyway, if we bump the savings rate up to 40% we wipe off 4.5 years!

BFYB: Great

Everyone’s circumstances will vary but the effort required in my guesstimation for Joe to increase his savings rate 30% to 40% is rather small and the BFYB is high.

This is what we want. Low effort, high reward.

And it’s why focusing on your savings rate is absolutely the best way to decrease the amount of time towards FIRE… up to a certain point.

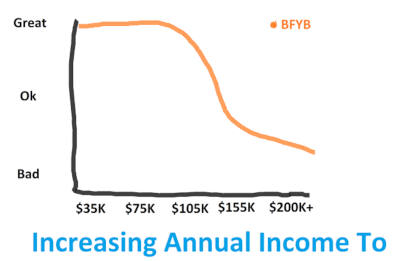

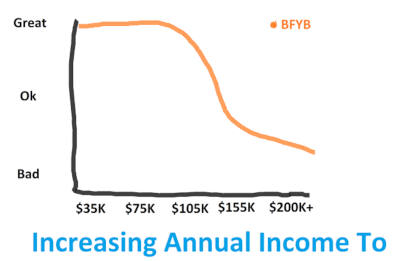

There comes a point of diminishing returns where focusing on your savings rate will not yield a good BFYB and the hard part is that it’s different for everyone because of circumstances. I can only speak for ourselves but this is what our savings rate BFYB chart looks like:

Currently, we can pretty much save close to 40% of our after-tax income without breaking a sweat. That means no sacrifice or comprising on anything. The effort for us to save 40% is almost the exact same as saving 10%. But the effort required to maintain a savings rate of >60% is when things start to change. For us to optimise our lifestyle further and squeeze out a few more percentages is astronomically harder to do when we start to get around the 65%-75%+ range. Don’t get me wrong, we could do it. And that would speed up our journey to FIRE… but at what cost?

If I can draw from our earlier metaphor of our savings rate being similar to a diet, we could say that cutting out junk food during Monday-Friday and making sure you eat some sort of leafy greens every day is a realistic goal with huge health benefits. But if we tried to never drink alcohol or eat Macca’s ever again, firstly we might be setting ourselves up for failure and secondly, whilst being the healthy option, it’s not going to have as big of a health benefit as the first goal. There are diminishing returns for eating healthy just like there are diminishing returns for improving your savings rate.

Increasing Your Income

This is the focus area that doesn’t get enough attention.

Increasing your income has a direct correlation with your savings rate but for whatever reason, a lot of people never put in the time and effort to improve it. There’s so much low hanging fruit which doesn’t really require a whole lot of effort but has a high BFYB value.

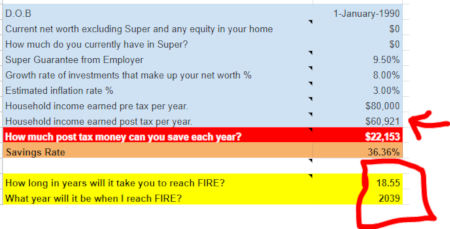

Let’s look back at Joe Smith from above but change one thing. Instead of him saving $5,538 a year, let’s have him earn an extra $5,538 (after tax) a year and see what happens.

Joe increased his after-tax income by $5,538 which in turn wiped off 2.7 years!

BFYB: Really good

We’re going to be talking about the low hanging fruit later on but if I’m being honest, Joe could easily make an extra $5,538 (after tax) purely from giving up more of his time. If we assume he’s making an after-tax hourly rate of $28, he would only need to put in an extra 197 hours worth of work over the year. And that’s not even factoring in overtime or weekend rates. An extra hour for 197 working days a year is really not that much.

Some of the stories I’ve heard first hand from young London bankers is absolutely mind-boggling. Think 70-80 hours per week… and work on weekends is to be expected!

2.7 years is not as good as our savings example above which wiped out 4.5. But if we combined them, we get epic results!

Improving our savings rate and increasing our income by the very same amount has annihilated 6.53 years of working.

Now we’re cooking with gas!

But just like our savings rate, there are diminishing returns in the pursuit of increasing your income. And I keep coming back to circumstances but unfortunately, it’s very much a circumstantial question when we start talking about this focus area because we all aren’t on an even playing field.

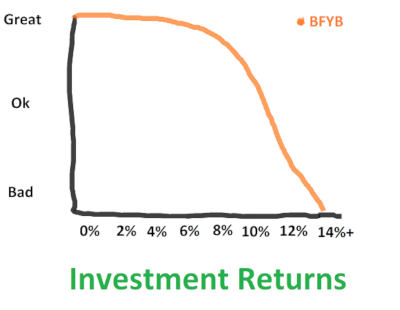

Below is my personal increasing income BFYB chart:

Let me explain what this means because it’s important.

Let’s say I’m unemployed next year (which is what’s most likely going to happen when we move back to Australia) and my salary is $0 (ignoring any investment income of course). I’m scanning through the classifieds looking for my next job, which, for this example will be the sole source of my income.

For my circumstances personally, it doesn’t require any extra effort for me to land a job paying $100K as opposed to around $35K annually. I don’t want to sound overconfident but I have a certain set of skills and experience that the market is willing to pay me and I’m 99% sure I could land a job paying close to $100K no worries. In fact, I’d probably have a harder time getting my old job back at Coles if anything. Beyond $100K is when the effort required starts to increase and the BFYB value starts to go down.

Remember, BFYB = The amount of effort required to improve a focus area.

The effort required to earn a salary past $100K starts to increase a lot and for me personally, the extra effort doesn’t justify the extra income at around the $130K-$150K mark. Beyond that, there’s too much sacrifice with not enough gain. Too many responsibilities and work-related stress that I don’t feel is justified for the extra $$$. You may have certain skills and experience where earning $150K is actually quite easy and no different (in terms of effort) than earning $100K.

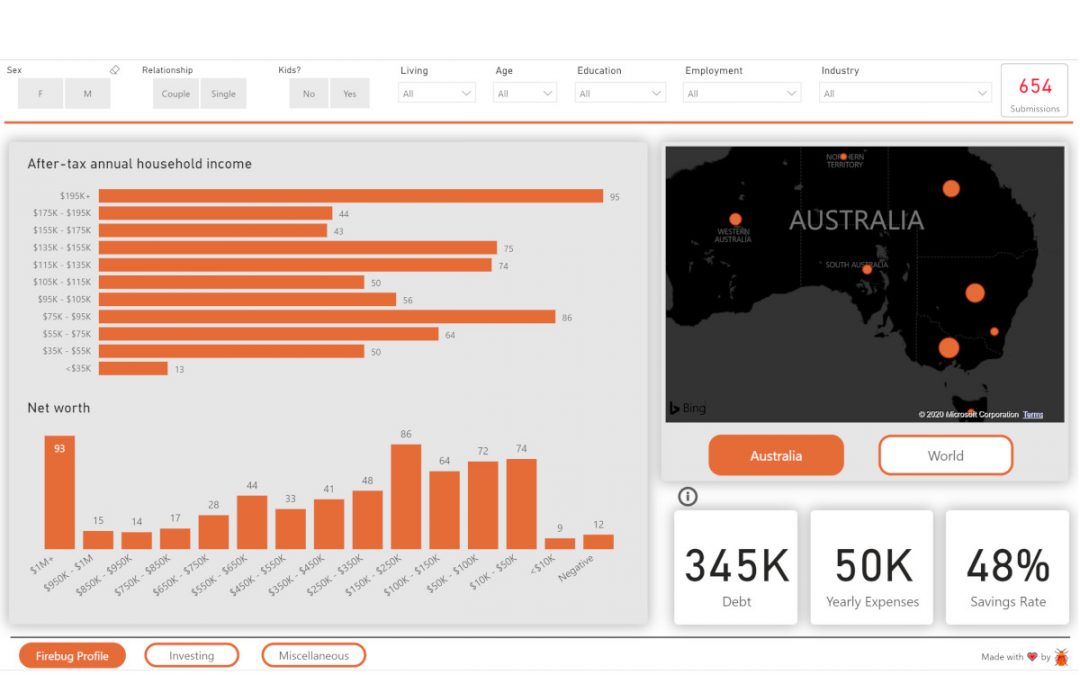

If we look at the ABS data from 2018 the median income for a full-time employee in Australia is $76K a year. If we adjust for two years of inflation we can round it off to 80K and we now have a benchmark.

$80K a year is the standard form of exercise for full-time Aussies. One light jog and occasional push-ups weekly would probably put you in the average to above-average category of exercise in Australia as sad as that is.

If you’re earning under $80K a year and have already optimised your expenses, you may be in the position to grab some really low hanging fruit and increase your income for an excellent BFYB return.

Adding in some resistance training 2 hours a week is such a small amount of effort that has an incredible return. Not only will you become healthier and stronger, you’ll potentially save yourself a lifetime of injury and illness that’s so common in our sit down all day 21st-century culture. Cardiovascular and resistance training has shown to help with sciatica, pelvic tilt, back pain, heart disease, diabetes etc. I have always considered myself a pretty active person but even I had hip issues 3 years after starting full-time work which I 100% attribute to sitting down all day and not stretching my hip flexors or strengthening my glutes. This hip issues crept into a lower back pain issue and before I knew it, I was going to the physio a few times a month. It didn’t take longer than a few weeks of specific stretching and strengthening exercise to completely resolve all of my issues and I continue parts of that program to this day nearly 10 years later.

You don’t need to jump into a 5X5 strength split or start yelling “Yeah buddy…Ain’t nuttin’ but a peanut!” after every rep in the gym. Three focused 45-minute sessions a week offers great health benefits just like spending a bit more time increasing your income can wipe years off your FIRE journey!

Improving Your Investment Returns

And now we’ve come to the most talked about, most analysed… most overrated focus area.

Investing!

I want to bring up two quotes to set the tone for this focus area.

“If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring.” – George Soros

“There seems to be some perverse human characteristic that likes to make easy things difficult.” – Warren Buffett

I am so guilty of the second quote. When I first discovered financial independence I was convinced that there’s some sort of magic formula that these rich guys must be using to get ahead. It’s part of the reason I started investing in a trust. It was like this complicated black box with all these advantages that only the rich guys understood and used. I wanted in on the secret and did my research hoping to stumble upon the golden goose. While there are some benefits of investing within a trust, I must admit that I was lured to its complexities and perceived mysteries (for whatever reason). It took me years to fully appreciate the power of simplicity and if I could start again, I would have never bothered with the trust.

I feel so many FIRE n00bs fall into the same trap. They go looking for a magical formula that simply does not exist. And even if it does, it’s almost certainly locked away in a secure blockchain quant investment hedge fund somewhere.

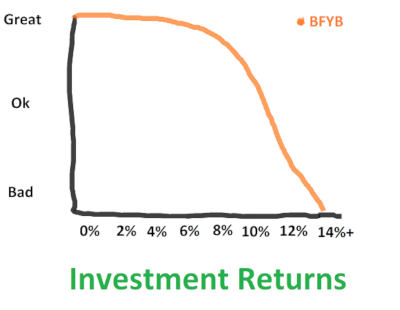

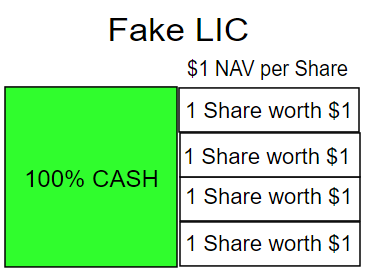

Here’s the deal, you can absolutely optimise your investment results up until a certain degree with barely any more effort involved. I’m going to ignore inflation, risk appetite and investment horizons for a second to make the point.

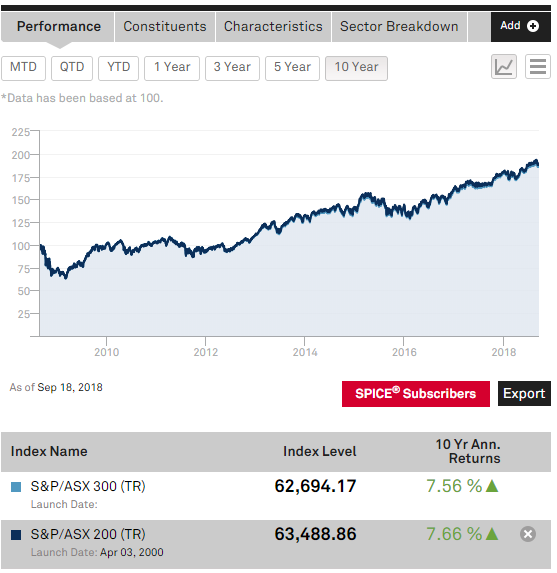

Investment returns have historically fallen around these marks:

0% – Storing your money in a shoebox under your bed

2% – HISA

3.5% – Bonds

7% – Real estate

8% – Shares

You can argue back and forth about how those numbers were gathered and what methodologies were used but it doesn’t really matter.

Realistically, any Aussie out there can achieve those returns rates in those asset classes without an economics degree. Index investing opened Pandora’s box and enabled the average Joe to grab a piece of the market without needing to spend the time researching and analysing financial statements.

Diversification and low management fees provide the best BFYB when it comes to this focus area. Everything else has such minute benefits that it’s laughable so many people spend so much time and effort trying to see which ones better.

To demonstrate this here is our BFYB chart for investment returns

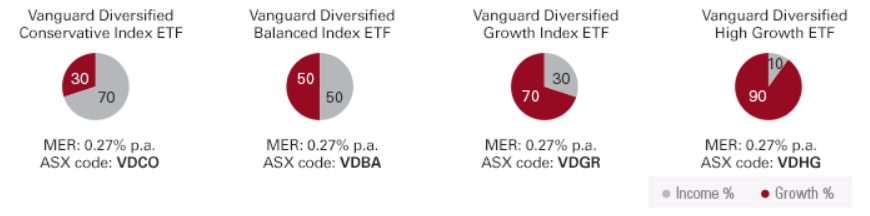

So basically we can get up to around 8% without much effort required. It’s always good to put the time and effort into understanding the asset class but theoretically, any Joe Blow could dump their money into a diversified index fund like VDHG and get ~8% over the long term.

I don’t know any assets class where you can get a better return without extra effort. There’s plenty of ways to improve your return on investment. I sold my first investment property and calculated an after-tax annualised return of 36% but the number of extra hours I put into that investment was the equivalent to another part-time job.

Newbies to FIRE and investing don’t really understand just how hard it truly is to beat the market consistently over a long period of time (20+ years). There are people who can do it, I’m not saying it isn’t possible. But the amount of effort and skill that is required to actually discover alpha year after year is something only a very few incredibly skilled people have managed to achieve.

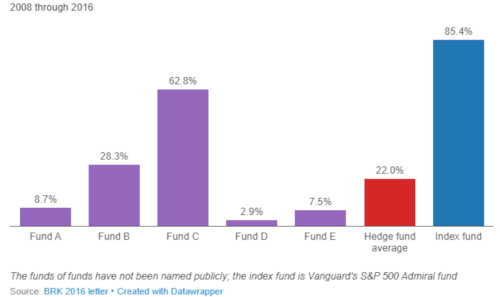

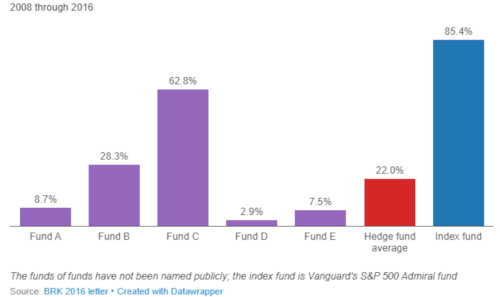

We’ve all heard the famous story of Warren Buffett betting a $1M bucks against 5 hedge funds that a simple index-tracking ETF would outperform them over an eight-year period. Not only did he win that bet, but it wasn’t even close.

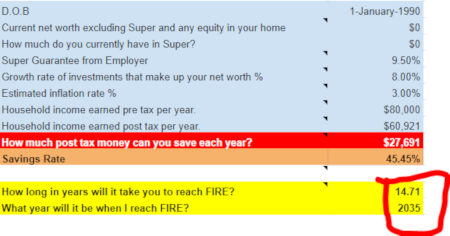

But let’s just entertain the idea that you’re an outlier. You possess incredible skills and techniques far beyond most active traders and hedge fund managers all around the world and you’re able to consistently beat the market.

How much better off would you be if you were able to outpace the market by a whopping 100 basis point (1%). 1% doesn’t sound impressive but if someone can beat the market by 1% over a long period of time then you’re most likely going to make more money in a hedge fund picking stock than you are at your day job. Your skills are extremely valuable.

We’re going to pretend that you keep this incredible skill to yourself and only use your god-given talents for your personal share portfolio. How much of a difference would 1% actually make?

Let’s find out.

Even using our top tier investing prowess we only managed to wipe off 2.3 years which was actually the worst result compared to saving $5,538 (4.5 years) or earning an additional $5,538 (2.7 years).

BFYB: Bad

Think about how much time and effort some funds put into research for investing. It’s a full-time job with an army of analysts and advisors all crunching numbers, creating models and using the latest predictive methods in the odd chance that they can justify their hefty management fees. And most of these funds don’t even beat the index when fees are accounted for.

What hope in hell do the rest of us have?

The example above used a huge 1% difference over nearly 20 years.

How many times have you seen someone ask about A200 vs VAS on the internet? It’s gotta be one of the most discussed and analysed topics within FIRE communities. The difference in management fees between these two funds is 0.03%…

Let me say that again. 0.03%

They do track different indexes (ASX200 vs ASX300) and do you know what the difference has been between those two indexes over the last 10 years… 0.04%

So maybe… just maybe those two funds might return a difference of +-0.1% over the long term.

10 basis points of difference is your reward for correctly picking the better performing ETF over that time period.. and that’s assuming you’re even able to use skill to pick the one that’s going to perform better (which you almost certainly won’t be able to do).

BFYB: Horrendous

A200 or VAS?

A200+VGS or VAS+VTS+VEU?

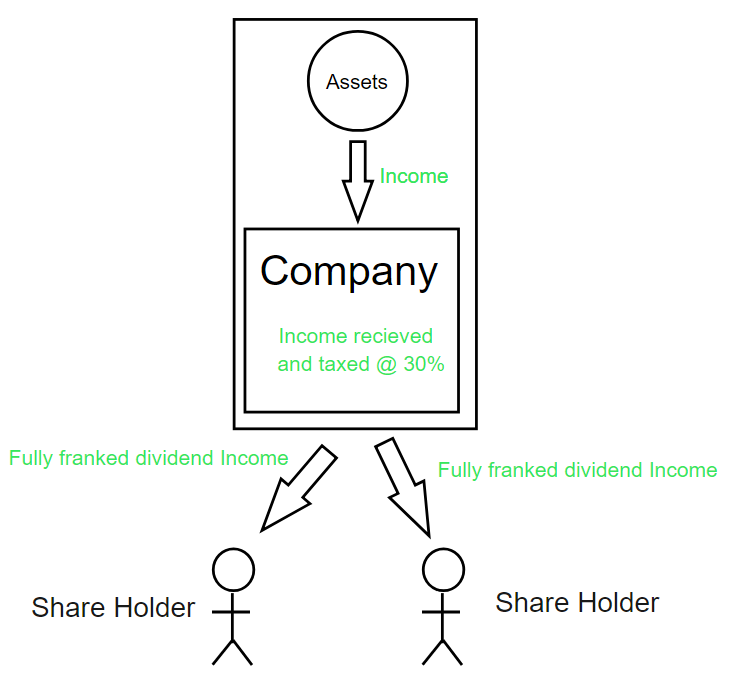

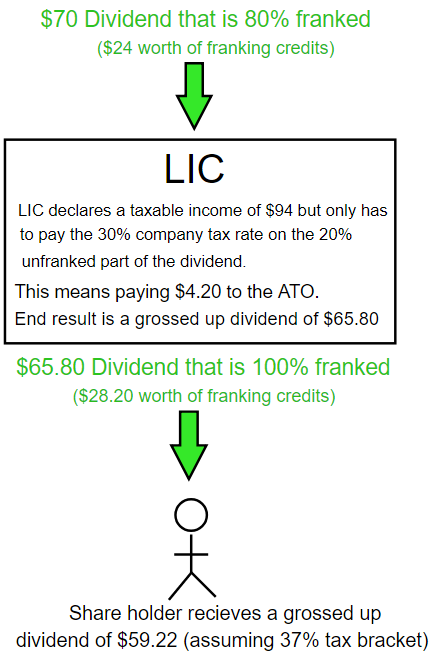

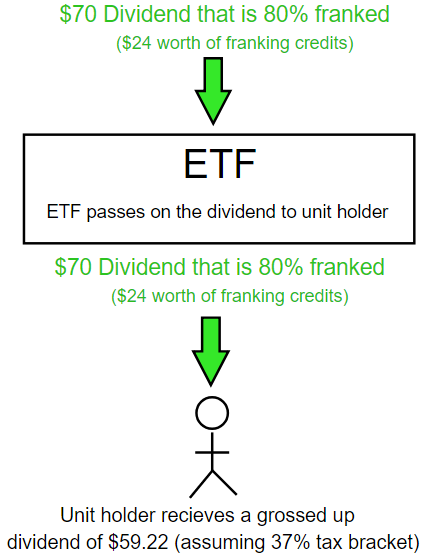

IVV or VTS?

AFI or VAS?

LICs or ETFs?

VDHG or create my own?

Most of these arguments don’t make a huge difference. It’s really important to understand the key concepts around management fees, diversification and why index investing works. But just understand that if you’ve got one of the above combo’s, you’re already more diversified and paying lower fees than most Australian investors to begin with.

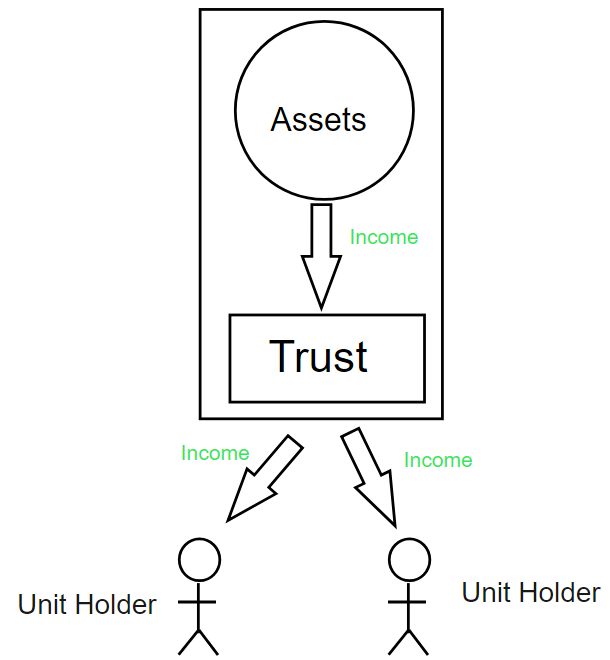

The basic investing principles for Australian FIRE is to build a low cost, diversified share portfolio mainly made up by ETFs/LICS. You want to buy consistently no matter what the market is doing and grow your snowball to a point where it’s passive income can fund your lifestyle.

There’s going to be a 100 different flavours of that ice cream but once you have those basics down pat, the bulk of the work is done. You can always tweak and improve your portfolio to suit your circumstances but honestly, if you’re trying to reach FIRE faster and think that crunching numbers in Excel for 10 hours a week is going save you years of working, you might be in for a rude shock!

Keep your investing simple and boring. Use your precious time optimising your expenses and working on ways to increase the amount of money that flows into your account because IMHO, focusing time and energy on savings and increasing your income has the best BFYB returns.

Different Ways to Increase your Income

I hope after reading the above you can now appreciate just how underrated increasing your income is. The saving rate is held in high regard within the FIRE community thankfully, so there’s not much to add there.

But my goodness does investing get way too much of the limelight. It’s largely out of your control too. Other than choosing your diversification levels and sticking to a low-cost fund, you’re very limited to how much you can improve the results.

When it comes to increasing your income though, the complete opposite is true. The harder you grind the more money you will make! And the more money you make, the higher your savings rate will be (if lifestyle inflation doesn’t get ya)

So let’s jump in to see how we can improve our crunches and pushups and maybe head over to the dark corner of the gym, away from the treadmills and cross-fitters… the weight room!

Ask For A Raise

We’re going to start by improving our current workout (salary job).

One of the easiest and most low hanging fruits on anyone’s list should be to simply have a conversation with their boss about their salary and ask for a raise if they think they deserve more money.

How many times have you heard about someone complaining for years that they’re underpaid but never actually taking the action of setting up the meeting to discuss their pay? I’m not saying this will have a 100% success rate but more often than not, it will start the process of you either getting more benefits or creating the plan for your next raise or bonus.

You probably want to approach the meeting with some sort of reasoning like citing average incomes within your industry or comparing the work you do with someone else that’s being paid more.

BFYB: Great

Hardly any effort with the potential to add thousands extra to your accounts for years to come! No real risk either and it’s not like you have to learn something new.

Change Jobs Regularly

Asking for a raise or putting your head down and bum up climbing the corporate ladder is a noble way to jump the food chain and reap the rewards. But the sad truth in my experience is that loyalty to a company (or business for that matter) is rarely rewarded.

Your utility provider doesn’t offer a better deal when you’ve been a loyal customer for 10 years. It’s only when you leave do they all of a sudden roll the red carpet out.

If your goal is to make the most money in your field, changing jobs every 2-3 years is the best way to do it.

Be bold, be confident. Apply for positions beyond your capabilities. Back yourself to get the job done after you land it.

Fortune favours the bold!

I’m not saying to lie your way to a position only to fall flat on your face. Just understand that an ungodly amount of people are in jobs they were never qualified for or completely lacked the experience necessary to perform it at the start.

When I worked for the government back in Australia, we would engage with consultants all the time from various companies who always charged an obscene day rate to perform projects. Think $1,000+ a day. I worked directly with a lot of these consultants on the technical side and it always struck me as odd when they clearly didn’t know a whole lot. Here we were, getting charged $1,000 a day and I would end up doing 30% of the work.

Fast forward 5 years and I became a consultant myself after picking up contract work in London. My second contract was at one of the big four global consulting firms who are widely regarded as having some of the best professional services networks in the world. And boy do they charge accordingly for that reputation.

I worked on client-side with a team of consultants but was the only contractor. Two of the team members were really junior. One was 18 months out of uni and whilst really smart and willing to learn, didn’t know a whole lot about the technologies we were implementing.

My day rate for that contract was a whopping £500. It was more than double my daily earnings from back home and I couldn’t believe that a company would be willing to pay me so much.

Well, you might have guessed that I was completely blown away when I found out that the consulting company who I was subcontracting for, was actually charging me out at their SC (senior consultant) rate which is a staggering £1,250 a day 🤯. Even at £500 a day, I was only getting 40% of the pie!

And now it made sense why all the firm’s partners were driving McLaren’s…

But here’s the point of the story… everyone on the team was also being charged out at £1,250 a day!

I mean… honestly. One of them barely knew anything. And it was at this point that I realised that companies will lie and exaggerate the skills and experience of their products/services in order to get the most amount of money they think they can get away with.

You should be doing the same!

Last point on this one, be prepared to move somewhere where your skills are in demand. This might mean international.

BFYB: Great

Side Hustles

Time to get out of your comfort zone!

The two tips above were focussed on improving your current situation. Everyone’s working out to some degree so it would make sense that we start by improving your running technique or buying training gear. But now I want to take you into that dark corner of the gym where you might not have been before. It’s not going to be easy and learning new things can be difficult. But I promise you that the benefits here are worth the effort.

I’d rather not bore you by listing every single side hustle I can think of either. I have personal experience in a few side hustles which I’d like to talk about but there’s really an unlimited amount of ways to bring in a little extra cashola.

Work a second job:

This one depends on how exhausted you are working your main job, but there’s plenty of people who work two jobs and cope just fine. Mrs FB used to do a bit of bar work on Thursday and Friday nights even though she didn’t need to. She worked with her sister and a few friends and half the time most of her friends were drinking at the bar (a small country town so not many other options lol) so she was sort of where she’d be anyway just earning money instead of spending it. A little bit of extra work equated to thousands of extra dollars in her account without too much effort involved.

The second gig can be anything too. Teaching piano, tutoring, Uber driver etc.

BFYB: Ok

Sell stuff:

One of my biggest pet peeves is throwaway culture. The amount of effort that went into digging something out of the ground, refining it, transporting it, manufacturing it, shipping it, storing it and to have someone finally buy/consume it… only for it to be thrown away in the trash not long after.

Utter insanity!

Never throw away something just because you don’t want it anymore. If it was once a good product, odds are you can sell it online to someone and recoup some of your losses. Hell, I even managed to sell my old pair of Nike’s for $30 once. Legit took me less than 10 minutes to list it. How many of you out there would be willing to work for $180 an hour?

At worst go down to your local Salvos and donate it. Chucking something that is perfectly fine in the trash is sooooo lazy, a bad financial habit and adds to humanities ballooning trash pile that mostly ends up in our oceans.

BFYB: Ok

Credit Card Hacking:

I’ve been credit card hacking for nearly a decade. In a nutshell, you sign up to new cards to take advantage of the signup bonus these CC companies offer and then spend the points on products, flights or convert them to cash. You can also pay for everything on the CC and accumulate points over the course of the year. A little bit of effort for a pretty decent bump IMO. The only risk is that you need to ensure you pay off the CC amount in full at the end of each month.

Oh, and some cards come with free travel insurance which can cost hundreds of dollars.

BFYB: Ok

Matched Betting:

Something I only discovered in 2019 after ignoring it for nearly 6 months because I thought it was a scam. The principles are very similar to CC hacking. The bookies offer you signup bonuses where you join with the caveat that you need to gamble the bet in order to access it. Matched betting is the mathematical approach for discovering arbitrage opportunities between back and lay bets. Or simply put, playing the bookies against each other to make money. When you do it correctly it’s mathematically impossible to lose but it’s a lot more complicated than CC hacking.

There’s a lot of low hanging fruit here for those who who want to put the time and effort into learning it. The two advantages that matched betting has over CC hacking is that firstly the amount of money you can make is a lot more. The low hanging fruit can be anywhere between $1K-$2K. And secondly, matched betting can be done for an extended period of time and not be just a one-off. I’ve had many people email me about the money they have made from matched betting exceeding $15K.

The signup bonuses are the low hanging fruit because after that it basically turns into another job. The fact that you can do it over the internet is a huge plus in my book.

Full warning with this side hustle though, you must do your research because if you make mistakes you can lose a lot of money. I’d suggest listening to the matched betting podcast I recording in 2019 and reading about the feedback I received from readers later that year. Some people had good experiences, some had bad.

BFYB: Ok

Start An Online Business

I’ve become an enormous advocate for having a crack at online business.

There are just so many advantages that being 100% online offers to the traditional way of doing things.

Some of my favourites are:

- Can run the business/company from anywhere in the world as long as you have an internet connection

- Startup speed. You can literally create a website/blog/YouTube Channel and begin creating content/a product and have the world at your fingertips within hours. This is simply mindboggling and it gives any entrepreneur a realistic chance to create something that will be successful.

- Incredibly small start-up costs. Gone are the days where you’d have to risk financial ruin in order to start a business. How many people over the last 100 years have had a killer idea but lacked the capital to get it off the ground? I think Aussie Firebug cost me <$100 the first year.

- Can scale as your business grows. This is what I love about cloud services in general. You only pay for how big you are and you can scale in a matter of seconds to accommodate a larger audience if/when you get there.

Aussie Firebug will always be a passion project but around late 2018 I officially started to monetise my content and miraculously it managed to make over $30K last year and I’m on track to make it again this FY.

I could do an entire article about how to monetise a blog/podcast because making money digitally is such a new concept (relatively) and there’s a lot to get your head around. Even though I’ve already listed a whole bunch of benefits above, probably the biggest advantage that an online business can offer someone on the road to FIRE is its ability to make semi-passive income.

A website/podcast/YouTube Channel is constantly available to everyone in the world. It’s not like a shop where you need to physically be there to make things run. And if your product is digital (you’re not selling something physical) you don’t need to store it and it can be replicated without any cost. If you sell a physical book you will need to pay to get that book printed and shipped. If you sell an ebook, you can literally just copy and paste a new version and send it to people straight away. The power of the internet!

Plus there’s a whole bunch of automation you can set up in the background where a lot of the day to day business operations can run on autopilot.

I think back to how many hours I put into Aussie Firebug during the first three years. The amount of time was crazy, probably averaged 1.5 hours each weeknight for 3 straight years. But the beauty of something like a blog/podcast is that most people are making the content because they really enjoy it. I didn’t earn anything for the first three years but I built the content that would later be the main drivers to allow the site to be monetised.

I’ve made over $60K during the last 2 years and I’d say on average I’m lucky to spend ~5 hours a month these days. My life has become completely different since moving overseas and travelling around and I just can’t dedicate as much to Aussie Firebug as I would like to.

But the point is that I’ve set up certain automations that enable the site to make me money while I sleep. I can’t tell you how satisfying it feels to wake up most mornings and see people taking advantage of companies that I use and recommend.

This concept is immensely powerful no matter what the online business is. Work can be recycled and can continue to make you money even while you sleep. I know a YouTuber that basically earns most of his money from a few videos he recorded years ago. Yes, he still continues to make new videos to keep the channel up to date, but the bulk of his income is still being generated from 2 or 3 pieces of digital content he created a long time ago.

That’s something you simply cannot do when you trade your time for money.

If you’re thinking about creating content I’d probably say that YouTube is the easiest way to start earning serious cash, followed by starting a podcast and unfortunately, dead last would be blogging.

The Double Whammy Effect

Side hustles and online businesses are a great way to bump up your income but there’s also a massive opportunity to simultaneously work on something that’s often forgotten about.

What are you going to do once you reach financial independence?

You don’t need to be FI to start plugging away at your passion project or whatever it is you’ve always wanted to have a crack at.

Start that project this weekend!

Momentum is a powerful force. If you have a little side hustle or project you get to work on for fun in your spare time, more often than not, when you do decide you’ve had enough of sitting in a cubicle for 40 hours a week, the transition is so much easier because you’ve already built up something to further sink your teeth into.

My preference will always be an online business but it doesn’t have to be that. Make candles, sell scented oils from Etsy, create a monthly COD tournament in your area. Anything you’re interested in will do. And don’t worry about making money because 9/10 times if you start doing something you love it somehow finds a way to pay for itself eventually.

Wrapping It All Up

I wrote this article with the intention of highlighting one of the most underrated focus areas in our community. Everyone should know by now that your savings rate is king but rarely do I see such admiration for putting time and effort into earning more money in your day job or by hustling on the side.

Far too often people come to the FIRE community hoping to discover the secret sauce that enables us to retire 30 years earlier than most. The methods we use to invest are actually incredibly boring and simple.

If you’re anything like me, discovering the concept of FIRE can change your life. I was bursting with excitement and enthusiasm when I realised that financial independence was an achievable goal that nearly any Australian can achieve if they prioritise it highly enough.

Focus more of this energy into something that’s within your control. That’s saving money and earning more. The majority of investment returns are largely out of our control which is why the never-ending debate between which investment is the best is largely a waste of your time. I’m not saying you shouldn’t educate yourself about investing. Just know that the difference between choosing A200 or VAS will not be a difference-maker that could potentially wipe years off your journey.

On the contrary, starting a hobby of making and selling custom jewellery in your spare time does have the potential to eliminate multiple years and maybe even decades. But more importantly, side hustles/businesses can offer the more important benefit of shaping your future in retirement. No one wants to reach financial independence just to say they did it. We want the freedom that it grants. But using that freedom to create your ideal lifestyle doesn’t have to start once you reach that magical number, you can start meaningful work right now and it can help you along the journey!

If I can refer back to our metaphor from the intro one last time I’ll leave you with this…

Most of you guys already have a great diet. Some are dialled in so well that you are hitting your macro and micro-nutrients to the gram. But it’s time now to look at your workout routine and see if you can fit in a few more sessions every week to really take it to the next level!

Spark that 🔥