Bills, bills, bills, bills, bills!

Another slow(ish) month with a lot of unsuspecting bills cropping up. I have compared my spending/bills with last years and March to June is a lot less bills so I’m hoping that it is true this time around too and I am able to save heaps.

I had one of my IP’s go up a bit the other month but other than that it’s been really quiet. My first IP has not risen in value for over a year now. Maybe signs of the market slowing down? Or maybe Commonwealth Bank are not updating their valuations as regularly as before?

It hasn’t bothered me anyway. I don’t think I’m going to use equity for a while. Just going to save like crazy. I will still pull the equity out, if it’s there and dump it into the offset because there is no reason not to have those funds available in case I need them. But I want to keep my cash flow position as strong as possible because I have a feeling that it might be bargain season soon and I intend to pounce if/when the market dips/crashes.

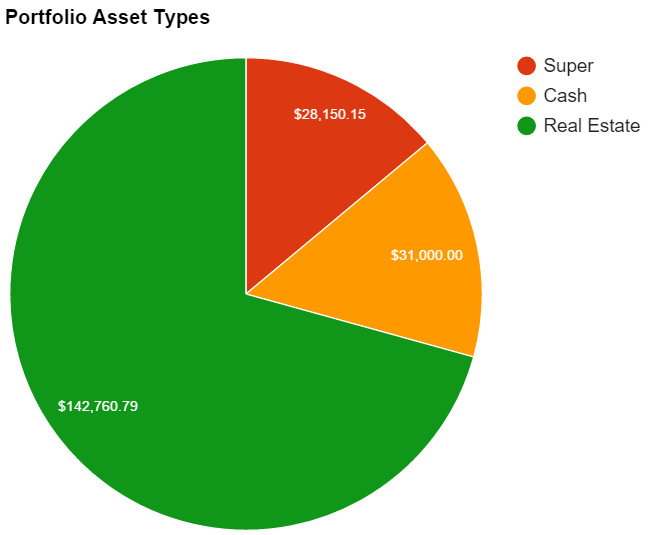

I’m going to be sitting on a lot of cash (currently at 16%) in the coming months. This may seem high to others but you have to remember that my cash does not sit in a HISA, it’s in an offset which is returning more than a HISA (my interest rates are around 4.6%). 4.6% is a decent return for cash so I’m happy with that at the moment. Plus with property there is always the possibility of something big breaking or something happening which could mean some $$$ upfront real quick.

Networth

[wp_charts title=”linechart” type=”line” align=”alignleft” width = “100%” datasets=”-36000,-36000, -32000,-7000,20000,32000,45000,65000,83254,130000, 186000″ labels=”1-Jan-2011,1-Jul-2011,1-Jan-2012,1-Jul-2012,1-Jan-2013,1-Jul-2013,1-Jan-2014,1-Jul-2014,1-Jan-2015,1-Jul-2015,1-Dec-2015″]

| Date | Rolling NetWorth | $ Change | % Change | Notes |

| 1-Jan-2011 | -$36,000 | $0 | 0.00% | HECCS debt |

| 1-Jan-2012 | -$32,000 | $4,000 | 0.00% | Started Full-time work late Nov |

| 1-Jan-2013 | $20,000 | $52,000 | 0.00% | Built property and recieved FHOG ($21,000) |

| 1-Jan-2014 | $45,000 | $25,000 | 125.00% | |

| 1-Jan-2015 | $83,254 | $38,254 | 85.01% | Bought second IP |

| 17-Feb-2015 | $110,215 | $26,961 | 32.38% | |

| 18-Feb-2015 | $121,541 | $11,326 | 10.28% | IP’s re-valued |

| 4-Mar-2015 | $123,715 | $2,174 | 1.79% | |

| 18-Mar-2015 | $122,128 | -$1,587 | -1.28% | Paid for holiday |

| 15-Apr-2015 | $125,906 | $3,778 | 3.09% | Withdrew equity from property |

| 14-May-2015 | $127,906 | $2,001 | 1.59% | |

| 18-Jun-2015 | $131,904 | $3,998 | 3.13% | |

| 21-Jun-2015 | $152,904 | $21,000 | 15.92% | IP’s re-valued |

| 12-Jul-2015 | $159,904 | $7,000 | 4.58% | Paid 4K off HECS Debt |

| 23-Jul-2015 | $161,904 | $2,000 | 1.25% | |

| 31-Aug-2015 | $167,904 | $6,000 | 3.71% | |

| 31-Sep-2015 | $170,110 | $2,205 | 1.31% | Car went out of Portfolio, Bought IP 3, Super went up and one IP went up |

| 31-Oct-2015 | $171,376 | $1,265 | 0.74% | Big bills. Not much saved. |

| 30-Nov-2015 | $173,263 | $1,887 | 1.10% | Super went down slightly |

| 31-Dec-2015 | $186,910 | $13,648 | 7.88% | IP went up in value |

| 12-Jan-2016 | $187,910 | $1,000 | 0.54% | Some big bills |

| 2-Feb-2016 | $189,910 | $2,000 | 1.06% | Bills (again) |

Well done mate! Keep it up! Both the writing and the saving.

A

Will do :). Have been a bit busy lately but have a killer podcast I need to upload. Transcribing it takes a while that’s all.

Looking forward to it. The last one was really good.

Hi Aussie Firebug,

I’ve just finished reading through your whole blog. I’m more than happy to lend a hand with the transcription, if that would help. I thought it was great that you went to all the effort of transcribing it – I’m a person that would much rather read than listen!

I think you will have my email address from my comment here? Feel free to email me.

Hey sorry for the late reply. Always looking for help with the site. I didn’t actually get your email. Mine is [email protected] if you want to drop me an email. If transcribing is something you do then I’d defiantly like to organise something.

Cheers

Definitely looking forward to another podcast! The first one with Ben was very interesting!

I was looking at your graph and it seemed like you paid off your HECS debt quite quickly. How did you manage to do that? We are thinking whether we should start investing first and just pay the minimum or pay off HECS before starting to invest.

Thanks =)

I pay the minimum amount each year that is auto deducted from my salary.

I was a relatively high income earner I guess when I first graduated so I think my repayments may have been slightly above average. But other than that I don’t pay off any extra.

HECS debt is the best debt anyone in Australia will most likely ever have. And you’re 100% right, I would invest first and just let the minimum payments do their thing until it’s paid off completely.

I owe around $10K still (haven’t check since last FY) and had around $30K at the end of 2011.

Really impressive, that net worth graph! You’ll be free before you know it at this rate. It’s kind of funny to think about the 15 years of education it takes to get ready for a career that then lasts 10 years!

Yeah it is funny when you think of it like that. If I had known what I know now I probably would have started full time work way sooner and maybe not have even gone to Uni!