It’s a decision most homeowners know all too well. Fixed or variable Rate? Do I fix my interest rate? Or do I go variable? Will the rate go up and I’ll feel like a champ if I fixed? Or will it continue to drop and I’ll just not tell anyone how much more I’m paying every month?

To Fix, Or Not To Fix?

There are some pros and cons for both. The main arguments made for fixing often include:

– Stability with repayments

– Laughing at others when rates rise

While the downsides usually are:

– Can’t make extra repayments

– Have to pay fees to set it up

– No offset

– No redraw

– Big, expensive, want to make you burn down the bank break fees if you ever decide you need out

– Crying internally if rates drop

Variable is basically the opposite of above where you have a lot more freedom and flexibility with your loan. You do pay for this extra freedom however by exposing yourself to more risk.

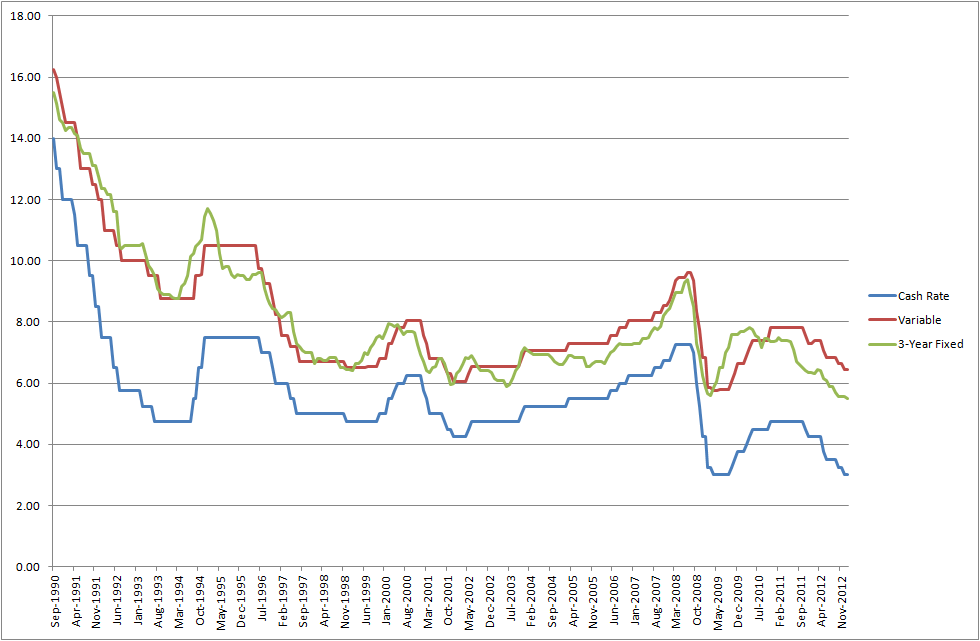

What’s interesting is that at the moment of writing this article you can find plenty of fixed rates that are lower than variable. I had a quick look at some historic fixed or variable rate data and it seems that this is not so uncommon.

I was under the impression that fixing your rate usually meant that you pay a higher rate but upon further research, this wasn’t the case.

So if a fixed rate is lower than your variable AND provides the security of a fixed rate, there’s no reason I shouldn’t fix right?

Yes and no.

Make no mistake about it. The banks are ALWAYS aiming to make the MOST profit at ALL times. If you think you will pay less by fixing your loan for 1, 3 or 5 years after you have factored in all the extra fees and potential rate movements then, by all means, go for it. But just remember that the banks have an army of analysts that are betting against you. Just look at the above graph and try to find a couple of years where fixing your loan will come out ahead.

And remember that you have to factor in the fees associated with setting up the fixed loan and keeping it.

Here are the CBA’s fees for fixed loans. Scroll all the way to the bottom to see the fees. They include:

- $600 upfront establishment fee

- $8 monthly loan service fee

- $750 Rate Lock fee. Applies to each Rate Lock. Only available on 1-5 year periods

That’s $1,446 in fees straight off the bat. How much of an interest rate hike would be needed for you to recover those losses and come out ahead vs variable? It depends on your loan and rate but there needs to be a BIG rate hike. And that’s just for one year. If you decided to fix for 5 years, the fees are spread out that’s true. But again, take a look above and try to pick any date where a 5 year fixed rate would still be lower than variable during its whole lifetime and by how much?

Are you starting to see how hard it is for this to actually pay off? There have been certain periods of time where fixing has been better no doubt about it. But how good and confident are you that you can get the timing right? The banks have an army of people working full time on this stuff and STILL get it wrong.

I truly believe that you’re gambling if you’re trying to fix your rate to save money. And the ones that win 90% of the time are the banks.

If you’re fixing for stability or peace of mind then that’s different. But don’t think for a minute that the odds are in your favor by fixing. If you do actually come out ahead it will almost certainly be because of luck and not your amazing analytic skills that you predicted that the banks didn’t.

Split Loans?

I’m not a fan of split loans because it’s sort of like taking the worst bits from each loan type and combining them into a shit sandwich.

Let me explain

Some of the main benefits from variable are:

– Loan flexibility

– Being able to refinance if needed

– Benefit from rate drops

– Offset and redraw

– Can pay off the loan at any rate you want

You get half of the offset, rate drop and redraw (assuming you split 50/50) which is Ok but none of the other benefits.

You still can’t refinance the entire loan, you still can’t pay off the entire loan.

Your flexibility is about as good as a pair of chalk hamstrings

You’re taking on all the risks associated with variable but not benefiting from all the advantages.

The main benefits of a fixed loan are:

– Stability with loan repayments

– Protection against rate rises

You lose both of those things with a split loan. Yes, you’re only going to have increased repayments from half the loan if rates do rise but then what was the purpose of fixing half the loan if your paying establishment fees for the fixed loan which will probably be more than the interest repayments from the rate rise???

And you’re stability is gone too because you still have the potential to pay more from the other half of the loan if you split.

But you still have to pay the setup fees plus you’re locked into the loan.

You’re getting nowhere near the benefit of either strategy but all the negatives from both. If you want stability and certainty then go with fixed. If you can handle rate rises, go with variable.

Wrapping Up

Maybe I’m wrong with my analysis of ‘fixed or variable rate’ and maybe I’m about to be blasted in the comment section about all the people who have ‘beat the banks’ by fixing their loan at a certain time. I’m a variable man, the flexibility, and freedom of a variable based loan is something that appeals to me. I think that fixed loans were invented by the banks to prey on the Ned Flanders of the world (the over cautious) and take more money from them by giving them peace of mind. That being said, if a rate rise means that you’re going to default on your loan, then you should definitely fix because you’re most likely overextending yourself financially. For the rest of us, riding up and down the variable roller coaster is financially better, for the majority of the time

Hey, nice considerations. I think it’s definitely something worth considering, the loan repayment is most people’s biggest expense, if we can positively affect that somehow, then we are all the better for it.

Fixing can give someone that certainty, so they know how much they will be paying. Sometimes the banks will increase the rates when it’s out of cycle (like the big 4 have done recently).

Personally, with the Aussie dollar being a bit higher than the RBA would like, I think there is a much bigger chance of the RBA decreasing the official rate than increasing it. The big 4 won’t increase much, if at all, as the smaller banks can match them pretty well now.

Tristan

I like your analysis Tristan. I’m also predicting a rate cut but can also see the dilemma the RBA are in.

Do they cut the rate to stimulate the economy? Or does cutting the rate just further damage the housing affordability as more investors flock to the market pumping it up more? And there is also something to be said about having some reserve in the tank. What happens if shit really hits the fan? The RBA would like a few hundred percentage points to play with if that did happen.

Don’t want to end up in a recession with the cash rate sitting near 0%

Having said all this, the RBA (and big banks) reduced the interest rate a day later lol.

I hope they don’t get any lower than 1.5% (which there’s a good chance of). Savers + companies that rely on interest, need income still.

Plus they need a bit of a buffer, like you said.

Tristan

This needs to be reviewed, considering the RBAs current all time low, sim chance of going lower, why not lock in now before rates gradually trend upward.

Nope. Doesn’t change my thinking at all.

The banks are going to know more about rate movements than us. You could lock it in and get lucky, but statistically, you have a better chance of paying less by going variable.