I can’t believe that September has finished already. Weren’t we just starting 2017 a few months ago?

We hit a big milestone in September. We reached $100K in ETFs!

A big milestone reached today. $100k worth of ETFs!!! Woohoo pic.twitter.com/VtaFoq4YB0

— Aussie Firebug (@AussieFirebug) September 12, 2017

We were so close last month and it felt like the market was just toying with us. It got to $99K a few times before dropping.

I knew we would eventually break through $100K because we were going to buy another lot of ETFs anyway but I really wanted it to get there on its own.

This was a big milestone for Mrs. Firebug and I and it’s important to celebrate the little wins along the way to financial independence.

We bought our very first bunch of ETFs on the 29th of September last year which means we managed to get to $100K within 12 months which was definitely unexpected and I’m actually shocked we did it in such little time. My payout this year when I switched jobs definitely helped, but other than that, it was mostly savings.

We made the decision to diversify our assets since we were too heavily weighted in property in Australia.

The plan was to get to $100K in ETFs and then decide from there as to what we were going to do.

We sat down and discussed our options. We could either:

a) Buy another property investment

b) Continue to buy more ETFs

c) Invest in something else

Option a) might have been more appealing if the market had suddenly tanked or the rental yields improved. But as it currently stands, option a) was not very appealing to me for the following reason:

- I can’t be bothered putting in the effort required to purchase a good IP. This includes the proper research, potentially value-adding exercises on weekends, dealing with agents and banks (errrr banks. No thanks) and having another IP to manage all the book work for

- The risk associated with Australia right now. A recession (whilst I don’t think it’s likely) is well within the realms of possibility. And if it did happen… Who the hell knows what the fall out would be.

- Cash flow just isn’t there for me.

Don’t get me wrong. You can still make a killing in real estate right now but you have to put in the effort. Which I can’t be bothered doing. There was a time when I could. But now that ETFs have proven such a great alternative. Why would I work hard when I can get great returns from hardly doing anything at all?

No other investment really caught my attention for option c). I did look into P2P and maybe someday I will dabble in that. But we are looking to build our base foundation for a prosperous wealth machine. P2P feels like a fun exercise and not something you could comfortably retire on.

So the only option that was left and the clear winner was option b)

More ETFs 🙂

The returns played a big part to our decision too.

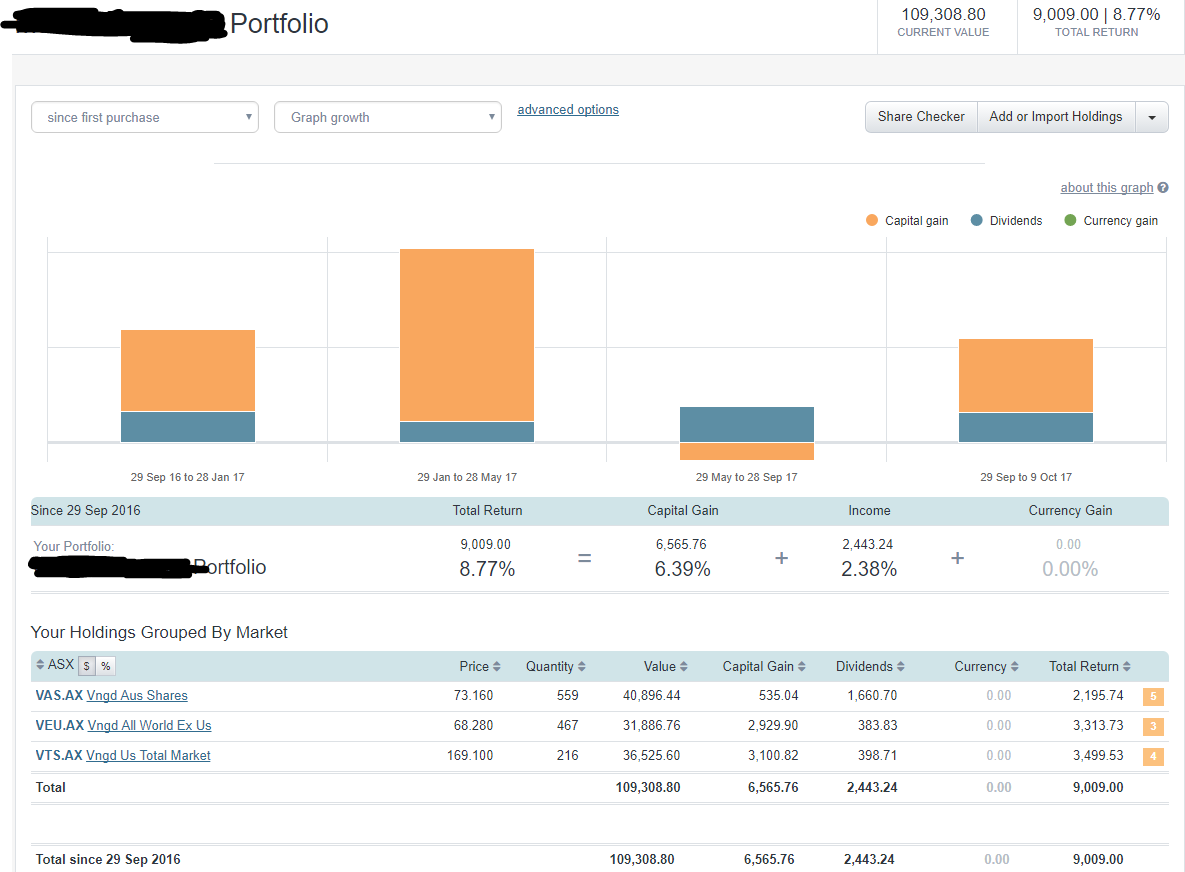

Here’s what our last 12 months looked like

A total return of just over $9K (8.77%) after investing roughly $100K which isn’t too bad. To put that into perspective, Australian based robo investing company Stockspot has 5 funds they offer. And only 1 fund managed to beat my return for the last 12 months.

You can see their returns here

This is a company I have had on the podcast before. They also invest in ETFs but offer rebalancing and a few other things.

My point is that with a very simple three fund portfolio, I got a great return with 0% research into what are the ‘hot’ stocks this year or time spent managing my investment and still came out similar to a professional investment company.

And when the dividends started to roll in it was like Christmas!

I also looked into our interest rate for the IP loans to see if there were any better deals out there.

I already have a mortgage broker, but didn’t have any luck with him being able to lower my interest rate.

I ended up signing up with a company called HashChing* who is basically a marketplace for mortgage brokers and loan deals.

Their website boasts some insanely good rates and it doesn’t cost anything to sign up so not much to lose I thought.

I ended up being contacted by a mortgage broker who has been great and is currently giving me options on all three of my loans.

The lowest option being 3.88% which is a whole 1% lower than what my current rate is at now.

This works out to be a savings of $6,791 bucks per year just from making a few phone calls!

I’m still in the process of choosing a deal but the bottom line is if you have a loan (home or investor) you need to have a mortgage broker working for you to get the best deals. They don’t cost you a single dollar as they get their commissions from the bank and 9/10 times they will get you a better deal than you could get by walking into the bank.

*The Hashching link above is an affiliate link to which I may receive a commission from if you sign up to their service. This is a service I have personally used and would recommend anyone to use if they have a loan to get a better rate. I would never recommend something I didn’t believe in (and there have been plenty of offers trust me)

Net Worth Update

Pretty quiet month with our smallest gain this year. There was a bit of Super bump and ETFs but mainly just savings.

Properties

No changed in the properties this month.

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs

ETFs more or less stayed the same, slight bump I believe.

Networth

What app are you using in the first screenshot?

Also interested to know which app this is

Hi Ben,

It’s the Commbank app.

thanks mate, congrats on the milestone. the Commbank looks a bit more user friendly than CMC is.

Have you looked at selfwealth?

Currently researcher mate. Been lazy but need to look at other cheaper options. The Commbank app is nice though.

Hi Ben/Aussie Firebug,

I’m a selfwealth user and have a similar ETF allocation to your Vanguard portfolio. $9.50 per trade regardless of size is hard to beat!

Currently looking at this Dan. I have heard good things

Same question, would like to know too! Congrats on the milestone.

Hi Kein,

It’s the Commbank App mate.

The Commbank App. Commsec is my broker but I’m currently looking into going with other cheaper alternatives.

If you are referring to the Portfolio screenshot with Graphs, it looks like Sharesight.

The portfolio screen is indeed Sharesight

What do you use to revalue your properties?

Hi Mo,

I used the Commbank valuation.

I have this disclaimer under the properties section.

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

Cheers

Congrats on reaching your goal, I’m also looking at different broker options. I’d be interested in hearing what cheaper options you find and if it would be better all round (including ease of use and tax reporting available) compared to Commsec

Yep. Planning to do a podcast on it soon. Watch this space

Hi Firebug,

Thought for a second there you’d logged into our system. We have an almost identical Sharesight, started 2 months before you- 29 July 2016.

$105k , 8.71% total return ( 5.9% gains, rest dividends, roughly 2:1 ratio) .

From a simple two fund – Split is $37k VAS, $68K VGS.

Keep up the good work.

Excellent.

VAS+VGS is very similar to VAS+VTS+VEU so I would expect minimal difference for the returns.

Gotta love ETFs right

Hey mate what sort of dividends are the ETF’s paying? Can’t seem to find this in the comm bank app. Keep up the great work!

Hi Marino,

Check out my Sharesight graph above. I shows you exactly the amount of dividends I was paid and by which ETF.

I received a total of $2,443 over the last 12 months.

Great job on the 100k in record time!

All the best for hitting 200k this time next year 🙂

Thanks mate 🙂