by Aussie Firebug | Jun 6, 2022 | Classics, Investing, Tax

We’re on track to increase our wealth by $100,000 dollars over the next 20 years by strategically changing the use of our home loan.

Not by taking on more debt.

Not by changing our asset allocation.

Not by increasing our risk tolerance.

2 transactions were all it took for us to start deducting interest repayments on part of our home loan.

This is a strategy known as ‘Debt Recycling’ (DR).

This article has been on my mind for a while but I really wanted to go through the process firsthand before writing about it. There are a few different ways to do DR but I’ll just be covering how we did it because I don’t know all the nuances with the other methods.

So let’s break it down!

What Defines Debt Recycling

DR = Turning non-deductible debt into deductible debt.

In our case, we wanted to be able to claim our PPoR (Principal Place of Residence) home loan interest as a tax deduction.

Without DR you can’t claim interest from your PPoR loan like you would with an investment property (IP) loan.

How We Did It

*Please note that all the examples in this article will be simplified. Things like rate changes throughout the year, loan repayments and when we officially started DR will remain constant to make it easier to explain.

For simplicity purposes, I’m going to explain our method of DR without our Family trust. I’ll add in the family trust later so everyone who does have a trust can see how we did it but I want to make it simple to start with.

IMO, DR works best when you have a lump sum that you’re planning to invest anyway. That was the position we found ourselves in after we sold IP2 and had over $200K in cash.

We also bought our PPoR last year and I was planning to DR part of our home loan so I made sure that we split it into two parts.

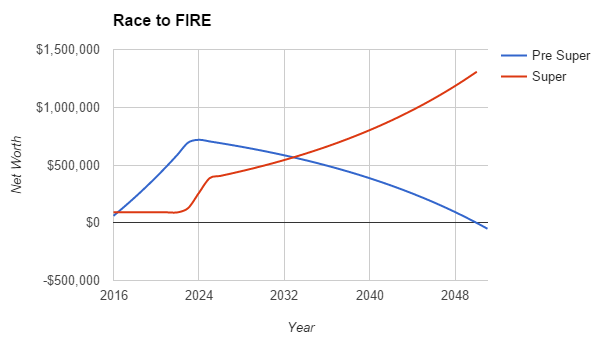

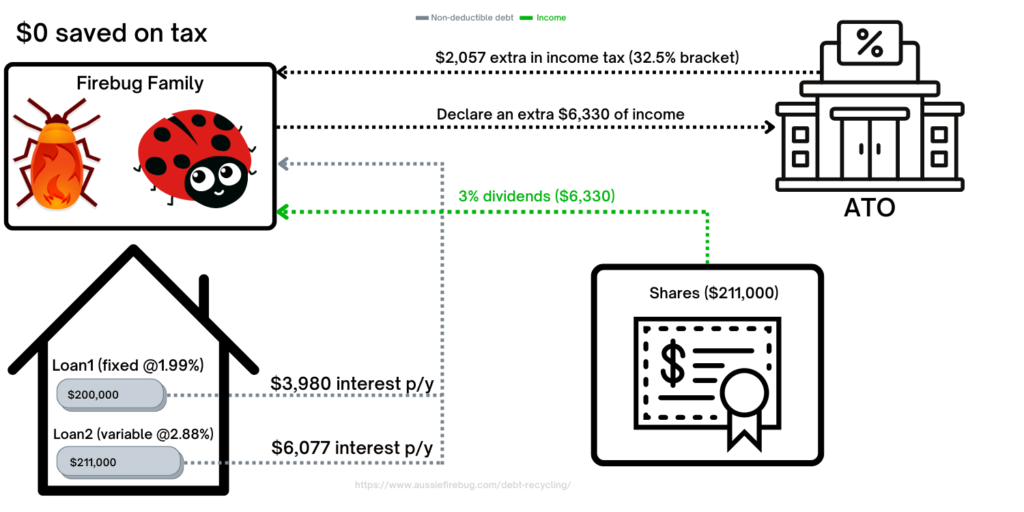

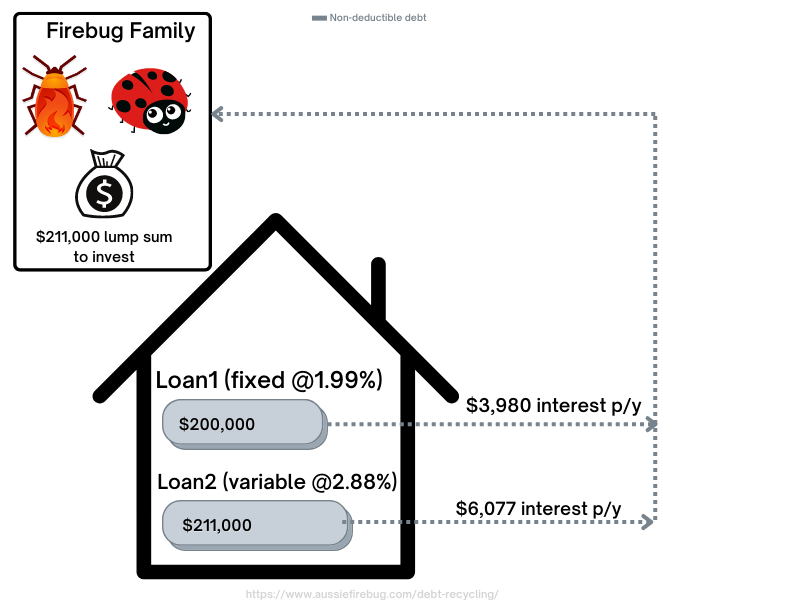

Here is how our situation looked before DR.

Before DR

As you can see in the above picture, Mrs Firebug (Ladybug in the picture 😂) and I have to pay ~$10K of interest a year for both our home loans (which are secured against our PPoR). These are real numbers (sorry Melbourne and Sydney folk 🙈) when we first settled on our home.

We can’t claim that ~$10K as a deduction because the use of the borrowed funds were for our PPoR and not an income-producing asset.

We also have a lump sum of $211,000 from the sale of our investment property that we would like to invest.

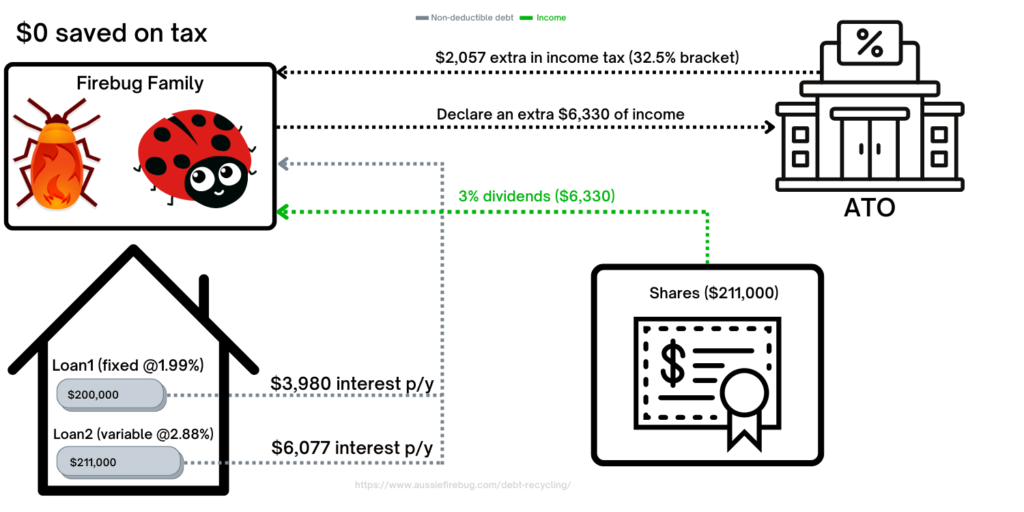

For illustrative purposes, below is how it would have looked if we skipped DR and just invested our cash in shares.

Investing without DR

There’s nothing wrong with the above picture but the Firebug Family doesn’t save any tax on their PPoR home loans.

The point of DR is to change the use of the borrowed money for deductions.

We were able to change the use of loan 2 by completely paying it down and then redrawing it out to invest in shares.

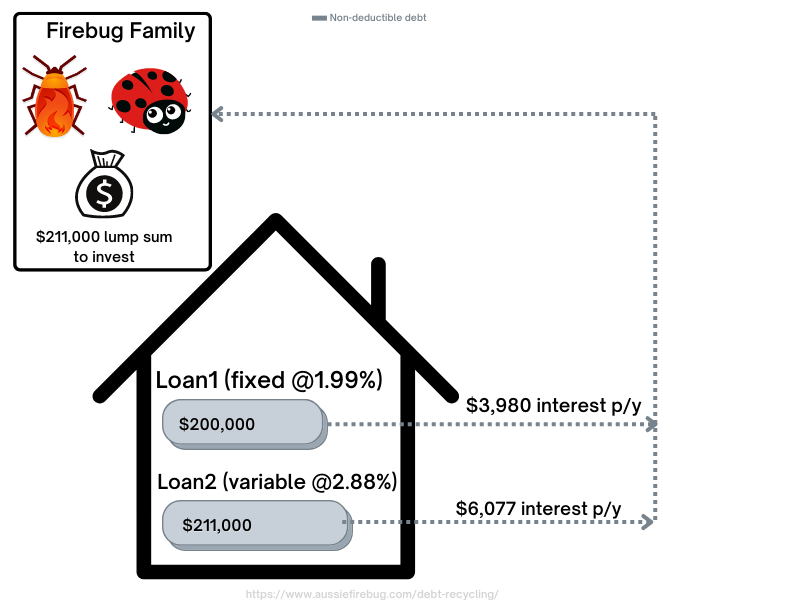

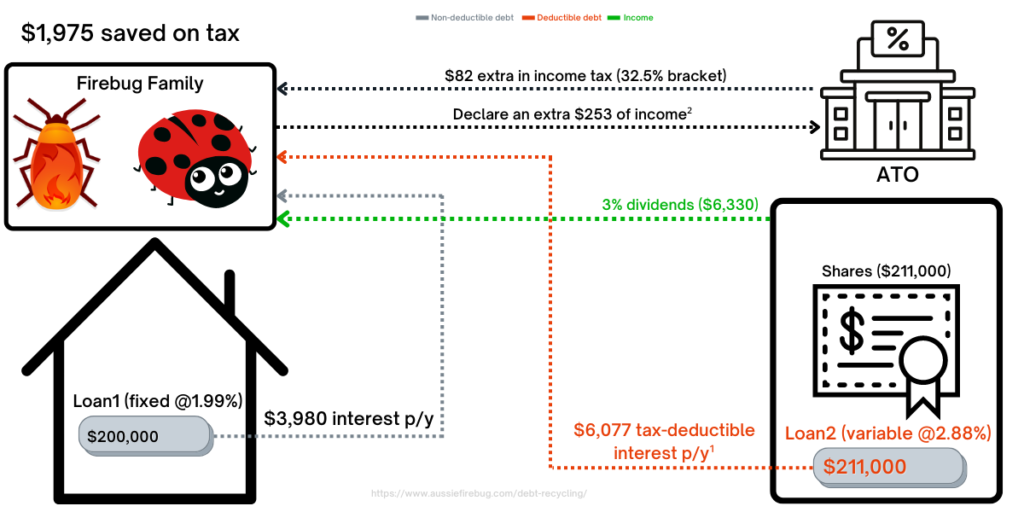

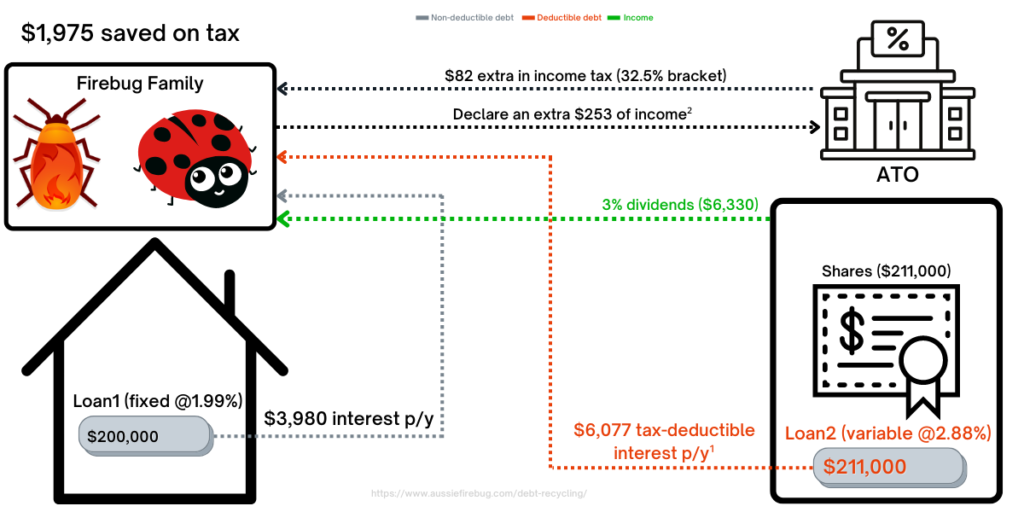

This is how it looked after DR Loan2.

DR

¹ Loan2 was paid down and redrawn to purchase shares. Loan2’s interest payments are now tax-deductible

² The Firebug family received $6,330 in dividends but can deduct $6,077 in expenses from Loan2 and thus only need to declare $253 in additional income.

As you can see in picture 2 we were able to change the use of Loan2 to become an investment loan.

We then used this new loan to buy income-producing assets (shares) and are now able to claim a deduction on the accrued interest saving a total of $1,975 on tax.

But how exactly did we repurpose the loan?

In one word… redraw.

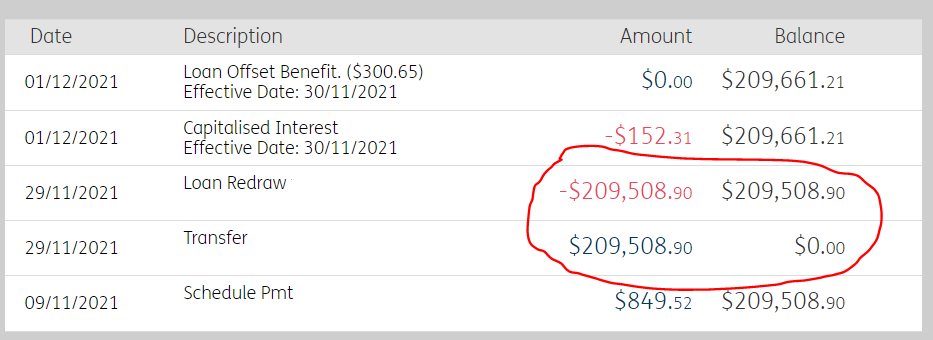

Once we sold IP2 and had the large lump sum, I simply paid down Loan2 completely and then redrew it back out.

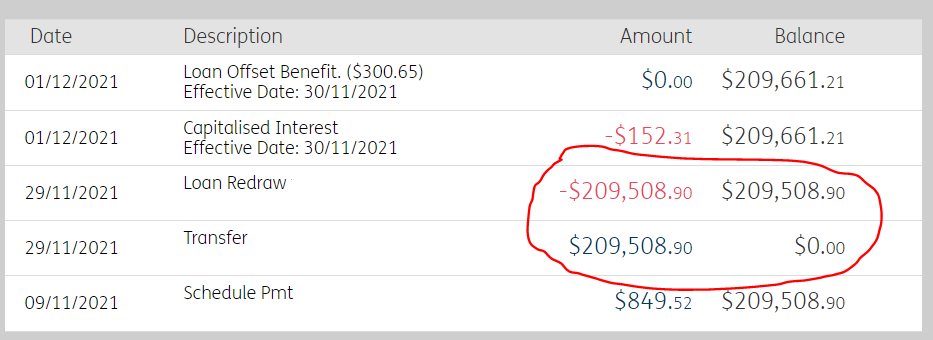

The above picture shows the balance for Loan2 to originally be $209,508.90 on the 9th of November 2021. I paid it down to $0 on the 29th and then used the redraw facility to pull the $209,508.90 back out straight away. Redrawing from a loan is considered new borrowings by the ATO.

I was very worried that the loan would automatically close so I went down to an actual branch to ensure that it didn’t. The girl that helped me actually knew what DR was which helped a lot.

And that’s basically it.

We essentially are in the exact same position we would have been without DR but now Loan2’s debt is tax-deductible.

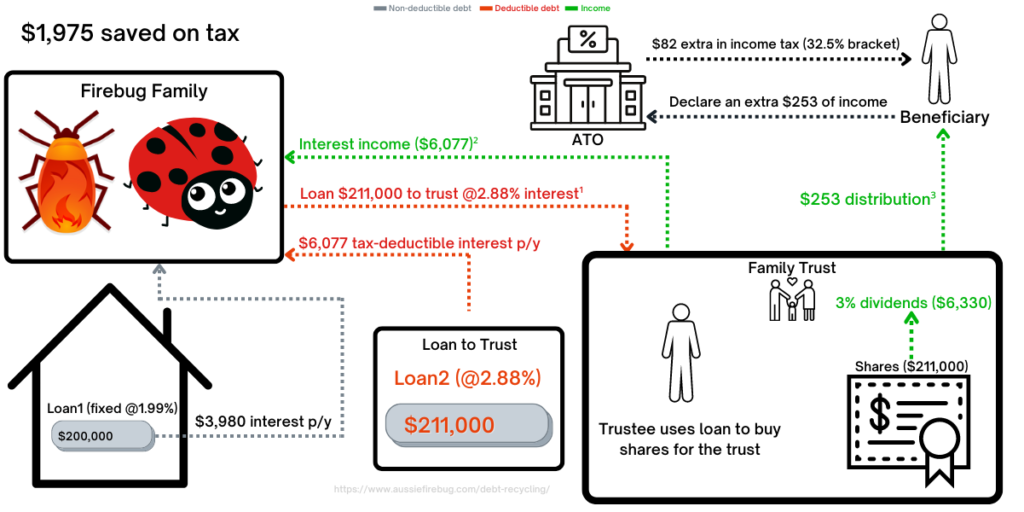

How We Did It (With The Trust)

The concept of DR remains the same, it’s just more complicated with a trust. (like a lot of things 😅)

Here’s how we did it.

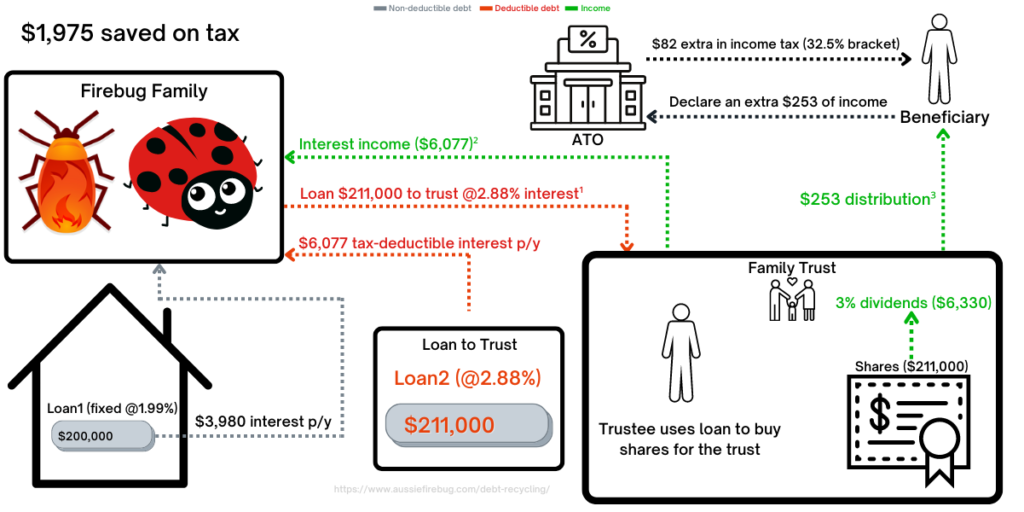

DR with a Trust

¹ You need to make sure that the terms of the loan allow for changes in interest rate to be the same as what the bank is charging you. In this example, it’s constant at 2.88% when in reality the interest rate would fluctuate. The loan agreement between the Firebugs and the trustee needs to be in writing and on arm’s length terms too.

² The Firebug Family pay and receive the same amount ($6,077) so their tax position is nill.

³ The distribution is only $253 because the trust had to pay $6,077 in interest to the Firebug Family. The distribution will be taxed at the marginal rate of the beneficiary.

There’s a lot going on in the above picture but I hope it makes sense. Leave me a comment below if you need something explained in more detail.

What If I Don’t Have A Lump Sum?

Not everyone will have a large sum of money to completely pay down a split of their loan. We implement a dollar-cost averaging strategy which means we don’t save up large amounts to drop in at once. The sale of IP2 presented a rare opportunity for us to execute our DR strategy but I understand that won’t be the case for most people.

Annoyingly, I actually had some examples and financial products that are suitable for people who want to do DR whilst DCA’ing. But since ASIC doesn’t let people like me talk about those sorts of things without paying them money, I unfortunately had to delete this part out of the article :(.

Terry W Tips and Future Podcast

I reached out to one of if not the best SMEs (subject matter expert) for DR in Australia for his top tips. I’m also teeing up another podcast with him to do a DR specific episode. Please let me know in the comment section what you want us to cover and I’ll try to add it in 🙂

If you want to know more about Terry, check out the first podcast we did together here. He also has his own podcast which you can check out here.

Terry’s top tips 👇

- You can only claim interest if borrowing to buy income-producing assets

- You need to avoid mixing loans as this will reduce tax savings

- Split loans first before repaying

- Repayment needs to be done once in full

- Redraws can be done in stages

- If borrowing to buy non-dividend paying shares the interest could be a cost base expense so it would still be worth splitting and recording the interest as it will reduce CGT.

- Written loan agreements on arm’s length terms are needed if the borrower and the investor are different

- Never redraw into a savings account with cash as it will cause a mixed loan

- Avoid paying into a share trading account with cash in there as this will cause a mixed loan.

- It is possible to debt recycle with any loan that has redraw, but some loan products are better than others, so see your broker about this.

- Debt recycling is a tax strategy so only registered tax agents or tax lawyers can advise on it.

- Advice on what to invest in would be financial advice if it involves shares or super as these are financial products so only an AFSL holder or authorized representative could advise on this.

- It is possible to debt recycle with investment properties too.

Conclusion

It’s important to note that DR didn’t change our investments, amount of debt, asset allocation or anything else really. We simply changed the use of the borrowed money.

I used the 32.5% tax bracket but this strategy would save you even more money if you have a higher marginal tax rate (I forgot to include the medicare levy too which would have made the tax savings even more impressive).

There’s also a pretty good chance that interest rates are going to rise in the next couple of years.

More interest = more deductions for us.

Oh, and if you’re wondering how I came to that $100,000 number in the intro. I simply punched in $1,975 into a compound interest calculator for 20 years at 8 interest. There are a bunch of assumptions right there but it’s impossible to know how the interest rate will move over that time period and we plan to redraw equity out of Loan1 and Loan2 which will mean more deductions. Essentially, we don’t ever plan to pay off our PPoR loan. I eventually want to DR Loan1 and then continuously redraw equity for the foreseeable future (Thornhill style!).

This strategy is something that took less than a week to sort out but will be saving us money for as long as we have debt against our PPoR.

Pretty cool if you ask me 🙂

Are you doing DR? I’d love to know why or why not in the comments section below.

As always,

Spark that 🔥

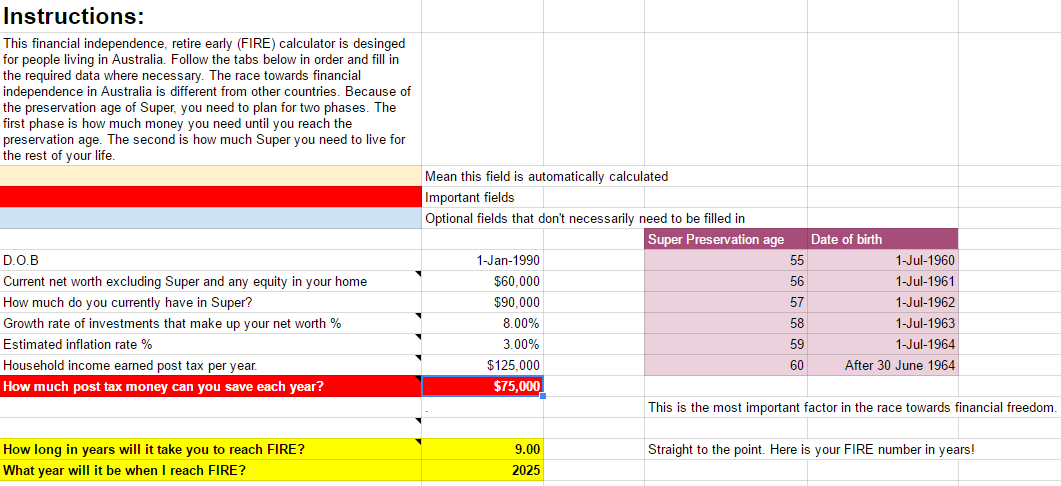

by Aussie Firebug | Jan 28, 2022 | Classics, Popular Article, Uncategorized

Reflection time.

I started full-time work at the end of 2011 and discovered the concept of financial independence (FI) sometime in 2012 after reading Rich Dad Poor Dad by Robert Kiyosaki.

That book (and the concept of FI) changed my life.

It wasn’t until a year after reading that book that I stumbled across Mr Money Mustache and the FIRE movement, which again, changed my life.

10 years. That’s how long I’ve been chipping away at this goal. And a lot can change ya know. My mindset, goals, strategy, desires, priorities have all shifted throughout the last decade. I’ve been thinking a lot about the lessons I’ve learned throughout the journey. What worked? What didn’t? What’s the point of it all?

Let’s get it.

1. The ultimate goal is to be happy. Never lose sight of this

We’re starting this list with the most important lesson.

It’s a bit philosophical but it’s really important and it sets the tone for everything we do. Have you ever asked yourself the following question and really mulled it over?

“What do I want in life?”

Now, there are going to be thousands of different answers to that questions depending on who you’re speaking to but the common denominator will always be the same… a desire to feel joy/to be happy.

Going snowboarding is pretty obvious. That’s fun as hell! But going to the gym 3 times a week and lifting heavy shit is… less obvious. One involves instant gratification whereas the other is delayed by a series of uncomfortable painful sessions.

The driver and end result for both activities is still the same. To be happy.

This driver for happiness is behind nearly everything we do. But figuring out what sort of life is going to be fulfilling and bring us purpose is a personal journey. The sooner you identify the key drivers of your happiness, the quicker you can start to plan out your ideal life.

I know life sometimes feels really complicated and stressful but at the end of the day, we’re still just another animal on Earth whose needs and desires haven’t changed that much over the ~50,000 years we’ve been roaming around.

In 1943 an American psychologist called Abraham Maslow published a paper called “A Theory of Human Motivation” which included the now very famous Maslow’s hierarchy of needs.

Maslow’s hierarchy of needs

This hierarchy of needs is universal and transcends generations.

A spice merchant in Ancient Egypt 3100 BC would still need to cover each level on the pyramid (pun intended).

Start from the bottom and work your way up and don’t skip over the physiological needs either.

You’d be surprised how many people would feel 10X better by just getting a decent amount of sleep each night and eating the right foods.

How FIRE plays a part in helping you achieve a level of happiness can be explained better in lesson 2.

2. Find your why of FI

One of the biggest mistakes I have personally made and that I see all the time is people thinking that reaching financial independence will make them happy.

Spoiler alert. It doesn’t.

You need to find your ‘why’. Why do you want to reach FI? What will reaching FI mean for you? How will it make you happy?

Speaking from personal experience, FIRE resonated with me because whilst I quite enjoyed my job, I resented the fact that I was ‘stuck’ there 5 days a week. I didn’t like that feeling. And before I knew that FIRE was even a thing, I thought I was going to be in the cubicle for 40+ years 🤮

FIRE for me was about gaining more of the most precious resource we all have. Our time!

Free time is crucial for satisfying the top level of Maslow’s pyramid.

Money is just a man-made abstraction that doesn’t have any intrinsic value. We can leverage money to create more time and freedom in our lives. The most important part is knowing how to use this extra time and freedom to enrich our lives. Having a rock-solid ‘why of FI’ will help tremendously throughout your journey.

3. Master behaviours, not spreadsheets

This lesson took me many years to learn but it’s a goodie.

At the start of my journey, I was really attracted to the math and statistical side of FIRE. I loved reading about the Mad Fientist’s tax strategies (even though they were US based), MMM’s shockingly simple math behind early retirement and how the trinity study modelled over 80 years of data to come up with the 4% rule.

I used to seriously whip out the calculator on my phone at all hours of the night to crunch some number because I was obsessing over a 0.07% difference in management fees lol 😅.

But the further down the FIRE rabbit hole I traverse, the more I realise that spreadsheets, modelling and the math behind money management all meant diddly squat if your emotions and psychological makeup are not equipped to stay the course throughout your journey.

I’m not saying the numbers don’t matter, because they most definitely do. But our behaviours matter more.

“Financial success is not a hard science. It’s a soft skill, where how you behave is more important than what you know”

– Morgan Housel

There’s a great story that illustrates this point perfectly. In the intro of one of my favourite books, ‘The Psychology of Money’ by Morgan Housel. Morgan compares the stark contrast between an American Janitor called Ronald Read with a Harvard-educated Merrill Lynch executive named Richard Fuscone.

From his wiki page:

Ronald James Read (October 23, 1921 – June 2, 2014) was an American philanthropist, investor, janitor, and gas station attendant. Read grew up in Dummerston, Vermont, in an impoverished farming household. He walked or hitchhiked 6.4 km daily to his high school and was the first high school graduate in his family.

Read repaired cars at a gas station for 25 years and was a janitor at JCPenny for 17 years. He purchased a 2 bedroom house for $12K in 1959 and lived there for the rest of his life.

Friends of Read have been on record saying that he didn’t really get up to much. Some said his hobby was wood chopping and he lived a very low key life.

Read died in 2014 at the ripe old age of 92 which is where the plot thickens… Read made international news when he left over $6,000,000 (USD) to his local hospital and library. He also left over $2,000,000 to his stepkids too 🤯.

Read’s friends were dumbfounded. Where did he get all that money from?

Friends and family went looking for answers but they discovered there was no secret.

No lottery wins.

No hidden inheritance.

No hidden high paying secret spy job that he’d been keeping under wraps.

Read simply spent less than he earned and invested the rest in blue-chip stocks. The power of compound interest over decades did its thing and his low-income modest lifestyle managed to create a snowball worth more than $8M (USD) 🤯🤯🤯.

Ronald Read

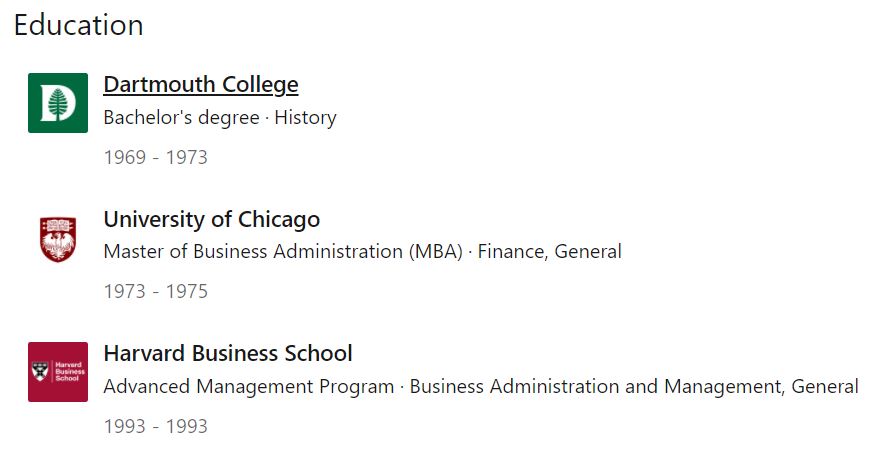

Richard Fuscone was in the news a few months before the passing of Ronald Read for very different reasons.

Fuscone is basically the polar opposite of Read.

To say he’s well educated is putting it lightly. Check this out for a resume

I mean damn! That’s some serious alumni. And for those who don’t know, the University of Chicago offers one of the most prestigious MBA programs in the world. We’re talking about the upper echelon of prestigious education here.

Fuscone was a high flying executive who retired in his 40’s to pursue philanthropy and was once included in a “40 under 40” list of successful businesspeople. Fuscone got into financial difficulty in the mid-2000s after he borrowed heavily to expand his 18,000-square foot home that had 11 bathrooms, two elevators, two pools, seven garages, and cost more than $90,000 a month to maintain.

Then the 2008 financial crisis hit.

High levels of debt coupled with illiquid assets left Fuscone bankrupt.

A few months before Ronald Read passed and left his fortune to charity, Richard Fuscone’s home was sold in a foreclosure auction for 75% less than an insurance company figured it was worth… ouch!

Ronald Read was patient, Richard Fuscone was greedy. That’s all it took to overcome the enormous education and experience gap between the two.

So what’s the moral of the story?

It’s not about how smart you are, it’s about how you behave.

4. Getting wealthy is simple. Don’t overthink it

“Life is really simple, but we insist on making it complicated.”

– Confucius

Almost every single wealth-building strategy can be boiled down to three steps:

- Spend less than you earn

- Invest the surplus

- Wait

That’s it… seriously.

Now there’s an absolute chasm between ‘get rich quick’ schemes and long term investing but those three principles hold true 99% of the time. How you invest and what you invest in doesn’t particularly matter. As long as you’re outpacing inflation and have strong conviction in your investments you should be moving towards financial independence.

Fidelity Investments is a multinational financial services corporation based in Boston, Massachusetts. An interesting discovery was made when a customer account audit revealed that the best investors in their database were either dead or inactive.

How could that possibly be?

How could someone that’s not adjusting their portfolio to the macro and micro economic news, outperform savvy investors with all the latest up to date data at their fingertips?

Well, it turns out that when it comes to investing… less is more.

Which is very unintuitive and goes against basic logic.

See the thing is, almost no one can beat the market over the long term. But people (myself included) constantly fall for the trap of trying to add complex financial instruments to somehow gain an advantage over ‘unsophisticated’ investors. I’ve always been raised that you need to put in the effort to reap a reward. You have to work hard to get anything in life worth having. This is true for most things… just not when it comes to investing.

I created and now invest through a trust fund because I associated its complexity and mystic with higher returns.

I thought I needed to do something different. I needed to outwork others to have a good return.

Choosing an ordinary index fund and adding to it each month without doing anything else just felt…lazy lol. I had all this pent up excitement after discovering FIRE and I wanted to channel this energy into the journey. I wanted to work my ass off so I could reach FI as quickly as possible and I felt like boring lazy index investing is only for people who aren’t willing to put in the work. It’s taken me years to accept that not only is this approach perfectly fine, but it’s also statically the most optimal choice most investors can make.

Keeping it simple also frees you up to concentrate on what’s really important in life which ties into the first lesson, to be happy.

Complexity has the potential to steal your most precious resources; time and energy.

Money is the slave that works for us, not the other way around.

5. What’s measured is managed

If I could give only one tip to anyone looking to be better with their money, it would be to start tracking your expenses.

That’s it.

You don’t even have to do anything else. I promise you that you’ll save money and optimise your expenses within the very first session. You might think that you know what you spend money on but I’ll bet the house that the first time you analyse three months of expenses, you’ll be surprised.

This lesson falls under the umbrella of Lesson 3 ‘Master behaviour, not spreadsheets’. It’s been well documented that keeping track of any metric and reviewing it regularly has a psychological effect on humans that can help us improve a focus area.

If a sprinter wants to be faster, they’ll keep a record of how fast they run.

If a presidential candidate wants to become the president, they’ll record and analyse poll data with their team.

If Tesla wants to design self-driving cars, they’ll create, test and record different algorithms continuously and keep track of what did and didn’t work.

I think you get the idea.

What’s measured is managed!

And if you’re not measuring the most fundamental aspect of FIRE, you won’t be able to manage it effectively. Plenty of people can still reach FI without ever tracking their expenses but I know first-hand that measuring how much you’re spending and what your spending it on has a lot of positive psychological effects.

Some of the positives of tracking are:

- You regularly review where your precious dollars are being allocated to each month. Think back to lesson 1. ‘The ultimate goal is to be happy’. Is the stuff you’re buying ultimately making you happy?

- You can accurately calculate your current FIRE number? Guessing how much you spend each year to maintain your current lifestyle can create stress and anxiety when the time comes to retire. You’ll second guess yourself. Even though things can and will change throughout your life, if you’ve been tracking your expenses for a few years you’ll have a much better idea of what size portfolio you’ll need to retire.

- It’s super easy to trim the fat. Unused memberships and subscription services can sometimes fly under the radar. Reviewing expenses bring this wastage front and centre.

But be warned… overdoing this area can actually have negative consequences.

I used to be one of the worlds biggest tightasses (still pretty tight compared to most ‘normal’ people haha) but what I’ve found through the last decade of managing money is that the majority of people will find great success if they focus on the big four areas.

- Housing

- Transport

- Food/drinks (including alcohol)

- Holidays

Try to optimise these big areas and don’t kill yourself for paying for a haircut.

I’d say that the top one (housing) is probably the most important. Buying a huge house at a young age can stunt your wealth creation potential. Spending 50+% of your paycheck on rent has the same effect. You want to get your snowball up and running asap and let the compound interest do the heavy lifting over many years/decades.

If you optimise those big four areas to a point where you’re living a great life whilst having a decent savings rate it’s only a matter of time before you hit FIRE 🎉.

Ultimately, this lesson is super effective at improving your behaviours when it comes to money management.

6. Income potential is often overlooked

Over the last decade, I’ve met and spoken to a lot of people who have reached financial independence and there seems to be a common theme.

- They are good savers

- They have a higher than average income

The funny thing is that a lot of these people are actually below average investors. I heard all sorts of stories about how they might have lost money on a development, got swindled by a pyramid scheme or lost it all on a speculative stock. Yet they seem to reach FI decades earlier than most after eventually figuring out some form of investment that works for them.

The bulk of their wealth comes from a healthy savings rate powered by a high income.

For the first 7 or so years on my journey towards FI, I focussed solely on saving a whole lot of money and investing it in both real estate and stocks.

It wasn’t until I moved overseas in 2019 and more than doubled my hourly rate did I truly appreciate the power of earning more money.

I mean it’s pretty obvious, isn’t it?

The more you earn the more you can save and reach FI quicker. But for some reason, I always prioritised saving more and reading the same investing strategies over and over again making little tweaks here and there.

Having a high savings rate is really important. I reckon we managed to optimise our expenses after 1 or two years at most. After that, it’s pretty much been on autopilot. We have a pretty good idea about what brings us joy and where our dollars go.

I’ve spent way too long (especially at the start) obsessing over the ‘investing’ part of the FIRE equation. There are soooooooo many articles, videos, books, podcasts etc. that dive into all sorts of whizz-bang investing strategies that it can be confusing as hell.

It’s sorta like when you go to the Cheesecake Factory. Their menu is so bloody big and confusing that it can be overwhelming. I’ll try to read absolutely everything because I don’t want to order a meal and then have food envy because something better was further down the menu 😂. This is what’s known as analysis paralysis and a lot of people can fall prey to it (it personally took me years of reading about the stock market before taking the plunge).

It’s natural to feel like you need to know absolutely everything before dropping your money into the markets. But the truth is that we all make mistakes and the most basic concept of investing is buying things (real estate, stocks, precious metals, bonds etc.) that make you money. Don’t stress too much about building the perfect portfolio because I’m telling you it doesn’t exist.

Index investing appeals to so many people because it’s passive, diversified, low cost and provides a great return with little effort. Don’t overthink it. Work out a portfolio that you have strong conviction in and one that will allow you to sleep at night. Save your money and keep adding to the portfolio regularly.

If you still have time and energy to commit to FIRE after your expenses are under control and you’re happy with your investing strategy, I’d seriously start to look to increase your income.

High savings + high income + below-average investments

is better than

High savings + below-average income + above-average investments

Obviously, it does depend on how epic your investment returns are but generally the above is true from what I’ve personally experienced and seen over the last decade.

There are heaps of ways you can increase your income. I wrote about a few of them in this article here.

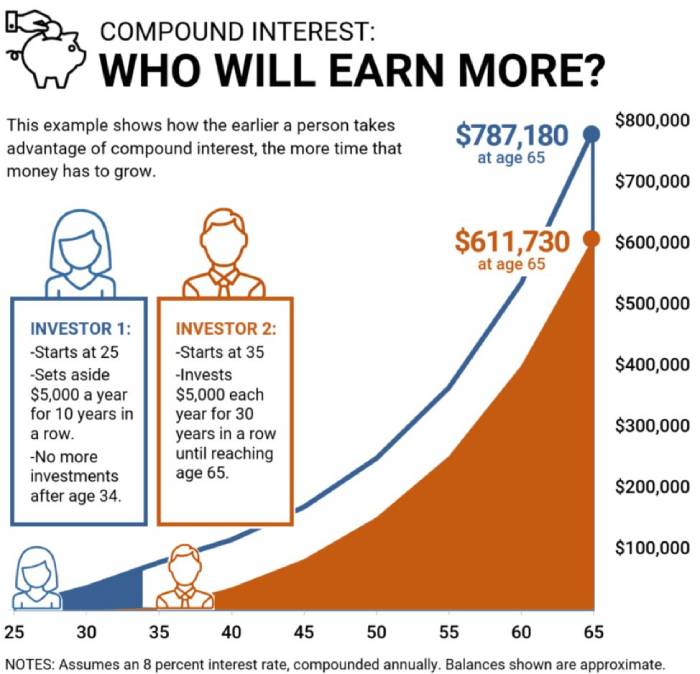

7. Compound interest takes years to notice

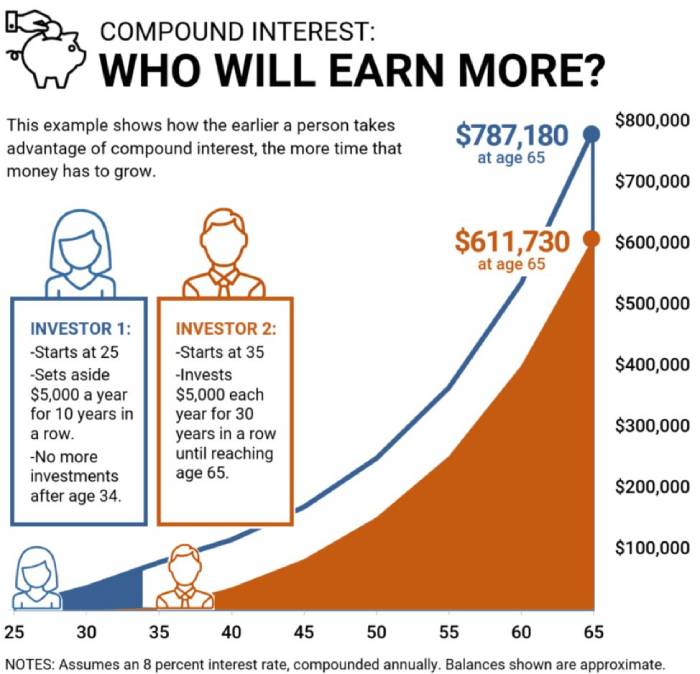

I learnt about the power of compound interest pretty early. There’s that famous story about two colleagues that’s told 100 different ways but it always illustrates the same point. Investing early and taking advantage of compound interest pays off in the long run.

This little graphic is one example.

Image Source: Mark Catanzaro

I’d like to think most people in the FIRE community have come across this (or something similar) before.

But most people (myself included) have a hard time truly appreciating the magnitude of compound interest and it doesn’t start to feel real until you’re near the end of your journey. There’s something about exponential growth that makes it difficult to grasp from an emotional point of view even when we understand the math. I think it has to do with most other things in life being linear. We do basic arithmetic almost every day in our lives but I don’t know anyone who can compute exponential growth without a calculator.

If we need half a dozen eggs for a recipe and know we already have 2 at home, that’s a simple subtraction problem that’s easy to think about on the fly and makes sense. If we choose to buy a car worth $10K instead of $15K. That’s an obvious savings of $5K which makes it easy to immediately appreciate on the spot.

But it’s hard sometimes to come to grips with putting away large sums of money now so the future you in 10-30 years can live a better life.

Here’s one of my favourite examples of exponential growth that you can play with your friends.

The story of the monthly coins.

If I gave you $1 each day in the month of January, how much money would you have at the end of the month?

Most people would be quick to shout $31 right.

But suppose I gave you $1 on the first day of January and double it every day until the end of the month ($2 on the second day, $4 on the third and so on), without cheating, try to have a guess in your head how much money you would have at the end of the month.

Take a few seconds to think about it and keep a mental note.

….

….

….

The answer is $2.1 billion dollars. That’s a billion… with a B 😱

Try this example with your friends to see what number they guess. 99% of the time they won’t get anywhere near the correct answer.

I use the example to illustrate the point that compound interest is not intuitive to grasp and it really only starts to take off in the later years. Speaking from experience, I really noticed compound interest once we had around $400K+ invested and our FIRE number is $1.25M for context.

Before that, it feels like you’re doing all the heavy lifting yourself through savings (which is pretty much what’s happening).

But boy oh boy it’s an amazing feeling when the freight train starts to pick up steam and suddenly your investments are making more money than you can save each month. After that, there’s no stopping it and you’ll feel like you’re almost cheating as you race towards the finish line.

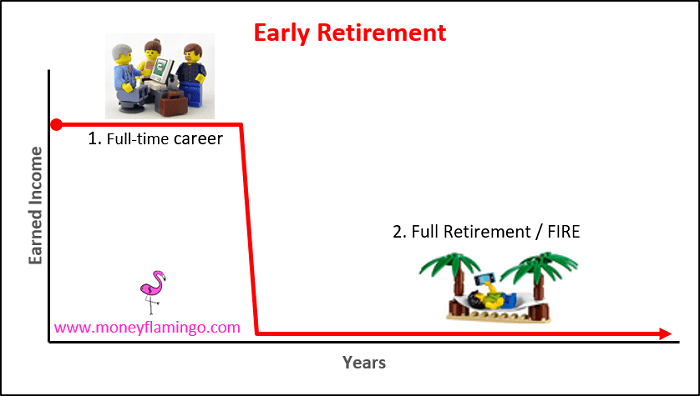

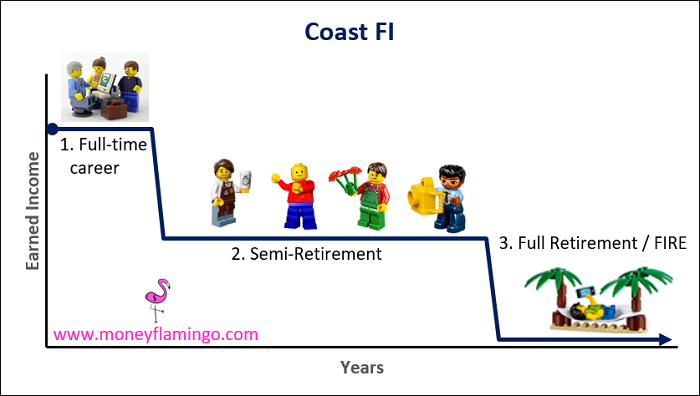

8. Most people are really after semi-retirement

Every single financially independent person I’ve ever met, read about or listened to still ‘works’ and makes money outside their investments one way or another.

I’ve added talking marks to the letter ‘work’ because it’s not really traditional work but people can get really anal when it comes to the word retire. I’ve always interpreted RE (retire early) part of FIRE as the moment you quit your cubicle/wage slave job and pursue meaningful work that brings you purpose.

But this can be confusing because not everyone has something they’re super passionate about. There’s a large portion of the community that really likes the social aspect and comradery of their normal day job but just want a little bit more free time in the week to get stuff done and enjoy life.

Based on the emails I’ve been receiving for the last 7 or so years I’ve come to the following conclusion. Most people in the FIRE community are really just looking to work 2-3 days a week and maintain their current lifestyle with some passive income to cover the rest/set them up for retirement in their golden years.

And as someone who is currently only working 3 days a week, I must say that I’m becoming more convinced that semi-retirement is the sweet spot for the bulk of the community too.

Full financial independence is great and it’s what we should be aiming for later on in life, but building up a portfolio that kicks off enough passive income to free up one or two days a week can have astonishing results.

And the best part about compound interest is that the momentum you build up early on in the journey only gets stronger and can carry you all the way to full fledge FI without you needing to add to your portfolio after a certain point.

This concept is known as Coast FI or Flamingo FI and the end result is the same. Full financial independence.

But if you drop down to semi-retirement during your journey you’ll obviously not have as much money to contribute to your portfolio and won’t reach FI as fast.

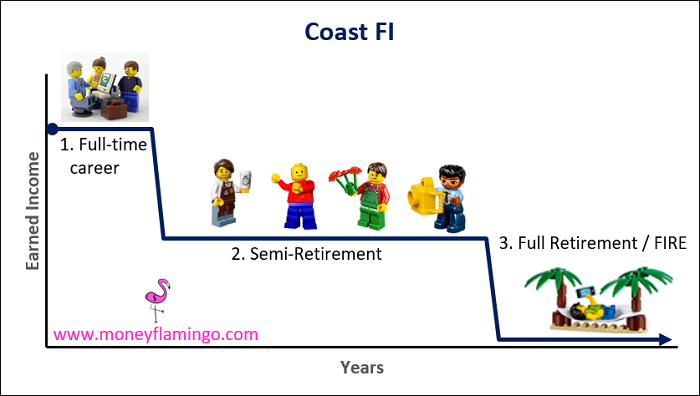

Traditional FIRE. Source:moneyflamingo.com

Coast FI. Source:moneyflamingo.com

If you want to know more about coast FIRE I’d highly recommend you check out this article at the money flamingo blog (Aussie specific too!).

The odds of someone never working and making any sort of income outside of their portfolio ever again after reaching FIRE is incredibly low. I’ve been saying this for a few years now but the 4% rule is over-conservative in my book. Putting aside the fact that the author of the 4% rule has increased it to 5%, any additional income after you’ve reached FI completely blows out the modelling.

Let me give an example.

Our FIRE number is $1.25M which will generate $50K per year based on the 4% rule.

Let’s assume that we get to the $1.25M, declare FIRE but decide to both work 1 day a week for 8 hours at $30 an hour.

Would you believe that our combined take-home income would be ~$25K a year? That’s half of what we need to bloody live on!

The portfolio could easily cover the rest and here’s the amazing part. Because we wouldn’t need to be drawing down 4% of the portfolio, it could compound away for longer at the higher amount.

Here’s what half of the portfolio ($625K), if left alone, could potentially grow to given an 8% return after 10 years.

~$1.35M is more than our original FIRE number!

And it’s really important to realise that we only worked one 8 hour day at $30 an hour in this example. You could imagine how dramatic the modelling changes if you worked an extra day or charged a higher hourly rate.

There are two main points here.

- You’re almost certainly going to be earning money post FIRE

- The 4% assume no extra income ever. This is extremely unlikely if you reach FIRE in your 20’s, 30’s, 40’s or even maybe 50’s.

9. Find your ‘enough’

Joseph Heller, an important and funny writer

now dead,

and I were at a party given by a billionaire

on Shelter Island.

I said, “Joe, how does it make you feel

to know that our host only yesterday

may have made more money

than your novel ‘Catch-22’

has earned in its entire history?”

And Joe said, “I’ve got something he can never have.”

And I said, “What on earth could that be, Joe?”

And Joe said, “The knowledge that I’ve got enough.”

— A poem for The New Yorker in May of 2005 by Kurt Vonnegut

I honestly think there’s something in our DNA as humans to always want more.

It has to be some sort of evolutionary trait right.

Imagine two homo sapiens coming across an enormous fruit tree bearing 50 ripe Apples.

The first human decides to only eat enough to be full and then leaves.

The second human gorges themselves and then picks and carries as many as they can hold back to camp with no consideration of others.

Which personality traits do you think has the better chance of surviving and passing on their genes to the next generation? As unfortunate as it is, selfishness is rewarded in the animal kingdom. I know it’s hard to imagine with all our fancy pants technology and civilisation, but we’re not actually that far removed from our prehistoric ancestors and evolution hasn’t yet caught up to deal with the current situation we find ourselves in.

Most of us are hard-wired to always want more.

But you’ll never become FI if your desires and wants continue to increase forever.

Think back to lesson one “The goal is to be happy”.

If you desire something and you don’t have it, this usually results in a feeling of unhappiness. And there are only two ways to fix it.

- You work hard and get what you want.

- You find happiness elsewhere and stop wanting it.

Depending on how exorbitant your wants and desires are, option 1 could mean many decades climbing the corporate ladder working 70+ hours weeks to fund your:

- 3,000sq m Toorak mansion

- 6 beds, 5 bathroom holiday house in Byron Bay

- 5 cars

- 3 jet ski’s

- And so on

Now I don’t want to be judgemental here. If you really want all those things and think the work required is worth it. Sweet. Go for it. Everyone is different.

But if you’re reading this article, odds are that you’re more attracted to the idea of living a simple yet great life that prioritises freedom, autonomy, health, relationships and ultimately happiness.

Figuring out what your ‘enough’ is takes a long time. This is partly because our wants and desires evolve as we get older and our circumstances change.

I for example, never really put too much value in travelling before 2019. I’d been on a few trips here and there and whilst it was good fun, I used to think that international travel was insanely expensive and overrated. Travelling around the world and living in the UK for 2 years completely changed my outlook on a lot of things and broadened my horizons. I now consider travelling to be part of our lifestyle and something we will need to factor into our numbers.

And even though I think a little bit of lifestyle inflation is perfectly normal and healthy, you’ll never have peace of mind until you discover your ‘enough’.

If you don’t figure it out, you’ll always be wanting more.

10. We’re all dealt a different hand in the game of life

There’s a quote that I can’t seem to find that loosely goes like this.

A CEO was perfectly happy with their $1M bonus until they found out a competitor CEO received $100 more

Comparisons. We’re all guilty of making them.

And the messed up part is sometimes we were happy until we see what someone else has.

It happens all the time and is part of the reason I’ve disconnected all of my social media accounts.

Practising the art of gratitude can be really helpful to remind yourself of all the great things in your life. But we’re humans and I’ve fallen victim to unrealistic comparisons a bunch of times. It’s perfectly natural to stumble across someone who you may have gone to school with and be jealous of the life they’re living now.

What I’ve come to realise after hearing from literally thousands of Aussies on their way to FI is that there can be a gigantic gap between peers within the same cohort. I’m talking about the advantages and disadvantages between two people who on surface value seem to be pretty equal.

There’s a great book called Outliers by Malcolm Gladwell that explains just how incredible one little advantage early on in someone’s life can completely change their trajectory.

Did you know that 40% of the best hockey players in Canada are born between January and March?

This is no coincidence. It turns out that in minor league hockey, children are grouped by birth year and players born in January are, on average, bigger and taller than December-born players.

This seemingly unimportant attribute gives players born in the first months of the year a head start that turns into a lifelong advantage.

That one little leg up can have the following flow-on effects:

- They are bigger and stronger than their peers which makes hockey easy for them

- They are noticed by coaches and identified as a good player. Extra coaching or special treatment may be given

- They will most likely be chosen to represent their squad team which means more playing time against a higher level of competition and access to better coaching

- They continue to get extra playing time against elite competition with the best coaches in the country year after year

These sorts of advantages happen all the time and compound throughout one’s life.

The same is equally true for disadvantages.

But it’s really hard to know what cards a person has been dealt even if you know them quite well. And it’s almost impossible when reading a stranger’s blog or listening to a guest on a podcast.

The goal of FI is a mastery of money that’s a personal journey.

A little bit of healthy competition can be good but never feel inadequate when you come across someone similar who seems to have it all figured out. They may have been dealt two aces.

The reverse is also true.

We have no idea what has happened in someone’s life that has influenced the position they’re in now.

In summary, compete against the person in the mirror.

Wake up each day trying to be a better version of yourself.

Because…

“Comparison Is the Thief of Joy”

— Theodore Roosevelt

That’s a wrap! 10 the biggest lessons I’ve learned over the past 10 years pursuing FI!

I’d love to know what was your favourite lessons in the comment section below 🙂

As always,

Spark that 🔥