by Aussie Firebug | Dec 6, 2022 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

Speaking as someone who works in data and analytics professionally, you wouldn’t believe how many companies are trying to sprint before they crawl.

The data science hierarchy looks something like this.

Data Science hierarchy

A lot of people are trying to jump to the top of the pyramid (artificial intelligence/machine learning) without establishing a solid base.

Half the time these companies don’t even have enough data to warrant paying expensive Data Scientists.

I’ve worked on some incredibly expensive proof of concept projects that had hoped to train models to better predict future revenue streams.

The issue? The company couldn’t even produce the necessary datasets that were needed to train the models. They couldn’t extract their own data into a meaningful format (the Collect part of the pyramid)

They were trying to bake a complicated cake without having the ingredients first.

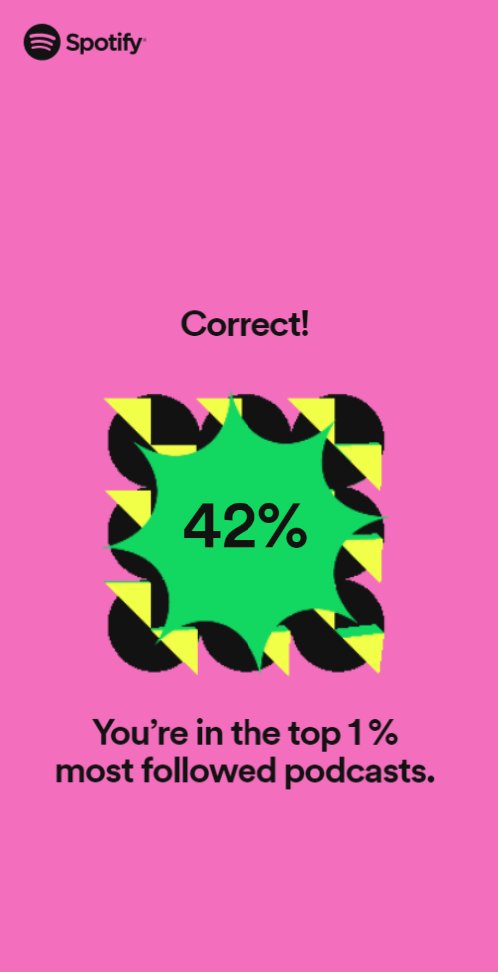

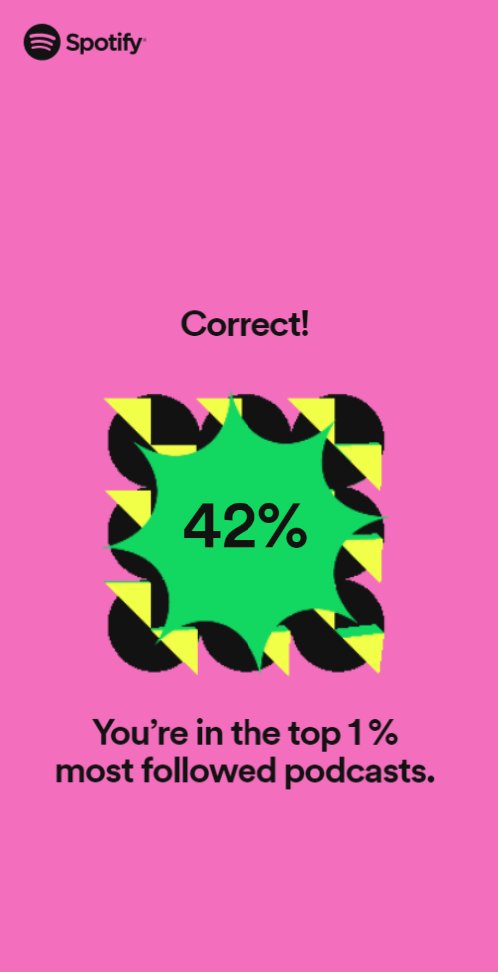

On the contrary, Spotify’s ‘2022 Wrapped’ feature is a perfect example of how to visualise data in a meaningful and useful way.

They’re not using any fancy pants AI/ML algorithms or training models or any of that higher-level stuff.

They’re just showing you your data. But their presentation of the data is what sets it apart.

This was the first year they releases a wrapped version for podcast hosts. It was really cool seeing some stats for the Aussie Firebug podcast.

It was a lot of fun seeing some of the posts you guys tagged me in on social media too. It means a lot to me when I see the AFB pod has made their top 5 podcasts for the year 🙂

P.S.

I’m so excited to meet some of you guys at the Rask event this Friday.

The event was a total sell-out and there will be more details on the afterparty on my Facebook events page here.

Net Worth Update

November was pretty much a carbon copy of October. Shares and Super were up, Bitcoin went backwards and our cash holdings went down after booking another holiday.

The big story in November for Bitcoin and Cryptocurrencies, in general, was the downfall of a Bahamas-based cryptocurrency exchange called FTX.

FTX’s founder Sam Bankman-Fried (SBF)

Before I get into my thoughts I want to make it crystal clear that I have part of my wealth tied up in Bitcoin.

This inevitably means my views are so what biased. It’s hard for me to objectively write about this story without it sounding like I’m trying to defend something I’m invested in 😅… but here goes nothing.

FTX was at one point in time, the third-biggest cryptocurrency exchange (by volume) in the world. We’re not talking about small potatoes here.

SMB (pictured above) and Zixiao Wang founded FTX in May 2019. On the 11th of November 2022, FTX filed for bankruptcy with reports stating $1.7 billion of customer funds had vanished.

😬

The story is still unfolding but obviously, some shady shit went down and a bunch of people lost their money.

So many people on Twitter, Facebook (in my own group) and Reddit have been parading this story around like it’s some sort of ‘I told you so’ moment.

This attitude represents a fundamental misunderstanding of why Bitcoin was invented in the first place and how third-party intermediaries must be regulated.

It’s actually a bit similar to people trying to tell me investing in shares is like playing the casino every time there’s a market crash. Most of us in the FIRE community know that isn’t true, but it’s unbelievable how widespread that rhetoric is within the general public that doesn’t know how it works.

A quick history lesson on Bitcoin.

- 2008

- An anonymous person/group called Satoshi Nakamoto designed the original bitcoin protocol in 2008 and launched the network in 2009. The whitepaper’s abstract read:“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

- 2009

- The genesis block was mined by Satoshi Nakamoto at the start of 2009. A secret message was instilled within the Block’s raw data:“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

- On October 11, 2009, Martti Malmi helped create the first exchange (Bitcoin for fiat) of Bitcoin, called ‘New Liberty Standard’.

- 2010

- In 2010, the first known commercial transaction using Bitcoin occurred when programmer Laszlo Hanyecz bought two Papa John’s pizzas for ₿10,000 ($253.3M AUD).

- 2011

- In February 2011 bitcoin reaches parity with the US dollar. ₿1 = $1 USD

- The first major users of bitcoin were black markets, such as Silk Road.

- 2013

- Bitcoin’s momentum builds and suddenly rises from $125 USD in September to over $1,100 USD at the end of November.

- On December 18, 2013, a drunk bitcoin trader created a meme when he misspelled hold as “HODL”.

- 2014

- In July 2014, the exchange platform Mt. Gox announced that 850,000 Bitcoins (valued at $460,000,000 USD at the time) had disappeared from the portfolio of its clients. According to investigations, the theft occurred because the hackers managed to gain access to the credentials of an official auditor who worked for the exchange.

- 2015-2017

- 2017 – present

- Multiple exchanges have been hacked and hundreds of millions have been stolen. The latest and most infamous being FTX

- Bitcoin’s value has fluctuated dramatically

- The network continues to run

There are other important things that have happened but that’s all the major ones I can think of.

What happened with FTX and all the other exchanges is not a fault of the technology.

Ironically, the entire value proposition of Bitcoin was a P2P transfer of value without needing a third party because they can’t be trusted… and then everyone started storing their coins with third parties.

Bitcoin was created to give financial sovereignty to the individual. You could send and receive your money without having to get permission from a financial institution.

Better still, you could protect your money from mistakes made by bureaucrats and central bankers.

The Australian dollar is a safe and secure currency so this concept is probably foreign to the majority of readers. But imagine if you lived in Venezuela, Zimbabwe or Turkey. Some countries have frozen their citizen’s accounts so they can’t take out their own money. And then they have the audacity to say it’s for their own good!

Let me make something crystal clear. I would never recommend anyone to put their hard-earned money into such a new technology like Bitcoin. Hell, I’m not even that confident myself that Bitcoin will be around in 10. It’s just too damn risky and so many things could go wrong.

However, what happened to FTX is in no way shape or form, a fault of the technology (which has a number of other shortcomings). It was greedy human nature/corruption that caused the collapse. I can’t speak for the creator, but I reckon there’s a good chance that greed and corruption played a big role in the motivation to create money that’s free from centralised human influence. It’s a lot harder to collude when the majority is in control.

This brings me to another interesting discussion point.

I had a fun back-and-forth with The Motley Fool’s Scott Phillips (a former podcast guest) on Twitter the other day.

Here was the Tweet thread.

If you’ve followed this blog long enough you probably know that I’m a big advocate for civil liberties and freedom for the individual. I don’t believe the government should restrict my investment options when I’m using my own money. I believe in the freedom of choice even if that choice carries risks.

I think it’s reasonable to allow individuals to make their own decision even if it’s potentially self-harming.

It’s a different story when it comes to affecting third parties though and that’s the reason why I’m in favour of regulating exchanges. I personally don’t think exchanges should be allowed to hold customer coins in a custodian manner. This goes against everything Bitcoin stands for in the first place.

Not your keys, not your Bitcoin!

Back to the point. Whenever the topic of rules and regulations in Super is brought up, eventually, all roads lead back to the same argument.

“Their risky investing does affect me because if they lose their Super the taxpayer will have to fit the bill”.

And this is where it ends for me. Because if that’s the way you think, then literally every single risky activity could potentially be affecting the taxpayer.

Do you smoke?

That’s selfish because you could get sick and then medicare has to fit the bill. We should ban that.

Do you race motocross?

That’s selfish because you’re increasing the likelihood of hurting yourself and having a tax-funded ambulance come and get you. Please consider others before you go out dirt jumping. We should ban that.

Do you eat junk food?

That’s selfish because the consumption of junk food increases your likelihood of medical morbidities which might put further strain on the tax-funded system. We should ban that.

Ok. Maybe I’m being a bit pretentious.

And those examples aren’t exact apples-to-apples comparisons but it’s really hard to think of anything that doesn’t have third parties affects.

Like seriously. I could draw a very long bow with just about anything to tie it back to third parties.

We put higher taxes on certain goods and services to discourage people from participating (such as smoking and alcohol). But we don’t outright ban them.

Where do you draw the line?

Ultimately, I’d never encourage or suggest to anyone that they should start buying Bitcoin in their own SMSF, but that doesn’t mean I’d support the government outlawing it.

Education is key. Forcing people never works as well IMO and we should be allowed to try and fail in our endeavours.

I’d love to know your thoughts on the topic. Should certain risky assets/investments/speculations (whatever you want to call them) be banned from Super?

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

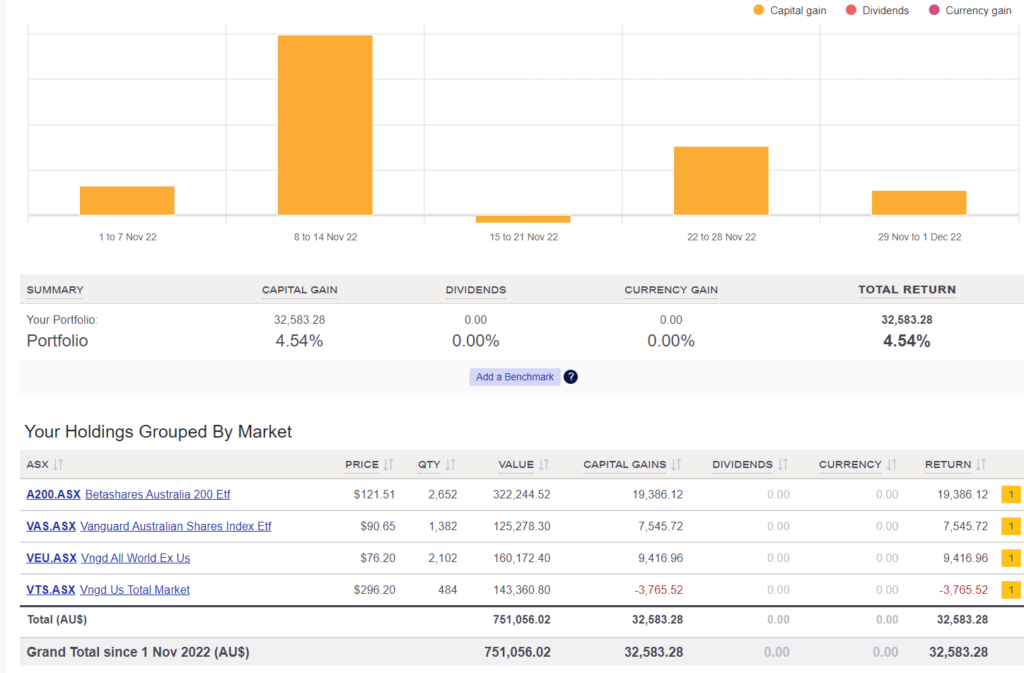

Shares

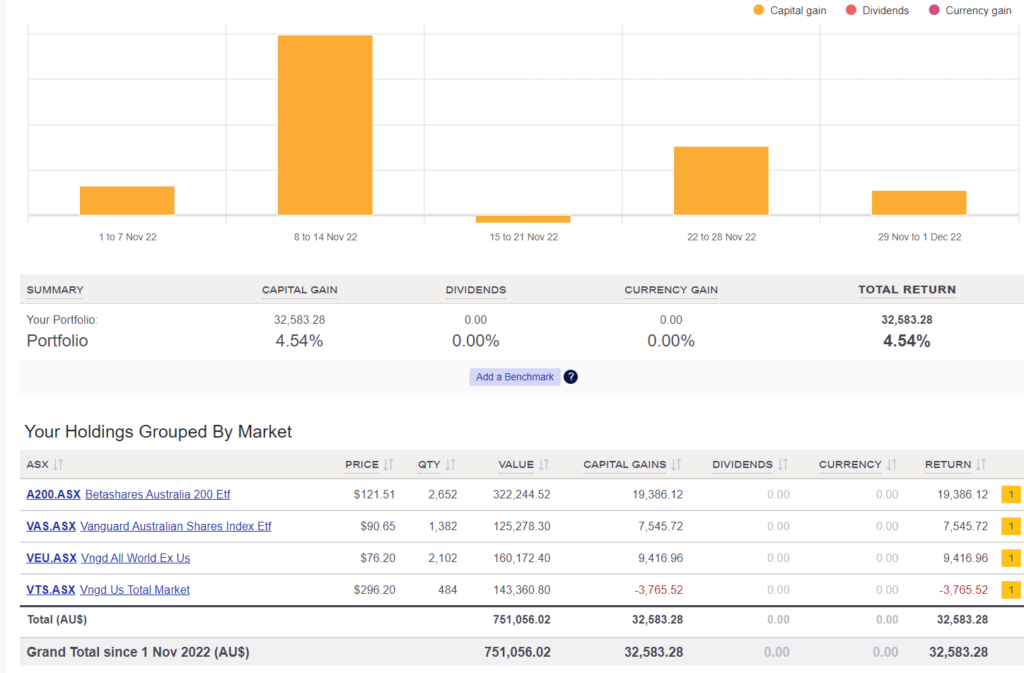

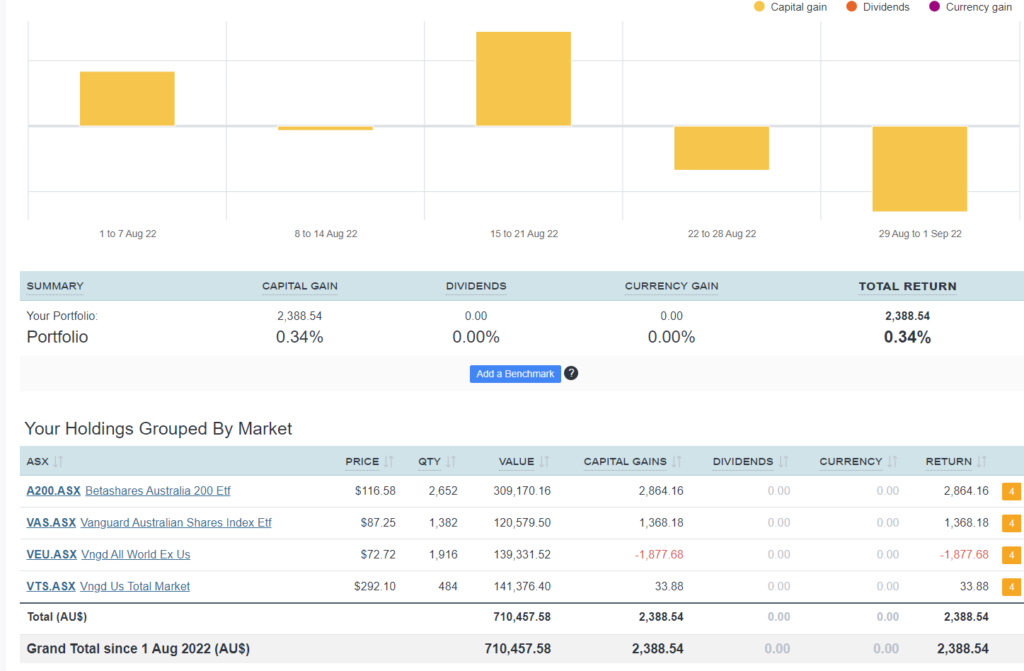

The above graph is created by Sharesight

A big month for our shares.

We didn’t purchase any shares in November but we did buy $2K worth of Bitcoin.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | Nov 13, 2022 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

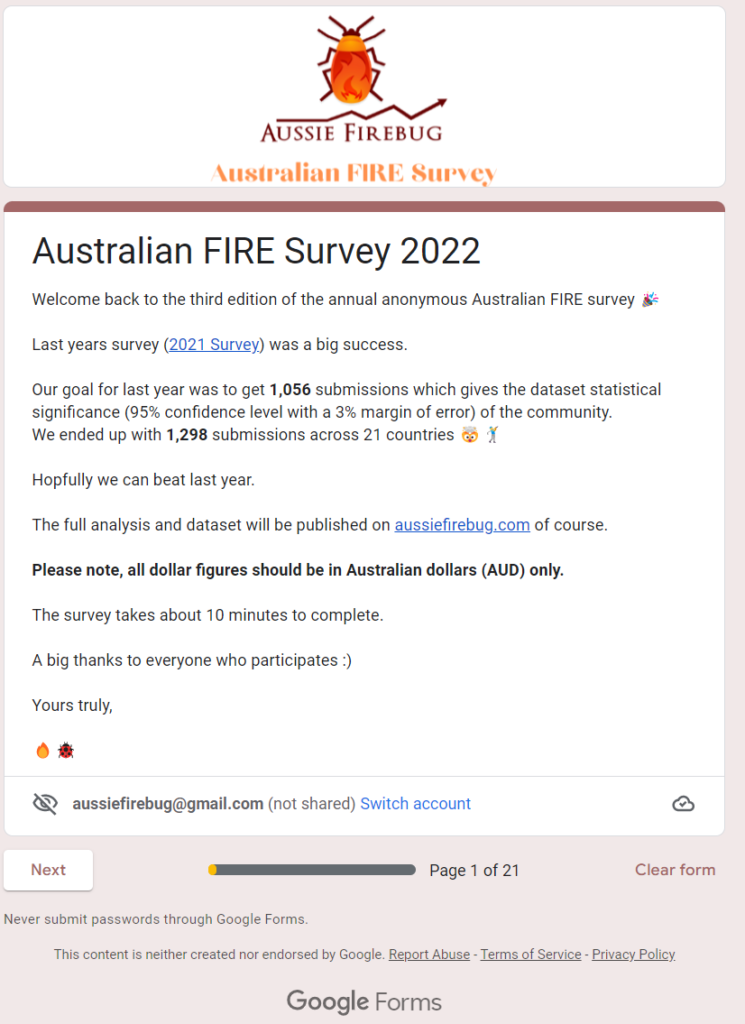

Before we get into the update,

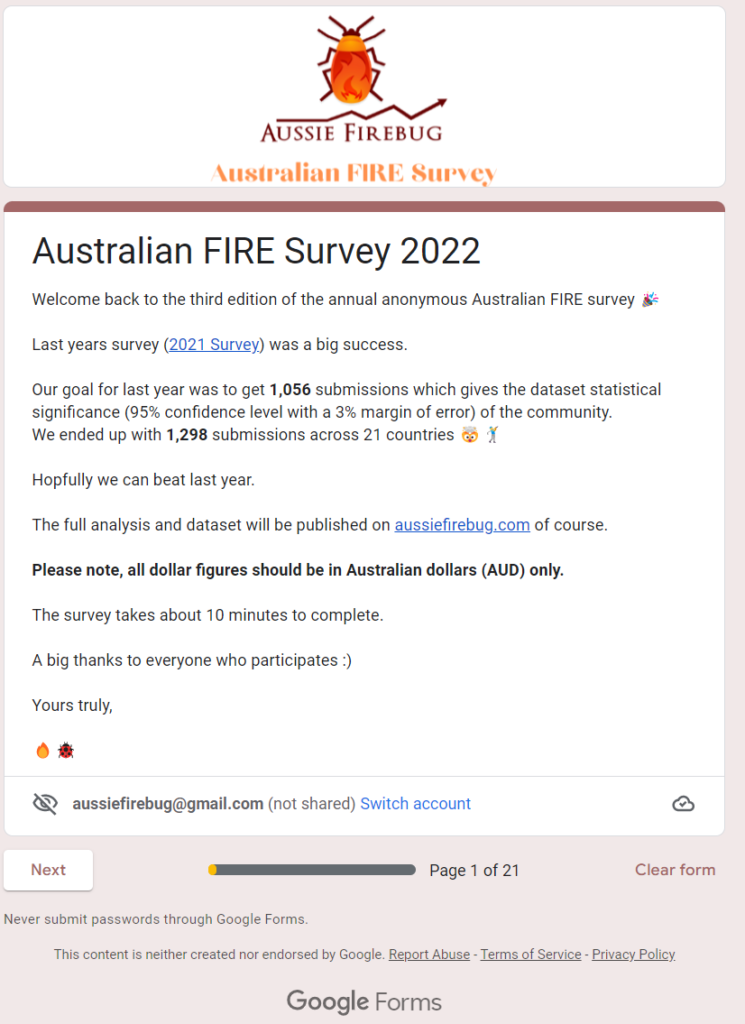

The 2022 Aussie FIRE Survey is currently open.

We had 1,298 submissions last year so that’s the target to beat 🎯.

The survey only takes about 10 minutes and I’m going to be leaving it open for the whole of November.

I headed up to Sydney in October for some sightseeing and to finally attend an in-person FIRE meetup that I’ve been trying to make happen for years.

Americans have a financial conference expo for money nerds and content creators called FinCon. I have been secretly hoping for years that someone would create a similar style event here in Australia which is pretty much what happened.

The boys at Equity Mates announced their Finfest (financial festival) a few months ago and I knew this would be a great opportunity to kill three birds with one stone.

I was originally planning to take the wife with me to Finfest but my mate Luke heard about it on one of my podcast episodes and said he was really keen to come with us. So he ended up taking my wife’s tickets since she wasn’t really keen in the first place lol.

Luke’s wife joined the crew and the four of us had an absolute blast over 4 days exploring Sydney, hanging out at Finfest, meeting everyone at the FIRE meetup and chatting with the team at Pearler HQ.

Here are some shots:

Hyde Park Sydney

Luke and I at Finfest

Sydney you are stunning!

Obligatory Opera House Shot

Luke trying his best to die near Manly Beach

My highlight was definitely meeting people at the FIRE meetup.

I love receiving emails from readers/listeners that enjoy AFB content but it’s so much better when you get to meet members of the community face-to-face.

Shout out to Derek too who helped organise the meetup 👏, although the music was really booming at the bar that I lost my voice from speaking so loudly 😅.

We ended the weekend by meeting the team from Pearler at the WeWork office. I had been banging on about this co-working space during the whole trip and I was low-key very excited to show everyone what it was all about.

Awesome co-working spaces are something I sorely miss from London and I’ve been trying to pitch the idea to Luke (who’s a builder) that we should try to do a watered-down version of WeWork in our hometown. I have no idea if it would work but I’m very confident more and more people are going to start their own little business in the coming years.

I just love the vibe at those types of places. The energy and atmosphere at co-working spaces that are mainly made up of entrepreneurs/creatives is inspiring. I found that there’s a lot of cross-pollination of ideas when you get a bunch of like-minded people in different industries in the same room.

Working from home this year has meant that socialising at work is basically non-existent for me.

Starting a co-working space would be awesome and Luke and I have already checked out a potential space in town. There’s a lot more research to be done and it’s exciting to think about the potential. I’ll be sure to keep ya’ll updated 🙂

Lastly, I’ve received some emails from my fellow Victorians asking when the Melbourne FIRE catchup is happening.

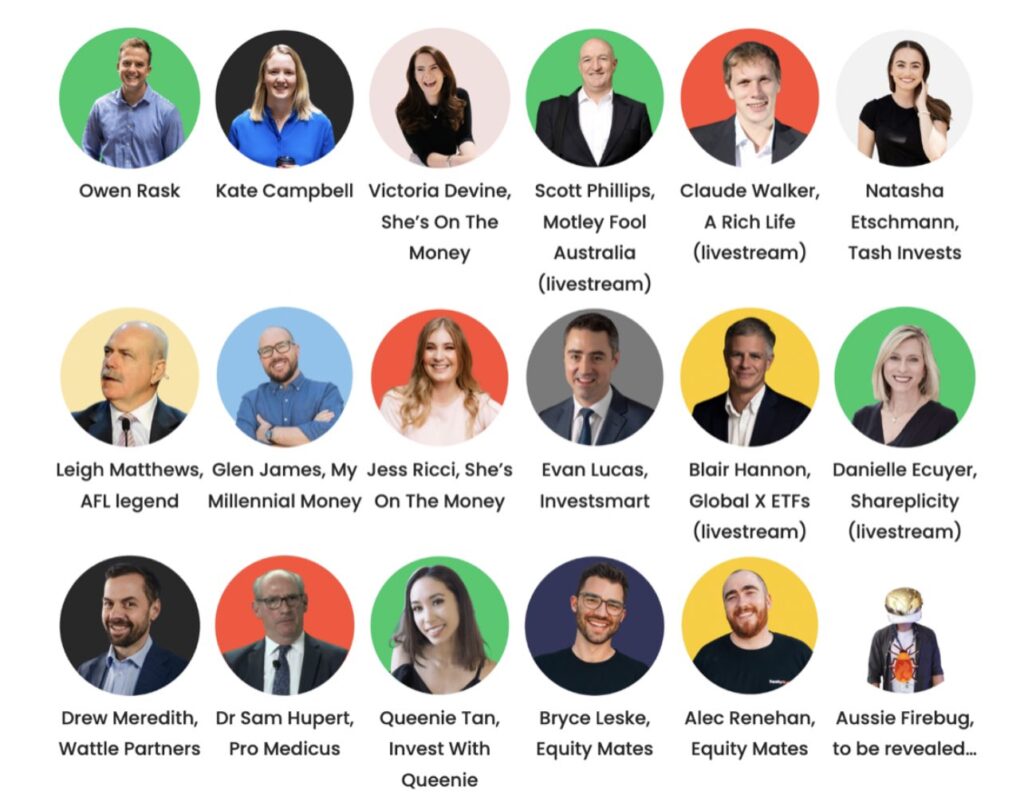

Well, it was a bit late for me to organise something and it’s surprisingly difficult to book a place without paying a fortune so I’ve decided to piggyback off an event that Rask Australia is hosting.

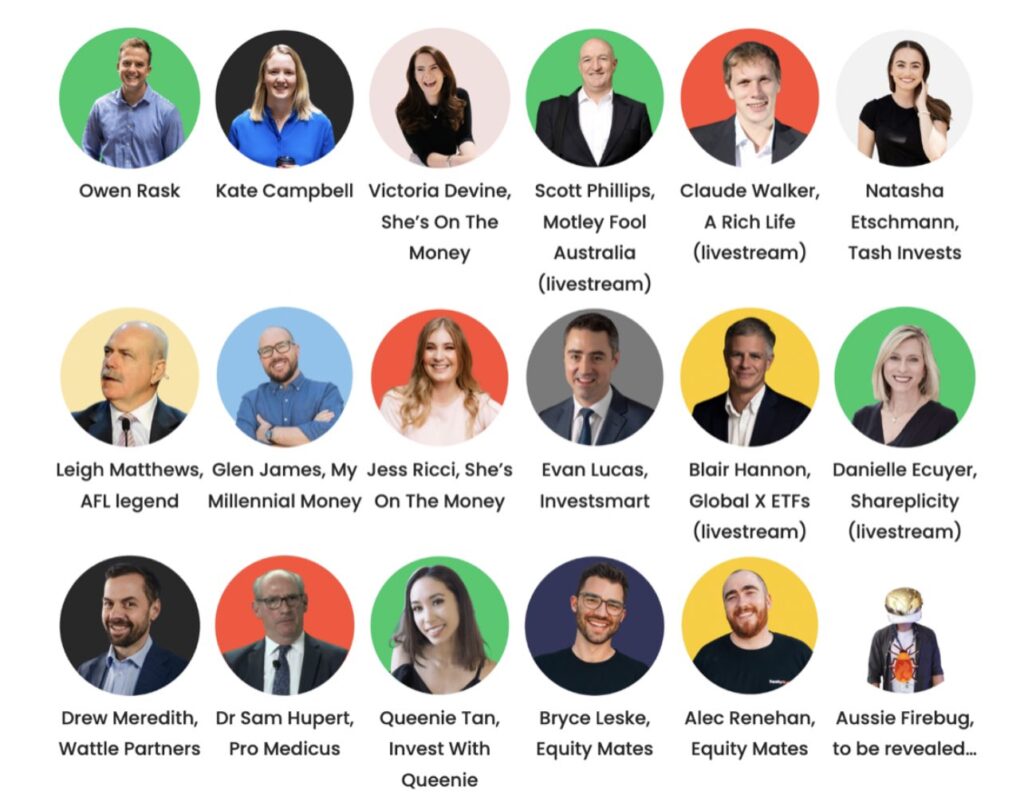

I was invited by Owen (founder of Rask) to speak at the event along with a whole bunch of other awesome guests.

The line-up

I’ve always been a bit hesitant doing live gigs just because of the whole anonymity thing but I think it’s time to step out into the light.

I’ve remained anonymous throughout the years partly because I didn’t want my boss to know that I’m planning to retire early. I thought it might negatively affect my career progression during my accumulation phase.

But since I’m my own boss now, it’s less of an issue 😂.

There are limited tickets but you can get $10 bucks off the price if you use the code fire on checkout (limited to the first 25 spots)*.

Tickets are available here.

There’s going to be an afterparty too but I don’t know all the details yet. I’ll be making an event about this catch-up on my Facebook page.

I’m really excited to be speaking and I hope I can meet some of you guys at the event 👊.

*I’m not receiving any kickbacks for that code/the event

Net Worth Update

A big month for our shares with Bitcoin being our only asset class that went backwards.

Sydney was relatively expensive but nothing major.

We bout $2K of Bitcoin during the drop in October.

Cash remains high and our shares are back in the 700’s

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

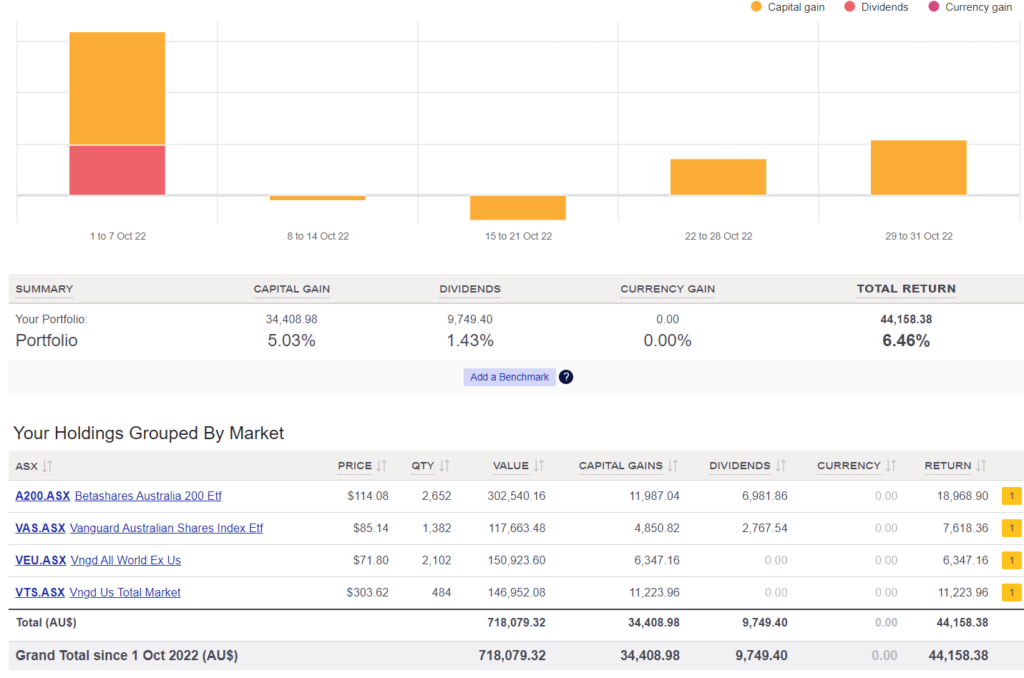

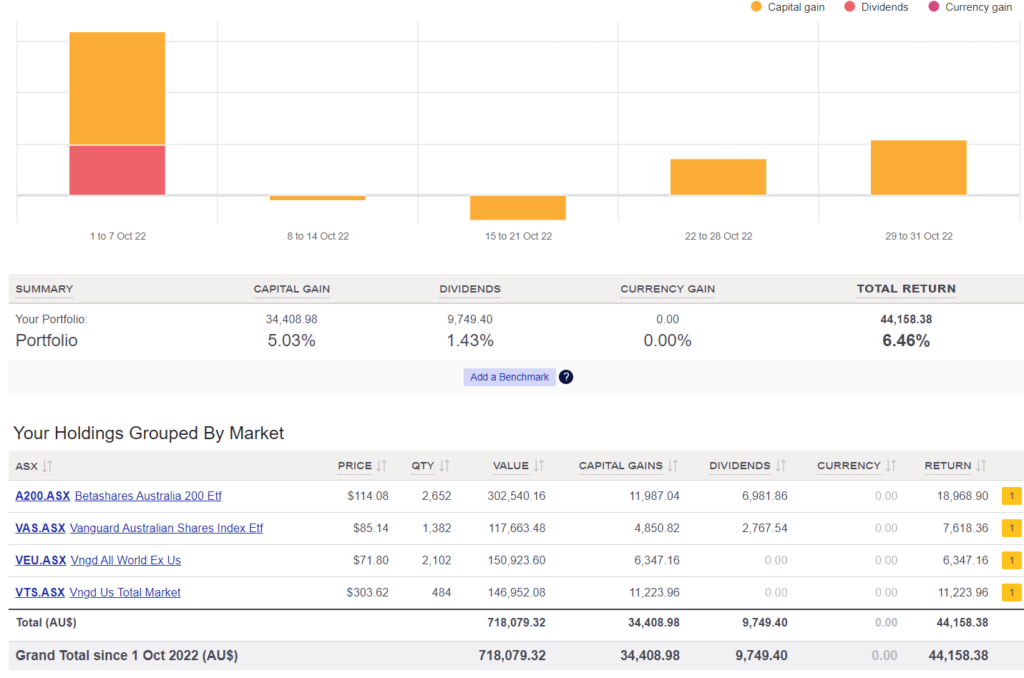

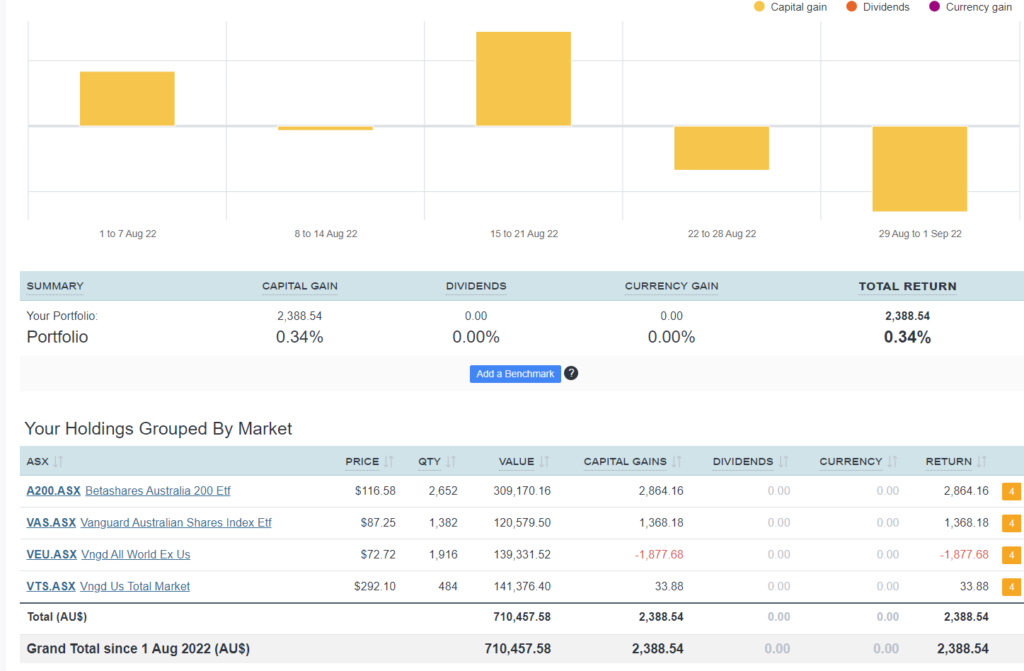

Shares

The above graph is created by Sharesight

Nearly $10K worth of dividends 🤑🤑🤑.

We’re still down ~$20K overall for the year but it’s always a nice little psychological boost seeing that much money being generated from the portfolio.

We bought $13K worth of VEU in October too.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | Oct 12, 2022 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

Firstly,

I’m going to be in Sydney this Saturday night for the FIRE meetup.

If you’re interested and want to hang out, the event is on Facebook here.

We headed to New Zealand for the school holidays in September.

This was our 3rd overseas trip for the year which is out of the ordinary for us. We’re planning on travelling throughout our early retirement but this year has been supercharged.

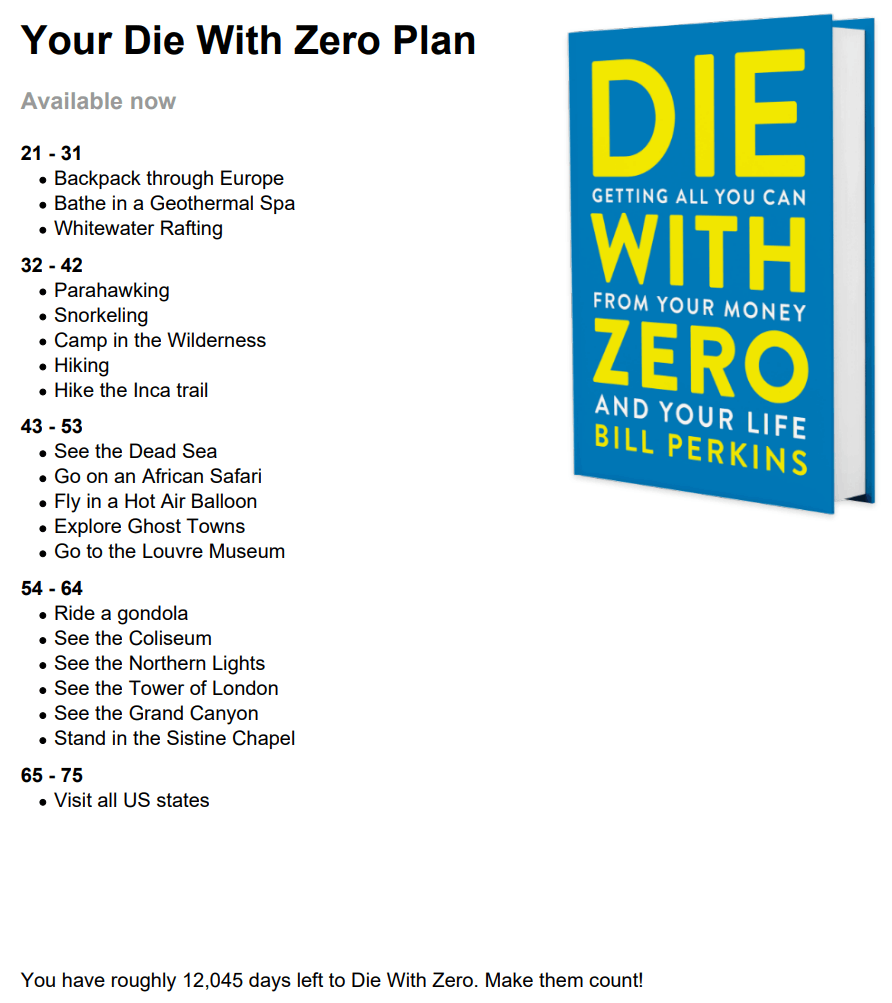

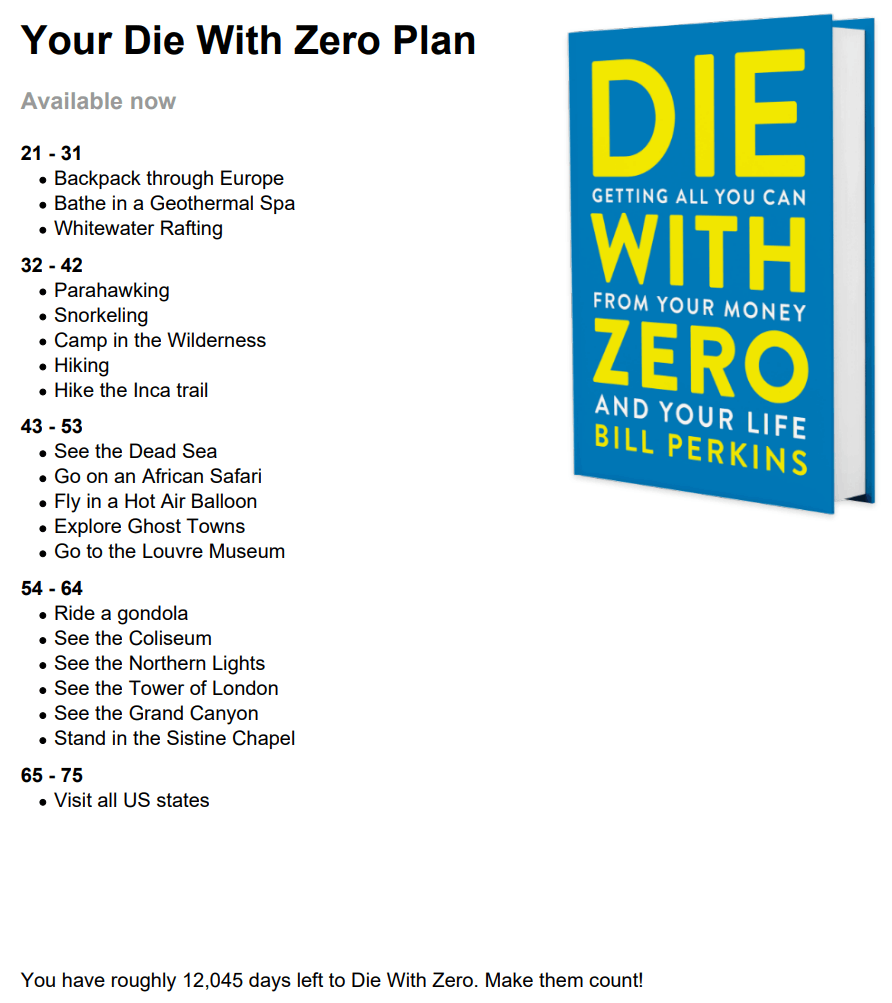

I attribute the excessive travel to a book I read early this year called ‘Die With Zero’ by Bill Perkins.

To cut a long story short, Mrs FB and I are trying to do as much travelling as we possibly can before we have kids.

After I read ‘Die With Zero’ I kept thinking…

We’re young, fit, healthy, have no dependents and have enough money to last 30+ years if we really wanted to. Why don’t we pull back on the accumulation phase a tad and start to harvest our hard work before we get tied up with raising a kid?

The logic makes sense to me. There are a bunch of experiences that lose value as you get older or are not available to you anymore. And conversely, there are some experiences that can be enjoyed much more when you’re older and can appreciate them.

Backpacking through Europe, whitewater rafting and hiking the Inca trail all take a certain level of fitness and stamina to do. These experiences would best be enjoyed when you’re young.

Other experiences like seeing the Pyramids of Giza, riding a gondola in Italy and seeing the northern lights are less demanding and will probably be appreciated much more as you age.

Writing down everything you want to experience in life and putting them into decade buckets helps to highlight the point I’m trying to make.

Here’s an example plan

https://www.diewithzerobook.com/apps

So basically what I’m getting at is you’re going to keep seeing our travel pics roughly every 3 months until we have kids 😅😂.

But back to NZ…

I had actually been to New Zealand before and we really wanted to do Japan instead but the travel restrictions are still a bit weird. I think you can technically travel there but everything you do has to be via a tour guide. So we decided it would just be easier to jump across the pond and check out the land of the Haka, sheep and hobbits 🙂

Here are some pics during our travels.

Incredible views from the top of Queenstown

NZ rocks!

Unbelievable scenery (Queenstown)

Biking fun

Morning walks

We started in the North island and made our way down to Queenstown where we spent most of our time. Milford Sound is amazing and the drive to Wānaka was breathtaking.

I have to say, Queenstown is seriously one of the most stunning places I’ve ever been to in my life. It’s not hyperbole to say it has 360 degrees of incredible scenery surrounding the town. The combination of the three snow mountains and lake is simply phenomenal.

I love what they’ve done from a town-planning perspective too. A lot of walkways and an entire area near the pier that’s open to pedestrians and not cars 👏.

And how could I talk about Queenstown without mentioning their arguably most famous product… the FERG BURGER!

The G.O.A.T of burgers

I’ll also give a massive shoutout to the Ferg Pie too. It would have to be up there with the best bloody pie I’ve ever eaten. Simple incredible.

Is there a Ferg ETF I can buy?

I also caught up with Ruth from the Happy Saver whilst in Queenstown.

Ruth and I enjoying a coffee

It was so cool meeting her and her husband Johnny in real life. We met for a morning coffee which lasted 3 hours!

Ruth and Johnny are some of the best examples of what FIRE and early retirement is all about. They’re the embodiment of being smart with your money and maximising happiness. We hit it off so much that Mrs FB and I actually swung by their home a few days later after coming back from Milford Sound.

It’s always fun checking out another podcaster’s set-up and home office.

Oh and lastly, for those wondering… yes, I did do a Bungy jump. It was 10 years ago when I first went, but I still did it!

Net Worth Update

Holy moly.

Pretty much all our assets got smashed except for Bitcoin which was up a bit.

The share market had big losses and combining that with our trip to NZ meant that the old Net Worth took a decent dive this month (our second biggest drop ever).

We bought $1K of Bitcoin at the start of September and we plan to do another $5K into ETFs for October once one of my freelancing invoices comes in.

A few people have been commenting on our unusually high cash buffer lately.

There are a few reasons for this:

- We want to buy a new car in the next 12 months and I leaning more and more towards an EV that doubles as a home battery solution. That might cost $60K+ all up.

- Mrs FB isn’t sure what she’s going to do next year in terms of work. Maybe she won’t work at all… this means our cash flow will be impacted which has resulted in us having a higher cash buffer. It helps our sleep at night factor

- My freelance business is sporadic. I love being a freelancer because flexibility and creative freedom are awesome! But if you need a steady paycheck, freelancing ain’t it. This again means that we just feel more comfortable having a higher cash balance than usual.

I’m finding it hard to allow myself to start harvesting money from the portfolio. I think this is one of the biggest physiological advantages of receiving dividends as opposed to selling shares for income. Receiving dividends just feels better because you don’t have to sell anything. Even if there’s not a mathematical difference between the two, I’m more likely to receive dividends and start to use them to pay for expenses vs selling down my portfolio for some reason.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

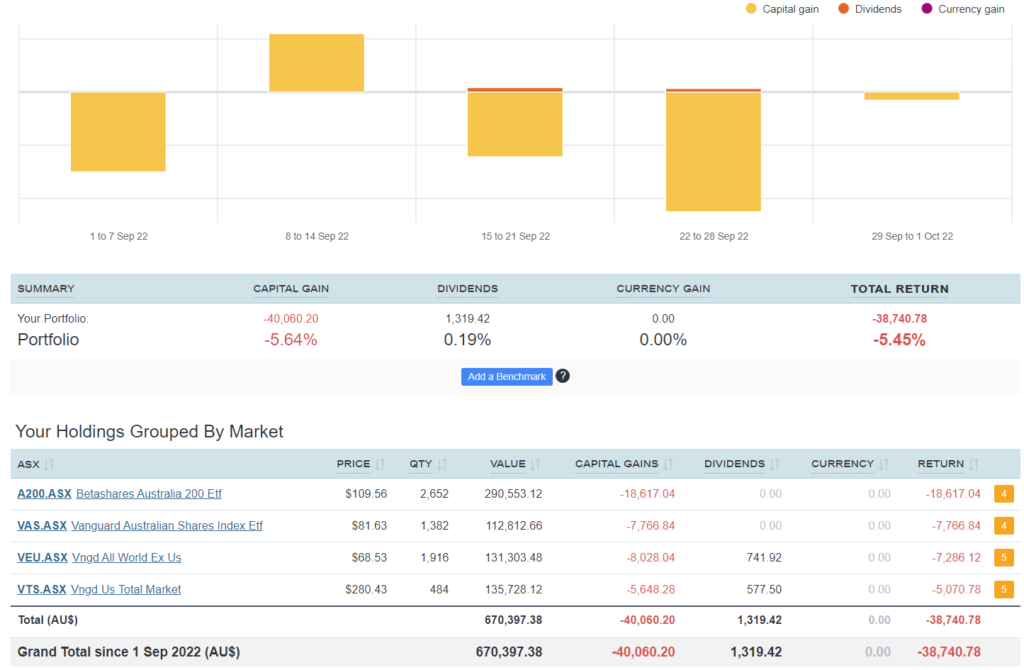

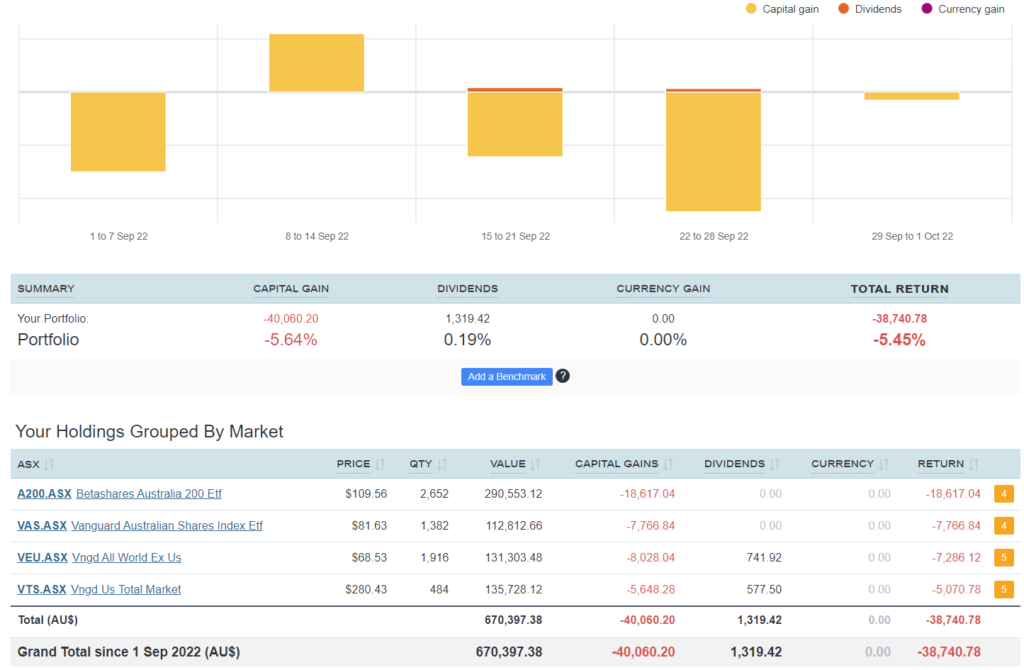

Shares

The above graph is created by Sharesight

A lot of red this month.

I’m feeling a bit guilty for not taking this opportunity to pour in as much money as we can. The thing is though, I’m not all as fussed about it as I once was. We’re living a great life at the moment and I know we will get to full fledge FIRE one day anyway.

I keep seeing the market drop and have thoughts about picking up some more lucrative contracting work to get more cash to invest. But this of course comes at a cost of time, energy and stress. I’m pretty happy with where we are sitting at the moment so I’ve just been plugging away with my freelance business and enjoying life travelling around.

It’s so hard to shift out of accumulator mode after being in it for most of your life. There reaches a point where building wealth takes a back seat to other endeavours. Even though we’re not full FI yet, I feel like we’ve reached that point now.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | Sep 5, 2022 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

One of the best things about semi-retirement are the new interests and hobbies you’re able to pursue with the extra free time.

2022 has definitely been the year of BJJ (Brazilian Jiu-Jitsu) tournaments for me.

I had always been interested in martial arts growing up. But between footy, gym and the occasional basketball/mixed netball comps, I never had the time to really pursue it. It’s been awesome training and competing with my mates for the last 20 months without sacrificing other areas of my life. Having the free time to discover new hobbies and pursue new interests is a real privilege!

I’ve been on a pretty solid training schedule in 2022 and part of me wanted to know how far I could go competing in the sport, especially since I’m not getting any younger 👴😅.

So with a bit of momentum behind me, I registered to compete in the Australian national Jiu-Jitsu championship in August.

It’s a knock-out style competition (sorta like Mortal Kombat haha) and my group had 16 competitors.

Every match was very difficult and I somehow ended up getting to the final round where I lost to a kimura submission.

I managed to snag the silver

I was pretty chuffed taking home the silver tbh.

At 33, I was one of the older competitors and I somehow hurt my back in one of the matches which has been bugging me for weeks.

I think this will be my last comp for a while because my body just doesn’t bounce back like it use to. I almost wish I could start again at 21 and see how good I could have been if I dedicated myself during my athletic prime but such is life, isn’t it. Ya can’t do it all!

At least FIRE has given me the free time to have a decent crack in my 30s which is all I can ask for.

August was pretty busy for me work-wise too. I’ve been heads-down-bum-up building/optimising the data product I’ve sold.

Quick reminder for the Sydney FIRE meetup on the 15th of October too!

We already have over 50 people coming and another 180 interested. I’m really looking forward to meeting the Sydney FIRE community in person 👊

The event is on Facebook here.

Net Worth Update

The big gain from this month came from our PPoR being revalued.

Our mortgage broker had been going back and forth with our bank to get us a better rate. The banks eventually came to the party after they officially revalued the house at $610K. Realestate.com.au actually has it higher but we’ll stick with the official valuation.

We bought the house in April 2021 (settled in July) and the gains are pretty typical of what we’ve been seeing over the last 16 months since. Our home’s value is probably on the way down with all these interest rate rises so I’ll be sure to keep an eye on it.

I gotta admit, it’s been a bit mind-blowing seeing the sold prices of similar homes around our area over the last 6-8 months. I remember thinking we had bought at the peak in April 2021. Never in my wildest dream would I have thought prices would climb to the heights they’re at now.

Once again, savers have been left holding the bag for asset rich/highly leveraged Australians.

The rest of the month was pretty uninteresting with some gains from shares and Super whilst Bitcoin and cash reserved dropped.

Cash continues to be high while we save for a new car. I pray to the gods each month that the second-hand car market returns to some sort of normality soon lol🙏

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Shares

The above graph is created by Sharesight

Not much to report here.

There was a big drop at the end of the month that wiped out most of the gains. Let’s see what happens in September!

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | Aug 10, 2022 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

It wasn’t too long ago that I was complaining about my lack of social interaction because I worked from home.

Well, let’s just say I’ve had a change of heart ever since the cold snap set in during July.

There’s nothing better than wearing trackies and a hoodie when it’s freezing outside and enjoying a cuppa/hot Milo during work. Our solar panels provide free electricity during the day so I’m able to run a little heater in my office guilt-free and I try to get all the washing/drying done when the sun is shining.

Mrs. FB, I, and some friends wanted to escape the cold during the holidays so we ended up booking a trip to Bali in July.

Quick PSA too. Mrs. FB needed to renew her passport and the whole process was a nightmare that took over 5 weeks. We had to go down to the Melbourne passport office TWICE! If you’re thinking about traveling soon and need to renew your passport, I’d suggest you start the process ASAP.

We ended up booking a 7-night stay in Legian, Bali.

Below are some of the pics from the trip.

Bali Mandira Beach Resort

Potato Head Beach Club

Jimbaran Bay Sunset

ATV Fun

I lot has changed since my first visit there as a 12-year-old with the fam.

My memory of Bali was a dirty, busy, and loud holiday destination that heaps of Aussies went to so they could drink cheap beer.

The island of Bali has had a really interesting transformation in the last 24 months. I couldn’t believe how clean everything was compared to my last visit nearly 20 years ago (damn I’m getting old). I spoke to a few locals about COVID and what happened to the place when all the tourists left.

They told me that a lot of people went back to farming. Either starting their own farms or helping other farmers out during the last 24 months. There was also a big push from the government to clean up the streets and beaches.

I was blown away by how nice the beaches were. I swear they didn’t look like that 20 years ago. I’m not just talking about lack of rubbish either. The quality of the sand and lack of rocks were what stuck out in my mind. Maybe I just went to a few crappy beaches as a kid but Jimbaran Bay, for example, had a world-class beach that would rival most Australian ones. And when you’re eating a seafood banquet on the beach for ~$40pp including cocktails in 27° weather, it’s hard to complain.

I also noticed that the island is becoming a lot more ‘westernised’. There were a lot more cafes and eating spots that cater to Australian tastes more so than Indonesian. This is either a positive or a negative depending on the type of person you are but we thought it was nice to have that option.

My mate and I did a bit of surfing which was awesome. I’d love to dedicate a few weeks to get a decent base because riding across the wave looks like so much fun (I can only do the white water for now).

The wife and I were so impressed by Bali that we’re thinking of heading back during winter again next year. Hopefully for a bit longer that time around. I would love to incorporate some sort of east Asian trip once a year where we live somewhere hot for a few weeks. I’m lucky enough to be able to work out of a laptop so I don’t see why not.

In other news, I sold my first data product in July which is a big reason for the big bump in this month’s net worth.

I can’t go into contractual specifics, but this is a bit of a milestone for my business. It signals a move away from consulting and more into product delivery. I think I’ll always consult to a certain degree, but I’ve had dreams about building this product for years and it was awesome to see there was a demand for it in the market.

I signed a three-year deal with my first customer 🥳

And lastly, I’ve been talking about it for years, but I’m finally coming up to Sydney and I’m going to organise a FIRE meet-up.

I’m heading up to FinFest on the 15th of October so I thought I’d kill two birds with one stone and organise a meetup for that night.

The event is on Facebook here.

All details and updates will be posted there. I’m really looking forward to meeting some of you guys in person 🙂

Net Worth Update

The share market and Bitcoin all had healthy gains in July but it was our cash balance that received an out-of-the-ordinary bump.

The cash injection came from the sale of my first data product being sold on a three-year deal (the first year being paid for in full).

Without going into specifics, I’m basically selling ready to consume data models to the customer. It’s a DaaS (data as a service) business model where I’m taking care of all the data engineering, architecture design, ingestion, modeling, and serving for a fixed cost. The customer receives the models via an endpoint and away they go.

I’ve had this idea for some time now but it wasn’t until I worked in London and dealt with companies there were running this exact business model did I know it was really viable. I’ve been tweaking the product for over a year and it’s really exciting to land this first deal.

The plan is to sell the product to a few more customers so I can have enough recurring revenue to justify hiring someone. I have a dream of running a small Analytics company of 5-8 amazingly talented and fun individuals where we can solve fun problems. I want to foster a similar working environment that I was lucky enough to have experienced overseas. That’s my dream for this decade, work-wise.

Cash is really high atm. It’s a combination of saving for a car and having money on hand for my tax bill. We also purchased around $3K worth of Bitcoin in July.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

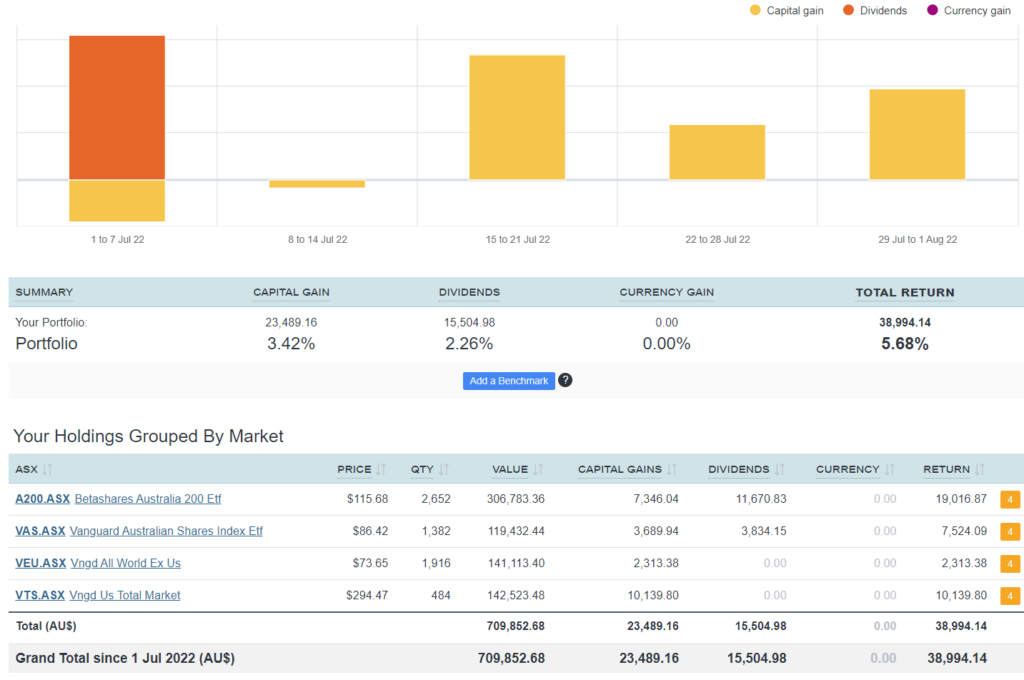

Shares

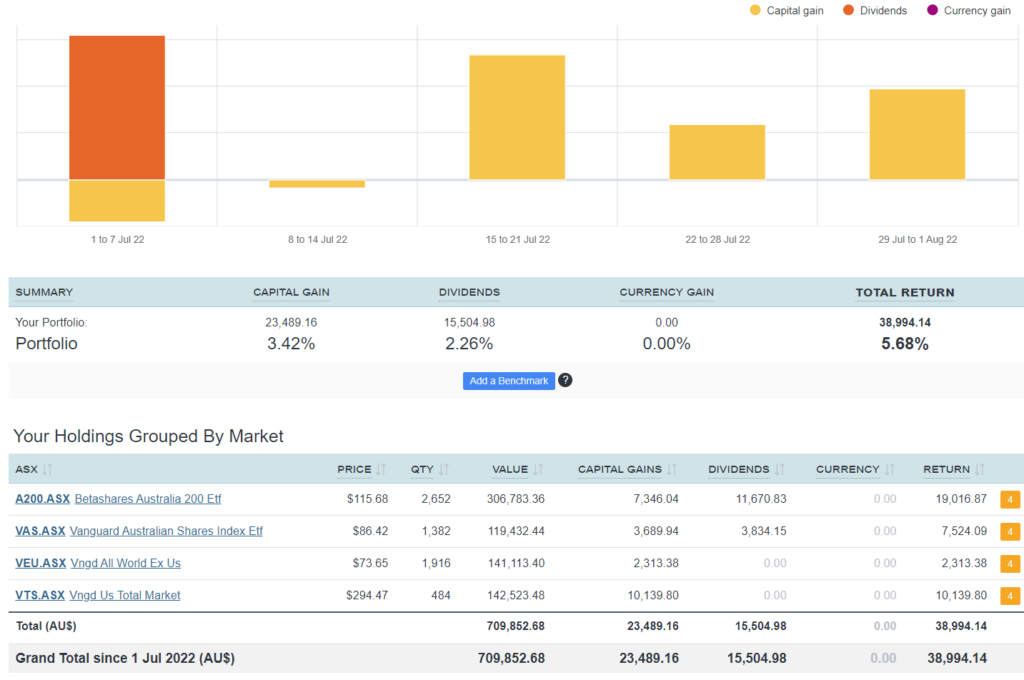

The above graph is created by Sharesight

Ohhhh Eeeeee!

$15.5K of dividends baby, plus some strong growth from our international shares. If only every quarter was as good as this.

Our overall portfolio is still down from the all-time highs at the start of the year so it’s all relative but you’ve gotta celebrate the wins when you get them.

We purchased $5K worth of VEU in July because that was the most underweighted split.

Networth