I had nearly two weeks off work for the school holidays this year. I didn’t go anywhere but just felt like a break. I didn’t do a really great job saving during this time either.

It’s funny because when I’m at work, I have such a schedule that I stick to and routine. I cook ‘X’ on Sunday that will last me until Saturday and all my snacks are planned out and bought at the start of the week. And of course the majority of my time is taken up by work which means it’s hard to spend any money of anything else.

But when I’m not at work and my days aren’t as planned, I end up spending heaps more money. I get bored. Suddenly eating out isn’t as bad and sounds more appealing when you have nothing better to do.

This is something I need to address if I am ever to reach early retirement. I don’t want my expenses creeping up just because I’m not at work!

I have started to get curious as to what my properties prices really are now because as you may have read on my previous posts. They have sat on the same value for quite some time now. I have enquired about a valuation with my broker and am waiting to hear back from him. Hopefully this will trigger Commbank to re-value my IP’s…

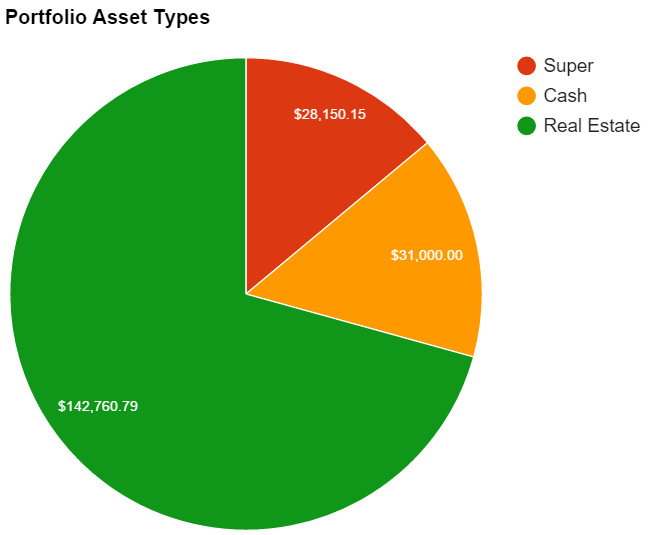

Neatly at the $200K mark too! I really wanted to get to quarter of a million before the end of the year but it’s looking unlikely. We shall see.

Networth

[wp_charts title=”linechart” type=”line” align=”alignleft” width = “100%” datasets=”-36000,-36000, -32000,-7000,20000,32000,45000,65000,83254,130000, 186000″ labels=”1-Jan-2011,1-Jul-2011,1-Jan-2012,1-Jul-2012,1-Jan-2013,1-Jul-2013,1-Jan-2014,1-Jul-2014,1-Jan-2015,1-Jul-2015,1-Dec-2015″]

| Date | Rolling NetWorth | $ Change | % Change | Notes |

| 1-Jan-2011 | -$36,000 | $0 | 0.00% | HECCS debt |

| 1-Jan-2012 | -$32,000 | $4,000 | 0.00% | Started Full-time work late Nov |

| 1-Jan-2013 | $20,000 | $52,000 | 0.00% | Built property and recieved FHOG ($21,000) |

| 1-Jan-2014 | $45,000 | $25,000 | 125.00% | |

| 1-Jan-2015 | $83,254 | $38,254 | 85.01% | Bought second IP |

| 17-Feb-2015 | $110,215 | $26,961 | 32.38% | |

| 18-Feb-2015 | $121,541 | $11,326 | 10.28% | IP’s re-valued |

| 4-Mar-2015 | $123,715 | $2,174 | 1.79% | |

| 18-Mar-2015 | $122,128 | -$1,587 | -1.28% | Paid for holiday |

| 15-Apr-2015 | $125,906 | $3,778 | 3.09% | Withdrew equity from property |

| 14-May-2015 | $127,906 | $2,001 | 1.59% | |

| 18-Jun-2015 | $131,904 | $3,998 | 3.13% | |

| 21-Jun-2015 | $152,904 | $21,000 | 15.92% | IP’s re-valued |

| 12-Jul-2015 | $159,904 | $7,000 | 4.58% | Paid 4K off HECS Debt |

| 23-Jul-2015 | $161,904 | $2,000 | 1.25% | |

| 31-Aug-2015 | $167,904 | $6,000 | 3.71% | |

| 31-Sep-2015 | $170,110 | $2,205 | 1.31% | Car went out of Portfolio, Bought IP 3, Super went up and one IP went up |

| 31-Oct-2015 | $171,376 | $1,265 | 0.74% | Big bills. Not much saved. |

| 30-Nov-2015 | $173,263 | $1,887 | 1.10% | Super went down slightly |

| 31-Dec-2015 | $186,910 | $13,648 | 7.88% | IP went up in value |

| 12-Jan-2016 | $187,910 | $1,000 | 0.54% | Some big bills |

| 2-Feb-2016 | $189,910 | $2,000 | 1.06% | Bills (again) |

| 1-Mar-2016 | $191,410 | $1,500 | 0.79% | Didn’t save very well |

Thanks for sharing – good luck on the $200k (and $250k following that!). I also find that when I am doing things I spend less, but when I “get bored” I find myself sometimes filling the gaps with doing things (that often cost money).

On a side note, what do you use for the graph (the blue one)?

Thanks Tom.

The plugin I use is called WordPress Charts (https://wordpress.org/plugins/wp-charts/).

I REALLY would like to hit a quarter of a Mil by the end of the year but we shall see.

Thanks – I will check it out. The jump from Jan 2015 to Jan 2016 is over $100k! I didn’t quite realise that the first time. Impressive!

Congrats on the increase. Seeing that graph is a great visual of the progress you’ve made in 5 years. Hopefully the next 5 years is just as good!

Tristan

Thank you friend!

I have been quite lucky with capital gains in recent years so not sure if the level of growth is sustainable. Just as long as my cash flow keeps up I’ll be happy 🙂