You’ve probably heard of financial independence (FI) before, but usually, that’s a term associated with decades of saving and investing with the promise of never having to worry about money again somewhere in your 50s or 60s if you’re lucky.

What if I told you that it is possible to retire 30+ years earlier than the traditional age of retirement in Australia (65).

Most people would naturally think that is not achievable without a big inheritance, huge risk, a high paying job or extreme luck.

Would you believe me if I said that it’s 100% realistically feasible for most Australians without any of the above?

Welcome to the world of FIRE!

So what exactly is FIRE anyway?

I like to think of FIRE as a mash-up of frugality, minimalism, stoicism and personal finance.

At its core, it’s mostly a lifestyle.

It’s about identifying what’s really important to you that brings happiness and cutting out all the other consumerism BS in your life that doesn’t matter. Pair that mindset with some basic education about investing and you’ll soon discover that reaching FIRE is not as difficult as it first seemed.

The beauty is that it really comes down to math and numbers. It’s very measurable with most of the important factors well within your control.

If you can save 25 times your annual expenses, you have an extremely good chance of living off your portfolio for the rest of your life.

For example, if everything in your life comes to a bill of $40,000 for the year. You will need roughly $1,000,000 invested to reach FIRE.

WOAH!

Does that make you as excited as me?

Saving 25 times your annual expenses doesn’t seem so bad to escape the daily commutes, pointless meetings, and asshole bosses.

The acronym itself stands for Financial Independence Retire Early and means different things to different people. It’s really broken up into two parts. Reaching financial independence and then retiring early.

Financial Independence

FI can be described as:

‘Having sufficient personal wealth to live, without having to work actively for basic necessities. For financially independent people, their assets generate income that is greater than their expenses.’

FI basically means that you have income-producing assets that generate enough money for you to live off…forever.

Seems simple enough right?

That’s because it is! But choosing the right asset class to suit your investing style is crucial. I started off in real estate but have moved to shares due to their passive nature and a raft of other reasons.

The details of how we’re investing our money to create a passive stream of income can be found in Our Investing Strategy Explained and more recently, our move to a more dividend focussed approach which can be read in the article Strategy 3 Revisited (starts halfway down the page).

Investing, tax minimization, debt recycling etc. get all the attention and is what most people focus on.

But make no mistake about it, the most important factor for reaching FI by a country mile is how much you can save each paycheck.

And you simply cannot start your snowball or add extra to it throughout the year without spending less than you earn.

(You can keep up to date with our snowballs progression as I publish our net worth each month.)

Your savings rate is the amount of cash you can save (usually in a year) from your paycheck expressed as a percentage. So if you earn $100K as a household after-tax (always after tax) per year and are able to save $30K. You have a savings rate of 30%

Your savings rate dictates the two most important things in the journey towards FI.

- Since you only spent 70% of your after-tax income. You’re able to contribute $30K towards your snowball and grow it fast. Each year your snowball will roll down the hill and collect a little bit more snow (capital gains, dividends, rent etc.) along with you pouring on $30K worth. A great recipe for reaching FI and growing your snowball to a big enough size for you to never have to manually add snow to it ever again!

- If you’re able to save $30K in the above example. That means you spent $70K during the year on everything. This means that to live at your current lifestyle, you need enough assets to generate a passive income of $70K! Using our simple formula above 70 X 25 = $1.75M$1.75M (in today’s dollars) is your FI number!

It would take 28 years for you to reach 1.75M in assets from scratch assuming you could add $30K each year and your investments were returning 8%.

28 years ain’t bad, but it’s not great.

Here’s the really important part…

If you increase your savings rate by just a little bit.

It can wipe years off the journey towards FI.

This is because your savings rate has a double whammy effect. If you increase it, not only are you able to shovel more snow each year on your snowball…but theoretically, you also don’t need as big of a snowball in the first place since you can live off a higher saving rate than previously.

You reduce your FI number whilst simultaneously being able to add more in assets each year.

If we increase the savings rate to 40%. Suddenly we can reach FI in just 21.6 years

That’s saving an extra $10K each year to reach freedom nearly 7 years early!

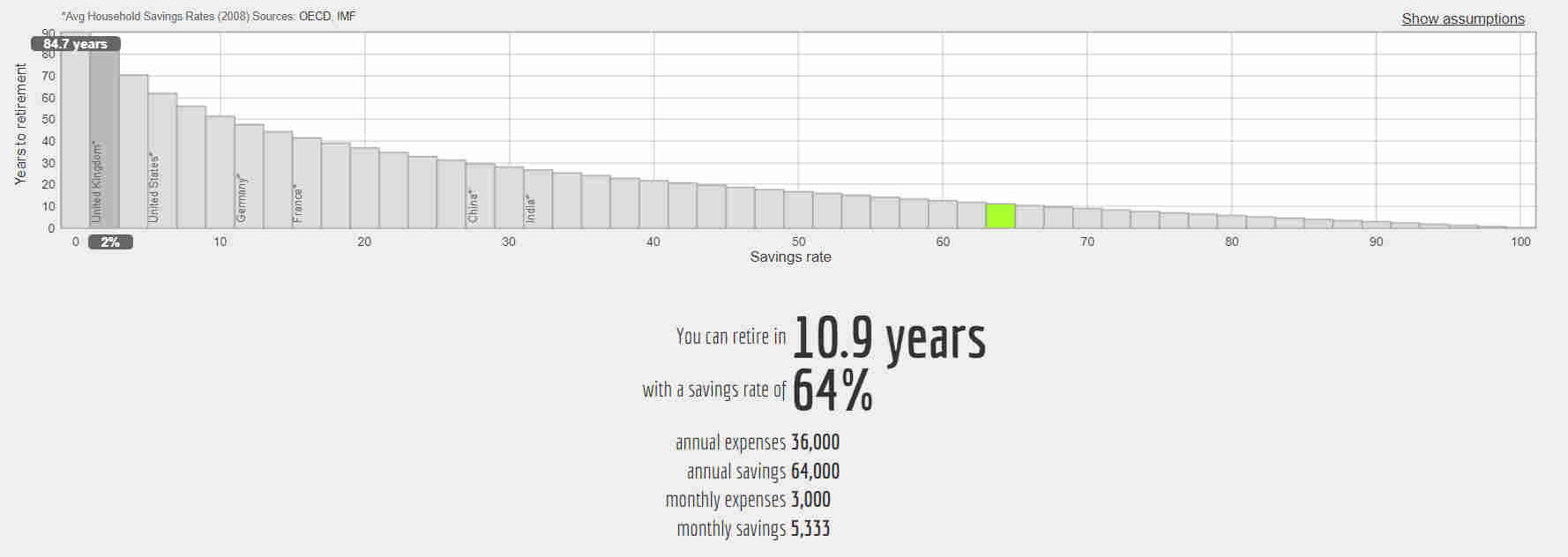

You can play around with the numbers using this really cool website networthify.com that basically crunches the numbers for you and graphs it nicely.

If you can live a great frugal and simple life with a savings rate of 64%. You only have to work a little over 10 years to completely pull the pin and retire!

Now that is incredible!

And the best part is that it does not matter how much you earn. Two people with the same savings rate will reach FI and be able to retire at the same time regardless if one is earning $70K and the other $400K.

But what does retire even mean? Wouldn’t it be boring not doing anything for 40+ years?

Which brings us to the second part of the FIRE journey…

Retire Early

Probably the most misunderstood and important part about FIRE has to be the retire early (RE) part.

So much so that I actually wrote an entire post dedicated to clearing up the common misconceptions.

To briefly summarise, RE in a FIRE context does not mean you stop working! It’s about retiring from the rat race and having the freedom to pursue meaningful work of your choice, whether that is paid or unpaid doesn’t matter.

Meaningful work that ignites a passion is awesome. I want to do work that brings purpose and meaning to my life forever.

But unfortunately, the fact of the matter is the majority of today’s society (myself included) sets an alarm to go to their place of employment to earn money.

We trade time for money.

Are there people out there that would do their job for free?

Sure.

Are there many?

No.

Retire is probably not the best word but FIRE is a catchy acronym and it’s stuck so you’ll just have to deal with it.

If you’re anything like me, the thought of having all the money in the world was not the exciting part when I discovered FIRE. It’s what having that money could do for your life. The freedom that financial independence can grant is something that has never left my mind since I stumbled across it in 2013.

But there is no point in having that freedom if you don’t utilise it and retire from the job you hate.

If you’re one of the rare lucky ones in a job that you’d do for free, congratulations! You’re already reaping the benefits of RE.

The Birth Of Aussie Firebug

I first came across the concept of FIRE after stumbling on a US blog called Mr. Money Mustache circa 2013.

I discovered financial independence after reading ‘Rich Dad Poor Dad’ which completely blew my mind, but what Pete at MMM was writing about was basically FI on steroids!

And the fact that he had actually reached the goal and retired at 30 was a big credibility boost. I must have read close to 10 posts a day for the next 2 months to find out as much as I could about this thing called ‘FIRE’ and if it’s all just a bunch of BS or the real deal.

I soon discovered that this movement was incredibly achievable and started reading more and more FIRE blogs like The Mad Fientist, Early Retirement Extreme, Get Rich Slowly, and many more.

But something was lacking…

There were incredible resources online ranging from blogs, podcasts, videos and heaps of other stuff.

But all of my favourite bloggers were talking about 401K’s, traditional IRA vs Roth IRA, state tax’s, Mint etc.

Awesome info but most of the tax strategies, investment vehicles, asset options, and cool software was not applicable in Australia.

Where were the Aussie FIRE bloggers?

There were heaps of Aussie blogs about financial independence, but I couldn’t find one that was specifically dedicated to achieving FIRE and actually retiring in your 30s for Australians.

Which is why I created the first Australian FIRE blog in 2015.

Aussie Firebug was born!

I created this blog for 4 main reasons.

- To keep me accountable on my journey.

- To create an Australian FIRE resource for others just like I always wanted back when I first started my journey

- A good excuse to create the Australia FI podcast to chat with people who have already reached or are on their way towards FIRE and occasionally businesses who are offering a service that can help us reach FIRE quicker.

- So other people who were a lot smarter than me, could critique my strategy and tell me where I could improve.

Number four has turned out to be my favourite so far. I have learned so much from the comment section on my blog it’s not funny.

And the Australian FIRE community as a whole has exploded with insanely talented content creators.

Some of my favourite Aussie FIRE blogs include Strong Money Australia, Life Long Shuffle, The Fi Explorer, Aussie HI FIRE, and many more!

The thing is, reaching FIRE in Australia is quite different than reaching it in another country, especially the US.

We have Super which cannot be accessed until your preservation age which is completely different to the states.

I created a calculator to work out the optimal amount you should have inside and out of Super.

Future Plans

This blog predominately follows my partner and I, in our journey towards FIRE with our monthly net worth updates. I occasionally publish other content on topics of interest such as savings, tax minimisation strategies, investing, real estate, and anything else that I find interesting.

If you want to follow along on our journey and never miss out on any post, please feel free to subscribe to the Aussie Firebug newsletter:

I only send out two or three emails a month and over 25,000 people are currently subscribed so it can’t be too bad 🙂

I’m really looking forward to the next few years as FIRE is well within our sights and we are steaming ahead towards freedom.

Thanks for stopping by and I hope you can get some value out of the content on this website.

As always…

Spark that 🔥