Okay, so if you’ve been following me for any length of time you probably know that I’m a big fan of ETFs.

You know, those little exchange-traded funds that grant instant diversification with rock-bottom management fees to provide a great return for extremely little effort. It’s no wonder that famous investors like Warren Buffet and Mark Cuban (US billionaire) are also big fans.

Buffet has been quoted as saying:

“Consistently buy an S&P 500 low-cost index fund. I think it’s the thing that makes the most sense practically all of the time.”

I wrote about the benefits of index investing briefly in ‘Our Investing Strategy Explained‘ post.

I’ve been a big fan ever since reading the Bogleheads Guide to Investing about 3 years ago. And I put my money where my mouth is and currently have over $160K invested in ETFs.

“So if ETFs are so great, what the hell are LICs and why should I care? “

I’m so glad you asked.

Let’s begin.

Listed Investment Companies

FYI when I refer to LICs, I’m referring to the older ‘granddaddy‘ LICs like AFI, ARGO, Milton etc.

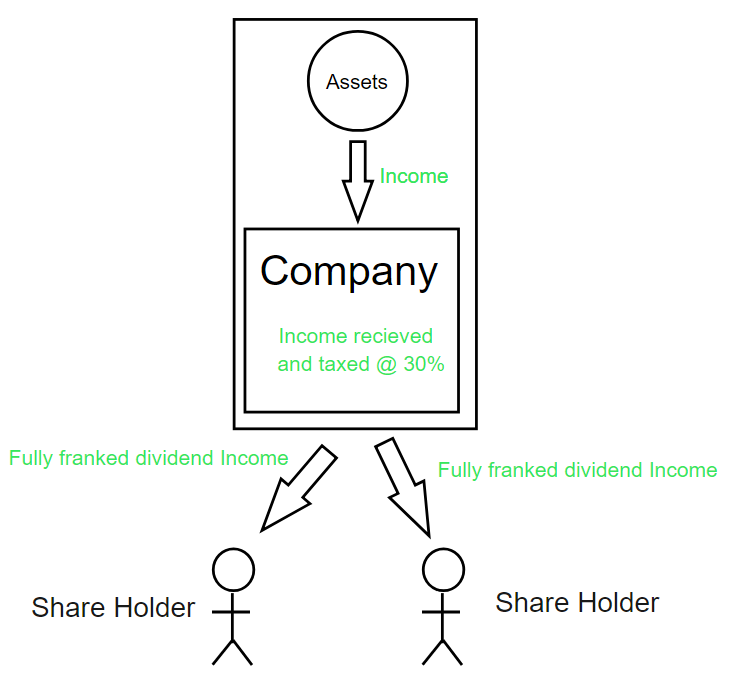

Listed Investment Companies (LICs) are first created by an initial public offering (IPO). Money is raised and a fixed number of shares are created for each investor. The money raised is then used for investing in assets such as a basket of shares which together make up the net asset value (NAV) of the LIC.

The shares of the LIC are traded on the stock exchange where investors are able to buy and sell when the market is open.

Sound familiar?

It should because, in a nutshell, ETFs are essentially doing the same thing. But there are key differences.

Key Differences

There may be more differences than what I’m about to go over, but the ones below are the key differences in my eyes and the ones that reflect my investing decisions.

Management Fees

ETFs tend to have a lower MER than the equivalent LIC but it’s not as bad as it sounds. If you stick to the older LICs (Argo, AFI, Milton etc.) the highest MER is around 0.18% which is not that bad. It’s still more than double that of an Australian index ETF such a BetaShares A200 (0.07%) though.

The management fees reflect the investment style of the two structures.

ETFs track an index or benchmark whereas LICs try to outperform the index. But given the low MER of the older LICs, some active management is acceptable in my view. I only have issues where the fund managers charge > 1.0% for their services.

WINNER: Generally ETFs

Legal Structure/NAV

ETFs are a trust structure whereas LICs are a company as the name ‘Listed Investment Company‘ would imply.

This has some semi-big ramifications.

I’m going to try to keep to as simple as possible because we’re about to get technical here for a second.

To truly understand the differences between ETFs and LICs we must first understand how they operate and what’s the difference between Open-End and Closed-End

Closed-Ended

LICs are closed-ended.

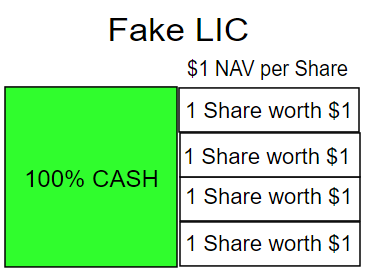

This means that when the LIC had its IPO and raised the capital to start the company, a certain number of shares are issued. Once the company has been established and begins investing the capital on the behalf of shareholders, no more shares are issues. New investors wanting to join the LIC have to buy already issued shares on the exchange. The LIC does not create new shares to deal with demand.

Imagine a new LIC that has started with 4 investors each putting in $1. The LIC currently has a Net Asset Value (NAV) of $4 and there are 4 shares issued to each investor.

Those four shares that own the LIC are each worth $1 according to the NAV. But those shares are bought and sold on the market. And depending on how bullish or bearish the market is on Fake LIC, will determine how much the share price will drift away from its NAV value either up or down.

If someone offers 1 unit of Fake LIC for 80c, this is what’s called trading at a discount. If someone offers the same unit for $1.20 it’s known as trading at a premium. LICs can drift away from the actual NAV quite a bit.

Can LICs ever increase the number of shares? Yes, they can raise capital and issue new shares just like any other company but this only happens every so often and not something that’s done daily like ETFs.

Open-Ended

ETFs, on the other hand, are open-ended and can create or redeem new shares in accordance with the market demand. If someone wants to enter the fund, they don’t need to trade with a current shareholder of the fund (like the LIC does). The fund can create a new share.

Conversely, if someone wants to cash out their share. The fund has to come up with a way to get the cash which may mean selling assets within the fund to give the investor their money.

But who sets the price of each unit?

When an Investor wants to buy or sell their units on the exchange, there is a market maker on the other side of the trade. The price they offer is generally very close to the Net Asset Value of the fund.

This is why you can’t really trade an ETF at a discount or premium to the NAV.

WINNER: LICs. The ability to trade at a discount is desirable but the company not having to sell assets during a crisis to meet demand is a big plus.

Investment Style

Traditionally ETFs track an index or benchmark whereas LICs try to outperform the index.

If you actually look into what is in the portfolios of Australian ETFs such as A200 or VAS and compare them with the old LICs, there is a lot of crossover. The whole active vs passive debate is more of a debate when the active fund managers are charging big fees (>1.0%).

I’ve got no issues with a little bit of active management as long as the MER is low. In fact, I like that most of the ‘Grand Daddy’ LICs have a focus on income. This is important to me and something that is reflected with historic returns for those LICs (more on that later).

One issue I do have with LICs is that they can and sometimes do change investment style. The fund manager that has a fantastic track record might retire or get offered a higher wage at another fund. I personally like the fact that most ETFs are legally obligated to track an index and can’t diverge from that strategy no matter what the managers are thinking.

Some would argue that being able to see waves in the market and adjust accordingly is a good thing.

WINNER: Tie. I prefer to track an index but don’t mind a little bit of active management as long as the fees are kept to a minimum.

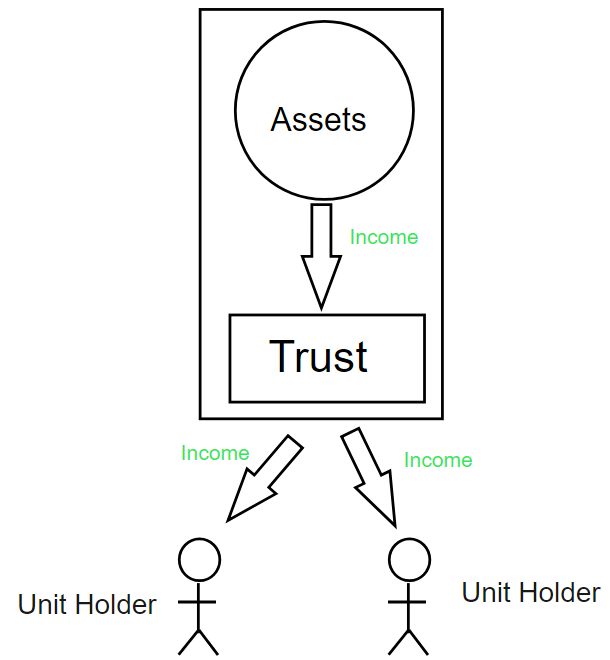

Retained Earnings

ETFs are a trust and they must distribute their income each year to unitholders. The income from assets within the funds such as dividends, get passed directly from the fund to the unitholder.

Because LICs are a company, they can receive income from the assets they own (usually dividends from shares), pay the company tax rate of 30% and keep that income in the fund for as long as they want. Then at a later date, the manager can decide to pass it on, usually as a fully franked dividend to the shareholders of the LIC.

This means that the income from ETFs are often lumpy and inconsistent because the market may do well some years and bad others. But if the LIC retains some income from the good years, they can distribute it in those bad years to make it more smooth and consistent.

Sounds like a good thing right?

This one is something that’s been on my mind for a while.

The ‘smoothing’ of income is often touted as a benefit whenever any debate comes up between ETFs and LICs.

I beg to differ.

I personally don’t want the LIC to retain any of my income. I would much rather they pass on every single dollar to me so I can make the judgement call on what to do with it whether that be reinvested or spent.

This might be a plus to some but it’s an annoyance to me and something I really wish they didn’t do.

WINNER: ETFs. This is my personal preference.

DSSP/BSP

Without going into too much detail, Dividend Substitution Share Plan (DSSP) and Bonus Share Plan (BSP) are offered by two LICs (AFIC and Whitefield respectively). It’s basically a plan offered by those two LICs which allow the investor to forgo the dividend in exchange for extra shares.

This means you don’t pay income tax and get more share instead. It’s great for high-income earners.

This is not offered by any ETF and is unique to the two LICs mentioned above.

If you want to read more about it, check out fellow FIRE blogger Carpe Dividendum’s excellent article.

WINNER: LICs

Fully Franked Dividends

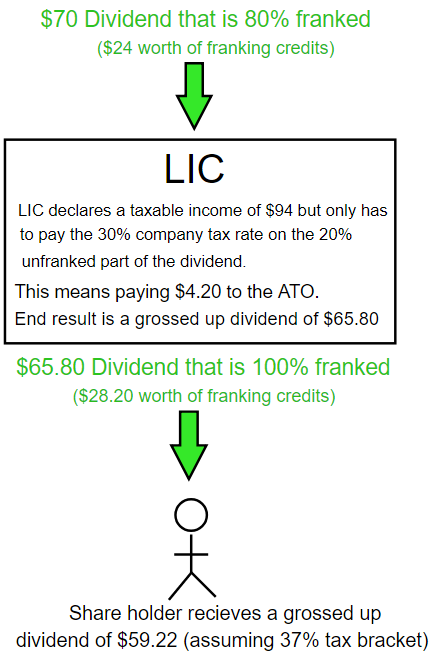

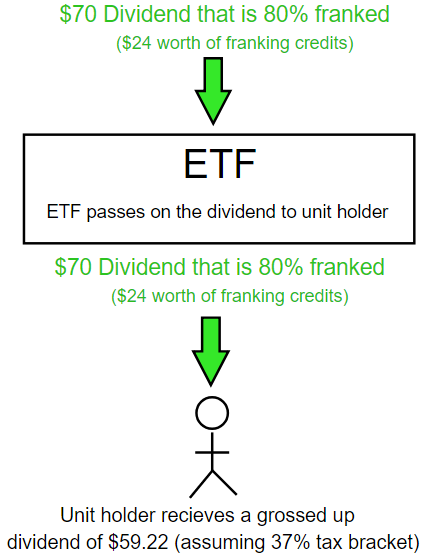

This is actually not a difference but I want to clear up a common misconception about the franked dividends that LICs are able to pay out.

Some investors think that LICs can magically produce more income from the same basket of shares because they often pay out a fully franked dividend whereas an equivalent ETF might only distribute a partially franked dividend.

Let’s say for example that a LIC and an ETF both invested in the same company that paid out an 80% franked dividend of $70 dollars.

Here’s how that money would reach the investor using a LIC.

Note that the end result for this investor who is in the 37% tax bracket is a grossed-up dividend of $59.22 after tax.

So how does it play out in an ETF structure?

The end result for the investor is exactly the same. A grossed-up dividend of $59.22 after tax.

WINNER: Franking does not matter when comparing LICs to ETFs.

In a nutshell, the key differences are:

| Type | Management Fees (MER) | Investment Style | Legal Structure | Net Asset Value (NAV) | DSSP |

|---|---|---|---|---|---|

| ETF | As low as 0.04% | Passive. Usually tracks an index and does not seek to outperform. | Trust | Trades on, or very close to NAV | No |

| LIC | Although slightly higher for an equivalent ETF, the old LICs generally are all under around 0.18%. | Active. Seeks to outperform an index over the long term. | Company | Can trade at a discount or premium to the NAV of the fund. | Yes |

So Which One’s Better?

If you’ve made it this far, I can almost hear your cries.

‘Just tell me which ones better FFS!’

After consuming all that info above, you’ll be rewarded with a clear and concise answer as to which investment is superior and what you should do.

And here comes the most annoying answer…

They are both great.

Both have pros and cons but either ETFs or LICs are suitable for FIRE chaser in Australia looking to generate a passive income. The most important thing is to understand the pros and cons for yourself and then you can make an informed decision as everyone’s needs, investment style, and appetite for risk are different.

The last point is often overlooked, it’s not so much about trying to achieve the maximum return in my eyes. It’s about choosing a strategy that will generate that passive income but more importantly, a strategy that you’ll be comfortable with through thick and thin. Because any portfolio is easy to hold in a bull market (see negative gearing). But it’s when the shit hits the fan that you’ll really appreciate a well thought out strategy that you’ll feel comfortable in when everyone else is running for the exit.

Conclusion

ETFs and LICs are similar yet different. They shouldn’t be seen as enemies, more like best friends and depending on your mood, you might want to hang out with one or the other…maybe there’s room in your portfolio party for both?… Which leads me to talk about…

Strategy 3?

If you have read ‘Our Investing Strategy Explained‘, I have been thinking more and more about a dividend focussed portfolio which mainly consists of Aussie shares since they offer a great yield plus franking credits. They certainly feel like the ultimate passive investment to fund early retirement. And our end goal, after all, is to create a passive income stream to retire on.

So after much research, learning from other dividend focussed investors such as Peter Thornhill and Dave at Strong Money Australia and much toing and froing, I have decided to direct all future capital into high yielding Aussie shares in the form of ETFs and LICs.

We currently have nearly $100K in international securities which makes this decision a little bit easier. We are basically accepting the risk of lesser diversification in order to gain a higher dividend yield through Aussie shares.

I completely understand the risk and acknowledge that an internationally diversified portfolio will most likely outperform an all Aussie one in terms of total return. However, I’m confident in saying that the international portfolio will not offer the same level of dividend yield that the Aussie one will.

I wrote a little bit more about my reasoning to move to strategy 3 in our September 2018 Net Worth Update.

Historic Returns

I would like to take a second to illustrate just how similar the returns are between most of the older LICs and Australian Index ETFs.

I’m going to be using the historical data of Vanguards VAS ETF because the A200 was only created this year and VAS has been around nearly 10 years. Since they are so similar it should be a fair comparison. And I’m choosing 4 of the most common older LICs for comparisons.

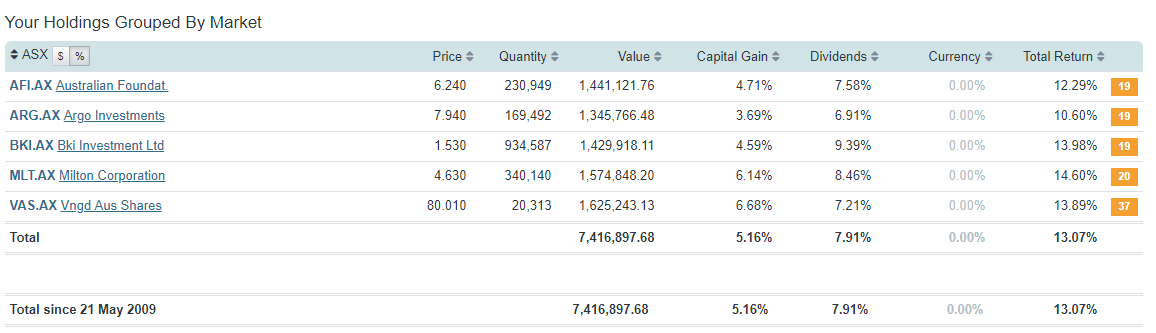

Below are the returns for investing $1M on the 21st of May 2009 (creation date for VAS) in each of the LICs and VAS.

It’s no surprise that the majority of the LICs returned more dividends than VAS. This is their main focus after all and a primary reason I’m investing in them.

Argo was a surprise returning significantly less than the others in terms of capital gains and dividends.

Maybe even more surprising is that VAS is smack bang in the middle of the pack for total returns. I guess that this just further illustrates that it’s hard to beat the index consistently over a long period of time. Some LICs might be able to do it (in this case MLT and BKI) but others won’t.

ETFs AND LICs?

Yes, I’m utilising a combination of an ETF and LICs for the Aussie portion of my portfolio which is what I have decided to focus on for the foreseeable future.

Here’s how it’s gonna work.

I will be purchasing either one of two LICs or one ETF once a month to the tune of around $5K.

Why 1 ETF and 2 LICs?

I have already been into why I think ETFs are so great if you’re looking to get exposure into the Aussie market and want to invest in an index style. BetaShares A200 or VAS are the obvious choices in my opinion and with the A200’s MER being half the price of VAS, it’s a clear choice for me.

One of the biggest pros for ETFs for me is that they do not try to pick winners and divulge from an indexing strategy.

LICs, on the other hand, can and do suffer from a fund manager change or investment style redirection.

This scares me.

To mitigate this risk, I’ll be spreading our capital out between two LICs even though what they’re investing in is incredibly similar and might look silly from a diversification point of view. But I don’t really care if others think it’s silly, if it helps me sleep at night then it’s all gravy baby!

The other reason I’m buying multiple LICs is to have a greater chance to be involved in a Dividend Substitution Share Plan.

So what am I buying and how am I deciding what to purchase?

ETF

A200

MER: 0.07%

Benchmark: Solactive Australia 200 Index

Why it’s in our portfolio:

BetaShares A200 made it’s way into our portfolio last month after Vanguard failed to respond and lower their management fee for VAS which is currently double that of the A200.

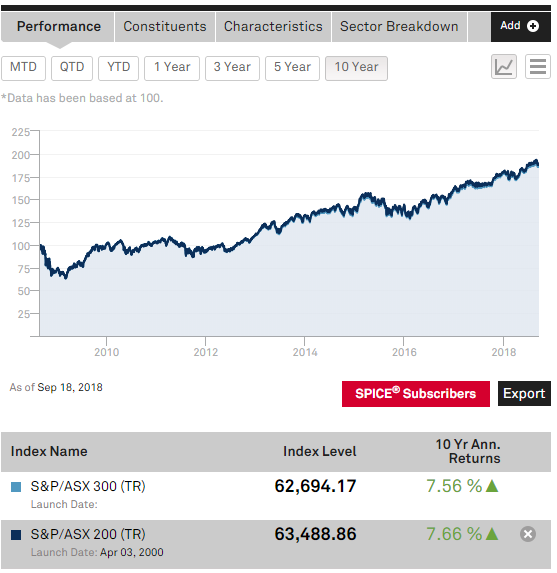

Given that the returns for the last decade between the ASX200 vs ASX300 (pictured below) were incredibly similar.

I’m choosing the ETF with the lower management fee every day of the week.

LICs

AFI

MER: 0.14%

Benchmark: XJOAI (ASX:200)

Why we will be investing:

Other than being a dividend focussed LIC with a MER of 0.14%, AFI is only one of two LICs that offer DSSP. The other LIC is Whitefield (WHF) and that has a MER of 0.35% which is too high for my liking.

A very good detailed review about this LIC can be found by the ever so insightful SMA. Check it out.

MLT

MER: 0.12%

Benchmark: XOAI

Why we will be investing:

Milton’s very low MER of 0.12% was attractive and we needed to spread our risk across another LIC so after much research, Milton it was. Milton also seems to be a bit more on the active side compared to the other older LICs which is another hedge against something happening with the index.

Full SMA review if you’re interested.

When To Buy?

So if I’m going to be directing all future capital into Aussie shares through LICs and A200 ETF. When do I know which one to buy since they are all essentially the same investment (Aussie shares)?

Here’s what I’ll be doing each month when we have saved up $5K and are ready to invest:

- Check both AFI and Milton’s NAV compared to their share price on the ASX to see if they are trading at a premium or discount (currently developing a web app to make this easier)

- Invest in whichever LIC is trading at the biggest discount

- If both LICs are trading at a premium, buy A200

That’s It…For Now

As of writing this article, for my circumstances and goals, I believe that an Australian based portfolio consisting of ETFs and LICs is the best strategy to produce a passive income for me to achieve financial independence so I can have the freedom to retire early.

But as I’ve always said, if I come across something that’s better than what I’m doing, I’ll make the switch.

My mind is always open to new ideas and strategies.

But that’s it for now… until strategy 4 rears its head 😈

UPDATE: We have officially moved to Strategy 2.5 in Sept 2019

Good grief mate, you’ll be missing out on some massive returns in Asia. Australia has a pretty short runway for growth and I wouldn’t want to be relying on franking credits in 50 years time.

I’m still invested in Asia Dingo, through VEU and Super so not all is lost. Also, what makes you so sure that Asia is going to have massive gains? Sometimes what’s prediticed is the opposite of what actually plays out…

Agree! If only the vibes around Asia were a ‘sure thing’. I would rather the benefit of franked income over speculation.

Not speaking for Dingo, but to answer my own reasoning about SEA. Regression to the mean and the problem of diminishing returns are my big reasons. Asia is currently lacking behind in technology combined with massive population (below the mean). It’s faster to adopt existing technology than to have to build new technology to encourage growth. The west is at that stage, while SEA is at the stage of adoption. Furthermore, the technology we’re typically developing is leading to small growths (diminishing returns), while the technology SEA is adopting is life changing, mechanized farming, computerization, industrial manufacturing etc. These are world changing technologies. The latest Iphone, or ML search algorithm is merely an iterative improvement. There’s simply more potential in the economies that currently lack, in my mind at least, but I’m willing to be proven wrong.

Hi Nath,

I don’t have any rebuttal to what you’ve said because I honestly don’t keep up to date with what’s going on in the markets. You sound like you know what you’re talking about but so do many many fund managers who underperform the index.

Over 65% of fund managers underperform… What makes you think you can beat them?

What makes you think I’m managing funds? Nothing about my investment strategy requires anything more than just picking a diversification target for the indexes I choose. There’s no analyzing businesses for financial fundamentals, or trying to predict which companies might corner a market or outperform competitors. SEA just has a slightly higher weighting in my index portfolio.

I tend to agree with Nathan and Dingo.

With the US and Oz markets being pretty overpriced and lots of negativity for the Asian market, I believe that there is huge room for growth in Asia, even if there are trading tariffs imposed on China. India also has massive room for growth with such a young population. China and India are set to be in the top three economies by 2030 and i’d love to get in on these gains. There are lots of good Asian ETFs like VAE and IAA which i’ll be buying investing in and no need for a fund manager for this, therefor keeping cost low. It is certainly a little more risky than putting funds into Milton or AFIC but being young I see the reward to significantly outweigh the risk.

Each to their own Lizzy. There’s no right answer here. Being confident and well educated with your decision is the most important part I think.

It’s fascinating watching your investing strategy develop over time, and your insights continue to guide my own strategy.

Ps. Thanks for the shoutout!

No worries. Thanks for the quality content. Keep it up

I like your idea of buying LIC with DSSP for a child in their name. I have been going around in circles deciding on what might be the simplest investment for kids future and get them involved in their own investing.

Will you be buying afi in your name and switch it to DSSP because your earning close to or 90k+ income from your day job?

And milton in miss afb’s selfwealth account since she earns less?

We invest through a trust Andy. We can distribute to multiple beneficiaries depending on the circumstance to achieve maximum tax efficiencies.

I’m really enjoying learning from your content. I’m interested in setting up a trust for investing. Can you please point me to more info on the pro’s & cons of investing through s trust.

Hi Lisa,

I’m glad you’re enjoying the content.

If you haven’t already check this article out. Have a squizz at this bad boy https://www.aussiefirebug.com/pay-less-tax-part-1-buying-assets-in-a-trust/

Excellent article Aussiefirebug. I really like your balanced approach. I agree there’s not huge amounts to choose, and once you’ve got down to this choice, you’re already doing 99% of things right.

I have a question in my mind only on two points, whether mixing LIC active management’s may just cancel each other out, in the end, and a second question I would have is whether it’s really correct to think about a below NAV LIC as trading “at a discount”. I don’t know the answer but I wonder if there could be other reasons at times.

Hi FI Explorer,

Maybe they will cancel each other out. But just knowing that all my wealth is not tied up in 1 company that could change investment direction helps me sleep at night. The odds of the older LICs drastically changing direction is low, but I don’t see a reason to not spread it out that risk across two LICs.

As for the NAV trading at a discount… what else would you call it? As I understand, these are technical terms and something that can’t really be debated. I mean, if the NAV per $Share is $1 and it’s currently trading at 80c. That’s a discount, right?

Now the question could be asked about whether there’s any point to worry about such minute details. But that’s another question.

I have investments with Wilson Asset Management and their investor materials refer to the share price as either trading at a premium or a discount in relation to the NAV of the company. It’s a pretty logical term for the subject matter.

Great article yet again Aussie Firebug.

Hi Aussiefirebug – Sorry for the late reply, I didn’t actually get a notification of a reply! I listened to the podcast version of this today, and it reinforced what a great job you have one. Your ‘sleep at night’ diversification point makes sense.

On the discount issue – apologies, I think I was being obscure. What I actually meant was I wonder if sometimes there are quite specific reasons why trading price is below NAV, beyond just market imperfections. One could be information that some participants in the market have. I do agree its a relatively small detail.

Do you have any sense of the “normal” range of trading at a discount or premium for a LIC is?

No, I don’t.

I was actually having a conversion with a mate on the weekend about this and he made some good points about whether or not a discount is really a discount if the LIC has been trading at a discount for the last 5 years for example. I’m not sure I know how to answer that either.

I’ll do some more research and see if I can get the data and form a ‘normal’ NAV baseline.

Check out the post here on cufflinks and the strategy of looking at the historical avg discount as the norm and the fact that most LICs either stay at a discount or premium. https://cuffelinks.com.au/lics-never-return-par/

Oh nice one. Thanks for that Paul 🙂

Hi AFB, this recently came up at a property development meet up in Sydney. I spoke with a fund manager who talked about a few terms I didnt understand like beta and whatnot, but what I did take away was that some LICs can always trade at a discount, for a variety of factors. What I have started doing is looking at the ‘discount delta’ which is the current difference between the daily discount and its average discount rate. I then include this as a factor when comparing which LIC or ETF to purchase every fortnight. Cheers

Interesting concept! I have noticed that some LICs are always at a discount…

Very interesting post Aussie Firebug, thanks for that! To be honest I don’t think it’s going to make a huge amount of difference whether people go for ETFs, LICs, or a combination of both but I enjoy reading your reasoning.

One thing that you didn’t mentioned, presumably because it doesn’t matter for your strategy given you plan on living off the dividends, is liquidity. If you have an ETF over a liquid index like the ASX200 then there will always be plenty of liquidity because index arb desks or market makers can easily buy ETFs and hedge with short futures, or vice versa. If you want even more liquidity then you can always do a creation or redemption basket trade for much bigger amounts. With an LIC it is much harder to hedge, there aren’t designated market makers, and you can’t do a creation or redemption. So there is much less liquidity and at much wider spreads for LICs compared to ETFs.

As I said it doesn’t matter for your strategy but it may for others who are planning on selling down over time.

Agreed with your point about ETFs and LICs. Both will do the job. Personal preferences really.

Ahh yes, I forgot liquidity. The post was big enough haha

Hello Aussie HIFIRE, the LIC liquidity issue works both ways, during a GFC or general market route those OLD LICs which tend to be held by older conservative divvy investors just don’t sell, and since more cannot just be created- then they tend to not follow the same steep downward trajectory of ETFs which can be “made to meet market”.

This is something I have observed over time, Im mixing LICs with ETFs and throwing in a bit of VGS on the side with a few growth picks thrown in for good luck. Im not planning on ever selling the LICs and plan to live of the divvies. Loving everyones input and the respectful nature of this blog Keep those comments /ideas coming

What website/source/software did you use to produce that table of returns comparing VAS overall returns with the overall returns of the LICs?

Thanks

Kieran

It’s Sharesight (https://sharesight.com). Definitely recommend.

Moving forward, do you plan to invest 50% on A200 and the 25% for each of those LICS?

Also, if the priority is dividend income, instead of investing in VAS and two LICS you mention, why not Vanguard Australian Shares High Yield ETF (VHY)?

I don’t have a hard rule on the % of any of the three. If the LICs are trading at a discount I will buy them, if not, A200.

I don’t like the MER (0.25%) of VHY. Too high for me

Are you keeping your VEU and VTS and selling VAS for A200, or selling all of your ETFs for A200/LICs?

I’m not selling anything. I’m keeping VAS and just replacing future purchases with A200.

Hiya, just curious about the refusal to sell if you value the principles behind Strategy 3 so much. Do you perhaps consider having the ~$100k of international diversification to be of some value as you perhaps hinted earlier in the post? Cheers.

I absolutely do!

I love the dividend approach but I like to hedge my bets by keeping VTS and VEU. I think it’s always smart just to have some fall back in case something goes wrong. I invest in both ETFs and LICs for that reason too.

Hello AF. Just curious as to why you wouldnt sell VAS given the potential gain of compounding if you put it all into A200? I get that you’d be hit with the CGT, but if you’ve been holding if for greater than 1 year, with the 50% reduction, wouldnt that play out to still be more beneficial with investing all that into A200? Forgive me if its something simple I’m glancing over.

Thank you

Hi Mahendrah,

There’s no real reason to sell tbh. There isn’t any potential compounding effects that would occur if I sold VAS and put the proceeds into A200.

The only real benefit I could see is less work come tax time which is a pretty good reason to sell actually. But at the moment I’m Ok withholding both even though they’re basically identical.

Cheers

Have been waiting for this one! Great content as usual AussieFireBug. Love the prospect of a web application to easily compate NAVs, i would definitely use.

Cheers,

Sam.

Thanks Sam,

It’s cooooooooming. I have many things in the pipeline that just needs some time to get out. Watch this space 😉

Hey AFB, really enjoy your posts and podcast – keep up the great work.

Incase you didn’t see it on Reddit, I posted a link to a Google sheets doc I created that i use to work out which LICs are trading at a premium or discount. Very rudimentary, but thought I would share in the off chance it could be of use at all.

https://www.reddit.com/r/fiaustralia/comments/9hyrk8/portfolio_spreadsheet/

Nice sheet dude!

Hey AFB – quick one.

“The other reason I’m buying multiple LICs is to have a greater chance to be involved in a Dividend Substitution Share Plan.”

MLT doesn’t have a DSSP/BSP, so am I missing something? Where is the greater chance to be involved in DSSP?

Thanks!

That was worded badly. I just meant that by spreading my LICs across two (Milton and AFI) I would have the benefit of being involved with a LIC that offers DSSP and also spreading fund manager risk.

I did look at Whitefield but didn’t like the management fees.

Can you please explain the pros and cons of investing for high dividend yield vs capital growth? If as you mentioned the overall growth of a more diversified portfolio will likely outweigh the dividend yield of an Aussie focussed one then couldn’t you just sell down your holdings to cover any shortfall to your cost of living? Thanks.

Hi Daniel,

That was my plan for strategy 2 (https://www.aussiefirebug.com/our-investing-strategy-explained/).

To sell down part of my portfolio each year to help supplement the gap between whatever the dividends didn’t cover. But the more I thought about it, the more I realised that I didn’t want to be held hostage to the volatility of the market.

Dividends are much more aligned with business fundamentals as opposed to share prices and won’t be affected as much by a crash. Think of it like house prices and rent. House prices can soar and crash, but rent usually stays relatively consistent through the cycles.

If I rely on selling part of the portfolio to fund retirement, I run the risk of a market crash coming just before or shortly after I pull the pin. This could mean delaying freedom by years…

And I simply feel more comfortable doing it this way even if that means missing out on some gains.

If I understand correctly, a LIC like Argo has 100% fully franked dividends, but an ETF like VAS has a lower percentage of franked dividends. Does this not present a franking advantage when comparing LICs to ETFs?

Sorry, I have re-read the article and I think I understand the answer to this question.

No worries. I was just about to say ‘Did you even read the article!’

Hi firebug,

Enjoyed your blogs and is trying to catch up as much as I can, I am new to the investment so please forgive me if it seems to be a plain dumb question to you, so how do you know if you purchasing LICs at discount or permuim?

Nice podcast explaining the difference between ETF’s & LIC’s. We look forward to seeing your web app to decipher what LIC is trading at a discount. Keep up the great work!

Will do Darren!

Thank you so much for explaining something I have been trying to understand for long time.

Great article!

Good stuff mate, you’ve clearly done a lot of research and thinking about this over the last few months and made the right decision for you. And that’s the important part. It suits you and you feel comfortable with it!

The MER for the big 3 LICs are 0.14% at the moment, slightly cheaper than quoted. Also you can go back to September 2001 on Sharesight to compare against STW – the other Aussie index ETF.

Regarding Argo’s lower return, it’s highly likely that it was trading at a high premium during the GFC – many old LICs were. They tend to move slower than the index on the upside and the downside, simply because there’s more long term shareholders who don’t rush in or rush out. Also more people flocked to old reliable LICs (pushing prices up) after trying their hand at stock picking during the boom and got burned lol!

Also I know everyone says international is the best because it’s been performing well lately, but these things go in cycles. The decade before this one, Australia way outperformed and before that it was US again. Based on current valuations, it implies Australia will have higher returns for the next decade, but again who knows. I’m not convinced overseas will continue to do better, but in any case, it doesn’t really matter to our strategy.

Keep up the good work buddy and congrats on forming your new strategy 🙂

Thanks Dave 🙂

I didn’t know about STW. A good one that’s been around for a while and can be used for comparisons.

Cheers

Why is low mer more important than return, eg WAM and PIC have high mer, but pay a much higher dividend than AFI or MLT etc……?

Thanks, really enjoy your posts

Because future returns are not guaranteed. The MER is a known value that does not rely on speculation.

Maybe WAM will continue to outperform, maybe it won’t.

It’s just my personal preference to go with the lower fees vs potential gains.

Thanks for another great post. Will you be ticking the drp box for your lic’s?

I would also be interested in knowing if you will be doing this or actually recieving the dividends to distribute out from the trust structure you buy them in to reduce future headaches eg if you were to distribute income to a retired parent and you did this transfer on paper only or if through money physically changed accounts and gets gifted back.

I don’t have DRP turned on. No other reason other than I like the dividends hitting my bank account. Give me a mental high (silly I know).

Great article and timely. I was looking further into the DSSP of LICs.. I would repeat Firebugs recommendation to read “FIRE blogger Carpe Dividendum’s excellent article”. Noting this Major difference to a normal DRP..

“Dividend Substitution Share Plan will eliminate your present income tax burden from the dividends, but it will also increase your future capital gains tax liability when you decide to sell the shares.”

Your cost base per share is continuously reduced using the DSSP. Which is great if you plan never to sell and get a hefty CGT Bill.

Hi AFB!

Would love to see the Sharesignt screenshot comparison between the two LICS + A200 versus the 3 ETF portfolio (VTS, VEU, A200) when say hypothetically investing $1M for “x” years. How much growth are we talking about and sacrificing in the name of dividend income if we only invest in Australian ETF/LICS than a more diversified portfolio?

Thanks again AFB! I’m still eight years away from retirement (using the 4% rule) and would like to have a clear strategy moving forward.

The only issue with that is A200, VTS and VEU are relatively new compared to the older LICS. So it’s hard to compare across decades (you can’t really).

The reality is that the future returns of Australia and the rest of the world are anyone’s guess. One thing that is a truth in this debate though, is that receiving income via dividends is slightly less efficient tax wise vs capital gains. This will compound over many years and decades. But again, I have come to terms with this fact and still pursue the dividend approach because it aligns more with my goals and mental side. I wrote a bit about it in my September Net Worth Update (LINK)

Thank you for a very useful article AFB! The more I read on the topic, the more I feel the Index Fund/ETF approach is best suited to US-based FIRE seekers, whereas the LIC approach is more suited to Australian FIRE seekers. The reasons in both cases are possibly due to the different taxation system in place in these 2 countries. Therefore it is so important we have Aussie-based blogs on FIRE by yourself Mr AFB, Pat (The Shuffler), and Dave (SMA). Most of the FIRE literature is US-based and focused on index funds. I think we need to wean ourselves off the US-model and instead focus on what works best here in Australia. For me, the low fee, ‘Grand-daddy’ LICs are the winner. Giddy Up!

It’s so great having a FIRE community in Oz. Challenging the norm is very important and we all benefit from it. I don’t think there is a right or wrong answer between the two if I’m being honest. It comes down to the individual but I like both for different reasons 🙂

Hi AFB. This is related to a question I have. Based on my research, I am looking at low cost index funds/ETFs with Vanguard. As I do not have 100,000 to setup a wholesale fund :-), Im looking at ETFs. VTS is one, but its not domiciled in Australia. What is the tax implications of investing in this fund? The equivalent is VGS from what I can see domiciled in Australia. I was planning to use my Commsec account to buy a lump sum. Or do you recommend another approach?

Thanks.

I’d buy IVV. It has the same low-cost MER of 0.04 and is domiciled in Australia. It doesn’t quite track exactly the same index as VTS but it’s close enough for me. I’ll be buying IVV in the future if I need exposure to the US market.

Will take a look. Thanks for the response.

I moved back to Oz this year to retire, and needed to create that income stream in one hit. We have been index investors for years, VAS is the preferred vehicle, but the pricing forced us to slow down. VHY on the other hand offered a different opportunity; the top elements of the company were struggling (four banks, Telstra, Wesfarmers), so the price is down and the divs unchanged. There is good reason to expect those elements to return to form, or at least the sentiment to change in the future. VHY does have a realised capital gain concern related to the small number of companies, 40-50, but in recent communications with Vanguard, the underlying FTSE index is working on rebalancing more regularly. One result of this is a lower franking ratio.

And on that note for the other outside super ERs, I would be interested to know how people are thinking to react should there be a change in the franking credits policy not being paid out in cash, this would require changes for us. One thing I have been thinking is to change from the 50/50 split with my wife, to weight to one side more, so that a tax bill is created so that I can claim the franking credits against tax paid. That, and I assume products will start appearing that are unfranked…

Huge changes to the Australian FIRE scene if the franking credit refund is axed. I have a bad feeling it will be too. Because it doesn’t affect the wealthy unlike some of the other proposed changes (CGT discount, trusts being capped at 30%) I think it will go through no worries.

Another great article, I was wondering how/if you would factor DRP discounts into your comparison of performance over 10 years, ie ARG give a 2% discount on additional shares acquired through their DRP.

Comparing return for return and not factoring DRP discounts during the accumulation phase would put some LIC’s at a disadvantage in your calculations.

Good question. Sharesight does have the ability to factor in DRP but I’m unsure if they would also factor in that discount… Not sure dude.

Would ETFs be the preference if at some point you plan to be an expat? (ie., retire overseas)

Yes. One main reason would be that I personally think the franking credit refund will be axed next year. This has big ramifications on returns that are basically half from fully franked dividends.

I had always wondered how ETFs were priced on the ASX. You explained it clearly as always! Love you work Firebug!

👍

Discount is not really a discount if you buy at a lower price but can’t sell at same price as NAV or higher. Since people are buying on discounts regularly, it means others are selling at price lower than NAV constantly. This basically just means LICs have low liquidity and nobody would buy people’s shares at their correct price so they are forced to sell at a price lower than what the share is worth.

Now, one can gamble on the fact that they buy LICs now at discount but liquidity will improve 30 years later when they sell and it will actually turn out to be profitable. But again LICs have been around for so long, if it hasn’t happened now, it’s unlikely to happen in the future.

The point of buying at a discount is not to sell it later to profit from the spread. It’s to buy the assets for less than their market value.

For example, if somebody buys BKI and it’s trading for $1.53, but BKI’s portfolio is valued at $1.61, it’s trading at around 5% discount.

Based on BKI’s current dividend of 7.235 cents per share, the investor buying at NTA value would get a dividend of 6.5% gross. But the investor buying those shares at a 5% discount to NTA, gets a purchase yield of 6.84%. The higher yield is locked in on purchase.

Couldn’t have said it better Dave 🙂

Would be great to see a post on VAS versus VHY. VHY paying out around 7.5% grossed up dividend. If investing for income paying 0.25% compared to 0.14% for MER is worthwhile as the difference is made up with the highe percentage of income

VHY is a great ETF. I just personally prefer to go with the lower MER. I don’t trust past performance that much

Hi there,

I was just wondering why in your Sharesight returns image VAS has the highest value but doesn’t have the highest percentage return. If you started with $1M then shouldn’t the highest value = highest return?

Most likely that dividends were not reinvested, so VAS had the greatest capital gain but not highest total return.

What Dave Said 🙂

Hi AFB,

Great blog btw. Definitely gives me a lot to think about.

My question is that knowing what you know now. If you were to start over again would you implement this strategy from the get go over your original idea of investing in the 3 ETF’s?

I have not yet started investing. Still trying to learn all the pros and cons over ETCS, LICS etc etc. What your thought process is when it comes to choosing your investments is very helpful to my understanding of how it all works.

Thanks again

For me personally…Yes I would go straight to strategy 3. YMMV

Great post.

If you go straight to investment 3 you wouldn’t hold the international share. Wouldn’t that be risky to be 100% Aus shares

Hi Anth,

I have an article incoming about the latest strategy update that will address this issue mate.

In a nutshell, giving the very real possibility that franking credit refunds will cease to exist eventually, Aussie shares to me are worth a lot less and are not worth giving up international diversification anymore. I’ll address this in detail in the article mate.

Cheers

Hi AFB,

Really liked your posts, keep up the good work!

The only comment I had was about the Legal structure / NAV section, when you say it is a disadvantage for ETFs that they have to sell underlying assets if lots of shareholders want to liquidate their shares in a bust – I don’t think this would be a negative, as all the losses would be borne by the person selling the ETF and they would just get a lower redemption value. Basically the trustee says “Fine, you want to sell the ETF even though the underlying assets are worth $75 (let’s say it was worth $100 last year). No problemo, it takes your 1 ETF share, sells 1 of each of the underlying shares for a total of $75, and pays you out $75”.

So basically, if you hang on to your ETF until the market recovers, you won’t be impacted. If you panic/sell, sure, you will cop a loss, but that would have happened with any legal structure (even if you held the shares directly), and at least you were able to sell and get your money (because of the liquidity). So actually this should be an advantage for ETFs, shouldn’t it?

Hi Szilveszter,

When markets become stressed, such as during the financial crisis, some assets may become illiquid, while others remain easy to sell. When this happens with an open-end fund, the first investors to exit will tend to receive cash obtained by the manager from sales of the more liquid assets.

Even ETFs that track an index have to internally rebalance every now and then to make sure that the fund represents the index they are trying to track as closely as possible. This rebalancing may trigger capital gains as some underlying assets may need to be sold.

This is good for the first lot that sell, but slower-moving investors are left with units in an imbalanced fund that holds mainly illiquid assets that cannot be readily sold and for which the theoretical valuation may fall further than the more balanced portfolio existing before the stress began.

This has been well documented for open-ended funds during the GFC.

Remember, you never actually own the underlying shares in an ETF. You own units of the ETF that own the underlying assets. The fund manager of the ETF must come up with the cash to give to the unitholder if they want to sell. If some of the underlying shares cannot be sold during a crisis, this is an issue! If an ETF fund manager has to rebalance and buy/sell shares during a crisis to keep the fund as close to the index as possible, this can cause headaches.

This process simply cannot happen in a closed-end fund because the underlying assets are not affected during the downturn (if you have a good fund manager that hold their nerve). The fund manager can sit back during the chaos and buy shares that are on sale and are not forced to sell.

If you’re invested in an ETF that’s highly liquid this is generally not an issue if you hold during a crisis.

Hope this answers your question.

Cheers

Very good post thanks AF

I have been thinking whether I should switch to all income and dividend focused portfolio like the one you have and the Peter Thornhill approach..

The main concern and question I have is that I am at the top of my income tax bracket, so doesn’t this make the all dividend income portfolio less attractive because of the high tax?

I presume you are investing your money in your Family Trust structure, is that right? I have a Trust also, so if I buy the shares in my trust, the dividend income needs to be distributed to the trust beneficiaries rather than re-invested…. is that what you do also! Or do you actually need to give the net income of the trust out physically?

Thanks

Victor

Hi Victor,

You’re correct that those dividends will not be as efficient as capital gains and because of your high tax bracket, the hurt is amplified.

Your trust actually gives you a very big advantage of having the ability to distribute to other beneficiaries INCLUDING a company… There’s a trick that involves distributing income from the trust to a ‘bucket’ company where the income will be taxed at a flat rate of 30% and can sit and grow within the trust. You can then wait until you’re in a lower tax bracket and have that income eventually flow down to you, the shareholder of the company.

If any of the above sounds confusing, speak to an accountant.

Hope this helps mate 🙂

thanks AF..

quick question: the NAV of AFIC and MLT… it’s basically the Net Asset Backing published on their website, isn’t it?

Correct

Milton’s MER is now 0.14% rather than 0.12%.

also, when you look at the LIC’s NTA.. do you look at the Before or After Tax NTA to determine whether it’s trading at premium or discount?

That’s a tricky question. I usually just look at the number on the front page of their site and use that.

But it actually does depend on the company. Have a read of this. https://www.intelligentinvestor.com.au/pre-tax-v-post-tax-nta-1811686

Hi AFB,

What if I plan to retire outside of Australia (either Portugal, Spain, Italy, Thailand, Philippines, Bali etc.), is it still a good to be 100% in Aussie ETFs/LICS? Or would it make more sense to have some International ETF (e.g. VEU + VTS or VGS) allocation instead of pure Aussie ETFs/LIC (e.g. A200, ARG, MLT)?

If Labour removes franking credits, I would lean towards more international especially if you’re going to be living overseas. If they don’t, the franking credit refund would be gravy if you moved overseas because you could earn up to $18,200 tax-free PLUS FRANKING CREDITS!

But if they’re removed, you would lose your franking credits 🙁

Thanks AFB! One thing to note also, if your Australian retiring overseas and is a non-resident for Australian Tax purpose, Franking credits are not available (https://www.ato.gov.au/Forms/You-and-your-shares-2013-14/?page=14).

Well, there you go. Scrap that then. Without the franking credits, Australian shares lose a massive advantage and I would go more international for sure. In fact, I probably would have any Australian shares at all if I was retiring overseas, to be honest.

Hey AFB, New reader here and very excited for the future.

Two questions.

Do you have a breakdown of your budget/spending monthly. My wife and I earn reasonable income and feel like we live week to week despite budgeting and trying to avoid unnecessary splurges. I struggle to imagine how we could accrue 5k a month.

Secondly. Do you have a post on How you actually invest. Directly through vanguard? or self-wealth/nabtrade etc.

Cheers mate.

Hi Trav,

Check these two posts out. I believe they are what you’re looking for?

https://www.aussiefirebug.com/savings-review-17-18/

https://www.aussiefirebug.com/how-to-buy-etfs/

I invest through SelfWealth

Cheers

Hi AFB! have 2 x main LIC’s in Argo and AFIC and am adding to them in $5k parcels. At the moment I am down quite a bit on capital because I think I have bought them at too high a price and now the market is down overall. Should I be worrying about this capital or not really? I’m trying to build the portfolio up so that it makes an income stream for me later on in life but it seems I bought just before the market took a downturn and am down quite a bit on capital for both LIC’s at the moment! Any feedback would be much appreciated!

Hey Mate. Great job on all the things you are doing. As I have just got to your site and read through a couple of your beginning blogs up to this one. Are you still using SelfWealth as your trading platform for ETFs and LICs? I am looking to put some money into ETFs etc.

Don’t bother about replying I literally just read the last comment here and you said you use selfwealth haha classic!

Thanks Phill.

Yep, still using SelfWealth. They’re the best!

Hi, I just found this blog and listened to this podcast. I enjoyed your talk on LICs versus ETFs. It was very clear to a non-finance-educated person. You have a clear but conversational style. I also like that you are Australian-specific. After having a quick squiz at your 2018 goals and costs I am amazed at how little you spend on groceries, it is definitely a space we can improve on. Keep up the good work and keep on inspiring others to achieve this awesome goal. Ps. it was funny to read how you attended a work function with others boasting about their BMW’s and fancy shoes as my partner and I encounter the same thing with others and have a little chuckle about how those things are definitely not in our list of priorities!

Thanks, mate.

It’s funny because I think groceries are one of our biggest splurge items and I’m not joking. We buy so many little treats and brand items. If we REALLY wanted to cut it down, I reckon we could chop off 35% of the bill no worries. But life is about living and we enjoy our treats 😁

Hi AF,

For someone who is just starting their LIC portfolio and is in the top tax bracket, it seems like going with AFIC and Whitefield (the two LICs with a DSSP) would be the best option.

Instead of having your dividends taxed at 45%, you can reinvest them without triggering a taxable event (as no cash changed hands). However in doing so, you give up the franking credit (worth 30%), but this still leaves you with a 15% tax saving overall. Is this correct?

The downside being you’re just off-putting a larger CGT event for later if you ever decide to sell. But for those who will never sell, and just want to retire and live off dividends – this seems like the fastest way to grow your LIC portfolio.

Btw I just discovered the blog and love it (especially all the Simpsons references). I’m very similar to you; a “90s kid” with migrant parents who grew up in Melbourne. Been sharing the blog with some family members and friends – keep up the great work!

Hi AFB,

If I’m a high-income earner and have 10-15 years before hitting FIRE, does dividend growth approach going to hurt me regarding paying higher taxes for 10-15 years of receiving higher dividend income? AFI most of the time is trading at a premium, and WHF carries larger MER (the two LIC that have DSSP feature), so does this mean the only logical method for me is to invest for growth (which means spending internationally, e.g. IVV or VGS)? By doing so, I can decide how much tax I’m going to pay by how much I’ll sell once I hit FIRE, whereas if I’m following dividend growth investing, I have no say in the matter (if I’m not invested in AFI or WHF)?

It may… AFI with DSSP turned on during your accumulation years is a great option.

IVV and VGS are also good options. There’s not really a right answers here.

Things changed also. It’s my opinion that investing in great companies locally or internationally should be the main goal.

Aussie shares or international shares can achieve this either way you look at it.

Maybe a bit of both wouldn’t hurt. If you invest in a trust you can hold the earnings in a bucket company to distribute later on life when you’ve stopped earning a high income.

A lot of food for thought.

Hi AF,

I am curious as to your thoughts on the potential ramifications of the (likely) change in Government to Labour at the next election and the proposed changes to Franking credits. In the short term, would it be beneficial to hold from purchasing AFI with a view that a likely discount could be coming following the election?

I will continue investing through strategy 3 until actual laws come in that dimishes it’s effectiveness.

Removing the franking credit refund would certainly affect our strategy and it would then be time to sit down and tweak the way we invest.

I don’t like to speculate on something that might to actually happen. It would essentially be the same as trying to time the market and we all know that rarely works out consistently over the long term.

Never stop adapting, never stop learning. What works well now might not work so well in 5 years. The strategy is never set in concrete.

If franking credits are stopped couldnt LICs just stop giving a dividend, spend more money (increase NTA by buying more stocks) and reduce their profit, thereby increasing their share price? Then if you needed some money you could just sell some shares. Does that make sense?

I don’t believe so Jimmy. The LICs invest in companies that pay a dividend whether the LIC wants it or not. As soon as its paid, the LIC has no choice but to declare that as received income and its taxed accordingly (@30%).

What might happen is the companies themselves would chose not to give dividends and retain earnings… But if this were the case, I would switch back to a more internationally diversified portfolio as the incentive of the dividends would now be removed.

You’re saying a company (a LIC) is taxed on gross income, but wouldn’t they be taxed on net income?

And would you think an LIC buying stocks is an expense? Where’s an accountant when you need one 😀

My understanding (probably wrong) is that LICs don’t currently distribute 100% of their dividends, so they could probably change that to 0%, unlike an ETF which needs to distribute profits.

A company is taxed on any profit. Income – expenses = profit. But since these LICs run at such low management costs, most of that grossed income will be taxed. You can minus a little for the cost of running the company but it’s not ganna be much.

Hi AF

Why have two LIC’s in the same market as in AFI and MLT? Doubling up?

Reduce management risk. Also, AFI has dssp but Milton has a lower MER.

What website did you use to compare the LICS and ETF in the historic returns section?

Sharesight mate (Podcast – Portfolio Reporting – Sharesight

I’ve just discovered and love your blogs and podcasts – what a refreshing insight into the sharemarket! Thank you!

We’re totally new to shares but have been researching to find what would work for us.

Partner and I are in our early 40s on average/lower incomes, but due to budgeting and some good timing in the property market, we are close to having our mortgage paid out – currently tracking for 3 years (if we continue to pay 70% more of our min mortgage repayments). Also had an IP in the past – not our thing.

So now we’re wanting to reset – and start to create a share portfolio that will hopefully enable us to not be reliant on our current jobs in 10-15 years. Obviously access to our modest super (projected $500k+ between us at 60) won’t be possible before 60, so hoping a share portfolio will help fill the gap in between.

Looking to cut back some of our extra HL repayments and invest in the market in $5K blocks (registered on self wealth already) – we have our first $5k ready – then further $5k investments every 6 months until the house is paid off (adjusted to 5 years), then maybe $20k a year onwards.

I’ll also be receiving $100k inheitance this year- not sure yet if this should be used to totally clear the mortgage (with $$ left over) or invest??

So far I prefer the liquidity of etfs? And I don’t think franking credits will be relevant/important to us… As we’re novices, should we just buy diversified ETFs like VDGR – my risk profile is balanced-growth (with the high MER I think you’ll say no), or choose a split of A200/VAS/VGE/IVV etc?? If the latter i have no idea of the ideal portfolio split to achieve, nor how with $5k purchase parcels? Then there is the inheritance?

Help! Any suggestions/tips/things to consider??

Thanks!

Hi Optimistic P,

Paying down debt is never a bad thing. Historically speaking you may end up more by investing instead but if you’re unsure, getting rid of debt can put your mind at ease.

VDGR is a great ETF and I think that any of the Vanguard diversified ETF’s are fantastic for someone who doesn’t know a lot and just wants to set and forget. You can’t really go wrong with that. I like to have a bit more control and a bit more of a fine-tuned strategy but honestly, the difference between the two investments will pale in comparison to keeping your expenses low. That’s the main thing you should be focussing on.

I’d say the most important thing is to just get started. Buy a small amount, see how it works, watch the dividends hit your account, etc.

And continue to read read read and learn as much as you can 🙂

Hey mate just wondering on that share site spread sheet comparing the LIC’s to VAS how the dividends are so high? When I look at them on CMC Markets they’re all around about the 4-5% mark

Don’t use CMC markets! They most likely don’t take franking credits into consideration. Stick with sharesight for comparing historic returns. Especially Aussie ones.

Will do thanks mate!

Howdy AFB. I’ve been enjoying your posts and podcast. Great stuff. I like the cut of your jib and your Strategy #3.

I’m new to the caper but began by investing recently using a diversified balanced growth portfolio with Six Park, who spread across six ETFs – Vanguard VGE, State Street DJRE, State Street STW, Vanguard VGS, VanEck IFRA and iShare IAF, with the lion’s share held in the Australian and international equities ETFs.

They charge 0.5% per annum

If your account balance is

between $10,000 – $199,999 but I like the fact they rebalance to the target asset mix for my risk profile. It’s set and forget and gives me diversification.

Sorry if you’ve addressed this but I plan to invest this month’s savings in an LIC, such as AFIC or Whitefield, or an EFT, such as VAS. The following article pricked my ears up. What did you think?

http://www.thefiexplorer.com/2019/01/19/sounding-the-depths-a-skeptical-view-of-listed-investment-company-investing/

Great article! I haven’t looked into it deeply, but I think there is another difference between LICs & ETFs that would favour ETFs. Both ETFs and LICs buy and sell their underlying assets. LICs do it when their management team think it’s a good idea and Index ETFs do it when the index they’re trying to mimic get re-weighted or when there’s a net outflow due to unitholders selling their units.

Companies (eg LICs) that own shares don’t handle capital gains very well – they get treated and taxed as if they were ordinary company income. Truss on the other hand pass through capital gains as capital gains. Thus as the shareholder of a LIC you miss out on the 50% CGT discount (if the asset sold had been held for more than 12 months). Hence the hugely complex tax statement you get from Vanguard each year. Since trusts work on a pass-through basis, ETF distributions are part dividends and part capital gain/loss.

Admittedly capital gains make up only a small part of of ETF distributions – and the impact varies depending on your top marginal tax rate – but every bit helps!

Good point JD.

Although the older LICs don’t usually sell the underlying assets often which minimising this point but it still stands.

Cheers

Hey AFB! I really like the idea of strategy 3, as it seems to make things super simple stupid. I’m 19, and have 5000k to spare; I want to invest this ASAP, but I’m not quite sure where to invest it. I was going to go with VTS, but this seems complicated- I dont like the look of the double taxation rules, estate tax, not being a U.S. citizen etc. Do you think it would be a good idea to take an aggressive approach and invest the 5000k into VAS ETF or the A200 beta shares? I like the sound of LIC’s but I would prefer the simplicity of an ETF (more hands off from what I understand). I would like to become a FIRE bug myself, so I just want to get started quickly, stick with it, contribute as much as I can as often as I can and see where it takes me. I am very new to all of this, and my family/friends don’t seem to have much of a clue when it comes to shares/index funds etc. I am also certain that I will be moving out of Australia in the future (after university) and would preferably like to never come back. What do you think is the best thing for me to do?

Hi Isabella,

Do you mean $5,000 or $5,000K which is 5 million haha?

Asking what’s the best asset to invest in is an impossible question to answer. This just way too many factors to consider. What I would say to you is continue doing your research and try to formulate a plan of attack.

A lot of people want financial independence. But that can look completely different depending on the person. Work out how much you spend and then work out how much you need invested to replace that.

Once you have those numbers you’ll be in a better position to make a decision on what’s the best way forward. Keep your expenses to a minimum and only spend money on things that make you happy!

If I were in your position, I would devour every book/blog/video/podcast about FIRE and investing I could get my hands on. You’ll learn a lot and more importantly, when you do take the leap into the world of investing, you’ll be prepared and confident and will be able to fully understand your strategy. This is the most important part.

I would love for you to become a FIRE bug 🙂

Hope that helps a little.

-AFB

Hi AFB, I stumbled upon your website and I had learned a lot!!.. This article is so informative. Now, in our portfolio, we are heavy in ETFs. Having said that, we also have a good percentage of AFIC.

I’m glad you enjoyed it 🙂

Are you still happy with your Milton purchase?

Currently looking at Milton and Argo and trying to decide which one to buy

Yep!

So far so good. Not really long enough to anything different though. Come back in 20 years 😛

Hey mate, would your strategy change with the evidence around growth of ETFs vs. LICs. Check out the first graph of the below article? Love your work. https://www.afr.com/markets/equity-markets/disastrous-performance-almost-all-listed-funds-underperform-market-20190815-p52hh4

Check out Whitefield, Samuel. Holds its own against any of A200 or VAS and has actually comfortably outperformed them in the past 6 months (small sample size, I know but it is a cracker). It also has a DSSP which is great. Thornhill knows his stuff. Industrial LICs are the go.

Hey Samuel,

I actually have tweaked my strategy in my last article (strategy 2.5).

Check that one out 🤙

Hey Mate,

Love what you are doing and the content you continue to produce. Found myself reverting back to this thread for some reason and was just wondering if you have made any headway on the development of your web app to evaluate the NAV of different funds? As I understand it this will assist providing a justification for which is the best fund to sink some coin into at that point in time.

Cheers,

Josh L

Hi Josh,

Ahhh man… the web app. So it’s a really frustrating story with that.

I have it done (basically) and I spent hours and hours on it. But what happens with me and stuff like this is I dedicate myself fully until it’s almost complete and then sit back and say ‘I’ll add the finishing touches and publish it… and that was nearly a year ago!

I did the same thing with the Aussie FIRE calculator. Spent ages on it… left it for like 4 months and finally finished it 🤦♀️

I need to dedicate some time to just get it out there and go from there. I’m ganna pencil in some time right now dude!

Thanks for reminding me about it

Hi Aussie Firebug,

I’ve listened to an american investor share his strategy and it consists of having 3 months of living expenses in a bank account, then investing the equivalent to 3 months of living expenses in Bonds, then Reits, then Blue Chip Stocks, then Large Cap stocks, then Mid Cap Stocks then Small Cap stocks.

He moves from lower levels of volatility to higher. He said very clearly that this is his own strategy, and that are many ways to achieve financial independence.

I looked at these asset classes myself and identified the ETFs for each one of them, except Bonds, and then run a portfolio simulation in Sharesight to compare those ETFs individually with my portfolio (AFI, ARG, BKI, MLT, VAS) and my portfolio gave me a higher Total Return and Dividends. I’m not sure if I’m missing something, if this is not as attractive in Australia or if he might have picked stocks individually that have better performance than the ETFs.

Have you ever considered those asset classes or do you think that’s already part of VAS and LICs? (I’m still learning)

Thanks

Hey Alex who is the American investor you are referring too?

Hi Kieran,

His name is John Demartini, he explains his strategy in one of his courses. He has courses about various topics, he’s a polymath.

Each to their own I suppose, but if your reason for investing is to get an increasing income stream, then dividend-producing shares are the best way to go. Furthermore, a portfolio of Aussie blue chips such as those found in our favourite low fee LICs and Vanguard ETFs is probably the only way to go. You could add some low fee, International Share ETFs if you want to chase a bit of growth, or just stick with the local market. This particular strategy should also result in a simple to manage portfolio.

Very nice 👍👍

My 2 Cents.

Thanks for your comment Jeff, it’s great having this space to discuss different approaches. I’ve been thinking of adding VTS to my portfolio. I have increased my international exposure in my superannuation.

Hey guys,

Please join the new FB I created for discussion exactly like these.

It’s sometimes a bit hard to follow and comment on these articles. I’m active in there too so feel free to ask questions.

Cheers

I thought your comment sound familiar by the man John demartini.

I’ve don’t a couple of his courses..

Correct me if I’m wrong but john says do that so you learn about each asset class as you go through which will leave you more empowered in your wealth. In saying that I know John has and always will never stop buying index funds.

Looking to do prophecy next year so will find out more about johns investing philosophy then.

Have you done any of his courses?

Thanks Kieran, yes, I’m slowly starting to understand the classes as he advised. He’s said even recently he buys index funds and has a passive approach.

I’ve done Breakthrough Experience, Master Planning, Prophecy I, Empyreance I and Demartini Method Training Program. You’ll love Prophecy I

Oh wow you’ve don’t a lot! That’s awesome.

See you at master planning in feb?

Not this time, maybe in another one, I’m in Sydney 🙂

Hi Alex,

Every single investor is different and will want slightly different things. They’re too much to cover in this comment but I suggest you continue doing your research on various asset classes and see how these could help you with your overall goal whilst also factoring in your risk tolerance, investment horizon and sleep at night factor.

There’s no such thing as the optimal portfolio because some people will want more returns and accept volatility while others will happily choose lower and more stable returns.

I’ve considered many assets and the portfolio we have now (you can see it in our net worth updates) is the ones that suit us best right now.

Hope that helps mate.

Great, thank you !! makes sense

Very good (and balanced) summary of ETFs vs LICs. Thank you.

Is there any reason why you didn’t throw AUI and DUI in the LIC mix. Their returns over the past few years seem to have been a bit better than their “old style” LIC peers. Plus DUI has some international exposure – ironically through owning ETFs in the LIC!

Thanks Al.

Ahhh no real reason. I don’t really know much about thos LICs I’m sorry.

I’ll take a look now 🙂

Hey AFB, just found your website and getting started on my FIRE journey. Just wondering how you go about reinvesting your dividends? I’ve heard about computershare that automatically does this for you. Any other options?

Hey mate,

I literally just transfer the dividend into my brokerage account when it’s paid. That’s it. Same tax result as turning on DRP anyway but I like the mental kick out of seeing the dividend hitting my account

Great post, Thanks for opening my eyes to LIC’s.

Whats your opinion of using IWLD as a one fund 100% stocks portfolio?

Hi Paul,

I’m glad you liked the post 🙂

I haven’t done any research on IWLD I’m sorry. From a quick Google, it looks pretty good. Very similar to VGS right? I’m not sure I’d go with it as a one fund portfolio though. That’s just me. I’d like to have some more diversification.

Hope that helps mate 🙂

Hey FB,

Thanks for the insights and info.

I have a question about Sharesight/Shares/Banks: I have a SMSF – just entered actual retirement…bit late, but better late than never. I currently use a Macquarie transaction account (currently negligible interest) for the Funds banking and day to day operation, and I also the Macquarie trading platform mainly for the intergration and convenience. Question is if I use Sharesight do I have to have my share holding transfered from Macquarie over to the Sharesight side? Thanks in advance.

Cheers Paul.

Hi Paul,

I’m glad you’re enjoying the site mate.

Sharesight integrates with whatever broker you use so you don’t need to transfer your holdings at all. Hope that helps 🙂

Cheers

Hi AFB! Just had a question about the section “When to buy”. Makes sense to wait until AFIC and Milton are trading at a discount, then to invest in the index. Have you thought about just holding until those LICs start trading at a discount? Or considered adding another LIC in the mix when assessing NAVs? What would the pros and cons be of each approach?

hey AFB I have been actively following your progress and wish you had been around 20 years ago as your information and wisdom is life changing! and your generosity – sharing all your knowledge, calculators/tool and research is awsome! keep up the fantastic work , it is so appreciated.

I love your approach and no nonsense, independent and verified approach.

Thanks Luke 🙂

Hi Aussie Firebug

Great website – there is so much useful information here!

I’ve just received a lump sum payment and want to do a similar strategy. Is it better to DCA or just lump sum the whole amount into the market right now?

And which online broker do you use/ recommend?

Thank you very much.

Thanks John!

I can’t give advice on those matters, mate. I’m a fan of lump sum investing though.

I also can’t talk about financial products like what broker I’m using because I’m unlicensed and ASIC might throw me in jail lol.

Sorry if that’s unhelpful

Hi, have you looked into FGX and FGG, both LIC with 0%MER, the equivalent of the MER is given to charity (1%). Their results seem pretty good, what do you think?