Since we do all of our accounting at the end of the financial year it only makes sense to see how we did in terms of savings in July.

You can check out last years review here, but to sum up 16/17, we achieved a savings rate of 63%.

So how did we do this year?

Let’s get into the numbers.

Savings Rate For 17/18 Financial Year

Our savings rate for last financial year was… 66%

We earned $141,497 (after tax)

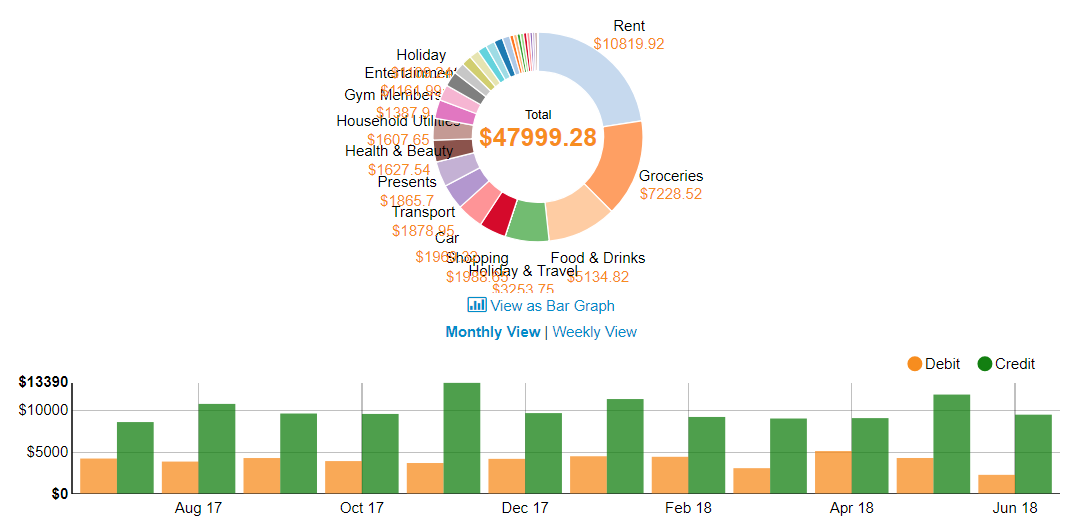

And spent $47,999

Sooooo happy with 66%! At the end of 2017, I posted our financial goals for 2018 and one of those goals was to achieve a savings rate of 65% or above. We ended up coming in last year at 64% 😭 haha, so I’m very pleased for us to reach 66% at the end of this financial year. Hopefully, we can carry it through until the end of the calendar year 🙏.

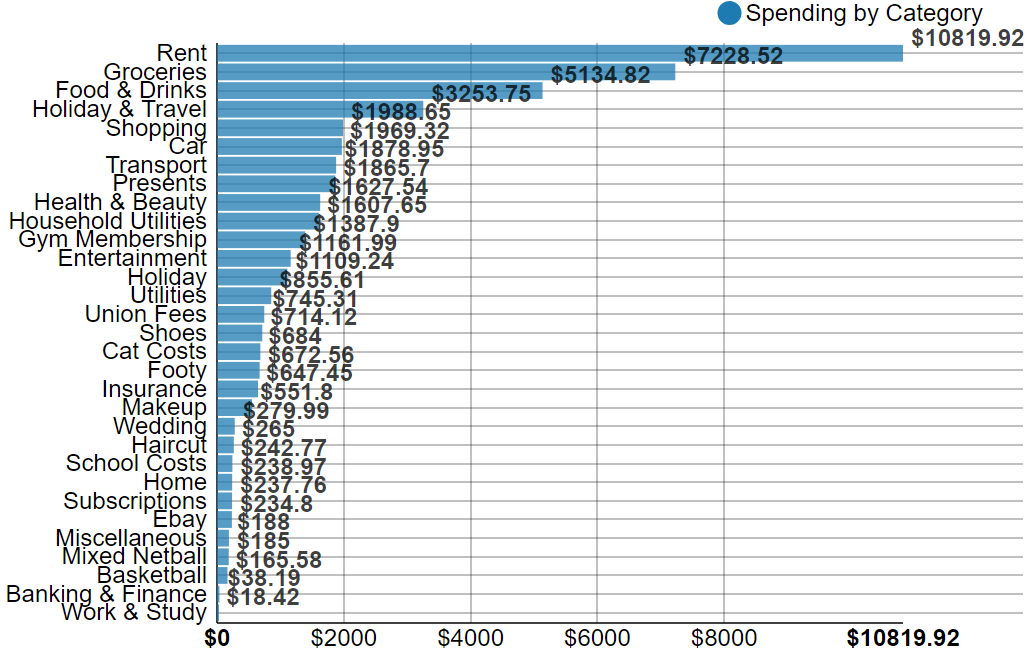

Breakdown Of Spending

So what did our precious $$$’s go?

And in pie form

There are a few little issues with the tracking categories for this year because Pocketbook had a major revision of their categories and it resulted in a few double ups and what Pocketbook thought something should have been categorized as and my interpretation. For example ‘Car’ was a major category for me using this software, but Pocketbook replaced a lot of my ‘Car’ transactions as the new category ‘Transport’. There’s also ‘Holiday and Travel’ and ‘Holidays’. The overall numbers are correct just some of the categories might not make much sense.

A few interesting things to note about this year’s breakdown compared to last years.

Rent and groceries still dominate the top spots so no changes there.

Interestingly ‘Food and Drinks’ came in at number 3. This category includes alcohol and going out for breakfast and dinners. It’s really no surprise that it’s number 3 for the last 12 months. Since I changed jobs at the start of 2017, we made the move back to our hometown which has resulted in us being a lot more social. We go out for drinks on Friday nights (in Summer) and get to hang out with friends a lot more. This has resulted in a lot more money being spent on social things but I have to admit, it’s been absolutely fantastic and well worth the extra spending.

A positive from the move was that we are now driving on average, less than 400km a week compared to our old commute to work. This has resulted in us being home a lot earlier, generally feeling a lot better because we’re not stuck in our cars so much and $1,523 difference in fuel mainly from our shorter work commute.

Amazingly we spent nearly the exact amount on groceries which is very interesting.

The lack of weddings certainly helped our savings rate. But interestingly enough, we have booked a lot more holidays than the previous financial year. I have a feeling that’s because we went to so many weddings in 16/17, it scratched that holiday ich that usually starts pestering in the colder months.

We spent nearly $2k less on presents which makes sense due to the lack of weddings.

And all the other stuff is pretty much on par.

What About You?

It’s so important to track your spendings. It’s always my number tip for people to reach FIRE quicker. I’m stoked with a savings rate of 66%! But it can always be better.

How do you stack up? Maybe 66% is easy street for you or near impossible for others. Remeber, it’s not so much about killing yourself to achieve a higher savings rate, rather acknowledging where your dollars go each month and being at peace with that or changing it up if you’re not happy with the current status quo. But you’ll never know unless your start tracking 📈

So what’s your savings rate?

Impressive stats! Quick question for ya, what percentage of your savings is in investments? I know it all comes down to personal risk appetite, but I’m trying to figure out a good starting point!

We keep around 6 months of living expenses as an emergency fund and the rest goes into investments. So pretty much all of the 65% savings from the last 12 months have been invested in the stock market.

Where do you keep your savings? Do you keep it in an offset?

Offset all the way!

You bloody legend. That’s an awesome savings rate. Great tracking, despite the setbacks.

Ditch the union fees!

Scab!

No way dude! Mrs. Firebug is a teacher and her income has gone up considerably in the last 4 years. The unions were a big part of the payrise we have benefitted from.

I work for a union and help low paid (and definitely some high paid more skilled workers) get together to bargain for higher wages every year. My union’s unlocked wage increases for some of our strongest sites this year of 12% over three years, which is remarkable given how stagnant wages are generally. Getting into a union and pushing for better pay with your workmates is a great investment for PAYG employees. Plus the fees are tac deductible.

Of course a controversial topic not all will agree, but happy to see one of the FI writers that’s inspired me with my personal savings/financial planning seeing the value in unionism 👍👍

Thanks heaps for this! HOW ANNOYING was Pocketbook changing the categories? It took us hours to sort ourselves out again.

Could I please clarify, do you count paying off the mortgages on your investment properties as savings, or are they cashflow positive?

Hi Emma,

They are all cash flow positive and we don’t pay off any of the mortgage. But if I did, I’d probably include it in our savings rate as it technically would be savings.

Congratulations Aussie Firebug, that’s a great savings rate! I do salary sacrifice into super so our savings rate can be calculated a couple of different ways, but looking at investments/(gross income – tax and Medicare) I get us to about 47% or so which isn’t too shabby. I’m pretty sure you’ve said you don’t do salary sacrifice into super because you figure it just puts back retirement for you, in my case assuming all continues as projected I can access it within 10 years of retiring so it kinds makes more sense for me given the big tax incentives.

Looking at your spending and comparing it to our spending I noticed a couple of major differences. In particular, you don’t seem to have any health insurance or personal insurance (Life, TPD, Trauma, Income Protection) although you may have at least some of the latter in your superannuation although this is usually absolutely terrible quality. Is there a reason you don’t seem to have much of these types of insurance? You do have a line for insurance which I’m assuming is contents insurance and your car insurance is bundled up into your car costs? I also can’t see anything about your internet or mobile costs, maybe that’s bundled up into another cost as well?

One of the other things this made me think about is that it’s so much easier for higher income earners to have a high savings rate than lower income earners. A lot of the costs of living are pretty much fixed, you need to pay rent or a mortgage (for a while anyway), you need to buy food, you need to pay the utility bills and as much as you can shop around for those things and pay less you do still need to pay a fair amount. If I look at my fixed costs for stuff like that it’s well over $20k, and that’s with the house already paid off. When I was renting it was closer to $35k (we have two kids so living in a share house is probably doable but really not ideal) and it’d be even more than that if I was paying off a mortgage. I earn a decent wage so all that sort of stuff is fine to cover, but if I was earning say $50k (which a lot of people are) and my wife was either not working to look after the kids or working but essentially just paying for childcare, then it’s a hell of a lot harder to have a decent savings rate. It’s not that you couldn’t do FIRE on a low wage, but it sure would be a lot more difficult.

To some extent this applies to having kids as well, you add on a lot of expenses through things like buying more food and clothes, ideally living in a house rather than just renting a room, kinder/daycare/school fees as well as sports activities and swimming lessons etc. Again it’s not impossible as plenty of FIRE bloggers have shown, but it does mean you probably have a fair bit higher living expenses than a pair of DINKs.

Hi Sean,

You’re right about the insurance mate. We only pay for car insurance. And building for all the properties of course (but this isn’t included in the graphs).

I’ve never seen the need for income insurance tbh. I get it for people who need to support a family, but when/if the time comes for us to have children we should be pretty well hitting FIRE or not far off it. So income protection doesn’t make sense for us. Financial indepence is sorta like the ultimate insurance I guess.

Our phone and internet bills come through as utilities from memory. I have a work phone but we pay $60 a week for internet and Mrs. Firebug owns her phone outright and pays around $35 a month.

You’re 100% right about high income earners. And it’s true that low income earners can still achieve FIRE it’s just a lot harder.

A DINK couple in their 20’s is really the sweet spot for supercharging your wealth. It’s a unique time in your life where you’re earning full time wages and with little to no responsibilities. It’s just unfortunate that it’s some of the best years of your life and a time when all your friends are going overseas and living it up. But nothing worth having is ever easy or without sacrifice.

I see income protection as protecting me until I have enough saved up for FIRE. Because if something happens to me and I don’t have that income coming in then there isn’t going to be any FI, and any RE is not going to be on the terms that I want. It helps that it’s tax deductible but I’d still have it anyway, plus it’s pretty cheap when you’re young.

I spent most of my 20’s and 30’s for that matter living and working overseas so didn’t get as much saving done as I would have liked, but I loved the experience. For me it’s about acknowledging the tradeoffs and prioritising what’s important to you. So doing all that travel when we were younger has definitely pushed back FIRE, but I had a great time doing it and my job is enjoyable most of the time anyway so the tradeoff has been worth it. Obviously it doesn’t work out like that for everyone though.

May I ask how you spend only $200/wk on rent?

Is that by sharing a house or apartment?

That’s county living for ya. $200 between Mrs. FB and I 👌. We live in a unit

Congrats on a great savings rate. How did you manage to spend only a little over $5100 on groceries for the whole year for the two of you? I’m spending about double that for two, so always looking for tips!

It’s funny because I think we can still save a heap in the groceries department! I meal prep all my breakfast and lunches. Mrs. FB has recently switched to a keto diet so our grocery bill has sky rocketed 😭.

I’d say meal pepping is a big one and to always bring your lunch from home when at work. We hardly ever buy steaks and try to only spend $16 or less per kilo on meats. When fish is on special, we buy heaps and just freeze it.

There seem to be some great specials on steaks at the moment actually, Aldi have blade steak for $10 a kilo! We stocked up with about 4kg worth which is 8 to 10 meals for us! Taking your lunch to work is huge though, that can easily be $5 to $10 saving a day or even more depending on your taste. I also buy cartons of soft drink cans and store them under my desk with a can going in the work fridge each day. It’s about $0.50 a can this way vs easily $3 at the supermarket or shop.

The pie chart has a different figure for groceries than the bar?

Oh I see the bar is just squashed together a bit, sorry.

Fantastic work. That is a lot of cash saved up. Well done to you!

Amazing work, keep it up.

Is this only possible with 2 incomes, as I’m struggling to work out how a 1 income family can make this work????

Hi Simon,

FIRE is defiantly possible on one income it will just take longer mate. It all comes down to your savings rate.

Slow and steady wins the race

$235k income after tax

spent roughly $101k – I haven’t been tracking the exact figures…but here’s the breakdown

– about $5k monthly ($60k per year) living expense incl. all bills, grocery, food, also include all childcare cost, swimming, piano lessons for the kids etc

– $11k mortgage interest

– about $30k holiday travels, monthly splurge ( a bit too much splurge)..

so a saving rate of about 57%

A lot to work on this year to get it to 65% but definitely doable… now that’s my new goal for the year!

Excellent savings rate. I mentioned you again my podcast series at CastBox.fm – Dev Raga.

Congratulations on a fabulous result!

I love a bit of financial comparison, I find it super interesting to see where people spend more/less than I do so thanks for sharing.

Hi FB,

Loving the blog. Just wondering what you use for all your spreadsheets? I know you use pocketbook to track expenses, but I like your spreadsheet.

Thanks, Josh.

Which spreadsheets are you referring to Josh?

I use Google sheets if that’s what you’re asking?

I mean the breakdown of your expenses. The graph & piechart look nice & our real easy to follow. I want to start using something like them to track my expenses.

That’s pocketbook dude! It’s the analysis part of the site.

Ah ok, so on the website and not the app?

Thanks Man 🙂

Congratulation for having such incredible saving rate. I can see most of the money spent on rent, groceries, and transport as well. But we can’t do anything for this as prices are hiking to fast like a rocket. I am not sure how much will be my saving percentage for the coming year but I guess, it would be less than the previous year.

Good luck! My wishes are with you that your saving percentage this year must be maximum say for 80%

Just calculated our savings rate – 84%

But we have a paid off house so that helps.

We also spend <5000 a year on groceries for family of 4. We do this by shopping at Aldi, markets and only buying the specials at the major supermarkets. We eat meat twice a week, fish once a week and lots of fruit and veg. We also have a lot of fruit trees and a small vegetable garden. We just got chickens so that's a bit of fun working out how to make them economic without spending lots of money on chicken food. We bike everywhere and only have one car. We still spend too much on insurance.

👏 that’s incredible. I look forward to the day where I can grow a lot of my food. Healthier, cheaper and better for the planet. Win win win really.

84% is the best savings rate I have seen – well done!

That’s awesome, less than $100 a week on food for a family of four; how old are the kids?

I’ve gone to Aldi a few times for bits and pieces but haven’t done a big grocery shop there

The kids are 7 and 10. Just did the figures again for annual year and it was $90 per week. I do get 4 free lunches a week at work though. We have a direct farmer to consumer store where there is lots of lower quality produce for cheap. I am absolutely fine with spotty apples or odd shaped capsicums. They also have seconds fruit and veg where other shops would throw it out. For example 1kg bag of mushrooms for 50c. We never waste food and I make vege soup that is essentially free. On a Sunday night I go through the fridge and cook up all those veggies that will be thrown out in a couple of days – like that half an onion, limp celery, dried black ended carrots, broccoli stalks, outside leaves of cabbage. I add weeds from the garden (rocket, plantain, dandelion, broccoli leaves, mint parsley). Beautiful tasty healthy soup. We don’t buy any preprepared foods except mustard, tomato sauce and some crumbed fish fillets. I make our own halloumi, feta, yoghurt, hummus, tahini, bread (not exclusively), cakes, biscuits, pizzas, pasta sauce. But we still eat fancy stuff – smoked salmon, capers, olives, chocolate but we buy on special and often in bulk. We know what is a good price for everything we buy and bulk buy when on special. We enjoy food preparation and hate food waste. Now any wasted food and garden pests goes to the chickens and gets turns into eggs.

We have the same income as you but managed to have a savings rate of 82% 🙂

Helps that I cycle to work, we almost own our house, so little interest paid, and we are probably more frugal then we should be but we don’t mind. no kids yet so we are trying to maximise our wealth now.

82% 😮!

Great work Grant

I’ve managed a savings rate of about 40% this year. Being pregnant and with my baby due in January, I’m aiming to just have a positive savings rate from when my baby is born until the time I return to full-time work (about 9 months of maternity leave), then start increasing it again. I’ve started my own financial independence blog to document my journey to FI as a young mum. Hopefully you don’t mind me posting this. I have learned a lot from reading your blog.

40% is fantastic 👏👏👏

What a great idea for a blog! Congrats on the baby and I wish you all the best for January 🙂

$150K post tax income and 50K expenses so pretty similar to AF. Would you consider the principal part of monthly repayments on PPOR an expense or saving?

I would look at it as a savings SD