And so ends another financial year.

Which leads us to the most exciting part…

It always amazes me when I hear people say they haven’t done their tax return yet month after July or even worse when they haven’t done one for years!

You’re leaving money on the table. And it’s so easy to complete a return these days that you really shouldn’t have an excuse for not getting it done once you have your group certificate. I’m seeing my accountant tomorrow actually (my return is a little complicated this year) but I’m doing Mrs. FB’s return through the ATO website MyGov since hers is very straightforward.

One of the cool things about posting monthly snapshots of our net worth is that it creates an online historic journal not only for you guys out there reading these posts but also for myself to look back on in years to come. Looking back on June last year it is amazing to see that we have grown our net worth by $81K over the last 12 months.

Like always, I plan to do a savings review in the next few days to see how much we spent over the financial year and compare that to last year. We only really have two years worth of real data because we only joined finances in 2016. It will be interesting to see if we have spent more or less than the previous year and how our returns have gone.

Net Worth Update

Bit of an ‘eh’ sorta month. Little Super bump in Super and ETFs. Saved pretty well and we received some dividends.

Not a huge gain, but a gain nonetheless. As long as we’re moving up, it’s still a win 😊

Properties

No changes in the properties this month again (over a year since a change)!

I have been doing some research in what properties are selling for that are similar to mine in the area and the current valuations I have from CBA seem way outdated (conservative). But to avoid too much speculation, I will keep the prices as they are being reported by CBA. It’s always better to be conservative

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs

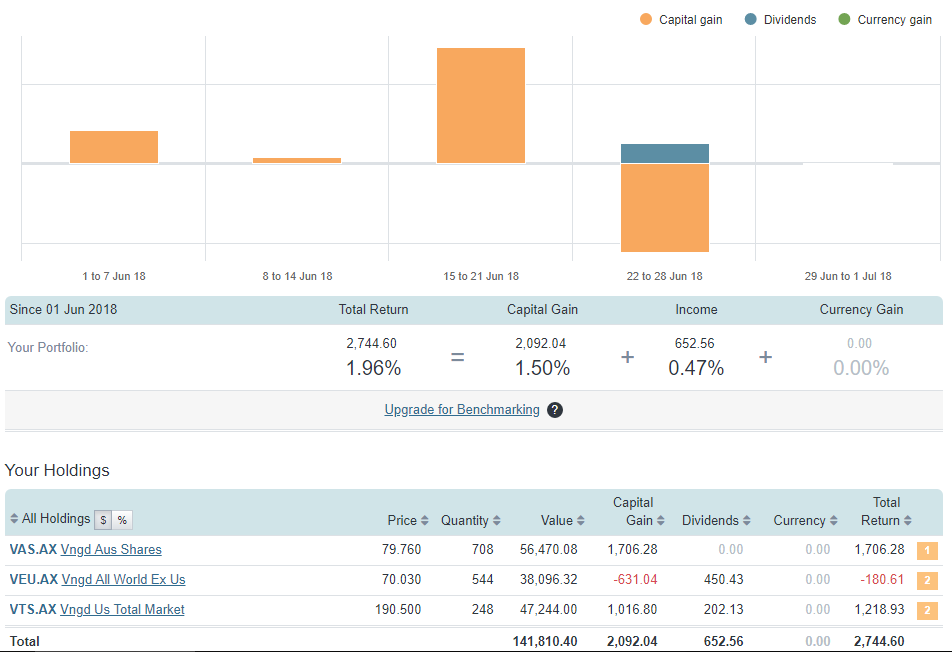

ETF performance update for June

Nice little bump from last month. Loving the dividends from the international ETFs 💪. I have the juicy franked Australian dividends coming in July which is something to look forward to.

Every time I get dividends makes me want to move to a more Australian focused portfolio and further away from a predominately capital gains international one. One on this in an upcoming post.

Networth

Well done.

How much take home pay are you adding to your ETF portfolio each month?

Also, I found a good report (you might have already read it) on portfolio diversification – https://russellinvestments.com/-/media/files/au/insights/2018-russell-investmentsasx-long-term-investing-report.pdf?la=en-au.

Perhaps having a well rounded, diversified, long term portfolio will provide a greater return than moving to a more Australian focused portfolio. Just a thought.

Dingo

Hi Dingo

VTS and VEU are international ETF’s.

VTS – Vanguard US Total Market Shares Index ETF

VEU – Vanguard All-World ex-US Shares Index ETF

I have a similar strategy .

Hey Kishore,

His current portfolio (VTS,VEU and VAS) is well diversified. My comment was in regards to starting to put money into only Australian LICs.

Interesting report Dingo.

We add $5k into ETFs each month.

It’s hard to say what portfolio mix will be the best over the next 50 years. I think the main thing is that you pick a strategy that you fully understand and are comfortable with. As long as the returns are outpacing inflation you’re winning.

The real mental test will be when the market is falling.

Congratulations on the big jump in net wealth from one year to the next, well done!

Personally I’d like to get my tax return done ASAP but there is normally a bunch of stuff to wait on before I have all the figures I need so it ends up being September or October before I send it in. Group certificates, tax details for income protection insurance, bank account interest, share dividends (I have a bunch of different ETFs and some auto populate, some don’t, and some auto populate incorrectly) and all the rest of it. I also find the myGov website to be really annoying and not just unintuitive but downright difficult to use if you want to do anything more than just fill in the most basic of returns. It probably helps that in your case at least your investments are all held in a trust so your personal return is actually pretty simple, but your trust one may be more complex although I think you’ve said it isn’t too bad. Do you do any of the tax planning stuff like spouse contributions etc or having your income protection outside super so you can claim the tax deduction on it?

Hi Sean,

Our tax returns are very straightforward because as you have correctly pointed out. The hard stuff is in the trust. I have seen an accountant over the last few years to get it right. When we have everything in the trust generating our income through dividends. The tax should be pretty straightforward and something I will take over at that point. There is still a bit of strategical planning that takes place before the end of the financial year if the trust has to distribute an income. We’re not at that stage yet (because of the property depreciation within the trust) but will be soon.

We do the tax planning stuff with our accountant.

Hi AF,

I’m in the same position as you regarding the Trust. I have all our shares and One IP in it. Do you have to do your trust tax return first to find out how much income you have to add to your personal tax returns?

Up until now, I have been doing my own trust tax return, but may need the help of an accountant next year. I spoke to a mortgage broker the other day, and she agreed that it is very hard to find a good accountant who will do more than the simple end of year returns and add value with tax planning.

Do you have any recommendations of a good accountant?

Well done, always love reading your info. Some really great insights into your finances, so thanks for sharing that with us as well.

Looks like all is going well.

Interesting stuff! Well done. What program are you using to generate the pie charts and graphs?

Cheers, Andrew

I might be wrong but it just looks like Excel / Google Sheets.

Google charts https://developers.google.com/chart/

Sounds like you’ve had a great year!!

I put off getting my tax return completed to

a) wait for all the number to be pre-filled as much as possible (usually happens in August)

b) delay the large bill I get every year due to my HECS debt and payroll not taking out enough $$ each fortnight. ‘

Hi, just wondering when adding to your Vanguard portfolio, do you buy at market or wait for a pull back? I’m tossing with with one at the moment as I am ready to buy and each day the market moves away a little more from me. Thanks.

I don’t try to time the market. We buy when we have $5K to put in. It’s natural to try to get a bargain though.

HI AF,

Doyou buy all three ETFs when you have $5k (split 40:30:30), incurring 3 x trade commissions, or only buy one ETF each time (only one commission) and rebalance at some point?

Commissions certainly add up, after using the free ones from SelfWealth…

I by one lot of ETFs. I have a video coming out about how I rebalance.

What a great blog from an Aussie perspective. I’ve finished reading all your posts and have started on some podcasts over the last few evenings. Over the last year or so I’ve devoured a lot of US based FI content from the likes of MMM, early retirement extreme, ChooseFI, jlcollins, jdroth and others.

I’ve just setup with selfwealth – what an easy process that was. Thanks for the 5 free trade referral from your podcast link.

Also have got the process of moving super into the choiceplus product offering from hostplus.com.au started – that has been very easy so far and their phone consultants have been exceptionally helpful with questions.

Looking forward to following along.

Glad you’re enjoying it 🙂

I’m loving this website and your regular updates, I learn a lot!

What software is it that you’re using that shows those great Line graphs of your net worth and your ETF tracking? I need to track my finances more carefully and I think it would be great if you could mention to us what software allows us to get a good picture of where we are…..if you could even do a blog post on the software you use and how that would be immensely useful.

Visualising the FIRE journey is super important to stay on goals.

I’ve been thinking of putting my spreadsheets out there. I’ll see what I can do

I’m loving what your spreadsheets produce too ! You’ve done well. I’m interested …… 🙂

Great job man. Those ETF holdings are beefing up nicely as % of your net worth.

Be careful on those dividends mate, it can quite easily become an addiction if you’re not careful 😉

I welcome the addiction Dave lol

Sorry you lost me on the trust part.

Yes agreed re tax return – you have to wait until CBA issue statements (so slow) and world vision send you donation statements or the most frustrating one – medibank issuing private health insurance documentation (which my husband and I cant estimate and he was overseas and had lifetime loading so there is a split of the private health insurance rebate into 2 categories and it all gets so complicated…Have tried to calculate myself based on premiums we paid but it just never reconciles to their number so I have to wait for it to come in mid july).

Love your posts

Belinda

Hey mate, apologies if you’ve answered this in a previous post.

Have you done any forecasting on your cash flow for when your IPs switch from IO to P&I? Curious to know whether you’ll attempt to refinance to IO as long as possible to keep cash flow better with surplus continuing to go into ETFs, or your strategy will change more towards debt reduction, therefore less cash into ETFs each month but building equity as the loans reduce.

Thanks.

Hi Matt, I can absorb an extra $9k a year before I need to start dipping into my own pockets. But I do understand the risk to the eventual IO period finishing and I’m looking to offload a property this year to reduce my exposure to this. I might actually just switch to PI because the rate is so much better than IO. This would affect my cash flow for sure but I’ll cross that bridge when if/when I get to it.

The plan is to sell all the properties for the right price and move to 100% shares to generate the passive income.

Hi there, really enjoying your blog. Have you got any graphs which just look at the ETF growth over time, preferably showing both dividends + capital growth and also split out between the three ETFs?

I am interested to see the growth/compounding since you bought the first ETFs.

Thanks.

I could probably get that info out from sharesight if you’re interested. But honestly, you can just plug that data into a dummy portfolio and see for yourself. You can see which funds I invest in so it wouldn’t be too hard to replicate