Firstly I would like to say that it has been quite some time since I have posted anything. This is because I just got back from an international holiday which involved an annoying large amount of ‘activities’ instead of relaxing which I had plan to use to write a few posts. Any-who! A few things have changed.

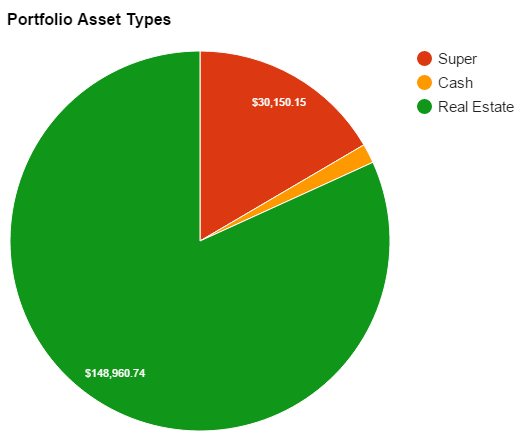

Firstly you may have noticed that I have removed my car from my net worth. It really shouldn’t have been there in the first place. Any depreciating asset has no business to be considered part of my portfolio. Which leads me to another controversial part of the portfolio…Super. Should I or shouldn’t I include my Super as part of my portfolio? I changed my mind on this a couple of times. As I plan to retire young, Super does not help me achieve this goal as should be separated from my ‘real’ portfolio which will be used to calculate my real net worth position. However, I’ve decided to keep my Super in my portfolio for this blog purely for the readers to see. In my own spreadsheets I have removed it but for the purpose of transparency I will keep it in here for all you readers to see it. Speaking of which, I checked my Super and it’s up $5K (mostly contributions from my employer) since the last time I checked it.

I bought property number 3!!! Exciting times. Everything went really smoothly and I’m happy with the results so far. Starting to really gather momentum with the properties as half of this one was funded by equity from my other two. I hope I can reach a stage eventually where I can simply wait a year or two and just pull equity to buy the next and so on.

And lastly, one of my properties went up by $4K during the purchase of IP number 3!

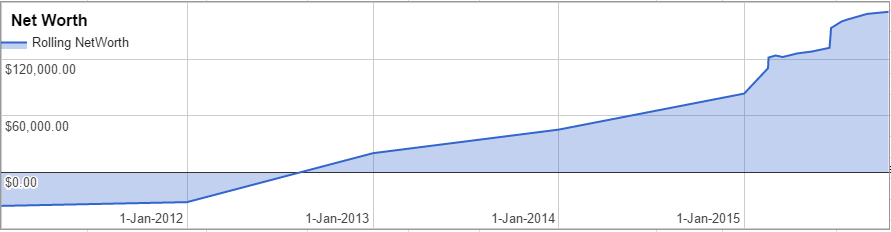

| Date | Rolling NetWorth | $ Change | % Change | Notes |

| 1-Jan-2011 | -$36,000.00 | $0 | 0.00% | HECCS debt |

| 1-Jan-2012 | -$32,000.00 | $4,000 | 0.00% | Started Full-time work late Nov |

| 1-Jan-2013 | $20,000.00 | $52,000 | 0.00% | Built property and recieved FHOG ($21,000) |

| 1-Jan-2014 | $45,000.00 | $25,000 | 125.00% | |

| 1-Jan-2015 | $83,254.21 | $38,254 | 85.01% | Bought second IP |

| 17-Feb-2015 | $110,215.44 | $26,961 | 32.38% | |

| 18-Feb-2015 | $121,541.41 | $11,326 | 10.28% | |

| 4-Mar-2015 | $123,715.44 | $2,174 | 1.79% | |

| 18-Mar-2015 | $122,128.44 | -$1,587 | -1.28% | Paid for holiday |

| 15-Apr-2015 | $125,906.00 | $3,778 | 3.09% | Withdrew equity from property |

| 14-May-2015 | $127,906.96 | $2,001 | 1.59% | |

| 18-Jun-2015 | $131,904.96 | $3,998 | 3.13% | |

| 21-Jun-2015 | $152,904.96 | $21,000 | 15.92% | IP’s revauled |

| 12-Jul-2015 | $159,904.96 | $7,000 | 4.58% | Paid 4K off HECS Debt |

| 23-Jul-2015 | $161,904.96 | $2,000 | 1.25% | |

| 31-Aug-2015 | $167,904.96 | $6,000 | 3.71% | |

| 31-Sep-2015 | $170,110.89 | $2,205 | 1.31% | Car went out of Portfolio, Bought IP 3, Super went up and one IP went up |

In considering my net worth, it’s tempting to include Super because it gives me a warm fuzzy (i.e. makes my Net Worth look better) but I omit it as well, simply because I don’t really rely on it / think about it. My plan is to just consider it winning the lotto at 65… 67… 75 or however old you’ll have to be when the government lets you access it.

Yeah I agree,

Not planning to use my super at all. Who knows when the access age will be by the time we retire!

Hi, I don’t see the access age changing for us. Usually what happens is as people enter the market they impliment new rules. Simular to the legacy for CGT etc and labours plans to cancel it. Too many voters will complain with the changes. Politicians self interest will prevent any radical change. You should include super as you can save via that method and is tax effective(unless your compolsury is greater than the 25k cap). You could then adjust your requirements for FIRE. Including super income after your preservation age reduces your required balance prior. Just as advisors suggest drawing down super in a non sustainable rate so that it’s depleted to the point of the age pension kicking in late in life. Great Blog BTW.

Thanks Mark 🙂

I have throughout the last few years realized the importance that Super plays with early retirement. It should definitely be included for sure!

I don’t include my super either. I do keep tabs on it purely because i enjoy watching it grow. I wouldn’t have car in there either. I would just write off the whole amount for the original purchase at the time of buying..

I have since changed my mind on Super. It DOES help you retire young. In fact, it plays a pivotal part.