Not a lot to report during the last month. I was able to save a bucket load of cash simply from the fact that I didn’t do anything that cost money other than necessities. I am going on a international holiday at the end of September so I won’t be able to save as much that month.

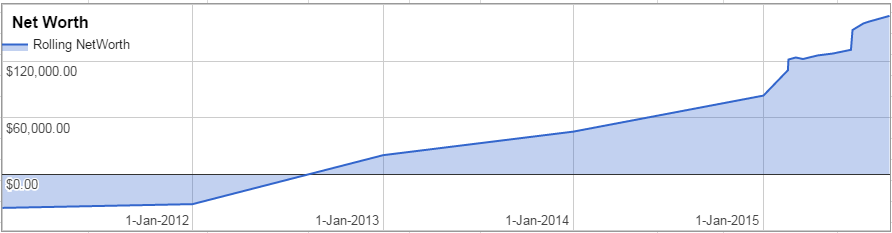

| Date | Rolling NetWorth | $ Change | % Change | Notes |

| 1-Jan-2011 | -$36,000.00 | $0 | 0.00% | HECCS debt |

| 1-Jan-2012 | -$32,000.00 | $4,000 | 0.00% | Started Full-time work late Nov |

| 1-Jan-2013 | $20,000.00 | $52,000 | 0.00% | Built property and recieved FHOG ($21,000) |

| 1-Jan-2014 | $45,000.00 | $25,000 | 125.00% | |

| 1-Jan-2015 | $83,254.21 | $38,254 | 85.01% | Bought second IP |

| 17-Feb-2015 | $110,215.44 | $26,961 | 32.38% | |

| 18-Feb-2015 | $121,541.41 | $11,326 | 10.28% | |

| 4-Mar-2015 | $123,715.44 | $2,174 | 1.79% | |

| 18-Mar-2015 | $122,128.44 | -$1,587 | -1.28% | Paid for holiday |

| 15-Apr-2015 | $125,906.00 | $3,778 | 3.09% | Withdrew equity from property |

| 14-May-2015 | $127,906.96 | $2,001 | 1.59% | |

| 18-Jun-2015 | $131,904.96 | $3,998 | 3.13% | |

| 21-Jun-2015 | $152,904.96 | $21,000 | 15.92% | IP’s revauled |

| 12-Jul-2015 | $159,904.96 | $7,000 | 4.58% | Paid 4K off HECS Debt |

| 23-Jul-2015 | $161,904.96 | $2,000 | 1.25% | |

| 31-Aug-2015 | $167,904.96 | $6,000 | 3.71% |

Hey! Fascinating blog, and really valuable to read through.

Can you clarify your net worth growth here? Where did you source capital for both of your IPs? And does this grapgh account for Debt?

Thanks Paul.

I saved $6k that month from saving my salary.

I used savings plus the FHOG to buy IP1. I used equity from IP1 to buy IP2 and used equity from IP2 to buy IP3.

The graph accounts for debt

Cheers

im assuming HECS was forcibly paid when you put in your tax return?

Yeah assumptions are correct mate.

Hey! After looking at your most recent net worth post I thought I would search back to your first net worth post. It’s very interesting to see the growth that you have had over the past decade. Keep up the great work and content!

Thanks Aussie FI!

It’s been a journey that’s for sure 🙂