A solid month of savings with a little help from the assets sees the net worth soar to new heights in May.

Averagish (not a word I know) month expense wise with us spending a touch over $4K.

The hidden costs of certain activities added up last month. A pet peeve of mine are trips to Melbourne for events, weddings or to see family and friends. Not that I don’t want to see family or friends or go to events in Melbourne. It’s all the added costs/hassles associated with it that sucks. It takes around 1.5 hours from where I live to get to Melbourne, the trip usually means a fast food lunch stop at the servo past Pakenham which, while relatively inexpensive, leaves me feeling like shit and still more expensive than if I had made lunch myself, city link tollway adds another $17.50, you then have to pay for parking in the city which can be another $25 and then there are the accommodation costs which are around $120 p/n depending on how cheap we are going.

So a typical weekend in Melbourne can end up costing us:

Fuel round trip: $35

Toll: $17.50

Parking: $25

Accommodation: $120

Wasted time in traffic: 3 Hours

Total: $197.50

I’m not including food or anything related to the event because we would still have to eat if it was local and pay for the event. I’m just adding the ‘Melbourne’ element.

$197.50 doesn’t sound like much. But invested at 9% over 50 years works out to be $14,723 bucks… Bit of a hyperbole but you get the point.

City living to me just seems so incredibly expensive.

Everything you do seems to cost money.

Parking:

City: Please drive around for 30 minutes before I give you the opportunity to pay $20 to park here

Country: You see all the spare parking spots in the main drag. Take your pick friend. Btw, what’s meter parking?

Clubs:

City: Hello gents. It’s going to cost ya $20 bucks just for the privilege of breathing the air in here. Also, the drinks are special tonight, $20 red bull and vodka’s

Country: Yeah, no shoes are alright mate. Just watch the broken glass down back and don’t feed the dog. That will be $3 bucks for a pot.

*Disclaimer: Well aware that city clubs offer a lot more but still

Driving:

City: Oh, you want to use the fastest route to your destination? Here is this great tunnel that you helped pay for (taxpayers money)…… But we’re ganna have to keep charging you more money to use it each time. And if you want to take the long way around, I hope you downloaded some Podcasts because surprise surprise, road works have just started 🙂🔫

Country: Follow this road for 20km straight and you’ll reach the town. Just watch for the potholes and roos.

Housing:

City: And this lovely two bedroom shack will only cost 1.2M, your first born and the tip of a black rhinoceros horn.

Country: $350k plus a slab of VB and you’ve got yourself a deal cobba!

Net Worth Update

Hitting new territory in terms of net worth this month as autumn comes to an end. All round contribution from savings, little bump from ETFs and Super to cap off a solid month.

Properties

No changes in the properties this month.

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs

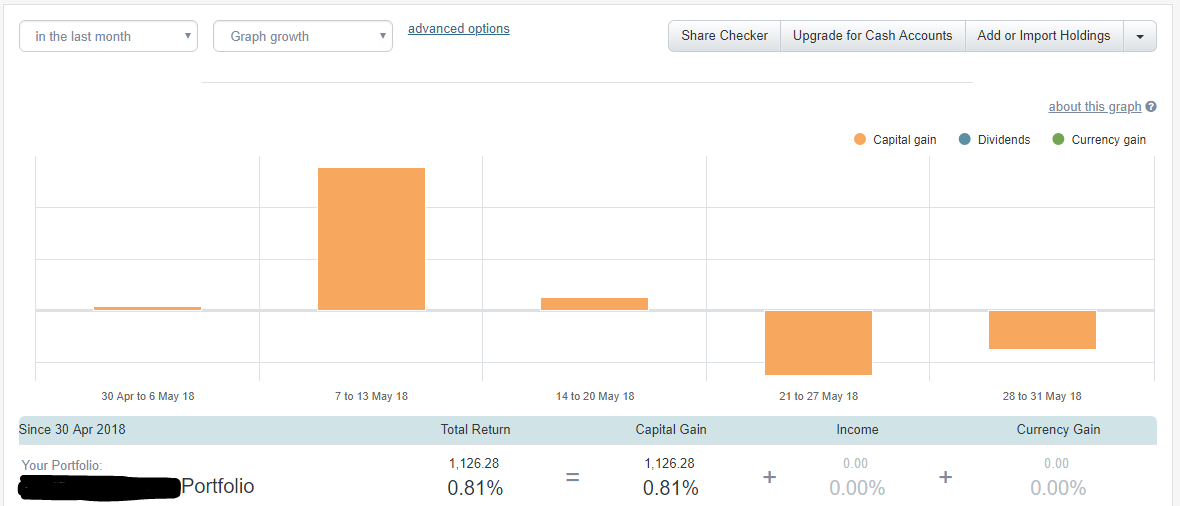

ETF performance update for May

Nothing to write home about but any gains are always a plus.

Networth

Nice one! A couple of thoughts – is taking a train an option? We’re doing a 30 day car-less challenge and our next test is taking the train to Bendigo to visit family rather than driving.

We live in Docklands, Melbourne which I think can be an advantage in terms of cost of living. We haven’t paid for public transport in ages. We can bike or walk almost anywhere including library, supermarket and the city. Rent for a 2 bed apartment is $600pw and it costs around $600k to buy the same apartment so buying is almost worth it (we bought). We’ve found that body corps, council rates etc quickly add up but the lifestyle and money we save on public transport is great. I should probably do the maths and figure it out for certain. Hopefully we’ll lose the car soon and then can start renting out our carpark. Also, we rent our spare bedroom on Airbnb and make around $17k per annum which makes it more affordable as well.

Next time you’re in Melbourne let me know if you guys are keen to grab a coffee. Big fan of the podcast and getting the Aussie perspective on FI!

Cheers,

Sam

There’s heaps of way we could have saved money on the trip but I’m just pointing out all the hassles with Melbourne. I’ve been known to take the toll free route many times lol but just highlighting that it’s annoying.

Wow, $17K a year for a spare bedroom? That’s AWESOME! Next time I’m in Melbourne I’ll probably send out a tweet or something as a few people have said they would be keen to catch up in real life.

Cheers

Some ideas

Food – can you prepare food to take with you? Even taking some simple snacks like nuts or fruit should help eliminate the need for a meal stop. Or you could duck into a grocery store in Pakenham.

Petrol – you can save a little by prepurchasing WISH or Coles eGift cards and using these to pay for petrol.

Tolls – how much time does avoiding tolls add? Can you offset the time it takes by driving at a more efficient time. The Waze app gives a great view of the best times to drive on certain routes.

Accommodation – is it possible to stay with family, friends, fellow FIers? You could rent out Sam’s AirBNB :p If you stay just a couple of kmout of the city centre this may also help eliminate the parking costs in the city.

Parking – apps like Parkopedia and Ubipark can help find cheaper parking deals. Prepaying for a parking garage can also reduce costs.

Thanks for the tips Matt. I do a lot of them already but in this instance, we were traveling with friends. Makes it harder/awkward to suggest the toll free way or for everyone to pack a lunch etc. I didn’t know about the parking ones though so thanks 🙂

Totally understand. My family is very frugal, so no problems there. But not so on my partner’s side. If we are ever traveling with them I pretty much have to suck it up. Food-wise, I take the opportunity to go on a fast.

Good stuff! Another big fan of your work. I live 40km east of Melbourne and definitely hear you re the cost of doing anything in the city. Have you tried pre-booking your parking? I’ve found that helps – I can usually get a city centre car park for $5-8 (weekend or evening rates). I use these sites – maybe they’ll help you too, I hope. 🙂

https://secureaspot.secureparking.com.au/

https://www.wilsonparking.com.au/book-a-bay

https://carpark.museumvictoria.com.au/ – this one isn’t the cheapest at the weekend but not bad for weekdays – $14 earlybird

And I’m wondering why you’re having to resort to that fast food lunch stop at Pakenham? You can’t take a trusty sandwich – at the risk of stating the obvious?

Thanks for the sites Sue. Very handy.

I do actually pack something to eat most of the time. We were travelling with friends in this instance which can make things harder to do. Definitely ways around a lot of what was said in the article for sure 🙂

Sooo….you live in Traralgon Aussie Firebug? Just a note re the CBA valuations on your properties. I had a 1 bedroom unit in inner city Melbourne that CBA valued at 360K which when we went to sell, the final sell price was 308K. I.e. Bank valuation doesn’t always equate to a minimum sell price. Just something to be conscious of and something that I learnt the hard way. Also, sorry if you mentioned it but is your net worth the combination of you and your partner or just yours? Cheers Firebug!

I found the same thing as Ben with CBA valuations. I would like to think they are at least ball park, but the reality is they are not. I have been working on a more realistic valuation I take from looking at the market and what has been selling, and then still being conservative again.

Hi Ben,

Yes, without going into too much detail, I do live in Latrobe City.

Good points about the valuations. From my experience, they undervalue properties. But it could be the other way also like you have discovered.

Net worth is my partner and I combined. We combined our finances in 2016, you can read about it here

Just discovered you Aussie Firebug and I’m a fellow Traralgonite. Devouring your podcasts right now.

Hi Shae,

There seems to be a lot of Gippy people interested in FIRE. I hope you enjoy the podcast 😄

The sum of parts in the networth seem to be greater than $423k

That is correct. But Mrs Firebugs HECS debt is not being accounted for in that graph. The debt brings our net worth down to $423K.

That’s the only debt that’s not featured in these updates. It should be cleared in a few years as we are not paying it down sooner than we need to

I wouldn’t even count HECS as a debt, since the only required payment is extra taxation if you are over the income threshold.

If you fired today, you’d never pay it back would you?

Hi from Munich, Germany. I’m visiting some university colleagues and was very surprised to find out that all undergraduate and post-graduate study in public institutions is FREE in Germany; even for International students…

Why can’t we offer free (or cheap) education in Australia?? Why do we lumber our best and brightest with all this debt at such a young age??

Jeff

Not sure Jeff. I didn’t think our HECS system was too bad tbh. But I like the sound of free even better!

Jeff we did have free Undergraduate education until economic rationalism reared it’s ugly head. Germany’s education system is tightly integrated into their industrial relations system which means industry partially supports the cost of vocational training. Education costs have to be paid by someone Government/Industry/Students. The fact our Industry has failed to invest in it’s future capability and Government has diverted education funds into the arms industry is a sad indictment on the Australian Elites. Fortunately we are not quite at the levels of the US graduate education scheme that lumbers the majority of students with lifetime crippling debts at the start of their working life when jobs are becoming more scarce.

Haha I love the city vs country comparisons – gold!

Who doesn’t want to see a friendly dog at the pub!

It does seem like everything costs a lot more and often just for the sake of it.

You do recoup some of that toll-fee though – Transurban (the owner of the big toll-roads) is the 13th biggest company on the ASX and they also pay a decent dividend which VAS receives 😉

This makes me feel a tiny bit better lol.

Great to read about your financial life and I do relate to your comments about it having to cost so much to visit family. Hoever, I do think you’re lucky because most of my family live in the UK (I’m in Perth) or, if they do come out here, they won’t visit Perth because it’s too remote. So any family trips costs thousands – what would saving an extra $10k every other year work out to over 20 years? And yes, I am having a whinge.

Wowee, $10K a year! I can never complain again!

Nice Blog Aussie Firebug, the rolling net worth chart is great and gives perspective

I personally like ETF’s but wonder why you’ve gone ETF’s and not LIC’s?

I had a look at “My Story”, but there is no mention of which states the properties are in?

Cash holdings seem to be high, is that part of the strategy?

Hi Barry,

I’m looking into LICs actually. Have a read of my latest article. It gives perspective as to why I have chosen the assets I invest in.

https://www.aussiefirebug.com/our-investing-strategy-explained/

I’m currently on strategy 2. But looking more and more into strategy 3 which would lead me down the LIC path.

Our cash holdings are high because we like to keep $5K liquid cash for each investment property in case we need something fixed.

Hi

I can see you have about $50k cash… so why are you investing these to buy the ETFs? Are you keeping the cash for any specific purpose, like when market crashes or have corrections?

If you can have $10k cash saved up for investment each month, what would you do?

a. Spend the whole $10k each month to buy the desired ETFs

b. hold $30k in cash for the first three months.. then invest the rest into ETFs each and every month?

c. others (please specify?)

I’m interested to hear your thoughts on this.

thanks

Victor

Hi Victor,

Our cash holdings are a bit high tbh. We have around $30K as an emergency fund and $5K for each property in case something breaks.

If I could save $10K a month I would be dumping that into ETFs/LICs each month without question.

Thanks for the reply.

that make sense re the emergency fund which I agree is needed… it’s what the Barefoot Investor calls it “Mojo” money

What are your thoughts on index ETFs vs. actively managed funds LICs which pays a high fee but performance beats the index.. which would you go for?

Cheers

Victor

I’m leaning towards LICs now mate. There will be another post about it coming up. The management fees of LICs aren’t too bad actually. And they very similar to index investing. The active component is minimal. All will be explained in an upcoming post.

I also get the impression that you dont pick your own stocks and have an individual stock portfolio…

Just wondering why is that? Is it because of

– no time to do the research/analysis

– lack of interest/motivation to pick your own stock

– doesn’t believe you can beat the index

– or what else?

thanks

Victor

You basically listed all my reasons. I can’t be bothered researching and analysing stocks. And the fact that all that extra work doesn’t equal better returns… why would anyone bother? Unless you’re really into that sort of stuff. I have other things I’d rather do.

Thanks for your response.

What if it’s through a managed funds like Platinum who’s shown proven track record of consistently beating the index, e.g. it’s Platinum International Fund has delivered 12.9% p.a. since 1995…… the Platinum Asia Fund had a 15.5% p.a. return since 2003!!….. Even though they charge a much higher fee of 1.35%… but it still outperforms the low cost ETFs assuming it’ll deliver a 10% return p.a….

I do agree that past performance isn’t indication of future performance.. but history and track record does speak volume… which I’m tossing between which option to go with (or maybe do both?)

What are your thoughts of active managed funds vs. low cost ETF or LICs (which basically tracking the index as well)….

thanks

Victor

I prefer to just accept the market returns. There are managed funds that do outperform the index consistently. But picking the right ones is hard to do. If you do manage to beat the index hats off to you. I’d rather just stick to low fees. There’s no right or wrong answer, it’s a personal decision.