2018 has not been kind.

Firstly, this is the first time since I’ve been posting our net worth updates that we have been in the negative two months in a row. I secretly knew that the run we had in 2017 was not sustainable but I was hoping that we could at least start to make some gainz at the start of the new year after taking a pretty hefty hit in December 2017.

I knew it was going to be a big month expenditure-wise, so I checking pocketbook religiously but it still got out of hand a little bit. It was like sort of like when you’re fully aware of the danger ahead but you can’t do anything to stop it from happening.

We had our most expensive month in a long time! Pre-booked a few holidays, went out a lot (such nice weather), and there were a few one-off expenses like new tyres for the car.

Mrs. Firebug is a teacher so the school holidays between December and January are always a bit more expensive because we’re out doing stuff and being social.

It didn’t help that I’m writing this update after our portfolio just got smashed by the biggest day drop in sharemarket history. So a few things factored in to explain this months drop.

I causally messaged Mrs. Firebug this on Tuesday afternoon right after we had figured out what we wanted for dinner.

She asked if we should buy more during this drop.

I shed a tear of joy

Net Worth Update

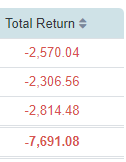

If one image could summarise nearly all our assets classes during last months it would be this one.

You can almost hear the signing *shudders*

Sooooooo basically we got smashed on the shares front. Property stayed the same. Cash reserves went down paying for everything and Super was around the same too.

The market has already bounced back again today as I’m writing this. But I’m not including the updated stats from today in this months update. Next months should have some decent gains as I’m already up nearly $3K from the losses and we dumped in some money during the downturn so we should see a decent increase next month.

So sad to fall below the $400K mark 😭😭😭

Properties

No changes in the properties this month.

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs

Down almost $8K during January!

This has been our first real test of a decent drop, but I believe we responded correctly and actually bought more shares during the dip. Who knows where it goes from here but we are being disciplined and sticking to our monthly schedule of dumping $5K into ETFs come rain hail or shine.

It was a bit strange to see so much of your money just vanish like that though.

But you only make a loss if you sell!

Networth

Didn’t the drop happen in February? Like on Friday?

It did.

I didn’t get around to writing this until yesterday. I gathered all my numbers and included the Feb drop because it’s just easier to work out my net worth when I write the post as opposed to trying to figure it out a few days before hand. Sometimes there is some cross over of a few days.

Noticed your ETF’s are all Vanguard, have you had a look at the new 2018 Diversified ETF’s Vanguard has released?

– Vanguard Diversified Conservative Index ETF (VDCO)

– Vanguard Diversified Balanced Index ETF (VDBA)

– Vanguard Diversified Growth Index ETF (VDGR)

– Vanguard Diversified High Growth Index ETF (VDHG)

Still being in my mid 20s I have started going into VDHG, keen to hear your thoughts.

Cheaper to own the similar assets as single ETFs. Also can avoid bonds until you need them.

In the middle of writing a post/podcast about this very topic!

Keep an eye out for it.

But VDHG is VERY appealing. I would say that new investors that want a one-stop shop should definitely check it out.

More to come on this topic 🙂

Aww, that’s a great lady you’ve got there! Our lives are a little like the stock market. They move in an upward trajectory, in your case your net worth, but only when viewed from a distance. A few months of negative trends, as long as you understand them, which is self evident by your explanations, don’t mean a thing. That’s just life happening. You guys are solidly on your path to winning! Great post.

Thanks Steve 🙂

You’re taking the right approach. And biggest ever point drop is just the mathematical flipside of the US market was higher than ever before.

Agreed

Still doing great. This is just a small blip in the grand scheme of things.

Yep. The market has already recovered 😬

You may falter but you will not fail

👊

Our costs have blown out since the start of the year too, ever since I started tracking it. Maybe that’s the problem? Haha I don’t like tallying it up though, definitely feels like too much.

Come on man, it’s not really ‘the biggest drop in history’. In percentage terms, it’s just a bad couple of days. Nothing unusual. What’s unusual is the markets went up for so long without a pullback at all. In fact, it was the first time the DOW has gone up every month in a row for over a year (or something like that).

Keep it in perspective and soldier on 🙂

It was technically (the best kind) the biggest drop in points, but yeah, a little dramatic I know 😜 (it makes for better writing, give me a break).

It basically recovered the next week anyway lol

We lost $8k like this too… and I wish my wife had the same comment as yours!

Hi Aussiefirebug,

Thanks for sharing! I’m a newbie trying to decide if I should go with ETF or an index fund for simplicity.

In this post, you mentioned, “monthly schedule of dumping $5K into ETFs come rain hail or shine”.

1) Do you buy really ETFs every month? Just surprised due to the trading fees involved e.g. $9.90 for each trade.

2) And if so, do you just buy 1 or the 3 EFTs (VAS, VEU, VTS) in equal proportion?

3) How do you maintain the asset allocation?

4) For VEU and VTS that do not have DRP, do you reinvest the dividends it in the next month?

Would appreciate your input.

Hi Coinfection,

1. We haven’t been doing it every month lately but yes that is our goal. I have so many free trades from SelfWealth through affiliate links that I haven’t paid brokerage fees for like 10 months. I don’t think I’ll ever have to pay brokerage fees again, to be honest.

2. Yes, we buy 1 ETF each month at around $5K.

3. Through a spreadsheet that tracks the weightings of each fund. You can check out a dummy copy here https://drive.google.com/open?id=14y8GQb9EgTH3nuwyuNlJErAQIbVNQfVv2C9Nuo7NqvM

I look at the percentage of each ETF. And the one that needs the top up the most is the one we buy that month.

4. Yes.

Hope that helps 🙂

Fun reading this from the future. Now you/we have Pearler Auto Invest to manage our asset allocations for us.

Love Pearler!