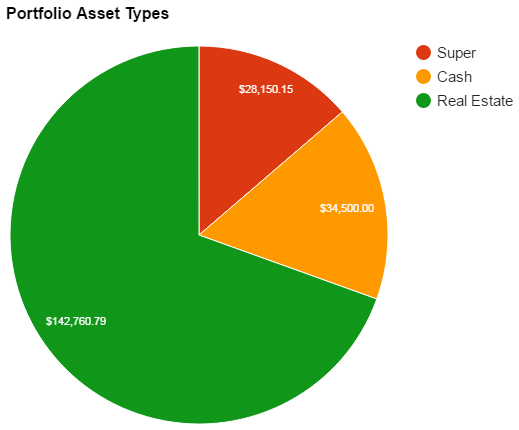

Creeping ever so close to the $200K club! I really wanted to hit $250K by the end of the year, but unless something drastic happens I don’t think I’m going to get there on savings alone. It’s much more likely that the real estate market stagnates or even dips to be honest.

What an interesting month. I finished a piece on Fixed or Variable Rate which basically said that unless you’re over geared and an interest hike will break your finances, than it’s financially better to stick to variable 95% of the time. It was interesting reading some of the comments to that article. Some people were still convinced that they knew better and that locking in now would be better over the long term. And then the cash rate got slashed to 1.75% about 4 days after I posted the article lol, talk about timing. I wonder if they still think they made the right decision…?

And what’s a double dissolution anyway? Does it affect my plans to escape from the 9-5 day grind? The answer is yes. For me anyway. Well actually I think it would affect just about anyone in Australia in one way or another, especially if you have invested your funds into Australian real estate which I have.

Housing affordability is a major topic for this coming election and with good reason. Hot topics such as Negative Gearing, capital gains tax, overseas investors, land tax, stamp duty and many more are all within the sights of eager politicians bursting at the seamed to tell you what you want to hear to get your vote.

You have the Libs that claim that axing negative gearing would cause house prices to plummet and start a recession. This may sound like a bad to some (home owners) but great to others (first home buyers). You can check out the ALP’s housing affordability plan here (nice site btw) which will tackle negative gearing in an attempt to make housing more affordable.

I read plenty of forums and article and it seems to me that there is clearly two camps here. You have the home owners/investors that do not want to see their asset(s) go down in value. And then you have everyone else but mainly first home buyers trying to get into the market. Unfortunately for first home buyers, the majority of voters/wealthy people/people in power at the moment are also home owners/real estate investors which would mean that they are going to look out for theirs before they look out for yours. Sorry, that’s just the inconvenient truth (shout out Al Gore).

It’s also interesting reading all these passionate comments and threads about how some are praying and wishing so hard for Australia to fall into a recession so they can pick up a cheap house while all the rich and wealthy people who have invested in real estate go broke and wither away into the slums.

LOL

Guys this is not how it works! If there is a recession, the middle and lower class are going to be hit the most. NOT the rich and wealthy.

How do you think you’re going to get a loan for this cheap as chips house? Will you still have a job in a recession? The ones hoping for a recession obviously have no idea what actually happens in one or else they would not be wishing so hard for such a miserable situation to come to fruition.

It’s going to be interesting to see what party is elected and what that will mean for investors…

Networth

[wp_charts title=”linechart” type=”line” align=”alignleft” width = “100%” datasets=”-36000,-36000, -32000,-7000,20000,32000,45000,65000,83254,130000, 187910″ labels=”1-Jan-2011,1-Jul-2011,1-Jan-2012,1-Jul-2012,1-Jan-2013,1-Jul-2013,1-Jan-2014,1-Jul-2014,1-Jan-2015,1-Jul-2015,1-Jan-2016″]

| Date | Rolling NetWorth | $ Change | % Change | Notes |

| 1-Jan-2011 | -$36,000 | $0 | 0.00% | HECCS debt |

| 1-Jan-2012 | -$32,000 | $4,000 | 0.00% | Started Full-time work late Nov |

| 1-Jan-2013 | $20,000 | $52,000 | 0.00% | Built property and recieved FHOG ($21,000) |

| 1-Jan-2014 | $45,000 | $25,000 | 125.00% | |

| 1-Jan-2015 | $83,254 | $38,254 | 85.01% | Bought second IP |

| 17-Feb-2015 | $110,215 | $26,961 | 32.38% | |

| 18-Feb-2015 | $121,541 | $11,326 | 10.28% | IP’s re-valued |

| 4-Mar-2015 | $123,715 | $2,174 | 1.79% | |

| 18-Mar-2015 | $122,128 | -$1,587 | -1.28% | Paid for holiday |

| 15-Apr-2015 | $125,906 | $3,778 | 3.09% | Withdrew equity from property |

| 14-May-2015 | $127,906 | $2,001 | 1.59% | |

| 18-Jun-2015 | $131,904 | $3,998 | 3.13% | |

| 21-Jun-2015 | $152,904 | $21,000 | 15.92% | IP’s re-valued |

| 12-Jul-2015 | $159,904 | $7,000 | 4.58% | Paid 4K off HECS Debt |

| 23-Jul-2015 | $161,904 | $2,000 | 1.25% | |

| 31-Aug-2015 | $167,904 | $6,000 | 3.71% | |

| 31-Sep-2015 | $170,110 | $2,205 | 1.31% | Car went out of Portfolio, Bought IP 3, Super went up and one IP went up |

| 31-Oct-2015 | $171,376 | $1,265 | 0.74% | Big bills. Not much saved. |

| 30-Nov-2015 | $173,263 | $1,887 | 1.10% | Super went down slightly |

| 31-Dec-2015 | $186,910 | $13,648 | 7.88% | IP went up in value |

| 12-Jan-2016 | $187,910 | $1,000 | 0.54% | Some big bills |

| 2-Feb-2016 | $189,910 | $2,000 | 1.06% | Bills (again) |

| 1-Mar-2016 | $191,410 | $1,500 | 0.79% | Didn’t save very well |

| 1-Apr-2016 | $193,410 | $2,000 | 1.04% | Steady month |

Congrats on the increase. Every little bit counts, you are getting there. You raise a lot of good points – it is impossible to make houses more affordable to first home buyers, without decreasing the value of current owners. Unless you use some sort of grant, which many states have – but this tends to just inflate the market. Using super to buy a first home wasn’t a horrific idea, but that would likely just increase the house price and then we’d be back to square one.

As young renters, who will eventually want to buy a house, I’d like houses to be more affordable. The deposit required and price-to-income ratio currently is ridiculous. It’s a good thing the market is slowing right down. Perhaps a few years of minimal growth (or a small decrease) would be best for everyone. The decreasing interest rate makes it harder for someone saving up a deposit, to catch up with the deposit required.

I think negative gearing (beyond one or 2 properties) is going beyond what the system was designed to do. I’m all for people owning 100 properties if most of them are positively geared and they’re paying the correct tax. It’s kind of a messed up tax system when it encourages people to speculate on property prices, whilst making losses throughout that time. The investment money would be much better going to Australian companies that would use the funding to provide products that make Australia better, or ones looking to expand overseas.

Tristan

Yep, the government is in a rock and a hard place. I don’t think there is an obvious answer unfortunately.

Anyone who negatively gears multiple houses will not get very far. I would love to see negative gearing axed and something to make the buy in for properties cheaper like no stamp duty or something. Doubt that will ever happen though.

you probably won’t reach 250k by end of year unless your property goes up.

also, you need to update your super balance.

Agreed.

I’ll update it for next months update 🙂

The money sitting in cash is your offset account right? Are you just gonna leave that to build or put it in index funds at some point considering that having offsets reduces your tax deductible interest?

I’m going to buy some EFT’s at some point this year. I have a lot of cash as a buffer in case anything goes wrong with the IP’s and you’re right that they do sit in an offset, which returns more than a HISA account so it’s not so bad.