Three big things to cover from last month.

1st. Joined Financial Forces With My Partner!

Because amazing things can happen when you team up with your best friend

We can refer to her as D-Wade eerrrr… I mean Miss Lady Bug

Aussie Firebug and Miss Lady Bug have officially joined financial forces and started to invest together. So everything you see from now on will the combined effort from both of us.

Now what does Miss Lady Bug bring to the table you may ask?

Well where to begin! I mean she is so fantastic, what doesn’t she bring? I couldn’t possibility say anything bad about her….. because she reads my blog…hi honey ?

But seriously. Miss Lady bug has only been working full time for technically 2 years (had a year off travelling) but has still managed to have saved around $27K since the start of the year with $2K in Super! With the only debt being her HECS debt of around $25K boosting our overall net worth by $4K.

To save $27K since the start of this year is an awesome effort I think.

Miss Lady Bug has always been sensible with money even before meeting me. I have always taken notice of these habits because I actually don’t think I could ever be with someone who was a complete n00b when it came to personal finances. I don’t expect everyone to be as frugal as me of course but just sensible with money is enough for me.

So $27K in less than a year is much better than the average.

2nd. Enter Exchanged Traded Funds (ETF’s)

With the influx of cash from Miss Lady Bug we had a decision to make.

Do we buy another investment property or start to look at something else?

I have been researching vanguard ETF’s for over a year now. Book after book I read about this investment strategy called index fund investing with a company called Vangaurd.

Now don’t get me wrong, I absolutely love property as an investment class, it has made me over $100K within 4 years. And I plan to continue to invest in it moving forward.

However!

There is this little thing called diversification. Having three properties all in Australia (different states mind you) is not very diversified.

We took the plunge and invested in the stock market.

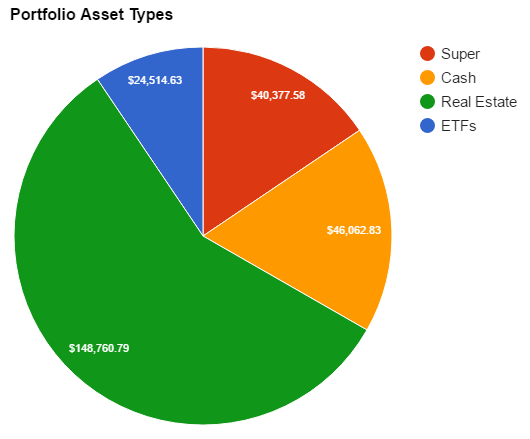

Below is our current portfolio

You can see that property makes up 56% of our wealth. I want to get this number down and spread our wealth across multiple asset classes. Which brings us to my next point…

A new player has entered the game!

That blue slice above represents the combined valued of our ETF’s.

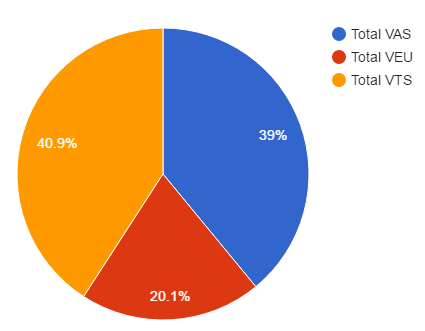

We have invested into three ETF’s

VAS – The Australian market

VEU – The Entire world excluding the US

VTS – The US market

And just like that we have essentially bought a slice of the entire worlds economy. I’m not going to go into too much strategy here but the general idea is that for me to lose my entire capital in these ETF’s 500+ of the worlds biggest companies would have to go down the shitter.

Think Apple, GM Motors, Nestle, Commonwealth Bank, Microsoft, Nissan, Nike etc. If it happened the world would have to be basically exploding.

Below are our current splits.

We are just going to be dumping $5K lots into each one and not worry about weighting until later.

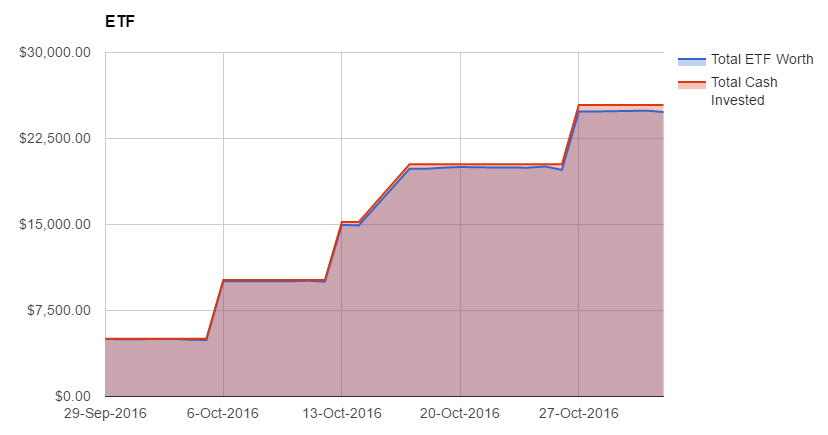

Since the stock market changes everyday, I’m also able to track it’s progress with a lot more accuracy than the properties. Here is where we are currently sitting:

As you can see, we are currently down close to $1,000 already LOL. But we are in it for the long run so it’s all good 🙂

The big bumps are where we have bought more ETF’s (around $5K each time)

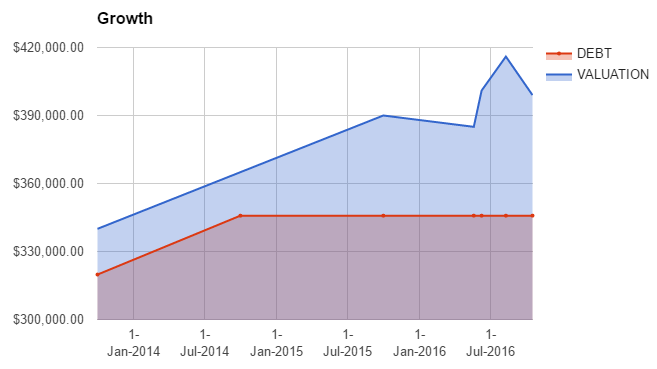

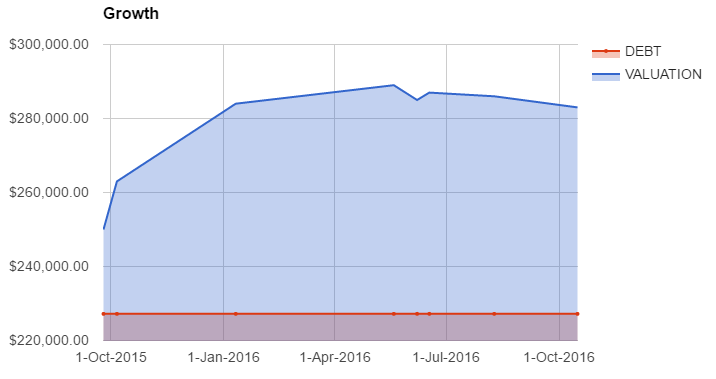

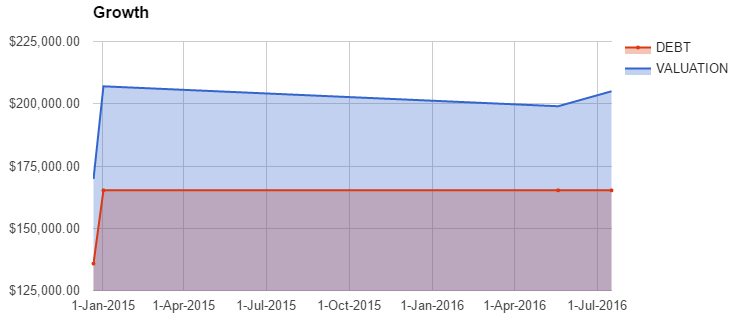

Third. Property Values Drop

You know how I was bragging about making over $100K in property just before?

Yeah…well you win some you lose some.

Bad month from my valuations with 2 out 3 properties going down by a total of $20K.

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

Oh and we also managed to save some money last month too 🙂

Networth

[wp_charts title=”linechart” type=”line” align=”alignleft” width = “100%” datasets=”-36000,-36000, -32000,-7000,20000,32000,45000,65000,83254,130000, 187910, 229010″ labels=”1-Jan-2011,1-Jul-2011,1-Jan-2012,1-Jul-2012,1-Jan-2013,1-Jul-2013,1-Jan-2014,1-Jul-2014,1-Jan-2015,1-Jul-2015,1-Jan-2016,1-Jul-2016″]

| Date | Rolling NetWorth | $ Change | Notes |

| Jan-11 | -$36,000 | $0 | HECS debt |

| Jan-12 | -$32,000 | $4,000 | Started Full-time work late Nov |

| Jan-13 | $20,000 | $52,000 | Built property and recieved FHOG ($21,000) |

| Jan-14 | $45,000 | $25,000 | |

| Jan-15 | $83,254 | $38,254 | Bought second IP |

| Feb-15 | $110,215 | $26,961 | |

| $121,541 | $11,326 | IP’s re-valued | |

| Mar-15 | $123,715 | $2,174 | |

| $122,128 | -$1,587 | Paid for holiday | |

| Apr-15 | $125,906 | $3,778 | Withdrew equity from property |

| May-15 | $127,906 | $2,001 | |

| Jun-15 | $131,904 | $3,998 | |

| $152,904 | $21,000 | IP’s re-valued | |

| Jul-15 | $159,904 | $7,000 | Paid 4K off HECS Debt |

| $161,904 | $2,000 | ||

| Aug-15 | $167,904 | $6,000 | |

| Sep-15 | $170,110 | $2,205 | Car went out of Portfolio, Bought IP 3, Super went up and one IP went up |

| Oct-15 | $171,376 | $1,265 | Big bills. Not much saved. |

| Nov-15 | $173,263 | $1,887 | Super went down slightly |

| Dec-15 | $186,910 | $13,648 | IP went up in value |

| Jan-16 | $187,910 | $1,000 | Some big bills |

| Feb-16 | $189,910 | $2,000 | Bills (again) |

| Mar-16 | $191,410 | $1,500 | Didn’t save very well |

| Apr-16 | $193,410 | $2,000 | Steady month |

| May-16 | $182,410 | -$11,000 | Two IP’s went down. |

| Jun-16 | $211,010 | $28,600 | All 3 IP’s went up and super was updated |

| Jul-16 | $229,010 | $18,000 | IP’s revalued with 2 out of three going up |

| Aug-16 | $233,653 | $4,643 | Super went up along with cash |

| Sep-16 | $237,390 | $3,737 | Super went up, HECC debt went down plus savings |

| Oct-16 | $222,832.69 | -$14,558 | Joined finances with partner, bought ETF’s, IP’s went down |

Hi Aussie Fire Bug,

I have been reading your blog from the beginning of this year. I enjoy the monthly updates as they help keep me stay motivated as well as the in between articles which are informative and help me look at alternative strategies.

Just a couple questions with your valuation methods of your net wealth I’m an accountant and I understand that you as well as many if not most other value their investments at market value. In doing this I would imagine a lot of your net wealth is unrealized gains (equity) and as Dave Ramsey would say ‘Cash is King’.

My question is what is your net wealth if you valued your assets be it investment properties or shares at cost. I myself do this because I’m very conservative and would only factor in gains/losses when I sold my shares (as I don’t have any investment properties). Would love to hear your thoughts or possibly a future article on this as I believe a lot of people run the risk of overstating their wealth through ‘paper gains’ than real ones.

Also side question wouldn’t your net wealth have halved if your combining finances this seems a scary proposition.

Keep up the great work.

Brendan

Hey Brendan,

|Just a couple questions with your valuation methods of your net wealth I’m an accountant and I understand that you as well as many if not most other value their investments at market value. In doing this I would imagine a lot of your net wealth is unrealized gains (equity) and as Dave Ramsey would say ‘Cash is King’.

I get this question ALL the time. So much so that I have actually updated the article with a disclaimer on where I get the property prices from so I don’t have to explain it everytime. But let me explain it to ya here in the comments too.

The value of my properties are what the Commonwealth bank estimate them to be. Various data source (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. Commonwealth bank actually approve loan amounts from this estimate (I have withdrawn equity from these estimates with no physical valuation occurring as long as I stayed under 80% LVR). If the bank is willing to loan money at this amount than it’s good enough for me to use in my net worth calculations.

I would also like to add that the banks are notoriously conservative and so they should be. I wouldn’t be lending money out on a security that was overvalued either. It’s in their best interest to be conservative when estimating values. I’m actually extremely confident that I could sell all three above for more than what the banks think they are worth… But that’s neither here nor there.

My question is what is your net wealth if you valued your assets be it investment properties or shares at cost. I myself do this because I’m very conservative and would only factor in gains/losses when I sold my shares (as I don’t have any investment properties). Would love to hear your thoughts or possibly a future article on this as I believe a lot of people run the risk of overstating their wealth through ‘paper gains’ than real ones.

Hmmm not 100% sure I get what you’re trying to say. So you value your shares at what you paid for them? Like, if you bought 1 unit of VAS for $50 then that unit would forever be worth $50 until you sold it??? Is that what you’re saying?

I agree with you that a shit load of people overvalue their wealth but it seems a bit ridiculous not include ‘paper gains’ since I have actually withdrawn some of these gains and have the cash sitting in my account. It wouldn’t make sense to do so on the flip side too. Imagine if the stocks tanked, would you still consider the VAS unit that you paid $50 for, worth $50 if for some reason Australia went into recession and it’s market value halved? I certainly wouldn’t.

I get the whole ‘you only win/lose when you sell’ but c’mon. What happens if you never sell? Surely you would agree the Bill Gates is the richest man alive? But this wealth does not come in the form of cash. The majority of it is ‘paper money’. He is a majority shareholder in one of the world biggest companies. The point I’m trying to make it that basically all reputable authorities include ‘unrealised gains’ when calculating wealth.

Also side question wouldn’t your net wealth have halved if your combining finances this seems a scary proposition.

Can you explain this one a bit more mate? Don’t understand it.

Keep up the great work.

Brendan

Will do Brendan. I’m glad you enjoy my updates 🙂

Thanks for the detailed reply.

I don’t question your valuation method of your properties you can’t get much fairer than a bank unless you were to pay a valuer which would be impractical given monthly updates.

Just thought it would be a interesting thought to see how much one is worth valued at cost vs market value in relation to F.I.R.E. I feel like for a individual specifically there are deficiencies in both methods. My argument to ‘What happens if you never sell?’ then any valuation would be irrelevant.

My thoughts against market value which I believe is the best way to go as it gives the most realistic picture. You are ‘generally’ always going to slightly overstate your value even if your valuation was 100% correct. As when you sell (if) you will always lose out on agent/advertising/tax/brokerage costs.

‘all reputable authorities include unrealized gains when calculating wealth’ agreed don’t change the way you go about it.

Combining finances clarification just the way I look at it. E.G. Person A net wealth 200k Person B net wealth 100k. Combined 300k Person A 150K(-50K) Peron B 15K (+50K).

Again thanks for responding and taking the time to go through in detail.

Cheers,

No worries mate.

Hmmm I see where you’re coming from with the valuations. I guess for simplicity I just list the value of the asset minus the debt attached to it. I guess I could calculate the cost of selling but I really can’t be bothered. It’s ganna be 3% at most and it is possible to sell a house without paying a cent FYI.

But then we get into how much tax will I be hit with when I sell? And that gets even more confusing?

I understand your points but I’m ganna stick with the basic way to calculate for now.

You can still access ‘paper gains’ even if you never sell via equity withdraws. This needs to be considered. I wouldn’t recommend it but some people actually live of a continuous drip feed of equity payments from their property portfolio (crazy I know). The benefit of this is they never pay tax on withdrawals. The point I’m trying to make is that ‘paper gains’ can be real cold hard cash too without selling.

Ok I see your way of looking at net worth now. It’s an odd way of looking at it I must say.

It’s a pleasure reading through these comments, I love writing and getting feedback 🙂

Cheers

Nice update Aussie Firebug. Diversifying into the sharemarket is a good move I think, giving your money more ways it can grow – and more income!

Tristan

Thanks DDU

Bit heavy in Australian stock compared to Australia’s actual market representation but I understand there are other things to consider in regards to this such as currency changes and Aussie tax incentives. Keep up the good work.

Yeah since we are just starting out I’m not super concerned about weighting just yet. I’m basically doing $5K chunks in every account each time we buy. Once we hit around $100K i’ll start to look at it a bit more. Probably go with 35-40% VAS. We will see.

Welcome Miss Lady Bug! Congratulations to you both, may we see the power of synergy in all future graphs. Not very technical, but the pie graph does look more complete with the fourth colour added. Thanks for posting the Vanguard funds – this is the type of mix I will be investigating before the end of the year. Can I ask – did you invest directly through Vanguard, or through a broker? Someone recently commented that you can invest directly through Vanguard in Australia, which I hadn’t realised. I haven’t done the research yet to determine if it is true.

Yeah it’s great to have Miss Lady Bug on board Whoo Hoo! LOL

Can I ask – did you invest directly through Vanguard, or through a broker? Someone recently commented that you can invest directly through Vanguard in Australia, which I hadn’t realised. I haven’t done the research yet to determine if it is true.

This was confusing for me too before I researched it. I went through a broker (comm bank). It’s $19.95 a pop but it works out better for me.

Have a read of this http://www.betterwealth.com.au/blog/index-funds-vanguard-etfs/. It will explain it way better than I can in the comments.

Much appreciated. Looks like it will come down to how often we want to contribute. We’ll do some thinking and number crunching so when it comes time, this will really help.

I like the BetterWealth site, but when I emailed the creator a while back, it appears as if he isn’t likely to move it out of beta any time soon (or at all), which I think is a shame. Now you’ve pointed me back there, however, I’ll spend some time going through the previous blog posts. Thanks again.

No worries. Yeah I emailed the creator too and he said he was no longer supporting the development of the product which was a shame. I had created an account and was planning to use it.

based on the information above, I think your asset allocation would be something like:

294% property

4% super

2% shares

-200% fixed interest.

Because you need to take in to account the total asset value of your houses, and the total amount owing on the housing loans. Not just the equity.

What do you think ?

I agree with you. I should re-title the pie chart to ‘my net worth’ instead of ‘my portfolio’ since my portfolio is actually made up ~ 89% property. I will add this change starting from next month.

Cheers

Actually I like the way you are doing it now, your net worth is what you are and have been tracking, and your equity in property is that percentage of your net worth.

With twice the savings you guys should rocket ahead. Do you have an end goal. At what point will you feel like you’ve got enough?

Not quiet twice the savings rate as she doesn’t earn as much as me, but yeah, looking forwarding to increasing our net worth more and more over the coming years 🙂

How much is enough? Great question Luke. I’m actually working on an Australia based financial independence calculator that incorporates Super! I did this mostly because I wanted it myself but also because there isn’t a quality calculator that I could find out specific to Australians.

So watch this space!

There should be two charts 1) Assets and 2) Liabilities.

The only liabilities not listed above are our HECS debts. I’ll consider adding them in. I didn’t want to add too many charts and make it too busy… I’ll tweak it and see what I come up with.