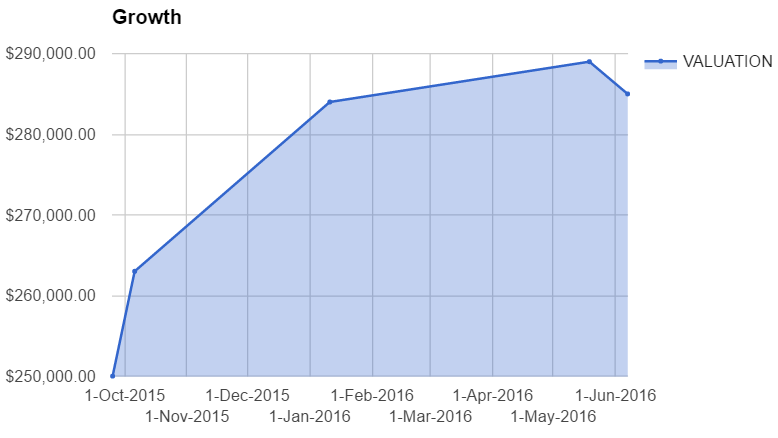

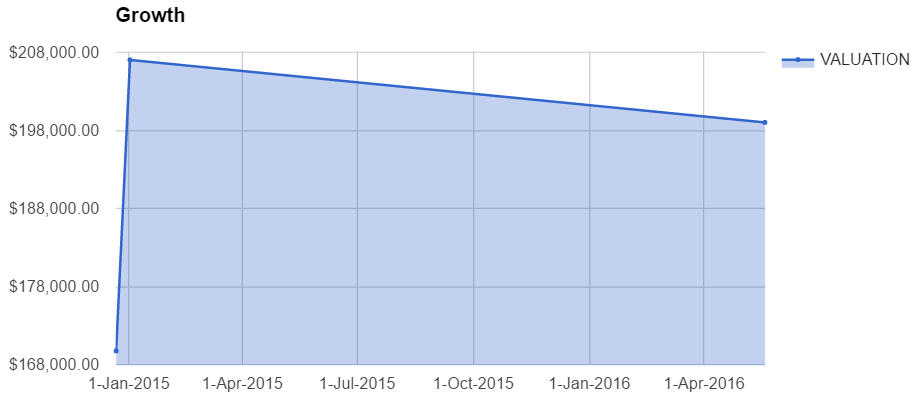

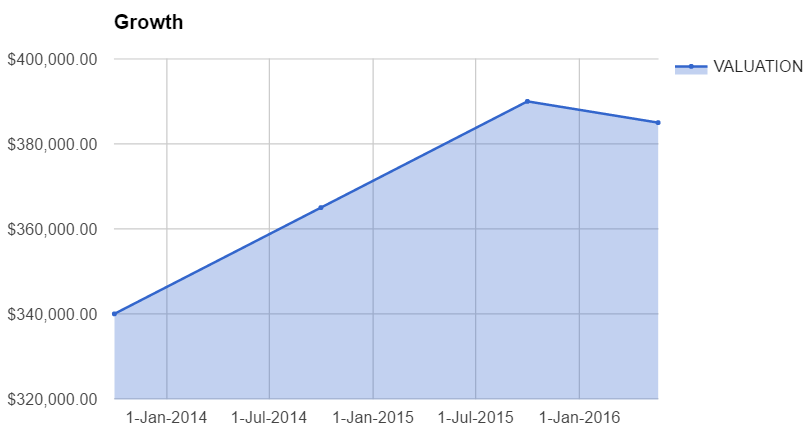

History of my properties values since purchase

Uh Oh… Is it happening? Two of my properties have declined in value since my last update.

Is the property market starting to crash?

Do I panic and rush to sell my properties before it’s too late?

What am I going to do? What happens if I lose ALL my hard earned money? I NEED TO SELL NOW TO MINIMIZE LOSSES!!!

Guys, chill.

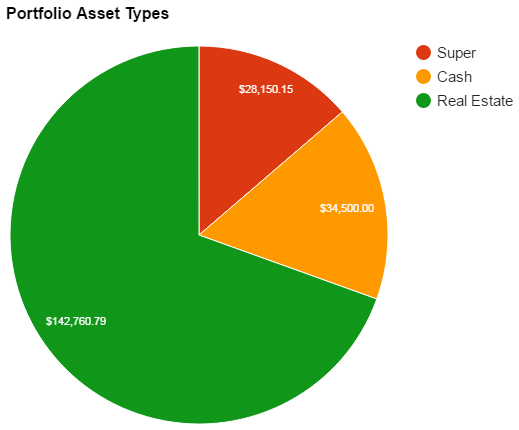

You never lose money unless you actually sell when you’re down. The funny thing is that even though two out of three properties declined within the last month. Rent has actually risen in two out of the three markets. I’ve said it from the start, I’m not too concerned about valuations but rather about cash flow. As long as there is positive to neutral cash flow I’m happy.

One enormous advantage of leveraged investing with real estate is lack of margin calls. With this recent dip from my properties, my LVR has risen above 80% which is not good. If you can recall from my previous net worth updates, as soon as any of my IP’s rise in value and consequently my LVR dips below 80%. I apply to pull out the equity to top it back up to 80% LVR and leave the cash from the equity withdrawal sitting in an offset against the loan. It cost me nothing to do and it’s essentially not changing anything because the offset money will negate any interest repayment increases. It’s there just in case and helps turn the asset to be more liquidable for an asset class notoriously know to be quite illiquid.

If this was shares however, I would most likely be getting a margin call to get my LVR down to 80% or even lower. Property is a slow moving beast and as long as you’re making your repayments the banks are Ok with the value dropping significantly. I have never heard of anyone getting a margin call from a property decreasing in value.

With this in mind, I would like to point out that there is no reason for me to panic with this small decrease. It’s part of investing. There will always be peaks and troughs. Cash flow is your lifeblood that will see you through the troughs and the peaks are just gravy on top of a well established portfolio that is built with a solid foundation.

To conclude, I lost $13K with two of three properties going down in value. One of them actually went up $5K and then dropped $4K within the month so I’m up $1K there. I also contributed a measly $1K to savings after some big purchases during the month for some events later of this year.

PS I haven’t updated my super balance, I will do it next update

Networth

[wp_charts title=”linechart” type=”line” align=”alignleft” width = “100%” datasets=”-36000,-36000, -32000,-7000,20000,32000,45000,65000,83254,130000, 187910″ labels=”1-Jan-2011,1-Jul-2011,1-Jan-2012,1-Jul-2012,1-Jan-2013,1-Jul-2013,1-Jan-2014,1-Jul-2014,1-Jan-2015,1-Jul-2015,1-Jan-2016″]

| Date | Rolling NetWorth | $ Change | % Change | Notes |

| 1-Jan-2011 | -$36,000 | $0 | 0.00% | HECCS debt |

| 1-Jan-2012 | -$32,000 | $4,000 | 0.00% | Started Full-time work late Nov |

| 1-Jan-2013 | $20,000 | $52,000 | 0.00% | Built property and recieved FHOG ($21,000) |

| 1-Jan-2014 | $45,000 | $25,000 | 125.00% | |

| 1-Jan-2015 | $83,254 | $38,254 | 85.01% | Bought second IP |

| 17-Feb-2015 | $110,215 | $26,961 | 32.38% | |

| 18-Feb-2015 | $121,541 | $11,326 | 10.28% | IP’s re-valued |

| 4-Mar-2015 | $123,715 | $2,174 | 1.79% | |

| 18-Mar-2015 | $122,128 | -$1,587 | -1.28% | Paid for holiday |

| 15-Apr-2015 | $125,906 | $3,778 | 3.09% | Withdrew equity from property |

| 14-May-2015 | $127,906 | $2,001 | 1.59% | |

| 18-Jun-2015 | $131,904 | $3,998 | 3.13% | |

| 21-Jun-2015 | $152,904 | $21,000 | 15.92% | IP’s re-valued |

| 12-Jul-2015 | $159,904 | $7,000 | 4.58% | Paid 4K off HECS Debt |

| 23-Jul-2015 | $161,904 | $2,000 | 1.25% | |

| 31-Aug-2015 | $167,904 | $6,000 | 3.71% | |

| 31-Sep-2015 | $170,110 | $2,205 | 1.31% | Car went out of Portfolio, Bought IP 3, Super went up and one IP went up |

| 31-Oct-2015 | $171,376 | $1,265 | 0.74% | Big bills. Not much saved. |

| 30-Nov-2015 | $173,263 | $1,887 | 1.10% | Super went down slightly |

| 31-Dec-2015 | $186,910 | $13,648 | 7.88% | IP went up in value |

| 12-Jan-2016 | $187,910 | $1,000 | 0.54% | Some big bills |

| 2-Feb-2016 | $189,910 | $2,000 | 1.06% | Bills (again) |

| 1-Mar-2016 | $191,410 | $1,500 | 0.79% | Didn’t save very well |

| 1-Apr-2016 | $193,410 | $2,000 | 1.04% | Steady month |

| 1-May-2016 | $182,410 | -$11,000 | -5.69% | Two IP’s went down. |

You may have mentioned this before, but how do you work out your investment property value? Surely you don’t pay or get someone to value these monthly? Perhaps it could be easier just having a proper valuation done twice a year to ride out the weekly/monthly property price changes?

Yeah I think I did mention it somewhere. I just use Commonwealths ‘My Portfolio’ feature for the price estimate. I originally thought it was pretty ‘fluffy’ but they actually use those estimates when approving loans can you believe it. As long as you stay under 80% LVR. So it’s basically what the banks think the property is worth which is good enough for me.

Sometimes the prices don’t change for 12 months. It has been pretty active as of late so I figured I might as well include it in my posts right.