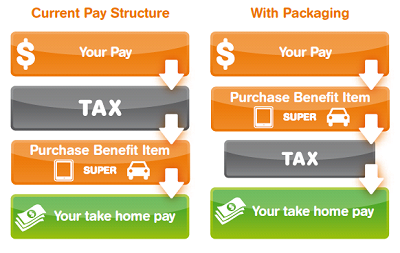

Part two of my Pay Less Tax series which focuses on various strategies for lowering the amount of tax you pay here in Australia. You can check out Part One – Buying Assets In A Trust if you missed it. This strategy is pretty straight forward, you buy stuff with pre-taxed dollars lowering your taxable income which results in you paying less tax that year.

What Is Salary Sacrifice?

Salary sacrifice, also know as a salary package is an arrangement between an employer and an employee. The employee sacrifices part of their salary or wages in return for the employer providing them with benefits of similar value.

The key thing to remember here is that you’re using pre-taxed dollars when you sacrifice.

Lets consider someone who is earning $80K and needs to buy a new computer worth $4K. At $80K per year, this person would receive $60,853 dollars after income tax.

They could pay for the new computer out of this post taxed income of $60,853 which would then bring them down to $56,853.

If their employer let them salary sacrifice the computer to bring their taxable income down to $76K per year, they would receive $58,233 dollars after income tax PLUS their computer.

That’s a difference of $1,380 dollars saved. Imagine if you did this or something similar for 30 years. That starts to become a serious amount of saved taxed money that could be invested or spent elsewhere.

You really have to check what you’re company is offering when it comes to salary sacrificing. I’m pretty certain (please comment if I’m wrong) that most companies allow you to salary sacrifice into super. There’s a limit of $25,000 a year before tax contributions.

Make Sure You Check

There are no restrictions on what your employer can package for you so it’s really best to check with them. I know a place that allows their employees to salary sacrifice their home loan! Yes that’s right, their bloody home loan. I’m not sure of the details but can you imagine if you could pay off your home loan using pre tax dollars every year. Unfortunately my work only lets you salary sacrifice super which is no good to me for now. So go check with your employer. You might have an expense coming up soon that you could potential pay for using pre taxed dollars.

If I am not mistaken, only people who work for not-for-profit companies can salary sacrifice things other than super – at my current institution it is capped at $9,020 per employer (which can be spent on anything such as credit card expenses), with an extra $2,500 for meals and entertainment. Though I am not too knowledgeable on the area.

Hmmm yeah maybe. The place I know of is a hospital. That’s awesome that you can do it! I wish I could 🙁

Hey Firebug,

I agree with what Luke said – to make public entities and non-for-profits more appealing to people (because they can’t compete with private wages), employees can salary sacrifice pre-tax dollars. Sadly this isn’t available for most of us, plus the Govt are slowly cracking down on this.

It’s cool for those that can do it though, I’m jealous.

Tristan

The difficulty you will find in most businesses is actually having the administrative setup to allow for salary sacrificing, which is why companies like Maxxia exist – to outsource the associated challenges. Maybe the biggest challenge though is that it’s not always in your employer’s interests, as in most cases there will be a need to pay fringe benefits tax.

Things like computers and voluntary superannuation contributions up to a certain limit are generally tax deductible (assuming the computer is used for work purposes), so by salary sacrificing you’re typically just reducing your taxable income and PAYG instalments rather than getting a big tax refund when you lodge your return. Where it isn’t the case, your employer will have to pay effectively DOUBLE the cost of the expense because they are unable to apply the “Otherwise Deductible” exemption for FBT and probably won’t go for it.

I’m not entirely across the FBT laws for not-for-profits, so there may be some exceptions for them as mentioned above.

There are new changes coming to super on 1 july 2017 – one of them allows people to pay super directly to their fund, and claim the rebate back at tax time – this makes it a lot easier for people to make salary sacrificed contributions without bothering their employer (I imagine many small businesses would struggle with it).

Good to know Nick.

I’ll have to read up about the changes.

Cheers

Hi,

good post but i get a churning feeling in my gut that tells me that this has some bad information in it. this section:

“You really have to check what you’re company is offering when it comes to salary sacrificing. I’m pretty certain (please comment if I’m wrong) that most companies allow you to salary sacrifice into super. There’s a limit of $30,000 a year for those aged under 50 and $35,000 a year for those aged 50 and over for all before-tax contributions.”

sounds like it is talking about salary sacrificing anything however the link is to Australian Super website and purely about Salary sacraficing to super.

Also I realise the article is old but the figures quoted are outdated.

Hi Nic,

I’m not sure I understand. I’m specifically talking about salary sacrificing. How does it sound different?

The $30,000 for those under 50 and $35,000 for those over 50 were correct at the time but have since been reduced to $25,000 for everyone is presumably what Nic is saying.

Ah I see. I have updated the post. Cheers

Hi Firebug,

Sounds like this post is talking about salary sacrificing and salary packaging, which big picture is the same thing (diverting pre-tax funds), however on a further drill down are actually different. Sal sac is for super, packaging is for things like computers, car leases etc. and has rules around fringe benefits tax. There are certain industries (health care off the role of my head) that also let you package things like rent and eating out. Might need to review this post or make a new one with more info (I work in financial planning and deal with these strategies all the time).

Hi Aussie Firebug!

I’m stuck on how much I should salary sacrifice. I’m 27 and have about $49 000 in super and an overall net worth of $118k (including super). My current income before tax is $83k. Do I invest heavily into super, or invest into my own ETF/index funds that I can access when I want to retire early. I’m hoping you can shine some light on this calculation. Thank you!

It depends on a bunch of factors. What are your goals? When do you want to stop working? Have you had a look at the FIRE calculator I made on the front page?