Woah!

Big jump this month with over $28K…well sort of.

Let me explain.

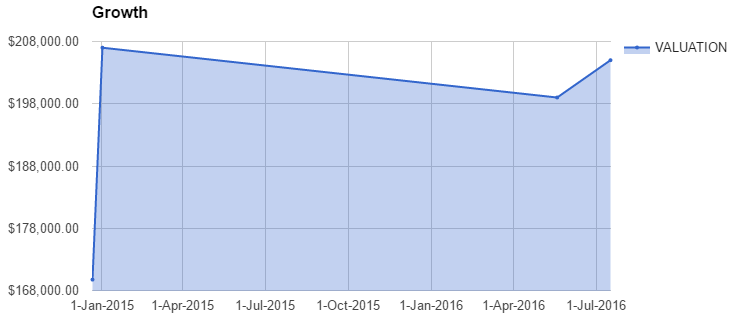

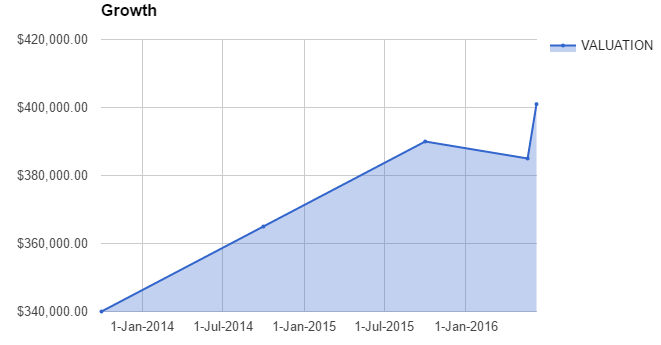

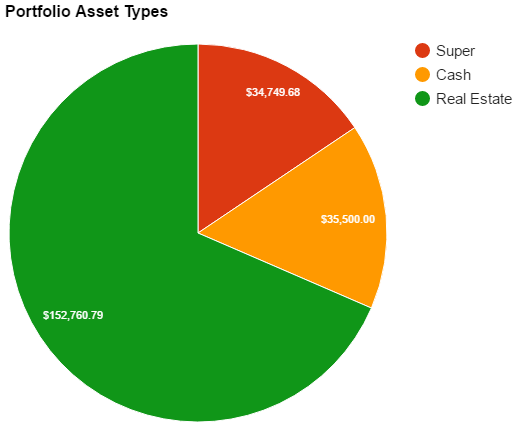

Firstly, I finally got around to updating my Super which has gone up around $6K since I last updated it. So that’s quite a jump there.

Secondly, my properties have rebounded a bit.

I have not been one to get valuations done monthly or anything like that. I usually try to do it annually or if I’m applying for another loan (in which the banks usually do a reassessment of the valuation anyway).

However, over the last couple of months my online valuation tool offered by Commbank has been very active. Sometimes the tool (which gathers data from various buy/sell information of similar properties and using RP Data) would not change a valuation on a properties for over 12 months! But lately it has been very active. Majority of the time you won’t see a change in my properties value in my monthly net worth updates because they usually don’t change that often. But when they do I include them in the update because as you can see, the swings they created in my net worth are substantial.

I managed to save a bit of cash too which was nice.

And I managed to break into the $200K club Woohoo!

I set myself the goal of reaching quarter of a mill ($250K) by the end of the year which seems more achievable now.

Time will tell.

Networth

[wp_charts title=”linechart” type=”line” align=”alignleft” width = “100%” datasets=”-36000,-36000, -32000,-7000,20000,32000,45000,65000,83254,130000, 187910″ labels=”1-Jan-2011,1-Jul-2011,1-Jan-2012,1-Jul-2012,1-Jan-2013,1-Jul-2013,1-Jan-2014,1-Jul-2014,1-Jan-2015,1-Jul-2015,1-Jan-2016″]

| Date | Rolling NetWorth | $ Change | % Change | Notes |

| 1-Jan-2011 | -$36,000 | $0 | 0.00% | HECCS debt |

| 1-Jan-2012 | -$32,000 | $4,000 | 0.00% | Started Full-time work late Nov |

| 1-Jan-2013 | $20,000 | $52,000 | 0.00% | Built property and recieved FHOG ($21,000) |

| 1-Jan-2014 | $45,000 | $25,000 | 125.00% | |

| 1-Jan-2015 | $83,254 | $38,254 | 85.01% | Bought second IP |

| 17-Feb-2015 | $110,215 | $26,961 | 32.38% | |

| 18-Feb-2015 | $121,541 | $11,326 | 10.28% | IP’s re-valued |

| 4-Mar-2015 | $123,715 | $2,174 | 1.79% | |

| 18-Mar-2015 | $122,128 | -$1,587 | -1.28% | Paid for holiday |

| 15-Apr-2015 | $125,906 | $3,778 | 3.09% | Withdrew equity from property |

| 14-May-2015 | $127,906 | $2,001 | 1.59% | |

| 18-Jun-2015 | $131,904 | $3,998 | 3.13% | |

| 21-Jun-2015 | $152,904 | $21,000 | 15.92% | IP’s re-valued |

| 12-Jul-2015 | $159,904 | $7,000 | 4.58% | Paid 4K off HECS Debt |

| 23-Jul-2015 | $161,904 | $2,000 | 1.25% | |

| 31-Aug-2015 | $167,904 | $6,000 | 3.71% | |

| 31-Sep-2015 | $170,110 | $2,205 | 1.31% | Car went out of Portfolio, Bought IP 3, Super went up and one IP went up |

| 31-Oct-2015 | $171,376 | $1,265 | 0.74% | Big bills. Not much saved. |

| 30-Nov-2015 | $173,263 | $1,887 | 1.10% | Super went down slightly |

| 31-Dec-2015 | $186,910 | $13,648 | 7.88% | IP went up in value |

| 12-Jan-2016 | $187,910 | $1,000 | 0.54% | Some big bills |

| 2-Feb-2016 | $189,910 | $2,000 | 1.06% | Bills (again) |

| 1-Mar-2016 | $191,410 | $1,500 | 0.79% | Didn’t save very well |

| 1-Apr-2016 | $193,410 | $2,000 | 1.04% | Steady month |

| 1-May-2016 | $182,410 | -$11,000 | -5.69% | Two IP’s went down. |

| 1-Jun-2016 | $211,010 | $28,600 | 15.68% | All 3 IP’s went up and super was updated |