Lets talk savings rate for a second. It is in my opinion THE most important factor to FI (financial independence) and determines a lot of things like:

- Whether you actually reach FI

- How long it will take you to reach FI

- Gives you a clear indication as to what your FI number is

It’s really the foundation for the concept of financial independence retire early (FIRE) which is what this entire blog is about.

There are only three things you need to do in order to become extremely wealthy:

- Spend less than you earn

- Invest the rest

- Wait

The very first step in becoming rich enough to retire early is to save your money. The second step is what gets most of the limelight and chatter.

Investing.

But don’t get it twisted. You won’t EVER invest your way to FI if you don’t spend less than what you earn, because that’s… you know…impossible.

And finally the third step is the time you have to let compounding interest dominate for you.

There could be an argument made for the amount of time you have as the most important factor but it’s kinda out of your control as in you 1. don’t know how much time you have (could die tomorrow) and 2. Can’t change it even if you knew you had X amount of years left. You have a lot more control over whether you spend less than you earn.

Savings Rate For Last Financial Year

Let me cut to the chase.

My savings rate for last financial year was…

74.39%

Last financial year I made $72,105.04 (after tax) and spent $18,468.42.

One of my top ten tips (LINK TO TIPS) I suggest to people trying to save money is always, always track your spending.

As the old saying goes ‘A goal without a plan is just a wish’.

You cannot set a plan of attack without knowing exactly how much you spend. You know roughly what your income is going to be, you then need to plan for the amount you want to spend each year to achieve your goal of whatever spending rate you choose.

Breakdown Of Spending

There are two ways you can track your spending:

- The hardcore way = manually inputting ever transaction into an Excel spreadsheet

- The easy way = Using an online service that feeds into you bank account (something like pocketbook)

I use the easy way but there is absolutely no problems using the hardcore method.

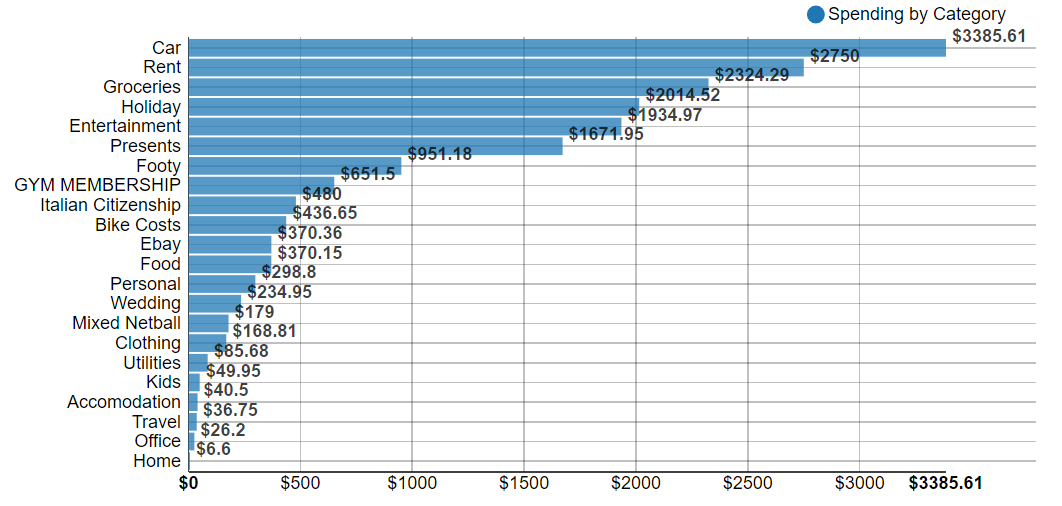

Let’s have a look at where my cash went last year

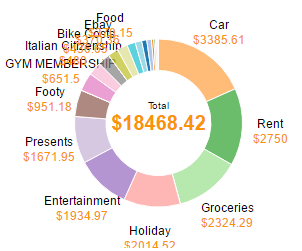

Below is the same data but represented in a pie chart.

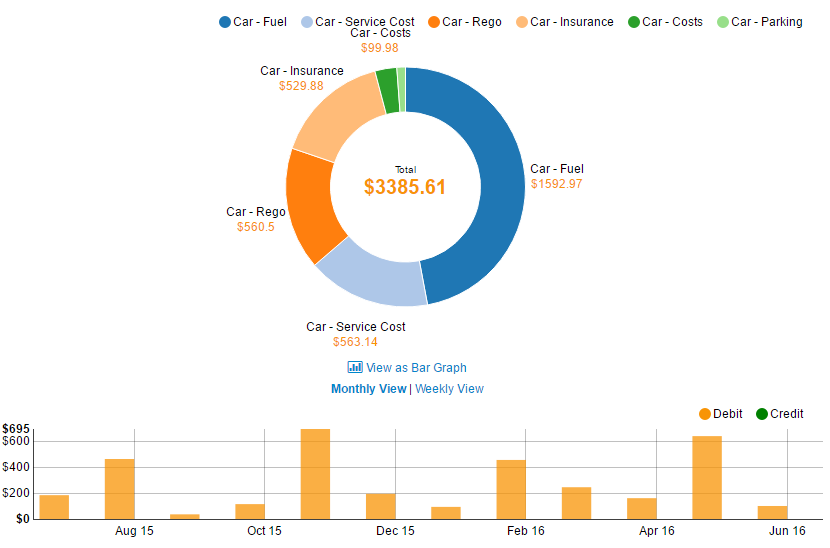

One of my favorite features of Pocketbook is its ability to create sub categories. My biggest expense is my car for example. I spent a total of $3,385.61 dollars on it last FY. But that’s a little vague isn’t it. Luckily I recorded sub categories for it and can dig deeper into the overall ‘car’ category to see it.

Pretty cool huh.

The software lets you see where the costs came from and even what months you spent the most amount on. The above are screenshots only, but this graph is actually interactive which is pretty cool because you can un-select multiple sub categories from above and the pie will change and you will see the spending per month change on the fly. This sort of stuff really excites my inner finance geek (what a sad existence I live lol)

Before You Ask

There are a lot of things missing or not quite right with my above spending, so before anyone points it out let me set the record straight!

- I only moved out of home at the start of this year hence why my rent is quiet low and overall expenses

- Everything above is only my income and expenses. I do however pay for me and my partner some times (like for dinners and what not) but she also pays for things too so it’s hard to keep track of that. We have not yet joined finances

- My rent ($110 a week) covered gas, electricity , internet, and water. This was a room share deal in the county (cheap as chips)

- I don’t pay a phone bill…sorta. I pay the minimum which is around $20 bucks I think, every six months so I can keep my number from Telstra, this small expense falls under utilities. This means a don’t have credit and can’t call people when I’m out and about. It usually blows people minds when I tell them I don’t pay for credit and am not on a plan. But with the availability of open wifi’s increasing, it is my opinion that we will see less and less people buy cellular data/credit unless they’re in a remote area. Nearly all calls and messaging will be done through the internet in the future

- I have not included the costs (or incomes) of my investments

- I have not included my accounting fees because they are a deductible expenses associated with my investments. In the end I plan to transition completely to index funds and will be doing the accounting myself. Anything investment wise I keep off because I would then need to include the income generated by those investments to be fair and that would get tricky

- Costs associated with this blog are not included

- Going out to eat as an activity fall under ‘Entertainment’, food is where we had to eat somewhere but not as an activity (like at a petrol station) and groceries are anything bought at the supermarket

- I group ‘Holidays’ as one big expense and than create sub categories for each holiday. Anything that is spent on the holiday falls under that sub category holiday. If we buy groceries during a holiday, it will be categorizes as the holiday and not as groceries. Gives me a better indication about how much the holiday costs me

- ‘Presents’ covers gift to myself and others (Christmas, Fathers day, Valentines day etc.)

- ‘Personal’ covers health related things like physio, dentist, ambulance insurance etc.

- And no I don’t have any kids. The one expense for ‘Kids’ is because I recently became an Uncle

How Do You Compare?

I like to compare the savings rate to the nutrition for a professional bodybuilder. Some people say that Bodybuilding is 80% nutrition and only 20% the other stuff (training and sleep). You can’t out exercise a bad diet. Period.

You can train the house down 6 hours a day 7 days a week, but if you’re not fueling your body with the right amounts nutrients it needs to function and repair itself then you’re not going to see results.

This is the same for those striving for FIRE. A healthy savings rate enables you to invest capital. The better the savings rate, the better the results are going to be.

It’s a rookie mistake among first time gym goers. They concentrate so hard on their routine and make sure they put a solid 2 hours in, only to swing by McDonald’s on the way home from the gym thinking they have improved their health.

You would have been better off simply eating a healthy meal and NOT going to the gym!

Optimism your savings rate first, and then concentrate on the investing part.

A dollar saved is a dollar earned. Where as a dollar made isn’t really a dollar, it’s more like 0.70c because of tax. Think about that for a moment.

I would love to know what your savings rate looks like. Have you optimized your expenses so much that my measly 74% savings rate pales in comparison? Maybe this was an eye opener and now you have something to aim for?

Thoughts, feelings and emotions in the comment section below.

Hey FireBug,

Awesome job with your saving – you’re saving a huge amount of your wage (which is nice too). Italian citizenship – are you Italian? Very cool if so.

I hope we (my wife and I) can get up to an awesome rate like that at somepoint over the next few years.

Tristan

Hey Tristan,

Half the year was living at home so it makes it easier, but I’m still proud of how much I managed to save.

My father is Italian! I applied for my Italian citizenship this year and thought it deserved its own category 🙂

I’m sure you will. Good luck!

Wow is your rent >$100/week?

And I like the bodybuilding analogy!

I only moved out of home at the start of this year. And when I did rent, I room shared for $110 bucks.

Hey there Firebug, nice work on the hyper-savings rate. As you say, it’s skewed a bit since you had minimum costs living at home but hey, take every boost and freebie as it comes and add it to the stash. There will always be times, along the finacial journey, where you get to win and others where you lose, like unexpected repairs for example. Hopefully we end up with far more wins than loses but we are still able to have control over many of them. Good decisions vs bad decisions, we decide.

Absolutely.

It’s all about taking advantage of situations. I have friends who moved to Melbourne and complain they have no money after they eat out 3 times a week, go clubbing, consistently update their wardrobe on Chaple street etc. Then they tell me it’s easy because I live at home…

Last time I checked they weren’t kicked out of home. They left own their own accord to have fun in the city, which is fine. But it annoys me when some people make out like they didn’t have the same opportunities as me when I know dam well they did.

They just didn’t take advantage of it!

That’s an awesome savings rate, well done!!

Thanks =)

That’s pretty crazy. My savings rate is around 46%, which is about all I can manage with a big family at the moment and one income coming in.

Hi Luke,

46% with a family and one income is a phenomenal savings rate mate! I only managed to save as much as I did because I was living at home for half of the time. I expect my savings rate to drop to around 60% when I write this article in a years time. We shall see

Wow, that’s an amazing savings rate. Ours was only 40% for 2016. We will work hard in 2017 to increase that. Well done!

Thanks 🙂

Our savings rate this year will be a lot more accurate b/c I have moved out with my partner and it will be the first full year of living expenses together.

It’s ganna be way under 74% I can tell you that much lol

Not sure what the savings rate is as the missus has a salary that bounces all over the place depending on how much work she has. She likes to keep her income a secret too, which makes planning for FIRE frustratingly difficult. I’m trying to lead by example by spending less, but it seems my wife takes this as a cue to spend more. We’re in the vicinity of about 50% (I think), but baby number 2 due this week means it’ll be negative for a year or so till she starts working again.

Good luck on optimising yours for this year Firebug!

50% is excellent Chris.

Yeah this year for me is going to be WAYYYYY less than 74%. Closer to 50%. I have been living with my partner for nearly a year and it shows lol.

Awesome job. Slowing reading thru all your blogs. Targeting 50% for our family of 3.

Thanks. 50% is a great rate for a family of three.

Really great for you to share your spending breakdown. It’s a real eye-opener for me, as my monthly spending for groceries and entertainment is nearly as much as your yearly spending! Admittedly that’s for a family of four, but it really helps inspire me to think about where I can save, and not just blindly accept “oh well, that’s just the cost of living”.

I only just discovered your blog, but I love your writing style – I find it informative and encouraging, not judgemental and preachy like some other FIRE blogs can be. Keep up the great work.

Thanks for the kind words Pete 🙂

It’s great to have some visibility of how much others are spending. I look at some other blogs and find they I’m lacking in some departments. Sometimes a real eye opener.

It’s really great having an Aussie blog as the US ones are great but in a few things, completely irrelevant for us, so thank you! The question I have is on pocketbook, I’m about to download the app to start tracking our spending a bit closer…is the app any good or should I be using the website instead? The App store also has the option of TrackMySPEND developed by ASIC – do you have any thoughts on that app in terms of comparison with Pocketbook? Thanks and keep up the good work 🙂

I can’t comment on TrackMySpend because I’ve never used it or seen it.

But for Pocketbook, it’s all about the website. The app is good for notifying you about spendings. Sometimes it does a really good job at alerting you to a fine or extra bill where it thinks you shouldn’t have been charged. But the site is where I do most of my work for categorizing and analyzing.

Thanks for the support 🙂

Our savings rate is about 65% for a family of 4. Would like to get it down more but can’t see it happening. Our Net Wealth should increase substantially over the next few years thanks to blogs like these.

Thank you for this insightful blog. What do you do for a living if you don’t mind me asking?

IT professional in local government