Until I discovered the concept of FIRE at around the age of 24, my life was on track to becoming pretty ‘normal’. What is normal anyway? I guess it’s what the majority of the people around you are doing?

The ‘normal’ where I live goes something like this:

> Go to school and study hard

> Go to either Uni or get a trade

> Get a job after you have finished your degree/trade

> Find a partner

> Get married

> Buy a home

> Have kids

> Raise kids for the next 20-30 years

> Start to seriously plan for retirement

> Spend the next 10 or so years adding to whatever nest-egg you have in hopes that you can retire soon

> If you’re one of the lucky ones you retire around 60 with enough investments to see you live comfortably for the rest of your life

This model of ‘normal’ usually involved around 40+ years of 9-5 full-time work.

Let me repeat that. 40 years of work…

When I first started working full time I was blown away by how much life you actually lose each week. I knew the hours and that you work Monday to Friday, but it wasn’t until I actually started work that I felt like so much of my life was being wasted. I didn’t even hate my job either, in fact, I quite liked it. But there were SO many other things I’d rather be doing than my job. I knew there had to be a better way. I just couldn’t accept that a human being living in one of the richest counties on earth is required to work the majority of the day for 5 days a weeks for 40+ years in order to finally retire. Which is when I started to learn more about investing and the concept of FIRE.

If you know anything about investing then you most likely have come across the term ‘compounding interest’. Albert Einstein is quoted to have said

“Compound interest is the eighth wonder of the world. He who understands it earns it … he who doesn’t … pays it.”

If Einstein is saying it’s the 8th wonder of the world than you know it’s some pretty epic shit.

Compounding interest is when your interest earns interest. It’s basically like a big snowball that gathers more and more snow as it rolls down the hill. To get this snowball started you need to supply your own snow. But once you have ‘something’ started then the snowball will roll down the hill gathering little bits of snow along the way (your gains).

After a year of your snowball rolling down the hill slowly collecting other bits of snow, you discover that it’s grown by 5%. Because your snowball is now a bit bigger, the following year it gains even more snow since as it can cover more ground now. This has a flow on effect and after years of rolling down the hill, the snowball has grown to such a size that the amount of snow it can now collect after just a single year of rolling is enormous.

There are two critical components to compounding interest, the initial amount you start with and the time in which you start.

Let’s consider two different examples:

Mike is 25 and he decides to place his life savings of $50K into a savings account that returns 9% per year compounding annually (meaning that the additional interest is paid every year). He makes a promise to himself that this money will be used for his retirement and he must never touch a single dollar of it until he reaches 60.

Ben is also 25, but retirement to him is so many years away that it’s not remotely on his mind. He knows that one day he will probably need to save for retirement as he doesn’t trust that the government will be able to look after him once he can’t work anymore. Ben puts retirement on the back burner and YOLO’s through his 20’s, settles down in his 30’s and has kids.

The years fly by and suddenly Ben is 50. Ben and his wife start discussing retirement seriously and decide to start putting away a decent chunk of their income each year into a similar savings account that Mike used, this account also returns 9% per year compounding annually. Since Ben and his wife started their retirement account later in life they now have to sacrifice their lifestyle and scrap together all the spare change they can get. They miraculously are able to save a whopping $50K each year to add to their retirement fund.

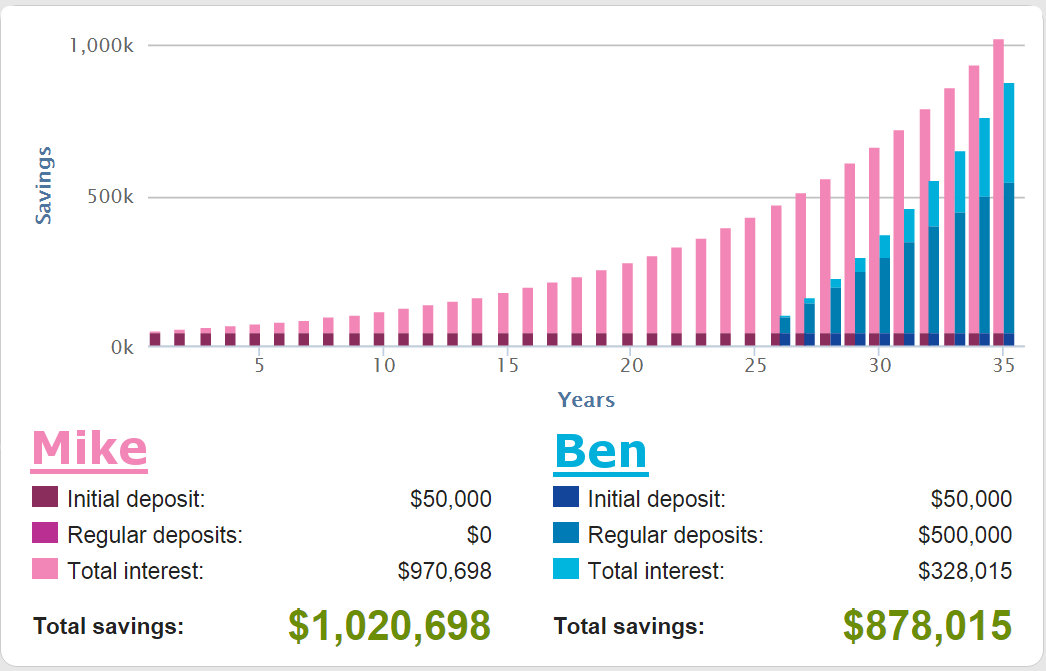

Lets recap for a second. Mike invested a once-off lump sum of $50K at 25 while Ben and his wife invested a total of $500K ($50K X 10 years) between 50 – 60 years of age. Let’s compare how much money they have when they both turn 60.

Mike is represented by the pink columns and Ben and his wife by the blue ones. Mike ends up with over a million dollars in his account with Ben trailing by over $100K on $878K. Keep in mind that Mike made a once-off departure with $50K at 25. T

hat’s it.

He also YOLO’d his way through the rest of his life, he didn’t have to save a cent past 25, he didn’t have to sacrifice his lifestyle for 10 years saving $500K and yet he STILL came out over $100K ahead of Ben when they reached 60.

Mike had the power of compounding interest working for him for 35 years. During that time, his $50K nest-egg grew from $50K to over $1,000,000 dollars without him ever having to add or do anything to it.

Historically the S&P 500 Index has returned 9.04% with dividends reinvested so you might not be able to find a savings account that’s going to give you 9% (you won’t) but it is entirely possible that you could have invested $50K and have it return something close to 9% over 35 years. What I’m trying to say is that Mike’s story is entirely achievable. Yes, I left out a lot of things (market swings, inflation, income growth etc.) but fundamentally, if you start young and let father time do the hard lifting for you, It’s 100% possible to build a small fortune with little to no effort thanks to the power of compounding interest.

A Final Thought

I hope that you now fully appreciate the awesome power of compounding interest and how it can work in your favor. I think that the majority of people are doing it wrong when they hold off saving for their retirement. You should start young and be consistent with small amounts rather than trying to play catch up later in life. Get the snowball rolling now not later!

PS* The above graph was made from the smartmoney.gov.au site which can be found here. It’s a really great calculator that lets you compare two different strategies. Have a play with it and you will be astonished at some returns you can end up with if you invest early and consistently.

Photo credit: 401(K) 2013 / Foter / CC BY-SA

The real issue is that no compounding interest guarantees anything close to 9%… In Aus at the moment term deposits earn around 3%. How does one find a guaranteed investment in Australia or accessible in Australia with decent returns?

Yeah fair point.

But if you look at the S&P 500, it has returned on average just over 9% since inception (I linked to the source in the article).

You can invest in US stocks from Australia by buying an ETF or going through Vanguard. I’m not saying you will get 9% consistently, BUT it is 100% possible to get around 9% average return over the lifetime of your investing (assuming it’s long enough).

Some years you may only get 4-5%, other years you may get 12-15% but nothing is ever guaranteed, not even term deposits!

Great article. I think I heard somewhere that humans aren’t innately capable of understanding exponential growth..? Once you see it in a graph format it really drives the message home. Also – head’s up that your quote code isn’t working 🙂

[pullquote align=”full” cite=”” link=”” color=”#ffa500″ class=”” size=””]If Einstein is saying it’s the 8th wonder of the world than you know it’s some pretty epic shit.[/pullquote]

Yeah it’s crazy once you understand the power of it.

Thanks mate. Had a plugin fail. Will fix it up

But that is before tax and inflation

Inflation can easy be factored in by reducing the overall amount by whatever inflation rate you want to us (2.5% for example).

But the tax part is too hard to calculate because everyone has different circumstances and situations.

If I have 50K cash sitting in my savings account, would you recommend once-off investment (let’s say everything into s&P 500) ? or should I wait till the price of ETF drops then invest bit by bit? Thanks!

I’m a believer in one lump sum. But have a Google of dollar cost averaging, it can calm the nerves of some who are scared of a crash right after they invest. Waiting for the price to drop is timing the market which I would not recommend.