A lot to cover for August.

We finally had price movement in our properties with one going up $16K?, one dropping by $22K ? and one not changing at all.

It feels like it’s been forever since there was a price change. But in reality, the last price fluctuation was 7 months ago in January which isn’t that long really.

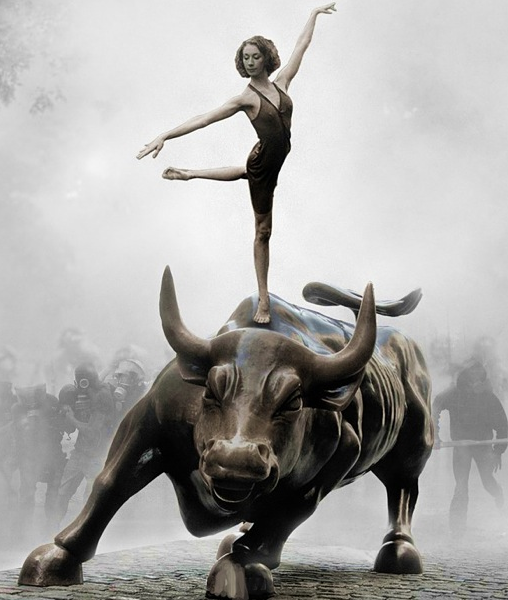

Property is like a big cruise ship. When the price goes up or down it takes a while for the ship to change direction. You’re not going to see prices zip up and down quickly. It usually takes a few months for a significant wave to build up and change the course of the ship.

The sharemarket, on the other hand, is a ballet dancer. Jumping, bounding and leaping up, down and sideways with no warning.

We had another influx of cash into our account from an event which I have hinted to in past posts. I still can’t give away details yet but there is a post coming in the future which will go into detail about ?.

We are so close to hitting the $100K in our ETFs. We’re currently at $99,705 and it feels like the sharemarket is just toying with us.

We set a goal last year around July that we wanted to get to $100K worth of ETF’s and then reassess what we wanted to invest in next. Pretty stoked to have achieved this goal ($300 off but c’mon) within 13 months.

We’ve already had the chat about what we’re going to do next and we both agreed that pouring more $$$ into ETF’s made sense.

I love real estate, but when I look at the current climate in Australia there are very few places where I think we could make money without a lot of risk and hard work. I’m a buy and hold investor. I don’t have the skillset, experience or desire needed to flip, renovate or subdivide in this market and come out ahead majority of the time. There’s too much at play right now for us to put so much capital into property especially when there is such a great alternative for us which requires no skill or experience to make money.

I’m talking ETF’s of course.

Don’t get me wrong, you can still make money in the current climate but you better know exactly what you’re doing. Because the yields just aren’t there for me in the capital cities and I don’t want to put in the work required for sweat equity.

If Australia does have a property crash and the yields get back up towards 6-7% in the capitals (especially Syd and Melb) I hope that we have enough spare cash to grab a bargain. If the banks are lending money that is…

Net Worth Update

$16k from an IP and -$22k from another. About $1.7k added to Super accounts. $5k into ETFs as per usual with ETFs adding an extra $500 through capital gains. We also had an additional $7k from another source which I’ll write about in due time. We saved well this month too but the majority went into ETFs.

On a side note. We broke our $10k streak which lasted 7 months!

That’s 7 months in a row where we managed to add at least $10k or more (sometimes a lot more) to our networth.

Sad the streaks over but I knew we couldn’t keep it up forever…for now at least ?

Properties

Finally some change in our properties!

One IP went up by $16k, one went down by $22k and one stayed the same.

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs

ETFs moved about $500 upwards. Pretty good months.

Networth

How do your properties change price so often?

Are you getting regular valuations? How does that work?

I have a house in Australia, and I don’t receive this sort of information.

Hey Yttrium (Science Major?),

This value is calculated from Commbank and updated yearly at least. Sometimes it changes monthly.

At first, I thought this was a flimsy valuation but it’s not. Commbank actually use this number to approve loans. It’s usually conservative but sometimes it’s safer to be that way.

Very nicely done. Looks like your net worth trend is fantastic. Look at that steep curve. That is what we love to see. Keep up the excellent work.

Thanks BHL 🙂

Well done! I’m sure you’ll crack the 100k mark very soon (if you haven’t already since this post).

Onwards and upwards 🙂

Thanks Miss Balance 🙂

Currently at $98,820 🙁 lol. We will get there this month

I am also interested to hear how your property values change!

Hi Kat,

Please see my response above.

Any questions let me know.

Cheers

Oh mah gaaad! Thanks so much! I put my property in (PPR bought this Jan extremely cheap) and my net worth has gone up $180k! I had the value at what I paid because I had no idea how to reliably value it.

Thanks again! Keep up the good work!

Also interested. Are you paying for regular valuations? If so, are you factoring that into your monthly expenses? (well, obviously, if so)

Hi Nick,

See above comment. I don’t pay for valuations

Hey mate,

Great read as usual.

Do you purchase the ETF’s in your name or jointly with your partner?

Wondering if there is a significant tax advantage to buy in one partner’s name if they are in a lower tax bracket?

We buy all our ETFs in our family trust. There are tax advantages that come with owning income producing assets in a trust vs personal name

The net worth graph is awesome. Doing well!

Cheers mate. We have had an incredible year so far

Love the analogy! I’m so curious about the cash injection story.

Thanks for your thoughts on where you are investing next. I don’t want a property, but I still feel the hankering. Dammit, we’re Aussies, it’s what we do! Maybe we need to make a cultural change to ETFs as the Great Australian Dream. Not sure how to start that process ?

Nothing wrong with property. Hankering on your own home (renovations anyone?) is a great way to add equity.

Haha the great Australian dream to ETFs? I very much doubt that. I like that the Australian dream is to own your own property, I think there’s something to be said about that. But of course some people go too far with that lol

Let the good times roll!

Never a down month in firebug land 😉

Yeah buddy!

A few down months since I started tracking them, but mostly in the green 🙂

Hey man,

Just stumbled across your blog and I’m loving the Aussie perspective that you offer on FIRE.

I also wanted to say kudos for reaching your current net worth. I’m your age, but started out on this journey about a year ago and nowhere near your numbers. Amazing stuff!

Thanks for the support Stephen!

Remember that my number is a combined number for my partner and I.

It’s all relative anyway right? As long you can keep getting closer to your goal you’re on the right path.

Hey there!

Just stumbled across your blog, so great to read and Aussie FIRE blogger as so many are from the USA and some things are difficult to apply here… terrific reading and net worth growth! Congrats ?

Your property valuations – using commbank property app? I’ve got the app but can’t seem to get any valuations, only recent sold and rent prices…? Or is it a different app?

Thank you!

– Angela

Hi Ange,

Thanks for reading my blog. I’m glad you have been enjoying it 🙂

I actually use the ‘Portfolio’ section when I sign into Commbank. My loans are with Commbank so I don’t know if they provide this feature to everyone.

That estimate uses a whole bunch of data from surrounding properties and gives that estimate that they actually use to approve loans up to 80% LVR with.

Awesome, thanks for the tip. I didn’t realize the portfolio section provided that data too, yay!

Keep up the great blogging and investing… ?

No worries 🙂

Thanks for the kinds words.