If you’re on the path to financial independence and follow a few bloggers as they save and invest their way to freedom. You no doubt have come across an investment vehicle that just keeps on popping up everywhere you look.

Exchanged Traded Funds (ETFs)!

The holy grail of investing, according to most in this space. I’m more open to other types of investment classes such as real estate (I can almost hear the boos and hisses) and believe that each asset class has its strengths and weaknesses. But honestly, ETFs are recommended by so many people (Warren Buffett included) for very good reason:

- Extremely low management costs (one of my ETFs charge 0.04%)

- Great diversification

- Low buy in and exit fees ($20 a pop depending on how much you buy/sell)

- Can start investing with little capital (investment properties, on the other hand, require considerable start-up costs)

And there’s more but you get the idea.

So ETFs are awesome right! But how does one actually go about purchasing these little bundles of investment goodness?

Directly through Vanguard vs Buying ETFs

This is the most confusing part of the whole thing. So you decide that you want to buy Vanguard ETFs because you’ve been hearing how awesome they are so you naturally do what any computer literate person would do.

You go to Google.

You punch in Vanguard, head to their site expecting it to be awesome and have them basically walk you through buying their product.

Errrrrr not so fast muchacho’s!

Vanguard’s site is crap. Yes, it has all the information you need on there in the form of white papers. But they have absolutely no funnel for a user to purchase their product. You sorta have to figure it out on your own. And to be honest, Vanguard doesn’t really need to rely on a fancy website or app (they don’t even have an app ffs). Their product is so good they don’t waste time and money on advertising and marketing.

Back to the point. You have two choices when it comes to buying a Vanguard product. You can either buy it directly from them (called managed funds) or you can purchase an ETF through a broker.

In a nutshell:

| ETFs |

|

| Managed Funds |

|

The biggest factor is probably cost. Because depending on how often you’re going to make contributions, will dictate which method is right for you. There is a really good article that goes into detail about the costings of investing directly through a mutual fund vs ETFs on the Betterment website.

I have never purchased Vanguard products directly from them because it works out better for me to buy ETFs, so I can’t comment. But I have seen videos and it’s basically a signup, get your details, pick your fund type deal. If you have experience please comment below.

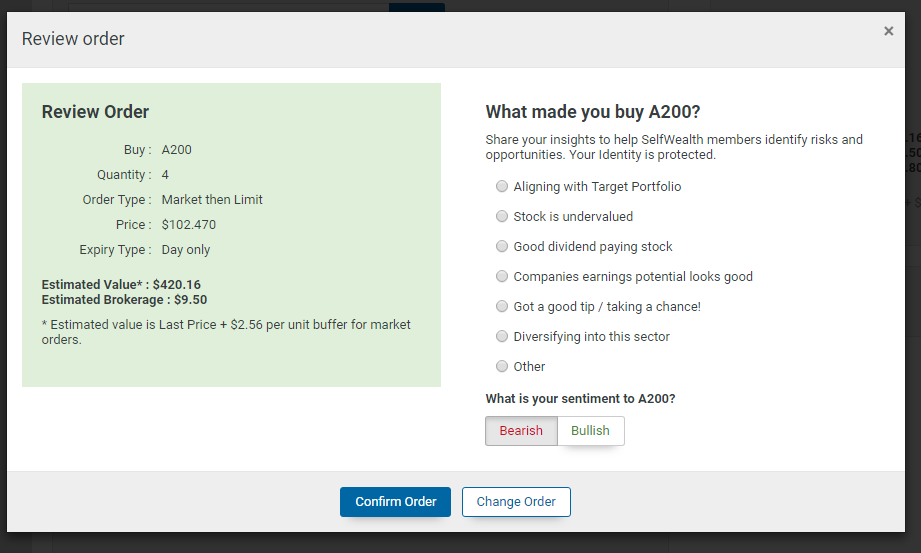

I do have experience buying Vanguard products through a broker though (see the video below to see me literally buying some).

Buying ETFs Walkthrough

- Log into your broker (I use SelfWealth) and head to trading > Place Orders

- Select the ASX (Australian Stock Exchange) code that you want to purchase (a list of all Vanguard listed ETFs can be found here) or use the search function

- Set order type as ‘Buy’

- Enter in how many units you wish to purchase

- Select at market value or list a price you’re happy with

- Set an expiry for the transaction

- Review your order and hit submit

Here’s an example of what mine looks like

It’s that simple. Proceed to the next screen and confirm the order and you’re done. It will take a few days to process and the money will then come out of your nominated account and boom. You have now bought some ETFs.

If you have any specific questions please let me know and I’ll answer them to the best of my abilities.

Now go forth and fear not the simple process of purchasing ETFs!

Ah fantastic! I have been trying to decipher Vanguard but I haven’t even managed to get to the investment part yet as I realised they have an entry point of $5000 minimum and while I have that money sitting around, I’m not quite ready to just toss that sum into the great open world of ETFs just yet. So this was very helpful, thank you!

No worries. Glad I could help 🙂

Thanks for the walk through. I don’t own any Vanguard but I also have found their website to be very hard to navigate. Hopefully one day they will make it a little easier for all to invest in. Thanks for sharing.

No worries mate. Yeah, they really need to improve their website. I don’t think it’s a priority for them though.

I just made the signup jump on the Vanguard site yesterday and have to heartily agree that their site is useless. Putting the starter $5000 doesn’t seem so bad though, I’m just going to BPay it.

Nice one. The BPay anytime for any amount without brokerage cost is appealing tbh

Trying to figure out if I buy/sell VTS shares when asx is open or the nose is open.

Any advice welcome

Nose was meant to be NYSE…

Do you still recommend selfwealth as a trading / portfolio platform?

Looking to join the investment game, just needing a easy to use and low fee platform

I bought into a Vanguard managed fund. I’m just beginning, and wanted to be able to contribute regularly. It wasn’t difficult, but you do still have to fill in a piece of paper, sign it, then fax or email a scan to them. I needed to call them to ask a question about the PDS. The call was answered by an Australian, and they were able to explain what I didn’t understand. Note that they have a sliding scale of fees based upon the amount of money you have invested with them: $100,000.

Helpful insight Mrs. ETT. Sounds like they have great support

Why are you still using Commsec? I dumped them months ago for SelfWealth. When you sign up with a promo you’ll get 10 free trades. Thereafter you’ll never pay any more than $9.50 per trade no matter what size the parcel is — and that’s the end of it. I got so sick of the Commsec gouge. Nice to be freed up. The SelfWealth platform is also so much nicer than the ugly and clunky Commsec. Check it out and thanks for today’s post.

Googling that as we speak mate. I have used Commsec out of laziness. I didn’t know there were such cheaper options out there. Thanks for the tip ?

Thanks for a great and informative post. I also looked into SelfWealth and looks like they don’t trade internationally, does that mean you wouldn’t be able to purchase for example VTS and VEU through their platform? I’m looking for a cheaper option but can’t seem to find anything other than your average Commsec or ANZ.

Not sure. I’d say they do though because VTS and VEU are trading on the ASX. I’ve heard good things about CMC markets but have never used them. I’m going to try to interview self wealth and ask the CEO some questions

Thanks for an informative post. I also looked into SelfWealth and it says they don’t trade internationally, does that mean you wouldn’t be able to purchase for example VTS or VEU? I’m a bit of a newbie to all this. I’m looking for a cheaper option but can’t seem to find anything other than your average Commsec or ANZ.

Oops sorry for the double comment, accidentally pressed the submit button twice and the comment wasn’t showing up 😛

All good

Awesome!

Hi!

So can you buy international Vanguard shares on SelfWealth?

Thanks

Hi Everyone,

Just wanted to ask and see if someone can assist.

If I purchase Vanguard like VAS.AX through a Vanguard account I don’t get charged a brokage fee no matter how many purchases I make as long I purchase Vanguard products however looks like they charged a yearly management fee 0.10% for VAS.AX so on $5,000 I would pay $5.00 for the year.

If I purchase VAS.AX on a trading platform like Suncorp Share Trading or Commsec, I get charged a brokage fee like $22 for each purchase however does anyone know if I would get charged the yearly management fee if purchased through Commsec or Suncorp Share Trading

Tony,

I do the latter. And yes, you pay mgmt cost of 0.1% if you buy the ETF via trading platform.

Cheers,

Marigold

Marigold,

Is this a hidden fee? I have A200 ETF in my bank trading platform and can’t see where they charge the 0.07% p.a. management fee? Looks like Vanguard has a 0.20% account keeping fee p.a. on the total portfolio as well as management fees p.a. for the products purchased.

deducted in the overall fund balance or returns. E.g. returns at 9.07%, so your return is actually 9% because the management fee is deducted.

I will second Mrs. ETT comment. I have had investments direct with Vanguard for about 10 years, and have always had good service from them. They were helpful getting old records, answering investment questions. Of course, this is true whether you are direct or ETF customer, except that for ETFs it is Computershare you need to chase down for your statements, tax etc.

Direct, Vanguard have the 500k limit to reach their ‘wholesale’ level. If you are not at this level (like me), then ETFs have a clear advantage. See, https://www.vanguardinvestments.com.au/retail/ret/investments/product.html. Relatively for Retail, Wholesale, ETF the Australia Share Index MER is 0.75%, 0.18%, 0.14%.

I spoke with Vanguard recently, they noted movements from Retail to the ETF, which I think may lower the ETF’s MER even more?

Very interesting. So they are leaning towards ETFs? Works for me I guess.

The support person indicated no preference at all, the underlying fund being the same, just the account handling and bookkeeping is done by Vanguard or Computershare and for reasons which still don’t make sense to me; Computershare is cheaper. They simply noted that this change in customer preference was going on.

One action that probably did make a difference was that the Retail/Wholesale threshold used to be 100k, but changed to 500k (not sure when). This would mean the bulk of their new direct customers were paying 0.61% more than the ETF. That would seem rather intentional, given the predictable outcome of driving all small investors into the ETF. Why not say 200k or 300k?

Thanks for this post, Firebug. We’ve also bought ETFs through our stockbroker (Interactive Brokers) but I’m yet to find out how the management fees are charged. Do they just get taken out of your stockbroking account at the end of the financial year?

The management fees are included in the units price. You don’t get charged management fees separately.

Really informative post Firebug. Any other ETF’s you’d recommend besides VAS?

I run a three fund split of VAS (Aus shares), VTS (US Shares) and VEU (World ex US).

I try for 40, 30, 30.

Check out my net worth posts for details.

Is there a reason you have gone for VTS and VEU instead of just getting VGS?

I’m about to take the first jump into ETF’s and after reading MMM and jlcollins it is awesome to find an Aussie website!

Lower management fees, exposure to emergings markets and I like that they are unhedged which means I can capitalize if the AUD were to rise.

Technical analysis can be found HERE

But honestly, both are great options. I think for tax simplicity and DRP abilities, VGS would be more suited for a beginner.

VGS is domiciled in Australia which is a obvious benefit. VGS also does not include Australian shares in its mix and thus is more accurate indicator of your international share holding percentage. (VEU has Aussie shares)

Hey Aussie Firebug,

So glad I found your site. I have just sold my house and downsizing getting ready for the next step to retirement and want to invest the surplus funds into Vanguard ETF’s

Do you still recommend the same 40/30/30 split of

VAS (Aus shares), VTS (US Shares) and VEU (World ex US)

Hi Mich,

I don’t recommend anything (not a financial advisor), but a portfolio of VAS, VTS, VEU split 40/30/30 is an appropriate investment for an Australian to reach financial independence in my opinion. It’s well-diversified and has rock bottom fees.

There are other products that may suit your needs better but without knowing all your numbers, goals, investment horizon and risk tolerance. It’s impossible to know which is the best option for yourself as we’re all different.

Hi Firebug, like many followers I’ve just found and devoured your content… thanks for some great content.

I’m struggling whether to go 100% VDHG, or 50/50 VDGR/VGS (higher US-tech focus) or, since reading your post above maybe 40/30/30 VAS/VTS/VEU.

What are your thoughts on the three?

Also, I think VTS and VEU need the US tax office paperwork … how big a deal/hassle/risk is that?

thanks, Erik

Hi Erik,

I get this question a lot. It really boils down to how much control over your investments you want.

I would personally choose:

100% VDHG if I didn’t want to do any work and focus on other things

VGS/VAS if I wanted to control my international exposure and not have to fill out the W-8BEN-E form

VTS/VEU/VAS/A200 if I wanted the lowest MER and even greater control over my investments. This does options means extra work at tax time. Not that much extra work but it’s a complication that isn’t really necessary.

IMO, 99% of Firebugs would be fine going with VDHG or VGS/VAS. It’s not really going to make that much of a difference honestly. Savings rate and income potential are the big factors that most people should be putting their time and energy into improving. Those two factors will speed up your time to FI greatly.

Nice post Firebug.

The ETF is definitely the way to go for Vanguard. The direct bpay option is just far too expensive unless you have a huge balance

Agreed

Do you mean they have a service fee if you deposit to Vanguard by bpay? I’m a beginner to Fire journey, and just open an account in Vanguard. trying to know more about it. Thanks!

This is a decision I’ve been trying to make for a while: ETF vs managed fund.

Very similar product, both with pros and cons. I think it depends on your life situation.

E.G. putting money away for kids. I don’t have kids yet but if I do, I’ll open a managed fund, with the plan of transferring it to their name when they turn 18. Good deposit for a house, a car, or whatever they want to do with their life.

The main benefit is the ease of small Bpay payments, a genuine set and forget situation.

Some quick calculations for a Vanguard managed fund, opened when a baby is born:

– Starting balance of $5,000

– Contribute $100 per month (the minimum contribution amount), set up automatic Bpay and forget about it

– Estimated return of 7.5%, taking fees into account

– $55,806.41 estimated value on their 18th birthday! What a nice little present that would be.

You could even just wait to see how their attitude towards money has developed during their teens, and make the decision about handing it over later. ;P

Love that idea Nick. Still waiting for my folks to surprise me with a secret fund worth millions lol.

I know this is an old post but I’ve just found it 🤣 This is exactly what I have done👍 I plan to match dollar for dollar what my kids have saved as a home deposit with the money I’ve put away in the Vanguard fund 👍 I do love the ease of BPay direct debit set up. Matching their saving rather than a strait gift will hopefully motivate the kids to be smart with their money and not waste our contribution.

I’m a big fan of REITs for those interested still being “in real estate”. Vanguard has a somewhat affordable ETF for lower net worth investors too. Although the site was never a problem for me I’ve heard that from many people as well, definitely worth the management fees tho 🙂

Jordan @ New Retirement

what REITS would you recommend

Bit late to the party but thanks for this post. We are property investors and have done pretty well from it, as I have always been a little hesitant buying shares (we have some but nothing major). I wish I was open minded enough to discover EFTs back in the day. Oh well better late than never.

No worries Cath. They are a great investment class along with property. Use both I say 🙂

There is one other important point that I think has been left out. NAV – Net Asset Value. Although the ETFs appear cheaper in terms of expense ratios due to the recent popularity of ETFs the cost to buy them are priced by the market. They do not track the index, only retail managed funds do.

For instance: VTS (ETF) is currently trading at $165.62 with a 0.04% expense ratio. The NAV on the Vanguard website is $125.42 (https://www.vanguardinvestments.com.au/retail/ret/investments/product.html#/fundDetail/etf/portId=0970/?overview)

When you buy that ETF you are essentially paying $165.62 for an asset worth $125.42. That is 32% overvalued + the trading fee. If markets go down or are volatile your overvalued asset will go much lower than the NAV and then if you want to sell you must find a market buyer.

Where as in the retail managed fund, you pay 0.9% as an expense ratio but you get the actual value per unit ($1.5662) of the assets in the fund. These are less volatile in price because they only track the index and you can sell regardless of the market buyer.

Would you rather pay 0.04% p.a. fee and possibly loose at least 30% or 0.09%

Warren Buffet did not recommend ETFs he recommended Index Funds. They are not the same thing. ETFs of an index do not track the index.

Hi Stan,

The NAV you have referenced to is in $USD not $AUD. When converted to AUD is works out to be $166.38 Australian Dollar which is roughly how much the ETF is being traded for (give or take a dollar to account for today’s rates and such).

An ETF and a fund that tracks the same index will be nearly identical in terms of return. It’s the brokerage fees vs the higher management costs that are the deciders.

I would like to link to a video of the founder of Vanguard (Jack Bogle) and paraphrase him:

Source

You’re correct that Warren Buffet does not explicitly say ETFs, rather that he is a believer in TIFs (traditional index funds).

But as I’ve explained above, they are pretty much the same portfolio just bought and sold differently.

Thanks for the comment.

I stand corrected. I did not see that the different ETF NAVs have different currencies specified, even between the international ETFs. Thanks for setting me straight, I was trying to figure out why the VGS was so much cheaper compared to VTS, but it looks like a currency issue.

Funny though that the Jack Bogle video is titled – Why Jack Bogle Doesn’t Like ETFs. But I guess he understands that the tendency for people to want to trade is stronger for them to just sit tight and ride out the volatility.

Yeah that’s such a click bait title. He doesn’t like the way some people day trade ETFs not the actual ETF. If you’re trading ETFs on a regualr basis, you’re doing it wrong.

Hi Aussie Firebug, I am recently new to the FIRE concept and am very excited! I love the concept of investing in ETFs / LICs and am just about to get started with my journey in shares. I just wanted some clarity around the NAV price and how to use it when buying shares? I am a bit confused with the above comments about the NAV being in US dollars when the ETF is listed in the ASX? Cheers – Kirst

I buy direct through Vanguard and you’re absolutely right about their website – it’s an absolute mess – I’ll find great graphs and information one day, then the next day find similar information presented in a completely different way in a completely difference place. Nightmare.

But, once you’ve figured out where to sign up it’s actually really easy. Paperwork was pretty simple, and once you have your account set up you get a list of BPay codes – one for each product. To open a new fund deposit 5k (minimum buy in) then after that you can BPay in $100 at a time whenever you want.

It works really well with banks that have no fees for multiple payments. I set up reoccurring BPAY transfers to Vanguard 2 years ago and now the only maintenance I have to do it change the amounts (generally up).

Sounds like you’re on full auto-pilot mode. Awesome!

This is exactly the content I was looking for in regards to Vanguard ETF vs Funds and I am also thrilled to finally find an Aussie FIRE blog (I currently follow frugalwoods, millennial revolution and mmm amongst others). I am a very active investor tracking the pulse of all my investments pretty much weekly. Thanks for this blog… I just need to figure out how to subscribe to new posts.

Glad you’re enjoying the blog 🙂

I checked my email list and you’re on it now so you must have figured it out.

Looking at making our own spreadsheet to track our NetWorth.

The spreadsheet you use in the video – how do you calculate your “Total ETF Worth” column?

I made a copy of my net worth sheet so people can take a look. I tried to remove all personal info. Take a look here:

https://drive.google.com/open?id=14y8GQb9EgTH3nuwyuNlJErAQIbVNQfVv2C9Nuo7NqvM

Hey AFB,

I am also interested to see how you calculated your ‘Total ETF Worth’. It changes every minute, don’t they?

So do you actually enter the current value then multiply by the number of units? Cos I don’t see this reflected on your spreadsheet. Is this how you do it or is there a simpler way?

I use the google sheets stock ticker function which grabs data (updated every 15 minutes I believe) from the asx and pumps it into the sheet. If you look at the top of the column in the ETFs sheet, you can see the formula.

Thanks heaps! I am trialing google sheets and loving it!

Hi Firebug, I just bought my first lot of VAS, I’m very excited!

Question- How did you set it up for Dividend reinvestment, do they contact you?

Hi MoneyVik,

You need to log into https://www.computershare.com/au and change the setting in there.

Hope that helps mate 🙂

Thank you!

HI Firebug,

A new fan on the blog-thanks so much.

Quick question on ETF’s; how often or not often should you be ‘trading’ them? I assume they’re a long term investment but when would you consider selling them, do you only do it to stick to your 40/30/30 balance?

Thanks in advance.

Hi Ajbay,

I won’t be selling unless I need to. I plan to live off the dividends in the future but won’t rule out selling some units in retirement if it makes sense. Ideally though I plan to hold forever and live off the income stream generated by the dividends.

I hope this answers your question 🙂

Sure does! Which leads to my next question; are you currently reinventing your current dividends?

And how often to you reassess your 40/30/30 balance?

Cheers, Firebug!

Hey,

I somehow missed this comment.

Anywho, I do reinvest my dividends.

I reassess my 40/30/30 split every time I buy.

It guides me to what to buy. I look at all my splits and buy whatever ETF is most out of whack!

It’s a clever way to ensure that you are always buying low

Awesome, thanks Aussie Firebug!

Hi Aussie Firebug,

Just stumbled onto FIRE. Going through your amazing blog! Quick question: What do u actually mean by rebalancing? is it assessing 40/30/30 split? or something else?

Hi Inba,

You’re right. Rebalancing is to ensure that your splits are as accurate as possible. Each time you buy, you can buy the portion of your splits that are the lowest to ‘rebalance’ the portfolio.

Cheers

Why did you choose the 40 30 30 balance and not something different? I’m thinking of doing the same as you but I’m not sure how great an impact currency risk would be on the returns.

40/30/30 is what I’m comfortable with.

VAS because of the sweet sweet franked dividends.

VTS because of the diversification into the US market. And I liked the fact that is unhedged as I think the AUD is likely to drop in the current years.

VEU because of diversification into the global market minus the US.

I just made up the splits. 40% Oz/60% International is what I’m cool with.

I also looked at what other professional companies such as Stockspot and Acorns had in their splits to make sure I wasn’t way off.

I was looking at purchasing the same ETf’s as you but I’ve decided to get VAS and VGS. VGS seems to be a combination of VTS and VEU except the dividends are automatically reinvested. Initially I thought that I would purchase one ETF each month and then just rotate the three each month but I’ve decided to just buy every second month and stick with rotating the two that way I can cut my purchasing costs down by half. I did read an article from Vanguard tha Australians should transition from about 25% international through to eventually holding 60% international which is what you have.

VAS+VGS is a great 2 funds portfolio. Have you checked out the new ETFS released just this week?

Have a look at this:

https://www.youtube.com/watch?v=GzUGm8pvS8w

I’m a bit confused by this, because a minimum investment of $5000 is quoted. However, if I go into my ANZ Share Investing website a price of $75 ( for example ) is quoted for VAS per share. So that implies I can buy whatever quantity I want – can someone clarify?

It may also be worth noting the behaviour of 4 ETF’s I have looked at ( VAS, STW, SFY, ILC ) is very similar. All their prices dip every year about mid- May, presumably due to the “Sell in May and go away” mindset. Best time to buy? I don’t know.

Hi Baz,

You can buy less than $5K per trade. But if you work out how much you’re paying in terms of % for the brokerage fee it may surprise you.

Everyone is different, but $5K seems to be a popular amount people are willing to buy at to make the brokerage fee an acceptable amount.

Does that clear things up?

I don’t buy according to peaks and troughs. I buy around $5K each month, year in year out and rebalance according to my weightings.

This is a the Bogleheads way!

Hi there

How did you develop your spreadsheet?

thanks

Using Google sheets mate.

You can grab a dummy copy using this link

https://drive.google.com/open?id=14y8GQb9EgTH3nuwyuNlJErAQIbVNQfVv2C9Nuo7NqvM

awesome thanks

Hiya, I’m new to ETFs (but long term follower of yours!) but glad to have found this article! I wasn’t aware that CommSec let you purchase these and it seems like a great way to quickly get into ETFs! Thanks!

No worries Ash. I actually have switched from Commsec to SeflWealth because of the lower brokerage fees FYI. But you can buy the same ETFs of either platform.

You might also consider Interactive Brokers (IB) if you

1. Many stock tickers. It helps in rebalancing if you ain’t into VDHG (one etf fits all)

2. Have a large portfolio. From memory, IB charges minimum US$10 a month, will be reduced/waived by fees via your purchases/sale

3. Non Australian tax resident ONLY. (Allows you to convert currencies at super cheap rates). As an Austraian tax resident, unfortunately you are not able to access the currency conversion feature.

4. Allows you to access international stock markets. E.g. buy VWRD in the london stock market to circumvent cons of US domiciled ETF. So if you are not into VAS/VGS/VGE, or VAS/VEU/VTS combo, then a one stop shop of VWRD covers all including emerging economies. It helps with simplicity and rebalancing.

Thanks for the comment, Barry. I’m really happy with SelfWealth atm. I have not come across a lower brokerage fee which was the major drawcard. I keep a spreadsheet to help me rebalance and it takes around 10 seconds to do.

Just wondering how you made the switch? Excuse my ignorance but can you transfer from one to another?

You can transfer your HIN across. The guys at SelfWealth will assist you through this process but basically, if you’re currently with a broker that is CHESS sponsored, the broker never owns your shares, they simply process the transactions that are linked to your HIN. So when you transfer brokers, you’re not transferring any shares or anything, you’re just bringing across your HIN that is linked to your shares.

It’s essentially a form to bring your HIN across but like I said the guys at SW are very good with support

Hey Firebug.

Any thoughts on the Betasustainability ethical ETF’s?

Cheers

Hi Michael,

I’ve never actually looked into it. Are you thinking about investing?

Hi Firebug,

Nice article, clear and to the point! Just a couple of quick questions, how do you handle tax with ETFs? Does CGT tax need to be paid every year or only when you sell up? Any Tips? The ATO are vultures! With ETF management fees how do you handle those? I’m looking to buy 10k of betashare NDQ ETFs through selfwealth broker.

Thanks!

Hi Dave,

Sharesight reports have everything you need in them. You just export the reports and plug them into your tax return. I’m going to do a video on this this financial year. You only pay capital gains tax if you sell at a higher cost them what you bought.

ETF management fees are taken from the fund automatically. You don’t need to actually pay Vanguard separately.

I use SelfWealth too 🙂

I will be doing more content on tax stuff later this year

Thanks so much for this firebug, super helpful and I love that NetWorth spreadsheet too. Wanted to set up something similar and now I can just build on that so cheers! Quick question, I have just set up a commsec acct thinking I needed that to buy the VDHG ETF through there, but above it looks like if I have $5k I can set it up directly through Vanguard themselves and BPAY regular amounts as well to keep investing. I can’t find any info about this though, would you happen to know how I get that set up? A link I can check out on Vanguards terrible website perhaps?

I just came across your podcast and listened to the Vanguard episode – so asked and answered! Thanks so much for providing such great, free resources for people like me who are just starting out and eager to learn. Really appreciate you taking the time to explain things in simple, relate-able terms for those of us who are not financially trained! Cheers! 🙂

No worries Amy. Glad you’re enjoying the blog 🙂

Hi Amy,

I have never signed up with Vanguard but check this out https://personal.vanguard.com/us/openaccount?lang=en

They do make it hard don’t they haha

Hi Aussie Firebug, thanks for the great info – I have just subscribed for more! Anyway, I agree that the Vanguard website is a bit backward, but the link you have above is the US website. The Australian site is here: https://www.vanguardinvestments.com.au and is a bit easier, I think.

Opps. Cheers

Hi Aussie Firebug, I’ve reached the point where I’m ready to invest in VAS. I joined Self Wealth but couldn’t figure stuff out like how do you choose the DRP option and how can I buy $50,000 of it instead of X number of them. I emailed for help and they were pretty unhelpful.

I flat out do not understand what Computershare has to do with VAS, and their Contact page on their website goes around in a loop (visit Contact page, click ‘Contact Us’, get sent to Contact page, repeat) so I’m not able to get any info from them either.

I feel like I’m missing something… like the secret handshake? It shouldn’t be this hard to buy something so simple! Can you point me to any info online that might break this all down? I’m not a finance person at all, so it’s probably really easy for everyone but for me it feels like I’ve fallen into a rabbit hole and I’ve got no idea where to turn next.

Thank you!

Hey mate, it sounds like you might need to do a bit more research in general. Watch some introductory videos if you haven’t already, does Self Wealth have any?

Take a look at the education centre of the ASX website: https://www.asx.com.au/education/first-time-investors.htm

Some of it will apply to you more than other parts. You might even want to try the share market game they have, to get a feel for how to actually buy something.

Also, I recommend finding a friend or family member who has done this before to sit with you as you make your first purchase. It’s not too hard and there’s no secret handshake, but a second pair of eyes may be all you need.

Thanks Nick. I played a game of “fake it till you make it” and got it done. At least I think I did…

These two videos should answer both your questions mate.

https://www.youtube.com/watch?v=3QtKGQgJDuc

https://www.youtube.com/watch?v=DlegwqqnKzg – DRP vid

Thanks AF. I watched your vid and you make it look so easy. For whatever reason I can’t login at Computershare even though I joined last Friday because I don’t have a user ID. I asked them to email it to me and they said my email address isn’t registered. So I registered my email and they said I can’t register because that email is already registered.

I shit you not, if I wasn’t already balls deep in this I’d just give the whole thing a miss. It really should not be this hard…

Can you send a password reset on your current email?

Sorry, should have updated… in the end I had to make two phone calls to Computershare (first guy was terrible, second guy was very helpful and got me sorted) but it’s still been quite frustrating. Almost as hard as claiming the baby bonus!

Thanks for a great Australian based Fire blog. Some of the ETFs you own through Vanguard are domiciled in the US. Hence the W8BEN forms. That means that you have to pay US tax and I suspect accounts for the extremely low MER in comparison to other Vanguard products. Brokerage costs must also be factored in to the slightly lower MER for ETFs compared with wholesale funds.

Hey Firebug, thanks so much for your amazing content. Looking at purchasing VAS, how complicated is the W-8BEN? Is it very complex and lengthy?

Ooops, not VAS i meant VEU. Goodness all these ticker names lol

Check this out LINK

Hi AF, would you have the referral code for selfwealth for free trades. In process of joining them. Many thanks.

http://www.aussiefirebug.com/selfwealth

What a good find, stumbling across your site. The articles are simple and useful. More importantly, you take the time to reply to comments and more often than not, the most value comes from those!

Hi AF, I just learned of the Stake app with free brokerage in trading US stocks and ETFs, I was wondering what are your opinions on using Stake to buy VXUS and VTI ETFs without any brokerage?

Thanks

It doesn’t charge brokerage but Stake make their money through FX (exchange rate) so it’s not exactly free trading.

I haven’t looked into it that much and prefer my Holdings to be registered with an Australian register. Maybe there’s draw backs with Stake, maybe there’s advantages… I’m not sure sorry.

I am new to all this. So I was wondering what is the return on ETS. I heard it’s aroubd 9 percent. Would you happen to know what is the percentage of dividends you receive on the best Australian shares?

The reason for my question is I am 61 years of age and wondering if I can “catch up”?

Hi Michael,

I’m receiving 5.94% in dividends from VAS (my best dividends performer).

One of the best things you can do is create an account with Sharesight (google it) and you can create dummy portfolios for free and see what sort of returns you’d get with different shares/combinations over different time periods. It’s really cool and free to do so for under 10 holdings.

Highly recommend.

Hello AF the profits that you show! Are they made with investing into EFT’s?

Thanks very much for sharing the info. Much appreciate it

Yes, they are made through ETFs/LICs and some through real estate.

Can you buy ETFs in a trust in Selfwealth as I understand you keep everything in a trust structure? Is there a sign up page for trust?

Sure can. Just email the guys at SW and they’ll sort you it. I’m not sure if there’s a sign up page specifically

Awesome blog – so can I confirm…?

– Go direct through Vanguard if you have $5K minimum investment for managed fund?

– Go through Selfwealth for ETFs with no minimum?

Is trading through SW going to be cheaper than through CommSec?

Is that correct?

Secondary to my question last night Aussie, Ive just checked with CommSec and if I am a commonwealth bank customer (which I am), and I open a Commonwealth Direct Investment Account (CDIA), trades are as such:

– $10.00 (Up to and including $1,000)

– $19.95 (Over $1,000 up to $10,000)

So what benefits would Selfwealth offer over and above CommSec if pricing is largely the same?

For example, does one give access to a greater range of options?

Hi Jason,

It’s pretty much all about the cheaper option for me. I only use a broker for trades so I just go with the cheapest option that’s all.

CBA is a more complete broker and gives you the option to trade internationally. But the extra features come at a price. I’m not willing to pay that extra price so I use the cheapest option.

Hope that helps.

Just checked the ASX and MLT is again back at $4.62 the exact same price as in the video

https://www.asx.com.au/asx/share-price-research/company/mlt

Hi there, we are a family of 3, not a whole lot of disposable income due to mortgage, would you be able to direct me to any easy ways of small invested amounts such as $50 a fortnight that possibly avoid the large trading fee? I have had a look at commsec pocket but would like some more variety such as VGS

Hi Russ,

There’s a lot to consider but if you want to invest small chunks and not pay the brokerage, you could look at opening an account with Vanguard directly. The MER is slightly higher but there’s no brokerage cost and you can automate investments by BPAYing X amount of $$$ each week/month/year etc.

Hope that helps 🙂

Thanks for the reply Aussie,

I was thinking of that but wasn’t sure if you needed a 5k deposit to begin? We are putting solar panels on the house in the hope to reduce expenses so it will take a bit of time to build back up to having the initial amount if that’s what you need. A friend has had a raise account but I somewhat detest the idea of paying someone fees to take out a little bit of my money and put it aside every week, I can do that myself with automated transactions into a seperate account and when going with raise he doesn’t actually own any share in the investments I believe, it’s all in raises name

I’m not sure of the minimum amount sorry mate.

Good old solar panels! Great investment and something I’ll be looking at when I return to Oz.

Those services like Raiz are really good for a certain demographic… but not really needed for those who take their finances seriously.

You would possibly be better off investing with peer – to – peer lenders such as Ratesetter or True Pillars. Minimum for Ratesetter is $10, True Pillars $50

Define ‘better’ Barry?

As far as the total return goes, those P2P platforms fall short of a globally diversified portfolio.

But they do give really good cash flow… so it depends on what you’re after.

I’m basing the comment on Russ’s statement he has only a small amount to invest, and doesn’t want that eaten up with brokerage. P2P takes the fees on earnings after the fact, not before.

As far as risk goes, one can diversify within P2P via different lenders or even within the one lender.

I have a mix of P2P and shares, with the shares mainly held for franking credits. TBH, if it wasn’t for those franking credits, I would quit shares entirely.

Cheers for the extra ideas Barry, will also look them up

Interesting take Barry.

Horses for courses. Shares are for the long haul, and I’m well into my seventies. I can’t afford the capital losses which inevitably occur when boards and CEO’s get it wrong. To me, the risks with P2P are less, strange as that may sound.

Westpac is a case in point. Blue-chip share. My capital loss on WBC is about 8K, and it takes a lot of dividends to get me back to break even. The culture is wrong. In my book, Hartzer should have been shown the door with nary a cent on exit.

I expect a shareholder class action will happen, but by the time it does get a result I could well be dead. Shares and ETF’s are for the young. they have time on their side.

I always like hearing from older investors that have seen a bit Baz! The Westpac debacle is a doozy that’s for sure 😒. Just one of the many reasons I prefer a broad range index

AFB – loving your work. I’ve spent the last 24hrs crawling over lots of content from your site.

In an attempt to synthesize your recommendations into the simplest actionable process for a new Aussie FIRE chaser (i.e. operating a “dual portfolio” with Superannuation), it seems like the process boils down to these steps:

1. Create a discretionary trust

2. Open a share trading account in the name of the trust (SelfWealth seems to be recommended)

3. Loan surplus funds monthly from personal bank account to trust trading account

4. Purchase diversified portfolio of high-growth and high-yield ETFs and LICs (A200, VTS, VEU, MLT, AFI), based on personal situation and needs

5. Monitor tax implications and distribute dividends through Trust as needed (to either personal or corporate beneficiaries)

6. Reinvest monthly until FIRE passive income level is achieved, then funnel all income into Super until preservation age is reached

Have I got the fundamental framework right here?

Thank you in advance for any feedback you can provide.

Hi Bowen,

I don’t recommend anything. I sometimes say what I’d do in certain situations but I have to be careful with the word ‘recommend’.

You basically have it right.

If I could go back in time though, I wouldn’t have bothered with the trust. It complicates things unnecessarily and you don’t need it to reach FIRE.

The other thing is, and again, it’s very circumstantial. SS some money into Super along the way to FIRE will probably be the most tax-efficient way to do (depending on how old you are) but we’re not relying on Super at all but I felt like I had to say that.

I’d break it down into 3 steps really (for us).

1. Save money

2. Buy a combination of one or money of the following VAS/A200/MLT/AFI/VTS/VGS/VEU/VDHG at appropriate splits depending on your risk tolerance and time horizon

3. Repeat step 1 & 2 on a monthly basis until you reach your FIRE number!

Thank you for taking the time the reply AFB, much appreciated.

Glad to hear I’m pulling it all together mentally! It definitely feels like the FIRE journey is more about growing awareness and refining your approach over time than simply following a blueprint.

I totally understand re: “recommendations” too, though your opinion is more than welcome 🙂

With the trust, is it the complexity of the setup, the additional movements of money, or the extra tax reporting obligations that steer you away from it now?

My wife and I already have a discretionary trust and bank account setup (with us both as personal trustees), though this structure isn’t currently being used.

We’re both early/mid-30s and approaching the phase of having kids, though we have no intention of taking the money out of the trust to support our lifestyle, so balancing the distribution isn’t really a consideration for tax minimisation at this point.

Wherever possible our focus would be dividend reinvestment so that the portfolio continues to grow.

I think the only other main legal consideration (for us) would be equally-shared control of the assets, so that neither partner has an individual account with all the money in their name.

That’s a great point re: salary sacrifice, as it’s a pretty instant win. Definitely will factor that into the mix.

Thank you in advance for any further insights you can provide.

Cheers.

My apologies AFB, I’ve just been through your entire post here (https://www.aussiefirebug.com/pay-less-tax-part-1-buying-assets-in-a-trust/) and seen your explanations for why.

I went hard the last few days to bring my knowledge up to a workable level for Trusts and put together a summary that might assist others (though Terry Waugh’s comments were invaluable).

Will add to this document as time goes by:

https://docs.google.com/document/d/1rfhksexTOhQOWoZnVV-KgAONShSpjemQTJ9Rv8ZfeWA/edit?usp=sharing

What a great document mate. Really helpful

Hi there,

really appreciate the informative post and corresponding video. Im new into investing and have been researching diligently the past few days with the aim of entering the market through ETFs including VTS, VAS and VGS through Vanguard. I had a few questions i hope you could help me answer:

1. On Vanguard lets say for example ‘Vanguard Australian Shares Index Fund’ there is an ‘ETF – VAS’, ‘retail fund – VAN0010AU’ and ‘wholesale fund – VAN0002AU’. What is the difference between the three? Why wouldnt you go ETF over the retail fund due to its lower management fee and no minimum investment requirement? Whats the difference and consequent benefit of the retail fund over the ETF? If you were in my position as a first time investor with 10k what would you do?

2. What words of wisdom or things would you look out for as a first time investor? Goals is to grow my wealth and be a more passive investor.

Thankyou once again! Hoping to hear from you soon

Hi Doman,

1. ETFs are exchange-traded funds bought and sold on the stock market. The retail fund is when you open an account directly with Vanguard. The wholesale fund is usually reserved for professional investors with > $500K of capital. I’ve heard that they do let you in sometimes with as little as $100K. My understanding is that the difference is only fee-related. There could be other differences but I don’t know them if there are.

I prefer ETFs because you get a lower MER for the exact same product. If you want to invest small amounts regularly, you’re going to get killed in brokerage and the retail fund is probably better.

2. Investing is the easiest part. Focus on building good frugal habits that can also translate to your work, health and relationships. Things, like setting up a good routine, keeping fit and continuously learning new stuff, is timeless wisdom but it does work!

Hi there,

thank you for taking the time out of your day to reply it means a lot!

I think i will choose the retail fund due to not having to pay brokerage fees and the ability to continue invest smaller amounts.

Im going to open a Vanguard account and begin investing in a few index funds that i think could do quite well in the long term (VAN0010AU, VAN0011AU, VAN0015AU).

I have about 10-12k to invest and given that retail funds require a 5k minimum. Would you suggest investing into 2 different index funds? Or only investing into 1 and using the leftover money to dollar cost average the next few months in order to make use of any further decreases in the market?

Kind regards,

No worries.

If I were you, I would spread my investment over two funds for diversification purposes. Up to you though. Make sure you do a tone of research and be confident in your strategy.

Hello AFB!

I am a first time reader and I’m loving your posts! It’s so educational!

I am still torn between ETFs and investing in Vanguards retail funds directly. If you trade 5k per month for a year, you’d end up paying 120 aud per year (assuming you’re with self wealth). How do you work out which is more worth it? Also, do you trade monthly l?

Thank you so much AFB!! You’re such a great writer and importantly, teacher

Hi Tiff,

I’m glad you’re liking the blog 🙂

The ETF management fees are cheaper than going directly with Vanguard for the same product (unless you’re in the wholesale fund). I also like the have the option of buying ETFs from other providers (like Betashares).

When I crunch the numbers, it was cheaper to go with ETFs because of the management fee even factoring in the brokerage costs.

It really comes down to how often you want to buy shares. We do one trade a month (usually worth around $5K). ETFs are cheaper for us but you’ll have to crunch the numbers for your situation.

I hope that helps.

Good luck on your journey

How do you achieve the split if you buy about 5k monthly (and only a single trade each month)?

Do you just buy it in an alternate fashion?

1st month – VAS

2nd month – VEU

3rd month – VTS

Wouldn’t this create 33% split? Do you buy less than or more than 5k to achieve the re-balancing?

It does create a 33.33% split originally but that is assuming that the stock price doesn’t move (which it will). And I don’t really care about the splits at the start so I just cycle through each ETF until they are at a decent size (>$30K). Then I use my monthly investments to alter the splits depending on what the market is doing. If VTS is having a good run, I’ll buy VEU or VAS to top up that split. Now that we have a pretty decent share portfolio (>$500K), the market movements are so big that it’s hard to rebalance each month with only $5K a month but that’s what we do.

I just bought VDHG using Self Wealth – your walkthrough was quite helpful so thank you! So my question is, now what? Will Vanguard send me a welcome letter? Do I need to register my holdings now? What happens now?

Congrats!

You will get a letter and you’ll need to register your account on https://www.computershare.com/

It should details what you need to do in the letter.

Hope that helps 🙂

Hi AFB,

I am nearly ready to try out Vanguard ETF. I just have one more question im trying to get help with. Please help me.

Vanguard now offers investor to buy ETF directly with Vanguard with no brokerage fee. Although you would have to open a account with them, therefore Vanguard charge 0.20% pa.

I would like to make investment here and there during the year and be somewhat a diversified passive investor. Im flexible, can invest every month or every 6 months, just whatever more cost effective)

I am looking to invest VDHG which tracks other 7 Vanguard ETFs. My questions are:

1. Should i buy VDHG on Selfwealth, (higher management fee + brokerage); or

2. Buy those 7 ETfs directly from Vanguard (low management cost + 0.20% Vanguard acc fee).

I hope you have time to answer my questions

Thank so much you

Hi David,

I have heard about this new product from Vanguard but haven’t looked into a lot so I’m not the best person to ask I’m sorry. Try putting this question in the FIRE discussion Facebook group as there’s a lot of people in there that can help with questions like this one.

Cheers

Hi FB, quick question from an Aussie based in Riyadh, Saudi Arabia. Once you buy for example Vanguard ETF via commbank (in my instance) – do you need to set an option so they automatically re-invest your dividends instead of paying these out to you in cash to your nominated account. I would like to have all dividends automatically reinvest buy purchasing more shares. Many thanks and super cool blog – I have shared it with a few expats out here and all loved your articles. NT

This should help Nic,

https://www.youtube.com/watch?v=DlegwqqnKzg

Wow

Is this Australia FIRE website? I’m just getting into more information and learning.

Then first, how to buy ETF.

Hi FB,

Intetesting read for someone that knew nothing about investing. Coming into inheritence of shares, property etc. Your blog has answered somethings but a big wake up call for an over 50 person, that needs to act wisely after my father was the Biggest Firebug, but never passed on the knowledge, im keen to learn on pass it onto my children. So signed up for your informative emails. Thanks so much.

It’s never too late Semut!

Gifting your children with knowledge is one of the greatest things a parent can do IMO. Love to see it 🙂