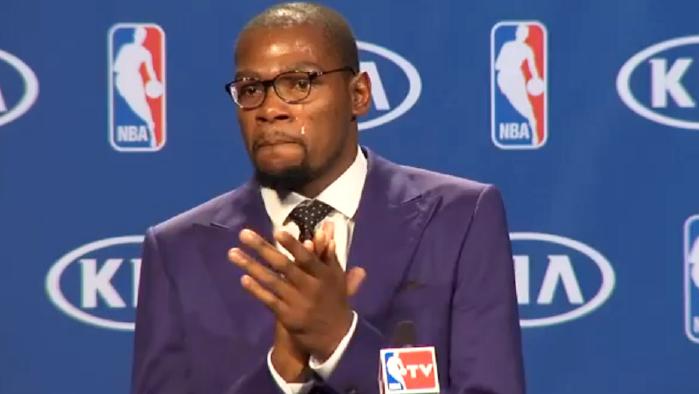

The properties were the real MVP this month!

Two went up and one went down over January. I think they got updated because I had my broker look at my interest rate to see if he could get me a better deal. This usually triggers the bank to access their position with me and the properties and see if everything is OK. As a result, the price is usually updated (for better or worse).

I’ve also noticed that when I pull equity out, the prices are updated. They do update automatically but it takes longer for some reason.

I’m currently paying 4.3% which may sound high, but there are other factors that come into play when you’re investing in property that needs to be considered. So while I could get a lower rate elsewhere, my current lender offers me what I need to continue to move forward with my strategy that others did not.

Net Worth Update

Very nice bump of $21K this month thanks mainly to the two properties. We saved pretty well for January which helped.

Oh and ETF’s went up slightly AND we got dividend payouts for all three funds (VAS, VTS, VEU).

The dividend payouts were an awesome surprise. We received close to $400 bucks for doing absolutely NOTHING!!! MHAHAHA

It’s funny, because with the properties there is definitely work involved. But with the ETF’s, it’s so incredible low maintenance that it feels like we are throwing money into a magical pot that spews out more money every quarter.

Amazing.

We FINALLY broke the quarter million mark!!!

Woohooo!

Now to concentrate on that $300K goal. Setting our sights to get there by the of the year.

Fingers crossed

Properties

Two up and one down. It’s nice that the two have gone up, but to be honest they have simply reached heights that were already reached last year. They are just now getting back to that price. I still hoping for them to climb to new highs.

I recently had the rent increased on my most recent property to $290 p/w which is really good cash flow considering I paid $250K for it in Q4 2015. It’s been my best performing property to date.

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs

Dividend payouts!!! And a slight bump in gains this month. Not too much action to report here.

Networth

Nice one! You’re a few years ahead of me! Where are your properties?

North east Queensland and outta suburbs Melbourne Victoria.

The Queensland properties have been winners for me though. Such good cash flow!

I’m currently doing some research on positive cashflow properties in Australia. May I ask where in north east Qld? I’ve seen some pretty good deals around Hobart but there’s not much out there.

Between Goldcoast and Brissy mate. Sorry I can’t be more detailed but in that region. Mind you I bought a few years ago and rent has risen as well as price. So the yields may not be as good anymore.

What is your ‘strategy’?

To be able to withdraw equity from my properties how I want was the big one that a lot of lenders failed to meet or had a lot of fine print that I didn’t agree with. Some questions I asked the bank that come to mind were:

Which LMI company do you use? GE? QBE? Self insure .. what LVR do you self insure at?

How soon after settlement would I be able to order a new Valuation and redraw the equity out?

If the valuation doesn’t come in how soon can I order another valuation?

Which companies are on your panel Valuers?

Can I order my own Valuation from one of the panel valuers and will you validate it?

How will the released equity be able to withdrawn? Cash Limits? Only on settlement of a new property purchase? etc or can I withdraw it as cash how I like? I.e for deposits, reno’s, closing costs..

What LVR can you do on trust finance? with a company trustee?

How long would it take for pre approve to take?

How long once I have found a property would it take to get unconditional approval? What are the steps?

What are you establish fees? and any other fees of getting the loan started?

From my experience shopping around. A low interest rate does not always allow an investor to move ahead with their strategy. For a homeowner that is simply going to pay off their loan ASAP, the lowest interest rate is probably what their looking for.

Your $290p/week is interesting to me, because I paid $250k for a place in Deception Bay (about an hour north of Brisbane) six years ago, and it’s now worth more like $200k but renting for $305 p/week. I’m really not sure what that says about the markets, but it’s interesting nonetheless.

Also yay for Vanguard ey 😀 My dividends were all reinvested, but I think I saw close to $1,000. Although the way the price spikes before the pay out, and dives afterwards the overall value always goes down around dividends time. It’s a wonderful rollercoaster.

$1,000! Nice. Can’t wait until we are getting that much 🙂

Ladyfire your experience mirrors mine, I bought in Redcliffe, not far from Deception Bay in 2006 for $300k. It appreciated quickly for a couple of years, to be worth around $400k and has not budged in the 8 years since. Rent has risen from the original 280/week to 375/week. So with the drop in interest rates it is throwing off a handy cashflow, and hopefully with the new railway line opening it will start to rise again. Certainly overdue!

Glad to hear that yours went up! Mine tanked 🙁 I’m really hoping it was poor management (who have moved on) and nothing else. Super keen to see how the trainline affects things.

do you rent, or owner-occupy ?

do you live in property 1, 2, or 3 , from the graphs above ?

I don’t live in any of the properties. I rent with my partner for $180 p/w for both of us