Jeez Louise where has the time gone?

Winter has come to an end (although it’s still shithouse weather down here in Vic), my footy seasons over and there is only 102 days until Christmas!

The good news is that now I have finished footy, I can spend a lot more time on the blog 🙂

Last months was pretty normal. My savings rate has definitely taken a hit since moving out of home. The first month was a blowout and I would have been lucky to have saved 40% which is a far cry from my 76% savings rate last financial year.

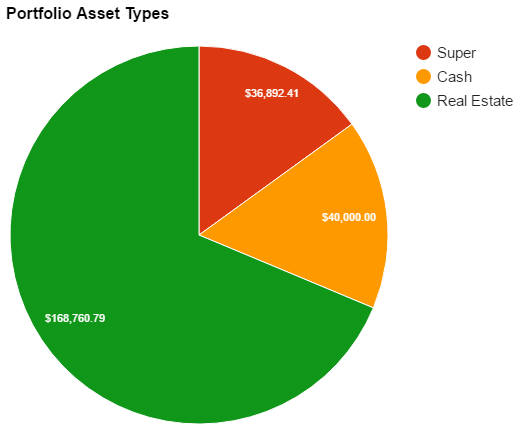

My IP’s didn’t move at all this month. I still managed to add a bit of cash to my savings and my Super had a nice little bump.

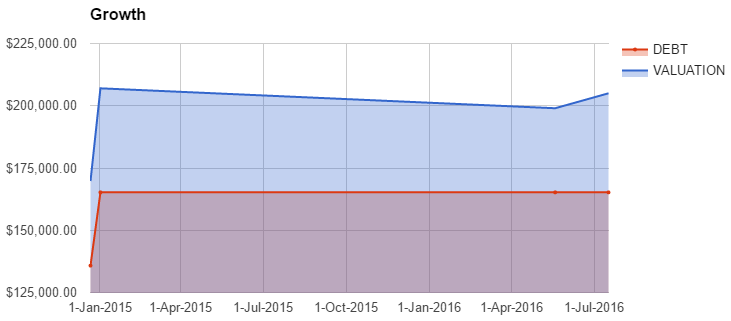

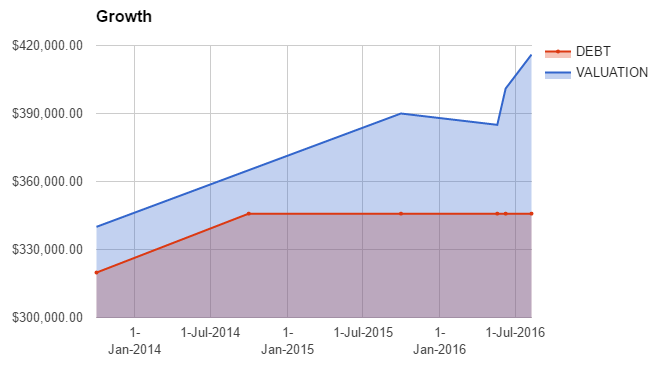

I also have decided to add the debt associated with my properties (as seen below) to clear up any confusion people might have been having.

Networth

[wp_charts title=”linechart” type=”line” align=”alignleft” width = “100%” datasets=”-36000,-36000, -32000,-7000,20000,32000,45000,65000,83254,130000, 187910, 229010″ labels=”1-Jan-2011,1-Jul-2011,1-Jan-2012,1-Jul-2012,1-Jan-2013,1-Jul-2013,1-Jan-2014,1-Jul-2014,1-Jan-2015,1-Jul-2015,1-Jan-2016,1-Jul-2016″]

| Date | Rolling NetWorth | $ Change | % Change | Notes |

| 1-Jan-2011 | -$36,000 | $0 | 0.00% | HECCS debt |

| 1-Jan-2012 | -$32,000 | $4,000 | 0.00% | Started Full-time work late Nov |

| 1-Jan-2013 | $20,000 | $52,000 | 0.00% | Built property and recieved FHOG ($21,000) |

| 1-Jan-2014 | $45,000 | $25,000 | 125.00% | |

| 1-Jan-2015 | $83,254 | $38,254 | 85.01% | Bought second IP |

| 17-Feb-2015 | $110,215 | $26,961 | 32.38% | |

| 18-Feb-2015 | $121,541 | $11,326 | 10.28% | IP’s re-valued |

| 4-Mar-2015 | $123,715 | $2,174 | 1.79% | |

| 18-Mar-2015 | $122,128 | -$1,587 | -1.28% | Paid for holiday |

| 15-Apr-2015 | $125,906 | $3,778 | 3.09% | Withdrew equity from property |

| 14-May-2015 | $127,906 | $2,001 | 1.59% | |

| 18-Jun-2015 | $131,904 | $3,998 | 3.13% | |

| 21-Jun-2015 | $152,904 | $21,000 | 15.92% | IP’s re-valued |

| 12-Jul-2015 | $159,904 | $7,000 | 4.58% | Paid 4K off HECS Debt |

| 23-Jul-2015 | $161,904 | $2,000 | 1.25% | |

| 31-Aug-2015 | $167,904 | $6,000 | 3.71% | |

| 31-Sep-2015 | $170,110 | $2,205 | 1.31% | Car went out of Portfolio, Bought IP 3, Super went up and one IP went up |

| 31-Oct-2015 | $171,376 | $1,265 | 0.74% | Big bills. Not much saved. |

| 30-Nov-2015 | $173,263 | $1,887 | 1.10% | Super went down slightly |

| 31-Dec-2015 | $186,910 | $13,648 | 7.88% | IP went up in value |

| 12-Jan-2016 | $187,910 | $1,000 | 0.54% | Some big bills |

| 2-Feb-2016 | $189,910 | $2,000 | 1.06% | Bills (again) |

| 1-Mar-2016 | $191,410 | $1,500 | 0.79% | Didn’t save very well |

| 1-Apr-2016 | $193,410 | $2,000 | 1.04% | Steady month |

| 1-May-2016 | $182,410 | -$11,000 | -5.69% | Two IP’s went down. |

| 1-Jun-2016 | $211,010 | $28,600 | 15.68% | All 3 IP’s went up and super was updated |

| 1-Jul-2016 | $229,010 | $18,000 | 8.53% | IP’s revalued with 2 out of three going up |

| 1-Aug-2016 | $233,653 | $4,643 | 2.03% | Super went up along with cash |

Nice update Firebug – did your super go up from your super contribution, or did the balance increase?

Always nice to have more cash on hand!

Tristan

Hi DDU,

The balance increased. I’m not going to be adding extra contributions until I near my preservation age.

Yeah I have a lot of cash relative to my overall net worth. But I’m getting a decent return on that by it sitting in my offset as opposed to just getting around 3% return from a savers account.

Great work on growing the net worth, Firebug, even with the hit to the savings rate. Oh well, good things don’t always last forever so you have to take advantage when these little bonuses come along. Great chart work by the way.

Cheers Martin.

Yes I agree, you must take advantage of everything available to you because it’s not always going to be so good.

I want to improve the chart actually lol. I have not found a decent plugin for it yet. The one I’m using is a bit clunky. Do you know of any good ones?

Cheers

I do like the inclusion of debt levels in the graphs. That’s a big sudden spike in the second graph, hopefully it holds. Did you move out of home on your own ,or are you sharing?

Hi Mrs. ETT

Good catch. You will notice that two out of the three properties have relatively big spikes straight after a purchased them.

I managed to buy them under market value with this being confirmed by the banks valuations immediately after purchase. You may also noticed that the debt levels rise straight after purchase too. This is because I immediately pulled any equity out to top up my LVR back to 80% and have the cash sitting in an offset to lock in the gains. So even if the properties did go down, I would still have that equity in cash sitting in the offset which is nice.

I moved out with my partner. We have actually joined finances 😮 . She is not included in these updates yet. I will add her in hopefully with the next update or potentially the one after.

+$15,000 for Aug/16

+$112,000 YTD

Thank you.

Are these your stats?