Pretty quiet month for October.

Had one major expense pop up out of the ordinary which was having the cats shaved.

We have two cats who must be around 2-3 now but left them at M.F.(Mrs. Firebugs) parents house when we moved in together. It was just going to be too hard to move them when they were so settled and I’m pretty sure that the parents love the cats more than their own children (not kidding).

I once witnessed Mrs. Firebugs dad come home from work during the day in summer to turn on the air conditioning for the cats (not kidding) and leave. This is the same man that yells when a light is left on too LOL!

Anyway, the cats need to be shaved once a year which turned out to cost $550 for two this year ???

I floated the idea of just buying two new cats every year to M.F. but it didn’t go down so well…

We still managed to come under our budget for October through which was a miracle.

Did everyone have good October returns wise for their shares?

We sure did.

It was our best month ever in terms of returns. We made around $5K from capital gains during October ????

Putting us up to around $118K worth of ETFs (we bought another $5K lot this month as per usual).

I recorded a really interesting podcast with Ms Frugal Ears in October.

Some of the topics were pretty deep and I’m glad Serina was brave enough to open up about sensitive issues, particularly what happens after a divorce and the power that comes with knowing your financial position.

I reflected on Serina’s story after the podcast and thought that if I ever have a daughter, how important it will be to make sure that she knows her financial position at all times and what the power of having your own money enables you to do…and not do.

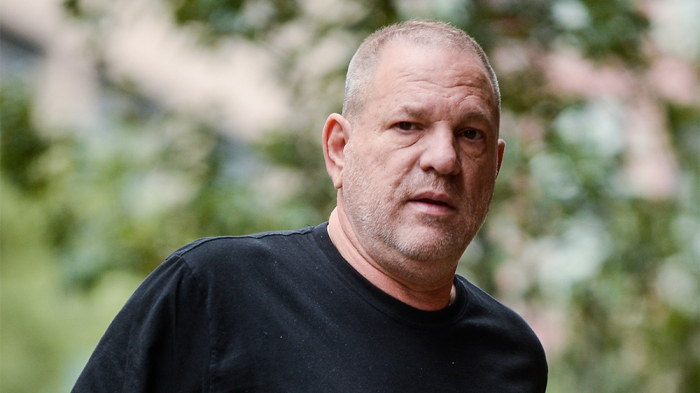

Reading all the allegations about Harvey Weinstein can make you feel pretty sick pretty quickly. Even if it’s only half true.

I can’t think of many more vulnerable positions than an aspiring actress trying to ‘make it’ in Hollywood. You read countless stories of people in the entertainment industry often working for pennies trying to chase their dream of making it big. And this guy is one of the head honchos that decides who gets the role and who doesn’t.

Could you imagine the emotional roller coaster it must be for these girls to go meet him thinking they are about to be offered their first big role only to have him force sexual favours on them? It really is disgusting and an abuse of power to the highest degree.

I know Harvey Weinstein is only one of many though. And unfortunately these people exist everywhere in every industry.

I would hate to think that some of these victims couldn’t turn down the unwanted sexual advances simply because they needed the job to survive. A positions nobody wants to be in, but unfortunately some are.

Net Worth Update

$1.5K bump from Super, around $6K from savings and another $5K from the ETF bump bring us ever so close to the $400K mark!

Properties

No changes in the properties this month.

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs

Huge month for ETFs in October. About a $5K increase!!! ???

Networth

We changed or Super allocation this month just gone, to take advantage of lower fees….gee Super is riddled in fees and I am heartily sick of pouring over PDS’s to ind and compare them all. I was also shocked to see how much MORE Super charges in fees once you go into retirement/pension mode – eeep!

Super is in area that I need to do more research on. I keep thinking that I don’t need to look into it because it’s so far away, but it’s good to have it sorted now rather than later

Be great to see a future article on super.

Low fees, index options, SMSF

Which fund follow your same principles of investing.

I have read into a few funds but haven’t committed to a change yet

Noted Steve. Will do when I find the time

I’ve just switched over to host plus. super low fees. https://pds.hostplus.com.au/6-fees-and-costs#1358a9a6-5427-457c-a1fc-080e9475fe25

Gone with 50% International Shares – Indexed which is 0.02% investment fee + 0.17% indirect cost ratio

and 50%in IFM-Australian Shares – which is 0.04% investment fee and 0.04% indirect cost ratio. It’s an ‘enhanced passive management’ whatever that means. I tried getting more info about them but only got a generic answer back from hostplus.

Can also buy into ETF’s if you go with shares plus option for an extra $180p.a.

We too went with Hostplus and their SMSF lite version called Choice plus ($180 fee yearly). I have 20% of my total Super in the Hosplus indexed balanced (0.07 mer) then in Choiceplus SMSF option, I have bought equal amounts of AFIC, ARGO, VHY, VGS, VGAD and IVV. I have emailed them to see if they can include VTS and the 4 new Diversified ETF’s released by Vanguard last week. They have replied to me that they will pass on the suggestions and let me know.

Wasn’t it a great month for shares? Looks like you are doing well and are really on track. Congratulations.

Thanks Serina 🙂

What type of cats need to be shaved each year? Poor kittehs. One of ours needs her teeth cleaned – there goes a similar amount because they have to anaesthetise them. Ridiculous, she eats exactly the same food as he does. However, 1/ prevention is cheaper than cure and 2/ there’s no way I’d be crazy enough to try to brush a cat’s teeth, so ?♀️.

“I floated the idea of just buying two new cats every year to M.F. but it didn’t go down so well…” This made me laugh out loud!

I don’t even know what type of cats they are. They were rescue cats. Adorable but long haired and no one brushes them regularly!

I think I’m going to try and shave them every month or so just lightly to stop the hair from getting out of control.

Will report back in a few months time if my skin has not been slashed to the bone 😉

Where are your investment properties located?

Outer suburb of Melbourne and South East Queensland

Few questions for you:

Which plateform do you trade on that gives you monthly reporting?

Are you int or dom EFTs?

Are you putting your networth as a goal for FIRE? I have personally stopped that exercise since you can’t really use the equity of RE for new purchase unless it is for equity investments for cash flow… and therefore more debt…

I trade with Commsec but am looking at cheaper options.

I use http://www.sharesight.com to monitor the performance of my portfolio. It’s free and awesome.

Both int and dom EFTs. Three funds. VAS, VTS and VEU. Allocations are above.

I just track my net worth as a bit of a motivator.

I do pull equity from the IP’s to buy more ETFs but since the banks have gone into lockdown mode I haven’t done that in years. Even though a few of them have gone up in value during that time.

I never go over 80% LVR though. That’s where I’m comfortable with debt.

Hope that answers your questions mate

Haha, new cats ey 😉

Your net worth graph is looking somewhat exponential, which is a lovely sight!

Just curious, is your goal $1M? Or a certain income?

Cheers mate

This year has been insane for us. Hopefully, we can keep it going but we’ll see.

I have 1.2M as a rough goal… We’ll see how these next few years pan out and go from there. I think at 1.2M we should be 100% completely FI. But we’ll see. Once our portfolio can fund our lifestyle for over a year I’ll think about hanging up the boots and pursuing some sort of hobbies full time.

Getting exciting just thinking about it now lol

Ahh the things people do for pets. That’s probably why MrB doesn’t want me getting any…

Well done on another great month 🙂

Lucky they’re so cute!

Great blog, recently stumbled across this from reddit sidebar links. I’m a relatively young person who is basically trying to do what you are doing, started my own blog and all to document the process. Keep up the great work!

Thanks Ivan 🙂