What a month February turned out to be!

The market had a big dip at the start of Feb which I included in my net worth update from last month because I didn’t get around to writing it until the 7th of Feb.

Now, what separates an astute investor from a novice? An astute investor has a plan and strategy they stick to and don’t let emotions get in the way. One of the worst things you can do if you follow the Bogglehead investment philosophies (which I mostly do), is to listen, read or watch too mubo jumbo market updates/predictions usually published by financial noobs who probably don’t invest at all and are living the consumer lifestyle.

The thing is, these media outlets, be it print, online or TV. All really exist for one reason.

To make money.

What do you think sells more. A headline that says “Markets ticking along fine with no need for concern”.

As opposed to “BIGGEST MARKET CRASH SINCE 1929 INCOMING” *written by our intern who majored in finance

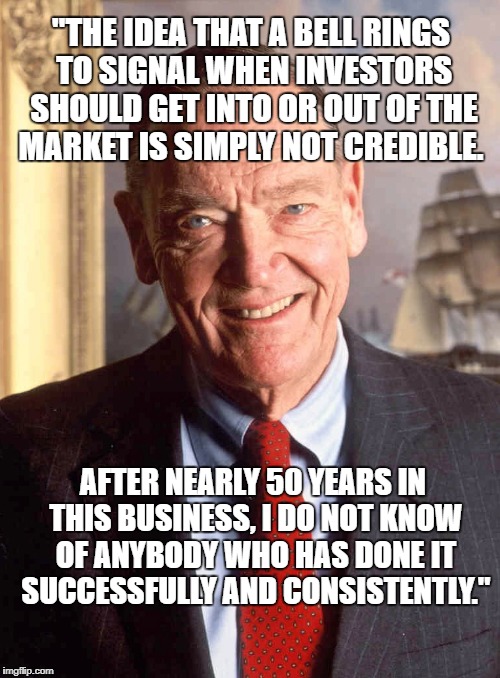

A lot of people can have predictions without any accountability. Where were all these experts in 2008? Or 2000 when the tech bubble crashed? I pay no attention to what 99.9% of people say about the markets and neither should you. Because at the end of the day, I subscribe to the philosophy of investing regularly no matter what the market is doing.

To quote John Bogle (the founder of Vanguard)

Which is why we bought in the middle of Feb just after the dip. This turned out to be lucky because of the rebound that followed after. We were going to buy anyway, the timing was just lucky. And in the long run, it doesn’t even matter that much.

HUGE news for the entire FIRE community in Australia came in Feb when Pat The Shuffler was asked to write a story about financial independence by the ABC.

When I first started blogging back in 2015, I could not find another financial independence retire early blog out there for Australians. There were plenty of money and finance blogs, but no specific FIRE ones (to my knowledge).

Fast forward just 3 years, and now we have one of our very own published in one of the major media outlets in the entire country!

If you’re after a good laugh, have a read of the Facebook comments from that article. People cannot wrap their brains around someone being able to live a great life by only spending $40K a year.

There was actually another dude who wrote a response piece to Pat’s article that was published by the ABC too. I can’t even begin to tell you how factually wrong it is but it’s another example that FIRE will never become mainstream because normal everyday people just don’t get it and won’t even entertain the notion of cutting down their spending habits.

I did an improv podcast with Pat about the whole article the other week to get his thoughts. I haven’t released it as a proper podcast yet (I just wanted to get it up quick).

The FIRE movement must really be making waves among the Aussie journalists because Aussie Firebug himself was actually contacted by one to contribute to a story that she was writing about the community. I actually had already responded to an online request from another media outlet looking for people involved in the movement but it was nice that one journo reached out.

Long story short, I made a few paragraphs in Sydney Morning Herald along with Ms Frugal Ears and Get Money Wise.

Pretty cool right!

I can now add that ‘As seen in’ cool little graphic on the front of my blog even though it was only a few paragraphs 🤣.

Net Worth Update

Back over the $400K mark 👊👊👊!

Decent bump this month mainly due to saving well and the markets bouncing back. We made a nice little gain by buying on the dip too.

We went a little over our budget for the month but nothing too major.

Properties

No changes in the properties this month.

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs

The ETFs bounced back after the first week and a bit of Feb!

The recovery was almost instant, but it made me wonder how I would go to see those sort of drops happen for an extended period of time.

I know the strategy that you shouldn’t sell in a bear market. But it will be interesting when push comes to shove to see how both Mrs FB and I respond mentally when we go through a proper crash.

Almost looking forward to it 😜

Networth

I get a full on shout out!

It has been a wild month for FIRE in Australia. Here is to hoping the movement gets more traction in the years to come.

Good to see the portfolio bounce back, but to be honest, completely selfishly I am firmly in the ‘I want a share market down turn’ camp. A crash would be even better.

PS. I am totally adding an ‘as featured on’ section to my website 😀

The funny thing is that the article I was mentioned in went to like 5 publications. So it’s going to look a lot more impressive than it really was lol 😂😂

Hi Pat,

Can you clarify something for me? How do you expect to retire with your partner and potentially have children on a post tax income of approx $35k pa?

Also how do you plan to quadruple your share portfolio in about 5 years?

Great progress! It’s been nice to see the FIRE community grow in Australia

Hi Aussie Firebug,

Love your work mate. Have been pushing in the direction of FIRE since commencing graduate work in 2014 from a range of influences

(starting with a couple of IPs but now looking broader primarily driven by APRA). Came across MMM, probably a year or two later and now most recently with the media coverage from Pat has helped uncover the Aussie scene for me!

Loving the podcast and have been catching up on most of the content, great to have Aussies to relate to vs the US content that I was only consuming prior.

Anyways all the best and I will be sure to get in touch if I have any q’s.

Cheers

You’ve come in at a good time Adam. The Aus FIRE community is growing rapidly and we have some great brains out there contributing to the movement.

I also starting to shift from property when APRA started going gangbusters. It was a lot easier back in 2012-2014

Do you have a breakdown of what ETF’s you are invested in? I’ve purchased my first investment property a few months ago and am looking to diversify myself some more.

Something went wrong with my graph (I have fixed it now).

I put my ETF breakdowns in every net worth post I do.

Have a look now mate 🙂

Haha definitely add that little logo to your blog mate – and good work on the contribution too! It’s great that there’s more interest building for FIRE in Aus.

Nice job buying on the dip. The news headlines and chatter about it are almost mind-numbing. It’ll continue as long as the volatility continues, even though sharemarkets have roughly gone nowhere.

Even a 10% drop is no big deal considering the US went up 30% last year!!!

As Pat pointed out, we should all be praying for lower prices (but not lower dividends) as we’re long term accumulators 🙂

Spot on Dave.

Thanks for sharing the links to the story and other bloggers out there. The FI community here is still small, so good to have these people flagged for attention.

Hi, great work on the growth of your portfolio. Min’es taken a bit of a hit over the last week or so. Hopefully wit will rebound a bit.

Just wondering what you use to create your graphs? Excel?

I use Google Charts Enzo https://developers.google.com/chart/

Sorry about the typo’s. Fat fingers 🙂

Hi Firebug,

What return rate are you working with on your ETF’s to estimate your net worth growth? Just wondering.

Cheers 🙂

Hi Bec,

Not sure I completely understand what you’re asking. I don’t estimate my net worth. I tally everything up at the end of the month and post my position…

Can you explain what you’re asking a bit more, please?

Here’s a tip. Stop trying to “play” the market hoping to buy in the dips and sell in the peaks. You may as well be investing in bitcoin. Get yourself a conservative portfolio and use dollar cost averaging for regular investments. Buy individual stocks that pay a dividend and then reinvest that dividend. Stop obsessing about your fluctuating monthly net worth. Invest as much as you can in a good industry super fund using the above principals.

In the meantime, get on with your life, live a little, travel, etc. Meet a nice girl that shares you philosophy versus buying new shoes every week.

Cheers

😂😂😂

You must be new around here.

LOL! ‘you may as well be investing in bitcoin’!

Classic

1. This is a blog for early retiree wanna bees. Hence Superannuation just wouldn’t cut it.

2. No harm buying in the dips. Helps in the psyche for investing. Still dollar cost averaging as he buys regularly. Dollar cost averaging only beats 1/3 of the time vs lump sum investing though.

Argument for dollar cost averaging as a risk mitigating tool ?, then rebalancing yearly/semi year is a subset of dollar cost averaging, yet allows you to purchase assets which are cheap and sell those expensive in effect some element of market timing and buying dips and selling the peaks.

3. No matter what we learn in theory. e.g. never sell during catastrophic event, many of us will still sell knowing fully well we shouldn’t. There is a big difference between a 50% drop in a 1 million portfolio vs a $100000 portfolio. The psychology of investing puts humans themselves as the greatest risk.

4. “Buy individual stocks that pay a dividend” ?. Are you implying stocks without paying a dividend or pays minimal are bad ? That case, VAS should be 100%, and we forget how much we have lost out to international shares !

What is important, is to have a decent amount of dividend paying stocks to override the psychological factor of running out of cash flow……….however, I would rather focus on the “earnings” yield than “dividend yield” and rebalance when I need cash flow. The idea behind cash bucket methodology or dividends are simply just to control our emotional fears to selling in a market crash.

5. “Invest in a conservative portfolio” ?. I would say Aussie Firebug has a high risk profile to be reassessed till he experiences a GFC like crash. If you are advocating conservative portfolio (30/70) instead ?, . Most FIRE have to consider the risk of sequential risk, but the biggest risk of them all the big daddy: Longevity risk. Even a 50/50 or 60/40 portfolio helps a mere 30 years. You do need a much higher risk appetite after moving out of the retirement risks zones of 5-10 years prior and after retirement.

6. Ignoring rebalancing eventually puts you from conservative to a riskier portfolio. No problem with that as long you don’t sell in a GFC like crash, which also means you have gotten your risk profile all wrong in the first place.

7. Instead of a conservative portfolio which typically has a max draw down of about 13 % during the worst period of GFC. Might as well utilise valuation type strategies such as Shillers cape ratios where risky assets fluctuates between 20% to 60%, gives you similar or less max draw down to a 30/70 portfolio of 13%*, yet gives you returns akin to a 50/50. allocation or more.

*a 30-70% risk asset fluctuation using cape ratio has a maximum draw down of about 16%. Hence I’m assuming a 20-60% risk asset fluctuation should have a max draw down of 13% or less.