If you follow any online FIRE blogger whether it be an Aussie or international, you might start to see a pattern that emerges more often than not.

The majority of these early retirees are living off an income stream generated by returns from Index Investing.

In this post, I’m going to go into detail about how I first started investing for financial independence and how my strategy evolved over the years.

In the Beginning

I first came across the term and concept of financial independence in a book called ‘Rich Dad Poor Dad’ by Robert Kiyosaki. It really struck a chord with me because it was so simple. You buy assets that make you money and eventually you will get to a point where you have so many assets that make so much money that you don’t have to work to live.

Mind = blown.

Now I was already pretty good at the saving and frugal part. But I had never invested in anything outside of a savings account. This leads me to pick up my next book in my quest towards FIRE, ‘From 0 To 130 Properties In 3.5 Years’ By Steve McKnight. Because if you live in Australia the most popular investing class by a country mile is without a doubt, Real Estate.

It makes sense too, most of our parents have seen/experienced incredible real estate booms without any real crashes in the last 25 years. My parents also invested in real estate so there was a comforting sense of guidance I could draw from when choosing this asset class. Mum and dad had been through it before and could mentor me.

Real estate is easy to grasp too. You buy a house, you rent it out and collect rent, the rent covers the expenses (hopefully), you sell it later at a higher price and make a profit. The other popular strategy with real estate is that you buy strong cash flow properties (where there is a surplus of rent after all expenses) and live off the rent, but this strategy is very hard to do in today’s market because of the low rental yields in Australia.

With time on my side for letting my investments grow for decades, my first investing strategy was to create an income stream through real estate.

Strategy 1 – Real Estate

The very first investing strategy I had, went something like this.

If I could buy 10 investment properties (IP) and hold them for 10 years, I could sell half of them and pay off all my debts. I would then have 5 houses pulling in rent with no interest repayments which would mean the majority would come to me.

The maths roughly looked like this:

| Equity | Loans | Rent @ 5.2 Yield | Expenses | |

| 10 X IP | $3M | $2.4 | $156K | $175K |

And after 10 years, assuming that rent and expenses (but not interest repayments) have increased with inflation @ 2.5%

| Equity | Loans | Rent | Expenses | |

| 10 X IP | $6M | $2.4 | $200K | $180K |

It’s important to note that while some expenses like rates, maintenance, water bills etc. would increase with inflation, the loan amount never changes. This is actually an advantage of leveraging your investments. You take out a loan in today’s dollars but can pay them off years later after inflation has eroded them. Which is often why you hear people say that debt is a good hedge against inflation.

And then I would sell 5 IPs and it would look like this

| Equity | Loans | Rent | Expenses | |

| 5 X IP | $3M | $0 | $100K | $15K |

I was well on my way with this strategy and bought my third IP in 2015 which was around the same time as I discovered MMM and index investing which I will go into later.

This strategy has worked for thousands of Aussie and isn’t anything new.

So why did I decide to change my strategy?

- Strategy 1 relies on capital growth.

- You can see in the first table that there is nearly a $20K difference between the rent and expenses. What is not factored in here is negative gearing. All my properties right now are negatively geared but cash flow positive. Because of the tax refund I receive, the properties pay for themselves. But I could never actually retire off this cash flow which is why the capital gains are imperative. Without it, the strategy simply doesn’t work. And capital gains only works if someone buys your assets at a higher price than what you paid for it. I never felt comfortable breaking even or making a tiny profit each year with the hopes that 10 years down the track it would all pay off. I felt that investing should be a snowball approach where you start with a small trickle of passive income and see it grow into a raging torrent over the years.

- Active Investment

- There’s no way around it. Managing property requires time and effort. When I first started I had all the enthusiasm and motivation in the world and wanted to do everything I could to reach FIRE as quickly as possible. If that meant some sweat equity then I was all for it. But roughly 5 years later my motivation for doing all the extra stuff has fallen off a cliff. I would much rather focus on other things than worrying about and managing my investments. To be fair, my properties aren’t too much of a hassle, but getting to 10 IPs would be a lot.

- Lending conditions changed

- It was around about 2016 when the APRA (Australian Prudential Regulation Authority) really made it hard for investors to withdraw equity and refinance their loans. This was to try and curb risky lending and make it harder for property investors. Interest rates were raised on all of my loans and the number of hoops I had to jump through for my last equity withdrawal was 10 times harder than in 2014 and 2015. Looking back now, I was very fortunate to get into property when I did. Interest rates were being cut and banks were financing loans a lot easier. In mid-2016 I could not get another loan for a 4th property which meant my dream of 10 properties was out of reach.

But if I’m not going to reach financial independence through real estate, then how else am I going to create a passive income stream?

Strategy 2 – Index Investing

I think I can speak for a lot of people when I say Mr. Money Mustache has a way of writing that people relate to. I guess it’s why he is so popular. When I read The Shockingly Simple Math Behind Early Retirement it just made sense. And his article about Index Investing really clicked with me and would be what I consider the catalyst for my desire to learn more about the stock market.

It’s quite funny to see peoples reactions when they discover you have 6 figure sums invested in the stock market.

“That’s so risky though. Don’t you ever get scared you’re going to lose it all? One minute it’s there, next it just vanishes. I wouldn’t feel safe having so much money in the stock market, I only invest in things I can see and touch.”

I too once thought like this because of the constant news outlets reporting on the stock market crashes and how billions were wiped out in mere hours. Scary stuff.

But if you actually take the time to understand how the stock market works and what index investing is, I think you would be pleasantly surprised to find out all the positives that come with this investing approach.

What is an Index?

Indices cover almost every industry sector and asset class, including Australian and international shares, property, bonds, and cash. There are companies that conduct and publish financial research and analysis on stocks, bonds, and commodities to create indices. One of the more popular companies that publish these indices is Standard & Poor’s (S&P).

Have you ever listened to the news and heard them talk about the All Ordinaries (also know as All Ords) and wondered what it is? The All Ords is Australia’s oldest index of shares and consist of the 500 largest companies by market capitalization.

Let’s take a look at the S&P/ASX 200 (top 200 companies trading on the ASX by market cap) historic data since 1992:

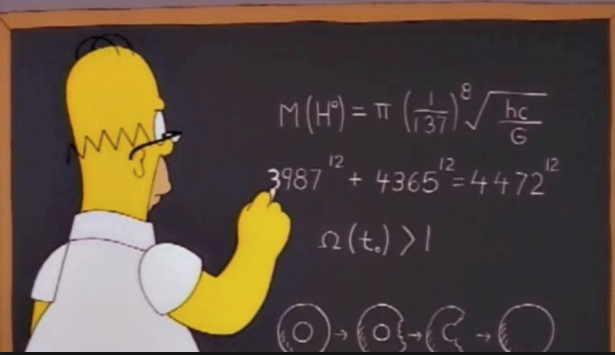

Here is the Dow Jones (US index) for around the last 60 years.

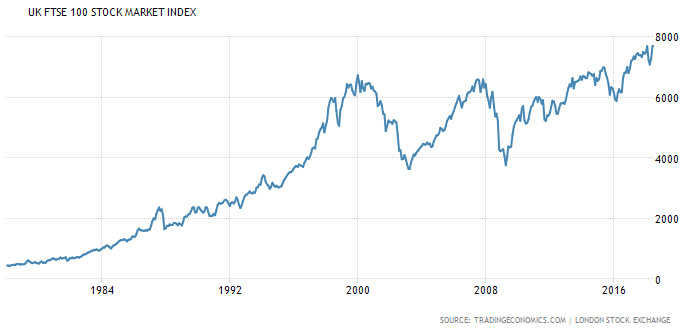

And lastly, here is the Financial Times Stock Exchange (FTSE) 100 Index which is the top 100 companies listed on the London Stock Exchange by market cap.

What is Index Investing?

You might notice a few trends from the above graphs like the dot-com crash around 1999 to 2003, or the GFC in 2008 or the constant peaks and troughs through the years.

But what is glaringly obvious is the overall trend in each countries index is up.

And these graphs don’t include the most important part. The entire time throughout these decades, those companies that are trending up or down, are paying dividends (or reinvesting them) each year! So combine the capital growth from the above graphs with dividends and you get the idea. The overall markets, given enough time, trend upwards!

This is a fundamental principle of index investing.

It’s hard to predict which companies are going to do well over the next 20-30 years. In fact, it’s almost impossible. A lot of active fund managers try to outperform the index and charge you exuberant management fees with the promise of higher returns. The thinking behind this makes enough sense. The fund managers have an army of analysts working 12 hour days using the latest analytical tools and datasets to ensure that they only choose the ‘best’ companies to invest your money in. But as history has shown, only a very small % of investors/fund managers are able to consistently over a long period of time (20 years+) beat the index.

Rather than trying to guess which investments will outperform in the future, index managers replicate a particular market or sector. This means they invest in all or most of the securities in the index.

Indexing is based on the theory that investors as a group cannot beat the market – because they are the market.

ETFs/Vanguard

So how do you invest in an entire index?

You could, in theory, buy all the companies within an index at the appropriate weightings. You would get killed in brokerage fees but I guess technically you could do it. But luckily there’s a much easier way.

There exists investment companies that cater to the index investing style and offer investment products that mimic an index with rock-bottom management fees. One of the biggest investment companies that offer these products is Vanguard.

The reason Vanguard and other companies can offer these products at such a low cost is that there is no money spent researching and analyzing which stocks to invest in. Index investing companies simply look at the index data provided by companies such as S&P and remove or add companies from the index plus a bit of paperwork. That’s it!

To put the management fees into perspective, a hedge fund’s fees might be as high as 2.00%. Vanguard charges me 0.04% for my US index ETF that I invest in.

To put it another way, if I had $1M in the hedge fund. They would charge me $20K a year for management fees. Vanguard would charge me $400 bucks. The difference of $19,600 reinvested at 8% over 30 years is $2.4 Million!!!

You can either invest directly with the Vanguards fund or you can buy ETFs which are exactly the same investment products but traded on the stock exchange. There is also a difference in management fees. You can read up a bit more about the difference in this article How To Buy ETFs.

Why We Decided To Move To Index Investing

I joined finances with my partner in 2016 and we made the decision to start investing in ETFs (index investing). After reviewing the two asset classes a year later, we knew that we wanted to continue to go down the path of index investing. Here are the reasons why we decided to move away from real estate:

- Diversification

- With our current three fund portfolio, we have exposure to over 6,000 companies in over 30 different countries. Our three properties are all located within Australia (different states mind you) and while I think it’s unlikely that they would all tank at the same time there is the possibility of a recession to hit Australia. If that were the case, those properties would almost certainly drop in value. And Investing Strategy 1 relies on capital gains to work. If something like that did happen, they have enough cash flow to make it through but who knows how long it might take for them to recover and ultimately gain enough value for the strategy to work. I might be waiting for decades.

The odds of the entire world tanking over a long period of time is not completely out of the realms of possibilities, but it’s a lot less likely than one country going into recession.

- With our current three fund portfolio, we have exposure to over 6,000 companies in over 30 different countries. Our three properties are all located within Australia (different states mind you) and while I think it’s unlikely that they would all tank at the same time there is the possibility of a recession to hit Australia. If that were the case, those properties would almost certainly drop in value. And Investing Strategy 1 relies on capital gains to work. If something like that did happen, they have enough cash flow to make it through but who knows how long it might take for them to recover and ultimately gain enough value for the strategy to work. I might be waiting for decades.

- Liquidity

- If we ever needed the money that was locked in the properties. It might take 6+ months to sell them and go through the whole process. With ETFs, I can put in a sell order and literally have the money in my account within 3 days. This means that selling off parts of your portfolio to fund your retirement is possible.

- Cash flow

- This is probably the biggest reason why we made the move. The path towards freedom is a lot clearer with ETFs. We know that we will need roughly $1 million in the market to generate enough returns each year to live off forever. The high cash flow/liquidity makes index investing a popular choice for FIRE chasers.

- No more banks

- Investing in ETFs does not require lengthy loaning processes. Leverage can have its place but it’s not required.

- Passive income

- Some may argue that real estate can be passive, and to some degree, I guess it is. But from my experiences with real estate, such jobs as collecting rent, doing paperwork, dealing with tenants, responding to emails, maintaining the properties etc. can add up to be a part-time job. You will not find a more passive income stream with the same returns as what ETFs offer. And I also love the fact that the more ETFs you have does not mean more work. More properties = more work. But you will do the same amount of paperwork come tax time on a $50K portfolio vs a $3M one.

- I don’t have to be an expert

- I believe that you need to know your shit when investing in real estate. I wouldn’t be comfortable investing in a property unless I knew the ins and outs of the area like the back of my hand. Where are the jobs coming from? What’s the population growth like? What’s the unemployment rate like? And on and on I could go.

The only thing I have to work out each time I buy ETFs is what I need to buy to rebalance my portfolio. That’s it! I don’t need to keep up to date with the latest trends or what’s the hot stock right now or any of that crap.

- I believe that you need to know your shit when investing in real estate. I wouldn’t be comfortable investing in a property unless I knew the ins and outs of the area like the back of my hand. Where are the jobs coming from? What’s the population growth like? What’s the unemployment rate like? And on and on I could go.

Our Plan Detailed

If you read my monthly net worth posts you can see that we invest in a three-fund portfolio. I’m going to go into details about why we invest in each fund and how ultimately they will enable us to reach FIRE.

Management Fees: I prioritize a low MER (Management Expense Ratio aka management fees) above almost everything else because paying less in management fees is a guaranteed returned and when it comes to investing in general, almost everything else is speculation to a certain degree.

Given my obsession with management fees, you can understand that Vanguard was an easy choice as an ETF provider since they offer some of the lowest MERs in Australia.

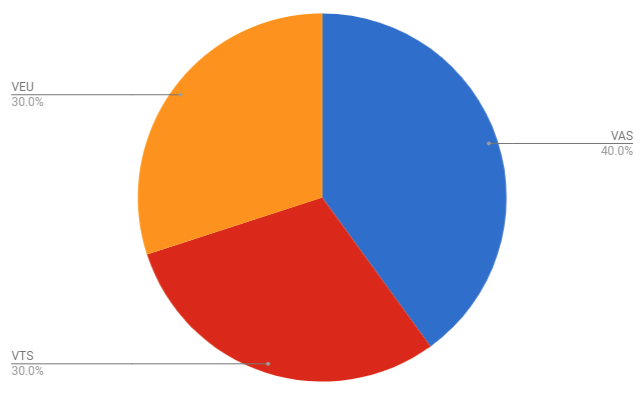

This is what our Strategy 2 looks like in pie form

Let me explain each fund and why it’s in our portfolio

VAS

MER: 0.14%

Benchmark: S&P/ASX 300 Index

Why it’s in our portfolio:

Some people will argue that Australia is such a small percentage of the world’s markets (around 2% last time I checked) that it’s not diversified enough and you’re better off going global for that diversification. I generally agree with that and what’s even worse is that out of my three funds, VAS has the highest MER at 0.14%.

So why do I invest in it?

Two words… Franking credits.

I’m not going to go into the technical details of how they work (Pat wrote a great article about that if you’re interested) but essentially they are an advantage that Australian companies can give Australia investors.

Australian companies for whatever reason emphasize higher dividends vs capital growth. I’m not 100% sure why this is, but please feel free to let me know in the comments for all those smarty pants out there. Anyway, this high dividends plus franking credits means that VAS pumps out a solid stream of dividends each year. The franking credits are too good of an opportunity to pass upon and are why VAS takes up 40% of our portfolio.

**A200**

A few months ago BetaShares released the A200 ETF.

It is essentially the same product as Vanguards VAS ETF except the A200 invests in the top 200 companies of the ASX instead of the top 300. Something to note is that the bottom 100 companies in VAS only make up 2.5% of the total in terms of market cap. So while the A200 is less diversified than VAS, it’s not as bad as it sounds.

The A200 boasts a MER of just 0.07%.

That’s half the price in management fees vs VAS!

I will be moving to the A200 if Vanguard does not respond with a lower MER next time we buy.

No one knows if VAS is going to outperform A200 moving forward. But what we all know, is that right now you will be paying double the price in management fees if you invest with VAS.

I won’t sell VAS moving forward, but I will be buying A200 instead.

VTS

MER: 0.04%

Benchmark: CRSP US Total Market Index

Why it’s in our portfolio:

Diversification? Tick (the US make up around 40% of the entire world market)

Good Returns? Tick

Rock bottom MER? Tick!

How can you possibly go past this ETF if you’re looking for a low-cost diversified ETF? At 0.04%, that’s the lowest management fee of any ASX ETF I can think of off the top of my head. I have often thought about going 100% VTS because I value a low MER with the highest regard. But the franking credits keep pulling me back to VAS and complete world exposure is why we finish with VEU.

VEU

MER: 0.11%

Benchmark: FTSE All-World ex US Index

Why it’s in our portfolio:

VEU rounds off our diversification by giving us the entire world minus the US at a very reasonable MER of 0.11%. And since we also invest in VTS, this means that with just three funds, we have exposure to the largest companies on planet earth.

Think about what would need to happen for us to lose all our money. Companies like Apple, Microsoft, Google, Exxon, Facebook, Commonwealth Bank, ANZ, Westpac, Shell, Samsung, Toyota, GM Motors, Telstra, Johnson & Johnson etc. would all have to go bust. All of them! I just can’t see that happening. And if some of those companies do go down the drain, they are simply replaced in the index by the next company with the highest market cap. And because the index is only giving a small weighting to individual companies (less than 1%), you won’t see it affect your portfolio. The only time a significant drop occurs is when the entire market as a whole is down (like what happened in 2008).

The 4% rule

The 4% rule is based on the 1998 paper called the Trinity Study and to put it simply, it means you should, in theory, be able to live off 4% of your portfolio. It’s an American study and is meant to last for 30 years so it’s not full proof by any means. But this is what we are using when calculating ‘our’ financial independence number.

So if we have a portfolio of $1M, we could live on $40K a year and never run out of money (it also factors in inflation).

How Much Do We Need?

We are currently on track for this F/Y to have spent a touch under $50K. That’s absolutely everything we spend to live our current life. It also factors in rent.

We do plan to own our own home one day which means that factoring in a fully paid off house, we spend about $38K a year.

Which would mean that we need a fully paid off house plus $950,000 in ETFs to generate enough income each year (factoring in inflation) to become financially independent! But being on the conservative side of things, I think a cool one million will be the target.

How It’s Going To Work

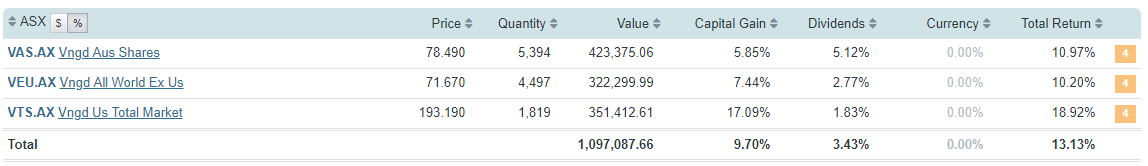

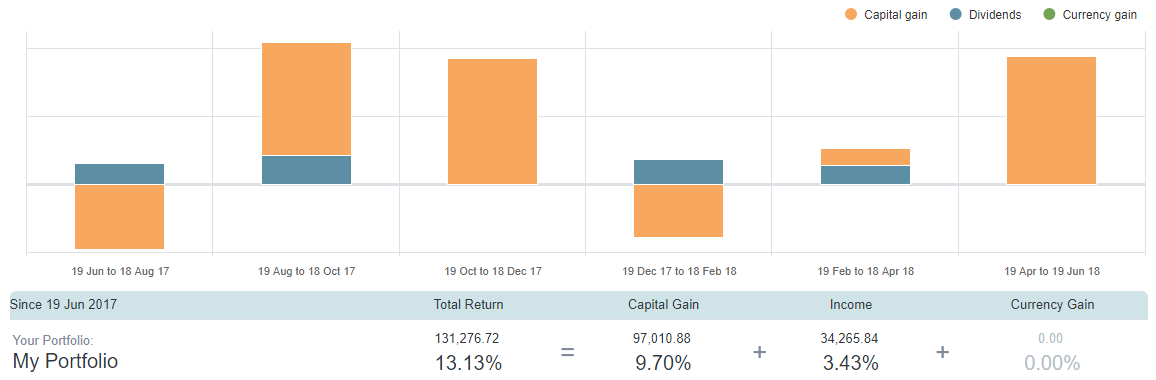

Let’s imagine, for argument’s sake, that we had reached our $1M portfolio goal with all the appropriate weightings for VAS (40%), VTS (30%), and VEU (30%) exactly one year ago (19/06/2017).

After one year, this is what the performance of that portfolio would look like thanks to ShareSights amazing ability to create dummy portfolios with historical data.

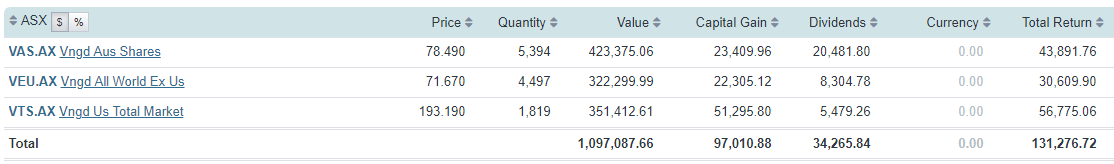

And if we look at how each fund performed for the last 12 months we get this.

Total Return for the 3 funds was $131,276 for the last 12 months!!!

A few things to remember though:

- We need to factor in inflation. If we assume 2.5%, that means that our real return was $127,964.

- The last few years have basically been a bull run for the whole world. This portfolio is not going to return these numbers every year. But that’s ok, what we need to do in the good years is not spend extra, but keep that surplus in the portfolio so when the bear market does come (and it will) there is enough to carry us through to the next bull.

- By looking at the total return, it would appear that VEU did really bad and VTS did really well. But how we actually should measure the returns is in percentage. Which looks like this

VAS and VEU are a lot closer when comparing % returns. VAS has a higher weighting which is why it returns more dollars when it’s very close in percentage terms. - We are aiming to achieve around an 8% return on average from the stock market. So 13.13% is a fantastic year!

The Dividend Part

You can see from the above graph that we received $34,265 from dividends in 12 months…  This is pretty good but you can clearly see from the fund breakdown where the majority of the dividends came from. VAS of course. Australian shares just pump out those juicy franked dividends like no other which is great.

This is pretty good but you can clearly see from the fund breakdown where the majority of the dividends came from. VAS of course. Australian shares just pump out those juicy franked dividends like no other which is great.

But what’s probably even more important to note, is how low the dividends were for VEU and especially VTS considering VTS made an overall gain of 18.92%! You won’t get much better than that and it still only paid out a lousy 1.83% yield.

We needed $38K last year. But this year inflation (2.5%) adds another $950 dollars. So we now need $38,950 to maintain our lifestyle.

The dividends cover $34,265, which means we’re short $4,685.

The Captial Gains Part

You know how I was just bagging out VTS because of its putrid dividend yield? Well, boy does it make up for it in the capital gains department!

VTS alone smashed our FIRE number of $38,950 and returned a whopping $51,295 (17.09% Gain!!!). Combine the other two funds and last year well and truly exceeded the 4% rule.

But how do we harvest these capital gains to actually live? The dividends are straightforward because they are paid directly into your account without you having to do anything. The capital gains part is a tad different.

We need to sell off units from our portfolio and realize a capital gain.

This is the part where a lot of people either don’t fully understand or are not comfortable with.

“Wait, I thought we reach a certain size portfolio and it pumps out a passive income stream we can live off? I don’t want to sell part of my portfolio. What happens if I have to sell it all”

It’s perfectly fine to sell off parts of your portfolio as long as it has the time to recover those losses.

For example, in the above scenario, I need an extra $4,685 which I must get from selling some units from one of the three funds or parts of all of them.

The most obvious fund to sell some units is VTS because it had the best return in the capital gains department and we can lock in those profits by selling. Each unit is now worth $193.190. So a bit of quick maths means I need to sell 24.25 units. Rounding it off and factoring in brokerage fees lets just say we sell 25 units.

$193.19 X 25 = $4,829

We have now made up what we needed to live for that year.

“But we are now down 25 units right?”… Technically right, but the wrong way to look at it.

Firstly, the portfolio grew by $131,276 dollars. We took $38,950 out of that growth to live on which leaves us still up $92,326. When next year rolls around, because of the power of compound interest, it doesn’t matter that we are 25 units down. Assuming we get the exact same returns in percentage terms, we will make more money next year because the starting value of our portfolio is higher than last year even factoring in 25 fewer units.

“But what if I run out of units?”

Highly unlikely. Each year you will have less and less units, but those units should be worth more unless it’s a bad bear market. Even so, we will have over 11,000 units spread across the 3 funds. Every few years they will be worth more and more meaning we will have to sell fewer units each time to make up the difference.

What Happens If We Retire And Another GFC Hits

This is the worst case scenario for our plan. Because it relies partly on capital gains, a huge downturn in the market straight after we pull the pin would mean we potentially would have to sell units at a rock bottom prices. And it’s possible that our portfolio might shrink too much in the early years and never make a full recovery when the bull markets come back around.

In this situation, I think the answer is pretty obvious.

At absolute worst, I’ll pick up some part-time work. Shit, even 200-300 bucks extra a week would dramatically reduce our reliance on ETFs. $300 a week for a year is over $15K which is 40% of our expenses!

Retirement

When our portfolio reaches $1M and we have the house fully paid off, I will at that point, declare financial independence.

But what will we then do?

If we are enjoying our lives to the fullest, then there would be no reason to change anything. But what I most likely will do immediately is drop my working days down to 2-3 days a week. From there the possibilities are really endless. Do I want to continue working at my current job? Maybe I only want to do part of my job 2 days a week? Maybe my boss won’t like that, but since I have reached FIRE I will have the power to quit my job without worrying at all.

I don’t plan to ever stop working, to be honest. It will just be 100% enjoyable work and probably not full time unless it’s a passion project. So the odds of neither Mrs. Firebug or I receiving some form of income post retirement is extremely low. This blog is even pulling in some $$$ now and I absolutely love working on it. I couldn’t imagine where it could go if I worked full time on it!

We will always have the portfolio there knowing we are financially independent, but there’s a good chance we will still earn some form of income from something fun 🙂

Strategy 3..?

Ok, long read so far I know. But we’re nearly there.

I’m a big believer in the following quote:

I’m constantly looking for new ways to invest, reduce our spendings, find tax efficient methods etc. It’s half the reason I started this blog. So a whole bunch of people way smarter than me could critique my strategies and explain better ways to do things. And it’s worked an absolute treat so far. The Australian FIRE community is the best for sharing information that will help you get wealthy a lot quicker than if you had gone at it alone.

So when I come across something that makes sense to me and is even better than what I’m currently doing. Why wouldn’t I adopt it?

Enter Thornhill

The entire reason I invest money is to reach the end goal of financial independence.

To have my assets generate enough income for my partner and I to live off forever.

The key word here is income. In Strategy 2, capital gains are still required because VTS and VEU predominately return capital gains vs dividends. VAS is the cash flow king out of the three because that’s the Australian index and Australia has a high rate of dividends.

Peter Thornhill is the author of the best seller ‘Motivated Money’ which details his investment approach to investing for dividends (mainly in the industrial sector) and not for capital growth.

He explains in his book that dividends are a lot more stable and less impacted by market swings as opposed to the share price. Something that really struck a chord with me is the way he explains intrinsic value. In a nutshell, the real value of a company or any investment, in general, should be determined by how much income it is able to produce over a long period of time. It’s the income that is key. And it’s the income that will either pay the investor (you) the dividend or be retained by the company and consequently have the share prices go up.

This is how it should work, but as we all know. Humans tend to speculate a lot and you end up with assets that have potential but no solid foundation of cash flow being traded for ludicrous amounts of money (BitCoin, Sydney Real Estate etc.).

I’m not saying these assets don’t have value, but the only way that an investor can make a decent return is if they find someone that is willing to buy it at a higher price than what they paid for it.

If the goal is income, why don’t we focus only on investments that yield the best dividends?

Why not go 100% Australian stocks?

Australian shares yield the best dividends AND they give you the bonus of franking credits. These two reasons make a very appealing case for any Aussie investor.

I encourage everyone to read Thornhill’s book ‘Motivated Money’ because he explains the dividend approach a lot better than I can.

Here is a little video of Peter explaining why he looks forward to a GFC event.

The more I listen to this guy, the more convinced I am with his approach to investing in Australia.

“Watching the share prices drop is a totally different thing to the cash flow that’s coming out of the portfolio. That is what we are living on, we are not living using the capital as the source of income, it’s generating the income for us” -Peter Thornhill

UPDATE: We have since officially moved to strategy 3 a few months after this article was published.

Conclusion

Hopefully, you can come away from this post with a much clearer understanding of how we are planning to reach FIRE in the next coming years. I really wanted to include as much detail in this as possible and try to convey our thoughts behind the investment decisions we are making.

I think it’s common for a lot of Australians to start with real estate but finish with shares. I feel like that is the natural progression that as we get older and don’t have the time or energy required for active investing, the share markets offer a fantastic passive alternative with many other benefits. We are on track with strategy 2 at the moment. But the more I think about strategy 3, the more I’m liking it.

$1M is our official FIRE number. When we reach that plus a house paid off, the goal will be reached. It’s still a few years away no doubt, but we are enjoying the journey and each month we move closer to our destination.

What about your strategy? Are you on a similar path? I would love to hear about how you’re going to reach financial independence in the comment section below.

Great read and thank you for sharing the detail, ironically very similar weighting to myself although I’ve added a small cap oz LICs in for good measure given concentration at the top end of VAS in banks a couple of miners and a dud telco. I’d be interested to know what structure you buy in and why, Ie personal/joint name, company or trust. Something I’m trying to figure out as we progress. Thanks again

Hi Regan,

We buy in a trust so we can distribute income at the most tax efficient rate. Asset protection is a bonus.

I’m looking into LICs. Will most likely be our next purchase.

Hi Aussie Firebug,

You commented that you buy in a trust. Do you just gift / transfer a residual amount from your wage into the trust and then buy your ETF’s that way? Do you dollar cost average monthly or periodic lump sum?

Great blog! Looking forward on further articles

Hi James,

We loan the trust a lump sum when we are ready to buy. Usually once a month @ $5K. If I sold the properties I would DCA with a large amount of money. Probably like $10K a month or something like that.

I’m glad you’re enjoying the blog mate 🙂

Hi mate I am very glad to come across your blog and want to use a similar strategy however have a little fear if it’s alright to buy 5k of ETF on a fixed day of the month for e.g 15th of every month. what if those are the days when market is high then I would be only buying at the top of the price hence not benefiting much. Can you please clarify how do you manage this is there a better way to manage it ? Thanks

I am not the OZfirebug but I can definitely tell you time in the market beats timing the market.

“Based on the historical performance of the , it’s that second decision—the fear-based move to sell—that is the more dangerous one. In fact, even if one was the world’s worst market timer over the past several decades, one still made money on stocks, according to an analysis done by institutional portfolio manager and financial writer Ben Carlson.

He names his awful (or perhaps unlucky) investor “Bob.” Bob made his first investment in the beginning of 1973, right before a 48 percent crash for the S&P 500. Bob then held onto stocks after the drop, saving a total of $46,000, and not getting up the gumption to commit more savings until September 1987—right before a 34 percent crash. Bob then continued to hold tight, making only two more investments before retirement, which came right before the 2000 crash and then the 2007 crash!

So how did “Bob” do after these 42 years of epic market misfortune? Actually, he made money. As the market successively made record highs, Bob turned the $184,000 he invested over the years ($6,000 in 1973, $46,000 in 1987, $68,000 in 2000 and $64,000 in 2007) into $1.16 million—for a total profit of $980,000. That represents an annualized return of roughly 9 percent, on a money-weighted basis. Even after accounting for inflation, Bob has increased his wealth substantially by investing in stocks.

The key is that Bob never, ever sold his holdings—instead riding the stock market’s long-term trend higher.”

https://www.cnbc.com/2015/08/27/the-inspiring-story-of-the-worst-market-timer-ever.html

Hey mate thanks for the really good insight so if I am investing 2k monthly in ETF should I select any date monthly and invest regardless of how should it be implemented ? Thanks

Brilliant summary Manny! I should have just said to look at this 😁

For some reason I cant reply to your comment below.

You should have a strategy on what ETF’s to invest, plus investing $2000 a month is not a great idea, the more you invest the better.

FE: if you buy $2000 on ETFs every month and use Selfwealth, in a year you would have spent $108 in fees. But if you spend $6000 every three months, you would have spent $36. Normally most of the people do this, when investing on Selfwealth, they use a minimum of $6000.

Hey mate thanks for saving on the charges. Will start investing quarterly now but should I have a fixed date every quarter regardless of what the index is. Is it a good idea to start when the markets at all time high or wait ? Thanks

Is there any ETF for emerging companies which invest in smaller companies which can be the future Apple, Microsoft, Google etc as i would like to allocate a certain percentage of my investment in it too. Thanks

Yeah I’ve been getting stung with the fees. But whilst limiting the fees by only purchasing 3-4 times per year, isn’t that limiting the ability for your money to gain returns between purchases?

Hi Harshang,

I’m glad you’re enjoying the blog mate 🙂

Over many years of consistent investing, the little peaks and troughs are largely irrelevant. I never look at the price anymore, I just buy at the same time every month no matter what.

Could there be a better way to do things? Probably… but it won’t make that much of a difference. Consistently is the key. Try not to stress about the little daily/weekly fluctuations.

Hope that helps.

Cheers

Hey mate really appreciate the efforts you have And are putting in the blog. Get you point on consistency but for someone starting would you recommend starting now when the markets are on top. Also I am thinking of investing 6k in VAS and VTS once every quarter but to avoid the fees would you recommend alternate quarters investing in each or any other strategy ?

I can’t recommend anything but if I were to start again from scratch right now, I would largely ignore the price and simply start buying.

$6K is a great amount to avoid paying too much in brokerage. Your strategy sounds fine to me 🙂

Hi Aussie Fire Bug,

So thankful that I found you! Great content. Just one question on the above you mentioned you buy in a trust what does that mean? I am new to this. I want to get started my wife is not really bothered about it so should I be opening my own account or a joint? Trust is a joint account right? I haven’t finished setting up my Self Wealth App yet but would like to get your input, regarding the trust part. How to set it up, etc. Thank you so much.

Hi Arnold,

We invested through a trust but it’s complicated. If I could go back in time I would have just went 50-50 or all in my partner’s name. That’s it!

Keeping it simple is very powerful.

Thank you for replying, and your transparency which helps beginners like me.

Looking forward for more podcast!

Thank you for this advice. I have now registered with my husband at 50-50 with Selfwealth after reading this comment. Can’t wait to start our journey.

Hi Aussie Firebug. I have a family trust which was set up for my small business many years ago so I could protect assets and distribute income to my children. It was a hassle workwise for my husband to take time off to go in to sign all of the documents so we didn’t include him in the trust. I didn’t even really understand what the trust was for so didn’t worry about it. Now that I am going to start regularly investing and I see that you use a trust I’m wondering if it’s a shame that my husband’s name is not on the trust. My business doesn’t earn much money so my income is small and my husband earns much more than me.

Do you think I should invest through the trust and just distribute to myself in my name?

Hi Lisa,

There’s too many things to consider to give you a proper answer as to what I would do in your situation I’m sorry. It may be worth getting some professional advice.

Trust structure makes sense if there are two of you especially if there is a big difference in salary but what if you are single (on 120k)? Just buy as an individual?

It works wonders if one partner has to have time off work for an extended period of time like having kids. I also have a few other family members I can distribute to who are retired. And there’s always the ability to park money in a company at 30% tax rate.

Plenty of options.

If it’s only ever just going to be you, probably more of a headache than it’s worth, to be honest. There’s always the asset protection part of it.

There are other variables to consider too but for our circumstances, a trust works wonders.

Hi Firebug,

Is there a possibility you could do a blog post about the process you went through to setting up the trust?

Cheers,

Shaun

Not much to it really. I found an accountant and they set it up for me. The whole thing cost around $1,200 or something (with the company set up and all that).

It’s pretty straight forward really.

Was there something specific you wanted to know?

Hey mate

Fascinating reading about your story and investing strategy. I’m a similar age to yourself and always been apprehensive about investing into real estate and hence have always simply put my money into a savings account since I started working.

You’ve inspired me to invest my approx. $200k in savings that I’ve had sitting in a bank into ETF’s.

Given what you have said around the benefits of purchasing these through a trust structure, hoping you could answer a couple of questions around how to go about setting this up –

1. Is there a difference going to an accountant vs lawyer vs financial advisor to set one up?

2. How quickly can they set up the trust? Will beneficiaries need to sign paperwork or can just you and the accountant/lawyer set this up on the spot?

3. What are the exact details you tell them to set up?

Cheers

Alex

Hi Alex,

I’m glad I’ve inspired you mate 🙂

1. A trust is a law binding document and I don’t think an accountant can technically set one up (could be wrong). I went to my accountant for this but I think they then went to a solicitor to make the deed. They will be able to point you in the right direction anyway and usually package the deal altogether.

2. Testing my memory with this one but I think around a week. The beneficiaries do not need to sign anything. The trust should be written in a way that means nearly everyone in your life will be a potential beneficiary. You obviously won’t use everyone but the options are there if needed.

3. You should speak to your accountant and explain what your goal is. I’m not sure what your goal actually is but people usually set up a trust for two reasons. The first is if they’re in a field of work that is more than likely to be sued at some point and they want to protect their assets. The second is to distribute income from assets within a trust in a tax efficient manner. But this is only possible if you have a decent amount of income being generated from the assets within the trust.

Explain what you’re planning to do to the accountant and they should explain your options and agree/disagree if a trust makes sense.

Hope that helps mate.

Hey mate, great read! Property is where I am starting my wealth foundation and then looking at an income stream ones I have enough cashola. A question for you: Did you sell down your properties and use that capital for the share portfolio? Also, do you see having a mix of bonds in your portfolio to be beneficial in a downturn? I say this because of Ray Dalios “all weather portfolio’ See link, its not giving great returns now but just wondering if you heard of it and your thoughts: https://www.nasdaq.com/article/why-the-allweather-portfolio-has-stumbled-cm937170

Hey, this was my first blog post read of yours, so ignore the property question. You kept them haha.

I still have all three properties Joe. Check out my net worth posts to see my complete financial position with assets and liabilities listed.

The plan is now to sell the properties when the times right (no rush) and put everything in LICs and ETFs. I might keep a little bit of cash for a deposit because we do want to buy a house to live in within the next few years.

I’m not a fan of bonds. I understand the role they play in a portfolio but I also understand the risk with an all equity portfolio. There’s no right answer but I’m willing to risk the market volatility in return for superior returns on investment.

Great read. I started with strategy 2 but have veered toward strategy 3 after reading Thornhill. It just personally feels better to me. I will likely continue to be 100% invested in A mix of Aussie small and mid/large LICs until I reach FI, and then look to diversify by adding some VGS or the like

Nice Leigh,

Is there something going on with your blog dude?

Cheers

Great read. I find myself drawn to strategy 3 more and more. Which I feel like I was always drawn to hence my overwhelmingly overweight AUS position with VAS. Having discovered LICs however feels like an even better fit for how I want to invest so I’ll direct cash that way.

Have you read motivated money? Is there an electronic copy I can get somewhere?

Read this thread Pat https://www.propertychat.com.au/community/threads/peter-thornhill.9877/page-3

Will do

Cheers

Try the (vid) podcast too; it’s seven episodes of Gold… Has the same graphs as the book: Check out this podcast: Peter Thornhill

https://m.youtube.com/channel/UCwH2W3eN7WoWWTC7KiUVR6A via @PodcastAddict

Can someone please explain to me how he got “The difference of $19,600 reinvested at 8% over 30 years is $2.4 Million!!!”

When i put 19.6k, 30years at 8% into a compound interest calculator its only $197,228.

Is it the dividends?? I assume dividends is 4% and capital growth is 4% giving him the 8%.

Am i missing something here?

I certainly have Pat. I borrowed it from a friend. I haven’t come across an electronic copy mate. I think some libraries have it though. Might be worth checking those out first.

I just finished Peter Thornhill’s book today in fact!! It’s a good read but, for readers of the excellent FIRE blogs out there, Thornhill is probably ‘preaching to the converted’ and you may not get a lot of new material out of it. The ‘take-home’ message for me was; if you want to create wealth then forget about property investing (an Australian obsession) and instead focus on investing in the Australian stock market, with the emphasis on Industrials.

Thanks for the very informative post! Looking forward to how you develop strategy number 3

Thanks JD 🙂

Great article once again mate.

It sounds like you’ve thought about all options.

I think a split of strategy 1 and 2 could also be an option, and something I am aiming for.

I have a diverse ETF portfolio consisting of VDHG, VAP, VAE and VEQ. All have a higher MER than the ones you have mentioned but I like to be able direct money to indices such as Europe and Asia that I believe are undervalued. I strongly think the US is currently overvalued and I wouldn’t be allocating too much there until there is a shift.

I have a small AFIC holding but I’ll be looking at how to diversify my LICs by reading Thornhills book. I love his video series and his dry sense of humour. I also love the fact that he will leave a monitory legacy to chosen charities when he passes, by the way of passive income from his investments. Very smart man.

I also hold two individual businesses that I believe to be undervalued which pay out a nice dividend + 100% franking credits. I enjoy researching businesses and hopefully I can make some informed decisions to create a better return on my investment in the future through buying direct. These are businesses I will hold forever unless some fundamentals seriously change. I would like to buy more individual businesses when the opportunity arises. “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price” – Wozza B.

Your approach of set and forget is fantastic. You will do well.

Keep up the great posts and have a cracking weekend.

Thanks Dingo,

Glad you enjoyed it mate 🙂

Thoughts on increasing Aus allocation higher to reach FI (having the the larger dividends)? Could push allocation up to say 60% and then reduce back to 40% later? Also possibility of adding low cost LICs into ur Aus allocation along with VAS when LICs are trading at discount to get the extra yield/100% franking credits

I really like the idea of buying LICs when they trade at a discount and buying VAS otherwise. I might do an article about it.

Any reason you didn’t look at VGS given it covers the rest of the world ex AUS?

I choose to go VTS+VEU vs VGS because it offers more diversification, exposure to emerging markets and a lower MER. But VGS is also a great options for investors

Three ways you could do it (invest in the world):

1. VGS/VISM/VGE (75/15/10) MER: 0.23%

2. VTS/VEU (50/50) MER: 0.06%

3. IWLD/VGE (90/10) MER: 0.13%

I’ve been concentrating on strategy 2 for the last few years, but more and more I’m drawn to strategy 3 lately as well.. I really like the ability to buy LICs at under NTA, it scratches all those value investing itches in me really really nicely, oooh yeah..

I’ve been thinking in terms of dividend return for a while rather than the strict 4% rule. I worked through my current asset allocation – 30% bonds (VAF & VIF), 20% International (VGS) and 50% Aus (mostly VHY, with some VAS, AFI and BKI) for the 5 year average of dividend returns to be ~ 5.8% div yield. Once I realised this I started working of a 5% withdrawal rate, and I still shouldn’t need to sell anything. I’m starting to think i might favour Aus LICs more in the future though, definitely a few hours of Sharesight modelling coming up…

Pat, I’ve been looking for an electronic copy for ages and finally bit the bullet and bought the paper copy a few weeks ago. It’s definitely worth reading.

You might have already seen this on the mustachian fb group, but this compliments Thornhills book nicely:

https://drive.google.com/file/d/1czVbqaRZ5WmibmRrS92JKjRhUT4f4DlG/view

Yes I have read it! Great read and covers a lot off the list of things to know about LICs, I might bite the bullet too soon.

Thornhill is actually in Sydney giving a talk soon. A truly rare occurrence and I’m having an internal tussle with the $106 price tag. If I don’t go I dear I will regret it. But surely the book covers more of his thoughts than he can get through in a public lecture.

Think of the $106 as an investment!

I’ve never been but I’ve read good reports form people who have gone. Simply for his passion that comes through when he’s teaching would probably help the messages sink in 🙂

And his dry humour as someone else said, along with his hatred of property and resources companies would be good entertainment!

If you do go (or anyone else here) I’d be really interested if you asked him his take on international exposure, and rebalancing. Obviously something like VGS or VTS will grow a lot faster than a bunch of Aussie LICs, with a lower dividend return, and I can’t quite get it right in my head if the international funds grow faster if they should be rebalanced to make the most of price differences or not… I suppose not? Perhaps rebalance as a function of total (capital and dividend) return? Perhaps don’t rebalance?

I really like his approach, but I worry about being so exposed to Australia, although I do like franking credits.

I would love to know this too Andrew.

From what I gather, he pushes the ideas that

1. Many Australian companies sell internationally, so an all Australian portfolio is already internationally diversified. Whether you agree with this or not is another thing though.

2. With recommending no international, and with dividend investing having no selling, rebalalancing is not something I have ever heard mentioned.

3. He despises index funds, showing in a chart (with his specific start and end points) that resources have under performed industrials which means to him that the all industrial index is a better measure and in that case the all ords has under performed as per his graph. He also hates property investment trusts since they are by law forced to pay out 100% of income to shareholders which means they can’t retain earnings to grow their asset base, but he fails to ever mention that an individual investor can easily re-invest part or all of their profits from REITs to grow their asset base.

I really like the idea of dividend investing and never needing to touch any capital, however unbiased comparisons are more important to me than emotion based enthusiasm and skewing perceptions by using opinion or leaving out important information.

I’m really liking that strategy too. Buy LICs when that trade under NTA and buy VAS or A200 otherwise.

I did notice that Thornhill actually works off a 5% rule instead of a 4% rule! That’s a massive difference in the final amount we need. The high dividends plus franking just feels too good to pass up.

I’ll have a read of that link tonight Andrew, thanks.

I think the important part is Thornhill doesn’t think in terms of a set percentage. Just simply how much cashflow the portfolio is throwing off.

Just like if you were living off rents from property.

If the market is high and yields are lower then naturally that may mean 3-4% dividend income. If the market is low and yields are higher, then this could mean 6-7% income.

It all ebbs and flows and comes back not to a magic number, but in separating the dividends from the capital, at least mentally, to live on.

Dear Aussie Firebug,

Have you invited Peter Thornhill for interview/PodCast with you? Seems like he’d be an excellent fit. I’m planning to attend his next Sydney event on 26 August…

Jeff

I would love to get him on. I haven’t reached out but it’s on my to-do list.

Please do it!!!

Thornhill has won me over completely now. Sell the properties!! Even the CGT hit would be minimised over time if you reinvest the proceeds using Thornhill’s approach. Buying in dips or at least always below NTA for LIC’s is the go – coupled with growing dividends. I certainly thankful for discovering Thornhill’s method.

Watch this space Phil, could be an upcoming article about the properties in the next few months if things pan out a certain way 😉

It’s worth remembering that the 4% rule actually uses a 50% equity and 50% bond portfolio, and as you say it’s for a US investor. I believe it was Morningstar who looked at this for a range of countries and found that using the above asset allocation for Australian investors if you wanted 99% certainty that the money would last 30 years then the safe withdrawal rate would only be 2.5%, not 4%. https://www.morningstar.com.au/s/documents/3SafeWithdrawal.pdf

Obviously things change depend on your asset allocation, how long you plan on needing that income for etc but it’s definitely worth remembering that the 4% rule is not an ironclad law.

It’s also worth keeping in mind that while dividends are indeed pretty stable over time, the few times when they are not are almost certainly going to be at the worst possible times to have to be selling shares to make up the difference. In good times dividends tend to go up, but if we get another GFC or equivalent that is the most likely time for companies to be cutting dividends, and that’s going to be the worst time to have to be selling shares to fund your living expenses.

All that being said I think the overall strategy is good, and I’m planning on basically building up enough of a portfolio that the income stream from dividends funds my living expenses, it’s a fair way from being guaranteed.

Hi Sean,

Did you know that Thornhill actually uses a 5% rule instead of 4%! I guess he’s more optimistic of Aussie shares than others but I found that to be incredible.

Also, with regards to dividends being lower in a downturn, that is not always the case.

I’ll refer back to the video in the post. In the GFC, Commbanks share price went down by 40%. Does anyone really think that Commbank lost 40% of its business within those few months? I think most people would say no. So even though the share price plummeted, the intrinsic value of the company (it’s ability to produce income) was maintained and they paid out a fantastic dividend yield of ~14% plus franking credits! during the GFC.

Very interesting to think about. The price of the shares plummeted, but the dividend yield went up…

As with all these things it really depends on what assumptions you make about capital growth and dividends, 5% sounds very high to me but depending on what you own it could actually be sustainable although I wouldn’t want to be relying on that assumption myself.

Dividends being cut during a downturn isn’t always the case, but it’s not guaranteed not to be the case either. Most banks share prices at least halved during the GFC, some much worse than that. Australia is really an exception in that the GFC didn’t actually affect the country much. I was living in London and working on an investment banking trading floor, and I can tell you that global financial stocks got slaughtered. Take a look at something like Citi (https://finance.yahoo.com/quote/C?p=C), the share price was about $500 a share and now 10 years later it’s about $70 a share, they also had a lot of years with no dividends as did many other major banks. Deutsche is much the same, there are plenty of others like those two although some recovered a lot better. So yes lots of banks did lose 40% or more of their business, it’s just that it didn’t happen much in Australia because we got bailed out by the fact we were exporting lots of raw materials to China rather than any smart moves of our own. Wayne Swan got voted best finance minister by doing a Steve Bradbury rather than actually being good.

When I came back here during that period for a holiday people were complaining about a GFC but it had very little actual impact. No mass unemployment, no downturn in the economy, it was business as usual. There is absolutely no guarantee that will be the case next time, or that Australia won’t suffer it’s own recession whilst the rest of the world is just fine. We’ve had property prices go up by double digits for the past however many years and people think that is just normal. Funnily enough when I was working on that trading floor we had a bunch of the US mortgage guys come and give us a presentation about CDOs, explaining correlation trades, various tranches and all that sort of fun stuff which sounded great, but relied on house prices going up forever and that didn’t turn out so well, and in fact it turned into the GFC.

BTW, if the share price goes down and the dividend stay steady or goes up, then inherently the dividend yield will increase. Dividend yield is calculated using the formula dividend/share price, so as long as the dividend doesn’t go down by as much percentage wise as the share price goes down then it will always increase. You also have to keep in mind that it is backwards looking for the dividend, so even if the dividend will be cut it will remain at the last dividend’s amount until the new dividend is actually paid (or it goes ex dividend, I can’t remember which).

I agree with your overall strategy and as I said I’m doing much the same myself so please don’t take the above as criticism, it’s just important to keep in mind that when things go wrong as they inevitably do, they will sometimes all go wrong at the same time. All your correlations turn to one (and not in the right direction!) and your stock prices get slaughtered at the same time your dividends get cut which puts you in a world of hurt. This also tends to be the worst time to be trying to pick up some work to help pay the bills as well, so it’s a triple whammy.

Good points Sean. I guess the real risk is in the first few years after FI, after that a sufficient margin of safety should have built up.

I think for me, worst case is I eat baked beans for a year or two. Actually I might do that anyway, they’re delicious.

Hi Andrew, yeah sequencing risk is a big issue. If you manage to get in a few bull market years after you’ve pulled the pin on work you’re probably golden, but if you run straight into a bear market then you may be on struggle street and as I said above that’s the worst time to be trying to get back into work etc and if you are still working part time it’s when you are most likely to get cut adding to your woes.

I agree that cutting costs if you run into trouble makes sense, the trouble is that most FIRE people have already cut out a lot of the unnecessary costs in their lives, so what’s left is largely necessary costs. Food and travel are probably the two big discretionary items that are still in most people’s budgets, and even those can only be cut so far.

I still think there is a very good chance that things will work out fine and as I said I am following a pretty similar strategy myself, I just prefer certainty as much as possible and like most things in life this doesn’t provide that.

Great points Sean and I never take different opinions as criticism. I love when people disagree and provide good counterpoints which you have done 🙂

Maybe I’m being optimistic, but I think with my resume and experience, I can at least get SOME type of work in a recession in a worst-case scenario. Surely I can get a gig back in the grocery department at Coles or as a pizza delivery boy. I really don’t want this to happen, but it’s like plan Z if we run into a bear market straight away and the portfolio doesn’t generate enough cash.

5% did seem high to me too. I would love to ask Peter about it one day

It’s great to be able to have respectful disagreements, and in this case it’s more about edge cases rather than anything being wrong with the main thrust of the idea anyway. 🙂

I’d be hopeful of being able to get some sort of work in a recession as well, the main problem is that it’s probably the backup plan for a lot of people as well as being the primary plan for others who are already doing those jobs. It’s fine in normal circumstances to make that assumption, but if unemployment is 10% then those supermarket jobs might start looking pretty attractive to a lot of people who are desperate for money.

5% drawdowns is probably actually pretty doable, just not necessarily with your generic broad market ETFs. CBA has a 5.9% dividend yield at the moment, gross that up and it’s 8.429%. Same with a lot of the other banks I would suspect, as well as Telstra. If you just own the major banks and Telstra then you can probably do it, although you better be hoping that there isn’t a housing market collapse or anything else that smacks the banks about too badly. Although having said that any broad market ETFs like VAS etc are going to own a lot of the banks anyway so you’re getting hit to some extent either way.

Actually looking at it STW (probably not your favoured pick but it’s a legacy position of mine) has a dividend yield of 4.26%, it’s got about 75% franking credits so comfortably over the 5% threshold, the new BetaShares A200 should be pretty much identical. RDV or VHY would both be even higher presumably, so that 5% might not be too difficult to hit, subject to no changes to the franking credit rules and not having to pay much tax.

As a side note I’m really hoping that with the new ETFs coming out that some of my existing ETFS like STW and RDV start dropping their MERs as well. 0.19% and 0.34% is a bit too much, but I can’t sell them without triggering a lot of capital gains tax and for the sake of not having too many holdings and admin I’d prefer not to have to buy other ETFs like A200 or VHY.

Yeah, those MERs are a tad high.

I think everything we do comes with a certain degree of risk. But as the old saying goes

“Not taking any risks is the greatest risk of all”

Great article,

No one seems to be addressing taxes that need to be paid each year that will have an impact on the amount you need to live on. Assuming you need $40k net , you really need your $40k plus tax , that is if your not in retirement phase 60yrs old and receiving earnings tax free from your super fund.

I haven’t yet been able to find any calculators online that incorporate Australian tax rates.

The modeling you get from share sight is great but doesn’t factor in tax.

You would need to take the gross earnings work out how much tax you will pay then you have your net figure which would impact how many shares you have to sell to make up your shortfall in income for that year. This in turn could affect your 4% rule.

Hi Josh,

Great point about taxes. But for us personally, we spend around $38K each year which will be under the tax threshold for us. If the portfolio produces $38K, we can distribute that $38K evenly between us and won’t have to pay a cent on tax. But it gets even better, as of right now (until the Liberals change it next year) because that $38K comes with franking credits, we would actually get a refund from the ATO and receive even more tax-free money. Of course, everyone is different and you would have to figure out your own tax situation and what’s best for you.

Strategy 3 baby all the way 😉

Great post mate. Wow looking at these comments it’s surprising how many people are coming around to the dividend approach!

Thornhill’s an excellent teacher and the message is solid. As you know I’m completely sold on it and try to spread the word regularly on the blog.

Dave,

Your blog has been a big reason why I’m leaning towards strategy 3. I love your LIC articles 🙂

Thanks a lot mate!

Good on you Dave, you have had a real impact on the investing decisions of the Australian FI community.

A little while ago, someone asked me “why the hell did you come out of the closet with the FI thing on Australian media?” and this is exactly it, attracting more thought, more talent and different views to drive us forward.

Cheers Pat.

And well said. As mentioned in the podcast with Firebug, I think it pays to question the way things are typically done and really consider whether it’s right for you or not – whether it’s the 9-5 work + inflated lifestyle or an investment strategy.

Great article! Thanks for sharing your thoughts and changes in them over the past few years. it’s a credit to you being so open to share. It would seem Dave from Strong Money Australia had a positive influence on you re: Peter Thornhill’s approach.

I’ve attended PT’s talk in Sydney and found it to be highly valuable, similar to his book and videos. As are the wonderful contributions of the long term LIC investors who kindly share they thoughts ‘hidden’ on the Property Chat forum. Some there have been at this for 20-30 years and share incredible wisdom after being through the 87, 2000, the GFC and all the others ups and downs.

On the selling down capital to fund retirement approach, personally (and I understand different strokes for different folks) I find it doesn’t sit well for me nor does the ‘total returns’ approach. Give me cash flow! A growing, highly tax efficient (AU fully franked LIC’s) passive income stream that grows faster than inflation and I’m happy. Maybe way down the track, a little international (PMC/VGS) for ‘diworsification’ as PT has called it and my SANF is where it needs to be.

What the capital is doing is secondary to me anyway. And selling it down at retirement? Go ahead, I’ll be buying it off them! Hopefully this will be a legacy for my family. I see myself as being a custodian of the income to pass on to the next generation to grow and help others.

As PT said at his last seminar ‘the dividend is the dog and the share price is the tail. I focus on the income when everyone else focuses on the share price’.

Keep up the great work you’re doing with this blog.

Glad you liked it KDM 🙂

I haven’t heard of diworsification before? What does he mean by it?

it’s a play on words more than anything I think. He’s not a fan of diversification outside of shares, particularly Australian industrial shares. Basically, adding cash, property, bonds, etc to ones portfolio worsens the outcome for him, hence ‘diworsification’. Note, he’s not saying don’t have a cash buffer (he highly recommends spending less than you earn and always having some dry powder for opportunities) just that there is a cost being in cash compared to being invested in productive enterprise.

Ahh yeah got it. I have a question for you. When would you consider adding international and why even add it in?

Good questions.

I don’t feel the to have international exposure (outside what i already get from the asx). For me its a want, not a need, as i enjoy business and investing. I like the idea of it more than anything.

At this stage would only consider adding it once lifestyle is accounted for via LIC dividends. But won’t know until i get to that point in reality.

Exactly! Great comment.

It doesn’t matter what the tail (share price) is doing if the dog (dividend) is going in the right direction.

We (sharemarket investors) are all barracking for the same team, in the sense that we are betting on society becoming more productive and a wealthier place in general over the long term.

This will be reflected, as always, in the capital markets with larger, more profitable companies in the future. These companies will be paying larger dividends and be more valuable too.

At the end of the day, it’s the earnings and income that businesses generate which creates wealth.

Most people are focused on how much these companies are ‘worth’ each day, week, year. We’re interested in how much they ‘produce’ in terms of growing earnings and dividends over the long term.

Thanks! And you’re spot on!

Is the VAS dividend shown grossed up for franking credits?

Yes. Sharesight calculates performance to include the grossed-up dividend in the return. Source: https://www.sharesight.com/blog/dividend-franking-and-performance/

Great piece. Couple of questions comments I have on the back of it:

Does VEU cover emerging markets? Do you have any exposure to this?

You didn’t cover the benefit of leverage in property a lot.

Do you max out your super contributions or are all of your investments in post-tax buckets. It’s a shame Australia doesn’t have anything like the ISA (UK) or IRA (USA) to help Aussies save for their future tax free.

VEU does have emerging markets (https://investor.vanguard.com/etf/profile/VEU). I believe VTS does also.

I didn’t take on leverage which is a major advantage property has over shares. I do go into that in this article though https://www.aussiefirebug.com/property-vs-shares/

I don’t add anything extra to Super. It’s not going to help me retire early. The most efficient method is actually to get to a certain point outside Super where you can live of your investments to the preservation age and then start to dump everything into Super. But psychologically speaking, I think it’s going to suit us more if we just reach FIRE outside Super. Once we have, we will then probably dump any excess into Super when we are approaching the preservation age.

I SUCKS we can’t get to it early like in the US. It would be a game changer if we could.

Fantastic read and very well explained. Plus (as you sort of quoted) there is nothing better than changing/updating your strategy because you have learnt more. Even little things like updating the index for a lower fee. One of the best reads I have had in a while.

One question however, do you factor your super into the 30/30/40 allocation? Do you SMSF or is Super just a “backup” pot of worst case money (and insurance) and therefore not included in the allocation?

Hi Tom,

I’m glad you enjoyed the article. I have meaning to get this piece out for a while.

Every time I think about FIRE Super seems to only be further and further away from the equation. It simply won’t allow us to retire early. It’s the most tax efficient vehicle available to us, but the preservation age kills it.

Super at this stage is a backup plan only. It would be a game changer if the rules ever changed to allow you to access it early though. One can dream

I believe I have stumbled across a way to legally get your super out early depending on your inclination, however it is not in cash.

Become a Primary Producer (through whatever means best suits), by doing this you are able to reside on the property with very few restrictions as it is considered necessary to the operations of a primary producing business.

Whilst I imagine this method would only suit a small number of people it has it’s merits and depending on the amount you had in super it could eliminate the need to work additional years purchasing and or paying off a house.

There are many potential advantages and disadvantages to going down down this path, but I though it worth a mention.

Interesting read Shannon. Not sure how practical that would be (everyone becoming a Primary Producer) but it’s worth a mention for sure.

Echoing Tom’s comment, although not contributing to FIRE, I’d love to hear about your Super strategy. For example, do you regularly research Super Fund providers and (noting we’re only allowed to change Fund once per year) swap between them when you identify a better offering? Do you SMSF, or stick with your Fund’s default Growth or High Growth investment options?

At this stage, both Mrs.FB and I have both moved our allocation to the most aggressive offered in our funds (all shares option). I’m with Vision Super and Mrs.FB is with Vic Super. I really need to look at researching different funds and see which one works best for us. But I just have so many other things to optimize and concentrate on outside Super for me to worry about it right now. I’ve checked the fees on our current funds and they are one of the better ones.

I’m trying to get an SMSF expert on the podcast.

Thanks for sharing. Great article. Have always focused on properties but it is totally true what you say regarding the effort to manage a portfolio. I have read about ETFs before but never really places in our retirement strategy. You have certainly motivated me to look into it more. Cheers!

Hey Firebug absolutely loving your content!

I’m a 22 year old and I plan on reaching FIRE ASAP, I really liked your VTS/VEU/VAS split so I followed along and did the same thing but I chose to go AFIC over VAS, any particular reason you chose VAS over AFIC? I’ve seen a lot of people say they’re essentially identical and provide a very similar outcome.

Thanks!

Josh, I am also looking at proceeding with a VTS/VEU/AFIC split, if you are in the high tax bracket it is worthwhile looking into AFIC’s DSSP as opposed to DRP.

currently at 100k a year, i’m not familiar with DSSP. Mind giving me a short rundown?

Tried to summarise best I could, there are some discussions on Reddit you may like to read and also.

Both DRPs (Dividend Reinvestment Plans) and DSSPs (Dividend Substitution Share Plans) are ways to automatically reinvest your dividends into more shares.

With a DSSP you don’t get a dividend at all (and hence pay no tax at the time). Instead, you’re just issued the equivalent value in shares. The main difference is how each works for tax purposes.

With the DSSP, you never actually ‘bought’ the shares. So you don’t pay tax on them in the first year, the tax event is deferred when you sell. If you do sell the shares, you’ll have to pay more in CGT as the shares were received at a low price per unit (Read FAQ’s of relevant LIC DSSP to understand how this cost base is calculated). As I understand it, if you plan to sell it can also be a bit of an accounting nightmare at sale time, as over time the ‘bonus shares’ are provided at different unit prices.

So it all boils down to two numbers, your marginal rate now vs your marginal rate at sale time.

If franking credits are 30% and long term CGT discount is 50%, I’d choose DSSP if my marginal tax rate is > 30%.

Ideally it’s best used when planning not to sell AFIC later. Just use the DSSP in accumulation phase for high taxpayer and switch it off once you hit FI, and start receiving the dividends+franking stream – this is my plan 🙂

Great explanation Elliot. You fall into my ‘Smart readers who teach me things” category 🙂

Ha thanks, to be fair I can’t take much credit. My post was just summarising a few sources of information, glad you found it beneficial.

Great post mate, been tossing up between strategy 2 and 3 for a little while now. I would love to know which LICs you would personally invest in for the long term if you decided to go with strategy 3.

99% chance I do an article about that in the coming months 😉

Join the mailing list (on the front page) if you’re not already on it and you’ll be notified when it drops.

Great article AFB.

Rich Dad Poor Dad was also the book that changed my mindset and then I read a number of property books including Steve McKnights series. But most property books actuall all property books sing the same song and never ever provide detailed information and strategies to reach FI.

I then cam across MMM and other FI blogs like you did and have known ever since that the best way to reach FI is through investing in the share market.

I originally was going to stick with the Vanguard wholesale high growth fund and make regular deposits via bpay, due to the ease, Vanguard rebalancing, no brokerage, fully diversified etc. 0.29% mer but worth the cost I believe.

But after reading Morivated Money and following forums I am leaning towards using LIC’S as my investment of choice as this could allow us to reach FI asap and live on the dividends year after year as long as the outpace inflation. obviously if FC are abolished it will take us longer to generate the income required. I do like the idea of diversification but as when one asset class is down another may be up etc. but I hate the idea of selling down assets to live off.

At the moment my plan is to invest in LICs most likely quarterly and leave the High growth fund open and just invest small amounts into that fortnightly as something for my children for when they are mid 20’s.

Thanks John.

Sounds like a solid plan. I’m sure your children will thank you in the future 🙂