Preface: When I talk about shares in this article, I really mean ETFs. I don’t buy individual shares or day trade.

Collingwood vs Carlton

Sydney vs Melbourne

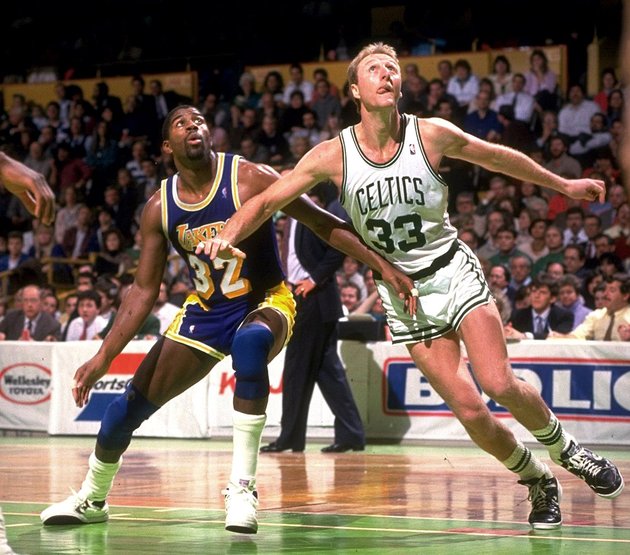

Magic vs Bird

Just some of the biggest rivalries the world’s ever seen.

But in the investing world, there is not a more hotly debated topic among avid investors. Property vs shares is a topic that everyone seems to have an opinion on, no matter how ill-informed they are.

Owning 3 investment properties and nearly $90K worth of ETFs (shares), I feel I have tasted the best of both worlds (and the worst) and can give you perspective to what I’ve learned over the last 5+ years of investing in these two asset classes. Both are great when used right, with pros and cons for various financial situations/types of investors.

But which one is right for you?…

Contestant 1: Property

The hometown favorite. This guy has been around longer than the stock market has existed!

You can touch and feel him, and your mum most likely loves the idea of you being with him. He has a strong track record in Australia and there is a firm belief that his value never goes down.

Now for realz:

Property is a great investment class but you need to be the right type of investor and have the financial stability for it to be used correctly. It’s an active investment. You’re going to have to do some sort of work to keep this investment running. You can minimize the work needed by hiring people but there are still headaches trust me.

However! Property has BY FAR the most potential to accelerate your wealth compared to shares for three reasons.

- Cheap leverage

- Ability to physically add value to your asset

- Skill and experience actually mean something (more on this below)

Cheap leverage is often misunderstood. Too often an article is published with statistics on how shares have outperformed property by comparing the % of capital growth and rental/dividend returns.

This is a dumb way to compare the two because I don’t know any property investors that buy real estate outright. It’s almost always bought with a loan. Which means the asset is leverage.

But what does this have to do with returns you might ask?

Here’s an example (for simplicity we are ignoring buying and selling costs and tax):

Property 1 is brought in 2016 for $500K with a 20% deposit of $100K. That same investor also buys $100K of shares in 2016 too.

Fast forward 1 year and the house is now worth $600K and the shares worth $150K

Let’s make it simple and say that the shares have no dividends and that the house had $0 net gain/loss factoring in everything.

The shares made a whopping 50% return in one year. The property on the other hand only made a 20% return.

Which investment did better?

Going percent wise the shares beat the pants of the house. More than doubled its return. But hold on.

If we actually compare how much money each investment made, it tells a different story.

It cost the investor both $100K to buy each asset. Property made a total of $100K in a year whereas the shares only made $50K.

This is because of the power of leverage. You technically can leverage with shares but not for the same cheap rate and you get nasty margin calls which you don’t get with property.

The ability to physically add value to your asset is where I would say active investors have a clear choice with which investment they choose.

Sweat equity is a proven wealth building technique that’s been around for centuries. You would have to be extremely unlucky to physically add value to your property and not have it go up in value.

Experience and skill is a very interesting point to look at when comparing shares and real state.

The entire premise of index-style investing goes something along the lines of:

“It’s impossible to beat the market over a long period of time unless your names Warren Buffett. Even if you do manage to do so, it’s almost always luck. People spend all day every day studying stocks and graphs and still get it wrong. So what hope do you have as an ordinary Joe Blow? Don’t even try to become a master of the stock market because there is only such a very very small percent of humans alive that seems to be able to get it right the majority of the time”

Now, here’s the difference. Skill and experience actually matter in real estate.

A skilled and experienced property investor has a very good chance of repeating his/her success over and over again. In fact, they most likely get better at it as times goes on. The same cannot be said for the stock market (except for those very rare people like Buffett). A skilled and experienced property investor will beat the pants off a skilled and experienced stock trader over a 7-10 year period 9 times out 10.

You can’t really be skillful in picking stocks. You definitely can’t be skillful in picking ETFs either. Sure, you can be smart about your allocations to reduce risk. But it’s not like an ETF investor of 30 years is going to blow out a brand new ETF investor in terms of returns. In fact, they should get relatively the same return. And that’s not a bad thing either.

Contestant 2: Shares

3 things.

- Diversification

- Low buy in and selling costs

- Easy peasy with hardly any management required

Have you ever heard the phrase ‘don’t keep all your eggs in one basket’?

The stock market gives you the ability to buy things called ETFs which is a slice of a lot (>200) of companies bundled up into one very convenient share. So instead of buying 200 individual shares. You can just buy things like ETFs and you get that vast diversification in one transaction. Couldn’t be any easier.

And the good thing about the stock market is the low buy in and sell costs. I pay $20 for around $5K of ETFs. Times that by 40 and I would have paid $800 for $200K worth of shares.

Think about how much it would cost you to buy a unit for $200K. Probably around $10K if we use the 5% rule.

And then you would have to sell it for anywhere between 2-3%.

When you want to sell shares there is another brokerage cost of around $20 per sell (depending on how much you sell).

This low buy in and sell costs are very convenient when compared to real estate.

And the last point I want to make is also one of the most important points. How little of your time and effort you have to put in for it to make you money.

You buy some shares, ETFs of course and turn on DRP (dividend reinvestment plan) .

You sit back.

Walk the dog.

Go on a holiday.

Get married.

Have a child.

And check up on your shares after about 7-10 years and get a pleasant surprise that on average, they have increased by around 9%

They only thing required during these 7-10 years is declaring the income earned through dividends on your tax returns which you can download electronically. No need to keep your own records.

THAT’S IT.

You didn’t have to manage anything and your investments returned a respectable 9% over 7-10 years. This extremely low management style is a phenomenal advantage.

Pros and Cons

Property

| Pros | Cons |

|

|

Shares (ETFs)

| Pros | Cons |

|

|

So Which Ones Right For Me?

It all comes down to what type of investor you are. Are you an active or defensive (passive) investor?

To quote The Intelligent Investor by Ben Graham:

‘The defensive investor is unwilling, or unable, to put in the time and effort required to be an enterprising investor. Instead of an active approach, the defensive investor seeks a portfolio that requires minimal effort, research, and monitoring.’

My rough guess is around 95% of people are passive investors.

That’s because the majority of everyday people don’t really care for finance in general and would rather be doing others things they find interesting.

But since you’re on this blog, it means you find finance stuff interesting. What a sad bunch we are ?!

If you’re a passive investor I think the answer is clear.

Shares are clearly suited for the passive investing style while still giving the investor a great return.

Coupled with great diversification, low buy-in and selling costs, no loan stress, liquid asset (can get your money out in 2-3 days), it makes for the ultimate passive style investment!

But if you’re in that very small group of investors that want to take an active approach, you’ve gotta ask yourself.

Are you REALLY an active investor? Do you REALLY want to manage your investments for potentially the next 10-15 years? Will your circumstances change? What happens if you have a few kids? Do you still want to be managing your investments on 4 hours sleep?

Do you have a lot of capital lying around for a deposit?

How’s your cash flow position? Could you afford to pay an extra $1,400 a month when you don’t have a tenant in?

Is your job stable?

Do you have a big cash buffer in case anything goes wrong?

If you answered yes to all the above then maybe you are suited for investing in property.

I have made money using both investment classes. They each have their own merits and downfalls.

Whichever one you choose to invest in, just make sure you educate yourself before taking the plunge.

Good luck!

I’m definitely a passive investor. I like the idea of property, but not the reality. I needed to take a good hard look at myself and accept I am too lazy to do the work required. Thank goodness for index funds!

I started as an active investor. I couldn’t stop thinking about investing. Constantly thinking about ways to improve my investments and make more money. But as I get older and older, the more I’m shifting towards a passive mindset. I have done reno’s and loved them. But nowadays when I have to fix up a property, it feels like more of a drag. I think I’ll eventually cash out of real estate when the times right and go 100% passive style index funds.

I am definitely passive and like shares but I am planning to buy property soon so I can leave some solid inheritance for my son. If it wasn’t for that I won’t bother with property at all.

Great to see an Aussie comparison. We have done well with property but the cash flow due to holding costs has been a bit of a killer for us since having kids.

So we are selling up some to free up cash to buy mortgage free then start the index funds fun. I am ready to be a passive investor now.

Yeah, a great strategy I think. Property has been great to me so far too. But I’m leaning more and more towards the passive style of investing moving forward. I couldn’t imagine dealing with property issues when I have kids. My time will be too precious at that stage of my life

Nice article, Matt.

Just a note that you can definitely be an active investor with shares as well. Not saying to the extent of day trading, but at least having a core of ETF’s and then researching and purchasing individual stocks.

I’m an active investor and like both types of assets and like them both in my portfolio

Hi Ryan,

You definitely can be an active investor with shares. But does your active investments beat the market over a 7-10 year time frame?

If it does, hats off to ya mate.

But from what I’ve read from people who are much smarter than me. Beating the market consistently is a very, very hard thing to do.

I’m currently an active investor with my properties. But am leaning towards passive moving forward.

Buffett famously has a 10-year $1m bet going with anyone who wants to take him on saying his S&P500 investment returns will beat any actively managed fund/s going around.

After nine years, the index fund has registered a compounded annual increase of 7.1%. And the average for the five funds (whose names have never been made public) is 2.2%. In total gains, the index fund is up 85.4%. The average gain of the five funds is 22%. (The best performer of the five is up 62.8%. The worst performer over nine years has been mind-bendingly bad: up only 2.9%.)

I’m currently a passive investor. Currently, I’m using NABTRADE as my brokerage, paying $14.95/trade. Is there a much cheaper option for this? I can only trade AUD 2k/month and pay 14.95/trade seems to be too much.

Also, InteractiveBrokers seems to be the cheapest online broker I can find.Would you recommend this?

I use CMC Stockbroking, they’re about 10 bucks a trade 🙂

I’m currently researching this actually. Next podcast will be about cheap brokerage.

I just found your site through this page and I’m wondering.. did you ever have a chance to do that podcast about brokerage?

Yes I did. At the time, SelfWealth was the best option that I could find. I now use a company called Pearler because they have auto investing features that allow me to automate things which I value very highly. They are always very cheap and more align to long term investing.

Thanks very much! I’m currently deciding how to invest in an index fund – mutual fund vs ETF so I’lll check our Pearler. Really appreciate your help

I grew up thinking that I was an active investor that would only ever deal with the property market because I couldn’t deal with the ‘up in the air, in the clouds somewhere’ type scenario with shares. You can touch and feel a house! But as I grow older, the reality of property investing is sinking in and I now am quite the opposite. Passive investor all the way, please!

I’m in the same boat. Started as an active investor. Made great money through property, but moving forward I’m going to be 100% passive.

Excellent article. Thanks for that. I hope in the future that I can have a mixture of both. At the moment it is shares for me for now. One day I hope to keep both growing continuously!

Nice comparisons mate!

It’s all shares for me going forward. Starting over I wouldn’t bother with property, the leverage aspect is overrated in my opinion.

What I find interesting is I’ve come across quite a few people who switch from property to shares… but none that switched from shares to property 🙂

I think there’s a very logical explanation to that trend SMA.

People are less active as they get older. The stress and headaches are not worth the potential extra money. I’m starting to fall into that category myself.

I’ve made way more money through real estate. But I don’t want to continue down that path moving forward because I don’t need the added stress, risk and problems even if that means reaching FIRE a bit slower.

Hey Dave, going back 2 years here, but can you add anything further to your comment that leverage for property is overrated ? I’m at the beginning of my FIRE adventures. Cheers

I’m 41 but have been ‘passively investing’ (with rebalancing here and there to take advantage of dips) in my super for 20 years. I love the fact that the hardest you have to work is point and click.

I recently sold my investment property because of the hassle factor. I’ll probably never go back, but it’ll depend entirely on crunching the numbers.

What I’m really after is passive RETURNS on investment. So if I can generate more of that by investing in shares I will. But if the numbers flip and property is more lucrative, that’s where I’ll go.

Every morning I have to leave my kids behind to sit in a cubicle is hell…

Cubicle Hell. Yuck!

I know all about that, unfortunately.

My Property vs. Shares story begins in 2004 when my neighbour offered to sell me his house for A$300K at the time when I had shares worth a net A$300K.

Fast forward 13 years and the neighbour’s house is worth about A$2M, my Australian share portfolio has grown to A$5.45M.

I eventually want to become a first home buyer, but I could never make the sums work buying a property compared to a well selected Australian Stock.

Keith,

That’s a great result, I wish I was in your position. On the share front is the growth mostly organic? What has been the focus of your investments, eg ETFs, direct shares etc

Hi Fletch, I only invest in Quality Australian Shares. I keep the good ones and sell the bad ones once a year. Rinse and repeat over 25 years and you could very well end up in the same position as me!

Hi Keith,

That’s great that you have done so well with Shares.

Here’s a bit of food for thought for you.

Imagine that you cashed out your shares in 2004 and had around $300K of cold hard cash (let’s just ignore tax for a moment).

You could have put down a 20% deposit on at least 4 houses (maybe even 5) in your street at $300K each.

Fast forward 13 years and you now say that they are worth 2M?

You would now have over 7 million in equity without doing anything! And that’s not including the rent which would have gone up in that 15 years meaning you now have 4 positive cash flowing IP’s plus 7M in equity.

Now imagine that you only put down a 10% deposit and bought 8!

More risky, but greater the reward.

You say that your portfolio has grown to $5.45M.

I’m assuming that you have been adding to that portfolio during the 13 years? Because if I look at the history of the All Ords. It has returned somewhere around 5.4% over the 13 years on average (SOURCE).

This is not a very good return at all!

So you must have either been buying a lot more shares. Or you are a master of picking stocks and beating the market?

Either way, it’s hard to argue that the Australian stock market particularly has been better than the Australian property market (which has been one of the biggest bull markets of all time) during the last 13 years.

But it’s riskier than ETFs and more hands on!

You summarise well in your article the potential perils of active property investing. The key point you make is how stable is your job and do you have the cash flow to cope with disaster. In 2004 there were signs I would be out of a job any day. It took two years of the threat of job loss before I was put out of my misery and packaged out.

Your eight property leveraged buy assumes you could borrow that much money and could avoid the coming property crash that ruined many people.

My $5.4M share portfolio is the result of 25 years of prudent investing with only a moderate 20% gearing rate.

If it was as easy as you say just buying an index fund then there would be more FIRE when there aren’t.

I started investing in Australian shares in 1990 with $10,400 bursary granted to me after I graduated from uni to start work as a cadet engineer.

One of my first share investments was buying CBA at $5.40 in the first float.

I have invested in quality Australian shares ever since using my savings and capital gains from selling over priced stocks and reinvesting in value stocks.

As I don’t invest in ETFs, the 5.4% return of the all ords has no bearing on my share portfolio value or performance.

So don’t confuse a passive share investment to the returns from a long term value investor.

The value of the house is nominally $2M based on the scarcity factor relative to demand.

No one could have predicted that a decade later an ordinary $300K house would be bought by cashed up overseas buyers for millions!

Just having the deposit is not enough as the rents would not cover the interest costs resulting in a huge cash drain.

4 years later the GFC would have bankrupted you through vacancies and demands by banks to repay loans against properties which have fallen substantially invalue.

Like that girl that Your Property magazine awarded property investor of the year only for her to lose her property portfolio after the mining boom ended and her over priced properties halved in value and became untenanted.

Speculating is a risky path to financial freedom.

Vanguard Share ETF returned 7.4% p.a. Over the last 10 years.

The top performing industry superfund earned 6.8% percent over the last 10 years.

I started my SMSF in Aug 2006 and it has delivered 7.8% p.a. CAGR over the past 11 years.

Starting with $330K super payout as a result of 17 years contributions as a wage slave cubicle dweller in a corporate machine.

I contributed an extra $850K in personal contributions.

My investments grew a further $1.4M to bring the balance to $2.6M out of a total $5.4M in shares.

I firmly believe long term value share investor can beat a passive index fund given enough time.

What to do when property bubbles burst: investor $3.5 million in the red

They bought 16 properties in mining towns such as Queensland’s Moranbah, pocketing $570,000 a year in rental income. Now, they are considering all their options, including bankruptcy.

https://www.domain.com.au/news/what-to-do-when-property-bubbles-burst-35-million-in-the-red-20160223-gn086p/

What shares have worked for you? Thats an impressive share portfolio

The neighbour’s house could be A$2M after 13 years, but did you consider how much money your neighbour paid to maintain it in 13 years? Can you guess what is the net income from the property after 13 years compared to your A$5.45M?

The Share investment CONS overstate the downside, For example:

C01. You can’t physically improve investment or add value to asset

No influence on how your investment performs. If the market is down there’s not much you can do

My share investing mantra is “Cut your losers and let your winners”.

This could be as simple as selling underperforming shares once a year in May/June and claim the capital loss against other profits.

Making sure your money is always invested in Good stocks lets compounding work its magic over the long run.

For example, I bought CSL shares for a split adjusted price of A$5 a share many years ago. I recently sold 1000 shares at $135 to generate gains to offset other capital losses and increase my taxable income.

C02. Can’t leverage at the same low-interest rate as property

If you do leverage (which I wouldn’t recommend), you may get margin calls

If you own a high quality share portfolio, you can get access to low interest rates and have sufficient collateral to avoid any margin calls.

I just fixed A$650K margin loan at 3.45% p.a. which compares extremely well with rising Investor Property interest loan rates.

My loan to valuation ratio is now 16.5%, so I will NEVER receive a margin call.

C03. More volatile

I stick to ASX Top 100 stocks, so they don’t tend to move much (except up! 🙂 ) over the long run as quality stocks benefit from Compounding.

The flip side of Property being less Volatile is illiquidity.

At least a stock will always have a clearing price no matter how dire the business.

A property appears less volatile, only because there is no daily trading of their property to identify a fair market unlike the share market.

C04. Fewer tax advantages than property

I would say the opposite is true.

Quality stocks benefit from Dividend Franking which can wipe out all your tax liabilities if your taxable income is below the corporate tax rate.

The tax advantages accrue to owner occupiers of residential properties.

Property Investors are getting hit with large annual land tax increases, Vacancy taxes and other outgoings and costs associated with maintaining your property in a rentable condition.

A depreciation schedule may appear to give you a tax deduction, but you had to spend the money on the capital improvements in the first place.

C1:

I hear what you’re saying. But that still doesn’t negate the fact that you can physically add value and have more control over your investment through property than through shares. I love both asset classes but this is just the truth.

C2:

Wow, your rate is 3.45%? I’ll be honest with you. I didn’t know it could get so low for shares. Can you help a brother out and point me in the direction where I can take advantage of this low rate?

C3:

2008…end of story lol

C4:

I’ll give you franking dividends (which are the bomb). But nothing will beat the PPOR capital gains exclusion. NOTHING!

Also… You can get a depreciation schedule without any capital improvements. A great example is when you buy a new house. HUGE depreciations benefits without any improvements.

C1. You are talking sweat equity in trading your time and effort for increased property value. But the implication is that you must as an ETF share investor lay back and think of England as the market has its way with you!.

The bottom line is the active investor will be rewarded for their efforts whether it is property or shares.

C2. I negotiated the fixed rate with NAB Equity Lending based on a package of a total of $10M worth of blue chip Australian stocks. The irony is if I did borrow to buy a investment property, I can draw down the loan immediately. But the math doesn’t stack up so far to buy low yielding rental property at the bottom of the interest rate cycle.

C3. 2008 was the great property crash which dragged down the entire world economy, not just shares. I was invested before and after the GFC with a margin loan and never lost a wink of sleep nor received a margin call ever over the past 25 years! So volatility meant my 200% capital gains shrank back to 150% capital gains and I was ready to pick up quality shares on sale.

C4. In original reply I differentiated that the tax breaks accrue to the residential home owner vs pure property investors who don’t benefit from capital gains tax exemption. You only get the depreciation schedule off a property once and it pales in comparison to the land tax rises that are levied against property held in a family trust of company as the property boom inflates this levy.

QUALITY SHARES IN A LOW INTEREST RATE ENVIRONMENT

Let me illustrate why Shares are more compelling investment to me than trying to find a Property which delivers me the same hassle free steady income to live as FIRE (Retired from work before 40th Birthday in 2006).

I pay in advance $22,425 interest on my Share Margin loan of A$650K at 3.45%.

I own 160,000 Telstra shares at $4-00 a share ($640K)

Telstra pays a total cash dividend of 31 cents per annum = $49,600-00.

So I gain a net $27,175-00 in cash had I not borrowed to buy my Telstra shares.

I also receive $21,257.18 in franking credits which I can use to offset tax due on personal income, interest or rental income.

So my gross return is $48,432-18 a year or 7.57% p.a. return on my geared investment in Telstra.

This excludes any future capital gains/losses as the share price changes over time.

As part of a larger portfolio, I can invest my other capital in lower yielding higher growth stocks to complement the lack of growth from owning Telstra shares.

If you can illustrate a Property investment that can give me the same certainty of income/return with a minimal hassle, I would be keen to invest in it.

Nothing is ever certain.

And you’re right. You won’t find a property investment that will yield those results with minimal hassle. But the key is the minimal hassle.

If you are willing to be hassled, I can link to countless stories of property investments that have yielded a superior result. But none are as hassle free as the stock market.

I enjoyed reading your comments, Keith.

Congrats on reaching FIRE by 40. Maybe you’d be interested in appearing on the podcast? You seem to be passionate about your investing.

Cheers

My uncle is a extremely successful property investor who has made millions from commercial property investing and doesn’t invest in shares.

However there is a personal cost to taking on the risks to leverage into property.

When interest rates shot into double digits and his rental income started to dry up his leveraged property portfolio nearly bankrupted him.

Despite being the youngest of three brothers his hair has gone completely white from the stress!

So hassle factor is paramount consideration when seeking to retire young and healthy enough to enjoy your freedom!

Hi Keith,

Considering the interest going high nowadays, are you still invested with Telestra with that loan? And taking into the factor that there is no capital growth on the share price?

I’m looking to be an active investor.

The idea of property has always intrigued me and doing more work won’t bother me. It’s not like I would be doing anything better with the time usually. May as well use it to learn and make a profit at the same time.

Nothing wrong with being an active investor. If you have made up your mind on being active, from my experience you have a much better chance of making more money through property than individually picking shares and day trading.

Good luck

While property may be a good investment vehicle to accumulate wealth, its ongoing management effort, illiquidity and poor (relative to shares) return make it a poor income source in retirement. Check out https://www.propertychat.com.au/community/ to see threads on how property-holding retirees struggle with this. Give me shares in retirement any day!

Couldn’t agree more Ozstache!

Property has its place for some investors at the start and maybe the middle of their journey to supercharge their returns.

But come retirement, you just can’t beat shares for the reason you have mentioned.

Changing to passive investor after learning hard way I am not interested in being a active property investor. Selling out of properties to have a stress free auto pilot investing journey

C2: Wow, your rate is 3.45%? I’ll be honest with you. I didn’t know it could get so low for shares. Can you help a brother out and point me in the direction where I can take advantage of this low rate?

I just checked NAB Equity Lending and am shocked to see what the ordinary punter on the street pays!

https://www.nab.com.au/personal/investments-super/investments/margin-lending/why-nab-equity-lending

Loan amount Variable interest rate p.a.

Less than $250,000 6.95%

$250,000 – less than $1.0M 6.70%

$1.0M and above 6.45%

Because I syndicated a package of AAA rated Share Portfolios worth A$10M for myself and a few family members, we were able to negotiate down the rates to:

Variable Rate Loan 3.61%

Fixed Loan in Advance 3.45%

Even at $1.0M+ loan size, you are paying 78% more in variable interest than I would be charged.

The key difference is attitude and approach.

If you take a business like approach to negotiating your Margin Loan as a professional investor you can get a more competitive rate than merely accepting a Bank’s advertised rate and hope they will lend to you.

I have rarely considered ETFs since I have always made good money buying directly into high quality Australian Share over the past 25 years.

Now that I am retired, a steady income would be nice.

So the Sat 08 July 2017 newsletter Hendersen Maxwell article highlights a possible hassle free strategy of getting regular income with minimal hassle.

One note of Caution is the asset backing of the ETF has been falling steadily since it launched in Dec 2014. To an all time low of A$18.27 on Friday 07 July 2017.

See the attached 1 year daily share price of the HVST units.

https://prnt.sc/ft4iob

So the risk is you get a 14.3% p.a. yield which is taxable at the expense of accumulating unrealised capital losses which will need to be covered by other capital gains.

So if you are after Australian sourced income and are not too fussed that you will be bleeding capital as a consequence, it makes sense to hold some money HVST in the lowest taxed person and/or Self Managed Super Fund.

—- START OF ARTICLE —-

Want 14.3% income in retirement?

If you could get 14.3% income from your investments in retirement, would you be satisfied? Of course, its a no-brainer. What about if you lost a little over 2% of the capital value over the year? Is it still a good investment? Again, of course.

Last week I met with Alex Vynokur from Beta Shares who developed the Harvester (ASX:HVST) Exchange Traded Fund (ETF) product that we use at Henderson Maxwell in our portfolios to provide our pre-retirement and retiree clients with a wave of regular income. When I addressed the high yield combined with a falling value, Alex simply said, “The key objective must be to reinvest the income and you’re still well ahead.”

At Henderson Maxwell, we invest millions of dollars into this product because of its attractive after-tax yield. When you’re in pension mode and not paying any capital gains tax or earnings tax, and you receive 100% of your franking credits back, this product can turbo-charge your income.

Importantly, like all of our investments options within our managed accounts structures (actively managed individual portfolios for clients), we use ETFs as a diversified approach in concert with direct holdings in cash, fixed interest and direct shares to reduce cost, spread the risk and provide diversity across the sectors and asset allocation for our SMSF and non-SMSF clients.

Exchange Traded Funds are like index-style managed funds that are bought and sold on the share market, and they don’t pay commissions to advisers. They’re also traded same day and cheaper than managed funds. Beta Shares is receiving around 30% of all flows into Australian ETFs, and we have no commercial arrangements with them, just in case you’re asking.

We just like their products because they suit our client base and we use their competitors products such as Vanguard, Russell, iShares and State Street in our diversified portfolios when appropriate.

—- END OF ARTICLE —-

http://www.betashares.com.au/fund/australian-dividend-harvester-fund/

Pricing Information 8 July 2017

Last Trade* $18.35

iNAV (live)** $18.327

*Data is delayed by at least 20 minutes.

** As at 8 July 2017 04:29 AM

Download NAV history

NAV/Unit * $18.49 * As at 6 July 2017

https://www.google.com.au/amp/s/amp.smh.com.au/business/banking-and-finance/celebrity-planner-who-offered-risible-advice-banned-for-three-years-20190724-p52aao.html

“I enjoyed reading your comments, Keith.

Congrats on reaching FIRE by 40. Maybe you’d be interested in appearing on the podcast? You seem to be passionate about your investing.” – Aussie Firebug

I LOVE investing, there is nothing better than being paid to do what you gets you out of bed each day!

Since I was made redundant/retired 11 years ago, I had the opportunity to turn my lucrative part time hobby of direct share investing into a full time career!

Not sure that an interview with me would be helpful given the divergent interest/positions I am relative to the majority of your readers.

I find little to like about EFTs given I have earned consistently high returns from direct shares.

I have never bought a property, but will eventually buy one to live in despite the cash drain associated with owning a fixed asset.

Really the key to reaching FIRE as expoused by everyone from Mr. Money Moustache and others is to live well below your income and reinvest the surplus until work becomes optional.

For most of my working life, I saved about half of my after tax pay and plowed the maximum deductible into my superfund.

But more importantly is I reinvested my saving into high quality shares that compounded my returns over decades.

During the past 25 years, I carried no undeductable debts and my deductible debts were never more than an average of 20% of the equity of my investments.

Setting good investment habits from my first pay packet meant when my employer was done with me, so was I!

Hi Aussie firebug,

First of all thanks heaps for all your work. Love reading stuff about FI in Australian context.

Question on ETFs:

You’ve mentioned in the comments previously you have VTS & VEU ETFs.

They are the two of the only Vanguard ETFs that you need to fill out W8ben form and pay 15% US tax on top of whatever you need to pay to AU govt on your income tax.

What’s the advantage of getting VTS & VEU over other ETFs like VGS where you don’t need to pay that 15% tax on the dividends. I feel like it’s a huge fee/tax to pay eventhough their management fee are significantly lower.

Thanks!

WSS

Hi WSS,

The W8ben forms stop that double taxation that you mention.

Because you’re already paying tax on the dividends from the other countries, the W8ben form shows the ATO that you have already paid X amount of tax so you don’t need to pay that much to them come tax time. We have a tax treaty with the US to stop us from being tax twice is the security is domiciled in the United States.

As far the benefits of VTS/VEU vs VGS.

– Lower management fees

– Greater diversification

– Exposure to emerging markets

– Unhedged against the Australia dollar

But then you need to consider that VGS has DRP and you don’t need to fill out the W8Ben form.

More can be read here (http://forums.whirlpool.net.au/archive/2449117)

Thanks a lot for sharing insights on your way to financial independence. This is a great strategy.

If your reading this today and thinking about ETFs there are new (2018) ones which are Australian domiciled thus not needing to go through the US tax system. Check out IVV or IWLD by Blackrock.

Agree for the most part, however, you can lever financials the same way you do with property using the NAB equity builder.

Similar interest rates, LVRs and terms, with no margin calls.

The only advantage property had was leverage, everything else, financials wins hands down. So with new loan products with no margin calls, this isn’t really an advantage anymore.

The thing about improving properties and trying to beat the market is rubbish. They are both bad. Just like most investors don’t beat the market, most property investors are not developers who would add any value above market returns and costs. Most property investors are better off buying a ready to rent property, doing nothing and keeping costs low. Most people make less money after developments and reno jobs vs doing jack. They think they made more because the market was rising market. A unlivable shack in Sydney made more money holding and selling than trying to redevelop it.

Getting good at beating the market is the same as getting good at property development… Most people shouldn’t. People overstate the returns, understate the costs, and don’t factor in time value of their own labour hours doing renos.

Anyways, is not a neither or, do both, but the advantages of property is much less now than before.

Also, your networth doesn’t factor in risk. Aussies concentrate too much of their wealth in property. Anything can happen, diversification is king. If you actually factor in the liabilities on your properties, you have even more concentration risk. This is simple, but why not just go 50/50 property and financials, lever them the same amount, balance out risk.

Leverage magnifies losses as much as gains, so you can’t just talk about levered gains without talking about levered losses. Risk management…

Leverage on low-interest rate: You can do the same with levered financials now with new loan products

Ability to physically add value to investment + Skill and experience can be leveraged + High return potential for an active investor: The same can be said about active financial investments.

Tax advantages such as neg gearing, depreciation and PPOR capital gains exclusion: Tax advantages are more or less the same. Depreciation only helps you with cashflow, you pay it back on sale. PPOR exclusion doesn’t help you with your investment properties, by definition your home isn’t an investment. Financials have franking credits. On balance, it works out the same.

Good protection against inflation: Stocks are better. You are coming from the perspective of an Aussie how got lucky. Stocks outperform property vs inflation when you look internationally, over longer time periods and get out of home bias. Also, you can buy the world via market cap, but you can only buy so many properties.

Less volatile than other asset classes: False. Financials are priced every second 24/7/365 with instant liquidity. Properties aren’t. This gives the illusion that financials are more volatile than properties. But do this. Take the annual opening price of a stock index vs the annual property valuation, it is the same. This always annoys me because:

– People think the property index is what their house goes up and down by, lol, an individual house is just as volatile as an individual stock

– Property valuations are rubbish, they can vary by as much as 10-20% and then try to sell and clear it, you can see easily an additional 10% variation

– People think their individual house value is as stable as the property index… yeah right. That’s like saying an individual stock is as stable as the stock index.

At an individual house, have a market depth offering prices every second of every day, have instant clearing, and you’ll see the same volatility. Go to an auction. A rainy day, less bidders, you might get 5% less than a sunny day.

Here is the catch as well, you can buy the whole global stock market via market cap and diversify away the individual stock risk and over the volatility, you can’t do that with property.

Can’t physically improve investment or add value to asset: You don’t have to, companies do that themselves through capitalism and competition. That’s why stocks have higher growth than property.

No influence on how your investment performs. If the market is down there’s not much you can do: Same with property. Doesn’t matter if you did a kitchen reno. People aren’t going to pay you if they can’t borrow and market is down. Sure you can, diversify and keep costs low.

Can’t leverage at the same low-interest rate as property: Yep, you can.

If you do leverage (which I wouldn’t recommend), you may get margin calls: Nope, new loans out there with no margin calls. Also, property loans can be called in as well, Aussies just haven’t seen it on a mass scale. i.e. look at rest of world.

More volatile: Nope

Fewer tax advantages than property: Nope

Do both property and financials. But in my experience, Aussies have way too much of their net worth in Australian property and they ignore the outstanding loans.

👍

Interesting..I’d love to see a detailed study going back 30 yrs. One thing about property is that it requires maintenance and costs like rates or taxes, whereas with shares you can even re-invest any dividends.

Of course you can rent out a property to get rent, but the one you live in doesn’t usually generate income. My personal idea is to live in a small place and invest the rest in shares or an investment property (though for me in reality shares are better 🙂 )

Hi Aussie Firebug, I’m a huge fan of your work – please keep it up!

While I’ve been putting away my savings into ETFs since starting full time work a few years ago, I’ve been thinking more about buying a property, especially considering the range of government initiatives that favor property investing for first-home-buyers (FHBG, Stamp Duty Exemption, negative-gearing etc). Just wondering if you or anyone you know has done the stocks vs property math pricing in the subsidies for first-home buyers?

Hi Gus,

Thanks for the kind words mate.

That’s a really good question but unfortunately, I haven’t compared the two with subsidies factored in. I’d be interested to see the results though so if you ever find a comparison make sure to drop me another comment 🙂

Cheers

I also have had the experience of investing in both property and shares, though am earlier on in this FIRE journey than you are currently. I started with property first, as it was “the thing to do” and its trucking along comfortably. Like you mentioned, the leveraging is an advantage and it has tax advantages. It’s still *technically* negatively geared but that is because I claim on depreciation (got in before that cut off date in 2017!). On the other hand, I really like the hands-off nature of the share market, where I can use a buy and hold strategy and hopefully never sell down. Whereas with property, yes you *can* build your wealth and cash flow retirement from property income alone, but the real value of property investment is in utilising the leverage and the capital gains to make profit. Also there’s ongoing expenses involved with property which is really just too annoying – and I’m only 28! So my plan at this point is to keep the property for now but eventually sell it off in 10-15 years and roll over the profits into the share market.

I love the no hastle aspect of shares, specifically ETFs which pay out dividends. Since my lifestyle goal involves travelling with low overheads, and I consider myself a financial minimalist, the idea of having hastle free and low overhead investments is really appealing. I just, have a fear of a property manager taking me for a ride when Im not around. +1 for VAS, or A200

Any thoughts on what is better financially at the end of the day? Renting and investing in index funds or home owner occupier and putting balance in index funds. This is assuming youve 1M net work and own or rent 800k house?

I have previously leaned towards renting + investing but in the current climate of extremely low-interest rates, I’m not so sure anymore. I’m looking at buying a home this year and when I crunched the numbers, it’s actually looking like buying + debt recycling will come out ahead financially. A lot of factors at play though.

Welcome back mate.

Would love to hear what your research shows now that interest rates are so low.

I myself was planning to rent and invest in index ETFs instead of buying property but with the interest so low I’m now having second thoughts…(knowing well the pros and cons of buying property)

I’ll most likely drop a post that goes over all the figure once we buy. The market in our region is bonkers atm though, we can’t even get to the open day before the property goes under offer. Insane!

I notice in your Cons for property you didn’t mention insurance and management fees, other than that a good list. I also notice that you haven’t mentioned that depending on your daily rate, that maybe a side hassle and shares more lucrative than the time need for active property investing.

P.s Love your whole approach to FIRE, website and calculators.

Good points Pete and I’m glad you’re enjoying the content 🙂

Vast content! i liked it! personally im more inclined towards investing in property.

Great! Thanks for sharing this article.

Very informative and a worthwhile read.

Thanks for the post – I really love your work!

I think there are a few other factors that are cons for property investing. First – capital gains on sale. You can’t sell 5% of a property like you can with shares. This means if you ever need more than the rental (which is likely given rental yield is less than 4% withdrawal rate) then you need to sell the entire property. This means you will likely realise all the capital gains and push you into top marginal tax threshold in that year. With shares, you can phase the sale to minimize taxes.

Second, the risk is much higher at an individual asset level than investing in ETF. The risk of not getting dividend on a diversified index is almost zero, but the risk of something bad happening to your property holding is quite high.

this is very helpful thankyou for sharing.

Thanks for sharing 🙂! I learned a lot through this

Great Post! I learned a lot through this. Thanks