Big month for the net worth in July.

We had a few things add up which explains the big jump which I’ll cover in the Net Worth Update below but it was a great month.

I went on a business trip to a major city in July which required me to catch the train each morning.

What an experience it was. Don’t get me wrong, catching the train is a bit of a novelty for a country kid like myself, and I did feel a bit more ‘Big City Slicker’ dressing up in my nice suit each day. But maaaaaaan I could tell that the daily commute on the train could get old really quick.

I’m not ganna say it was this bad

But it was pretty cramped.

And everyone seems to be in a rush. I honestly felt like most people around me were in the rat race.

Another thing that struck me was the apparent wealth that most of these people had. I had dinner with a few other professionals from the city one of the nights and the whole conversation was just one big dick measuring contest. No one knew each other but we were all in the same industry and I had a very good idea of the income for all of them and let me tell you right now, it’s not that much higher than mine.

So you could understand my amazement as the conversation drifted from work to other topics such as:

- One dude bragging about his $600 dress shoes only to be one-upped by another noob who was happy to part ways with $1,000. I looked at them and trust me, they look like every other bloody black dress shoe I’ve ever seen.

- How BMW’s are an essential item and how one guy could ‘never go back to a merc’. Righto cobba.

- Somehow paying more for a house is seen as a badge of honor. It’s amazing how impressed some of these guys were with a postcode.

And there was other stuff like fancy watches and custom-made suits but you get the point. I’m not saying that they weren’t wealthy, for all I know they are loaded. But this trend of ‘flashy’ shit was everywhere! No way everyone is rich.

These dudes nearly fell over when I told them that were I live you could get a kick ass new 4 bedroom house for around $400K. And it was hilarious when they found out I was renting. I could feel the entire table’s attitude towards me shift when that was bought up. I swear some of them must have thought I was some loser who couldn’t afford a house.

These guys definitely don’t read the blog 😂

Net Worth Update

Two big things happened which mostly attributed to the big bump this month.

- HELP debt

- Tax Returns

Mrs. FB HELP debt was reduced from her payments through the year which equated to $5K.

The other one was that both of our tax returns came through which came to around $5K mainly due to the property deductions.

Other than that, we managed to save around $10K cash after a great month and two extra pays (both of us got an extra payday due to the way the payday fell). We had a $3K Super bump and the ETFs chipped in $2.7K.

Properties

No changes in the properties this month.

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs

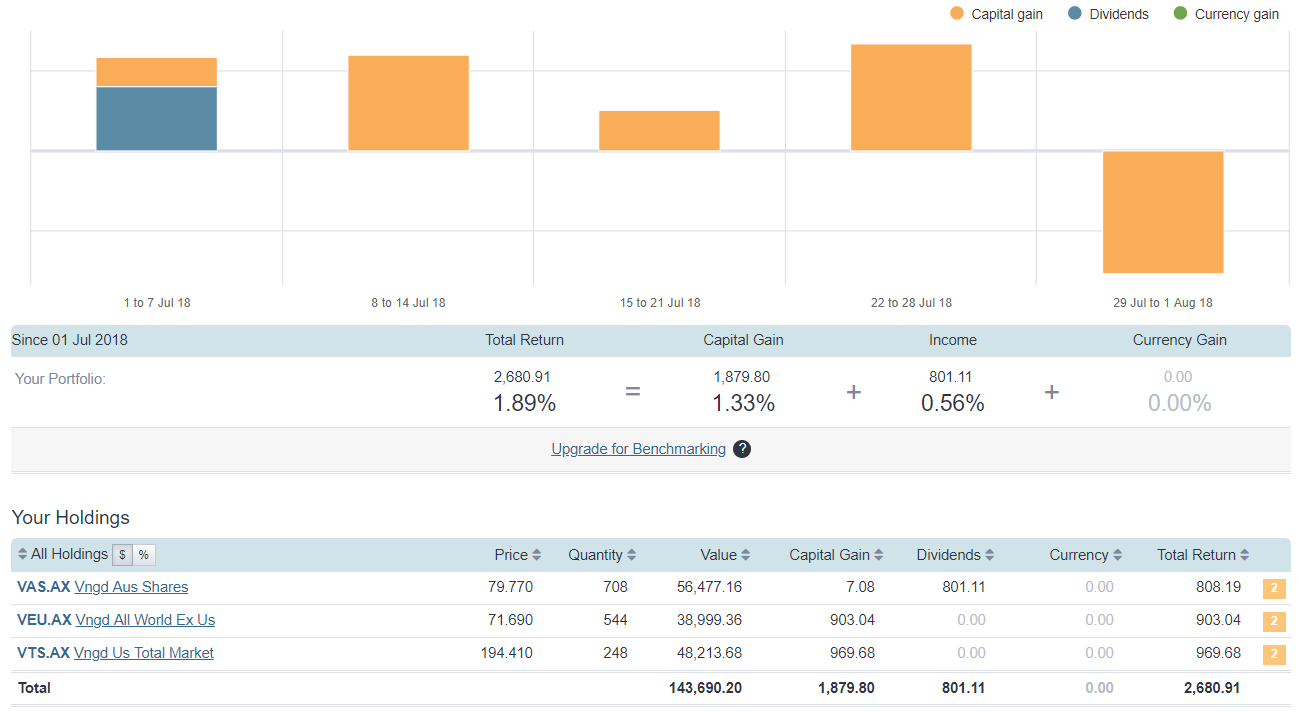

ETF returns for July

VAS coming in with the good on the franked dividends and the rest making up for it in cap gains. Nice little bump for July.

Networth

I havent been able to finalise my tax returns as i don’t believe Vanguard ETFs have put out their tax statements yet – how did you manage to lodge your returns without this information?

You dont need to. Just the declare the dividends you received in that last tax year. If you get dividends from the ETFs when they issue the report it will be in the new financial year and will need to be declared next tax return

Hi Adam, I haven’t done my trust return yet (the ETFs are in the trust). Can’t you get the tax info from sharesight though?

You cannot just declare the amounts you received in the last year, since ETFs are a unit trust and Australian trust income received in July for the June quarter relates to the prior year and is declared as income in that year that it relates to.

Also they are not dividends they are trust distributions with different components (franked distributions, other income, franking credits, capital gains, deferred tax etc) so you need to wait for the Vanguard tax statement which gives you the components for the tax return. Sharesight cannot help with this.

However for foreign domiciled ETFs, slightly different as i believe you do only declare the gross amounts received in that year as foreign income, and include any foreign tax withheld as a credit.

Secondly, when you do the tax return for the trust that you hold your ETFs in you will need to distribute the trust income relating to those ETFs to someone, otherwise it will be taxed in the trust at the top tax rate, normally this someone will be you, so you need to include that income distribution in your return.

So i think you may possibly need to amend your return.

My trust isn’t distributing any income this year mainly due to the deprecation from the ip’s within it. It won’t need to distribute income until next year I have forcasted.

But even if it did, the sharesight taxable income reports include everything you have mention (Franking credits, capitals gains, foreign income etc.). I don’t believe you need to wait for the vanguard statements (please correct me if that’s wrong). The sharesight reports should be the exact same what vanguard sends through.

Ha, that’s why I gave myself an out with ‘may need to amend’. Wasn’t sure if you were distributing to yourself or not. Interesting that you have IPs in a trust!

The sharesight reports may indeed eventually include everything that is in the vanguard tax statements, but they get that information from those tax statements so you do need to wait for vanguard to release these before doing the tax return. I would use the vanguard statements even if sharesight had some info, better to get it from the source. Before that info is released I would imagine that sharesight just shows the amount of each distribution. Not possible for them to know distribution components before vanguard knows them!

Just to add to Adam’s comments regarding the Trust distributions, you are basically losing the franking credits from the Vanguard distributions as there is no income to distribute to anyone! Have you ever tried to quantify the loss? Why would you have negatively geared IPs in a Trust?

The original plan never had Franking credits consideration. We planned to have had 5 fully paid off investment properties in the trust positively geared. The negative gearing losses can be carried forward so the thinking was that even though we couldn’t claim those losses on our PAYG income, future taxed income from the trust could use those losses.

Now as for the Franking credits. To my understanding, we don’t lose them! The trust receives the dividends which are partly franked and it can still get the refund (under current laws) when I compete the trust tax return. The money sits in the trust and I don’t have to distribute it because it technically made a lose.

Happy to be corrected though.

If there is a loss in the Trust, you can not distribute it to anyone including the Trustee. Hence, you lose the benefit of the franking credit.

PS. I am an accountant!

After a quick google, unfortunately you’re 100% correct 😭😭😭! And come to think of it, I now recall my accountant telling me the same thing last year.

Looks like I’m going to loose my Franking credits again this year 😤. I’m looking to offload a property within the trust by the end of the year and I’m forecasting the properties to be either positively and neutrally geared anyway so this will be the last year hopefully I won’t be able to use them.

Thanks for the heads up dude!

Also, I dont think you are allowed the CGT discount when selling property/shares within a Trust. Trusts are primarily used for protection of assets. I dont use Trusts for my IP’s..

You can still get the CGT discount when using a trust https://www.ato.gov.au/General/Trusts/Trust-capital-gains-and-losses/

But if I was to do it again. I wouldn’t have put the properties in the trust tbh.

The sharesight report doesn’t exactly match the Vanguard report actually so it is worthwhile waiting to make sure it’s done correctly.

Agreed! I think Sharesight even say to make sure you check the numbers with the financial statements

How do ETF’s go at Tax time? Do they differ from other Stocks? Due to their Distributions/Dividend structure? When do they typically release their tax information?

I think its different per fund. But their annual reports come out on sept. The same for super.

With tax you declare any capital growth income from the sales of stocks and any dividends (including a section for franked dividends)..

If you received any dividends this last tax year then declare them. You dont need to wait for the etfs to release the reports

I’ve only ever bough ETFs but I believe they are treated the same as individual stocks. You pay tax on dividends, some come franked, capital gains are the same etc.

Usuallys takes a month or some for them to release the tax info. I think you can get it from sharesight earlier though. Could be wrong

Great Blog, I look in all the time. Anyway, I just got a Vanguard statement today (VHY). It is a lot different from sharesight (in a positive way, franking credits and stuff). Hope this helps.

Thanks Tony. That’s strange, with the statement out today, the reports should mirror what’s released by Vanguard. Strange that it’s out by a lot. Are all your transactions entered in correctly? Do you integrate with your broker or manually enter in the trades?

Maybe it takes a few days for Sharesight to update once the tax statements are released? I’ll be looking into this one

That train conversation is laughable. It’s weird how people base so much value on material items. I’m indifferent about the items and impressing people, I value relationships and a simple existence where I can pick and choose whether I work and can truly engage with all the things I love. All the best for August and living beyond the consumerism!

It’s such a waste of money imo. That’s so much extra work to fund those purchases I could

never justify it.

I think you might have made a minor error with the copy paste on the $ change field there.

Fixed. Thanks mate

Interesting observations about the dinner conversation you had with your ‘apparently wealthy’ colleagues Firebug… They could do with reading The Millionaire Next Door! And heeding Warren Buffet’s advice; “The thicker the carpet, the thinner the dividend… “

👌

So valuable! Thanks for this information. You are one of the few that is being super transparent with how you do things and in particular in Australia. Obviously Mr. Money Mustache does his thing for the states but OZ is an odd one. If you know how to work the system it’s def possible to make it work for you. That train convo reminded me of this https://www.youtube.com/watch?v=cISYzA36-ZY

Haha 😂😂 oh man that was a great clip. IT WAS ALMOST LIKE THAT! Like, who actually gives a fuck about these sort of things. Consumer marketing has brain washed 99% of the population I swear lol.

Haha, that was pretty funny. Yes, loved the style of the post and the clip Daren shared.

congrats on a great month! That passive ETF income/growth is so enticing.

Thanks for sharing all the good stuff. What do you think of A200, because of the low fee I am itching to start investing in it instead of VAS. Do you see any reasons not to.

Thanks

My next etf trade will be for a200. I’ve essentially swap out VAS for A200 now.

Wondering if you’ve crunched the numbers and whether the annual dividend of A200 vs. the quarterly distribution of VAS influences the total return?

Ooooo that’s a good one. Hadn’t thought about that one before actually 🤔🤔🤔. Let me get back to you on that one.

Great work mate.

I also know some people like that from school. He brags about his $900 a week apartment near the river in Sydney and his Merc. I asked him about investing and his response was that he has a few bitcoin. I asked about shares and he said “na too slow for me”.

Oh well, can’t win them all.

Cheers

So, any plans to buy Betashares A200 or any LICs yet? Or still pouring money into VAS for now?

LICs and A200 will be making an appearance in the next net worth update!

which LICs will you be buying next?

Argo and AFI I think.

Ooo… I’m watching you closely… if u jump, I jump! Lol but no pressure ya?

I love the simplicity of your investment principle and thanks heaps for sharing! You’re doing a service to the FIRE community.

I see a lot of people investing in multiple ETFs/index funds/stocks and maybe they have good reasons, or maybe they are just being reactive, who knows. It seems so complex and I wonder if it has to be this way.

However, the real test is during the retirement phase with a 4% withdrawal rate.

Well done on the gain this month mate and I completely agree with you about the feeling of suburb snobbery which is really obvious with big city dwellers. Unfortunately, I believe they take that same attitude with them when they eventually move regional… Don’t laugh, but I have custom made suits and I can understand why some would. My size is not very standard at all and I struggle to find clothes that fit properly off the rack. I could never understand why in most photos when I was younger that I still looked “shabby” even when wearing a suit. It took a few years to understand it was because my suits were always quite ill fitting even after being “adjusted”. As soon as I wore a suit that fit me properly, I got a better job with more money and seemed to be taken more seriously. They also make me feel good and a good suit should not need replacing for 10 years if you look after them. So a $3000 custom suit is a far better buy than a $500 off the rack suit, in my opinion.

Interesting that you are moving from VAS to A200. I hold VAS and have been watching A200 since it launched. For the first couple of months, VAS outperformed A200 (whether the lower fees for A200 close that gap, I don’t know – need someone smarter than me to work it out), but since early July A200 has been outperforming VAS! I’ve decided to stay put in VAS until it becomes clearer that A200 are a good bet. I’ll wait to see a 12 month return on A200 vs VAS and see how the liquidity in A200 is then as well. A200 is not as liquid as VAS and if you ever needed to get out in a hurry in a market downturn, you would be far better off being in VAS than A200. While A200’s management fee is enticing, I just think that A200 needs to be proven first. It would suck if you move to A200 and find out that despite their lower fee, VAS still outperformed it over a whole 12 months.

I actually own a tailored suit myself mate and at the end of the day, everyone values things differently.

I’m not too interested in the value of A200 VS VAS but mainly the dividends they produce. They are so similar that I can’t see how VAS outperforms A200 by much or vice versa. And the liquidability isn’t as much of a concern because I’m planning on never selling the Aussie shares.

Given the above and without knowing the future returns, I’ll be taking the 50% cheaper management fee of A200 over VAS because I can’t see a good reason not to.

I guess we’ll find out how it turns out though.

I like the idea of getting the top 300 stocks with VAS rather than top 200 with A200, although the last 100 stock is a pretty small percentage overall. Understand the motivation of the low fee though. Kinda feel a bit loyal to vanguard over profit driven companies although this is a bit silly really.

Hi Christopher,

I totally agree with you. I am willing to spend good money on well-made quality items that I use regularly i.e. watch, laptop, phone, car etc. I maintain them well and use them for years, and it maintains good resale value if I decide to sell them. Some call it minimalistic luxury.

Excellent month by the way. Keep up the good work.

Just wondering what you use to track your ETFs? What are the ETF screenshots in your blog posts from? Your content is great, keep up the good work.

Sharesight mate.

Love the blog mate, very inspiring as someone of similar age to you but massively behind financially.

I went down the path of Vanguard Index Funds and automatic BPAY payments each pay cheque but haven’t worked out if it’s worth switching to ETF’s or just keep the dollar average approach going.

Mannnnn 10k cash saved in a month?! How is it even possible 🙁 🙁 Great job though if that’s not a typo.

We usually earn just a tad over $10K a month. But with the way our paydays fell in July, we both had an extra pay each which worked out to be an extra $5K. Being a DINK couple in relatively high paying jobs in the country had its advantages that’s for sure!

I’m new to all this, but wow, some fantastic information. Learning a lot. Just wondering why you keep so much in cash?

We firstly keep around 6 months of livings expenses in cash as an emergency fund in case anything goes wrong. On top of that, we keep around $5K for each investment property in case of an urgent repair or something like that. We have had a little extra cash in there recently though… We are putting $20K into the market this month so next update will reflect this.

What program or website do you use to track your rolling networth?

Sharesight is used for the EFTs reporting. And I use Google Charts for the rolling net worth. But I have to enter the data in manually.

Hello Mr. Firebug,

I noticed your 15k tax refund. That’s really high. Have you looked into a PAYG withholding variation? Instead of getting a 15K tax refund at the end of the year, you can simply reduce how much tax gets taken from your pay each month. So every month you will have an extra $1000 to invest. It’s better in your hands than the GVTs… more time in the market.

Yeah I have, but I’ve been a bit lazy in that regard. I agree with your points and should really get onto it 😓