It’s that time of the year again.

Time to review where every single one of the precious dollars we earned last financial year went.

This is usually an eye opener, but we review our spendings monthly so it shouldn’t be too much of a shock.

It will be interesting though because this is the first full year Mrs. Firebug and I have spent together with our finances joined.

I posted my savings rate last FY in this POST. I’m under no illusions that a savings rate of 74% will not be repeated again this year. I have hope that we will be around the 60s though. We did spend a lot of money when we moved with new furniture and what not.

Enough rambling, let’s get into it!

Savings Rate For 16/17 Financial Year

Our savings rate for last financial year was… 63%

We earned $137,419 (after tax)

And spent $50,595

Pretty pleased with 63% tbh.

Anything above 60% was winning for us.

Being in a relationship is all about sacrifices. The last year by my standards was extremely luxurious with a heap of unscary spending. But Mrs. FB felt we were very frugal and tight. At the end of the day, it’s a sensible a sustainable budget that’s going to work and both parties need to be happy with it.

I felt we struck that balance this year gone. And as all the fellas out there know…

“Happy wife, happy life”

Even though I’m not married… These are words to live by ??

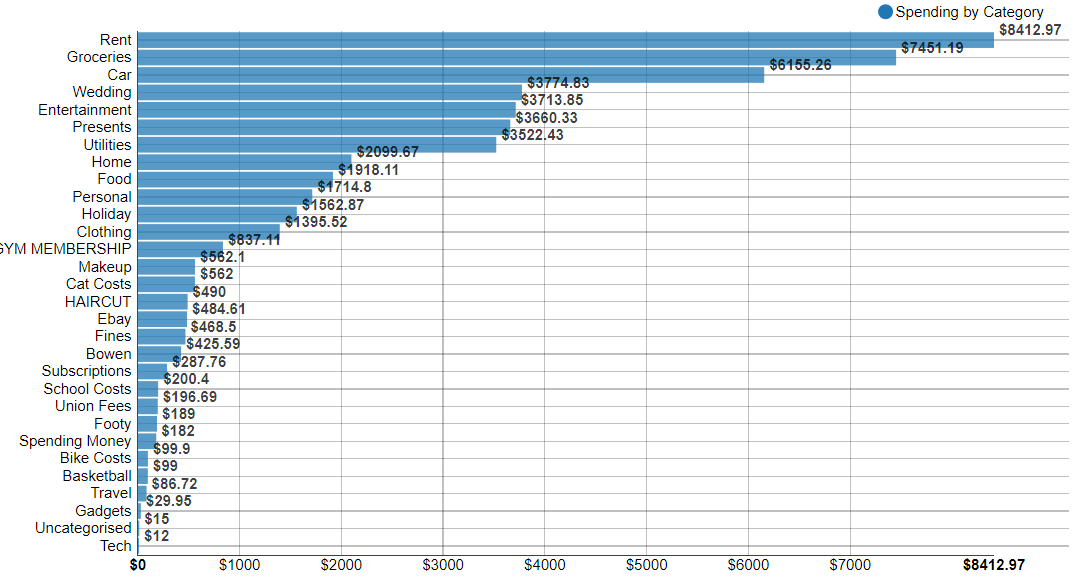

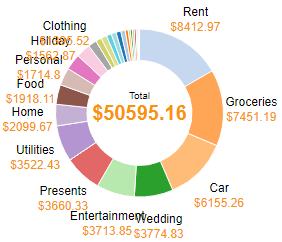

Breakdown Of Spending

Down to the nitty gritty.

How in the hell did we spend over $50K!?

and in pie form

Let’s start with our biggest expense…RENT!

$161 bucks a week is great. But that included 2 months house sitting my parents home before we moved into our new place. So it’s really about $195 bucks a week which sounds about right.

I’m sure some Metropolitan readers out there are shocked at how low that rent is, but that’s just one example of the cost of living differences between the city and the county.

Groceries is next up. Man, we eat a lot! But let’s break it down to how much we spend a day to fuel our bodies.

$7,451 on groceries + $1,918 on food + $2,176 on entertainment>food

Those three different categories account for everything we consume (except booze)

= $11,545 a year on food

=$222 a week

=$31 a day

=$16 a day per person

It’s actually more like $21 per day for me and $10 per day for Mrs.Firebug because I eat so much more than her.

I have to be honest. I’m actually shocked that we only spend $16 a day on food each. Considering that this figure includes every time we go out for dinner for like $70-80 bucks, breakfast Sundays, birthday dinners …everything. I eat 6-7 meals a day too. We could definitely improve this category by not going out so much but we live a great lifestyle and there’s always fat to be trimmed if we need to I guess.

It helps that we both make our lunches every day and hardly ever go out during the week.

The car expense is pretty standard. With the change of job this year, the fuel costs should go down though.

And then comes 3rd place…WEDDINGS!

That’s right, we spent $3,774 attending, participating, flying to and from weddings in 2016/17. CRAZY!

The only other two things that jump out at me are how much we spent on presents and utilities.

I know it’s hard because every household is different but is $150 a month a decent usage amount for gas/electricity? I’d be interested to know how much everyone else spends on utilities.

How Do You Compare?

We managed a 63% savings rate last FY. This included rent, food, car costs, holidays, a bunch of weddings…absolutely everything!

And it didn’t feel like we sacrificed at all! In fact, I still think we could cut out heaps of unnecessary spendings if we really needed to. But as mentioned earlier. Reaching FIRE with a partner is about sacrifice and compromise. And I felt like we struck a nice balance last FY.

But I will use this year’s numbers to set the target for next year.

70% here we come!

Ah, you guys have done well! I only just started tracking so next FY, I’ll be able to show what our average is. Personally, I think if I can hit 40% and above, I’d be stoked! Mainly because it just seems like such a lofty goal right now. So your 60% is super inspiring!

Thanks Pia.

40% is great! Setting the goal is half the challenge!

Such a great year and a bit of a stretch goal for next year too!

$195/week rent?!?! You are right, us city folk are jealous. That is less than half of our rent for a 2 bedroom apartment at $420/week.

Interestingly, utilities are about $100/month, electricity only as we don’t have had so that is a bit cheaper.

Weddings are expensive! I went to 2 last FY and have at least 3 coming up. I was lucky that only one was far enough away to require accommodation. I’m a sucker for a good wedding though, all sentimental and whatnot so I make the most of it.

Well done on a great year and best of luck for next year – you’ve got this ?

Thanks Miss Balance.

Yep, rent in the country is so cheap. It’s only a two bedroom unit mind you, but still.

Great work! I only hit 41% last year, but that’s without Mr. FIRE. Despite living together for three years we’ve yet to combine finances – mostly because he refuses to track his spending 😀

41%! Great work.

Have you offered to track his expenses for him? That’s basically what I do with Mrs. FB haha

Constantly :p He says it’s his responsibility.. which is true, but it’s still not happening *sigh* stubborn…

Thanks for the breakdown AFB. We know we spent a ridiculous amount last year. We’re trying to reduce by 10%, but it will still be a ridiculous amount this year. Your breakdown will help me see where we are really OTT it’s our spending and where we might be able to cut back more.

Our gas and electricity has averaged $125/month in 2017. That’s for 2 of us.

I knew we were paying too much. I need to re-asses our current rates and how much we use.

I’m new to this blog, how do you (and everyone else) track your spending for a full FY?

Hey Taz,

I use YNAB 4, import your credit card and bank statements, don’t use cash for anything (or keep receipts) and reconcile it monthly.

Really only works out to an hour or so a month and gives you some great visibility into where you money is going

Hi Taz,

I use a program called pocketbook mate.

There are others out there. Or you can go hardcore and just use excel.

Thanks for the breakdown man. I got you beat on car and groceries, but pay more on mortgage and WAY more on holidays. We totaled $55.7k last year for 2 people.

$55K is great dude. I wanted sub $50K so bad and we came so close lol. Next year

That rent is so low when considering your great after tax salaries. I’m in regional Victoria and a pretty poor house is about $400 pw. where I live. Are you in a unit? Thanks for the breakdown.

Yes, we live in a small 2 bedroom unit. Heaps of space for us though 🙂

Great job man that’s a killer savings rate!

Balance is key, and it ain’t worth an unhappy spouse to squeeze a few more percent out of the savings rate. Although we may fantasise about it, it’s not in our best long term interests 😉

Our gas/power is around 100 a month so you guys are doing pretty good, but maybe still room for improvement. Something to aim for this year maybe?

Definitely. I need to check our gas/electric supplier and see what the rates are for others. We (Mrs. FB) uses way too many heating appliances.

Good job! We’re sitting on 59.5% with a similar income in a capital city (I count super, HECS, and PPOR principal payments as savings, do you?). I have also left out our wedding expenses which is controversial, but is hopefully a once in a lifetime expense : )

What do you mean by counting HECS as savings?

PPOR repayments technically add wealth to your net worth but I wouldn’t really consider them savings.

Each to their own I guess. The numbers are people specific anyway.

I definitely count HECS as savings, or net-worth increase I guess. If you’re putting money towards either building an asset or reducing a liability it seems like saving to me. Once those HECS are paid off you’ll presumably be putting that money towards some kind of “proper” saving right?

Yeah I guess. But would you include it in your savings rate?

I wouldn’t count it in the savings rate. I would count debt payoff (which is what HECS is, even if its a very good type of debt) as an expense. Think of it this way; net worth is assets minus liability right? So if in a given month you pay X amount of dollars to HECS, it reduces your liability column by X amount. But you haven’t actually gained any net worth, as you paid off the liability of debt using an equivalent asset of cash – it’s a net zero.

Great work hitting a 63% savings rate for 2017 AFbug. Making the most of good years counts for a lot, many of us millennials would let our monkey brains take over and start spending the increased income on one off splurges or worse, ongoing splurges!

$150 per month sounds about right for utilities, mine came in at $158/month (inc gas, electricity, water, internet, mobile phone) although that’s for one person, I suppose cooking, heating, cooling and entertaining 2 isn’t that different to doing it for one. My savings rate for the year was 26% – aiming for 30%!

Congrats on the savings rate.

I can’t agree more that you must make the most of the good years. Your 20’s I believe is the best time to really leapfrog your way to FIRE.

Once kids come on the scene it’s very hard I’m told.

But your 20’s is also some of the best years of your life so it’s hard.

I have placed my priorities on establishing our financial foundations in my 20’s though. I have definitely missed out on some overseas trips with friends as a result.

As the old saying goes ‘You can’t have your cake and eat it too’

So very impressive!!!! You’re such an inspiration…. I noticed that “insurance” isn’t listed. Is this under “Personal” for you? Insurance is a major expenditure for us and I’m looking at ways to cut back on it.

Hi Tricia,

The only insurance we have other than the investment properties (which I don’t include in our expenses since they fall under an investment) is for our cars. This cost comes within the cars category and is under $1K for both of us.

We don’t have private health either and rent so no insurance for the house.

What are you spending insurance on?

At the moment, we have home & contents, car, private health, life, TPD and income protection. Have you written about insurances previously? I’m very keen to know your thoughts / decision making regarding your choices regarding insurances.

I’m also interested to know more about this, though no doubt I will come across it at some point as I read through your blog. For me private health insurance is a FI must in order to reduce tax via medicare levy surcharge, and I also have several other personal insurance policies as well.

My current savings rate is 76%. The idea is to keep rent/housing expenses as low as possible. Next biggest expense is food, but willing to splurge a little on this.

76%! 😮😮😮 insane!

Good job Jim. We splurged on food also but you have to enjoy some things. Also, the healthier options cost more but I prioritize health over wealth every day of the week

“Fines” almost 500 bucks? Dude what 😀 You can fund a nice takeaway coffee habit here in Sydney for that. 🙂

Mrs. FB got caught on her phone whilst driving. It’s a bit of a long story and the car actually wasn’t moving so it was sorta bs but still. Big ass fine. Killed that months savings rate 🙁

Thanks for the inspirational saving rate and the very important message of the balance of enjoying life with savings. I’m current at 50% savings rate living on a grad wage and living alone in Melbourne (I enjoy my provacy to much for a sharehouse). Will be hoping to increase this soon as income increases and move in with girlfriend.

No worries Thomas. Balance is very important when it comes to FIRE

Hi, would love advice and tips on what to invest in and how. Do you go into more detail in any blog posts on this? Thanks

Thanks to an ASIC ruling thats literally illegal for him to do!