In case ya missed it, earlier this year I published what turned out to be my most controversial article of all time (and it’s not even close). The Curious Case of Franking Credits and the FIRE Community of course.

The thing is, I actually really don’t like talking about politicians and what they say and plan to do at all. That piece was never meant to be political but after reflecting for some time now, it was always going to be that way due to the nature of the subject matter.

So why the hell would I ever go near it again?

Because even though I don’t like those 🤡, politicians do affect us in the journey to FIRE and I need to set the scene first in order to talk about how we come to the conclusion at the end and where we’re heading moving forward.

And the beauty of having your own blog is you get to write and publish whatever you want. I create content from my point of view and never claimed my writing was balanced. This site isn’t the ABC or some neutral FIRE outlet. I presented facts in that article with my opinion which I understand everyone isn’t going to agree with.

However, that topic was interesting to me (and a bunch of others) so if I’m offending you or you don’t like what I’m writing, maybe you should follow another FIRE blogger ✌

Franking Refunds Survived…For Now

Like Steven Bradbury before him, ScoMo and the Coalition skated past the ALP for a come from behind victory and with it, the franking credit refunds will remain for the foreseeable future.

This was a hot topic amongst the FIRE community and now that the election has passed, it seems like things should proceed as per normal right?

I mean, franking credit refunds didn’t get the chop so fully franked dividends are safe to retire on yeah…?

Well… about that

Whilst I think that the result of the election speaks volumes to where the majority of Australians priorities lie, I strongly believe that a lot of the policies the ALP were trying to win votes on will not be touched for a very, very long time. They were aggressive with their tax reforms, franking credit refunds being one of the smaller changes (CGT and trust distributions being a lot bigger).

This was supposedly the unlosable election for the ALP. Every poll in the country had them winning by a landslide. Sportbet even paid out on them winning two days early to the tune of 1.3M 😮

For them to lose in the fashion they did, especially after all the shit the Coalition has done during its previous term tells me that the majority of Australians did not agree with the policies they were proposing.

And it’s my opinion that aggressive tax reforms played a huge part!

Now I’m definitely not an expert on this subject and don’t know for sure (no one really does) but I doubt we will see such aggressive policies proposed by any party for some time. I’d almost bank on it that scraping franking credit refunds will not even be thought about in the next election. They’ll go after something else, that’s a given. But it won’t be the same policies that contributed to them losing the election this year.

Sidebar: I’m not here to talk about the policies or politics so for the love of God don’t @ me in the comments about it.

But that’s enough about the election.

Again, I really don’t like politicians in general and try to avoid talking about them as much as possible. I only bring them up because it’s important to set the scene for the decisions we’re making in regards to investing for financial independence which is what this blog is all about.

Which brings me back to the point about the franking credit refunds.

Whilst I truly don’t think any political party will go near them for a very long time. I also learnt something very valuable from that campaign policy.

The legislation risk associated with franking credits in general.

I was completely naive in thinking the government would not pull the rug out from underneath us and the refunds would be here to stay.

What a fool I am!

I’m just thankful we’re still in the accumulation phase and have a chance to mitigate this risk a bit moving forward (more on this below).

But wouldn’t it have absolutely sucked if you’d worked your whole life and built up a retirement fund utilizing franking credit refunds only for the government to turn around and change the rules on you!

The refunds are safe for now. But I plan to be retired for 50+ years. That’s a long time for people to forget what happened in 2019 and if I were a betting man, I’d wager that sooner or later, franking credit refunds will be back on the chopping block!

Are Aussie Shares Worth It Without Franking Credits?

The thing about franking credits for those who are chasing FIRE in Australia is that without the refund, they are worth a hell of a lot less and in some cases, will mean that you don’t receive any benefit from the franking credits at all.

Let me give you an example.

Mrs FB and I know that to fund our current lifestyle in Australia, we spend around $48K over the course of 12 months.

We plan to own a house one day, so if we remove our rent and add on a bit to cover rates, maintenance on the property, insurance etc, we get to around ~$42K at a guess.

The plan before the election was for us to split our dividend income 50-50 and pay ourselves the $18,200 (tax-free income threshold) each from Aussie franked dividends. Let’s assume that the dividends are fully franked.

We each would receive $18,200 in cash throughout the year plus $7,800 in franking credits each. This means that the ATO would look at us having a taxable income of $26,000 for that year (dividend plus the FC).

Here’s the math behind the grossed-up dividend.

| Dividend | % Franking | Franking Credit | Tax Before FC | Tax After FC | Grossed up dividend |

| $18,200 | 100% | $7,800.00 | $1,482 | -$6,318 | $24,518.00 |

The franking credits soaked up the owed tax of $1,482. This will still happen if the refunds were ever removed.

But more importantly, the franking credits refunded us $6,318!

Because we, as the shareholder, have already pre-paid tax @ 30% that was removed from the dividend before it hit our accounts. It’s only fair that this is recorded (the franking credit) and the ATO is aware of us pre-paying the tax so we can be refunded later if we paid too much tax for that year which in this example, we did.

This was always the intention of imputation credits. Not to only stop double taxation (which consequently it also does), but to ensure that income is taxed once by those obliged to pay it.

So the end result is around $24.5K each to fund our life after retirement.

That’s almost $50K! More than enough for us to live comfortably forever whilst factoring in inflation.

But if we remove the refund. We only end up with $36K between us.

That’s a whopping $13,036 dollars difference and means we need to head back to work.

Or let me put it to you another way. You’re losing 28% of your return 💸

Tipping Point

I was on the fence for a long time before moving towards an Aussie dividend approach with Strategy 3.

A lot of people out there don’t realise that a major part of the dividend approach for me was not about total return. In fact, I even mentioned it in Strategy 3 that if I were to guess, I’d wager that Strategy 3 would slightly delay my FIRE date because of the less efficient tax method of income (dividends are less efficient vs capital gains) and less diversification.

We moved to Strategy 3 predominately because of the psychological aspect of receiving income that was not affected as greatly by human emotion (share prices) and is more anchored to business fundamentals (income of a profitable business that is passed to the shareholder via a dividend).

There have been great Australian based articles written that objectively looks at retiring on dividends vs capital growth and I constantly receive messages that link to studies showing superior returns for an internationally diversified low-cost ETF portfolio.

Guys, I’m a die-hard FIRE fanatic,

I’ve come across most of these theories and articles before! What’s missing here is the human element. We’re not investing robots. I’m not too fussed between minor differences in returns and place great value in simplicity and sleep at night factor.

I thought the trade-off of less international diversification and a slightly delayed FIRE date was worth retiring on dividends vs dividends + capital gains.

But everyone has their tipping point.

Without the franking credit refund, Aussie shares just don’t cut the mustard IMO.

The difference is just not worth it for us. But everyone’s circumstances are different.

For instance, those looking to retire on FATFIRE will not be as greatly affected by this change since they will have more of an income to soak up those credits.

And many people have rightly suggested to me that there are a lot of alternative strategies to generate unfranked income such as REITs, Bonds, P2P lending etc.

These are viable alternatives for some, but we want to continue investing in companies for now.

Mitigating Risks

Let me be quite clear.

I’m still a massive fan of the dividend approach.

But placing such an enormous amount of faith that politicians won’t change the rules around franking credits over the next 50 years just doesn’t seem logical to me.

I want to mitigate the legislation risk of a potential franking credit refund axing as much as possible but at the same time, continue our overarching investment philosophy of investing in great companies.

We want to reduce our portfolios franked dividends and take advantage of a more diversified portfolio again. Which means…

I kept the international part of our portfolio when we decided to focus on Aussie shares. And when the very real news of potential changes in franking refunds was mentioned, I felt such a huge sigh of relief knowing we still had some international exposure. I guess this just goes to show the power of international diversification. If one country stuffs something up, there’s plenty more out there so you’re covered… doesn’t really work if you’re all in on the one country though 😅

Given that I don’t think franking credits refunds will be there over the next 50 years (no refund for us basically means no credits at all). I would like to receive some income from international companies along the way. It’s not going to be as good as the Aussie yield, but it helps the situation and my sleep at night factor.

Also, with the help of capital gains, an internationally diversified portfolio according to almost every major study done of the subject, will reduce risk, volatility and increase safer withdrawal rates!

To LIC or Not To LIC?

This one’s quite straightforward. A LIC has to pay a fully franked dividend. An ETF does not. VAS, for example, has a franking % of around 70-80 % which means that part of the income is not franked.

As I detailed in my ETFs vs LICS article, they are so similar that we are basically splitting hairs when comparing the two. As such, the greater legislation risk associated with LICs to me has shifted my favour towards ETFs.

I want to make myself clear again. I’m still a fan of LICs. I love the dividends they produce and the two companies I’m invested in (Milton and AFIC) have goals that align with my own (to grow their income over time).

It’s just that A200/VAS are so incredibly similar but have the key difference in utilizing a trust structure and not a company. The legislation risk has tipped the scales in favour of ETFs for me moving forward.

This is purely a tax minimisation decision. It has nothing to do with changing the overarching investment principles (investing in great companies) or a shift away from Aussie dividends.

The FI Explorer wrote a great piece on a sceptical view of LICs which some of you out there have emailed me about. I agree with what is written in that article, always have. I never invested in LICs expecting a superior return. What I go back to is the mental aspect of investing. A lot of people who retiree will feel more comfortable living on a relatively stable smooth flow of dividends vs more volatility but a slightly higher return.

Strategy 2.5

Okie Dokie.

So here she is. The new…ish strategy moving forward.

It’s called 2.5 because it’s extremely similar to strategy 2 just with a few tweaks. It’s almost like we’re going back to strategy 2 and I didn’t think enough has changed to honour it with strategy 4.

Change 1

Firstly, with the addition of buying more international shares back in the plan, we will move back to a ‘split’ approach.

Our splits have changed slightly from strategy 2 with more of an emphasis on Aussie shares as the dividends are still attractive regardless of franking credits refunds.

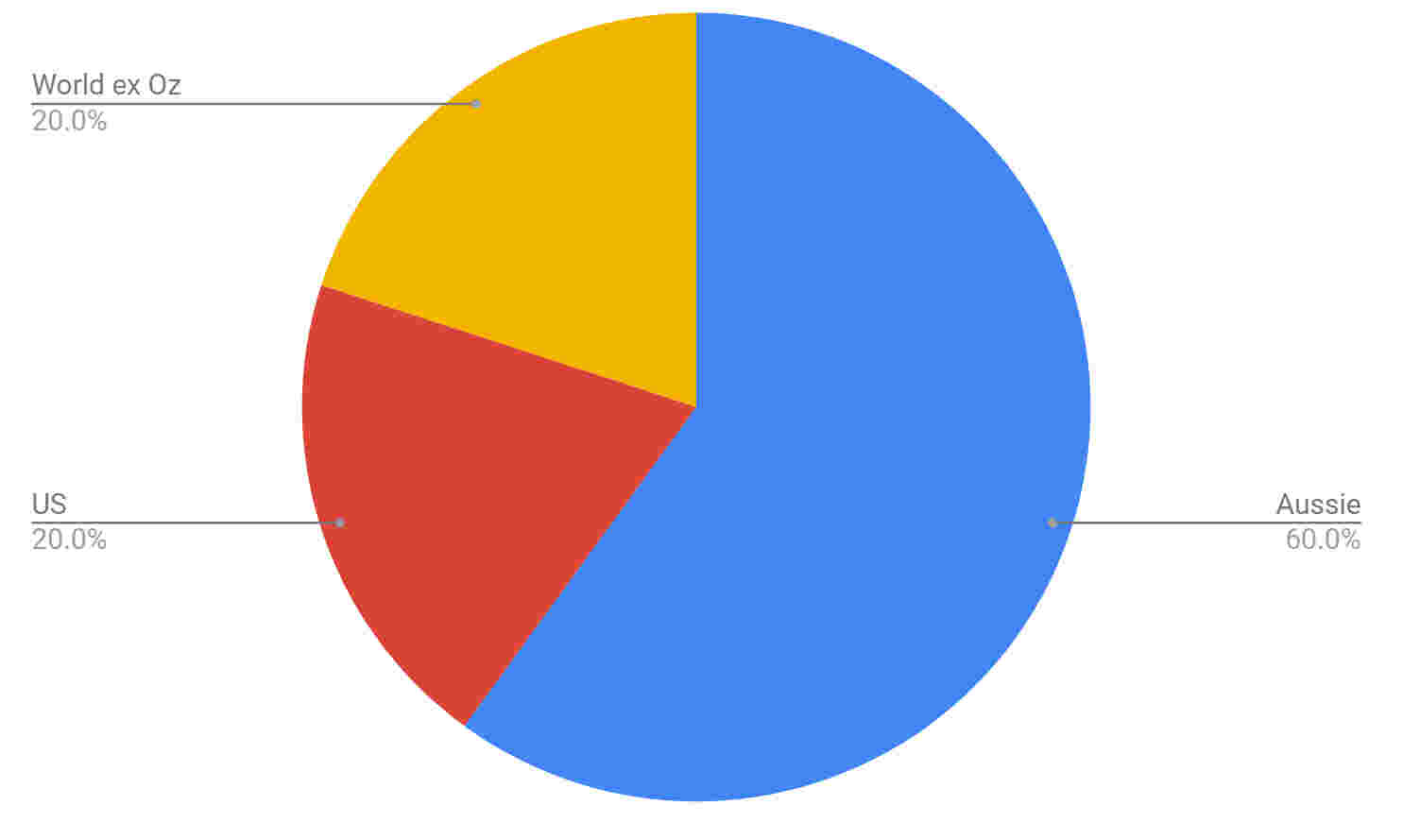

We will be looking to maintain a split of

60% A200/VAS/LICs (Aussie)

20% IVV/VTS (US)

20% VEU (world ex US)

We’ll keep our two LICs in the portfolio but won’t buy any more units moving forward.

The plan when buying new shares is a lot easier than looking at when LICs are trading at a premium or not.

Before we buy each month, we will look at the current splits in the portfolio and purchase the shares which have the lowest targeted weighting.

For example, this is what our portfolio currently looks like.

So next time we buy, it will be to ‘top-up’ the lowest split, which in this case will be World ex US or VEU. The splits are all out of wack because we focussed on Aussie equities during the last 12 months. Ideally, you want to be as close to your splits as much as possible. When your portfolio reaches a certain point however, the market movements will be so great that you might find it hard to maintain your splits even by buying the lowest weighting split. But this will be a good problem to have since your portfolio at that stage will be in the 7 figures.

Something really cool about this strategy is that you’re always buying the split that is down. If one split booms but the others don’t, you won’t be purchasing more of that booming split.

Change 2

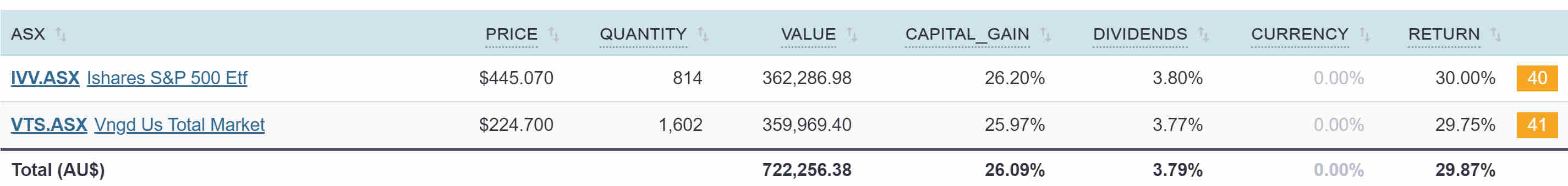

The second change we will be making is switching from VTS to IVV.

iShares Core S&P 500 ETF is extremely similar to VTS with a few differences but no major ones we’re concerned about. VTS is more diversified and 0.01% cheaper but is not domiciled in Australia and does not offer DRP. This means that we need to fill in the W-8BEN-E form every three years or so.

The W-8BEN-E form is literally 10 minutes of your time every 3 years and is often overblown in terms of effort, but nonetheless, the two funds are so similar that it’s worth saving the extra admin plus having the DRP option available which I’ve been looking to use as of late.

Here are their 10-year returns to just show how similar they are.

Change 3

The third part of the plan is a hybrid approach between relying only on dividends vs dividends and selling parts of the portfolio. IVV and VEU don’t pay a lot of dividends, but they still pay them.

IVV has returned 3.27% over the last decade and VEU has done 2.85%. Not great, but still cash flowing into the account. And more importantly, those dividends are unfranked income!

We will aim to not touch the portfolio and use the dividends from both Aussie and international shares to live on. If it’s a bad year, however, we will look to sell-off some units to cover the shortfall.

I’ve already gone into why selling parts of the portfolio is perfectly ok if you allow for it to recover in strategy 2. In fact, from a rational market point of view, there’s really little difference between selling units for income and having the company pay you via a dividend. In theory, both should have the exact same consequences. But markets are not rational so they vary to some degree and is a prime reason why we like the dividend approach more.

How It Works

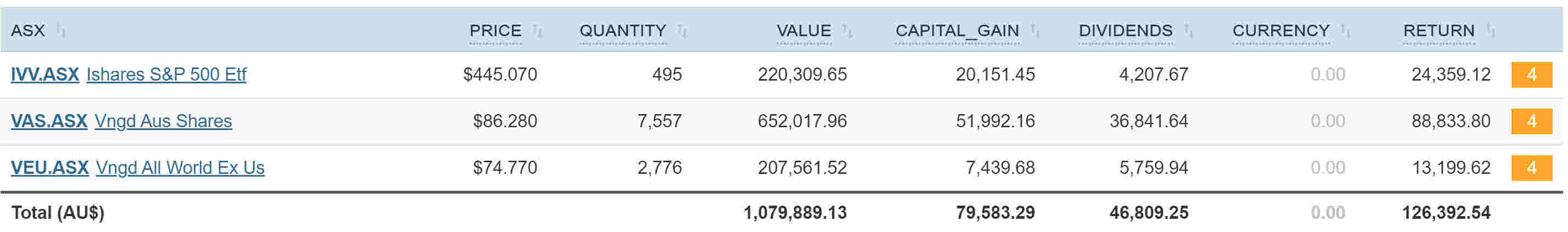

Let’s look at how the newly allocated portfolio would have done during the last 12 months. Here, I have created a dummy portfolio with all trades done exactly one year ago with the total of the portfolio’s value being a cool $1M which is what we’re aiming for.

Aussie equities (I had to use VAS to go back far enough) @ 60%

US (IVV) @ 20%

World ex US (VEU) @ 20%

$46,809 worth of dividends ain’t bad and is more than of FI number of ~$42K!

Bumping up the weighting of Aussie shares to 60% (it was 40% for strategy 2), plus the lower dividend payments of our international shares have actually generated enough income for us to live off during the last 12 months.

But this was a particularly good year for Aussie shares and it won’t be this good all the time. We will save any extra income during those good years to create a cash buffer in preparation for the bad ones that will no doubt come.

If it’s a particularly bad year for dividends, we will look at selling off some units to cover our expenses.

The other thing is that the likelihood of us not earning any money in retirement is extremely low. I’ve covered this in what retire early means to us in the context of FIRE.

I’m extremely confident that the dividends from a $1M portfolio that is weighted to 60% Aussie shares plus any additional income will be more than enough for us.

Selling off units is there as an option but I don’t think we’ll need it tbh!

Time will tell.

To summarise strategy 2.5

- An internationally diversified portfolio consisting of 60% Aussie shares and 40% international

- Buying IVV instead of VTS moving forward for DRP and Australian domiciled.

- Buying Aussie ETFs and not LICs due to risks associated with franking credits. ETFs don’t pay fully franked dividends and are impacted slightly less in the event of legislation passing.

Stop Changing Strategies Dude!

This is you

“Man, you flip flop more than my thongs! Stick to one strategy mate and stay the course. If the axing of the franking credit refund caused you to change strategies, you were never in it for the right reasons.”

And this is me

“Yo! The overarching strategy of investing in great companies has never changed. There was definitely a major difference between strategy 1 and strategy 2. But the fundamentals from strategy 2 to 3 and now to 2.5 are exactly the same”

The thing is, investing in great companies should always be the number 1 goal. All this other shit comes later.

The issue with picking the good companies from the duds is that it’s really hard to do. Which is why index investing is so cool.

The tweaks between our strategies are really fine-tuning our portfolio to meet our specific needs in the following areas:

- Mindset/sleep at night factor

- Simplicity

- Tax minimisation

- Mitigating legislation risk (something I hadn’t considered before)

I think everyone should be a bit flexible with how they invest to a certain degree. Picking one strategy and literally not changing anything during your whole life seems unlikely. Franking credit refunds are a great example of this.

And what’s to say the government won’t impose some stupid tax on other asset classes or something else within our life?

It would be ridiculous to suggest that if the government turned around and started taxing Aussie shares an additional 30% that everyone should just ‘stay the course’ and not look at alternative methods.

Everyone has their tipping point when enough is enough. And even though the refund remains, for now, I’m looking at protecting against this potential rule change without drastically upheaving everything.

I think strategy 2.5 is a nice balance between everything that’s important to us in an investing strategy.

Conclusion

I’m still learning as I go.

Judging by some of the emails I get, you’d think that I’m some sort of investing guru which couldn’t be further from the truth.

This years election taught me a valuable lesson that I hadn’t considered as much as I should have before.

The legislation risks for investing in general but particularly the very real possibility of no more franking credit refunds one day.

For us and I assume a lot of people chasing FIRE, franking credits without the refund in retirement won’t be worth the concentration risk or the ~4% yield (still pretty good) when you consider that you’re losing up to 30% of your return due to the additional tax that you otherwise wouldn’t be paying had you invested in something other than franked dividends.

Although not completely, Strategy 2.5 mitigates this potential change by re-introducing international shares back in the portfolio which reduces our reliance on Aussie dividends. It also makes other small changes as mentioned above.

When we made the shift away from property to focus on shares, the number 1 goal was to invest in great companies. None of this other stuff is as important as that. Index investing means we don’t have to research which companies are going to be good or bad. It filters that stuff out for us.

Because we don’t have to worry about choosing the good companies from the bad, we can instead spend our time to tweak our strategies so they align with what’s most important to us.

Mrs FB and I optimise the portfolio to improve these areas:

- Mindset/sleep at night factor

- Simplicity

- Tax minimisation

- Mitigating legislation risk (new)

Strategy 2.5 improves on all of these areas whilst not uprooting our investing fundamentals which is what any good tweak should do!

That’s it for now.

Let me know what you think in the comment section below 🤙

Spark that 🔥

The long awaited revised strategy!

You’ve touched on a lot of issues I’ve been wrestling with myself. I hold a combination of LIC’s and ETF’s with a higher weighting towards Australian shares but still with around 30% International diversification into VGS.

The majority of my Australian shares are in LIC’s but I’ve slowly been building up VAS in response. I think I will still continue to purchase LIC’s when at a large discount to NTA as I still like them but i’ll be purchasing more of VAS at the same time.

I’m sure it’s not the most optimal or simplest strategy but it’s what I feel comfortable with for now.

Thanks for the post! Was great to hear your thoughts on everything post-election.

Thanks Scott 🙂

I read the Barefoot Investor’s Idiot Grandson Portfolio the other day. I was fascinated that he wrestled with the idea of going 100% Aussie equities but decided to include international at 25% because of the risk of his idiot grandson selling Aussie shares for international ones down the track.

I might even bump up the Aussie part to 70% after reading that very detailed and research paper (highly recommend).

Your portfolio sounds very similar yet again and as I touched on in this article, the differences between all these slightly modified portfolios are really peanuts in the grand scheme of things right.

Much better to focus on savings and lifestyle creep!

Ahh yes!

I had a look at that report the other day (I might re-read through it again as its extremely detailed). I was surprised to notice his weighting allocation was very close to my own so that was a bit of a confidence boost that I might be on the right track.

Barefoot Investor’s Idiot Grandson Portfolio – Where can I read this?

Hey AF!

I love your approach staying dynamic and shifting with risk appreciation. I’ve been investing in AFIC for my kids at a slow pace and have just purchased their first international shares of IVV.

It will take a while to balance the ratios you’ve suggested but I am a keen follower of your pathway.

Thanks mate!

Yes the Idiot Grand Son portfolio does weight VAS higher, but from my understanding it is designed to automatically rebalance over 40 years to split approximately 65/20/15, with no meddling from the Idiot Grandson. This brings it more closely in line with your new 60/20/20 split. It is a passive rebalance, where as if you have the inclination yours is actively rebalanced. I expect the overall gains from the active portfolio to be higher than the passive over the 40 year window Barefoot uses. IVV does seem do be dropped from the final cut for no apparent reason that I can see rereading the report, so that may be an editorial error?

I heard some rumors Vanguard might domicile VTS in Australia.

https://www.reddit.com/r/fiaustralia/comments/cz0lq6/veu_vts_vanguards_intention_to_create_aus_domicile/

I’ve looked at IVV myself, but would rather go with VTS if its domiciled.

Oh nice!

I wonder if they could add DRP if it was domiciled in Oz. If they did that I’d stick with VTS for sure!.

I really don’t understand the mentalilty that once you’ve decided on a strategy you can never deviate from it. As you learn more about any given subject you’re likely to want to modify your approach, as legislation changes you may want or even need to modify your approach, as your circumstances change you may want or need to modify your approach. It makes no sense to rigidly stick to a plan if that plan is no longer optimal, or is unlikely to be at some point in the future.

I agree with you that sooner or later refunds for excess franking credits are going to be on the chopping block at some point. I also think that being able to stream income from trusts will go at some point as well, and no doubt changes will be made to CGT and the tax system as a whole. Who knows what changes will be made to superannuation but there are pretty much guaranteed to be a bunch. You need to remain flexible with your plans because things will change over the years.

Personally I’ve decided not to go ahead with creating a family trust. Although there are a bunch of benefits to it and it doesn’t look like there are changes coming anytime too soon it’s going to be a while before we would reap the benefits of having one, we have the upfront and ongoing costs in the meantime, and I think its likely that sooner or later the ability to stream income which would be the main benefit to us is going to go away. I’m still sticking with my asset allocation, despite my belief that changes will eventually be made to the franking credit system as I’m going for HIFIRE (none of this unhealthy sounding FatFIRE stuff) so I’ll be able to use the franking credits to offset more tax and as I have a more diversified portfolio anyway I receive less franking credits percentage wise than what you’re looking at. But if anything changes on that front, then changes will be made to my strategy as well. Nothing is set in stone.

One thing you prioritise is the mindset/sleep at night factor. You’re at the stage now where a 1% swing in markets is about $4k up or down on the day, how have you coped with this or do you just not watch it much? And how do you think you will cope when the dollar amounts of the swings are much larger? Would you consider diversifying the portfolio into other asset classes at that point to reduce volatility?

Good points.

I wouldn’t have bothered starting a trust if I could go back in time. Overcomplicates things and isn’t really necessary to reach FIRE. We’re already set one up and have invested time in how they work so we’ll stick with it for now.

It would be interesting to see a change to the trust distributions but I think it will be a long time before it actually happens. Political parties will no doubt continue to campaign on the promise of stopping it but actually getting it passed as law is a lot harder. Especially when the rich and powerful use it.

Market fluctuations have never bothered me funny enough. Even when we were down around $11K in one week earlier this year, it didn’t bother me one bit. The power for the dividend approach for me is I feel extreme comfort knowing that market fluctuations do not affect how many units I own in an ETF/LIC. And as long as I continue to amass more units, I will be one step closer to our goal of financial independence!

I’m always interested in new ideas and other asset classes.

Maybe at some point in the future, I’ll consider adding in something other than equities.

Cheers HIFIRE

I think a lot of the FIRE community makes a few very dangerous assumptions that things will basically continue as they are ad infinitum. And as a result are poorly diversified.

Tax treatment is one example. Expected returns are the other big one. The long bull market in equities won’t continue forever. The AU property market will (hopefully) fall dramatically at some point.

While my overall strategy is similar to yours (invest in great companies) I do a couple of things differently:

1) target a 25/25/50 split AU/US/Asia

– AU market is small and not very diversified so I bias heavily internationally

– I’m currently AU/VTS/VEU/VAE roughly equally so there is some european exposure in the mix. I’ll be holding VEU rather than expanding though.

– I’m overexposed to China-US risks am thinking about adding African and expanding European exposure

2) It’s heresy but within AU I am mostly actively invested (5% VAS, 20% active)

– I think the ASX200/300 is way too exposed to property and finance. AU housing market is bonkers, will come under demographic and tax pressure. The banks mean the ASX200/300 is heavily correlated with property.

– I look for micro/small cap stocks with growth potential. This adds a degree of risk and effort. FIRE is psychological though and I enjoy investing so I think a relatively small active component is OK.

VEU is the world ex US not AUS.

Also I can’t understand why you would use the DRP in your situation. Since you buy shares all the time wouldn’t it make more sense to redirect the funds in line with your splits instead?

Good catch, I’ve updated it now.

I use to like seeing the dividends hit my account each quarter for mental kicks. But having the reinvestments automated is a nice feature that I’ve been thinking more and more about. It’s not a big deal but it’s a bonus if it’s there vs if it’s not.

It’s horses for courses.

People chasing FIRE are going to have vasting difference portfolio allocations to someone who is looking to retire more around the traditional age of 60.

I’d say that 95% of FIRE people have more diversification than most Australians simply because they invest in something other than real estate.

Thanks for the comment DG86

Cheers

I’ll be moving to UK in November would be good to hear more about how you’ve adapted to life there and to catch up in Nov.

Sweet dude! Yeah drop me a line and we’ll catch up for sure.

I’ve had the Oz-UK post on the back burner for a while. It’s a pretty big one but there seems to be a lot of Aussies that make the move over here so it should help a lot of people.

Also looking to move to the UK in 1-2 years. Interested in an OZ-UK post for sure.

I think it’s great that you are reviewing your strategy as more information comes to hand and as your own priorities change too. Thanks for sharing your thoughts on this and I also read the idiot grandson portfolio so you are obviously on the right track 🙂

Thanks Emily,

Won’t lie, it is extremely comforting to see that Scott Pape has recommended a portfolio that is incredibly similar to one I’ve had since 2015. I’ve read that report and it’s very detailed with hours and hours of research put in. I also loved the psychological aspect of his decisions in the report.

Cheers

Scott Pape is a legend and deserves to be voted for the Australian of the Year award. He may not know yet but with his books and information shared via Blueprint and newsletters have saved many lives/families.

It’s worth to mention that Vanguard ETF’s are not for profit hence their MER cost will come close to nothing soon.

Hey mate great article! Keep em coming. Two questions:

1. In retirement how do you intend to keep your portfolio balanced if you keep living off the heavily weighted AUS dividend portion of your portfolio surely this will grow much more slowly (in total value) than international and put your weightings out of whack when you aren’t purchasing more etfs anymore?

2. You mention articles on weighting AUS even higher than your 2.5 strategy can you link theses? I just think everyone is too Australian biased and have mine at 50/50. Happy to be shown data otherwise.

Thanks!

No worries mate, I’m trying my best to keep these bad boys coming 🙂

1. Very good point. Once the portfolio reaches critical mass… do I even worry about rebalancing? I understand that rebalancing is optimal for total return over the long term. But I don’t know if I even care about that once I have enough to live off.

Something I forgot to mention in the article is that I would like to build up a lot of ‘dry powder’ before stopping work and venturing into other areas. I’m thinking around a year of living expenses in cash. This will help immensely with not having to rely on drawing down the portfolio.

So for our situation and circumstances, I’m not sure that it’s that big of a deal if the weightings get all out of whack once we have reached FIRE.

Happy to hear from others about this point though as I may have missed something.

2. Which part of the article are you referring to here mate? Or are you referring to the Barefoot Investors ‘idiot grandson portfolio’?

Cheers

Makes sense if you have a big enough cash cushion and still work it probably won’t matter.

For 2, yes I mean your comment “I might even bump up the Aussie part to 70% after reading that very detailed and research paper (highly recommend).”

Keen to understand how that high weighting can be a good thing. If Australia tanks into a bad recession wouldn’t it be better to be internationally diversified?

The paper was from the Barefoot Investor which is a paid subscription only I’m sorry, so I can link to it.

Of course, it would be better to spread the risk around if Australia tanked, but investing is more mental than it is returns. Aussie dividends are a powerful psychological tool in this sense.

You really need to read the whole report because it explains it way better than I ever could.

I like that your articles are well researched and reasoned.

Do you think you’d have a different strategy or asset allocation if you were single?

Hi Kat,

Nope. The allocation and strategy would be the exact same. I’d keep building that snowball largely with Aussie equities for that great dividend stream with some international exposure to hedge against concentration risk.

Seeing the increase in dividends the snowball spits out year to year is truly addictive!

Cheers

Are you switching on the DRP?

Thinking about it. Got any cons against it I may have missed mate?

I like seeing the fund in my account (feels like a little win) but both do the same thing really.

Won’t you get stung with brokerage if you don’t have drp on?

The biggest con in my view to DRPs (an enough to make me switch them all off a decade ago) is the increased admin burden when it comes to calculating your Capital Gain when you sell. The ATO requires the purchase price of shares be recorded for the purpose of calculating your capital gains tax (CGT) liability. If you hold shares in a company for 15 years and it issues dividends twice a year, you would need to keep track of 30 separate transactions for tax purposes – just for one company.

Less of an issue for you, as you seem to be in the buying phase, but eventually you will want to sell something…

DRPs are great for people that might be tempting to spend the cash on something other than an investment though!

https://www.asx.com.au/education/investor-update-newsletter/201409-pros-and-cons-of-dividend-reinvestment-plans.htm

Eric, my thoughts exactly plus the lack of control over the buying price and the money that is held back in trust if the number of shares doesn’t align with the dividend.

Hold ~$20k of IVV and you’ll be issued 1 share per year.

Good stuff firebug, keep the articles coming. Nothing wrong with improving your strategy to maximise future returns.

Thanks Dave, will do mate.

Regarding political polls: Don’t believe them.

1) They are done with very low budgets and therefore are using smaller and smaller samples which make them increasingly inaccurate.

2) If a poll has a different result to the majority of other polls the researchers think they’ve made a mistake so they tweak their weightings to align with the other polls. None of them want to be outliers.

Bela Stantic from Griffith University tracks social media postings via Big Data analysis and some very tricky algorithms. He predicted Brexit, Trump and Scomo/LNP. That’s the type of research that you should track in the future if you want an indication of what the electorate is thinking.

The government will always change the rules. In my 40 years employment they’ve changed tax, superannuation, investment deductions, franking rules, CGT, etc so many times that you learn to roll with it, re-assess and make some changes.

I was once told by someone who works in statistics that if done right, polling a small percentage of the target audience can be very accurate. But as we know, man o man they have got some big ones wrong lately.

I’ll take a squizz at Bela.

Cheers

Yes. Very accurate if done right but that takes money and the agencies / commissioning companies are trying to do it cheap with robo-calls, small sample groups, etc.

I won’t do a survey unless I get paid AND it takes less than 5 minutes.

Have you considered something like WDIV (https://www.ssga.com/au/en_gb/individual/etfs/funds/spdr-sp-global-dividend-fund-wdiv) for a portion of your international stocks?

I have looked at it in the past but haven’t pulled the trigger because of the MER (0.5%). But curious to hear your thoughts (and others)?

Hi Matt,

I briefly owned something similar, the Betashares Aussie Dividend Harvester (HVST). It did as the tin said and paid me something like 13% dividends in the year I owned it.

Unfortunately it lost 13.5% in capital value, so a negative total return! I hadn’t realised it rebalanced every 2 months to pick up the top dividend payers, so lots of transaction costs, and capital losses, on top of the already steep fees.

Peter Thornhill covered this in his book I think. Stick to the index funds, in the long run it’s a far better total return. 😁

Hi John,

Yeah that is my attitude to most of the “high dividend” funds too.

But WDIV seemed a bit different from my research. It only invests in companies that have had increasing or stable dividends for at least 10 consecutive years. As opposed to just investing in companies that have a high yield right now. I think this naturally tilts you towards higher quality companies (similar to some LIC’s that try to increase your dividends consistently over time, but for international companies in this case).

For WDIV, this has resulted in 4.30% growth since inception (2013) and 5.59% in distributions. This seems a lot more balanced than most “high dividend” funds.

Anyway, it’s starting to seem like I’m spruiking this product when in fact I don’t even own it (it is on my radar however). I just wanted to point out the differences I can see from other “dividend” funds.

Thanks for your article, always interesting to read what you have to say.

I note that you’re now in London now. Are you able to tell us a bit more about how that affects your FIRE number if you decided to stay? You probably won’t stay given how good Australia’s healthcare is, but I’m interested in knowing how it affects you.

Will you be writing an article on using Trust in the future and when it’ll be worth it to considering getting it accounting for the upfront and ongoing costs? Kinda in two minds about it.

No worries mate.

Yeah we are definitely coming back. Most likely at the start if 2021 when our working visa runs out. It doesn’t really affect our FIRE number too much because we’ll be returning back to our home town where we have a pretty accurate number of what our lifestyle costs there. It’s a bit all over the shop here in London as it’s only temporary and we’re trying to see and do as much as possible.

I have written an article on trusts before but it’s well and truly due for an updated one. A lot has changed with my thinking.

I’ll add it to the list 🙂

Great writing AFB – please do write article on trust and structure. I am not sure whether to build the portfolio under joint account (me and my wife) or company or trust? What are the tax implications once we starts drawing the fund or get dividends?

Please do a series of posts 🙂

Hi Dave,

I already have an article on Trusts but it’s a bit outdated and my views have changed since I published it. Maybe an updated article is due 🤔

Leave it with me mate and I’ll add it to the list!

Hi Aussie Firebug, I love your content and you are smashing your net worth goals, you’re a big inspiration.

A company’s board have several options as to how they distribute their profits, ie dividends, share buybacks etc. How they distribute is essentially dependent upon how they can get the most money to their shareholders after tax. So if the tax rules change, they change how they distribute the money. This is why different stock markets around the world have different dividend payouts as a ratio of profits.

So if franking credits are given the chop by the government, boards will find a way around it.

That’s true Adam.

But surely most Aussie companies wouldn’t be able to keep the high dividend yield if franking credits as a whole disappeared? It wouldn’t make dividends very efficient right? And if that ever happened, the attraction for Aussie dividends would be lost for me and there would be no reason not to allocate more to international.

Always interesting to see what your thoughts are.

I always have a laugh when I think of the unlosable election. Everyone was so sure that Labor would win. I wasn’t so sure and put a little money on Libs to win. Luckily for me it came through. Eitherway, that would have to hurt Sportsbet surely, who am I kidding? A million is nothing to them.

Anyway, looks like a solid strategy. I hope it all works out for you. Keep up the great work.

Yeah, 1.3M is a drop in the ocean for those guys but still.

Good to see you are going more international 🙂

Ps.

“VEU (world ex AUS)”

“World ex Oz (VEU) @ 20%”

“in this case will be World ex Oz or VEU”

VEU is the world minus VTS (which is the total US market)

5% of VEU is Aussie shares

Ben Felix – The Irrelevance of Dividends

https://www.youtube.com/watch?v=f5j9v9dfinQ

Hi Matt, great read and podcast, isn’t VEU also US domiciled meaning you’ll need to fill the W-3BEN form every so often as well?

Will you pick something similar then as you are from VTS to IVV?

Cheers,

K

Yep.

Haven’t found a good replacement for that yet.

But as others have pointed out, there’s talk of both of those funds become Aussie domiciled which would solve a lot of issues. Maybe I’ll wait this one out a bit.

Updated/fixed.

Thanks for pointing that out.

No worries. Pie charts still say “ex OZ” too btw

Yeah I cbf editing that picture lol.

Hi AFB,

Legislative risk is always present. I remember when the Hawke Government released its white paper (which lead to the introduction of CGT and dividend imputation, amongst others). Prior to 1985, people were interested in capital gains (speculation) rather than seeking income in form of dividends because capital gains attracted 0% tax whereas corporate earnings suffered from two layers of taxation – 49% at company level and as much as 60% at the shareholder level. The reforms were designed to change investor behaviour – by encouraging investment in productive enterprise rather than capital speculation. Similarly, the changes made to super in 2007 encouraged people to maximise the amount they put into their retirement savings. If you studied the tax changes to super over the last decade, you would realise that successive governments have clawed back a lot of the benefits arising from the 2007 changes without a lot of fuss. What makes the franking credits situation unique is that the opposition went to an electorate with this high profile policy stance. I would have thought the Labor Party would have learnt the lessons of history (Hewson’s GST policy debacle of 1993). My point is that legislative risk is always present and therefore, investment decisions should never be based on tax outcomes (e.g. negative gearing).

Great points steve.

I agree that investment decisions should firstly not look at tax and rather be focussed on the best companies/properties/whatever you’re investing in.

But do you think decisions can be made afterwards for tax minimisation purposes and other benefits?

Great article AF. I appreciate your work and was interested to read your new 2.5 strategy. As we learn more, we are entitled to alter our strategies to maximize our gains. I also read the latest Barefoot IG portfolio and was interested to see him not have any LIC’s in it. My current portfolio has a 70/30 split with 70% Aussie LIC’s and 30% VGS. But I am now considering including VAS and VEU in my portfolio and maybe moving it to a more 60/40 split. Keep up the good work.

Thanks Glenn 🙂

Could you just invest in VDHG and just let the big boys rebalance for you?

For the greatest simplicity, I think this makes a lot of sense. Yes the fee is a bit higher at 0.27% and yes it is 90% equities (vs100%) but I do like it.

Yeah that’s what I’m doing and later you can add bonds which should make a nice two fund portfolio.

Yes.

Cons: higher MER, and less control over CGT when in drawdown.

Pros: protects against negative behavioural effects.

Yep. And that would be a great strategy for a lot of people. I prefer a touch more control over the weightings.

VDHG and VDGR are great investment options for kids. The current MER of 0.27% will go down as Vanguard is not-for-profit management. I will personally invest in VDHG for one of my kids.

I have been trying to decide on our strategy for a few months now. Scott’s suggestion was a great read and I’ve been eagerly waiting to see what you had to say as well.

I’ve been looking into IWLD as an option for a domiciles whole world ETF in place of VEU/VTS. Any thoughts on this?

IWLD looks solid. I think I’d come across it before as it looks familiar but I had never looked into it too much. I’m thinking now that I’m going to wait a bit as there are talks of Vanguard turning VTS/VEU into Aussie domiciled.

Thanks Fire bug, great article.

I have also read the Idiot grandson portfolio.

My main holding is the Lic DUI, for the very reason it has a slither of international equities.

Once my portfolio grows larger will probably add international ETFs, for the sleep at night factor.

Once again Great article mate, came at a perfect time.

No worries Heath.

I would also want a more diversified international portfolio. As you say, you can always sell units rather than rely on dividends.

Interesting stuff mate!

I also heard Vanguard may be redomiciling VTS/VEU so maybe hold off on that? Don’t wanna end up with more holdings than you need.

Just FYI, the Sharesight calculator includes franking credits, so keep that in mind – the portfolio example will have lower cash dividends in reality with franking removed. A 60/40 Aus/Int portfolio is likely to have a cash yield of around 3.5% before franking (assuming Aus yields 4% and global yields 2-3%).

Haha I got a chuckle from the ‘guru’ comments. At the Sydney FIRE event, Pat and I openly stated as much to the crowd (that we’re still learning and we probably know less than you think lol!).

Nothing at all wrong with your approach. Our international is held inside super and it’ll keep growing while we live on the Aus portfolio, meaning the allocation will increase over time without doing anything. That’s what we’re happy with at the moment. As you know, no one size fits all 🙂

Good points Dave.

DUDE, I watched the YouTube clip of you guys. Everyone on stage was fantastic!

Great representation of the Aussie FIRE community 👌

Now tell me the truth… how many beers to did you have before you got on stage? 😂

Will be good to catch up when we’re back in Oz.

Haha thanks man. Hmm, how many…. it was just a couple! Enough to relax us but not too many that we start talking nonsense 😉

>Our international is held inside super and it’ll keep growing while we live on the Aus portfolio

Hi Dave, do you run your own SMSF to give more weight to international intentionally? Or is that just the way your super fund is managed already? Either way, that makes a lot of sense to me too.

Hi Dan. Nah no SMSF, just a low cost industry fund (SunSuper). It’s setup as 100% international index on purpose, as our personal portfolio is 100% Oz. Cheers.

Interesting post, I continue to wrestle with the same question regarding domestic/international split. I’m currently going for 80:20 domestic because I’m pursuing a debt recycling strategy which is more effective with a high dividend yield.

You mentioned in a few places that if refundable franking credits are abolished in Australia, it becomes more tax efficient to invest overseas. I don’t quite understand this? There are no refundable franking credits (or any franking credits) in overseas markets, so you are similarly pre-paying the company tax rate in those jurisdictions and not getting it back…?

Bob, you are able to claim Foreign Income Tax Offset for overseas income.

However it is limited, and non-refundable. So it can reduce tax payable for a tax payer, but not so effective for a low income earner or retiree on a low tax rate.

To calculate the limit is a bit tricky. (I leave it to the accountant 😉

https://www.ato.gov.au/Individuals/Tax-return/2018/In-detail/Publications/Guide-to-foreign-income-tax-offset-rules-2018/?page=3#Calculating_your_offset_limit

Hi John, my understanding is that the foreign tax offset allows you to claim a credit for any personal income tax withheld overseas. It does not allow you to claim a credit for any corporate tax paid by the companies you own shares in (as franking credits do)

Foreign Income Tax Offset works the same as franking credits.

The system is designed to recognise the tax already paid overseas (with the 40 countries we have a tax treaty with), and avoid double taxation.

Ie. for US dividends you claim the 15% withholding tax charged to non-residents. (30% if you didn’t sign the W8-BEN).

Hi Bob,

The big difference is that the majority of returns from overseas are done through capital gains where some companies don’t pay dividends at all. My understanding is that because the tax system is less efficient to receive the growth as a dividend, most companies will pour the money back into the company which theoretically means the stock price will grow.

Australia is different because we have imputation credits which means it’s efficient for shareholders to receive dividends.

If you take away the credits (no refund for us basically means no credits), it means we are taxed 28% on our dividends (using the example above) which is a lot less tax-efficient than choosing to sell down units from international shares.

If franking credits were ever to be removed though, Aussie companies may opt to not pay such a high dividend and offer share buybacks. A lot can change and no one really knows.

Just my thoughts.

Any thoughts on the below for your strategy?

https://blog.stockspot.com.au/compare-lic-vs-etf/

Baz, that article is let down by the fact the author compares LIC and ETF performance over it 5 years for domestic and 1 year for international!

It is impossible to draw any conclusions over such a short time period. While the author is certainly correct that the majority of LICs underperform, the large low fee LICs have a long-term history of tracking the index.

I agree with Bob.

Sort of pointless to compare over 5 years.

Hi AFB,

Great article mate, love to read your content.

This may sound like a silly question but it has been on my mind lately, inflation.

Using your yearly expense figure of $42k as an example, if inflation is similar over the next 30 years as it was for the prior period you would require ~$95k per annum in 2048 (source RBA calc).

How will withdrawing $95k p.a. in your late 50s affect your overall portfolio? Do dividends increase to offset the inflation?

I appreciate there may be a perfectly simple answer to this that I just need to get my head around and would love to hear your thoughts.

Thanks again,

Tom

Hi Tom,

No such thing as a silly question, especially when it’s a great one!

You’re correct that inflation means our 4% we need will increase over time. So yes, that $42K will turn into ~$95K in a few decades.

But to keep things simple, we use today’s dollars and then factor inflation into our numbers. Most people do this.

So let’s say we think our investments are going to return 8% over the long term, we can remove 3% (as an example) for inflation and say our real return is going to be 5%. Withdrawing 4% through either capital gains or dividends will mean that we have a safety buffer of 1% and in theory our portfolio should, in fact, grow over time by 1% in real terms including inflation!

We also need to factor in tax within that real 5% of growth but that’s really hard to do because everyone’s circumstances are different.

Hope that makes sense 🙂

-AFB

Great article Firebug. Is there any more information going around about the VTS/VEU redomiciling to AUS? I did read this somewhere but thought it may have just been a redditor’s wishful thinking. I have emailed Vanguard in the past however they are keeping a very tight lid on any potential changes they are making.

Thanks Chad,

No more info, unfortunately. If you do hear anything, please let me know. Vanguard can be tight-lipped and they take a while to respond to changes in the market. iShares IVV converted to Aussie domiciled last year so hopefully, they get around to doing it sooner rather than later. It took them a while to lower VAS’s MER to be closer to other competitors after all…

Hey AFB,

Thanks for the post and offering such a transparent look at your thinking and reasoning! Regarding the move to IVV over VTS, is it not better to stick with VTS purely as the share price is lower and you’d get more bang for your buck? Am I missing something here?

Thanks again,

Tom

The way i read it:

IVV is the S&P500 (top 500 companies in the S&P)

VTS is the total US market – around 3600 companies

So they are 2 different funds with a different investment mix.

Apologies if I have this totally wrong

Hi Tom,

No worries mate 🙂

A share price is an arbitrary number. What do you mean by ‘bang for your buck’?

Cheers

Hi AFB

Thanks and congrats for all your great articles.

Not sure if this has been asked but what are your/others thoughts on VTS/VEU possibly becoming Australian domiciled like VGS has. Will it happen? If your structure was different and you were investing in your own name would you have a plan or instructions to sell US domiciled funds upon your death because of estate taxes? Cheers.

Hi Paul,

Good question.

I’m a lot different than most when it comes to this stuff. I recently answered a question about leaving behind a legacy in one of my AFF here.

In a nutshell… I don’t plan to leave my kids the portfolio and if I’m being honest, the entire snowballs purpose will be to grant Mrs FB and I’s financial freedom during our lives. I’m not too concerned about what happens to it after I’m gone. I would love for my own kids to become FIRE before I kick the bucket and for the portfolio to go to a charity I’m passionate about.

I know a lot of people don’t like the idea of Uncle Sam potentially getting some of the snowball through taxes but I don’t even think or care about it. I’ll be gone by then.

I’ve got a million other things I’d worry about before this issue. And if it’s something that does bother you, try out IVV which is domiciled in Oz.

Cheers

Hey AFB,

I am a new investor and looking to invest a bulk amount around 50k to get the ball rolling

I’ve loved your blog and strategy posts! Clarified a lot of my own research on IVV for US and the ETF vs LIC debate.

Strategy 2.5 aligns with what I am thinking at the moment.

My main question is around a bulk investment and timing in 2020. I am comfortable with the long game strategy, but not experienced enough to know what might happen in the next 6-12 after a strong bull period.

Probably the million dollar question….?

Whether to wait for a flat period or correction, OR get the money in ASAP.

Wondering what your timing strategy is on ETF?

Thanks for your time!

Blake

Hi Blake,

My views have always been that it’s almost impossible to time the market.

There’s a good quote that goes along the lines of:

‘The best time to invest was 10 years ago, the second-best time is now’.

No one knows what’s going to happen and funnily enough, if I were to guess, we’re probably going to get hit with a big correction within the next 24 months. But that’s pure speculation and when investing for the long term, it doesn’t matter as much as you think.

So with all that being said, I simply invest each month and concentrate on other things.

Hope that helps 🙂

HI guys,it is the new year 2022 – I like reading the historical replies here. There was no correction. In fact we smashed the high limit in the US and also here in Aust. So therefore – better ‘time in the market’ NOT timing the market.

Hi AFB,

Hope all is well in the UK.

Quick question – I know you are a fan of debt recycling, but haven’t implemented it (yet maybe), but wondering if your strategy would change again if you were to start it? Would your splits change? Would you start to buy LICs again?

Maybe it wouldn’t, but considering the idea is that you put your dividends straight back onto the mortgage, to then lower the debt and borrow more (so effectively you want strong dividends) – I am guessing it might be more effective to then basically implement strategy 3 again?

Cheers

Ryan

This is such a hard question and one I get asked all the time.

Hindsight is 2020, so if I could start again knowing what I know now. I would have invested everything into Bitcoin and Tesla stocks back in 2012 😁

But that’s not how this works. So realistically, when it comes to shares, I’d probably just stick to the simple 3 fund portfolio (A200, VTS and VEU). But I’m always learning and evolving.

Needs and wants change over time. There is no perfect investment strategy because people have different risk tolerances, investment horizons and stomach for volatility.

Hope that helps,

Cheers

Thanks mate.. yep a crystal ball would be nice.. I guess you do own some Tesla shares anyway through VTS…😁

I do have a long term horizon and comfortable if there is a significant drop.

I am leaning towards putting the lower yielding international etfs in my name (higher income earner) and higher yielding etfs/lics in my wife’s name (much lower bracket).. read a fair bit about that idea on Reddit, which seems to make sense to minimise tax (just need to make sure the loan splits are in the same names)

Just can’t decide on the lics vs A200 bit, but I’m probably just splitting hairs… Have read through all the articles though you have posted, so thanks for your hard work on this as always , been helpful

No worries mate 🙂

Hi AFB,

Love your content!

I have a question in regards to your investing. How often do you buy your shares? Are you reaching a certain dollar value (e.g $5k) and then buying….. or are you buying at specific times throughout the year (eg every quarter)?

Would love to know 🙂

Thanks heaps!

Sam

Hey Sam,

We shoot for a minimum of $5K once a month.

Lately, we’ve been fortunate enough to be able to invest more than this because we’ve been earning a decent amount of money plus I had a lot of money left over from the sale of IP1 which we’ve been DCAing into the market over the last 18 months.

There’s no particular day I put the buy order in. I’ve stopped watching the markets. I just pick a day towards the end of the month and buy the next lot of shares.

Hope that helps 🙂

G’day AFF,

Did you still end up committing to IVV? Or decide to stick with VTS? I noticed in your monthly updates you don’t seem to have IVV, but have been unable to find any literature you might have written explaining why you decided to stick with VTS.

Cheers mate.

Hi mate,

I haven’t had to buy the USA split in years (because it’s performed so well) but when the time does come. I’ll probably stick with VTS because I’m still waiting to on Vanguard to switch VTS and VEU to be domiciled in Australia. If it doesn’t happen… ahh who knows. Maybe I’ll just put up with the W-8BEN form every 3 years.

Hi Aussie Firebug,

Hope that you are well.

Thanks for the information. I’m quite new to FIRE and have found your blog and podcast very useful and informative.

I was wondering if you are still sticking to this strategy. And does it mean you take out your dividends instead of reinvesting them?

Apologies in advance if you have mentioned it somewhere.

Kind Regards,

Kenneth

Hi Ken,

Yep still sticking to this strat. We reinvest our dividends and are currently aiming for a portfolio that’s made up of 70% Aussie equities and 30% international. There’s no scientific reason for that split, it’s just what we feel comfortable with. Plenty of people have different weightings for different reasons.

Cheers

Thanks, AFB. Does that mean you would only switch to collecting the dividends once you are prepared to retire?

Correct!

Hey AFB!

I’m 21 years old and have been reading your website/researching for a while now but just nervous to get started in investing!

My plan is to have a 70% Australian to 30% international split. Since I am brand new do you thinks it’s worth even going for Aussie LICs? I’m thinking of just sticking to A200 and VAS as I read in one of your previous comments that if you could start again you probably wouldn’t bother with LICs! Also, I know a portion of your portfolio is VTS and in strategy 2.5 you intend to make a switch to IVV – if you were in my shoes and starting fresh, would you even bother with VTS and just stick to IVV?

Your help is super appreciated! Keep up the amazing work and hope you and Mrs. FB are staying safe!

Julian

Congrats mate.

The hardest part in investing is just getting started. You’ll figure some stuff out as you go.

For simplicity, if I were to start all over again I think one of the following would be perfectly fine to reach financial independence in Australia. VDHG (the easiest), A200+VGS (second easiest), A200, VTS, VEU (has added complexity due to W-8BEN form but not a huge deal).

I still have hope that VTS and VEU will become Aussie domiciled eventually.

But the main point is to just get started honestly.

I agree. I see too many people wanting to get it right from Day 1 and simply wanting to follow an investment recipe.

As you educate yourself you will want to tweak your strategy.

Personally, I would turn on DRP until the distribution was enough to give a meaningful number of shares. Early DRP will be regretted further down the track when sold. I’ve just done a tax return for a friend where there was 300 “purchases” of 1 share from an employee bonus share scheme. It was a bit of a nightmare as the record keeping was less than perfect.

What I seem to understand from the reading I have done (ATO and ETF tax guides), Is that ETFs can distribute you less money than they attribute to you but you have to pay income tax on the amount they attributed to you. So you are paying income tax on money you didn’t receive.

So say the grossed distribution amount is $120 but you only get $100 but you have to pay tax on the $120, they give you $20 as an increase to your cost base so you save tax on CGT if and when you sell.

They say they give you the money you didn’t receive to you as AMIT increased cost base which reduces your CGT tax if you were to sell. I just can’t see how that works.

So effectively if you are holding ETFs for long term, you can be paying tax on money you have not received because AMIT ETFs are not required to distribute all their income anymore. I don’t see this talked about anywhere in the fire community? What are your thoughts on it?

Hmmm not sure on this one Whit. Are there any articles you can point me to for further reading?