Something bizarre is happening and I have no idea why.

It’s to do with the Franking Credit changes that Labor are proposing to make if they win in this upcoming election.

This article is not going to go into whether the changes are good or bad, or even a technical breakdown of the franking system and how it works. In fact, the target audience for today’s article are people who understand the franking system and what the changes propose to do.

What I’m going to cover is the strange phenomenon I’m seeing more and more of as we inch closer and closer to the election.

Let me introduce you to ‘The Curious Case of Franking Credits and The FIRE Community’

What’s Being Said

Assuming that you’re up to speed with the debate at hand, I’m going to go over the most common arguments I’m seeing online and give my take.

“Franking was introduced to stop double taxation not to give refunds. Howard–Costello changed it in 2000. It was never meant to have refunds”

The reason that the franking system came about in the first place was from an independent review into the Financial System in the 1979 commission by the Fraser Government. This resulted in the ‘The Campbell Report’.

The fundamental principle behind dividend imputation is to ensure that income is taxed once by those obliged to pay it.

If someone does not receive the franking credit when their tax obligation is zero, they have paid additional tax when they should not have. This means that they have paid more tax than others who earn the same amount but through other means of incomes such as rental, PAYG, sole trader business, bonds etc.

For example:

- Person A works part-time and grosses $16,000 a year. They are under the tax-free threshold and don’t pay any tax.

- Person B operates a small sole trader business that nets $16,000 a year. They have no tax obligation.

- Person C is retired and owns part of an Australian company through shares that bring in $16,000 a year. Person C receives a fully franked dividend of $11,200. Person C at this point has effectively paid $4,800 in tax on their $16,000 income. Under the current law, the ATO refund the $4,800 to keep things at an even playing field and treat all income fairly no matter how it was earnt.

If you remove the refund, Person C has to pay $4,800 in taxes when they are only receiving an income of $16,000.

Now back to the point.

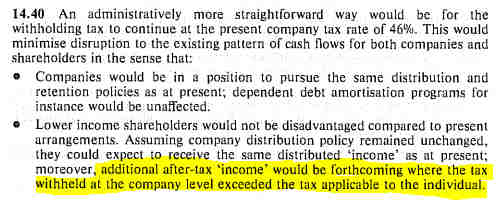

The Campell Report did, in fact, have refunds included in it!

“Lower income shareholders would not be disadvantaged compared to present arrangements. Assuming company distribution policy remained unchanged, they could expect to receive the same distributed ‘income’ as at present; moreover, additional after-tax ‘income’ would be forthcoming where the tax withheld at the company level exceeded the tax applicable to the individual.”

AKA a refund!

What actually happened was the Hawke-Keating Government in 1987 implemented the ‘interim’ recommendation of the Campbell Review. This was not the original recommendation and ended in 1999 following the Ralph Review which introduced the refund of excess franking credits under the Howard Government.

The current system we have (which includes franking credit refunds) was designed by an independent body and was implemented with the support of both houses!

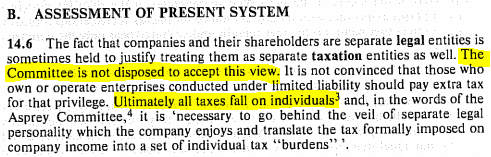

“A company and an individual are separate legal entities. A profitable company should always have to pay some tax. The franking credit refund is a loophole where the share payers can potentially pay no tax”

This is very clearly addressed in the Campbell Review.

“The fact that companies and their shareholders are separate legal entities is sometimes held to justify treating them as separate taxation entities as well. The Committee is not disposed to accept this view. It is not convinced that those who own or operate enterprises conducted under limited liability should pay extra tax for that privilege. Ultimately all taxes fall on individuals and, in the words of the Asprey Committee, it is ‘necessary to go behind the veil of separate legal personality which the company enjoys and translate the tax formally imposed on company income into a set of individual tax ‘burdens'”

Pretty straight forward. They might be separate legal entities but all tax eventually falls on individuals!

The company is simply prepaying tax for the shareholders.

If you accept that franking credits can offset an individuals income to $0, you must accept the refund as the shareholder has prepaid more tax than they should have.

If you want to still argue this point. I’m assuming that you’re in favour of completely eliminating imputation credits altogether right…? Tax will be paid twice, once for the company and once for the individual. They are separate after all, right???

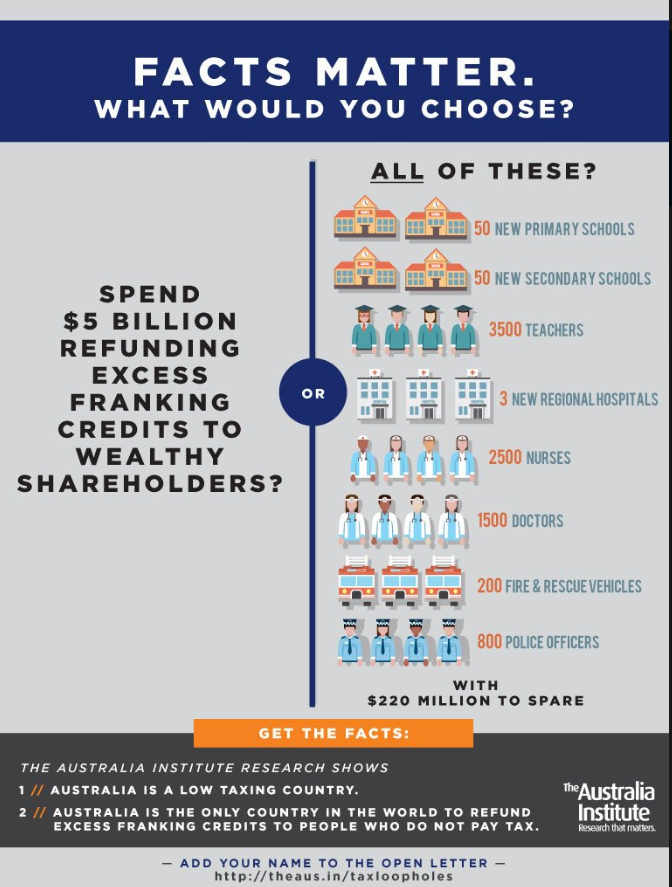

“These refunds are costing taxpayers billions each year. That money could be spent on schools, hospitals and roads. Why should the rich get a refund from the taxpayers?”

This is one of the first arguments from people who don’t understand how franking works. To be fair, most of the FIRE community-related arguments on this matter don’t raise this point. Because we fully know that the refund has absolutely nothing to do with other taxpayers and is simply returning money that is rightfully owed to the shareholders from which the money was earnt in the first place through the company!

I’ve yet to see anything that specifically stipulates that the ALP will use any revenue received by these changes on schools/roads/hospitals etc. What most likely will happen is any extra revenue will be added to the Federal government’s coffers where god knows what it will be allocated to.

Let’s take a little look at the fiscal management of the Government, shall we?

- Same-sex marriage plebiscite for $80 Million – Clearly a stalling tactic the government used to postpone the inevitable. All good though, getting into power is much more important than using taxpayers dollars wisely.

- Victorian government settles East West Link claim for $339m – Total cost for a road never built, between $800 million and $900 million.

- $4 Billion Victorian desalination plant that’s hardly been used – To add insult to injury, it’s costing the taxpayers $649 million a year to keep this plant open even if it’s not producing water! I personally had a lot of friends work on this project and let me tell you, taking the piss doesn’t even begin to describe how much money was being thrown about on that job site. I’m all for unions fighting for their worker’s rights but c’mon… some of my apprentice mates were clearing $2,500 a week after tax whilst also getting $800 a week travel allowance and living away from home pay plus god knows what other EBA entitlements. Four or so of my mates were renting out a beach house in Inverloch and getting $800 a week each for travel pay… Inverloch to Wonthaggi (site of desal) takes 13 minutes 😐 I’m all for tradies earning as much as they can but when taxpayers dollars are used we need to look at the fiscal management of these projects… some of what was happening was a complete waste of money. This was one desal project, Sydney also have one that cost $1.8 Billion and is currently costing taxpayers $535 million a year to keep it in a state of hibernation. Other states have them too but you get the idea.

- $51 Billion for failed NBN project – Telstra pointed to NBN information that there was $14 billion “of unrecovered revenue … that will ultimately need to be recovered from consumers within the current regulatory and policy framework”.

So what are we at now… around $20+ billion of wasted taxpayers money without even really trying (I’m allowing for some actual value of these projects to be returned).

Seriously.

These projects were off the top of my head and I did a bit of Googling to fact find. I’m sure there’s plenty of others out there that cost even more.

I have worked for the government for over 7 years and trust me when I tell you, we are not good at managing money/projects.

The late Kerry Packer summed it up best in 1991:

‘I am not evading tax in any way, shape or form. Now, of course, I am minimising my tax, and, if anybody in this country doesn’t minimise their tax, they want their heads read because, as a Government, I can tell you you’re not spending it that well that we should be donating extra.’

“Australia is the only country in the world that have franking credit refunds”

My response to this one has always been… so what?

I actually think it shows a sign of weakness from that side of the argument. I mean, what has that got to do with anything? There’s plenty of things unique to Australia.

Does that make us wrong?

No!

In fact, I’d wager that Australia must be doing a lot of things right as we are consistently ranked as one of the best countries to live in on the planet and our citizens are some of the richest in the world. There’s plenty of factors to attribute to these claims but it just strikes me as odd when people bring this point up as if it’s a bad thing 😕

The Propaganda Machine In Full Swing

The ALP are clearly trying to win votes from the working class by exploiting on their lack of knowledge around a policy they want to change (franking credits this time around) which is how politics have worked since the beginning of time.

They are spinning this debate into:

‘The rich aren’t paying their fair share’

Check out some of their propaganda.

I have no idea who ‘The Australian Institute’ is but they call themselves a ‘think tank’ but are clearly a propaganda machine.

I really enjoy the play on words with the poster insinuating that the taxpayers are somehow ‘spending’ $5B to refund franking credits whereas we know perfectly well that the taxpayers don’t have to pay for anything. The refund is simply returning the tax paid by the shareholder if they paid too much tax that year…like … you know… how it works with every other form of income.

But hey, good job PR team! Nothing is more likely to get votes than if you pretend you’re fighting for the working class and trying to get the rich to pay more tax so you can fund more public services.

So Robin Hood of you. In fact, Robin Hood is almost a perfect analogy because this policy is indeed stealing from the rich but I’m not sure about giving to the poor. As I’ve covered above, the government sorta sucks with money and to quote Mr Packer again, if you think that the money that is retained by this policy (assuming they are able to retain any money, which is highly debatable) will be going to these public services … ‘You’d want your head read‘

There are also other countless articles written by prominent financial figures with large followings that also raises eyebrows about the sincerity or purpose of some of the content that’s published.

The Real Reason Behind This Policy

It’s pretty obvious (to most) what’s happening here.

The real issue with this whole debate is the tax-free pension with Super. When you start to receive an income from your Super (pension mode) you don’t have to pay a single cent of tax on that income up to $1.6M. This means that because your taxable income is $0 if you receive Aussie dividends with franking credits attached… you guessed it, you will receive a refund!

The unsustainable tax-free pension mode of Super has been debated countless times and I’m not going to go into it.

But make no mistake about it, the ALP are targetting this and the FIRE community is getting caught in the crossfire.

‘But why wouldn’t they just change the law so there’s not a tax-free pension mode’

Because that’s not smart politics!

Does anyone honestly think that this move to axe franking credit refunds wasn’t strategic? Hell, half of the FIRE community doesn’t understand it well, how are we to expect that the general public will get it? The answer is they probably won’t. And I don’t blame them, it’s complicated and confusing. They are sold the dream that the wealthy will have to pay more tax (which will be 100% true) and that money will be used to fund public services (lol).

That’s a great PR campaign if you ask me. And incredibly hard to argue against because it’s so confusing.

Nevertheless.

Everything I’ve covered so far is pretty stock standard on the battlefield of the political juggernaut trying their best to win all of our precious votes.

But there’s something else afoot that I can’t figure out…

Where It’s Getting Weird

To summarise everything I’ve covered so far:

- Franking credit refunds make perfect fiscal sense. They were designed by an independent body and implemented with bipartisan support

- ALP want more revenue

- They won’t directly tax Super pensions because that would be political suicide so instead, they have gone after Franking credit refunds and are exploiting the general publics lack of knowledge about how they work

Here’s my beef.

The entire reason this article exists is that I’m noticing a trend amongst the FIRE community where an uncomfortable number of members are not only in support of this change but are actively campaigning for it to go through.

This change directly affects the FIRE community!

If you are planning on retiring from Aussie dividends, you could be set back years until you reach freedom if this goes through.

Yeah yeah yeah I know you can tweak your investments to get around it and people did just fine without franking and all that but that’s not the point I’m making here.

My point is that a lot of the community is not taking an IDGAF approach. They are trying to argue for the changes that will directly disadvantage them and it’s doing my head in.

Here is what I’m talking about and I want to preface this by acknowledging that every single one of the screenshots below is from a FIRE or financial independence community group (Facebook, Reddit, forums etc). I have not included the whole quote or comment in some of the screenshots FYI.

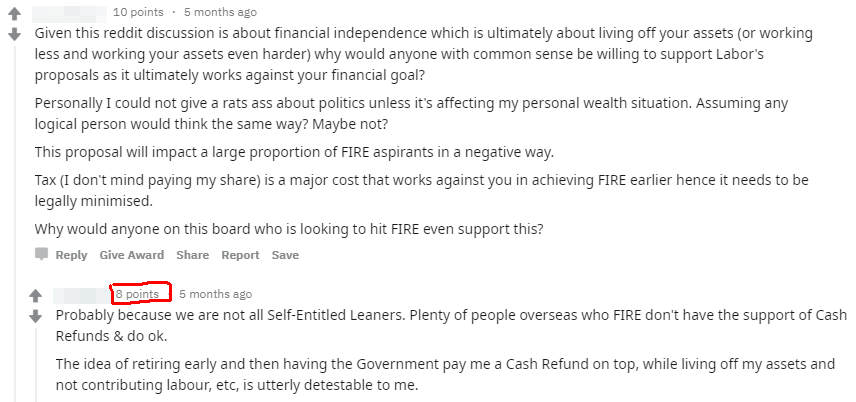

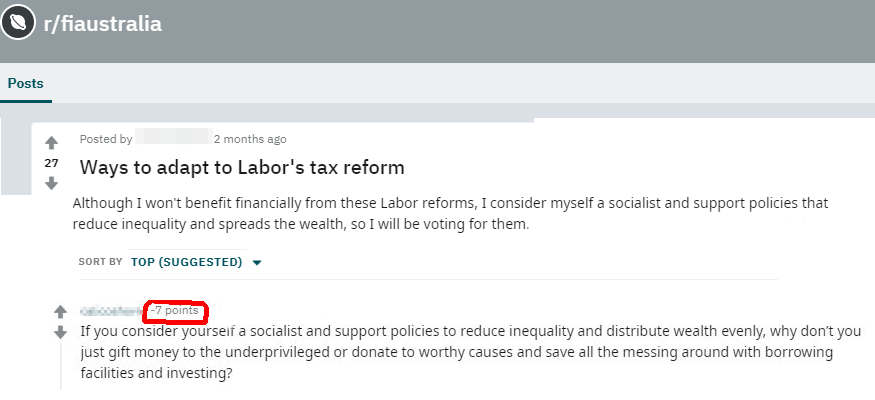

The first comment pretty much sums up view spot on. I’m glad to see it sitting on 10 points (basically an agreement for those who don’t use Reddit). But the response has nearly the same number of upvotes which would indicate that a significant amount of the sub (which was small when this was posted) would disagree.

*(this edited screenshot is not the whole post, just the part I’m highlighting)

Same sub as above. 27 upvotes for a post that clearly states that they won’t benefit financially from these changes but will be voting for them anyway. This was posted on a financial independent specific forum. When another member replies with what I would consider a pretty reasonable response, they get downvoted and are currently sitting on -7 points.

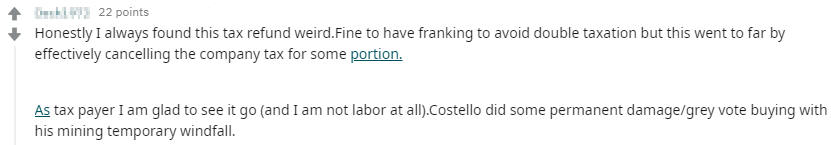

Another forum member glad that these changes will go through. But the community is really getting behind this comment with 22 points.

Some ALP propaganda posted on the ‘Mustachians Australia’ group.

19 Likes and 3 Loves.

The first comment is even a clapping hands emoji.

PEOPLE ARE CLAPPING ABOUT THESE CHANGES IN A FIRE GROUP.

Australian Facebook group specifically geared towards reaching financial independence has the ALP propaganda we seen posted above… And wouldn’t believe it… It has 10 Likes and 2 Love reactions. People who are trying to reach FI are loving the fact that they will have to pay more tax… 🤔

Excuse me…

But what the actual fuck is going on?

I fully expect to see these sort of posts and more importantly, responses from any other group in Australia. I think it’s unrealistic for the general public or anyone who these potential changes won’t affect to give two shits. But a good percentage of the FIRE community actively promoting and wanting these changes to go through is… confusing me.

Why Is This Happening?

I don’t really know but I have four theories.

- The most likely theory I have is that there is still a decent amount of people in the FIRE community that still don’t quite know how franking works. The refund can be confusing to understand. Combine this with a slightly naive attitude towards how tax dollars are spent and what you have is a genuinely good-hearted person who just wants to spread the wealth around. All I would say to anyone who falls in this category is please consider direct donations to good charitable organisations. I have worked for the government for over 7 years. Trust me when I say that you are 100% better off directly helping out the less fortunate than you are by paying more taxes in hopes that it will be put to good use.

- The FIRE community was once a smallish niche group that all had aspirations of escaping a lifetime of working a job they didn’t particularly enjoy. And then the word got out, and what started off as a relatively small group has grown exponentially. I suspect that there are a lot of people out there that are apart of FIRE groups, forums and pages that have no intention of doing what’s necessary in order to FIRE. Maybe the influx of FIRE phonies are delighted with this speed bump in our road to FIRE. This can best be described as Tall poppy syndrome.

- Some out there have been drinking the ALP ‘Kool-Aid’ and actually think that franking credit refunds don’t make for a good fiscal policy.

- And now it’s time to put your tin foil hats on…Although highly unlikely, is it possible that members of the ALP have infiltrated the FIRE community? I honestly don’t think we’re big enough for any political party to really care about, but maybe there are a few interns out there pushing their parties’ agenda… Stranger things have happened!

Conclusion

Guys, I get it.

You should never base your strategy around tax laws. The most important rule for investing should always be to invest in great assets (whether that’s locally or internationally). Tax strategies should come later down the track and we shouldn’t get too upset when they change or are abolished. This is to be expected at some point after all.

I’m not saying we need to band together to fight this (I’ve got better things to do), but for the love of God, we don’t need to be actively campaigning to disadvantage ourselves.

Maybe I’m missing something here, but I can’t work out why so many of us are happy to pay more tax to a government who has consistently shown its incompetency to spend money wisely.

I’m really interested to know what the community thinks.

Are you picking up what I’m putting down? Or maybe I’m just out of touch and need more faith in the government?

Please let me know what you think down below 👇.

Spark that 🔥

*Credit to these two Cuffelinks articles for most of my research around the history of franking. Article 1, article 2.

Great article aussiefirebug… Im only pretty new to the FIRE community and it is a confusing topic but I loved the way you’ve explained it. Im certainly pro franking credits and I hope it stays this way… Thanks for an easy to read article love you blog 😁👍

No worries mate 🙂

I really enjoyed this post AFB, and although I’m an accountant this is the first time I’ve actually read about those independent reviews to implement franking credits, so that was a good bit of extra info. One point that I’d make is that the govt makes the tax laws and they are in many ways distorted for all manner of reasons, for example super is not effectively taxed at the individual level, it’s 15% irrespective of the individuals tax rate. Tax free super pensions is an example of where income is taxed, or not taxed, in a special way, and so franked dividends are not alone. I can see both sides of this franking credit refunding issue and I don’t have a great problem with the ALP policy in its outcome as it seems quite unfair for someone with significant wealth getting a tax refund. As with all things tax it’s not just this policy that needs to be fixed, as I really do have a problem with tax free super, which as you identified is the real problem here. Maybe one positive outcome is that the discussion will improve understanding of the tax system, but maybe it will make people even more disenchanted with it….

I’m glad you enjoyed it Ross 🙂

I’m not going to try to convince you or anyone what’s right and wrong.

The whole reason this article exists is me being dumbfounded that people are actively campaigning to pay more taxes.

Shit, wars have been started over less.

A better understanding of the tax system would be a great result I agree!

I well understand the resistance to paying more tax! But maybe they just see it as unfair and because they are on the way to FIRE they are comfortable in their financial position and feel they can sacrifice some of their income?

Yep, I think you’re on the money.

And that was my number one theory too!

Mate, I dare say you’ve worked for a state government the last 7yrs. Federal gov still wasteful but not as wasteful i’d suggest, but always depends on the policy area. Having worked at both state and federal gov level, and in the private sector, it’s foolish to think it’s only governments that waste money. Private sector does too. And don’t get me started on many charities with admin overheads. And some of your examples of wasteful spending are by companies rorting things. Like most people you’re having a whinge when a change proposed by any government hurts you rather than others. Happens all the time – there’s no interest like self interest. And no one seems to want to pay for things they actually use like roads, hospitals, infrastructure etc that they and companies rely on. Yeah tax is a pain in the arse, but imo capital gains tax is going to be the worse one for FIRE folk and shareholders in general. Negative gearing changes no probs. Tax credits, understood. But taking away capital gains change is going to hurt more I think.

Ben, I’m not going to argue with anything you’ve written.

I never wanted this article to be about anything else other than what I’m observing specifically from a FIRE standpoint.

Thanks for the comment mate.

Actually, it angers me more so because it is simply unfair – And I say that even though for me it won’t affect me.

Why? Because it treats that income as different from ANY other income in it’s tax treatment, for EVERYONE. And because the changes (bot that they admit it) really only affect the lower end of town.

The “Rich” that they are pretending to tax need those tax credits to offset other incomes, so it won’t hurt them.

It’s just a money grab and envy politics.

it’s also monumentally stupid because it’s so easily circumvented, and the money they think they will get, they wont. They’ve already had to change the rules since announcing it to protect their mates running super funds, and retirees on pensions (but note that retirees without pensions are not saved – again different rules for same type of income)

“super is not effectively taxed at the individual level, it’s 15% irrespective of the individuals tax rate”.

Don’t forget Division 293 tax !!

Hey Aussie thanks for the article, this makes the whole franking credit thing a lot clearer to me. I feel like it’s just a lack of research or education on the subject leading to others points of view supporting the change.

Love me a bit of Kerry Packer and he had it bang on. why pay more to a government that doesn’t care where the money goes just about what votes it can bring it.

I have never been big on politics actually hate it but this year I’m taking some interest and can’t get my head around why people just keep voting in the 2 big parties. It’s been the same for so long and everyone complains about how poor they perform why not change it!

That whole video is worth watching, not just the bit about the taxes that I linked to.

Yeah, you’re most likely right. I think it just comes down to education on a really boring subject for 99% of people. To make things worse, it doesn’t affect the majority of people. Very hard to make people listen if it’s not going to affect them.

As soon as ‘let tax the rich’ is mention, it’s an easy sell for votes.

Yeah i have seen the video doing the rounds on Facebook lately too.

I consider myself pretty into the FIRE movement but can’t bring myself to put to much research into it. What chance has the general public got lol it’s hard enough to get my wife to read anything in general about money.

And yes ‘let’s tax the rich’ is how the US government sold taxes in the first place too bad the ‘rich’ were smart enough to then push taxes down onto everyone else. And now here we are.

Your whole post is propaganda, whilst bagging the other sides propaganda. I’m neither for or against scrapping franking credits. I am a fan of your blog but this is shit.

Damn, I spent days researching this topic and I thought I laid the evidence down pretty well lol.

Sorry to hear ya feel this way mate.

Why is it propaganda, when it explains how refunds are actually applied, how can facts be viewed as propaganda?

Funny how no arguments are presented to counter your clear and concise article. No surprise really.

This article was the opposite of propaganda. The research you put in shows. Thanks for doing the work.

Short on facts there Leigh.

What was propaganda specifically? What was wrong?

Your comment is hardly helpful as it is.

You’re pretty much bang on. If you write an article such that you take a stance, you’re not providing evidence, you’re issuing propaganda whether you like it or not.

People worrying about how much they will personally be worse off is what got us into this shitty political situation in the first place. Where’s the long term thinking gone?

Thank you for cutting thru the political bullshit spin on this. Keep up the good work and stoke that FIRE!!

🤙😁 🔥🔥🔥

Fantastic article mate and I’m 100% on board with your viewpoint on this issue.

I’ve also struggled to understand why there are some in the FIRE community who seem to be quite keen on these changes, especially given the massive impact they would have on anyone who would be getting a refund. When I ran the numbers a couple looking at an income of $40k a year in early retirement would be down to $28k a year, that’s absolutely huge and takes away a lot of the nice stuff that you’d have anticipated enjoying! I ran the numbers for a bunch of other scenarios in my blog post about it as well, it’s just a massive hit across the board.

The argument about Australia being unique in having cash refunds doesn’t carry much water with me either. Sure Australia is unique in the way we do it, but there are plenty of countries that allow up to certain amounts of dividends tax free or advantage them over earned income in some way, why isn’t that ever brought up in the discussion?

I agree that the real issue here is the tax free status of up to $1.6mn in pension phase in super, but that’s an issue which is apparently untouchable politically. What a lot of people don’t realise is that in many countries around the world your superannuation isn’t taxed in accumulation phase at all, only when you start drawing down on it. Funny how that doesn’t get brought up as being an unusual thing globally?

Hopefully this changes a few minds and makes a difference.

True about the dividends!

I’m in the UK now and have started my own company. Being paid in dividends is a LOT more tax efficient here. It doesn’t get added to your income like in Australia. It’s completely different.

My parents set up a self managed super fund and will lose 20k a year which is huge for them. They have no-where near the $1.6m. IN retrospect they should have kept their money with a retail fund in which some other members are still in accumulation phase and they fact they are retired in tax free mode would be hidden and the credits would be used across the whole fund. I’m angry for them as its unfair to change rules on people whom have planned for 40 years on the basis of one law to have it taken away from them. Super is a long term investment and its inequitable to keep chopping and changing the rules.

They may be able to transfer their holdings across to a retail wrap account or one of the industry funds, or at worst sell down and buy back the same holdings. It’s not an ideal solution and moving to an industry funds is obviously exactly what Labor wants as it’s more moneywhich ends up in their hands but for the sake of $20k a year it’s probably worth checking out.

Hey mate. New to the fire idea and trying to take in lots of info at the moment to see how I can best apply it to my life, in reading this post I noticed your knowledge of the Inverloch and wonthaggi areas. Are you from this area? I’m not to far from Inverloch myself.

Latrobe Valley mate. Although I’m currently living in London doing the whole ‘see the world thing’.

Ah good work. Well thanks for, and keep up the good posts and info, knowledge is power!

Very well put mate.

I cannot understand anyone who is chasing FI and supporting the change, a position of indifference maybe, but full on support is madness.

It’s one of the few tools the average punter can use to get ahead (especially those with a partner not working or working part time and home raising kids).

Thanks Firebug – that’s a really interesting post.

A twist that’s been mentioned elsewhere is that whether someone can ultimately benefit from excess can now depend on the investment vehicle used. So, for instance, the number of members and working age profile of some superannuation funds will mean that at an aggregate level excess credits will be able to benefit retiring fund members fully, compared to a retiring individual with excess credits. This would seem to drive some inequitable outcomes when two individual with the same income/wealth are compared.

Using extensions of the logic you describe in your post, it’s not impossible a future government could one day seek to revert back to a pre-franking credits system.

Thanks dude!

I left out a whole bunch of stuff as to why I disagree with these proposed changes but I was trying really hard not to make this a ‘let me try to convince you that this policy sucks’ article.

All I wanted to do is highlight the strange things I see happening in the Australian FIRE community.

It strikes me as odd how a decent percentage of a group that I’m part of seems to be actively campaigning to pay more taxes.

That’s really the observation point I’m trying to make here.

Thank you for writing so well what I thought anyway (I too was confused by the video on the FB post and the comments). Cheers!

My pleasure Carol. I’m glad you enjoyed it 🙂

Would the franking credit change affect everybody who has super as super funds or SMSF invested in shares?

Although not directly affecting a person’s individual tax would it indirectly affect their final super entitlements?

(No way I’m relying on my super for retirement- aiming to get there a lot sooner with a range of investments not only shares.)

Just a thought that it may be a way of taxing everyone without actually increasing the super tax rate.

I think it’s refreshing to see people vote for policies that they think will benefit everyone, instead of voting for whoever will make them the richest.

I hear what you’re saying Sue, and I honestly believe that the majority of people I’m picking on in this article have the best intentions! I simply don’t think that paying more taxes = more benefit to more people.

That’s just the way I feel.

I appreciate your comment and voicing an opinion from that side of the argument.

I totally agree with your point Sue that people are better off should they vote for the long term future rather than what fills certain groups’ pockets on the short term, which we see happening with all the meaningless cash splash that is happening from both sides of the politics. I would however highlight the fundamental point Aussiefirebug is making, which is: Are we really better off putting more money in the hands of an inefficient government?! I have been working for big multinationals for close to two decades and I have seen how inefficient investment decisions are being made on daily basis, which is far from being in the best interest of the business or its owners, the shareholders, who have less to say on the daily operations. It is no different when it comes to governments and their shareholders, which is all of us in this case. What makes it even worse and more inefficient that governments, as opposed to corporations, have more power to raise capital all the time and can keep investing on inefficient projects (cash splash) through raising MORE TAXES. Slogans like ‘taxing the rich to provide for the poor’ are easy-sell political messages however it is not as easy as it sounds when it comes to managing this money and delivering the maximum value. Whether we like it or not, everyone works for their own interest in one way or the other and governments are no different.

Spot on AMO 🙌

Surely the benefit of a government is that it can invest in projects that will not make a profit – things that the commercial world would not look at, things that benefit all?

The government definitely has its place. The tone of this article maybe was a little too harsh.

I didn’t mean to insinuate that all of the services the government provides are useless. I love Medicare, serviced roads, subsidised university education etc. etc. More than happy to pay my fair share for such services as I have done my entire working life.

But let’s be real… the government wastes a lot of mula and corruption is rife.

I find it frustrating when politicians use the classic line of ‘more schools, better infrastructure, more doctors’ when there is no guarantee that they will use the extra revenue for such things and we have seen time and time again that they like to do stupid shit with our tax dollars, most of the time completely in their self-interest.

I simply don’t trust them.

I can see your point of view, can you see mine?

I can definitely see your point. I think the point of difference is that I just don’t agree the waste is that great – especially for the benefits brought to society as a whole through taxation and government spending. There definitely are areas that could do with the reducing of wasteful spending, but you will find this anywhere within large organisations. Corruption should be found and stamped out – no question there.

The benefit of a government, to me, is that they can make spending decisions based not on making a profit, but on what is good for the people of the country – a situation that no other institution can.

I agree with your sentiment, and I wish people would in general vote for the country overall and a bit less for them selves. On this one policy though – you’re wrong.

It’s treating the very same type of income differently according to your class.

I can see one of three reasonable arguments.

1) Keep it as it is. The tax paid on your behalf is credited to you, and in the end if you’ve paid too much you get it back.

2) Dividends are untaxed, and come tax time you may need to ante up and pay the tax shortfall

3) There is no imputation credit for anyone. Period.

#1 is ultimately fair, and the gov’t got a free loan of your money until they had to pay you back.

#2 is fair, but introduces income leakage to overseas entities holding stock, and bill shock for some when they get a tax bill.

#3 is double taxed income effectively, but at least everyone is on the same footing.

What is planned is a shamozzle, and will be circumvented by many.

It creates a whole class of people earning say $15,000 and paying 30% tax, where they wouldn’t on ANY other income source.

You gave an example above of persons A, B & C earning $16,000 via different means. Can you provide the same example for those earning an amount that would place them in the highest tax bracket?

Boom. Preach it! ❤️

Well in that situation, there should be not much difference because under the Labor policy, you still get to utilise the franking credits to reduce your tax liability.

the top tax rate kicks in above $180K, so for someone on an income of $250K (commonly used as the level where you are “rich”) tax payable would be $85,232. For a person receiving all their income from franked dividends, franking credits would be 75K and the balance payable would be $10,232.

So all of those examples should pay the same tax, but for the person with dividend income all credits would be used up.

In other words, rich people no change, poor people get hurt. Great result for Bill and his rich mates.

Preach that.

I could but I don’t see where you’re going with this?

The higher the income, the more effective the franking credits. If this law was to pass the lower income earner would be most affected not the high one…?

Thx. I am just trying to understand this stuff. There are conflicting reports on the net i.e. whether rich or poorer people are the most affected by labor’s proposed changes.

Well @Conflicting…. If Labor are saying how it works – stop listening because they’re lying.

Just like they say Negative Gearing is for people buying their 5th or 10th house.

Given my work is involved in that space, I can tell you that’s utter BS.

There are 2.1 million property investors in Aus.

1.3m own one property

460k own two

250k own three

Do the maths….

That’s 2.010m people who own 3 or less.

You’re down to 90,000 people owning 4+ properties.

It’s around 77,000 own 5+

That’s 3.6% of the property investor population, or 0.3% of the population.

The numbers from there dwindle significantly.

The average from what I have access to is 1.3 properties on average, and my dataset is above average for the type of investor.

The people who need negative gearing the most are the people trying to start investing and buying their 1st or second property.

But that doesn’t have the nice tall poppy syndrome ring to it that Bill wants.

I may not have all the latest facts, but the last time I looked at it, most of the multi property “owners” had invested their savings and weren’t kiting their property empire based on negative gearing. There are a few, of course, who have gone to a get-rich-quick seminar, drunk the cool-aid, and are destined for bankruptcy.

So BS wants to accelerate the bankruptcy of people who are inevitably going to get there on their own without government assistance. I do wonder about the sanity in the labor party.

If you’re going to invest in residential property, make sure that it’s positively geared. Your investments should make money, not lose it.

It’s a bit sad to see this blog get political all of a sudden 😕

To be honest, the “I don’t want to pay more taxes because the government wastes money” argument feels shortsighted and slightly selfish to me. Yes, there is inefficiency and corruption in government. Human nature makes that unavoidable to some extent, though we should of course strive to minimise it. In the grand scheme of things, Australia is actually much better at this than many other countries.

You seem to assuming that *all* extra government revenue will be wasted, which doesn’t seem logical to me. Some percentage will be wasted for sure, but the rest will go towards improving government services. I feel like this is a worthwhile tradeoff, but of course people have different opinions on this. Fundamentally it feels like a political discussion that isn’t well suited to a FIRE blog though.

Hi James,

I really tried hard not to focus on the politics in this one.

But that’s all everyone seems to want to focus on.

The main goal of this article was to highlight the oxymoron of people who are supposedly trying to reach FIRE sharing content that is in opposition to this goal specifically in a FIRE forum.

I see the argument to pay more taxes all the time and I fully expect to see it everywhere except in a FIRE forum, it really had me scratching my head.

Let me put it to you this way.

Imagine if for some reason the government wanted to tax Electricians more. Maybe something to do with climate change, the reason behind it is irrelevant and it could either be justified or not.

Do you think that:

A: The ETU would start actively campaigning for this change online and a good percentage of sparkies out there would ‘Like’ and ‘Love’ the fact they are going to paying more tax?

B: Gather 100,000+ members and shut down Melbourne CBD for the day in protest?

I don’t want to argue the policy and I moved on with my life in approximately 5 seconds when I heard what they were proposing.

The point I’m making here is not to try to convince anyone to vote this or that way, I couldn’t care less, it’s an observation piece about a strange phenomenon I’m seeing more and more of.

Cheers

You can’t compare apples with oranges.

Scrapping excess franking credits from people who don’t pay income tax IS NOT A TAX.

It is literally getting rid of the ATO’s practice of giving free money to people who do not pay income tax at all (and therefore don’t need a credit in any way ON MONEY THEY THEMSELVES DID NOT PAY).

FFS – Well FFS – they have paid tax.

The Franking Credits are exactly the same as how your employer withholds tax before he pays you.

The line about not having paid tax is an absolute lie.

As part owner of the business (shareholder) you are entitled to a percentage of the profits.

The business withheld tax of their behalf before paying the dividend (hence why the franking amount is shown on your share dividend receipt – to show the tax was paid).

When you do your tax return, you include that in tax already paid, like you would where your employer group certificate does the same.

In the end, TOTAL INCOME is assessed, the tax on that amount calculated.

If you have had too much tax TAKEN already, you get a refund.

If not enough you pay more.

It’s that simple. YOU HAVE PAID TAX. Labor’s line that you haven’t defies logic, and goes against the very reports they had commissioned when Hawke / Keating changed the rules way back when, the reports they acted on to stop double taxing of income.

Very well articulated Simon and absolutely spot on

This is the part that people keep missing. People keep saying that shareholders don’t pay tax, but it is already paid on their behalf. So they are not in fact getting free money, but a refund on tax that they have paid. Same as everyone else. To all those people who complain about not getting this refund (which I doubt read this blog) buy some shares then you get some too, it’s not only for rich people!

AFB,

Firstly, thanks for the piece and trying to articulate your observations. If nothing else you have started the conversation. In terms of providing an insight, I think Ffs’s response above could be indicative of the phenomenon your seeing in the FIRE community. Because the taxation of company profits is done before dividends have been distributed, shareholders possibly don’t see that the franking credits are rightfully theirs and it is their share of profits that has potentially been taxed at a higher rate, therefore potentially making them eligible for a credit if on a lower or zero tax bracket.

Great article mate and thanks for the time you put into it. Can’t remember the last time i followed politics like this. I feel like this shouldn’t be labelled as a tax on the rich, when it affects so many people like ourselves and we don’t live rich or plan to ever live rich and flashy.

It’s a method everyone can use to to help them for their future plans and its possibly going to be removed. Which means, as a result more will be needed to be done by the government and a greater need by Australians to depend on the government for support.

I think were doing the government a favour by working towards taking care of ourselves in the future, and personally we’ve seen how the governments spend and its disgusting.

No worries Ray. I’m glad you enjoyed it 🙂

There are more issues then franking credits in the election.

Healthcare, Enivornment, Education, Social services.

God, I sound like a broken record in these comments but focussing on the politics/policies is not what this article is about!!!

🙃🔫

@Guy, The article is about how with this change it is creating the very real possibility that your income tax on a given amount (Say $15,000 to keep it easy) could now be either 0% or 30% depending on who YOU are and YOUR circumstance.

It’s about observing how some people don’t seem to really get that, and even champion the change, when it’s manifestly unfair.

It’s not about politics.

Thanks Aussie Firebug for setting out a major issue for the FIRE community so misunderstood and to Simon for clearly articulating the real impact here.

So frustrating to see so many people in favour of treating lower income earners (such as those members of the FIRE movement aiming to be self-funded via franked dividends) worse off under the guise of hitting the rich.

Fantastic article AFB! NOW I get it! So incredibly well

written. Thank you.

🙏

An interesting post

Like you this phenomenon interests me. I do my best to not diminish their arguments or thoughts as simply

‘they must not understand Franking’

but it is honestly very hard not to do that when you hear things such as

‘it was meant to prevent double taxation not give a refund’

Or

‘Australia is one of the only countries in the world to…’

Or

‘Why give the the rich a tax break when that money can be better spent’

None of those arguments even actually make sense and I can’t help but conclude the same thing as you. A combination of genuinely good willed people who lack an understanding of the system or perhaps a bit more insidiously a bit of virtue signalling.

Thanks Pat,

The thing that gets me is these ideas are getting love in the FIRE community.

You can be against the refunds and still want to FIRE. They aren’t mutually exclusive. But to start to campaign for it in a FIRE group it the bizarre part.

Well this article should definitely stir the pot a bit. I think you did a great job at explaining everything.

I think the tension arises from Australia’s egalitarian roots combined with Tall Poppy Syndrome.

For what it’s worth I think Labor will struggle to pass the legislation through the senate ‘in full’ as the majority cross-bench who are in the middle of six year terms are strongly opposed to the changes. I would expect a major watering down of the proposal in some form.

Yeah I’ve woken up (London time) to a lot of…interesting emails lol.

It feels like the bloggers and people who do the research to try to share with the community do acknowledge the issue and that it negatively effects those pursuing fire.

The comments to the contrary seem to come from newer or more “anonymous” members.

This isn’t about politics, it is about self interest and it should be.

The community was born out of ideals to leave the rat race to pursue your own passions.

If people want to debate the merits of paying tax and propping up the economy than we change the narritive to “retire early” is bad as an overall concept.

Instead lets plug away in factories working until we die, not to provide for ourselves and our families but because its better for the Commonwealth of Australia as a whole and makes us the most economically productive per hour of our lives. You can take any arguement to a ridiculous extreme and political discussion often breeds that.

AFB is simply pointing out that if you are in support of this franking credit change while also wanting to pursue FIRE then that is fine, you can have your opinion.

But opinions can also be illogical and against your own self interests and in this case it would be.

Hi Ben,

I couldn’t care less about what people think and do.

Just trying to share my observations with the community that’s all 🤙

Cheers

To be fair Mr Firebug – if you didnt care what people think and do, this whole blog post wouldn’t exist…? This whole blog post is about what other people are thinking ( about franking credits) and doing ( posting in FIRE communities)…

I strongly support the changes even though they will cost me $$$ in the long run.

The reason I support the changes is because if we all vote in pure financial self interest it hurts the greater community. I’m comfortable that this tax benefit is excessive and goes to the wealthy and that we can pay our fair share to create a better community.

Btw I’m a chartered accountant and financially rock solid.

I’d encourage you to think more broadly about what is best for the community rather than pure self interest. I think that’s where the debate is at

Hi Nathan,

You, like many others who have an issue with this article, are turning this debate into something it’s not.

You can want to spread the wealth around and also chase FIRE.

I donate to charitable organisations every year, I also want to become financially independent.

What I don’t do, is bring in my political agenda to FIRE forums and groups online.

This article has highlighted where I have seen these instances occur. I have laid down the facts and why I think it’s happening but I’m not trying to convince anyone to do anything and would never try to make my audience vote a certain way.

The above is my thoughts and opinions about people in FIRE specific forums posting content that directly disadvantages the group they’re in. I find this to be an oxymoron and I’m pointing that out.

I’m finding the constant feedback of ‘Do what’s best for the greater good not for yourself’ tiresome. Have you read the entire article?

Cheers

Nathan I’m also a chartered accountant and I’m shocked that you wish to permit double taxation on a select few just because they invest via a company. It is discrimitory. Under current rules I have an investment company, I make 19k, pay 30 % at the coy level then get a refund when I pay the dividend because I’m below the tax threshold. This is logical common sense.

If the ALP want to raise more income they shd have the guts to simply increase the tax rate, not target people investing in shares.

Amen John.

I can’t see how anyone who reads the FULL article could logically come to any other conclusion.

It honestly baffles me.

Well said. I work in the tax area and agree with you. Your logic is sound. I know Scott Pape the Barefoot investor agrees with the move as income streams in retirement phase aren’t taxed. Just introduce tax on super funds in retirement phase (but no-one will go there politically). I think its a cynically based targeted move (why do pensioners get the refund but self funded retirees do not? Target politics as pensioners are labor heartland) at a narrow band and there is widespread confusion being passed around. Franking credits are a hard topic but you’ve stripped it to the bare essentials. Thanks

Thanks Belinda 🙂

I understand that Labor originally proposed the franking credits change for all & then provided an exemption to part/full pensioners & others on benefits. So will the proposed Labor change impact those relying on franking credits that come as a cash refund and:

1) Working people receiving a low income

2) Self funded retirees, in particular the early retirees who do not yet have access to their superannuation?

Originally is was All.

Then the pensioners kicked up a fuss.

Then the big super funds (you know “the industry ones” backed by unions) kicked up a fuss.

Now (if the policy passes as is) you have those two groups allowed to claim overpaid credits and others not.

To answer your specific questions

1) No you can’t.

2) Not you can’t unless you are the recipient of a Government Aged Pension. Fully self funded? Bad luck.

Thx Simon, you have made this much clearer. I did not realise that the industry super funds had also received exemption. Too bad for the self funded retirees who did not want to rely on the pension.

The industry funds didn’t get a specific exemption because that would be just a little too obvious, but because most of their members are in accumulation phase most of the industry funds pay enough tax that the changes wouldn’t impact them anyway. There are apparently a few exceptions to that but not many. The retail and SMSFs are generally in the opposite position, most members in pension phase so not much if any tax to offset and they would lose their franking credit refunds.

Thanks HiFire.

Yeah the specific rules around which funds will pay what tax is “clouded” to me – probably because I’ve long treated superannuation as something the gov’t of the day keeps playing with as there’s just too much money in the system they want to get their hands on.

As for the changed for Super – No wonder most people don’t understand the impacts, as it depends on how many in a fund are in accumulation versus pension, and potentially of those who is on an aged pension.

It’s interesting that “Charities and not-for-profit institutions, such as universities, are exempt from these changes.” – I wonder if that includes Unions, being Not For Profit… hmm…..

It’s still stupid, creates more complexity and exemptions (aka Loopholes), and won’t get the money they think it will, even though they’ve already spent it….

There are far more effective ways to get everyone to pay their fair share.

For those that still defend it – it’s laughable that people think no one will really be affected – HELLO – there’s over $10 BILLION “savings” (aka taxes) – where do you think that money comes from? They’re taking it from someone, and if you’re planning on FIRE – you are in their sights, because they want you working longer and paying more taxes so they can spend that too….

No. Your argument to keep franking credits for everyone falls flat because you conflate franking credits (to people who pay income tax) with UNUSED franking credits (to people who do not pay income tax).

If a company pays 30% tax on profits, it is fair to refund that tax to the INDIVIDUAL shareholder ONLY if the individual shareholder does indeed pay income tax as it is.

Someone who does not pay income tax at all, does not need a franking credit refund on UNUSED franking credits. Why? Because in essence it is like being paid a bonus by the ATO, not a refund of income tax that would have been paid.

Do you pay income tax in Australia?

See this article by The Australia Institute for clarification on how misguided your article is: http://www.tai.org.au/content/why-government-doesn%E2%80%99t-want-you-understand-how-franking-credits-work

Hey mate. Check the article again. Something is fishy with those numbers. They mix up franking credit refunds, and franking credits.

High income earners, naturally will get the most franking credits since they have the largest capital, ditching refunds for these people won’t do much if anything at all as they are likely paying enough tax to use the credits.

I’m not arguing to keep the refunds. I’m pointing out a strange observation I keep seeing

Thanks for stopping by 👍

“No”, I think you need to re-read this post again and all the comments. Why should those not paying tax (or paying low tax) be unfairly treated & not be compensated by company tax already paid when they receive dividend payments?

To answer your question, I most certainly pay tax and have done so for many years in Australia.

No – you are seriously going to quote an article by a left leaning organisation, who uses it’s own previous reports as a reliable reputable “source”, and whose article has a GLARING error?

“74% of franking credits go to the top 10% of income earners”

Then that same article has the ATO data that states that > 50% goes to those with incomes less than $180k

BOTH cannot be true.

They then cite SINMOD (A simulator with who knows what real world relevance) as a trusted reference source, when the actual facts would have been available.

And of course just to distort the facts, we’ll use the dollars received, not the number of people, because that makes our case look better too.

You need to do better research…..

No, your thinking just doesn’t make sense to me. As many others have said in other comments, anyone receiving any amount in franked dividends HAS paid income tax – as a part owner of the company their share of the company tax paid (the franking credit) was a tax on their dividend income. If their total income from all sources is less than the threshold then they aren’t liable to pay any tax and should get what was withheld from their dividends and paid as tax on their behalf refunded.

Hi, firebug. I have been reading your article for some time now but never made a comment. I like reading what you put out, makes sense to me. The ALP keep going on about franking credits and your article explains that clearly. If they want more money why don’t they look at their own back yard, why do they get better super, incentives when they are meant to represent the whole country and not start a class warfare with rich v poor. Why don’t they give back, slash their super to the average persons etc, that will raise some money???

Hi Rob,

I’ve got no idea mate. Politicians are a funny bunch 🤡

Being in my mid fifties unfortunately I’m not FIRE but I do enjoy reading your posts. What annoys me the most about BS’s proposed changes is that there is an assumption that if you have a SMSF, you must be rich. My husband and I run a small business and purchased the business premises through our SMSF. With only 500k between us in our SMSF we are nowhere near being rich yet these changes will affect us greatly. We tried to do the right thing by not having to rely on a handout but feel the rug keeps getting pulled from under us

Note: this is the first time I used Bill Shorten’s initials. I think it sums it up nicely…

Judy how much do you have in super? If it’s all invested in property it has zero impact

LOL.

Maybe this will be grandfathered in? Who knows

The thing is Labour want people to be reliant on the State as that is part of their socialist agenda. Just research how many current Labour MP’s are part of the socialist group ‘the fabians’

Great blog and I agree with every point.

If you really want to get wound up check out the Australia Institutes Podcast “Follow the Money” and the episode titled “What the Hell is Dividend Imputation”. They bring up all the points against franking credits and refunds you stated and in my opinion did a shit job of justifying why they are bad or unjust.

Did you notice that the video of Maureen, the lady in the Facebook group, was actually posted by “GetUp!”? By their own words: “GetUp! is an Australian left-wing political lobbying group. It was launched in August 2005 to encourage Internet activism in Australia”. I would hazard a bet that if Maureen does even exist that she was paid for that opinion. I also wouldn’t put it past these groups to be joining the FIRE Facebook groups to post likes, “clapping hands” and positive comments.

Keep up the good work, AFB.

I certainly thought it was odd too mate.

Awesome article.

Unfortunately BS and Cowen have been incredibly poltically astute in narrow cast targetting of a group of self suffient investors who have no voice and because they have investments in shares they make them out to be tax cheats.

The most disgracefull element of this tax policy is that members of union funds will continue to get access to the franking credits. It is the most discrimitory tax policy I have ever seen.

The Australian public seem to love the idea of putting an additional tax on anyone who has put money aside. This is a scary trend.

1) Hello, it is not a tax.

2) Franking credit refunds will remain in place for people who pay income tax.

3) Franking credit refunds will cease to be paid to people who do not pay income tax, because the Australian Tax Office should not refund something to the individual shareholder that was not paid by the individual shareholder to begin with.

4) Why are so many of you people commenting on this blog missing the point by a mile / thick as a brick?

The end.

1) Hello, and yes it is a tax.

2) Franking Credits (aka tax already withheld on your behalf) do stay 100% available for some people, varying degrees for others, and unusable now – all depending on who YOU are, not simply what your total income is.

3) The ATO is not “giving” a bonus. They are simply refunding OVERPAID TAX.

4) Why are you missing the point by a country mile?

I suggest you go read the original report that Labor based their changes on (Hawke / Keating days) where they referred to it as withholding tax on the shareholders behalf.

Argue it however you want, but it is manifestly illogical to not say it’s a tax, or say they haven’t paid tax.

If you STILL don’t get it, do this:

a) For a non-pensioner, with no other income, received $15,000 Fully Franked Dividends – $10,500 cash and $4,500 franking credits.

b) For a non-pensioner, with no other income, received $15,000 Unfranked Dividends – $15,000 cash and $0 franking credits.

Now tell me what each person will pay in tax under the proposed rules.

If that can’t show you why it’s stupid, nothing can.

Absolutely spot on, Simon. I just don’t get why people aren’t understanding this after it’s laid out clearly for them.

Possible reasons could be from my experiences:

1. the masses are largely NOT mathematically/logically incline. Some dare to deduce accounting tax math into language they copied from some articles. Language has a way to produce more than one outcome.

2. Hadn’t done sufficient research on ATO website. Even so, the language causes even greater confusion. e.g. salary packaging; salary sacrifice…

3. Self taught wannabe experts in personal finance/tax who blindly believe they are experts in investment and tax when they have never ever prepared their tax return by themselves especially in areas of dividend income and CGT in shares and the more complicated form: unit trusts.

And if they did, still hadn’t learnt their lesson when the ATO corrects them. They then spread their rubbish in their work place while holding senior positions. And this rubbish continues to perpetuate over the many years. The masses continue to believe in this falsehood and REFUSE to believe in the actual truth when the math clearly states so.

4. They learn from their Accountants (who rely on them for their rice bowl), and then proclaim they know it all, when actually they learned only half the truth.

5. Bottom line, Aussie Firebug is spot on.

Thanks for tackling this head on. I am really surprised, too, with the ALP taking this on. There has been much backlash against it in the grey brigade, but as you point out, until now not in the FIRE community. This is strange because, as you point out, the FIRE community is likely to be affected more (no pension to fall back on)!

Great work AFB and really relevant article about the ALPs intention of atacking a minority of people in this country who are trying to be self funded and not rely on the governments handout in the future.

I have a hunch though if they are elected and it doesn’t get through BS and Chris Bowen will try another angle.

The Serina 🙂

Yep doing my head in the number of people who see it as a good thing. One thing I’ve noticed is a lot of jealousy…the have nots seem to want to punish the haves. They almost delight in it…….. but if the boss over pays your payg you get a refund. This is no different. I’ve stopped arguing now because they just get nasty

There’s definitely some of that happening but I’d say 95% have good intentions.

Like you said, most people don’t fully understand franking credits – I’m one of them. This is the first time I’ve seen an well written explanation of the changes and how it will affect investors. I didn’t have a firm opinion on where I stood before, but now I’m definitely against the proposed changes. Thanks for your work AFB.

I totally hear that this is an opinion piece, and you don’t want to make this about politics. But for a lot of people ultimately it really is. Next month we will all go to the polls. By the looks of it, Labor is likely to win. Which means that puts them one step closer to implementing the changes, which will end up affecting us all negatively. So if we don’t want that to happen, what are the options? Vote Liberal? Vote for the other minor parties? Campaign so that Labor will drop the franking changes? Campaign to raise awareness about how much worse off everyone will with franking changes? Pack up and move to a different country?

It’s good that you’re trying to raise what is a very pertinent question to the FIRE community. But a question like this has mega strings attached politically, and like it or not, that’s how people will respond.

By the way I don’t really have an answer to the problem, I’m just trying to point out why you’re getting so much heat. You don’t owe anyone any answers but my guess is most people here want some way of knowing what to do if the agree or disagree with the ALP changes.

You make some great point Ms FM.

It’s been over a week since I published this and I’ve done some reflecting. I can see now that while I truly didn’t want this to be political (I was actually pointing out people who were bringing politics into FIRE forums), a topic like this is always going to go there.

So many people tackle this issue by bringing in outside noise. From a pure fiscal policy point of view. The refunds make sense. From a pure FIRE standpoint, the refunds means we pay more tax which would delay our path to freedom. But the majority of people don’t think in a vacuum like that. They are considering a range of other policies and ideas when talking about this change which is why politics is inevitable. And I can respect that so many think this way with the majority coming from a genuinely good-hearted place.

To answer your question about what we can do?

There’s plenty of strategies we can implement that will nullify these proposed changes quite easily actually. Let’s see what actually gets passed in the Senate first and then I’ll most likely make an article about what our options are.

Thanks for the comment 🙂

I agree that we shouldn’t panic, but we need to be prepared. Don’t wait until the Senate passes the law. Plan ahead. There might be some things you need to do before the legislation is approved. Wating for the Senate decision might be too late.

I’m already buying strategically Richard… But I don’t like to speculate too far into the future. Time and time again what they propose before an election is vastly different from what actually gets passed.

Wisdom. I’m retired (I’m here because there’s a lot of common sense in your blog and, I sense, a lot of people looking for information) and I need to preserve what we have saved.

I have a master’s degree in Engineering, but I got more interested in software development. I’ve managed multi-million dollar software development projects and was in the group that my employer approved to run mega projects that included the hardware and the software. The biggest one our employer had done that we studied was worth $US 800 million.

One thing we learned was that planning was everything. We did one exercise where we had 10 minutes to come up with a solution to a problem. There were 6 or 7 people on the team and two of them had minimal English. We didn’t spend any time planning (Aaagh! There’s no time!) and we didn’t solve the problem. So we repeated the exercise with a new problem and this time we elected a project leader, spent 5 minutes planning, and got a solution to the problem .

With that background, I try to plan ahead as far as I can. It sometimes drives my wife mad 🙂 But, if you don’t think of everything that could possible go wrong and work out what to do, you may end up in the poo.

Hi Aussie Firebug,

It’s a slippery slope making attributions & coming up with conspiracy theories about other people’s motives. We all have different world views and come from diverse backgrounds.

I would argue that it is a good thing people are posting their views (either for or against) this policy on FIRE forums and FIRE Facebook pages. We tend to seek out information that confirms our beliefs by joining forums, Facebook pages, news feeds etc that align with our beliefs – we can end up in a bubble if we never hear conflicting perspectives.

Hi Jo,

I must admit, the theories I have as to why this phenomenon is happening is pure speculation.

Let me clearly state I have no idea what’s causing this.

I think everyone voicing their opinion is a great thing! And this article is me voicing my opinion on what I’ve seen which has lead to some damn interesting discussions.

That’s all I can ask for really.

Thanks for the comment 👍

Appalled that you would use your platform to spread inaccurate information.

Love your work normally, but this is quite a deviation from quality.

Franking credit refunds will remain in place for people who pay income tax, to prevent double taxation.

You mention: “Australia is the only country in the world that have franking credit refunds”

… not true, because you left out the most important part: Australia is the only country in the world that have franking credit refunds FOR PEOPLE WHO DON’T PAY INCOME TAX.

Quite a significant difference which you failed to include.

Laughable that you question whether it is indeed taxpayers paying the $5billion in franking credit refunds (to people who don’t pay income tax). Who do you think funds monies paid by the Australian Tax Office, whose function it is to deliver

franking credit refunds?

Hint: Taxpayers.

If you are too young or naive to understand this topic, why comment and make hilarious claims about “propaganda”. It damages your credibility.

I can understand why sensible people in the FIRE community support the abolishment of franking credit refunds for people who don’t pay income tax. They understand that getting a refund for money they did not pay themselves is… ridiculous.

If you pay no income tax yet expect franking credit refunds, consider deeply why you believe receiving free money from the ATO, which you yourself never paid in the first place, is fine.

You cannot be “robbed” of something that, as someone who don’t pay income tax, was at best an ATO freebie to you, and something you should never have been entitled to.

A person receives a dividend $X. The dividend they *actually receive* is X minus 30% company tax. The 30% tax paid by the company is held as a franking credit.

However as stated above, ultimately tax liability falls on individuals.

Say this person currently happens to be below the threshold for paying income tax (low income, retired with super balance <1.6m etc.). Their tax bracket is 0%. Therefore they *should not* be paying tax on any income they receive (unless the income takes them into a higher tax bracket). Therefore they should receive the full dividend of $X.

Currently someone in a 0% tax bracket would get this 30% tax that was *subtracted* from their dividend refunded so that their dividend income is taxed at their actual tax rate (and the way their other income is taxed).

With the proposed plan their dividend income will be taxed at 30% because company tax has *already* been deducted from the dividend they actually received – even though they are in a tax bracket where they shouldn’t be paying any tax on this or any other income.

If this individual (tax rate 0%) happened to receive an equal amount of income from a source where tax was not withheld (eg. a distribution from an investment trust as opposed to a company) the person would be in the same situation as if they received a company dividend and franking credit refund – i.e. they receive the full $X from the trust, and since their tax rate is 0% they keep the full $X. Would you suggest this income be docked 30% tax to bring it into line with the proposed policy too? What about wages from part time work? Should 30% be taken out of this income?

Franking credit refunds are not ‘free money’. It’s money that is rightfully theirs based on their individual tax rate. That’s why the policy originated in the first place. So that income is taxed at the rate applicable to the individual receiving it.

Quoting you in first paragraph here but adding corrections in bold text:

“Their tax bracket is 0%. Therefore they *should not* be paying tax on any income they receive (unless the income takes them into a higher tax bracket). Therefore they should ALSO NOT receive the full dividend of $X BECAUSE THEY THEMSELVES PAY/PAID NO INCOME TAX.”

The 30% tax was paid by *the company*, and therefore refunding it as a franking credit to someone *who does not pay income tax* would nullify the company tax paid.

Quoting you: “Franking credit refunds are not ‘free money’. It’s money that is rightfully theirs based on their individual tax rate.“

As you’ve outlined above, their tax rate is 0%. They paid no tax themseves, therefore they should get zero franking credit refunds.

Refunding franking credits to people *who pay no income tax* is indeed like the ATO sending a lovely cash gift (i.e. a freebie), nullifying the company tax that had already been paid by the company on company profits.

@Joseph – ARGH !

Argue it however you want, but it is manifestly illogical to not say it’s a tax, or say they haven’t paid tax.

If you STILL don’t get it, do this:

a) For a non-pensioner, with no other income, received $15,000 Fully Franked Dividends – $10,500 cash and $4,500 franking credits.

b) For a non-pensioner, with no other income, received $15,000 Unfranked Dividends – $15,000 cash and $0 franking credits.

Now tell me what each person will pay in tax under the proposed rules.

If that can’t show you why it’s stupid, nothing can.

Not the person you replied to, but what does your example show?

a) Has earned $10,500. The company paid $4,500 tax (30%). Under the current rules the individual A pays no further tax on their income, under the proposed rules A still pays no tax.

b) Has earned $15,000. Assuming the income comes from a similar source as A, the company has paid 6428.57 in tax (30%). Under the current rules the individual B pay’s no further tax and under the proposed rules they pay no further tax.

The proposed changes only affect what portion of the already paid company tax A or B may receive back. B doesn’t receive it in either case and A currently would but would not under the proposed changes.

Hi Neil.

Thanks for the reply. Sorry if I wasn’t clear (was perfectly clear in my head LOL). Hopefully this is a but better, if not ask away.

Terms quickly for those that don’t know them:

Franked Dividends means tax already taken by company before dividends distributed. May be only on part of the dividend, say 50% franked.

Fully Franked dividends means tax paid on 100% of dividends

Unfranked means no tax taken from dividends before distributing.

a) Has CBA shares and earned $15,000 of which $4,500 was withheld in tax (Fully Franked). They received $10,500 in their bank.

b) Has ZEL shares and earned $15,000 of which $0 was withheld in tax. (Unfranked). They received $15,000 in their bank.

Come tax time….

Today – a) gets his $4,500 back and then both (a) and (b) have paid $0 tax on their $15,000 income. You could quadruple the income and whatever the tax payable would be – it would be the same for both (circa $8,500 each) . Fair, equitible and even.

If the rules change as proposed…and (a) is not on a Gov’t aged pension…

(a) Gets nothing back, so (a) only gets to keep $10,500 of his income where as (b) gets to keep all of his.

Therefore, (a) has paid 30% tax on $15,000 earnings, where as (b) paid no tax at all.

Both income from shares. Both the same in every other way.

Either you get the tax credits, or you don’t – I could argue either way, but the planned changed just make more inequity and hurt those on lower incomes.

Hope that helps.

Oh dear Lord. Is that what Getup told you to say?

I would posit a different reason. It’s an issue of intergenerational wealth equality.

As the distribution of wealth in Aus is skewed towards older people (who have benefited disproportionately from increasing asset values, taxation reform and gov spending) and structural barriers within the economy prevent many younger people from accessing a similar lifestyle, any measure which is ‘perceived’ as leveling the playing field (no matter what it’s effect is in practice) will be popular with younger people (or those who support greater wealth equality).

In other words it’s the view (however misconceived) that removing franking credits will hit rich older retirees harder that makes it attractive to a group which is chasing FIRE but which feels (rightly or wrongly) unfairly disadvantaged in the pursuit.

The ALP and the Coalition have reinforced this contest in their respective messaging around the policy eg. ‘pensioner tax’ (Coalition) and ‘wealthy shareholders’ (ALP).

What is lost in the binary debate is that the policy will affect people of all ages and at all levels of wealth, including younger people in the FIRE community and not just the old or the wealthy.

Actually it will hurt those who it pupports to help the most.

And most retirees aren’t rich – well not the ones I know anyway. Unless you consider relying on the aged pension and a say $200 dollars a month rich…. The “richest” I know have gov’t superannuation – I guess that says something about our taxes at work….