Our Euro adventure has finally come to an end in September 😔.

We ended up travelling around for just a tad over 2 months and I’ve come to the realisation that our sweet spot is around 6 weeks. Anything over that and I start to get a bit ‘over’ it because I’m a creature of habit who follows an unvarying routine most of the time.

We also spent the entire two months travelling with other people which was a total blast but you end up ‘going with the flow’ a lot more which can mean doing certain thing you’d otherwise have been happy to skip. Eating out every single day comes to mind 💸

Here are some of the spots we hit in September.

Colosseum

A lot of people have asked me what my favourite place was when I got back.

And this is a really hard question because I liked some places for holidaying like Spain and Croatia, and others where I would be happy to live like Munich, Germany. The Middle East was the biggest culture shock with incredible history so it’s very hard to pick!

My top 3 overall countries for the trip would be:

- Germany

- Croatia

- Netherlands

I would recommend a Sail Croatia to anyone, but you need to book for the type of trip you’re after. Since we’re a bit older, the four of us went on the more expensive cruise and while we had some great nights partying, it was comforting to come back to your own cabin with ensuite and A/C.

We went past some of the ‘younger’ pirate cruises and it looked pretty intense with the drinking and whatnot, which to be fair, is what most people are probably chasing at 18-21 right haha.

Munich was a super clean and impressive city, that I could easily live in. The public transport was efficient and inexpensive. We were able to get a group ticket for 4 adults for 4 days of unlimited travel for only €29. The food was a major highlight for me, especially the pork knuckle, bratwurst and potato pancakes with sauerkraut, yum! They also had nice drinking water from the tap which is something I took for granted in Australia. Clean drinkable water that taste nice is not common throughout the world apparently (as I’ve discovered this year). I understand that taste is subjective, but a lot of places have shitty pipes and it can be disguising. London, for example, has horrible water. Drinkable, but gross H2O. Oh, and most importantly, the Germans have god-tier beer 🍻 🤤🤤

Amsterdam has the best bike infrastructure I’ve ever seen and it’s not even close! It’s hard to explain why it’s so good but the whole city is basically designed for bikes and you can get around so much easier on a bike vs a car. They have their own little highways and the way the roundabouts and roads are weaved into the bike tracks is incredible and so cool! I really wish Australia and other counties for that matter would invest heavily into a biking network like Amsterdam. It would make commutes so much easier and safer.

One country that was a bit disappointing for me was Italy 🙁

I had very high hopes as I have family ties to the country and actually have an Italian passport!

The thing that annoyed me most about Italy was everywhere we went was overpriced and mostly average quality/quantity. This was especially true for food but even the sightseeing was a bit underwhelming.

Like yeah, the Amalfi coast is stunning and beautiful… but it doesn’t justify charging €20 for literally a piece of cooked chicken on a plate with nothing else. No sauce, no sides, no nothing 😤.

Tourist traps everywhere was another annoyance.

We were in Venice and this dude told us on the street about this 3-course meals for €15.

Great! That’s so cheap we thought (fools!)

We get to the desserts and the waiter just casually says something along the lines of

‘So we have four options for dessert…blah blah blah…’

We ordered, thinking this was included in the price only to have a big surprise when we looked at the bill that the dessert was not included and almost cost as much as the three-course meal… which by the way was an entree, main and the side dish of chips and salad FFS 😤😤.

Little sneaky shit like this pissed me right off for the majority of the time we were there. They just straight-up trick you which makes me not want to go back.

I did have the best ravioli of my life in the Isle of Capri though so there were some positives.

The other thing that made Italy a bit rough was completely my own fault lol.

So I had this grand plan of renting a camper van and travelling around Italy with Mrs FB and another couple we were with. I researched it and followed the Indie Campers Instagram page. They made it look like so much fun! I mean, just look at this:

That’s some great marketing because let me warn you right now… do not.. and I repeat… do not… rent a camper in Italy during summer with four people!

I can’t believe people didn’t talk me out of this beforehand.

The first issue was the roads! The roads are so small that driving a camper through the likes of the Amalfi coast was the equivalent of trying to maneuver a semi through Chapel St in peak hour. It didn’t help that I was driving on the wrong side of the road and it was a manual 🙃🔫.

The other big problem that I did not anticipate was the heat that 4 people can generate within a confined space. It’s really hard to sleep with minimal airflow.

I was glad to see the end of that camper in Austria that’s for sure! It makes for funny stories now but there were some sleepless night 😅

Net Worth Update

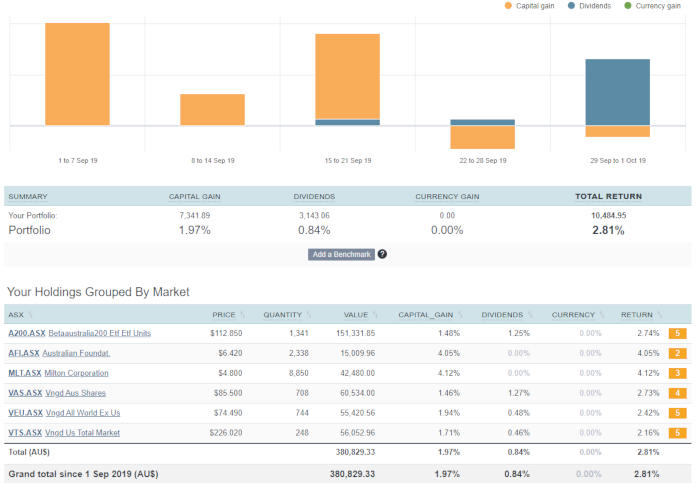

The share market did the heavy lifting for this months increase (as you can see on the Sharesight graph below).

For the second straight month, we only really spent money on day to day spendings as we’d pre-booked most of our accommodation and activities.

The last consulting invoice was paid in September which means no income for a while now. Even if I get back on with my old mob, they take a month to process invoices which means work done in October will not be paid until the end of November 😭 so the old net worth updates could be looking grim in the next few instalments.

Mrs. FB is heading back to work and gets paid weekly which helps. We’ve also got our other income sources like dividends, rent and money made on this blog which all adds up.

This year has exceeded every expectation of how much I thought we’d be able to save so I’m not in the slightest bit mad at all. I expected us to delay our FIRE goal by going on this trip and had made peace with the notion that our NW may decline and end up smaller by years end then it was at the start!

What I did not expect was how lucrative the day rates were in London for data developers and how quick I managed to nab one! The consulting checks really made it an even playing field when I factor in the more than double rent we’re paying here compared to country Victoria.

The power of compound interest is really starting to kick in now too.

Properties

No changes in the properties this month.

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs/LICs

The above graph is created by Sharesight

Epic month all around!

Following the recently updated Strategy 2.5, we purchased our first international ETF (VEU – world ex-US) in over 18 months!

VEU had the lowest weighting in terms of our desired portfolio split allocations so bought around $15K worth 😁

I recently read The Barefoot Investor’s Idiot Grandson Portfolio which, reassuringly, had a combo of 75% VAS, 10% VTS and 15% VEU. Which were the same three funds I originally started out with back in 2016 for Strategy 2. But what struck me more from reading that detailed report was the idea that Scott was considering going 100% VAS (100% Aussie equities).

After finishing the report I’m almost inclined to bump up our Aussie allocation to 70%. It’s not a hard or set rule so you could see the portfolio’s Aussie exposure drift anywhere from 60%-70%.

Oh and one last thing… ETFs/LICs officially make up more than 50% of our portfolio now!

Networth

Of all the photos I like the Gondola caption, it’s so true, glad you said it as it is since a lot of clever marketing goes with it like the camper thing in Italy. You can even blame plenty of bloggers spicing up trips that are in real life shitty.

I agree we should push for a better bike infrastructure here in Australia. A lot of motorist here think as soon as their behind the wheels they own the road! I share a bit of traveling around the world myself and I can say we are so privileged and spoiled in Australia.

Maybe people like yourself who has some influence could be a voice for change, I mean it!

This is btw my first ever post in a blog as I am not a blog reading type of person but I have a lot of time now, enjoy life!

Holy shit ain’t this the truth. I see a photo from Contiki Facebook the other day about how the city of Pisa is stunning and a ‘must-see’.

I went there and literally the only reason people stop is because of the leaning tower. The city sucks.

Like, STFU and stop lying.

I would not at all be surprised is the cities tourism department actually pay that page money to promote their city. It makes sense but c’mon.

I think the whole bike thing needs a culture change which is really hard to do. Living in the country certainly makes it easier though. I look forward to when I return home and can bike down to the supermarket in 4 minutes

I hope you are a paid subscriber to the Barefoot Blueprint for access to the content.

Idiot Grandson from the future: “Wow wish my idiot granddad didn’t have such a heavy Aussie bias before that Australian crash no one saw coming”

Don’t tell that to Peter Thornhill.

Yeah hopefully, for Peter Thornhills sake (and all those who follow him), it doesn’t happen in their lifetimes.

Of course Mr Pape.

Looks like an awesome holiday AFB, there’s so much awesome stuff to see in Europe. And how good is a big football match over there?

Great to see the power of compounding doing the hard work for you now as well! Once you get to the point where market returns are more important than your additional investments it’s a hole new ball game!

The football was epic mate!

Amazing crowd and I’m glad there were a few goals. One of my favourite parts was just the lead up to the game. The city was buzzing and the crowds at the pubs were singing and chanting. And then the big walk to the train station.

Loved it!

I’m really excited to see what our dividends are going to be for next year as we’ve pumped in so much cash into Aussie equities. It’s really exciting and motivating see that passive income grow each year.

Hi AFB. Am interested in your definition of networth and what the calculation is behind it. I understand you are renting but if you owned the house you were living in would you include the equity in your networth calcs? Any good references you recommend for calculating your networth?

Hi Joel,

You can download my net worth sheet on this page mate. Just enter your email address and it will automatically be sent out.

I don’t include PPOR but others do. It’s up to you mate and it’s not going to really make a difference in the end.

Perfect. Thanks AFB. Love the blog and pod.

I’d include the PPOR, cos its essentially the equivalent of the portion of your investment that covers your rent… So, say someone had 500k of shares doing 4% and was renting for 20k a year, and another had a 500k home mortgage-free that he would normally have had to rent for 20k a year, they are in approximately the same financial position…. And yes, some might argue that there are rates and maintenance in a house, well, there are fees and market dips in shares as well….. . And if values rise in an area, rents usually go up as well, so, the numbers still work… The only danger here is the temptation to buy too much house… A million dollar house in a 500k neighborhood isn’t doing much good cos it wouldn’t rent for double rents of the 500k houses……… But I digress…. Hope this helps with your decision…. For me, ppor definitely counts, especially if its paid off ..

Another great post, I love traveling so I enjoy reading your highlights.

I’m curious, do you buy VTS (MER 0.03%) + VEU (MER 0.09%) instead of VGS (MER 0.18%) because with the first 2 you get a similar performance with a lower cost?

Keep enjoying Europe

Cheers

Alex

Hi Alex,

Yes, that’s right. VTS+VEU also has greater diversification and exposure to emerging markets. But honestly, VGS is fine too. The difference is so negligible that it’s almost not worth thinking about. Optimising savings and living expenses like utilities, phone plans, interest rates, rent etc. offers 100 fold the return on investment.

I use to spend a ridiculous amount of time doing the research between funds but I’ve come to realise there’s more important things to worry about.

Cheers

Will you be buying vas or a200? a200 divi is 1.39

A200 mate. VAS is fine too though.

What? No obligatory photo of one of you pretending to hold up the Leaning Tower of Pisa? 😉

Only because you asked for it lol

🤣🤣🤣

Interested in where you keep your (~90K) cash. If it was in an offset account I guess it would count towards equity right? So does that mean it’s in a “H”ISA?

Ps. I relate to your comments re Italy – felt the same when we were there. Expensive and a bit underwhelming. Luckily I was only driving a manual station wagon though!

All spare cash sits in an offset but I don’t count it as equity.

I think part of the reason I didn’t enjoy Italy as much was because we went to all the touristy areas which unfortunately is a lot of Italy.

I would like to go back to where my dad’s side of the family is from in Sicily which I have heard is a bit less touristy.

Ah yeah because you don’t count PPoR in NW. And your cash would be in _that_ offset account. Thanks that makes sense.

Dear AFB

There are some truly gorgeous places in Tuscany. The places you visited are Tourist Traps unfortunately. If you go back to Italy, be sure to visit the Tuscan countryside. Heaven.

Will do Jeff!

Hey AFB great report once again.

Love the travel pics, seems like you had a great holiday!

I’ve recently begun tracking our networth and was wondering in the path to FIRE do we count our place of primary residence (which is now mortgage free since September. WOO!) or just cash, super and shares (or even exclude super)?

Only liabilities at this stage are my wife’s HECs debt.

For us our property asset will always be our home rather than for rental income.

Hi Tom,

If you’re going by the 4% rule you shouldn’t count it. Because it’s not part of your snowball that’s going to be generating the passive income.

You can count it in your net worth but it doesn’t really make a difference. Your ‘snowball’ needs to throw off income for it to be part of the calculations and a PPOR doesn’t fit this criteria.

Hope that helps 🙂

Cheers

It does indeed. Thanks!

Love the blog and pod.

Reply

Imz

Imz on October 10, 2019 at 12:45 am

I’d include the PPOR, cos its essentially the equivalent of the portion of your investment that covers your rent… So, say someone had 500k of shares doing 4% and was renting for 20k a year, and another had a 500k home mortgage-free that he would normally have had to rent for 20k a year, they are in approximately the same financial position…. And yes, some might argue that there are rates and maintenance in a house, well, there are fees and market dips in shares as well….. . And if values rise in an area, rents usually go up as well, so, the numbers still work… The only danger here is the temptation to buy too much house… A million dollar house in a 500k neighborhood isn’t doing much good cos it wouldn’t rent for double rents of the 500k houses……… But I digress…. Hope this helps with your decision…. For me, ppor definitely counts, especially if its paid off

I don’t include PPOR, simply because when you look at your expenses, you already have in there what your home costs you, and it isn’t generating income.

If you counted it, you could mistime your FIRE.

Eg including your home and you own it

800k house

400k Shares

1.2m total

@4% = $48k

Your current real Expenses $45k (no rent as you own the house)

Eg Excluding your home

400k Shares

@4% = $16k

If you include the house you think you’re FIRE, but you aren’t!

People don’t thing what it would cost to rent if they own their home, and average return on property value is typically < 4% in capital cities anyway.

As I said, the problem is the potential temptation to buy too much house..

However, for me, fire goal is 1m with expenses of 40k INCLUDING rent…. If I turn around and use 500k of that to buy a house in a place where it’ll cost me 20k per annum to rent anyway, … Then I’ll have a 500k house, 500k shares throwing off 20k… Thus, I’d have a 1m net worth giving me 20k of cash BUT no rent expense…. Which is EXACTLY the same as a 1m portfolio giving 40k of cash INCLUDING a 20k rent expense

It only goes sideways when you buy too much house…..

Essentially, it comes down to whether its cheaper to rent or buy in the place you wanna live..

If a house can’t rent out for 4% per ANNUM of what you paid for it, its probably too expensive to buy anyway..

To illustrate, real estate investors in the USA, UK and Canada use the 1% rule (and thats per month) which works out to 12% gross per annum

I understand what you’re saying, but you’re also thinking about your expenses and allowing for it.

My worry is too many people wouldn’t.

Then there’s the instance of being in the family home that sure is more than you need, but change costs are massive so it’s cheaper to stay.

My rule is unless you intend to sell it, don’t include it.

If you however you want to include it, then you need to adjust your expenses calculation as if you had no mortgage and ownership bills, and then add back on whatever the next home would be (either rent or own)

You’re doing the latter, and that’s fine because you’re allowing for either way.

Been following for about a year now, even in that short time you can really see how the original hardwork is starting to snowball and create bigger leaps and bounds. It’s definately hard at times at the start not to feel that the goal is so far away but I try to look at your NW graph to see those first initial years of smaller movements and trust that in 5-10 years it will really start snowballing on it’s own. Interesting with the stratedgy change as well, I’m all Aus ETF at the moment (tiny portfolio by comparison) and the next move was to start introducing LIC’s or International, have been fence sitting for a little bit as the idea of dividend income via Aus ETF/LIC is super appealing but it’s definately worth keeping in mind future changes.

Amen to Munich, great place and the beer… man, take me back! I’ve heard it’s pretty rediculouse price wise though to actually settle there. Travelling in general you’ll probably find most of the ‘bucket list’ stuff is overated, overcrowed or overpriced and in some cases a combination of all three. I was a travel agent for 2 years and know exactly what you mean about the marketing side of things, it can definately be deceptive. I think I’ve either read somewhere on here or heard in a podcast that you guys do a bit of hiking in Victoria, travelling Europe in my opinion can get a little dreary if you just constantly city hop. Have a look into Slovenia, lesser known/travelled and gorgeous, it mirrors places like Canada and the Swiss Alps. Poland is another good spot, super affordable by comparison to western Europe, I recall paying sub 5PLN($1.90AUD) for a pint of beer at a local pub, the south (Zakopane) has some nice hiking/mountains as well. Enjoy!

I hear ya Beau,

When I first discovered FIRE in 2013 I was semi depressed because I knew it was so far away. I went from being happy at work to miserable which is not something I’d recommend to anyone. You almost are better off not knowing about FIRE until you’ve built up a bit of wealth. It can be disheartening at the very start and some people give up before they even begin!

The power of compounding takes time and you don’t really benefit from it until many years later which can be a mental hurdle to get over. But man oh man, once you do start to see the results it’s an absolutely incredible feeling 🙌

A few people have mentioned Slovenia and East Europe in general. Will definitely try to hit it up next year for sure!

Hi AFB,

Great going and loved your photos.

May be a silly question but wanted to know what you used for those pie chart and graph? 🙂

Thank you

Google charts mate.

https://developers.google.com/chart

Great to see your chart really taking off. And v jealous of trip to Italy, althougth I make note to research food options prior rather than getting tricked into expensive rip off joints – Athens was the same!

I’ll give ya a hot tip. Rome was the dodgiest place I’ve ever been to!

If you’re after good cheap food (and huge servings) then Eastern Europe is the place to go!

Roger. We will probably hit up the East next year I reckon!

Glad to hear you’ve got plenty of cash on standby. Which account do you use? ING? BANKWEST?

Citibank and ING in Australia.

I’m glad to hear you enjoyed your time in my neck of the woods so much! I lived in central Munich for 12 months a few years ago. The cost of living is absurd. I was lucky because my work paid for everything. Most people with normal jobs can’t afford to live anywhere near the city or surrounding suburbs and spend hours on the train each day. It really is a lovely place though and a great base for weekend trips to the mountains.

Germany is fast becoming one of my favourite places in Europe! It felt really affordable compared to Italy tbh.

Hi FB,

Great BLOGS and info.

I’m sitting on $400k and trying to decide whether I go into more commercial property or direct it into mores shares(currently have a bit of both).

My question: What quarterly/annual income is your ETF/LIC bringing to you? And do you DRP that income or sit on it and reinvest when you choose?

Cheers,

Hi Rob,

Our shares returned $8K last year. But we have bought a heap of shares since then so I’m expecting a return of around $15-18K for next year. It all depends on how the markets perform though right.

I don’t use DRP but re-invest all our dividends. I like the mental aspect of seeing the dividends hit my account.

Cheers

Hey AFB, I was wondering how you compare your Net Worth to your FIRE goal, since you cannot access Super as part of your annual income?

E.g. if you want 1 million balance to retire with 4% draw-down for $40k per year, I guess you can’t count Super into the balance when you’re “under age”?

Cheers

Hi Dan,

These net worth posts are just to give readers a complete picture of our finances.

The number we really want to focus on is the value of the shares portfolio. This is a much better way to access our progress to FIRE. We’re aiming for a shares portfolio of around $1M.

Hope that helps.

Cheers

A lot of my friends have not enjoyed Italy due to the tourist traps, the mafia and the dishonest techniques used by the cafes and restaurants. I think Italy can be the most disappointing because the expectations are high with the food and the fantastic historical sites on offer.

Agreed!

What’s your thoughts on just sticking with VTS as the US market has an average annual return (10yr) of 14% and VAS is only 4% based on the vanguard website! I’m sorting out of my future percentages for VAS/VTS/VEU for diversification but VTS looks like it’s just too strong on the returns! Am I missing something with VEU and VAS average returns to justify having them instead of just VTS? Cheers for everything your doing mate. I’m just beginning my FIRE journey

To quote the old saying…

“Past Performance Is Not Indicative Of Future Results”

Who’s to say VTS will do well in the next 10 years..? No one knows, unfortunately.

Congrats on starting your journey too 🙂