This years review was a lot more complicated to calculate because we earned and spent money in two different countries which meant keeping track in two different systems. The tax was a bit tricky too and it has taken a lot longer than I would have hoped but better late than never!

You can check out last years review here where we achieved a savings rate of 66%.

So how did we do this year?

Let’s get into the numbers.

Savings Rate For 18/19 Financial Year

Our savings rate for last financial year was… 56% (▼-10% from last year)

We earned $185,441 (▲+$43,944…mostly after-tax*)

And spent $80,817 (▲+$32,818)

Compared to last year we increased our income by $44K, which is great but unfortunately, that was accompanied by a record-breaking amount of expenses which was mostly due to our travels. We spent more than $32K compared to the previous year which decreased our savings rate by a whopping 10%. This further illustrates that it’s the expenses that are a lot more important vs how much you earn when it comes to your savings rate!

I’m pretty stoked about 56% tbh. It’s a fair dip down from 66% but considering our travels this year, we can’t complain at all.

I’ve included a breakdown of our income for this years update too so you can get an idea of where our $$$ come from. But the really important part is still the expenses.

*I’m still in the process of completing the tax obligations for the trust and AFB. I’ll update this article when it’s done

Breakdown Of Spending

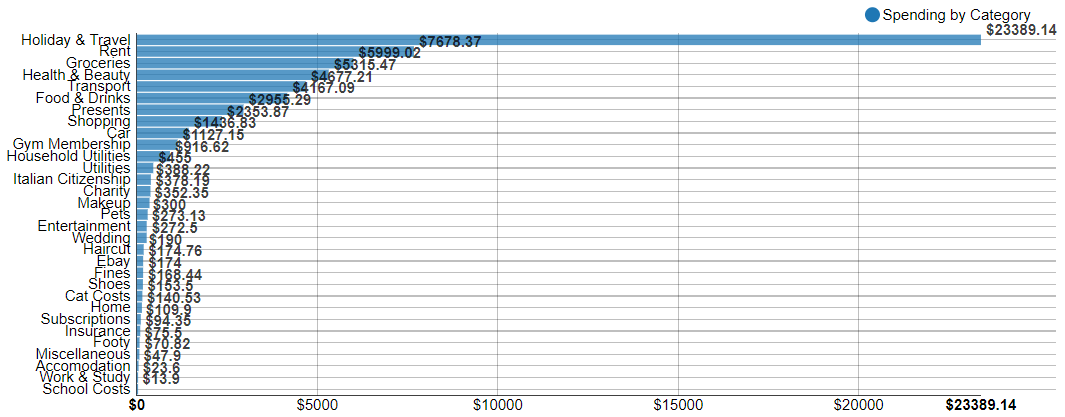

Below is our Australian expenses for the last FY.

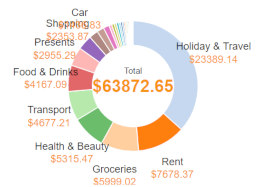

And in pie form

Holy Mackerel our ‘Holiday and Travel’ category exploded into our number 1 expense which isn’t all too surprising really. Majority of that $23K was the costs of flights, accommodation, food/drink and cash out for activities. It also covers some of our London setup costs when we were still using our Australian Money to pay for things before we set up our UK account. It’s a lot of money and it’s crazy how it all adds up but this trip (that we’re still on) was never about saving money. It’s not something we plan to have in our yearly budget once we FIRE though.

Not surprisingly, rent and groceries come in next which was our number 1 and 2 expense for last year.

‘Health & Beauty’ came in 4th because Mrs. FB had a toothache about 4 months before our trip which resulted in an operation to remove her wisdom teeth. We went private because we needed it done ASAP but it cost around $3,500 💸. If we had more time to plan properly, I would have liked to research how much it would have cost in Maylasia or somewhere similar. I’ve heard stories about how dental care there is just as good as in Australia but 1/5 the price.

‘Transport’ was the new category instead of our ‘Car’ one for last year. It went down a little because we left Australia in January and only had ~7 months of Car expenses instead of 12.

‘Food & Drink replaced ‘Entertainment’ and went slightly up.

Our ‘Gym membership’ went way up because I started to train Brazilian jiu-jitsu twice a week but I absolutely love it! I’m still a white belt and haven’t found a gym to train in London unfortunately.

Those were the main ones with the rest of the expenses being pretty similar to last year. Nothing else really jumps out at me.

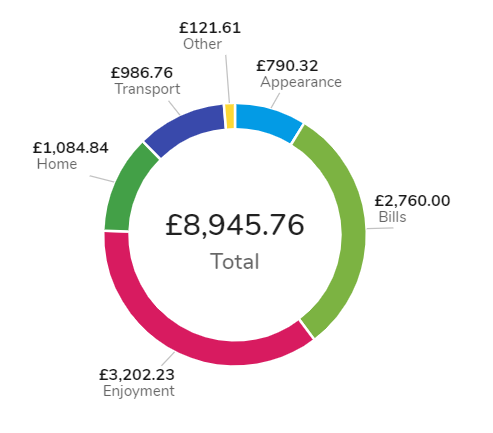

And here is our break down for the UK

We use an awesome money management tool here in the UK called Money Dashboard which works very similar to Pocketbook but it’s actually a lot better. For one, you can split transactions! This has been a feature request I’ve wanted pocketbook to do for like 3 years but they just won’t bloody do it!

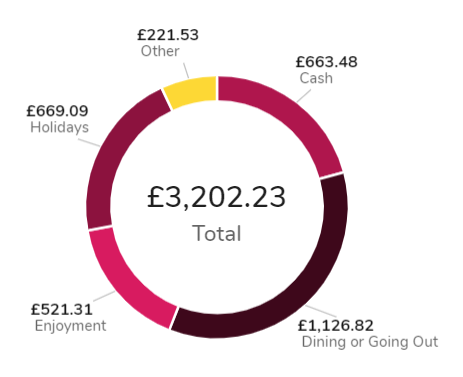

Anyway, our ‘Enjoyment’ category has been our biggest expense while being in London and it drills down to look like this.

To say we have been ‘treatin’ in London when it comes to our ‘enjoyment’ category would be an understatement. Part of experiencing our new city has been taking advantage of what it offers in terms of sporting events, restaurants, concerts, activities and nightlife. The funny thing is, we don’t actually spend that much compared to our friends over here. We still take a packed lunch, get the bus/train, look for things second hand on GumTree etc. It’s just that if I compare how much we spend on doing ‘stuff’ in London vs back home in country Victoria, it’s been a blowout!

‘Bills’ has been mostly made up of our £900/m rent costs and ‘Home’ covers all our groceries home set-up costs.

Breakdown Of Income

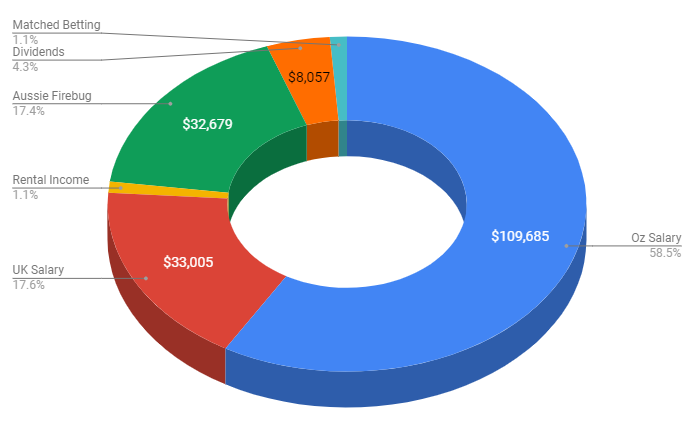

A new addition to the yearly update. I thought it might be helpful for people to see where we earn our money and how we have built multiple streams of income that contribute to growing our snowball.

No surprise that exchanging our time for money (a job) generates the bulk of our income. A combination of our Australian and UK salaries equate to over 70% of our income. But the remaining 30% is a little bit more interesting and is part of the pie that we are aiming to grow over time.

This blog generated an astonishing ~$33K during the last F/Y (excluding taxes). That was through a combination of sponsorships on the Podcast and affiliates. I only started to seriously monetise this site last year with companies I was already using. I actually pioneered a few affiliate programs that you now see being used by a lot of other bloggers/authority figures. It’s amazing what a simple conversation can do.

I approached some of my affiliates with something along the lines of

‘Hey, I use your service and love it. I often recommend your product on my website if people ask. Would you be interested in buying some adverting space on my podcast or maybe an affiliate where my audience gets something that’s not available to them now? What do you think?‘

Sometimes I don’t hear back from them, but other times it works out better for everyone. I end up getting paid for my work, my audience gets a better way to sign up with a company I use and recommend, and that great company gets a new customer!

A lot of people have mixed feelings about monetising a blog. I’m a huge sceptic myself whenever anyone receives a financial incentive for recommending a product and there’s really nothing I can say or write that will convince some people otherwise. I’m pretty transparent on this website and I would like to think that I’ve built up a certain level of trust amongst you all, but I understand that there’s always going to be people who don’t dig it.

Having a side hustle can be a huge accelerator towards FIRE. But let me tell you straight up, if you’re thinking of starting a blog with an intent to monetise it later, you’re probably not going to get far. And even if you do, I’d doubt you’d make anything worth your while if money was the sole intent. If I was to divide the money made from this blog by all the hours I’ve put in, I’d be much better off working at Hungry Jack’s on minimum wage. This site is about money but was never intended to make any, I simply love creating FIRE content for Aussies and will continue to do so with or without the sponsors/affiliates.

You can see every company I’m affiliated with on the resources page.

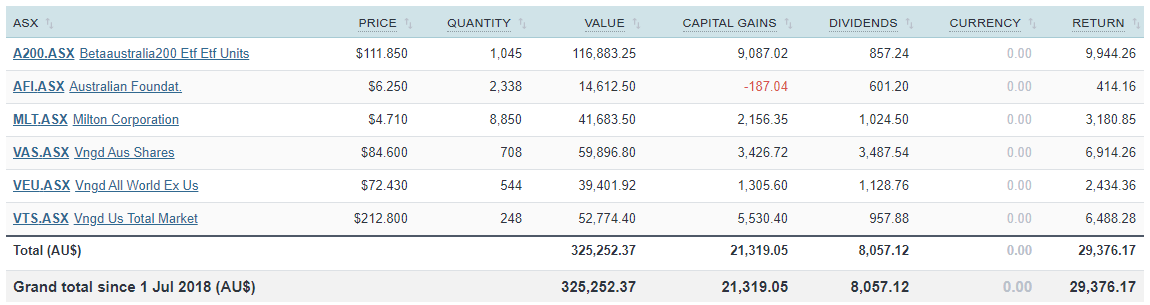

Dividends were broken down like so

I’m stoked with $8K but am really looking forward to seeing the results of this report next year. A200 only returned $857 mostly because it was a new fund. Considering we currently have over $150K in that ETF as I write this now, the dividends should be closer to $5K-$6K assuming there’s not a crash or bear market. This is the slice of the pie that we want to grow as much as possible and will become the foundation for our financial freedom. It’s so exciting seeing the income grow each year especially now it’s starting to add up to a considerable amount.

I mean shit, even at $8K a year, that’s a kick-ass yearly holiday for the rest of our lives! Not to mention that even if we never added another dollar to the snowball, it would continue to grow faster than inflation and consequently raise the income without us having to do anything!

We ended up making just over $2K from matched betting which came mainly from the signup bonuses of the bookies. While it is possible to continue making money through matched betting, it takes time which I didn’t think was worth it for me personally after we had exhausted the sign-up bonuses. A Family On FIRE documented her experience using matched betting as a side hustle which is a fantastic case study and well worth reading if you’re considering trying it.

And last but not least we have the good old rental properties generating us a measly $2K. I’ve said it before but I’ll say it again, Australian residential property absolutely sucks at cashflow. The amount of time and effort I put into our two remaining properties with all the banks, conveyancing, tenant issues, chasing rent etc. makes it laughable that they only returned ~$2K cash last year. Now we all know that the real reason most people invest in Aussie property is for that sweet, sweet capital gainz gravy but eh… I won’t know how much that turns out to be until I sell and it doesn’t help me until then.

What About You?

That’s it for another year!

My number one tip has always been to track your expenses. You won’t ever know how much passive income you’ll need to FIRE unless you do and it creates good financial habits. I hope this post was helpful to you as it’s always interesting to see what people spend their hard-earned dollars on.

What about you? Do you have a category you really need to rope in? Or maybe it’s time to look into a side hustle to boost your income?

Let me know in the comment section below.

Larger expenses driven by travel and ‘treatin’, not recurring but bloody fun by the sounds of it! Good on you 🙂

Very fun, can confirm 😁

You’ve inspired me to start tracking my expenses in more detail. When using Money Dashboard or Pocketbook do you need to update it manually eg to allocate cash expenditure to particular items /categories or is it automatic? How much time would you spend on this each week or month? Thanks!

Hi Jonathon,

The software has pre-built in rules. If the word ‘Coles’ appears in the transaction, it will most likely auto categorise it as ‘Grocoriers’. That accounts for around 90% of transactions. The other 10 percent you’ll need to go through it and ‘train’ the software that this transaction type goes into this category.

The cool thing is that it remembers it so you’ll only need to do it once.

I spend about 15-20 minutes every Sunday night going through and just seeing how we went.

Thanks. Is there one you’d recommend for an Australian context?

I use Pocketbook but am looking into PocketSmith atm

I’m also looking into pocketsmith.. What are your thoughts on the paid subscription? I’m leaning towards it because pocketbook maintains it unpaid service due to data collection and the onward selling of this data (so I’ve heard) … Also pocketsmiths forecast feature is pretty sweet! Any chance for an affiliation deal with pocketsmith🤔😜

Haha we’ll see mate

Have you tried Frollo? It was suggested by How To Money Australia. What do you do when you use cash for purchased, like coffee etc?

No I haven’t. I’ve been trying pocketsmith and have been extremely impressed!

I try to avoid using cash as much as possible but when I do, I try to remember what I bought with it or I just chuck it in the ‘Spending Money’ bucket which isn’t great for reviewing but sometimes there are things I can’t remember.

I’ve been working in Europe too for the past year so my savings rate has taken a hit as well but the experience of travelling has been amazing. Money well spent, in my opinion. We might be delaying FIRE by a few extra years as well (not that I’m close!) but I don’t mind too much – you can make more money but you can’t make more time.

Very true!

The whole point of FIRE for me is to create more time in the future, spending time wisely now while we’re young seems like a good trade-off.

You got the balance right, Mate. It is true that travel is the only expenditure that makes you richer! Keep that your number one expenditure and you will not regret it later, promise. I am celebrating 20 years of travel this year across 60 something countries. Love it and will keep traveling.

Nice one FG,

I haven’t regretted this decision one bit! I actually wish we went earlier now 😁

What is the difference between dividends and fire in yr pie chart ?

Not sure I understand what you’re asking Pete 🤔

Can you explain a bit more mate?

Solid income (i reckon those income are net of expenses).

AFB, would you or anyone you can interview with regards to this idea of “Slow-FI”?

I mean most FIRE bloggers especially in the U.S. are into Fast -FIRE where they scrimp and save and sometimes not enjoying their journey towards F.I. and at when they retire they not much happier. I think The MAD FIentist shared something about this.

All im saying is that we somehow need to find a balance on our journey towards F.I. and sometimes we need to compromise. Hope you can write/talk to us about the “Slow-FI” philosophy.

Hi Sageybadegey,

I reckon just about everyone who became obsessed with FIRE made the same mistake at the start. Not enjoying life hoping that reaching FIRE will somehow make it all better.

It happened to me…

The trip we’re on is delaying our progress to FIRE but it comes back to that balance you’re talking about.

My thoughts have changed a lot during the years and I think that anyone looking to FIRE shouldn’t scrimp and deprive themselves. It’s just about cutting the expenses out of your life that are rubbish. The $6 coffees, $150K cars, $1.5M house etc.

If you’re depriving yourself along the journey, IMO you’re doing FIRE wrong!

6K a year for rent ? You scored big on that one, I just can’t see how it can be done. Did you live with family or friends?

Hi Douglas,

The Pocketbook line chart is terrible for aligning the categories to the numbers.

We paid $7,678 for rent in Australia plus $5,210 (£2,760) in the UK which totals up to $12,888 in rent for the last FY. A little bit confusing I know.

We didn’t live with family but room shared with another couple in the UK who we’ve become great friends with.

Hope that clears things up.

Cheers

Yeah a few of us here were also wondering how that’s possible

I’m going to be in London in a few weeks time (eeee! first time visit!) so any tips on visiting the touristy things and saving a few bucks?

This year is also a blow out for us in terms of holiday expenses (among other things) but despite that we’re still doing pretty good I think. I’m so glad I found your blog so I could start tracking things and being more accountable with our money. It’s certainly helped us.

Hi Jess,

I actually have been working on a monster ‘Australia to UK’ post that covers a lot of this. Keep an eye out because I’m hoping to publish it soon.

Read this post

https://www.aussiefirebug.com/jul-2019-net-worth/

It explains how to see Stone Hendge really cheaply.

I have a few other tips but there in the other post. Stay tuned

Hey Firebug! Awesome blog. Appreciate the transparency. I recently moved from London to Melbourne, started a personal finance blog and also writing a post about ‘London versus Melbourne’ – am super curious to find out how you find the UK/London. I am also on the FIRE path but my ‘weapon of choice’ is property (yes, I know how you feel about it and I feel the same about shares :P); maybe we should do a virtual race who achieves FI first :)? I think I saw somewhere that you had issues with your UK bank account – have you got your borderless account and multi-currency card from Transferwise? May be too late to mention it but, just in case you know of anyone else who may need it, you can also get a UK account with Revolut card [you can get the Revolut card for free with a friend’s referral]- both cards have great exchange rates, so perfect if you travel around. Do feel free to me give me a shout if you have any questions about living in the UK. Good luck with all your plans. PS.Congrats on the engagement!

Hi Nikola,

I’m glad you’re enjoying the blog mate 🙂

We LOVE London/UK but definitely not for the weather 😅

I think a major reason why is because it’s the first time we’ve lived in a major city and have been enjoying all that it offers. There’s a world of difference between moving to London as a broke student vs a couple who are well established in their careers and are strong financially. Being the gateway to Europe is also one of it’s biggest attractions to us.

There’s absolutely nothing wrong with property! I actually like it as an asset class for the right investor and we definitely wouldn’t be in the position we’re in if we hadn’t invested in property at the start. I think all asset classes have merit and there’s no such thing as the perfect investment.

I’m all sorted with the banks now after I discovered transferwise and Monzo thank god.

I race to FIRE eh haha well I checked out your site but not sure I know how far along you are? Friendly competition is always a good thing 😁

Cheers

I wish I could tell you the weather will get better but, well, you will just get used to it 😉 I am way behind you, at around 450k net but will catch up…one day. Unfortunately, Australian law has massively restricted my property investment option in Melbourne.So, am looking for some short term investment for the next 3 years (btw, would you have any suggestion)? I may check out P2P lending. Forgot to mention in my previous post- thanks for the clearly and nicely layout resources page. Want to come to London next year so, hopefully, using the Point Hacks will help.

Hey Jess. I hope I am not overstepping and Firebug will not mind if I respond to your question about visiting London. As a rule of thumb, you should not pay the full price on ANYTHING. There are sooooo many discounts, sales, deals in London that can save you A LOT. I would start with checking out Groupon. There is also London Pass (I think it is pretty good for an intensive tour).Public transport is expensive comparing to other cities but ask any staff member at a station and they will explain to you what would be the cheapest option for you as it depends on how often and where to you will travel. If you have a student card- ask if they have discounts (signs are not always up). Check out bookatable.co.uk for restaurant deals (London Pass has a discount too). If you are going to buy anything online, next day delivery is pretty much standard (often free) and yes, it really does come the next day so if you compare prices you can save quite a few quid (pounds); if delivery is not possible usually John Lewis will have the best prices for premium cosmetics, Boots is also very good (you can compare the prices online). Get a multi-currency debit card from Transferwise (there is a link in to Transferwise in the Resources tab) or Revolut to save on the exchange rate. My fav place in the London Dungeon – just Google London Dungeon discount and you should get some £ off. Nice view of the city in the evening from the Walkie Talkie/SkyGarden tower (bar + restaurant) or the Shard. Hope you will enjoy it.

Hi FireBug! Thanks for the update. Super interesting and I love the high light of the dividends, make me think about my next investment.

Odd question about the app Pocketbook. I think you work in IT, are you concern about the link to your bank account? I do not understand much but i think that because each time that you refresh the app need to connect to your bank to update the data… means that if the app company is hack they could see all your log in information.

I installed the app, I link everything and at night showing to hubby (Cibersecuruty consultant),for him was a no no, and I need to change all my passwords!

Just wondering about your tough, any really, thanks for sharing! You know what they said, sharing is caring 🙂

Hi Pilar,

Yeah there is a greater security concern for sure. I have 2-factor authentication for transfer with my bank so even if someone got my details. They couldn’t steal my money.

It’s a risk, but I choose to trust the security of these companies. If you don’t, you could always export your transactions as .cvs files and upload them into the software. Works the same.

Cheers

Thanks for the tip about the .cvs! I did not realize you can do that. Thanks!

Hi AFB,

Appreciate the regular articles rolling in. I have done the same as you about 4 years ago and consider it certainly best “investment” one can make, especially whilst we are young and can really enjoy it.

Question regarding your holdings – any reason why you have not considered a fund like ASX: GEAR as you have the power of time to ride out the amplified highs and lows..?

Cheers

Hi Michael,

I gave my thoughts about internally geared ETFs in this Ask Firebug Friday.

I’m not a fan of them due to their ‘volatility drag‘.

They aren’t the same as traditional leveraged investments like property or a margin loan.

Cheers

Just found you YouTube channel and blog this week, love it! Really appreciate how detailed you are. Whatever money you make off the effort you make is very well earned. I totally appreciate your frankness and am happy to read/hear content that may be sponsored so long as you truly support it, after all, it is up to me to do my own research before I take my own actions. Thanks!

Thanks a lot Cindy.

I really appreciate when people have this perspective 🙂

I always tell people that you need to do your own research. Never blindly trust anyone. Especially some random dud eon the internet!

Loved the insight mate, great work. I tried match betting and came to the same conclusion, not worth the time. Had a mate lose his entire bankroll from one agency, just not worth while. Also very refreshing to see an honest take on the romance of investment properties, give me AFIC or VAS any day. Loved the dividend summary, you are flying now.

Thanks DD,

I like the low hanging fruit of matched betting. I think it works well for someone with a bunch of time like a uni student during the summer or something. The ability to do it online is a big appeal too.

Haha, the old properties have actually done pretty well with the capital gains but I agree that I’d rather the money being put into the share market.

Hey mate

Do you include your super in these figures?

No I haven’t! That’s a very good and valid point though. I’ll look to update it 🙂

Hi AussieFirebug,

Ive recently discovered your vlog and I absolutely love it. I’ve read almost every single article you’ve written and I have become a big fan!! Thanks for making this vlog.

You probably get asked a lot about how to get into etfs and LICs. I understand the concept of how they work but, what is advised to start? I have saved $5000 and I’m a student in uni so I’m only part time. I really want to buy LICs like Milton And etfs but the amount that I should purchase is what I find difficult to divide. What’s a good starting number? Thanks in advance if you have time to reply

Hi Leah,

Thanks for the kind words and I’m glad you’re enjoying the blog 🙂

The hardest part when investing in the sharemarket is getting started! Too many people suffering from analysis paralysis. Dipping your toes in is a great way to get started.

Making a trade worth $1K is a great way to start the process and gain confidence. I wouldn’t stress about the brokerage for the first trade. But doing it is a hurdle in itself.

Hope that helps

Great article, FB. Great to see how it can work in the real world.

Just thinking, your dividends are a great advertisement for VAS over A200.

A200 was a new fund. The dividends will be a lot closer next year and once it reaches maturity, they should be almost identical.

A really great tool for anyone who’s thinking about tracking their expenses in more detail would be what’s offered by the newer digital banks here in Australia (I’ve heard there are already a few over in the UK). I used to use Pocketbook but the security put me off but now that I’m with Up, all of my transactions are automatically classified and I get weekly and monthly spending insights. You can even set up your pay such that it’s cut up into certain percentages and sent to different savings accounts in a similar way to the Barefoot Investor’s bucket strategy.

Hi Brendan,

I’ve given UP Bank some thought precisely due to the convenience of the savings rate being across multiple accounts and the insights it provides, etc.

However, how do you handle direct debits as I understand you can only have one transaction account and they won’t let you have DD come out of any of the savers? Seems like that is a a huge downside.

Hi Mate,

How often do you purchase the index shares? Is it monthly?

Sorry if this has already been answered.

Yep. We aim for $5K each month but have been doing more since we sold IP1 last year and had a lot of excess cash.

$8k in Dividends is real nice, next year’s report should be a solid number!

I’m expecting to generate $6-7k in Dividends by the end of this financial year. I feel like I’m finally starting to see that momentum really kick off with my investments.. it takes a long time to build but the compounding effect is unreal to witness in action.

I don’t currently track my expenses so I might look into PocketBook, somewhat curious now!

Nice one!

Once you break past that first $100K it really starts to come easier IMO.

Tracking your expenses is a must for FIRE I think!

Hey AFB,

I spend thousands a year on insurances. You spend $75??

What’s your thoughts on insurances? Surely you’d have building at least for your investment properties? Health? Car? Life?

Thanks in advance. Pat

Hi Pat,

We actually spent $94.35 (pocketbook doesn’t line up the chart correctly).

This was for family ambulance cover.

A few things to keep in mind:

– That only covers our Australian expenses for 7 months in Oz

– We don’t have private health, life insurance or income protection

– The cars insurance is covered under the CAR category. This will change next year to the INSURANCE category to make it easier

– The expenses above do not include all expenses associated with the properties, running the website or my business expenses here in the UK which include £1,000 worth of insurance. These are contained in their own categories for tax reporting responses. It would blow out the number if I included all the interest we have to pay for the properties and everything else. We definitely have insurance on both the properties.

Hope this clears things up mate. If you have any other questions please do ask 🙂

Cheers

Thanks heaps for your detailed response mate, really appreciate that. It definitely clears it up. I know I’m heavily insured but I was like what am I missing if yours is only $75?! Haha. I was like How can I get mine that low! Lol.

I pay the health insurance only coz it’s cheaper than the Medicare surcharge levy. Car is unavoidable unfortunately, 3rd party. I do have income insurance though at this stage of my career. And also building/contents for my PPOR. No investment property at this stage.

Anyway mate keep up the great work and thank you. You’re a big inspiration to me.

Agree with the importance of tracking expenses and formulating a financial game plan. Without that, its as good as running with your eyes closed.

Any thoughts on why AFI is trading at a premium whereas MLT is trading at a discount ?

The difference between the 2 is nearly 7%

No idea mate. Good little discount though!

Thanks for being so transparent as always, how do you guys find living and cost of living in the UK compared to Oz? I think travel and holidays is the number expense for most young couples (ourselves included), but is always worth it!

SO worth it hey.

Best things we’ve ever done!

That is quite the comprehensive breakdown, thanks for sharing. Good to see multiple sources of income. That’s always very important.

Thanks for a good post. I remember your thoughts and justification of going from VAS to A200 being it’s lower costs. Now looking at both ETFs dividend returns does it still make the same sense? I understand that A200 is a new fund and still growing but I also read that dividends going to be lower for the same reason. I am asking as I haven’t made my choice yet.:)

I’m still happy with my Decision Yuri but honestly, the difference between the two is so small that I’d never lose sleep over it. Getting started is often the hardest part

Hi Firebug, Have you considered trying to grow some of your own food at home to reduce your living costs? I have really enjoyed gardening and found it to be a very therapeutic hobby. I have been able to successfully grow about a third of the food that I eat, including lots of fresh greens, herbs and things like tomatoes and snowpeas. Its quite fun and I like the challenge of keeping it low cost. I think I have spent $1000 all up on plants and equipment, but saved much more than that on food. Just an idea. Cheers

YES!

It’s a bit hard to get any sort of veggie garden going living in a flat in London atm but we (Mrs. FB and I) totally want to grow some of our own food when we go back home and have some space. It’s one thing I can’t wait to do actually!