Oh baby!

BIG bump this month after we sold Investment Property 1.

The huge influx of cash actually hid a terrible month for every other asset we hold.

The reason it was such a big jump this month is because CBA valued my property at $416K which was almost $100K less than what I sold it for!!!

And I can completely understand why they would do that. Some people think the banks overvalue properties, but my personal experience has been the complete opposite. I don’t think it’s in the bank’s interest to overvalue if I’m being honest. The property is their security for the loan after all. If something happens and you can’t pay back the loan, they are hoping that the sale of the property will pay them out. This is why a deposit is important for banks. It mitigates risk.

If I were to put my tin foil hat on for a second and cook up a spicey conspiracy. I believe the banks have specifically not updated any of my properties to their true value or even a conservative value to curb further exposure to property. A very specific algorithm that takes into account what similar surrounding properties are selling for has been paused across the board.

Just look at everything that’s been happening within the last 18 months. I/O loans are so much more expensive than P&I. I’m actually in the process of switching my loans over to P&I not because I have reached the end of my I/O period, but because the rate is so much better for P&I and it only works out to be around $100 extra each month but with the added benefit of paying less interest plus cutting into the principal (which I will get back when I sell).

The banks are making it exponentially harder for anyone to get loans (both investors and homeowners).

I don’t think that this is necessarily a bad thing. Something needed to be done in Melbourne and Sydney as the prices were getting out of control.

But still…Undervaluing by $100K? Really?

Net Worth Update

We got smashed in everything but cash this month. Our spending was way more than usual, ETFs and Super were way down and we started to put money onto our travel card for our overseas trip next year.

We are sorta dollar cost averaging into the travel card lol. Instead of doing a big transfer before we leave, we are doing it gradually over the next few months to spread the risk of the AUD dropping.

Our cash holdings are currently $218K 😱

I would often see people with large cash holdings and scoff since that money should obviously be invested straight away…But I’m telling ya. When you’re actually in the hot seat, it’s different.

I know that the research says that a lump sum works out better the majority of the time vs DCA… buuuuuut I just can’t do it. Our money is sitting in our offset and we are going to drip feed $15K in each month over the next 18 months unless there was an opportunity too good to pass up on.

It’s kinda cool to know we could pay off all our debt if we sold our shares too. Very comforting 😊

Properties

IP1 has officially been sold! Wooohoo 🎉

Should I remove IP1 from further updates? It might confuse future readers

‘Hey, why do you have IP2 and IP3? Where’s IP1?’

I might just leave the following

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs/LICs

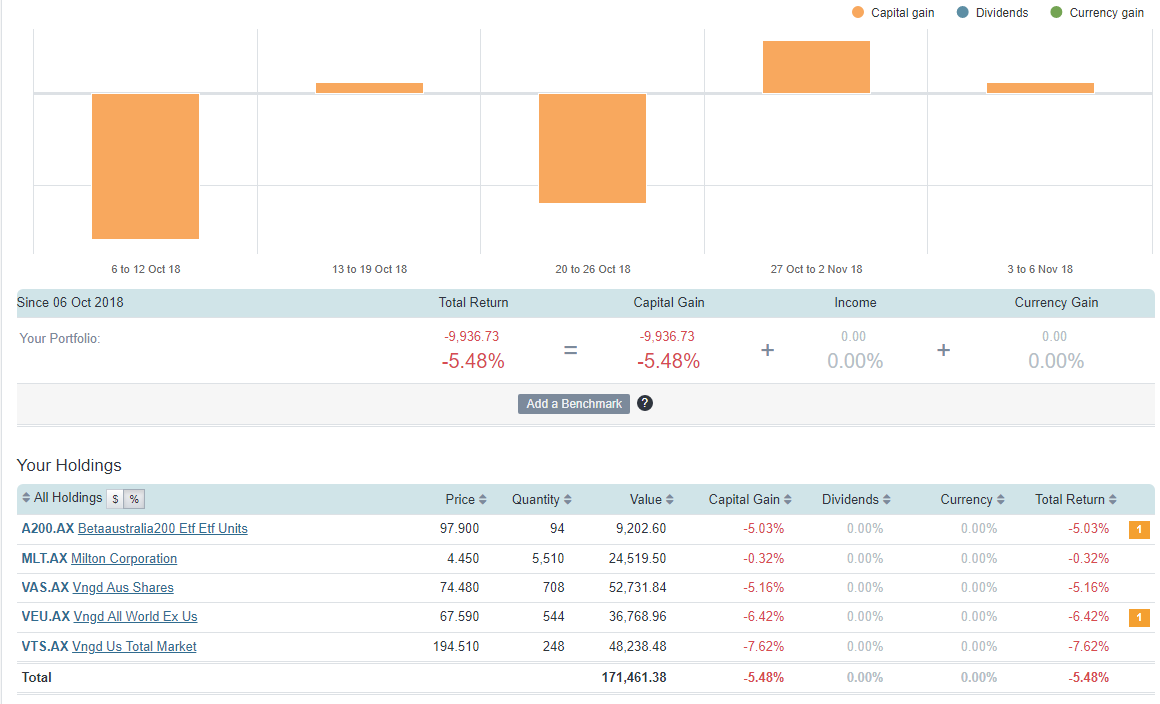

Our shares had a terrible month 😭

But I’m secretly happy. We are cashed up right now. If this global recession everyone keeps talking about could just drop already, that would fantastic.

We bought $15K worth of Milton during the dip last month 😬. The plan is to drip feed our cash into the market over the next 18 months at around $15k a pop.

Networth

Hi AFB

You made a good point that it is hard thing to do when you actually are in the hot seat to put the entire $200k invested especially in the current market environment (we aren’t far away from the crash I think)… but I think since you are still working and able to come up with meaningful monthly fresh cash injection, then why not simply invest about 70% of the lump sum cash and leaving the 30% as cash holding?

Not a bad idea. I’ve been thinking about dumping in 50% and DCA the rest.

Hey AFB.

I feel your pain with the market gyrations over the past few weeks and likely the coming weeks too.

Have you detailed why you have put more $ into Milton rather than A200 which has a significantly lower MER etc?

And, why Milton over AFI/ARG/BKI….. particularly given BKI has a better yield?

Cheers J

He detailed that his newest strategy is to invest into MLT and AFI if they are trading at a discount and then if they are both trading at a premium, he will invest in A200. It wouldve just been that MLT is trading at a bigger discount than AFI still.

Matty’s comment is correct

So true regarding CBA. I had the same issue when I sold one of my IP’s last year. It wasn’t $100K less than their value, but it was still substantially less. I have also changed my remaining IP’s over to P&I for the same reason you mentioned. I would have done it sooner if I had realised the rate difference was so large, but better late than never.

I totally get your reluctance to dump it all into ETFs – I was lucky enough to have a lump sum last year after selling an IP really successfully and immediately dumped a third of the proceeds into another IP, a third into the renovating our PPR (which we thought we would sell but liked it so much we are staying -facepalm) and a third to our PPR mortgage. The benefit of another IP is that you can’t keep yourself up at night watching the price bounce around like you can with shares. However in theeeooorrrry if I had a lump sum again, and didnt have a PPR to pay off, I’d like to think I’d just smash it into shares because of this article: https://jlcollinsnh.com/2014/11/12/stocks-part-xxvii-why-i-dont-like-dollar-cost-averaging/

Either way though – it won’t affect your big picture that much and if it helps you to sleep at night – may the force be with you!

I’ve been wrestling with the idea of dumping in 50% and DCA the rest… The cash is currently in an offset account against the two other IPs which makes me feel a bit better. The interest saved is a lot better than what I would be getting in a HISA minus income tax 🤘.

Nice work mate congrats on the sale! What is your target percentage for LICs within your whole portfolio? What other LICs have you considered? Would be interested to hear your thoughts on the target split down the road.

Interesting thoughts on DCAing into the travel card, definitely a decent idea!

The other LIC we will be investing is AFI. We don’t really have a set number for splits like we did for ETFs (40% AUS 60% international).

We just buy LICs when they are trading at a discount or else we buy A200.

Nice and simple 😊

Hey, what travel card do you have? From my experience the exchange rate on them all is terrible! Years ago I had a CBA travel card and now looking back at the exchange rate they use makes realise my terrible mistake which cost me thousands I AM SURE. I now use a combination of 28 Degrees CC which has no fee’s and a good exchange rate for car hire and hotels. Then Citibank debit card which has no overseas transaction fees and also the wholesale exchange rate. I will be signing up to ING soon so I get the same benefits as Citibank but also they refund all ATM fees anywhere in the world (*requires $1,000 deposit and 5 transactions/month). You probably know all this already but wondering if you have found another good option or if you use a CC with points for those benefits?

Thumbs up for the 28 Degrees CC and Citibank Debit suggestions.

+1 for the above, also the Bankwest Platinum credit card for the case of credit. sometimes easiest when travelling to book the hotels etc on this, and charge back later, also gives backup card if you lose one etc.

They are good cards you mentioned, they came up when I did my research too

I was going to use the CBA travel card for convenience (I should know better) but now you have been thinking. I already have an account with CitiBank because they don’t charge international fees.

I had a look at the different rates and found these pages.

https://www.citibank.com.au/aus/investments/forex-rates/AUD.htm

https://www.commbank.com.au/personal/international/foreign-exchange-rates.html

I could be wrong, but I believe CitiBank sells the customer BGP (for example) at 0.5585 (as of the 16/11/18) and CBA sells the customer BGP at 0.5430.

If I’m correct, that works out to be a difference of £77.50 after transferring $5K AUD. It’s a decent amount but nothing to lose sleep over.

I’ll still use Citibank instead and maybe I’m calculating wrong but that’s what I concluded.

Thanks for the tip 🙂

Hi mate,

I know this is an old comment now but that Citi link is not what you should be looking at to determine what Citibank plus will charge you. That page shows the price charged when making international transfers. When you use the card, you are actually charged the Mastercard rate. Thus you want to be looking at this link instead.

https://www.mastercard.us/en-us/consumers/get-support/convert-currency.html?intcam=U_CTA_0_Card_CCGen_UBNCC_UBNCR_1

Sadly, travel cards are a ripoff and my preference is always to use something like Citi or ING when travelling.

A bit late now but maybe next time 🙂

Well done with your sale! Interesting comments about the banks undervaluing your property. My experience only ( I am not trying to draw conclusions generally), was the opposite. Admittedly this was four years ago though and perhaps the bank’s risk appetite has changed. I refreshed a valuation with them for my line of credit ( which I am not using since but anyway it is still there), and I estimate their valuation was easily more than 20% too high. With the Melbourne market weaker in the last year I would guess it is even more out of whack, i.e. overstates the true worth by greater than 20% now.

I think they did this as I was on a solid income at the time and wanted to encourage me to borrow. I wonder how many others they do the same with. I doubt they are doing it much now but I mean about 5 years ago, could come back to bite them. Anyway I guess now you would be even more pleased to see share markets head south over the next year or two, probably better for you in the long run. Good luck with the new share purchases in that time.

I think you’re on the money with the bank’s appetite for risk.

5 years ago they were throwing ridiculous money at me, who just finished uni and hadn’t saved a cent to his name. They probably were overvaluing everything just to get people to loan more and more.

Everything changed now but I fear it’s too late for them as well. Too little too late

Pretty disappointing that you could have squeezed another $449 out of the IP sale to make it +$100k for the month. Unbelievable!

lol I know!!! The IP did its job. It was literally every other asset class that sucked last month haha. I don’t know if I’ll ever get as close to a $100K bump again. Highly unlikely.

Dear AussieFIREbug

The graph showing your increasing Net Worth over time is truly a thing of beauty…

Keep it up 😀

Jeff

Sure is. It’s crazy how it all adds up over time…

Great work on the whole website, and to give the FIRE an Aussie slant.

The sale of your property must have been a welcome surprise, and reminded me of the “Bank error in your favour, collect $100” card you get in Monopoly, but in your case it was a much larger amount.

I had a question regarding capital gains tax and whether you have accounted for that as part of your net worth or will that be done at the end of FYR18/19?

Thanks, and keep up the good work, 🙂

Thanks mate,

I actually wrote about the tax part in my other post HERE

In a nutshell, I don’t have to pay any CGT because of this rule

Very lucky.

Hi FB, Would you mind sharing the excel template of your Net-worth tracker. I am sure lots of people would love to track their net-worth over the years, especially people that are starting out.

I’ve had it on my todo list for the last 6 months. I will set up a mailing list and send out my spreadsheet to people. Just have to find the time. It will be done by the end of the year.

Cheers

Awesome stuff man, that’s like Christmas coming early!!!

We also switched most of our loans to P&I, the interest savings are too good to pass up, but it does mean less available for shares in the short term until each property is sold.

I like your approach for investing the cash, it’s likely to have the least regret and be better to cope with psychologically. In the past we’ve done half lump sum, half dca and that’s quite an enjoyable way to do it as well.

I have been really slack on the I/O vs P&I thing.

It’s insane how much of the difference there is between the two now. The banks REALLY want you to start paying off your debt.

This isn’t a bad thing per se but takes away from why I wanted to invest in real estate in the first place. Leverage. Not to buy an IP and slowly pay it off but eh.

Hi AFB,

Congrats on your big cash bump this month, what a boost! My husband and I have been following your movements for a while and are just about set to drop our nest egg into shares finally, woo! We’re 99% convinced we’re investing in LICs following Peter Thornhill’s strategy but just wanted your quick thoughts (if possible) on investing in growth shares (ie. non dividend paying shares)? Do you think it’s worthwhile keeping say 20% of the portfolio in growth shares while you’re young and have a riskier appetite and sell them off down the track for dividend shares for retirement?

Keen to see your net worth spreadsheet template too, will keep an eye out for it before xmas (what a great Christmas gift to your followers!).

Thanks for all you do,

Laina

Hi Laina,

I think that growing shares that also pay a nice dividend is the ultimate goal of course! It’s going to be interesting next year if Labour gets in power and franking credit refunds get abolished.

This has big ramification for those of us who want to retire early. I had it in my mind that if we split the dividend income between Mrs. FB and I, we could realistically cover our expenses from around $25K fully franked dividends which would work out to be around $36K grossed up (using the franking credit refund). But if the credit is removed, that means we lose out on $9K of dividends and our portfolio will need to be much bigger to compensate!

The removal is looking likely and if it goes through, it will take away a major reason we invest in Aussie shares to begin with. I’ll probably go back to a more globally diversified portfolio and focus more on ‘growth shares’.

Hi FB,

New to the podcast and just started following. I’m sure this question has been asked before, however I was just wondering what software (if any) or if its an excel spreadsheet that you use to calculate and track your net worth on a monthly basis?

Cheers,

Josh

Hi Josh,

You can download my spreadsheet here https://www.aussiefirebug.com/ask-firebug-fridays-6/

Cheers

All that cash and all this buying opportunity, I hope you’re making some really nice buys at the moment. Cheers

About $15K each month. If the markets went full GFC 2.0 it would be hard not to throw a decent amount on them… We’ll see

Lol at the conspiracy theory! I do agree banks prefer to estimate on the lower end of market value in order to cover themselves. That said, I recently entered my IP into the commbank app (though my loan is with a different bank) and it overvalues it be 15K compared to the market value estimates on commercial real estate sites. Interesting 🤔

Also now I, really in a hurry to read the rest and find out what you did between this post and Feb 2020!