A new player has joined the game!

Our very first LIC (Listed Investment Company) made its way into the fold in September after we officially transition our portfolio to Strategy 3. This is the dividend focussed portfolio that will mainly consist of Aussie shares through a mix of BetaShares A200 ETF plus AFI and Milton LICs.

That doesn’t mean I’m going to sell the international part of our portfolio (VTS & VEU). Oh no no no. It simply means that we are focussing on the above combo for the foreseeable future.

Although less diversified, and slightly less tax efficient than Strategy 2, Strategy 3 offers something that no other strategy to date has offered.

Strategy 3 does not rely on selling down to fund retirement.

The thing is… when you are relying on selling any part of your portfolio in retirement to survive, you are at the mercy of the market. I pondered strategy 2 over many nights…weeks…months… I have full faith in an indexing strategy and believe that international diversification is important. But I kept coming back to the day we pull the pin and stop working. What happens if the market tanks right after we retire or when we are close to?

It could mean working for years and waiting for the market to recover.

The thing about dividends and the reason that strategy 3 ultimately won me over was the fundamentals of a business is less affected in a crash than the share price.

After reading Motivated Money by Peter Thornhill, intrinsic value became crystal clear and I really made the connection between a business and its share price is largely tied to their ability to produce a growing income. There are of course exceptions to this rule, many companies have insane valuations based on potential alone. I like potential and ceilings when we’re talking about NBA rookies, but when it comes to investing, give me the proven vet who can consistently give me 15,5,3 any day of the week.

There were many businesses back in 2008 that were not affected greatly by the GFC in terms of the bottom line. But the ass fell out of the share price because human emotion got involved. Sure the dividends may have dipped, but nowhere near the same level (in terms of percentages) as the share price. This is because the dividends are tied back to fundamentals and how much income the company is able to produce, not based on how many inexperienced and ill-informed investors are rushing for the exits after reading a doom and gloom article in the Herald Sun.

I feel a lot more confident that Strategy 3 will hold up through thick and thin vs Strategy 2 even though Strategy 3 could delay our fire date. This is because even in a recession, good income producing companies will still do just that, produce an income. And seeing those dividends hit the account each quarter will help immensely.

Confidence is the name of the game and something I have come to appreciate more and more as I have been reading and listening to overseas FIRE bloggers and what they went through in 2008. It’s hard for most of us Aussie millennials to truly understand what a recession can do to your psyche and confidence. A lot of people talk a big game online and how they didn’t understand why people weren’t buying everything in 2008 when the market bottomed out and it’s easy not to sell if you don’t have to during a crash.

Let’s see how mentally strong everyone is when we actually go through a big crash. When everything you’re reading is doom and gloom (shoutout /r/ausfinance), every finance interview is diving into why this is the end of capitalism as we know it, and why now is the time to learn basic survival skills in preparation for the upcoming Armageddon.

It’s super easy to do all the right things when you have nothing to lose. Shit’s a lot different when you have hundreds of thousands of dollars on the line.

Strategy 3 will help us mentally during the next bust which, depending on who you listen to, is either right around the corner or many years away…

Net Worth Update

Really expensive month for us. We booked a trip overseas 🎉🎉🎉 and basically paid for most of the travel and accommodation in September.

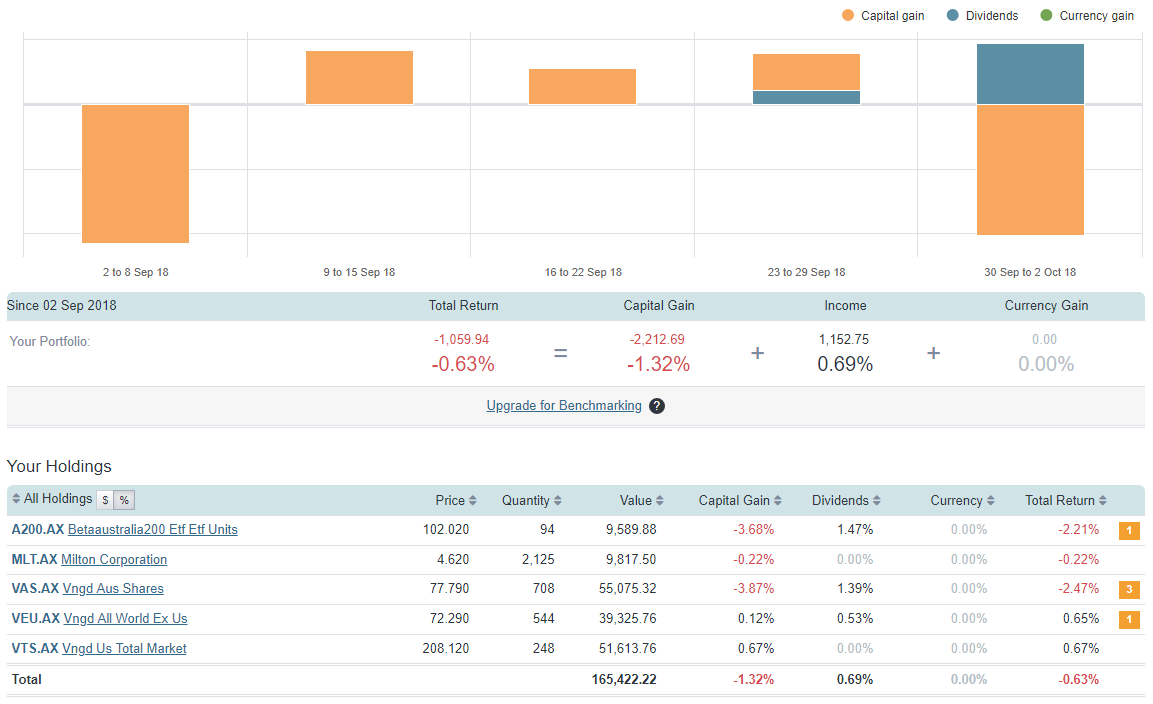

The markets weren’t good with our ETFs and LICs down overall. We did receive dividends though 🤑 but it hasn’t hit our account yet (Div Ex date only) so next month will benefit from that bump.

ETFs/LICs have officially overtaken real estate equity and has become the biggest slice in our net worth pie 😊

Properties

No changes in the properties this month.

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs/LICs

Welcome aborad MILTON! Not off to the best start but I have faith in your ability to produce some juicy franked dividends for us over the next couple of decades 😘.

Bad month for the Aussie market. Internationals keep chugging along though. When will the US market decline??? It’s the bull that never ends 📈 (it will end at some point)

Networth

Great post again mate. Just wanted to ask you about your change from VAS to A200. Although the MER for A200 is half as much as what it is for VAS, VAS’s current share price is still significantly less than A200 (currently VAS is 3/4 of A200’s price). Since the index they track are very similiar and should have very similiar dividends isn’t probable due to the current share prices that VAS will give you a better return on investment?

Apologies if this is a stupid question.

Thanks!

Share price is a random number set as the start of the etf. Could be $500 could be $250. It will track up and down following the index

similar dividends as a percentage

Hi Jarrod,

The difference in share price will not affect overall yield. If one unit of A200 is higher than VAS. I would expect the dividend payout per share to also be higher. Does that make sense?

AFB, do you get your drp’s to go into the selfwealth ANZ holding account as cash and just let it build up?

No I have them go into my Commbank account. But now that you’ve mentioned it. Straight back into SelfWealth might not be a bad idea.

Excellent article mate will definitely look into LICs

Love the blog mate! Looking forward to following along whilst building my own FIRE portfolio.

👊

You’re killing it, Bug. Almost at halfa mil.

What’s your thoughts on BKI? Why did you go Milton over say BKI?

Dingo xxx

BKI is a solid LIC. I just went with Milton because of the slightly lower fees. No other reason.

Doesn’t look like you’ve revalued your properties in the past year or any change in debt?

Would be interested on a post about your property portfolio performance, maybe compared to the ETF/LIC’s. A summary of cash flows and different options/projections changing the LVR to positively/negatively gear with tax consequences, or use equity for ETF/LIC purchases would be interesting.

Might be some movement in this space with the next net worth post John 😉

Yes what he said ^

Well done mate! You have inspired me to a similar monthly analysis.

What is your reasoning for holding so much cash?

Hold a little bit extra in case of emergencies for the properties. But I do have a little too much cash. Need to do a few more trades.

Hi AFB, Agree with your strategy change, I have recently started investing in AFI and MLT in addition to A200. Considering international EFTs but not sure yet.

Interested in your strategy and plans for your properties, in particular Property 2 which looks like the value is declining towards what you owe on it. Do you have a strategy in place for this “underperforming” property, especially if it keeps going down. What is the rental yield?

We will be looking to sell the properties when the times right. The current market is terrible for selling atm. No one can get loans and the values are dropping in the big two cities. We are lucky that our properties are cash flow positive and we can ride out a crash. Can’t remember yields off the top of my head but the most important thing is that it has positive cash flow.

Maybe a bit more detail in next months update 😉

Great to see the update. When do you think you will sell off the Investment Properties and pump the money into LICs ETFs?

Wanting to sell 1 each year for the next three years. But the current lending conditions are terrible and are pushing the prices down because people can’t get loans. May have to wait a year or 10 for the price to go up. I’m in no rush though and they are all cash flow positive. No reason to panic sell

Oh ok, Advantages of cash flow positive property at least

Well done mate! I always enjoy reading your articles and monthly networth updates!

Great to see and hear you’ve jumped on board with adding LIC’s to your portfolio – You will enjoy those smooth consistent dividend returns 🙂 Soooo close to cracking the Half a Mill networth milestone too…Fantastic stuff!!!

I hope you don’t mind with me asking a question? I would love to know how much in total so far you have contributed into shares and compare that with the value of $165,422 🙂

Love your stuff – Looking forward to reading more!

PerthFI

We have invested $145,228 dollars into shares.

This has returned us $26,237 over two years ($18,829 capital gains + $7,408 dividends)

Thanks for the reply and the information! That’s fantastic stuff mate! Beautiful gains coming in from both ways 🙂

Milton Corp is extreme,y exposed to Australian Banks with near 30% of their investments in financial services. They pay good dividends but there is a lot of commentary that they face serious headwinds.

Are you comfortable with that exposure?

Love your blog btw. I’m a chartered accountant who has invested in stocks for over 25 yrs. I love reading about stocks and personal investing.

Hi Nathan,

As with the Aussie Index, Banks make up a large number of holdings for most Australian ETFs and some LICs. I don’t solely invest with Milton so I would say that my overall portfolio is quite diverse.

I’m personally comfortable with that exposure but some may not be. Everyone different I guess

What do you use to trade international stocks? I’m looking to get started and I’ve just started a SelfWealth accoutn through your link! 🙂 and also what are your thoughts on lump-sum investing vs. dollar cost averaging?

I get international exposure through international ETFs. I buy these through SelfWealth. I don’t trade on the NASDAQ or NYSE.

It’s more efficient statistically to lump-sum invest vs dollar cost averaging. But if I ever came into a large sum of money I would DCA just because of the mental side of it. Would be hard to sleep if I went all in and the market tanked haha

Love your work, very impressive

Thanks Wendy 🙂

Hey, I missed this post. Well done mate, and welcome to the dark side 😉

The behavioural advantage of dividend investing will come in pretty handy I think when the sh*t hits the fan during FI – at least we’ll still have some juicy cash payments rolling in!

Yeh Boi!

Excellent article Aussie Firebug and great to know you’re partly going with the dividend route. It makes so much sense doesn’t it. I’m going to go this way too and am researching Aussie LIC’s… just need to wait two or three years for that big crash 😀

Yeeeeah Buddy.

Let’s just pray that Labour don’t remove the franking credit refund 🙏

The crash needs to happen asap while I’m still in the accumulation phase haha

Hi AFB, I’m starting out on my FI journey. Finished Uni and start my grad role next week. It’s so great to finally find an Aussie Centric podcast and this info. on LICs is a game changer for me.

I’m interested in following strategy three and focusing in predominately on LICS. I was wondering what proportion you would ideally aim for in terms of ETFs to LICs in your Aus focused portfolio? I understand you’re basing it on whether there is a discount on LICs, however, I’m interested to know what your ideal proportion would be?

I also had an idea from your podcast with the Mad Fiantist. He talked about splitting your overall retirement strategy into your FI retirement strategy (personal portfolio and pre 67 years of age) and your super retirement strategy (super portfolio and post 67 years of age).

For the FI retirement strategy, as mentioned, I’m aiming to follow strategy three and focus predominately on AUS LICs and an AUS ETF. For the Super retirement strategy, to diversify my portfolio, I was thinking of focusing on International ETFs, basically strategy 2 excluding the AUS ETF and instead replacing it with a low cost ASIA (Excluding AUS) focused ETF.

I was wondering what impact this new strategy will have on your super portfolio strategy and if you think the approach I outlined could be a way to diversify risk and get a good balance between dividends and capital gains over the course of your entire life.

Hi Liam,

I would be hesitant to have more than 50% of my portfolio in LICs just before they have the active management riks. I’m not fussed if I’m 100% ETFs but LICs just have a few more risks imo. But they provide a superior yield so it’s a trade off.

Super to me at this point is sort of a cherry on top situation. I don’t even really consider tbh. It’s only in my net worth updates because I took it out once and was blasted with requests about it, so I put it back in.

What you’re suggesting isn’t a bad strategy and I know a few who do it like that. Aussie in their own name and international for Super.

I still have a decent amount of growth ETFs (VTS and VEU) which I don’t plan on selling.

It will be interesting to see how things go over the next few years for sure 👊

That makes sense, so that’s why if they’re not trading at a discount you will just go for the A200 and then cap at 50% for LICs to eliminate some of the active management risk. Do you have a rough idea of your ideal structure for your remaining 50% of ETF investment in terms of A200, VTS and VEU? Fair point about super as well. At the end of the day, super is more a secondary play. Thanks so much for the response mate and for the info! Love your work

Hey AFB!

Just wondering how your strategy would change if labour removed franking credits? I love the idea of a passive income stream through dividend investing however it does sound risky if the government changes the rules?

Thanks and love your blog,

Jake

Hi Jake,

Take a read of this mate.

Cheers