I cannot believe 2018 has come and gone. What an incredible year it’s been!

We spent Christmas locally and thankfully Mrs.AF is from the same town as me along with all her fam so there was no traveling 🙏. We used to travel to Melb a lot on Christmas day to see my sisters and driving around can be a drag.

Christmas time is always awesome because a lot of my old mates that are living in Melbourne come down to be with their families which means I usually see them out and about. It’s great to catch up as everyone has such busy lives these days.

I remember last year that me and a few mates kept saying we should do a trip together and we just need to organise something. Well, Mrs.FB and I booked a trip for NYE in January 2018 because nothing ever happens unless someone pulls their wallet out and organizes shit.

I’d almost forgot that we had that trip coming up so it was nice to be reminded about it at the start of Dec and the whole group was pretty pumped.

We bought in NYE in Mornington Peninsula which was awesome!

So incredibly busy though. You’d hate to be a local when the tourist come and invade your town haha.

Big, big plans for 2019 which I’ll write about in another post but can’t really complain about the last 12 months.

The net worth has risen to heights that I didn’t think was possible at the start of the year and it’s only getting better.

Net Worth Update

Finished off 2018 at $600K 😁😁😁

The properties were the real heavy lifter this year and I was very lucky with IP1 and the re-vals for IP2 and 3 (more on that below).

I couldn’t be any more stoked to finish the year at this number. We’re getting into some serious territory now. I always thought that once we hit around $700K. The last $300K will come really quick because of dat compound interest baby.

We still have a lot of our net worth in cash. But I’m super pump to slowing drip feed it into the markets and see our passive income rise accordingly!

Properties

Property was the real MVP this month. I have mentioned in previous posts, but we have swapped lenders (from CBA to Macquarie) to get a better rate and to switch to P&I since the gap between I/O is at a comedic level now. It’s almost… cheaper (payment wise per month) to go P&I.

Insane

Because of the switch, Macquarie revalued the two properties and they came back higher than what Commbank thought they were… Which was no surprise to me really, I had suspected that CBA had put a halt on higher valuations for a while whilst they dealt with the whole royal commission thing.

This valuation saved what would have been a very red month.

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

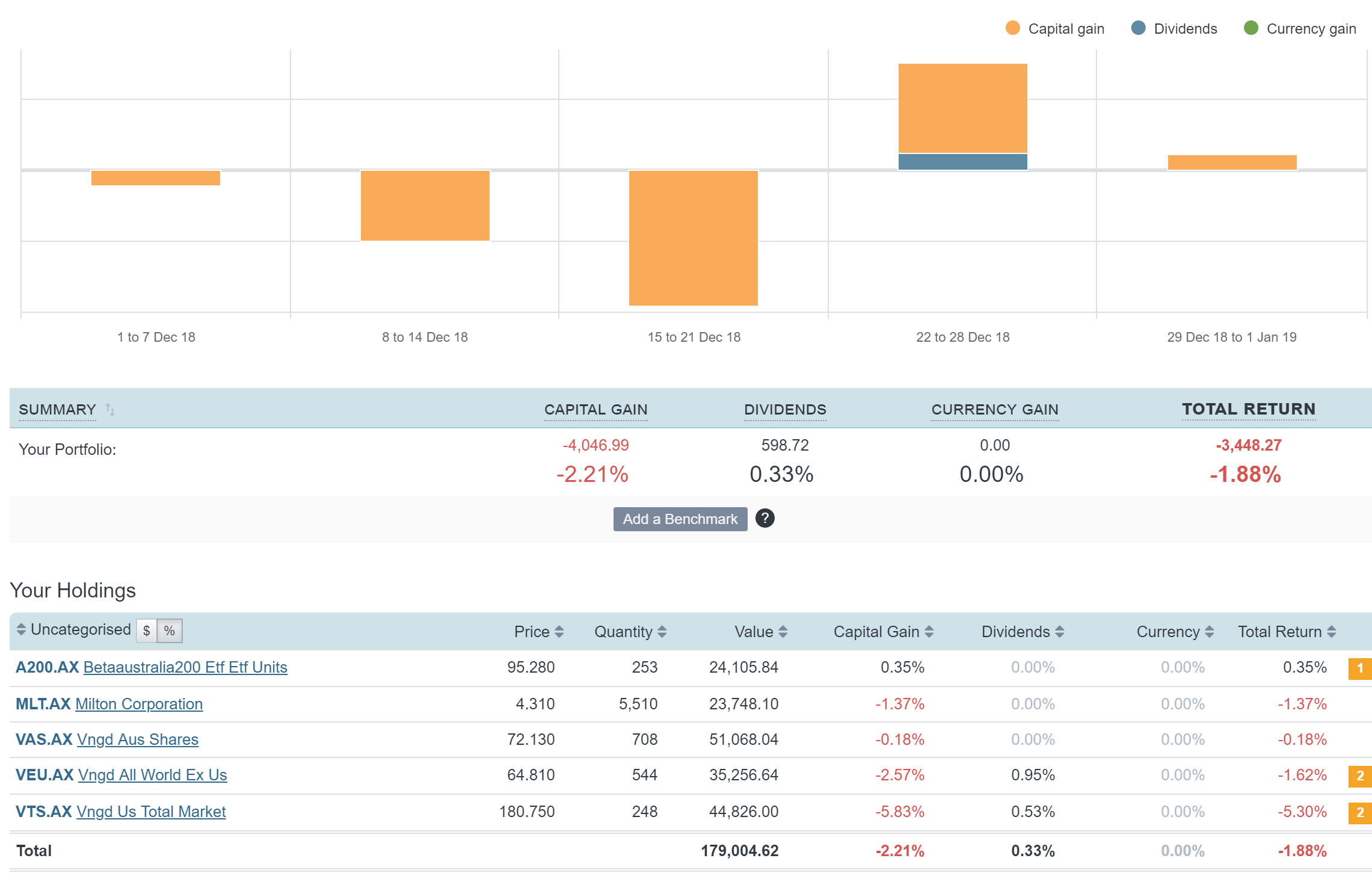

ETFs/LICs

Put your hand up if at some point, you thought we were heading for another GFC during December?

🙋♂️

The shares portfolio got rocked in December, some weeks we were down $10K+ grand and it looked like it wasn’t slowing down.

This might scare the n00b investor, but we understand that whilst you’re in the accumulation phase (still working and building our snowball). We welcome a GFC like event! It helps us collect more units than you otherwise would each time we buy, and it’s all about the amount you own,

not how much it’s worth.

More units = more income

More income = closer to FIRE

Don’t get me wrong, it is nice to have a quick gander every once in a while and see you’ve made more money in the markets than you might have at your full-time job. But this boost of dopamine that makes you feel good is a false win. Because if the prices rise, next time you go to buy your favorite

ETF/LIC, your money will net you a smaller piece of the pie and ultimately, a smaller income stream in the long run.

I was getting really excited at the thought of a huge crash because as some of you may have read, we are currently cashed up from the sale of IP1. Not only are we still in the accumulation phase, but we also have a big chunk of capital to invest over the next 18 months. I was starting to get itchy with all the prices dropping and at one point was considering investing half our cash holdings.

But as I type this today (mid-Jan), the markets have recovered somewhat so we shall continue with DCA over the next 18 months.

Networth

A 50% increase in net worth in one year is nothing to sneeze at, well done!

Out of interest, how does your property valuation compare to something like http://www.onthehouse.com.au?

We too would have welcomed GFC 2.0 (Bigger, Better and Uncut). The ASX index with a 4 in front of it would have been all-in for us!

Cheers,

Alex

That website would add another $40K to our real estate equity (I hope they are right). The valuations I got from the bank in December was IMO conservative. It’s so hard to know with property. You never really know until you sell.

The graph of your projected networth is looking spectacular, congratulations!

Fully agree with the focus on acquiring the underlying asset at times of market stress.

It’s also nice and refreshing, I have to say, finally seeing some green in amongst bloggers network updates. 🙂

Also enjoyed the podcast with Peter Thornhill and mentioned it in a piece I wrote on LICs. One thing was that the link the ETF risks paper he sent you seemed broken (404), so wasn’t able to read it.

Thanks FI Explorer!

I’ve yet to read your piece but it’s high on my to-do list. I’m currently in Malaysia (post about it incoming) and haven’t had much time to do blog stuff.

Just getting through all the comments tonight and emails 😤

I updated that link so you should be able to read it now mate.

Congratulations on a stellar year and look forward to hearing about your big plans for 2019.

Thanks Serina!

2018 was my first year of FIRE (22M) Hopefully I can make the sort of progress you make Matt, keep up the good times. P.s. the Thornhill podcast was so helpful. I’m going 100% going for the passive dividend stratwgy, can’t thank you enough

Congrats mate. SO young! Many years to have that compound work for you 🙂

dollar cost average and stay the course 👍 well done

Congratulations on a positive month, well done! And like FI Explorer I wish I had a bit more green in my portfolio at the end of the year, it wasn’t pretty but oh well.

Just a heads up that the popup for your net worth spreadsheet doesn’t seem to have that X to click?

Oh really? Are you on mobile or desktop?

I was on desktop (Chrome) at the time, on mobile now and the X shows up. Weird.

I have friends who live on the Peninsula. They say that the locals hibernate in their homes for 4 weeks at Christmas, especially on the weekends. The crowds drive them nuts.

Absolutely fantastic. You just snuck in for 600k net worth at the end of the hear.

Looking forward to hearing the big news this year. Cheers.

john bogle died last week. its sad when you lose a good guy

He was/is a legend!

Hey AFB, I remember you saying you were considering putting all your IP cash into the market at once, but in the end decided to DCA. Was that before the recent crash – i.e. – is DCA already looking like it was a great option for you?

That was before the crash. Indeed it looks like DCA may work out better this time. We shall see

well done mate!

out of interest, what sort of dividend yield income (in $ terms) are you expected to get from your equities

over 2019 (approx?)

keep up the great work!

Around $10K. If we had dumped all our cash into the market… around $20K.

Impressive numbers. I was wondering how to even keep up with your rate. Are your numbers for a couple?

Thanks Bob. I joined finances with my partner in 2016 (it’s in one of the updates). Up until then it was just me. When we joined, our networth actually went down lol, Mrs. FB had a heccs debt and no assets but quickly made up for it over the next few years as a DINK couple.

Hello,

Looks like you are doing very well. Could you tell me what software you are using to manage your investments? Those screenshots look good. I am currently trialing https://www.stockportfolioorganizer.com do you think it any good? I am looking for something that can manage dividends and trust distributions as well.

Thanks.

Sharesight mate. It’s the best performance and tax reporter in the market IMO. Check this out Sharesight

Thanks. I will check it out.

Congratulations AFB for your achievements and also for realizing life if short and YOLO (you only live once) attitude on your new trip and just going for it! With all investors we have to know that FIRE is the goal but to also enjoy life along the way as much as possible. Great job and can’t wait to hear about your journeys along the way, keep us all updated with photos, beautiful locations and tips along the way!

Will do Susan 😊