It wasn’t too long ago that I wrote about starting a new job because my old one went through a ‘restructure’ back in 2016 and essentially screwed over the team I was apart of.

You can read about that here.

Long story short, I took a $12k pay cut back in 2017 to get out of that environment and move closer to home.

Fast forward 18 months and four out of the six original team members have left that employer (myself being the second to get out of dodge). But more importantly, I managed to climbs the ranks during the last 18 months and have just accepted a new job that pays around $15k more than my old job!

So not only have I managed to get back the loss in pay, but I’m in a better position (income wise) then I was 18 months ago plus it’s only a 10-minute drive from home!

Everything’s coming up Milhouse right… not quite

Yes, it’s more money.

Yes, it’s the job I’ve wanted for a while.

Yes, I feel more important with the added responsibilities… but I can’t help but feel it’s not worth it.

Let me explain.

The new position is in management. It’s something I’ve wanted from a career standpoint for a while. I don’t know about you, but when I discovered FIRE, building a long career as a corporate drone sort of went out the windows and I stopped giving AF about climbing the corporate ladder.

But I have a competitive streak in me that won’t quit. Even though I know I’m not going to be at this job for many more years I just can’t sit back and not give it a crack. Part of me wanted to prove something to my other employer like

‘Hey, check it out. I left you guys 18 months ago and now I’m the manager here getting paid more 🖕’.

So I’ve been acting in the job for around 3 months now (officially got it last month) and it’s so bizarre what I’m willing to give up just for some extra cash and an ego-boosting title. My old job was basically stress-free and I left on time nearly every day. That has now significantly changed. So much more stress and a lot of unpaid hours after work to get stuff done.

I don’t think I’m the only manager with these issues. It seems to be the norm for all the managers and above. The big wigs at the top of the food chain routinely stay back until 7:30 pm – 8:00 pm and might even come in on weekends.

Fuck. That.

I supposed I could have knocked back the job, but I wanted the challenge, extra $$$ and the self-satisfaction knowing that I at least reached this level before I hang up the tie in the corporate world.

I’ve lost on average around 1.5 hours of free time each work day I reckon. This just strengthens my desire to reach financial independence so I can get back more hours in the week. If you’re forever increasing your consumption, you’re going to be chasing more income at the expensive of your life. What do you want? Your money, or your life?

I actually really enjoy the job but it’s a lot more stressful and time-consuming (and now I know why managers get paid more). It should get better as I become more efficient in it.

Net Worth Update

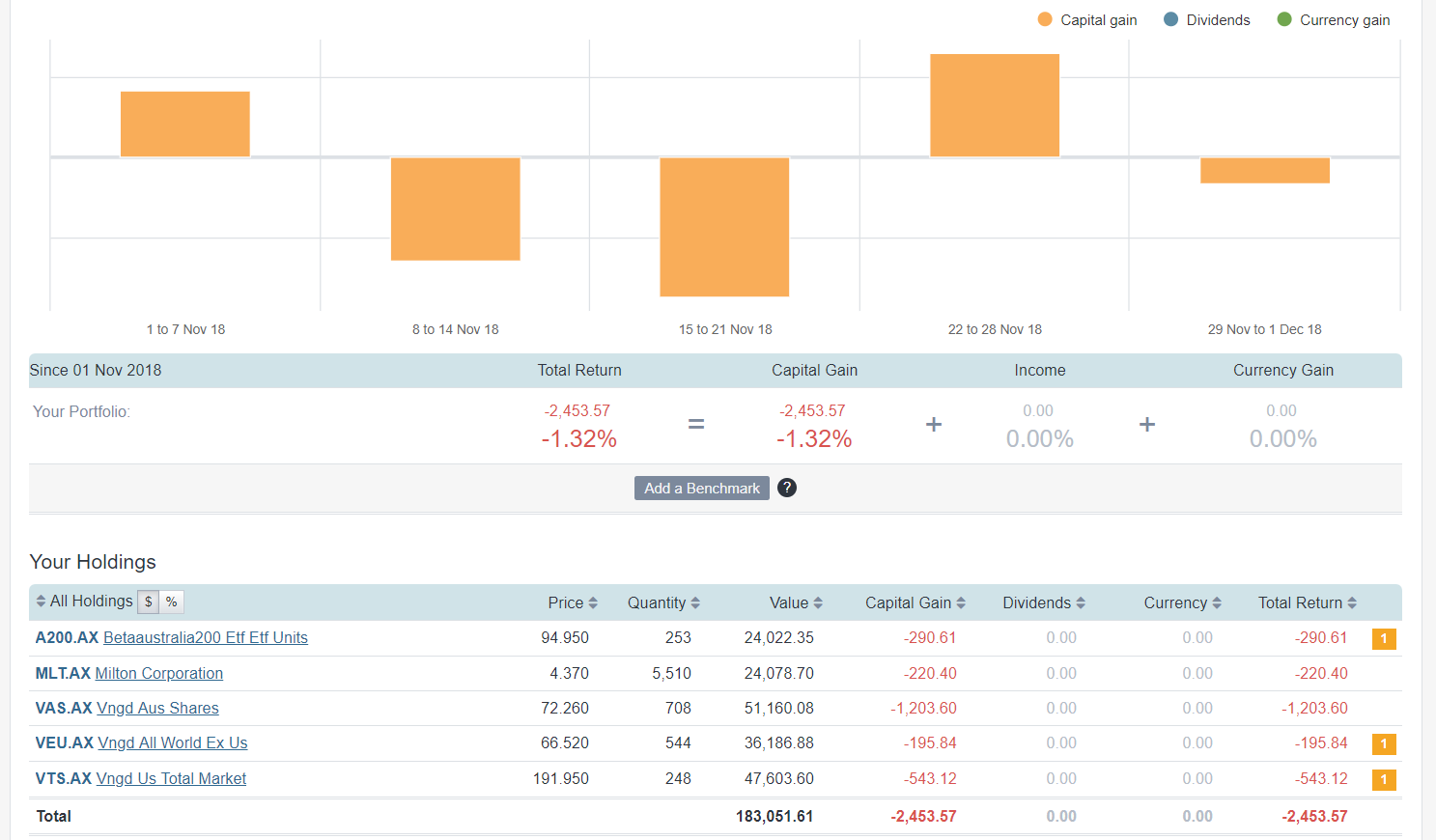

Shares had another bad month. I keep waiting for this GFC 2.0 every keeps talking about. Still sticking to the plan of putting in $15k into ETFs/LICs each month.

We had a decent month in terms of savings which was surprising considering Chrismas is just around the corner and we have been buying presents.

Properties

No changes in the properties this month.

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs/LICs

And the onslaught continues… which is actually fantastic am I right? Everything on sale!!!

Because we have so much cash at the moment from the sale of IP1, we are praying for a big crash so we can swoop in.

We bought $15k worth of A200 even though Milton was trading at a discount. This would seem like I’m deviating from Strategy 3.

BUT! After some more research, it would appear that A200 had dropped even further (in percentage terms) than both MLT and AFI. There’s a whole debate on why ETFs can drop more than LICs in a correction but long story short, I decided that A200 was on a bigger sale than MLT and AFI so I went with that 😁

Networth

That’s an impressive result given market conditions AussieFirebug! Congratulations!

Hope as you say the job gets easier though time. I am assuming the 15K invested per month is partly the drip feeding in of the property sale, is that right?

Otherwise, there is a some serious frugality at play!

Thanks mate.

Oh definitely, we don’t make $15k a month let alone save it haha.

That’s an impressive result given market conditions AussieFirebug! Congratulations!

Hope as you say the job gets easier though time. I am assuming the 15K invested per month is partly the drip feeding in of the property sale, is that right?

Otherwise, that is some serious frugality at play!

Always a great time of month when this net worth update comes out 😀

Hi Firebug,

Wanted to congratulate you on a job well done. The promotion is just the concrete recognition of your hard work. Yes, it will get stressful and it will be more stressful, but the upside is that it will get you and Mrs Firebug to FIRE faster.

I myself work long hours for a job that is part of an international firm and so the late calls at night and early mornings kill me sometime, but I always remember it’s just another day closer to FIRE.

Thank you for keeping us all motivated with your Networth updates.

Good points Anita. But I hate the idea of working a stressful job just to get to FIRE a little quicker which is ironic because that’s essentially what I’m doing… Well, at least it’s satisfying stressful work. It’s not that bad, I might be carrying on a bit 😁

He bud – great job. I often wonder what Im doing on the corporate treadmill. Work often 80 hrs a week and have no time for anything but work – and the stress I carry – arghh. So keen to be FIRE BUT I live in Sydney and we have a house close to the city – its cost us a bomb but couldnt imagine living anywhere else. I need to be in the middle of the action.

Can you please let me know what software you use to track your net worth? Ive been tracking mine for years. Im just curious how you do it. I track everyone – a little OCD.

Anyway keep up the great work.

Who else do you track?

I meant to say track everything.

My fav FIRE Blog is http://www.thefiexplorer.com he has really insightful analysis of his plan to FIRE.

(I’m asking out of curiosity because living here for the past 7 years as an outsider since I’m American)

When did you buy your house?

Why do you feel the need to be “close to the action”?

What is it about Sydney that makes you okay with paying this premium for living?

Why is Melbourne/Adelaide/Brisbane not an option?

I just use a Google docs spreadsheet mate. You can get mine at the bottom of this article.

Great work mate! Management is never going to my dream but I have seen both amazing and incompetent managers. You can make all the difference in the world for others above and below you in the company. Hope it goes well for you.

I was wondering if there exists, or if you would be able to do a blog post on your budget/monthly expenses. You’ve managed to save more in cash this month than my wife and I (28/27) earn and we are not on terribly shabby salaries. I’d love to know in some more detail how you manage it. I feel our savings rate is quite poor for our income at around 15% .

We briefly ticked over 400K net worth this month before property prices updated leaving me 15K short again. Was super excited!

The $15k per month is primarily from the proceeds of his first investment property sale being drip fed/DCA’d in to shares, not just salary and savings. For your own savings rate, consider the changes you can make to boost this. In the last 6 months I’ve started riding my bike to work, 90% of meals home-cooked, drinking less (booze can be a big drain), and in-sourcing some costs like ironing my own work shirts. Has made a big boost to our savings rate and is a more satisfying way to live all round :). Good luck!

No but he’s referring to the 10k cash AFB saved in the month being more than their combined salary.

As Linc says it was the 10K cash that suprised me. Considering their annual salary as of july was 140k after tax if they did that every month thats only 20k to live off per year.

Work is within riding distance hypothetically but would take too long. 35 minute drive as it is. Wife could bike though. Let’s see if she likes that idea 😮

We do eat out more than AFB but not crazily as I love to cook. We probably don’t bargain hunt when cooking though Groceries around 10k in last 12 months. Looking at the last 12 month it needs to drop by a few thousand dollars for sure. We barely drink so nothing to be saved there.

I have to ask.. How much were you spending on ironing befre? haha.

Check this out SgtBatten https://www.aussiefirebug.com/savings-review-17-18/

Hi Firebug

Be careful not to get sucked in into the 70hrs plus routine.

Extra cash is great but remember your doing it to get FIRE

Long hours can put you onto soul and even health destroying treadmill.

In some situations delaying your retirement while being in a line of work that is less stressful and all time consuming can be a better option.

The money or your life

All the best

100% agree Greg. It has crossed my mind in recent weeks that this promotion might have been a mistake. There was a week there where I skipped gym 3 times and just felt really shitty because I wasn’t getting the best sleep from worrying about work stuff. Is it worth it just to get to FIRE at best a year earlier?…

Part of me wants the challenge while I’m still in the corporate world though. I 100% won’t be one of these people who never leave the high paying job though. As soon as I hit my number, I’m either scaling back the days to 3 days a week or straight up quitting if it’s still this time-consuming.

It’s a tough one. I had plans to climb up our companies management ladder but that all changed once I found FI. I can come in do my work and get the hell outta there (early most of the time!). The pay rise isn’t worth the extra time and stress to my life. I would much rather do my bit and get back home to spend more time with my family.

Popping in to promise you that management gets easier, but at first, it’s a tough slog as you get proficient. I got ‘bored’ of my management role of three years and switched to a similarly paid job with no team. I started with 5 direct and 70 indirect reports, so to go to none was a WORLD of difference. I miss managing people though – people are so rewarding, and challenging. Now I’m the whipping girl at the bottom of the ladder, but hey so be it. Stick with it, and congrats!

Thanks Sarah 🙂

Congratulations on the promotion, hopefully as you get more experience with it you can get the hours back to 9 to 5 or whatever it was previously. Unfortunately though once you get past a certain point in your career there is no more stress free work, if you want more money then you the tradeoff is more responsibility and stress.

Great news on the increase in net worth especially with these market conditions!

I’m enjoying the experience that for sure. It’s easier knowing that I won’t be doing in for 30 more years.

Good job, you definitely know what you are doing. I actually turned down a job that was paying me almost 100k a year to ultimately go to one that paid half that because the skills that I was going to learn in the new one were more valuable to me. Work to learn not to earn! I am hoping it pays off.

Thanks AMM 🙂

Hi ozFB, been going through most of your posts and podcast – fantastic crash course into FIRE.

Quick q re: dollar cost averaging – as silly as it may be, do you

1) always buy as soon as you have 5k and on that day, or would you even try to time the market (by week/ days if it may go up or down) and

2) do you buy the price as it was listed on that day or provide a limit on the share (effectively – trying to hope that it will go down in share price) or time the market in $ share price terms…

1. No hard rule. If the market dips…I have been known to pounce. But honestly, it doesn’t really matter over the long term unless you’re unloading tens of thousands at once. We plan to live on dividends so it’s much of a muchness really.

2. I buy at market value on the day. Never price limit.

Fantastic work mate. You are definitely correct about the markets at this time and in the near future. It’s discounts time right now. I’m looking to add to mine even though my Portfolio is significantly smaller than yours. Every little bit counts. Cheers