If you don’t already know by now, we jetted off on our overseas adventure in mid-Jan to begin a new chapter of our lives working and living in the UK.

You can read about the decision and ‘why’ in last months post ‘You Only Live Once’.

I’ve had so many people reach out to me with amazing stories about their travels when they were younger and how it’s one of the best things they’ve ever done. We left in the middle of Jan and have been trecking through South East Asia for the last 3 weeks stopping by Singapore, Malaysia and Thailand.

And before you ask, no this is not becoming a travel blog 😂 I just couldn’t resist showing off some of our photos.

There are a few things that stick out like a sore thumb when you visit SE Asia. With the exception of Singapore, everywhere has been so incredibly cheap! It’s mostly a reflection of how much taxes we pay in Australia, but drinks and smokes (some of our most taxed items and for good reason) are literally 10% of the price in SE Asia. I mean, even at a swim-up bar where you’d probably be paying $10 for a stubbie in Oz, you could get an ice cold long neck for around $2.

Food and accommodation are also insanely cheap and most of the time it’s really healthy and fresh. Half the reason we went to SE Asia was because of the food. Our favourite place has been Thailand for food (legit have ordered a Pad Thai every meal for around $2.5).

We have been mostly staying at backpackers for around $20-$30 a night (which was cheaper than our rent back home lol) but occasionally we splash out for a ‘luxurious’ night in a fancy place for around $100!

Hostels are such great places to meet people from all over the world. Whenever we say we’re from Australia, one of the most common themes from other travellers is how expensive Australia is to them. It is one of the most expensive places to live in the world! But the advantage that we as Australians have is that we can move and travel to cheaper countries if we chose to do so. Someone growing up and earning a normal wage in Malaysia would almost find it impossible to have a holiday in Australia because of the difference in purchasing power.

We off to Cambodia and Vietnam during Feb and then a stopover in Dubai before starting work in the UK mid-March.

As a result of this travelling, I haven’t had the time to respond to all your emails. So if you’re waiting for your question to be answered, please be patient. I will get around to every last one eventually!

Net Worth Update

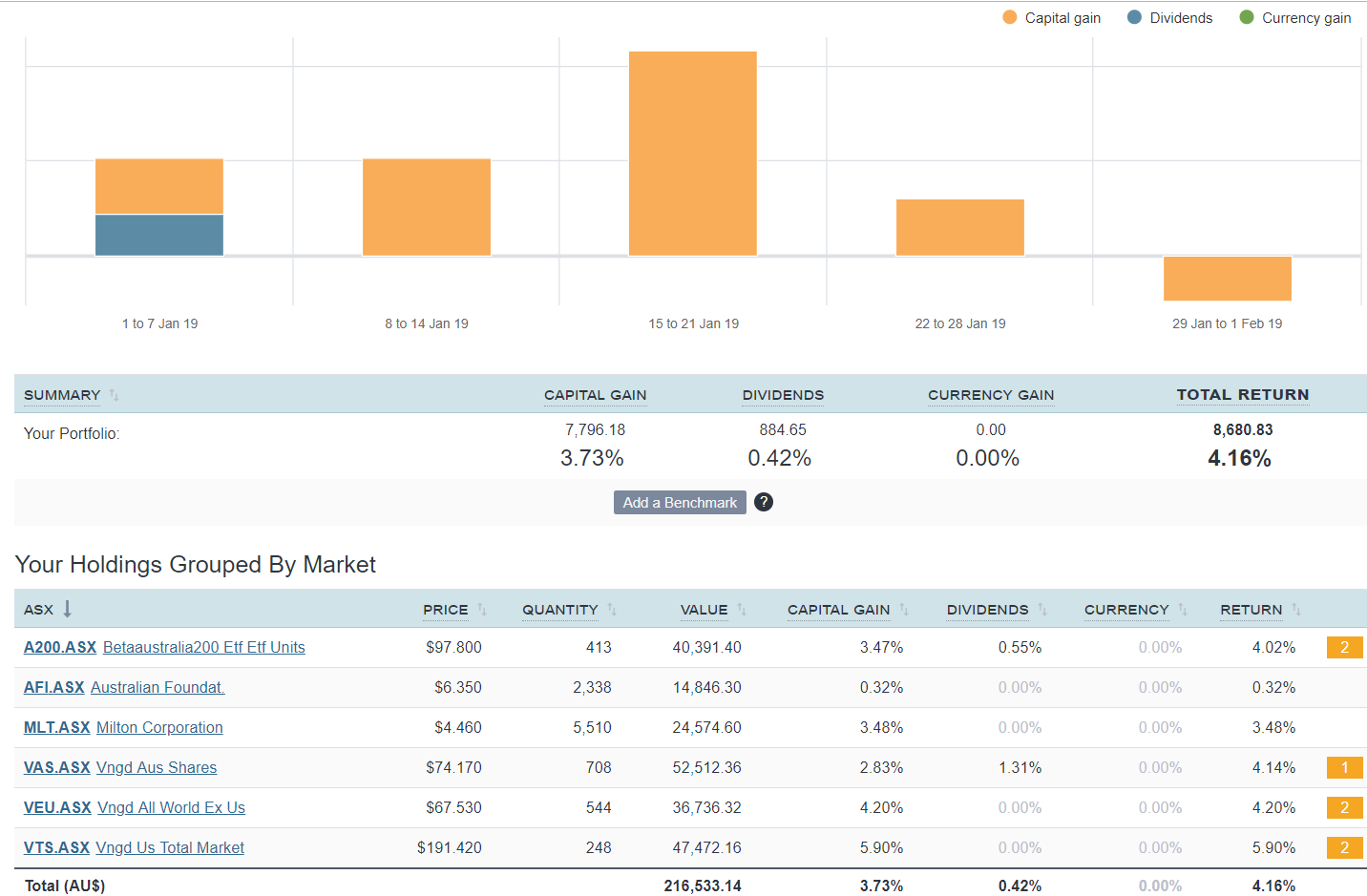

Great start to 2019 with a big bump of over $20k!

The sharemarket bounced back from what was a turbulent December. This looks good in theory, but during the accumulation phase of FIRE. We actually want the sharemarket to not go up at all, in fact, it would be better for it to head south whilst we are gathering units are of favourite ETFs and LICs.

Nevertheless, shares and Super (ours are mainly in shares anyway) really beefed up the gains for January and added around $14K into the portfolio.

The other bump from cash was a nice surprise. I’m currently using my annual leave which benefits from leave loading. In a nutshell, I’ll be earning more each fortnight until the start of March which is when my annual leave runs out and I’ll switch over to long service leave at half pay until July. It’s pretty insane that I have long service leave already built up when I’m not even 30 yet. I don’t feel old enough to have it but I’ll sure as hell take it 😁

Mrs. FB got her last paycheck last week (teacher) and won’t get paid again until she finds a job in the UK.

Just because we’re on holidays doesn’t mean we aren’t tracking our expenses too. And would you believe that travelling around SE Asia has, in fact, cost us roughly the same as living back home for the last 3 weeks 😲

And we have been living our best life too, even doing a few expensive things (night safari in Singapore, river tour etc). I met a dude who was from Amsterdam (a student) and he had been living on this tropical island in Malaysia for the last month without dipping into his savings at all! He works at a local coffee house as a barista and gets a free bed plus a bit of money which he can stretch to live on! He only works like 5 hours a day too.

Insane.

Properties

No changes in the properties this month.

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs/LICs

We have a new addition to the portfolio this month…

Australian Foundation Investment Company (ticker AFI) has joined the fold. It’s a LIC that forms part of our strategy 3.

It was trading at a discount so we pulled the trigger. I have to say though, I have been thinking more and more about Labor’s franking credit refund plan as of late and it’s hard to not factor that into the equation when we are buying LICs.

Also, the FI Explorer wrote an extremely well written and researched article about A Skeptical View of Listed Investment Company Investing which I encourage anyone who is considering investing in LICs to read. It’s important to hear both sides of the story and have a well-balanced view on an investment before you put down your hard earnt dollars.

I’m not going to refute the article in this post (I pretty much agree with everything that was written) but will say for anyone wondering, my view is and has always been as part of strategy 3, I’m willing to accept a lower return and diversification in exchange for a more dividend focussed portfolio.

LICs have a ‘focus’ on dividends which I like. I don’t feel easy that there is a human making the investment decisions which is why I split my management risk over two LICs and only buy when on discount. I have also modified my strategy to ensure that I’m never weighted too heavily in LICs with a good portion of the portfolio being in ETFs (currently a 17% to 83% split).

At the end of the day, no one knows if LICs will outperform ETFs or the other way around. I dabble in both and think they are both suited for anyone looking to reach FIRE in Australia.

One thing I think we can all agree on though is the quality of content within the Australian FIRE scene continues to reach new highs. FI Explorer’s article, whether you agree with it or not, was one of the most thoroughly researched with sources to back up his claims articles I’ve read! This only strengthens the movement and welcomes healthy discussion.

Networth

Congratulations on a great and important month AussieFirebug!!

Thanks for the mention of the article and very kind words about it, I really appreciate it. There is nothing better than debate with an open mind and a view to the evidence.

Very jealous of your trip and the pleasures evident in the photos! Glad to hear we will keep on being informed of your adventures and continuing journey.

No worries mate. Keep up the great content 🙂

Love the photos! Glad to hear you are enjoying your travels. They also sparked some memories of my time travelling through SE Asia a few years ago which I loved and would highly recommend.

A great start to 2019 and all while you are ‘living your best life’ as you say. That’s what it is all about.

Looking forward to the rest of your adventures for 2019.

Cheers to that!

Great update and thanks for sharing photos of your trip.

Looking forward to following your journey for the rest of the year!

Fantastic work guys. Keep that net worth going up, it’s going in the right direction, that’s for sure. Keep up the great work and enjoy your time off before the work starts again.

Great to see you making progress, it’s been a good month for the portfolio.

Those travel shots look good and man I miss me some authentic SE Asian food, Thai in particular but Vietnamese as well. And as you say it’s so much cheaper over there. Enjoy the rest of the holiday!

And as you say it’s awesome to see the content being produced keep getting better and better!

It’s good to see you enjoying your travels. Some outsiders view the FIRE community as not being able to enjoy any of the finer things in life so this provides a good balance of what it’s all about. I’m in Ho Chi Minh City this month so if you make it there and bored enough to catch up with another blogger let me know!

Hi Steve,

We actually get in thee on the 12th (next Tuesday). Will you still be there then?

Yes I’ll certainly be in HCMC then. Feel free to contact me valueinvestingforaliving @gmail.com if you get time. No pressure obviously I understand most tourists usually don’t allocate a heap of spare time within HCMC. Either way enjoy your travels!

Great post AFB.

Quick question – how are you working out if a LIC is “discounted”?

Cheers

You can check it on their site. I use a spreadsheet. Pat @ life long shuffle has a Google spreadsheet you can use too.

Lol. I was dying to see what you look like, Firebug. Now I know you have MASSIVE eyes 😉 All the better to see beyond the hours for dollars mentality, right? Love Southeast Asia. enjoy!

Great to hear that you’re not overindulging like most people when they use YOLO as an excuse to spend. We love SE Asia and it’s a great destination on the cheap. I’m interested to hear how you go in London on a budget. Great blog and journey.

Good point. Yolo shouldn’t mean spend everything. To us it’s just about taking more risks and doing something that will delay our fire date (working overseas).

I’m not looking forward to the prices in London (especially the rent) but it is what it is. I don’t think we will be able to save much really but as long as we don’t dip into our savings too much it won’t be that bad. That’s the plan anyway.

Looks great – Thai food is so yum & cats are adorable. I left my long standing job recently & was pleased to leave on a good note. This morning I enjoyed a 2km swim in a half salt pool. My aim is to keep fit, catch-up on house projects & to do some volunteer / community work. I want to give back to the community & also keep up contacts with people.

I would like to hear from others who have achieved financial independence & retired / semi retired early or started a completely different line of work to match their passions. Anyone out there to comment?

Hi AFB

Great month, very happy for you and Ms FB

One question though, you mentioned you added AFIC due to its trading at a discount.. I noticed you bought AFI at around $6.3.

The net asset backing as at 31 Jan is $5.83… so it’s not a discount but premium to NTA…

am I missing something?

Thanks and enjoy your travels and new life.

Best wishes

Victor

Hi Victor,

I bought before the 31st of Jan and I believe the NTA was different when I bought. It was showing a discount when I pulled the trigger. But one of the difficult things about LICs is the NTA is only updated monthly. So it’s hard to know what it was exactly when I bought.

Doesn’t make a huge difference either way really.

Congrats and keep up the good work.

Great Website.

Noob Question; Do you have a blog post on how to sort out the numbers.

I’m a bit thick with concepts like ‘Equity’ etc.

For example, If a property is worth $400k, loan is $300k, but has $50k in offset; what numbers go where on the networth pie chart?

Also, should a paid-off property (to live in) be part of the Networth amount goal ($1mil) or in addition (like $1mil plus 400k home)?. Thanks for the great learning. Really appreciate it!

Hi Tom,

Everyone has a slightly different take on what should and should not be included in their portfolio.

In your example, I would consider you to have $100k in equity and $50k in cash.

I have always considered something that produces an income to be an asset. This is a little controversial, but a home that you live in does not produce an income. It only ever costs you money (unless you sell it later at a higher price). I will never include a home we live in to be apart of our portfolio.

At the end of the day, it doesn’t really matter. It’s all about how much passive income the portfolio is throwing off. That’s what you’re going to live off!

Great pictures mate, sounds like you’re having a fantastic time 🙂

TYSM Dave