Mrs. FB and I were well and truly in ‘The Grind’ for roughly the last 4 years back home. We had holidays every year and plenty of social events but the routine of work, gym, nightly wind down (book/Game of Thrones/Youtube) from Mon-Fri was pretty much the same for a very long time.

When you get stuck in ‘The Grind’ it seems like days melt into weeks, weeks dissolve into months and before you know it, a year has passed without you even blinking!

When you’re out of the grind and exploring around through … it feels like you get to see and experience more in a month than you might in a year!

Which is why these monthly updates are so long these days I guess 😁

I have been contracting as a consultant for over a month now and the dynamics of the workplace have been extremely interesting to witness. Without naming names, I have landed a contract with a multinational corporation within the heart of London. I had come across the ‘corporate elite’ back home but it feels like it’s ramped up over here. Where you work and what position you have is very important in some groups. And the cost of living is so high that a lot of people who have relatively high paying jobs can’t afford much. A lot of it has to do with ‘Keeping up with Jones’, where you live, why do you have roommates? Can’t you afford a place yourself, bars you go to etc. etc.

I will say this though, the Brits know how to drink! It has been really fun working a new job and getting to know a new team.

I have been working a few days a week outside of London at the client’s site which has been a bit of a hassle but my employer pays for all transport, food and accommodation which helps. When we’re out at the client’s site, all dinners are paid for on the corporate card. Now I’ve been a public servant for the last 7 years so you could imagine my shock when they started to order alcohol 😱.

I can definitely see the appeal for working these consulting jobs though. It’s almost like a trap. Basically, everything is paid for, the money is great and you get to travel internationally if you want.

But there is a secret tax which is paid without you noticing if you’re not careful. And that is the impact these jobs have on your health and relationships. It’s so incredibly easier to eat bad and drink wine every night because one, you’re not paying for it, and two, it’s what everyone does and you don’t want to be the only one not going out with the group. And the time away from home sucks!

But I tell ya what, if you’re young without a partner/family (or if your partner is willing to relocate), this type of work can be amazing!

I’m going to try to stay in London 5 days a week for my next contract and we’re only here for a short period of time (relatively) so it’s not quite the same… part of me wants to get back to ‘The Grind’ but the new experiences have been cool so far!

Speaking of new experiences. We attending our first Rugby match in April.

We also made our way down to Brighton for the long weekend and was blessed with amazing 22c weather 😂. But for real, the weather was actually good and my goodness does everyone get up and about for it. Volleyball, beach ping pong, skating down the boulevard, sunbaking, beach bars were absolutely packed!

When the sun is shining, everyone is up for a good time and the vibe was amazing.

Although I had to laugh that they called this a ‘beach’

It’s more of a rock barrier but let’s not spoil their party 😜

We are trying to stick to one country per month and somewhere in the UK too with the other two weeks off just to recharge.

Our first Euro trip was catching the Euro Star to the land of chocolate, waffles and beer… Belgium!

Even though the UK is apart of Europe… it’s not really Euro in most peoples eyes. I definitely noticed a more European vibe when we arrived in Belgium.

The cobblestone streets are just incredible. Also, I know there’s plenty of them but my God the elaborateness of the churches and the town centre is out of control.

Just staring at the detail of the craftsmanship on these buildings is mind-blowing.

This one must have had over 1,000 individually crafted statues that were nearly the size of an adult (seriously, click on it and zoom in). Can you imagine how much work went into those statues… and there’s over a 1,000 😱

There will never be buildings built like this again because most of today’s buildings are built for profit or are built with taxpayers dollars. Everything about these structures is over the top and not efficient but gee whizz they look cool.

The waffles, beer and chocolate lived up to the high standard I was expecting so no complaints there!

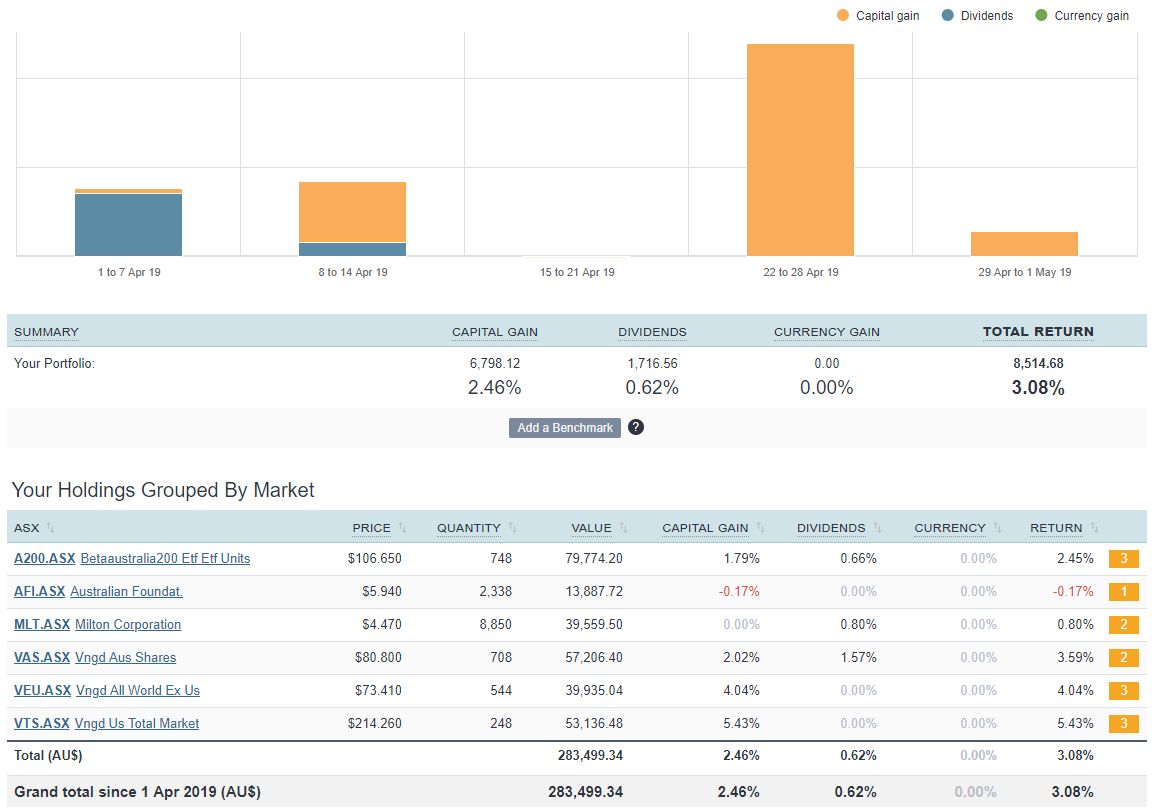

Net Worth Update

It wasn’t much but we keep progressing with the net worth in April moving the needle by about $4K in the right direction. The big change, however, is the weightings of our overall net worth have changed significantly.

I refinanced (again) to a new lender (Macquarie) who has given us a really good rate of 3.90% for both the investment loans with an offset. But unfortunately, they wanted a lower LVR to complete the deal and so I had to throw in about $30K extra to add to the loans. I really didn’t want to have to do this but the rate was really good and I was looking at finishing things up with CBA anyway.

They also required the loan to be P&I, not IO. So whilst I don’t really want to pay down the IP’s loans, the rate difference is past the tipping point and it’s more attractive for us to get the cheaper rate vs staying IO (good job APRA).

As a result, you will notice that the pie chart for our net worth has added $30K to real estate equity and our cash holdings have dropped by the same amount.

It’s what happens when the real estate market is going through a downturn. Even though our properties are in Queensland, the major capitals (Melbourne and Sydney) have taken a hit and the banks are being extra cautious.

We will wait for the market to bounce back whenever the hell that is and then sell the IP’s as per the strategy. They are cash flowing nicely so no stress on that part.

Properties

No changes in the properties this month.

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs/LICs

We continue our trend of pouring money into A200 in April with another $18K added.

This is diverting from Strategy 3 where we were originally planning to buy LICs if they were trading at a discount (which they are), but I just keep coming back to regulatory changes (the franking refund being axed) that would severely impact this strategy. I’m a big believer in not speculating potential future changes but I just feel more comfortable buying the vanilla index.

There’s plenty of ways around what’s being proposed but for my sleep at night factor, the A200 just sits better.

YMMV.

Networth

Knock knock, Forward here. Really look forward to these monthly networth updates. You must love looking at them also. The graph is a thing of beauty.

A200 is now your biggest holding in the portfolio. That’s gotta be pretty exciting. It’s really a return to Strategy 2 isn’t it? Index investing

Sort of. Strategy 3 is more about a dividend focussed approach through Aussie companies. A200 fits this bill. Where I’m slightly diverging is not buying LICs when they are on a discount. I give my reasoning above under ETFs/LICs

Hope that helps 🙂

So A200 gives some dividends which are great for income but when compared to LICs which are mostly dividends and little capital growth, you’re going for the A200 for a capital growth play in the uncertainty of the future govt and franking credit policy?

Article incoming about this. This election has opened my eyes to a few things. Stay tuned.

Hello. I have a few individual stocks and also a few ETFs i want to invest in.. who would be the best to get these through ?? I have tried researching but Im not getting anywhere.. I have also emailed you.

I assume Strategy 3 will be back on the cards now?

I fully expect the issue to be raised again in the future, I doubt this will be the last we hear on franking credit refunds, either way I’ll continue to hold both LICs and ETFs.

I actually think the complete opposite Scott. I feel a big reason the ALP lost this election was because of their aggressive tax reforms.

No one knows what will happen in the future but I suspect no party will go near negative gearing, franking credits, capital gains tax etc. for a long, long time.

Time will tell.

Also, I’m in the middle of writing an article about strat 3 right now. Watch this space

Can’t wait to see your new article. I really liked strategy 3, I was worried about the election but now that the libs got it, I would like to keep on with a steady income stream of franked dividends with strat 3.

Can’t wait to see your new article. I really liked strategy 3, I was worried about the election but now that the libs got it, I would like to keep on with a steady income stream of franked dividends with strat 3.

How do you know when the ETFs/LICs are on discount? I’m researching a lot about it and the only guide I have it’s the graph. How do you choose what to buy?

How do you know when ETFs/LICs are on a discount?

Check this out mate https://lifelongshuffle.com/2018/10/28/pat-the-shufflers-lic-discount-estimator/

Nice to see the portfolio ticking upwards. I also enjoyed reading about your experience in the UK and Europe. Something I wanted to do at some point but never got around to it.

I lived the consultant life for a while some 10 years ago. By the looks of it things haven’t changed. It’s all too easy to spend when on the employer’s dime, and sometimes that can creep into personal spending. A lot of consultants I know work hard and play hard, and it shows in their discretionary spending! But there’s good money to be made if you can save up the per diems. A friend of mine financed her house deposit purely from per diems!

Were Macquarie easy to deal with? We’ve got a couple of loans coming off IO soon and are looking at refinancing away from the big 4. Macquarie is one on our shortlist.

Too true.

Room service is one of the greatest inventions ever! I’d never order it if I was paying but man it’s so nice being able to experience it haha.

I never delt with Macquarie directly, I went through a mortgage broker.

Well done mate. I enjoy reading your updates.

I’m a bit older and financially secure but so cautious. Not sure how you have the balls to invest in A200 at the moment with GDP slowing and unemployment set to rise. But I know the literature says to keep investing through the cycle. My cautious nature has cost my wealth creation hugely but I’ve accumulated very safely.

Most importantly you need to enjoy life and it seems you are doing just that.

Safe travels.

Hi Nathan, I am in my 50’s. I am somewhat overly cautious myself! Regarding investments, share market etc… etc…

I am also waiting to invest some of my savings, but! The more News i read …. i come away more uncertain about the Worlds economy>

Whats your take on it ?

Brad

Thanks Nath 🙏

We did the same refinancing with Macquarie, after about 8 months they put the rate up by 0.25% 🙁

If you are looking at refinancing mortgages have a talk to Trent at Mates Rates Mortgage Brokers. You get the same mortgage plus rebated commissions paid monthly in to your account. I have had my mortgage with them for a couple of years now. I am getting 0.18% rebated minus an admin fee.

I nearly went with Macquarie, but a better deal came up elsewhere. Same mortgage you would get at the bank but with a rebate.

Hi ,

I’m currently with Comm Bank and my rate is 4.64%. The rates offered my Macquarie are significantly lower and I’d be eager to find better. Were there significant fees in transferring across for you?

Damn… I hope that doesn’t happen to us 🙁

Mr. firebug, when you are in the UK, are you topping up your super contributions when your away?

Hi Shane,

No I’m not.

That was my concern if I moved back to Europe. But seeing as I bought a house now, I wont be leaving anytime soon!

Nice work mate, looks like you’re settling well in UK without too much issues on finding a job! IT is really the area to be!

It’s the first time I’ve looked at your ETFs in detail, but I note the fact that your overall return is ~3% which appears really low, how are feeling about the return? Given that the fact that equities have reach record highs, do you have any concerns?

As someone considering moving to a similar set up to you I was just wondering as currently I got a good set up with Raiz on the aggressive profile where I’m on around 12% return after 8 months and I know people who’s been on the same profile for 3 years with over 20%. The question is there really much benefit of changing other than to be able to take advantage of a correction in one of the ETFs?

I think you’ll find it’s only displaying the overall return from 1st April 2019.

That’s correct. 1.27% for March, 5.02% for Feb, 4.16% for Jan.

Thanks for answering, I didn’t know that. Can you tell me your average return since you started and your 12 months return?

I was speaking to @aussie firebug with this response.

Sure.

Overall return since inception is currently 13.86% and for the last 12 months has been 8.55%.

But keep in mind that the 12 months return has trades included in it that are not 12 months old yet.

For example, we bought Milton this year. Its return for the last 12 months for us has only been around 5% but that has a lot to do with the fact that we have only held it for less than 6 months and haven’t received the other 6 months of dividends if that makes sense.

Aussie. I told you about the ‘heathrow injection’ didn’t I? Love your updates. Its like a trip down memory lane for my hubby and I that both went to london (separately before we knew each other). He did the whole incorporate a company too. You must jump on the train to paris for a weekend. I truly recommend it. A shame I never made it out to Versaille but the Rodin statutes in Paris are a treat. This is half a travel blog now isn’t it?

Paris isn’t Paris…go to Berlin instead.

Haha yes you did!

OMG… this blog has always been about documenting our journey to FIRE but these monthly updates have well and truly had their fair share of travel pictures am I right haha.

People seem to be enjoying them so I guess I’ll keep posting 😁

What are you doing about AFI?

It looks like you are on DSSP – have you thought about your tax residency?

I’m keeping everything. Not planning to sell.

We don’t have DSSP turned on. I have been thinking about the tax residency a lot and I think we’re going to change residency for tax purposes at the end of the financial year.

There will be an entire post about it.

Keep in mind that all our assets are within a trust and we have the ability to distribute income to others back home. I’m going to get specific financial advice about it and share what I conclude 🙂

Hi Aussie Firebug

Love the blog, podcasts etc. Great Stuff. I am new to FIRE movement and looking to get cracking asap. Having just turned 40, my husband and I are keen to reach FIRE asap. We have focused on being mortgage free, and we have achieved this couple yrs ago. Now rather than living mortgage free (and spending too much) I want to seriously reign it in and invest, and reach FIRE and have a legacy to leave ur girls when the time comes 😛

We are considering if best to invest in our own names or Trust (we have 2 children aged 2 and 6yrs). Just read that you have all assets in Trust. Can you give some of your thoughts around this.

I was thinking of a family trust, ability to distribute income etc, especially as my husband and I take it in turns to work full time with the girls so young. So be nice to be able to distribute the income… as well as when they reach 18yrs we an distribute to them (plus once we ‘move on from this life’ there will be ease of leaving the shares and avoiding CGT etc).

WOuld love your thoughts around trusts vs investing in own name etc … of course no specific advice for my own situation. 🙂 thanks again

My thoughts briefly are that investing via a trust is really not necessary to reach FIRE. Yes, you can distribute income but it comes at a cost of adding complexity. If I could go back, I would have never bothered with it. But in some curcumstances, it can work wonders.

I know that the answer is very generic but it’s the truth, it really depends on the situation I’m sorry.

I look forward to reading this future post. This is something my husband and I discuss a lot – he’ll be expanding his business overseas in a couple of years.

Sorry to be late to the party but can I ask from the timeline above, are all of the contributions a combined effort of Mr & Mrs Firebug or are the figures solely yours? I find trying to sail the ship straight solo very daunting at times

Some solid figures either way.

Thanks

Hi,

It just me up to Oct 2016. Then we joined finance which I cover in this post https://www.aussiefirebug.com/october-2016-net-worth-222832-14558/

Hope that helps 🙂

Awesome that you’re able to keep tucking away savings every month even when O/S. And man your Net Worth graph is beautiful. Cheers for sharing!

Yeah it’s been great. No worries, I’m glad you’re enjoying it 🙂

Excellent work, AFB. Hard to stay off the gas when the boss is paying!!

I just whacked almost $10k into AFIC today. I like the idea of DSSP being in a high tax bracket.

Is the 0.07% fee the reason for going with AS200 as opposed to VAS?

Keep up the great posts. I really enjoy reading them.

So true!

Also hard to not overindulge in the food. Hard life isn’t it haha.

VAS vs A200 is so close and similar that I just go with the cheaper option and don’t think about it too much. The difference is so trivial that it’s not really going to make much difference in the long run tbh.

Fantastic work, keep those dividends rolling in! Looks like things are going well for you guys, well done.

Thanks BHL 🙂

The div’s are just such a blessing each quarter. So comforting

Hey AFP,

I notice you’re holding nearly 120k in cash. Is that so you can deploy if the market crashes? It just seems high to me given that you are in it for the long term. Where do you hold that cash?? high interest savings?

Cheers

Ditto.. keen to understand your cash strategy. Is it a buffer for a rainy day? Or war chest for a falling market?

Where do you keep it? Offset against your properties debt? High interest saver or some other place?

In our offset Sam.

Basically, it was part of the lump sum left over when we sold IP1. I was too scared to dump it all in the market at once so we are dollar cost averaging it out over the next 12 months or so.

We like to hold around $30K as a savings fund plus $5 for each property for emergencies.

All our spare cash sits in the offset.

Hi!

I was just wondering what your current thoughts are about SOL? or just LICs in general in comparison to ETFs.

I have some funds in SOL but i bought in when it peaked months ago, now its dropped down a lot and im not too sure if i should buy more into it to take advantage of the low price, or look into other things.

Thanks!

I wrote about ETFs and LICs here https://www.aussiefirebug.com/etfs-vs-lics-and-strategy-3-revisited/

My thoughts have changed slightly since the election and I’m in the middle of an article that goes into it. Stay tuned

Well done mate seems you have settled in well in the uk.I will be there in sunny Leeds in a couple months, (don’t mention the football)home to see the brothers, and mates,and probably a six week piss up.Do you think ,with your net worth in AUD.Would you still be feeling comfortable if you lived in UK ,and was at the same stage.

Thanks Yorkie,

Ahh that’s a good question. The cost of living is a lot higher here compared to where I’m from. But at the same time, my income has doubled due to the lucrative contracting market that London offers so it’s hard to say. I might have been further along if I lived here my whole life… Or I might have been way down.

It is what it is and we’re living very comfortably at the moment.

Hi AFB.

What is the return total return of A200 since inception? Thanks

Got it! All good.

Hey mate, do you use DSSP for your AFI shares?

I only just checked the DSSP box today after getting the AFIC letter in the mail.

No I don’t. Need to look into it more. Just really busy at the moment.

Man those buildings are beautiful, and the beer looks alright too 😉

Sounds like you’re doing a good job balancing enjoyment and work… tough life ey lol.

We also switched to P&I on most of our loans and while it hammers us in terms of monthly outflows, the rate difference was too big to ignore. A couple of interest rate cuts wouldn’t hurt either if they happen, tho half our loans are fixed.

And speak of the devil. Another cut this month. Insane really. How low can it go….?