Such an incredibly busy month June turned out to be and the next few months coming up are gonna be even busier!

This update is two weeks late because I’ve honestly just not had the time to sit down and put it together. I’ve been juggling work, traveling, tax admin work for five different things (personal return, trust return, Aussie Firebug return for the money made through this site and my UK company returns which also includes a personal one), organizing our big Euro summer trip which starts next week and enjoying our new city 😅

So if you’ve sent me an email during the last 3-6 months please known I’m not ignoring you and that I’ll eventually get around to replying to you when I get a minute!

With that said…

A few biggish things happened in June.

I officially quit my job back in Australia!

I didn’t quit back in January when I left on this trip because I always felt like it was unnecessary. I had long service leave and I knew there was a very good chance of them giving me 12 months off with some unpaid leave.

I was hedging my bets against the very real possibility that we wouldn’t like it over here and wanted to move back. Some of our friends went through a very similar experience where they moved to London and it wasn’t what they imagined so they came home.

But the funny thing is that having that job to come home to was a bit of a mental blocker for me and our future plans. We’re well on track that working for money will become optional within a few years and as good as the job was, it’s not where my passions lie and I’d like to try something new when I get back to Australia.

Even just a wondering thought about the possibilities for next year was often met with the anxiety of knowing I’d have to return to my job.

But the beauty of FIRE is that it gives you options and you no longer have to make every decision based around money. Money works for you, not that other way around!

I thought long and hard about it and concluded that ultimately the job was holding me back from doing exactly what I wanted to do.

Resigning from a perfectly good job in my home town that may not come up for grabs again for a decade (low job opportunities for my line of work in the country) sounds insane to most people (including my mum).

But I knew I’d made the right decision straight after calling my boss as I was hit with the ultimate wave of freedom, excitement, and nervousness.

It’s extremely liberating not knowing what the future holds. Playing it safe can be boring sometimes and we’ve been playing it safe for as long as I can remember. Time to get adventurous for a while 😎

So these monthly updates have now turned into a part-time travel blog of late haha.

And keeping up with that tradition, we traveled to the land of the Scots in June. Here are some of the places we visited.

Edinburgh was absolutely amazing with breathtaking scenery and the city is stunning! I don’t have the photos to do it justice but it just feels so badass walking around it. Very old and has a great grunge feel to it.

I was sort of expecting London to feel how Edinburgh felt. But London to me is a very new modern city, I believe this is partly because of the big fire that burnt down half the city in 1666 so maybe the streets don’t feel so old but Endinborught just had that old school vibe that made it special.

We also hit up Glasgow but I can’t say it was that special especially considering we just came from Edinburgh (the Glasgow locals would kill someone for saying that lol).

It was a short trip but we loved Scotland and will be back!

Net Worth Update

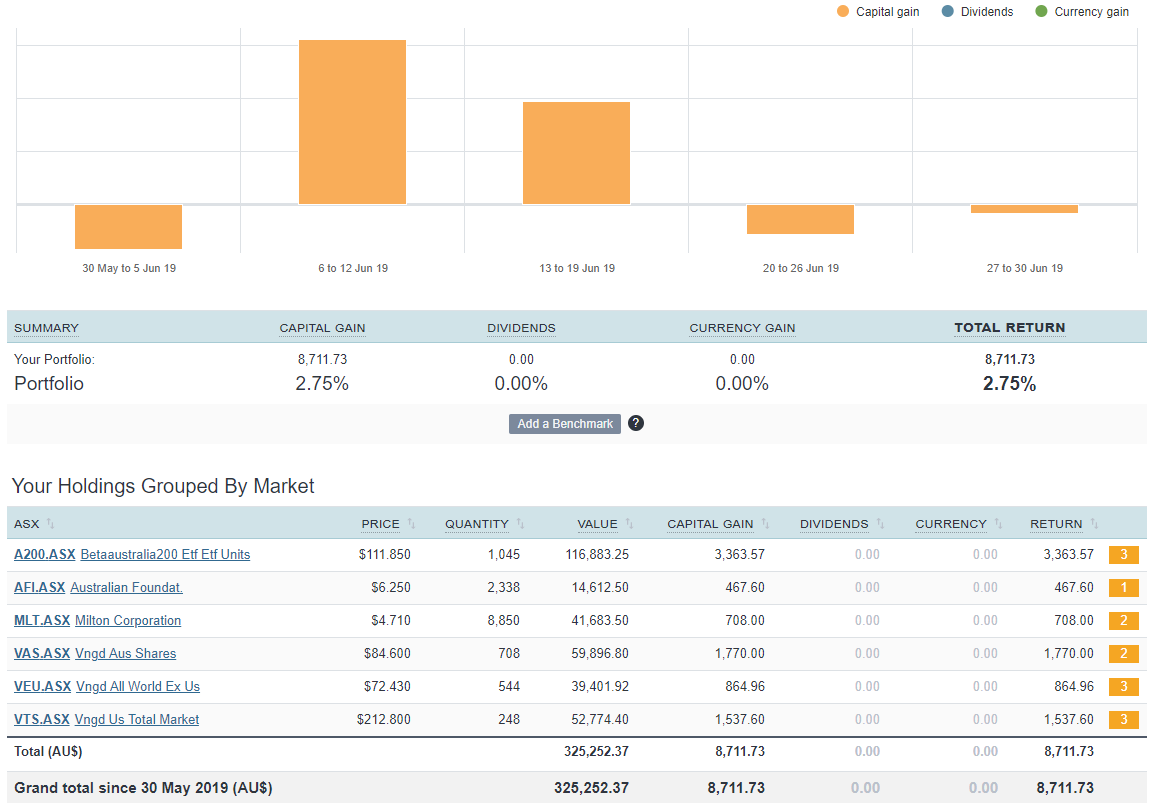

Huge month for the old NW which can mainly be contributed to three big factors.

The first is that I received all my entitlements (basically the rest of my leave that was owed) when I quit my job which turned out to be around $10k.

The second was that the markets had a very good month bringing it around $8k.

And lastly, I received my first full month contracting paycheck 🤑. Would you believe that it took almost 2 months to be paid at my current contract because there was a bit of a process with the payroll system and getting me on it?

The other thing that cannot be overstated was how much expenses I was reimbursed with that paycheck. I’ve been paying for all my work expenses like accommodation at the client site, meals, travel, etc. the entire time which amounted to close £2.5K. So my invoice had my rate PLUS all the stuff which turned it into quite a decent amount of cashola that hit the account.

I currently owe a heap of tax though (which is paid quarterly in the UK I believe) so it’s not as much as it seems… But still, it was a nice bump to hit the account.

It still tripped me out that I didn’t get paid for almost two months and had to pay for everything during that time. I mean, we had the spare cash thankfully, but not everyone could have done that. If you’re thinking about doing contract work make sure you have AT LEAST 6 months of living expenses.

Bring on $700K 👊

Properties

No changes in the properties this month.

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs/LICs

And the Aussie Bull run continues!

I have no idea what the future holds, but I do find it interesting that nearly every single economist/part-time financial guru out there was calling the next recession back in December. I thought it was heading that was for sure as well!

But as we have learned time and time again. No one knows what’s around the corner and I have found it to be extremely relaxing just sticking to our routine of investing once a month and not caring what the markets are doing. I’ve been so busy that I haven’t really had a chance and it’s and it’s something I think less and less about anyways these days.

Networth

Great job in June, I enjoy reading these updates.

I also can’t believe the turn around since June, I held off buying in December and waited until Jan, I should’ve just stuck to buying monthly. Keep it ip, enjoy Europe!

Thanks Andrew 🙂

Great to hear things are going well over there. It sounds like it was a big change mentally for you once you’d quit the Aussie job, amazing how much being fairly financially independent opens things up for you?

Where are you off to for your big European trip?

We’re heading to Edinburgh and Glasgow as part of our UK trip in August, so hopefully the weather is as good as it looks like it was for you! Looking forward to seeing London again too, let me know if you’re going to be around for a beer!

The mental aspect of being on the way to FIRE without even reaching the end goal is absolutely huge! We could theoretically take a mini-retirement and still be in an extremely good position to hit FIRE before our mid 30’s.

Our Euro trip is pretty big and we won’t be back in the UK until the end of September. I might miss ya, unfortuently mate :(. Flick me a message anyway and I’ll see where we are.

We’re heading all over the join but I’ll make sure I post some of the places we hit in the updates for sure.

Edinburgh was so cool, you’re ganna love it.

-AFB

First time poster here, thanks for sharing your journey it really encourages people like me to have a crack at FIRE.

On a different note, I can tell you there is nothing like living abroad to open your mind to new perspectives, it is just liberating. I can tell you by experience (born overseas – migrated to Aus)

From your June update, I would say you are already on FIRE as long as you keep your investment habits, you are already making decisions in your life without thinking about money, hence for us (paycheck slaves) it is just insane to quit a job like the one you had because we don’t have that freedom. I always remember the Mad FIentist who experienced a bit of depression, as he was depriving himself of many things just to hit his number even though he was not far away, but once he reached that he felt nothing special, later on he discovered that FIRE is about feeling and embracing financial control not the number. By the way he lives in Scotland these days.

Thanks for the kind words Douglas.

I totally agree with you about the FIRE aspect. I feel like we’re already benefitting from the ‘Retire Early’ part of FIRE because that’s the part to me where you actually pull the trigger and starts making decisions based on happiness instead of money. We’re not quite there yet but our options are nearly endless right now. I feel as free as a bird 🦅 and it’s only going to get better 😁

I actually message Brandon (Mad Fientist) but he was away the weekend we went up. We’re hopefully going to organise another meetup.

-AFB

Great post, I’ll keep following you even if this becomes a travel blog lol I love travelling myself and constantly have the conflict between doing that and saving for the future.

I liked your points about quitting your job and not making decisions just around money, they tend to go hand in hand, but I think we can enrich our lives in many different ways now and not wait until the day of the million $ in shares.

Enjoy the experience!

Thanks Plutarch 🙂

I agree. The balancing act is to live life the fullest whilst also being financially responsible so you have options later.

-AFB

Awesome stuff, Firebug! Congrats on quitting your job and on this travelling/working overseas adventure that you guys are on.

I did a similar thing by quitting my well paid and comfortable engineering job a couple of months ago to run my own small engineering consultancy and it’s been an amazing experience. The feeling of being able to choose what you do and when you do it is great. I think it’s not too different from contracting work as well. We’re not 100% FI yet but well on our way and considering that I don’t want to stop working means that we are essentially free to do what we want.

One example is that I’m starting a Diploma of Financial Counselling (got a scholarship!) as I think this line of work could be really fulfilling and allow me to teach people in difficult situation how they can turn their lives around. I don’t care what the pay is because that’s way down on the list of priorities. Anyway, sorry to ramble on, but congrats on everything and looking forward to your next podcast!

Oh and lastly, do I remember correctly that you like to play chess? If so then it would be great to have a game online sometime.

Cheers,

Len

Hey Len, great response, I think making the decision of going for what you want while you walk the path to FI will make a big difference because doing what you love will probably bring more income. I like what I’ve seen from some bloggers in the US about having strategies to minimise as much as strategies for making more money. Focusing only on saving ca become boring, so good on you !!

I thought about doing a Diploma of Financial Planning with Monarch which is not too expensive but probably not yet. That’s great you got a scholarship.

I keep learning from the comments as much as from the blog posts.

Cheers

There is a big difference between Financial Planning and Financial Counselling, so make sure you know which one you want to do before enrolling. In Australia you can only be licensed as one or the other, not both.

Nice one Len,

Yeah I still don’t quite understand the difference between consultants and contractors. I’m a contractor but I’m working as a consultant at this job 🤷♂️ lol.

Next pod is dropping soonish..haha. Hard to pump them on these days.

I’m do play chess mate. Are you on chess.com? What’s your username?

-AFB

Yes, I am. Username is lennybro. Let’s have a game!

Just added ya mate. We’ll have to tee up a game… the timezones might make it a tad hard though.

First 6 months of the year and you’re up nearly $100K! Smashing it.

Hey Dan,

I do owe a shit load of taxes which is coming up but it has been a good run this year so far!

EdinBURGH!

Nice one! Very few people can afford to just quit their job – but you’re absolutely right in saying that being somewhat financially independent can give you options that would never have existed.

Great work on the networth uplift – hope the bull run continues!

Thanks FOF 🙂

I hope it continues but the logical side of me says that I should be wishing for a huge drop as we’re still in the accumulation phase of FIRE.

-AFB

Nice work Firebug, that net worth chart has definitely taken a huge bounce in the last 12 months – but as impressive at it looks, it means far more that you’ve been able to make some exciting and liberating decisions with your life.

Enjoy the travel, as well as the butterflies in the stomach that the unknown brings!

Cheers, Frankie

Thanks Frankie 🙂

The unknown is such an exciting feeling for both of us. Absolutely loving it!

Loved this, although I’m only 22 I have been saving consciously for several years and investing my money as best I can. With that comes a lot of internal pressure so it’s great to hear about your journey and the reward for the hard work. Hoping to follow suit in the years to come. Safe travels!

Thanks Lachlan,

There will be hard moments along the way for sure but the payoff (for us at least) has been absolutely worth it and we’re not even at the finish line yet 😁

Been following your blog now for a month and loving it.

The content you provide is really well written so keep it up!

Having just been back in Sydney for over a year now after spending 3 years over in London I can tell you it was one of the best decisions I’ve ever made.

I just wished I found your blog earlier so that I had some tips/advice on what to do with my money whilst I was away (I left it in a HISA without topping it up during my 3 years).

But now having discovered FIRE and blog I’m starting my journey.

Best of luck to you and let me know if you want any recommendations on things to do/places to check out whilst you’re over there.

Summer is one of the best period in Europe (especially since 3 quarters of the year is so cold 😛

Hi FIREPhan,

Thanks for the kind words and I’m glad you’re enjoying the content 🙂

Everyone’s journeys are different but just knowing about this stuff sets you apart from around 90% of the general population.

We got here in April and it was never super cold so we have had it good so far haha. Not looking forward to winter that’s for sure.

Good luck on your journey.

Hi AFB

With your property valuations do you check these monthly?

Also as most give a price range do you go for the lower end of the scale, the higher or the mid range each time?

Lastly with the data from Share-sight, what gives with dividends at 0?

All Ords at 6862 at COB today :o)

Hi Baz,

CBA updated them ad-hoc and there was never a real indication of when they’d do it. It was very random.

It didn’t give an upper or lower price, just one price prediction.

I’ve actually moved on from CBA now though so I might use a product like Price Finder to give an estimate.

Can you explain your Sharesight question a bit more mate? I didn’t receive any dividends in June?

Yeah All Ords back to record highs after 10 years 😀

Hi Matt,

Hope you are enjoying UK and your travels.

Just want to say I miss your content. I only discovered your blog and podcast few months ago and had a pleasure of devouring all the content at once but now feel a bit empty. The bus/bike rides into work are just not the same. I am trying to fill this whole with other Aussie based podcasts and blogs but they are just not as good or as relatable.

Anyway, just wanted to say well done on what you’ve done so far and I look forward to reading/listening to more of your content even if it is drip fed. I appreciate that it can be very hard to settle overseas, travel and create content.

Take care,

Such a lovely comment V_lad 😀

I get truly inspired by messages such as these. I’m trying my best to continue to produce content but as you’ve said, it is hard to do whilst travelling.

I’m committing to at least two posts every month though, these NW ones and AFF at the end of the month.

Thanks for the motivation this morning, I’m off now to get cracking on a new piece I’ve been meaning to write 😎

Hey dude, great stuff here. You might be surprised to know, I was actually born near Glasgow!!! The Scots are supposed to be naturally frugal so perhaps I inherited some good genes there lol 😉

It’s really good to hear you’re enjoying it and the freedom is liberating – even if you’re a little too busy right now. Take it easy FB.

Oh nice one mate!

And yes the Scots are notorious for being tight, but they love and own it haha. Almost like a badge of honour.

First time poster, I have to admit your blog has me hooked. I am an American with an Australian wife and learning things about the Australian investing and taxes had me a little confused. You have solved some of those problems. You are like one of the only financial blogs I have found that reminds me of Gocurrycracker.com.

I do have one question. Why do you have so much in your cash reserves? I guess I have noticed it with a good amount of my Australian friends having a lot of cash reserves. As an American, I guess my thoughts are to invest it like in ETFs and Index funds rather than cash.

Keep writing and podcasting, I am slowly trying to absorb your content. Thanks man!

Hi Steve,

I’m glad you’re enjoying the content mate. What State are you from? I’ve been to the states twice and really enjoy your country. I’m a huge sports fan which makes it extra exciting for me haha.

So I sold IP1 last year and had a big cash buffer from it. The plan was to originally drip feed it into the markets over the course of 18 months as I was too scared to dump it all in basically even though the data says it’s better to do so.

I’ve always been dragging my feet a bit having such a large amount in pounds right now that I need to figure out the whole situations of transferring cash back to Oz so we can continue to invest. We’re travelling around atm so I’ve put it on the back burner until we get back to London and then we’ll figure it out. I want to keep the cash buffer at around $25K-$30K I think.

Hope that answers your question mate 🙂

Cheers