A relatively quiet month this update.

The federal election has finished and I’m in the middle of a dedicated post about what the outcome means for our journey and to share a few more in-depth thoughts and opinions on how our strategy has changed from not only the result but also, more importantly, the potential changes that were being talked about.

Work has been ramping up lately and I can distinctly remember thinking last Thursday in the office as the team and I were diligently working away at 8:30 pm…

“Damn… I’m definitely not at the council anymore”

😂😂😂

But for real, the timelines for consultants are brutal. We have a deliverable due next week and it’s crazy the hours we’re putting in. It 100% helps that’s I’m getting paid more than double what I was back home but for some of the junior analysts, that’s a tough pill to swallow!

The other thing is that I know this isn’t going to be my life for the next 10-20 years. The projects are really interesting and it’s kinda cool working on different problems each contract.

We hit up Frankfurt in Germany for May to see my cousin who has moved there with his partner. This trip was predominantly to see my cuz who I haven’t caught up with in over 6 years! He’s from Canada and our parents are first cousins so I’m not sure exactly what that makes us (4th cousins?).

He actually came to Australia in 2009 to meet all his Aussie relatives (me included) and we’re around the same age so we had a lot in common. Would you believe that he arrived in Victoria on Black Saturday of all days! I remember meeting him for the first time and having to explain that these bush fires were the worst I’ve ever seen and this was not the norm.

I went to see him and his family in 2013 in Toronto and I made a promise that I’d be back at some point. We have actually decided to spend Christmas this year with that side of the family in Toronto and hopefully, we can have a white Christmas once in our lives. That would be pretty sweet.

There’s something really special about catching up with family you’ve never met before. It was my favourite part of my US/Canada trip back in 2013 and I’m really looking forward to it again at the end of this year.

Here are some shots of Frankfurt.

I can’t remember what this was called but it’s a traditional dish of some sort. There is a whole block of cheese under the pink stuff (I had no idea what I was eating half the time).

And ya just can’t go past some German beer 😋

Germany gets the 👍

The other news from May is that it was my birthday!

I have officially entered my 30’s 👴

You know how you always read about insanely young successful people who are millionaires before they turned 30? I had secretly hoped that I would join this elite group when I was still in high school. I had a lot of ambition and drive and thought I could climb the corporate ladder and be a ‘young gun’ property millionaire before the big three zero.

But priorities change right?

As silly as it sounds, I almost pity senior managers/directors and CEOs now when I once envied what they had and the power they wielded. I look at things completely different these days and instead of envy, I just think about how stressful and time poor these people must be. I couldn’t think of anything worse than running on the corporate treadmill for how long it must have taken them to reach the position they’re in now.

There are exceptions to the rule of course and I’m sure there’s some CEO out there running their own startup or something and loving life. But odds are if you showed me a ‘normal’ week in the life of a CEO I’d imagine it’s not something I’d aspire to.

Mrs. FB still has a really good chance to reach the exclusive millionaire before 30 club though. She turns 28 in December and depending on how these next few years pan out, it’s definitely possible.

Who really cares though, it’s just a number.

I honestly couldn’t be any more happy than where I’m at right now at 30!

It’s really easy to be lost in what you don’t have in a world of Social Media where all these influencers are just uploading all the good stuff and none of the bad, but man… when I sit back and think about the life we’re living I really have nothing to complain about.

I think it’s really important to have goals and it would have been cool to join one of my biggest FIRE inspirations, MMM, and reached 🔥 by 30 but as the old saying goes…

“Shoot for the moon. Even if you miss, you’ll land among the stars.”

And we’re loving the stars right now 😁

Net Worth Update

Not much to say for this month. We’re slightly down after booking some flights for our Summer trip coming up in July.

Super was down a bit with our shares basically staying the same.

Properties

No changes in the properties this month.

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

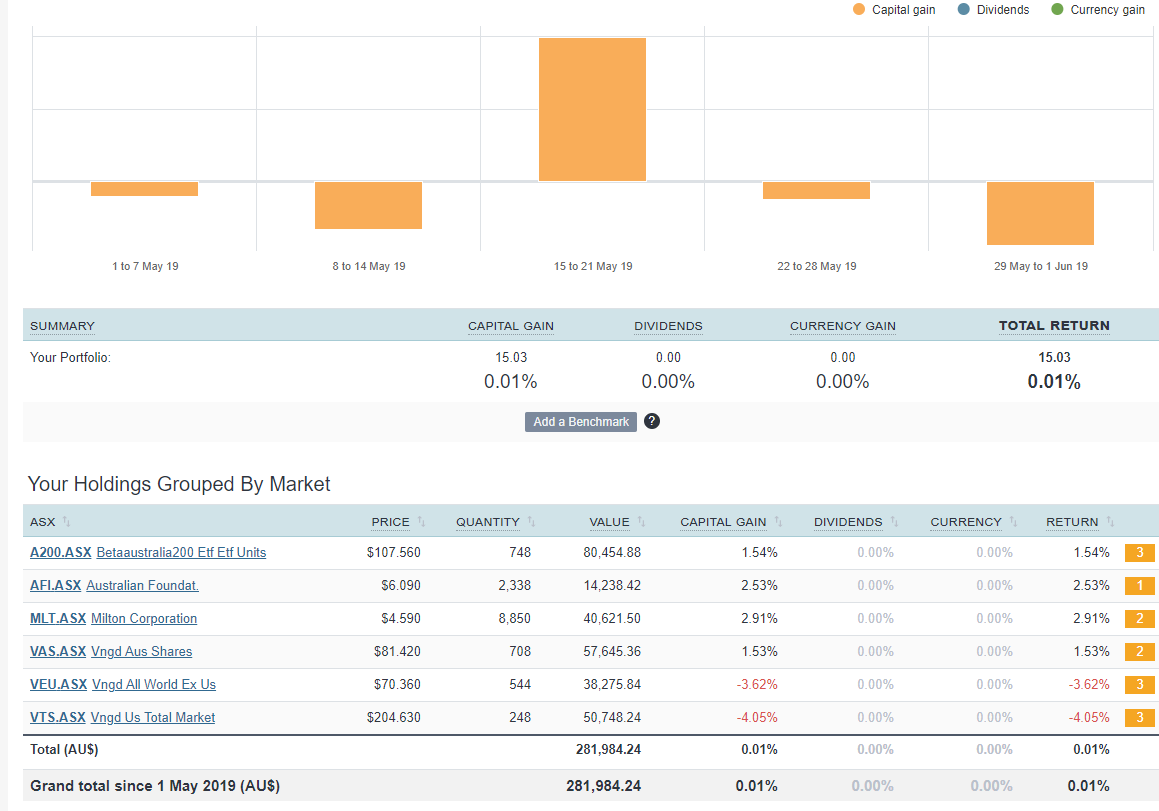

ETFs/LICs

Woohoo!

We made $15 bucks this month lol.

After what started out as a really good month has turned mostly red as we finished off May. This was largely due to Australian shares bouncing back from ‘priced in’ changes that were potentially going to happen at the election. I’m only guessing here, but because the other party got in, we seen those prices swing the other way and a lot of Aussie ETFs made some serious gains in May.

So whilst our Aussie shares had a great run, our international took a major hit especially from the states.

Speaking of Aussie shares…

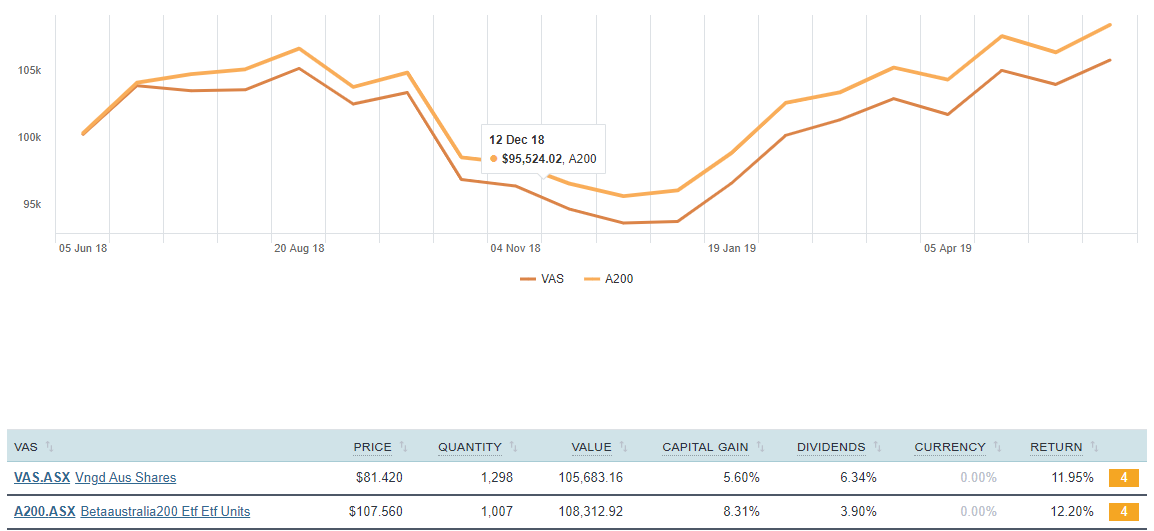

It’s officially been over 1 year since the release of BetaShares A200.

I thought it’d be interesting to see how it went over the last 12 months and compare it to my other Aussie ETF index, Vanguards VAS.

Here were the results

I made a quick dummy portfolio (in Sharesight of course) of $100,000 in each A200 and VAS in May 2018 to see what the differences were like over the 12 months.

I’d imagine to see an almost identical return between the two funds as historically speaking, the different between ASX200 vs ASX300 has been around 10 basis points.

What’s interesting to note is the significant difference in capital gains vs dividends between the two. This was fully expected because A200 is a new fund won’t have similar dividends until it reaches a mature size in a few years. If you’re in the accumulation phase, as in you’re not yet retired and are still adding to your snowball., I think the A200 makes for a more efficient investment vs VAS because it has not yet started to generate a lot of dividends. This will change over the next few years though but right now, especially the situation we’re in (earning income in another country), this makes for a far superior tax efficient vehicle vs VAS and all of our other LICs. We’re in the middle of deciding to change our tax residency to the UK but basically if/when we do, it would mean that all dividends are taxed at the higher bracket. The ability to distribute income via the trust helps this situation but I’m aware that most people don’t have that luxury.

I’m actually surprised to see such a difference in returns in just the first year, to be honest. A200 is half the cost of VAS in terms of management fees but the 7 basis points would need a few decades of compounding to really make a difference between the two. The return difference was definitely made up by the top 200 out performing the top 300.

Will this happen in the future? I’ve got no idea.

Nevertheless, without a crystal ball, I’ll always choose the cheaper option.

Networth

Nice one. Are there any tax benefits to having UK tax residency instead of Australian?

You’re doing far better than most 30 year olds already. And idk, the photos you’re posting of your Euro trip is pretty influencer like, and so are your networth figures.

I’ve done quite a bit of reflection on the election outcome as well and I’d be interested to see what changes you plan to make in your strategy.

Because I have my own company and get paid through dividends, there’s a major tax advantage which will have its own post.

In a nutshell, though, the advantage is removed if I’m still an Aussie resident for tax purposes.

The beautiful thing about having our assets in a trust back home is that whilst we’re away, we can divert the income to someone else to avoid paying the top tax bracket. I’m getting professional advice on this subject and I’m going to share the outcome when it’s all said and done.

OMG you’re so right about the influencer stuff 😂. Well, I try to keep it as real as possible but the truth of the matter is that we are indeed living our best life right now. At least the net worth went down this month I guess lol. That’s a negative haha.

A slight change to the strategy is coming up. Just getting smashed at work at the moment. Finding it hard to dedicate the time I’d like to for the blog 😔

Great stuff mate.

I’ve closely modelled your index portfolio. I’m 24 and was about to buy a second IP and am very glad to have found your podcast before I did. Also love the concept of net worth reporting.

Please let me know if you’re ever in need of podcast guests as I’d be more than happy to.

Brisbane based, 24, net worth of 260k (long way to go), but I’ve achieved this with a clever rennovation. I’ve travelled extensively too but have always been tactical with costs.

Nice one Matty.

Will do brother!

Still following Spurs Firebug ?

Of course! What a match against Ajax, but the handball was a shame and the final game was a bit boring. It will be good to follow them for a whole season when they start up again.

Come on you Spurs!

Hi fire bug. Just wondering how much much you are earning a week at the moment and how much you were earning in Australia before you left? Am I correct you just put 17k into ETF’s last month? You are doing exceptionally well and will accumulate great wealth the way you are going.

Hi Dave,

£2,500 a week at the moment but contract work is not guaranteed. It’s good for now but who knows if I’ll get work straight away when I get back from our travels.

It’s working out for us at the moment though!

Is that like 4.5k a week in AUD?

Yeah something like that.

That’s amazing money. You are obviously a very clever man. I was earning £1000 a week 10 years ago in the UK and thought I was doing well. How did you manage to invest £17k last month. Was it from the profit selling the first investment property

Yeah can’t lie, I’ve been super happy with the market rate for my line of work. And I’ve actually spoken to people on a lot more than £500 so we’ll see how I go with my next contract. I was nervous for the first one so just took whatever I got which worked out to be great in the end.

We had a big lump sum left over from the sale of IP1 and have been drip feeding it into the market ever since. Try to aim for around $15K each month. We have a few more months left and then we’ll be back to saving $$$ and investing as much as we can each month.

It makes it harder since we’re traveling around but we still plan on sending $$$ back home and continuing to invest.

I have enjoyed and followed your blog and podcasts very closely but I think we just became enemies, a SPURS supporter… Guess my gooners aren’t setting the world alight unfortunately.

😂😁 I also like Arsenal even though I’m not meant to lol. I’m going to a Premier League game in September I think. I can’t wait

Booo cmon Chelsea

Great to hear, the new stadium is a good experience from what I have heard. I have thouroughly enjoyed your blog since moving to Australia from London. COYS !

Hi Paul,

Yeah the new stadium looks unreal. I’m definitely going to try to get some tickets before next season.

If you and your cousin’s parents are first cousins then you are both second cousins to each other!

I thought my dad’s first cousin is my second cousin? Ahh I have no idea though, I’m going with you on this one!

Your dad’s first cousin is your first cousin once removed

Your dad’s first cousin is your cousin-once-removed 🙂

Keep up the good work!

Thanks Luke 🙂

Hey firebug

What did you invest in this week into you’re portfolio? Can seem to see any difference from last month.

You are correct. No change in number of units between April and May

~$17K into A200 mate

“Shoot for the moon. Even if you miss, you’ll land among the stars.”…….what if you land in the asteroid belt or worse, a black hole

Lol that’s definitely a pessimistic way to look at the quote.

Awesome stuff.

I love your comments about hours, CEOs stresses etc. My first job was as an analyst for a management consulting firm and one of my friend’s parents commented as I arrived late for my friends’ birthday dinner .. “the saddest part is that for the rest of your life you will think that working until 7pm is normal”.

Yeah F that life. Fair enough if you do it temporarily to live a better life down the track or something. But I couldn’t imagine what it would be like to have that be your norm. No thanks

Hey Matt. Long time listener and blog reader, don’t really post much but wanted to wish you a happy birthday. Hope you had an awesome day and got spolit by the missus. Seems like your trip is going swell – I can imagine the photos really don’t do the places justice. You’re only a couple of years senior to me but definitely aspiring to be in a similar position as yourself. I whole-heartedly agree with you in that age is just a number. I especially liked your podcast a while back where you were going a bit deeper into looking into the journey of FIRE and what it really means to you.

In my line of work I have been honoured to witness people in the their late 90s, living at home with their partners and still chipping along like they are in their 30s. I met a gentleman in his 90s the other day, highly decorated CFA of 60+ years. He and his wife lived comfortably in a small block in a suburbs, well within their means. Alas we talked a lot about his life, career and also got talking about investments. He mentioned he’s been in the sharemarket since his 20’s and used index funds from what I could gather! It was a timely reminder for me about focusing on our long term goals despite all the “fluff” we can see presently.

Thanks for continuing to share your story and I hope that you can always “stop and smell the roses”! Enjoy wherever the next adventure takes you.

What a wonderful comment Elim 🙂

I liked the story and I’m glad you’re enjoying the podcast.

So true about looking at it long term hey, you can get lost in the short term crap everyone likes to focus on.

Loving the graphs – what a climb in the positive direction! I find your blog (and podcast) rather inspirational – and unfortunately for me, the need for financial knowledge only clicked in my brain after I passed the 30 age mark, so there was definitely no hope for me to reaching that millionaire club before that number!

Lovely to hear Pia 🙂

I know in the realm of FIRE, your 30’s is considered to be old but honestly, the fact that you’re even switched on about your finance before the age of 50 puts you ahead of about 70% of the population. It’s still really, really young in the grand scheme of things.

I hope I can continue to provide inspiration and I love getting comments like these 🙂

Please don’t try to blog about the election again. You’re just not smart enough to comment on it. Your ‘bro-style’ vocabulary works great for basic investing tips for other beginners like yourself, but you simply cannot comment on national economics and what’s best for a country with your limited knowledge and selfish ambition.

We will slowly slip into recession with the coalition at the helm just as you wished and many Australians will lose their jobs. But who gives a **** because you’ll be getting those extra couple of bucks.

You seem like a very fun and reasonable man Simon!

Buy indexes and be happy 😉

Hey Simon,

Why do you come here if you don’t like what I’m writing about dude?

Maybe just ignore my stuff?

Have a great day mate 👍

Why Simon just why!!! Why be a dick! What’s with the negativity. Sod off with your bullshxt.

Good on you FB !!! So inspirational!

I’m in my mid 30s and with a baby due in November; on top of that, and after arriving in Australia coming from a 3rd world country and buying my first home, I feel extremely blessed. However, I want more! … I bet you know that feeling. But, I feel that my wife and I don’t earn enough to invest properly. We earn 157k pre-tax in Melbourne and with our mortgage eating away 30% of that (post tax) we feel a bit stuck. At this point we can’t invest anything, we barely have 1 month of expenses saved.

May I ask you how much you were making in Oz before you move and in what occupation you were working on? I’m thinking in a career change… Thanks mate!

There’s nothing wrong with paying down mortgage! In fact, it’s a lot safer vs investing and has a guaranteed return. People ask me all the time should they invest or smash their mortgage, there’s nothing wrong with doing both but the safer option is paying down debt and that’s never a bad move. Sure you can make more money than you save on the interest but there’s room for things to go wrong!

I was making ~$100K in IT at a local government council before we moved. My wage has varied over the last 7 years and I even took a pay cut to move closer to home in 2016. If I average it out it’s been around the $90K mark over the last 7 years.

Thanks for getting back to me! I wrote that comment just when I stumbled upon this blog. So much to learn… What I have in my mind is that I want more! … It doesn’t go away. I’ve just finished reading Rich Dad Poor Dad and I’ve started reading MMM. I want more. I believe I can do better, I can accomplish more, I can be different. We have been quite good with money, considering our background. We are coming from a country with more than 1.000.000% inflation rate with massive scarcity and poverty; and now we both have secured good jobs in Australia, bought our house and will be Australian citizens very soon, as you mentioned on one of your podcast, being average is good enough for some people, but I want more.

I believe we can slightly adjust our lifestyle and stop spending so much in our new house and invest 15% of our income after tax (~$1500/month). It’s doable for us after some effort. With the new baby coming and maternity leave in the horizon we might just put $4000 in the market now, just to have a taste and have a starting point. We need to pay ourselves first! Expenses can be accommodated after that. We can start that recurring 15% invest as soon as my wife returns to work (she is the bread winner, she earns 25% more than myself, but together we are stronger).

Good times ahead.

I’m not asking anything with this post (I need more reading, specially on how to buy our first ETF), we just don’t have people around us to share our vision/goals. My friends are in “the grinder” and in the rat race, and encourage us to get into more debts and judge our sense of frugality and saving… We just want more.

Does this make sense? 🙂

That absolutely makes sense mate.

I love that you’re doing a bunch of reading and research. It’s honetsly the best thing you can do. No one is ever going to be as interested or concerned about your fianncial position than you!

Love your story 🙂

Hey I’m new to the blog but binge reading it currently 🙂

Was just wondering when/if the time comes that you want to have kids you mentioned you would want to buy a house. Would you then sell shares/property to buy a house in cash with no loan or take out a mortgage? Or what would you suggest?

Cheers,

Caitlin

Hi Caitlin,

We’re planning to never sell the shares. For us, it’s always going to be a mortgage when we eventually buy a house. I don’t think we’ll ever pay off a PPOR, ever! It’s just too much money parked against something that’s isn’t generating any cash. The opportunity cost is too great in my eyes.

But I’m more comfortable with debt than most people. Most people sleep better at night knowing they don’t owe anyone anything. I’ve always been ok with debt but everyone’s different.

There’s no right answer, unfortunately. It’s all very circumstantial

Cheers